Política Monetaria

Monthly Monetary Report

Septiembre

2022

Monthly report on the evolution of the monetary base, international reserves and foreign exchange market.

1. Executive Summary

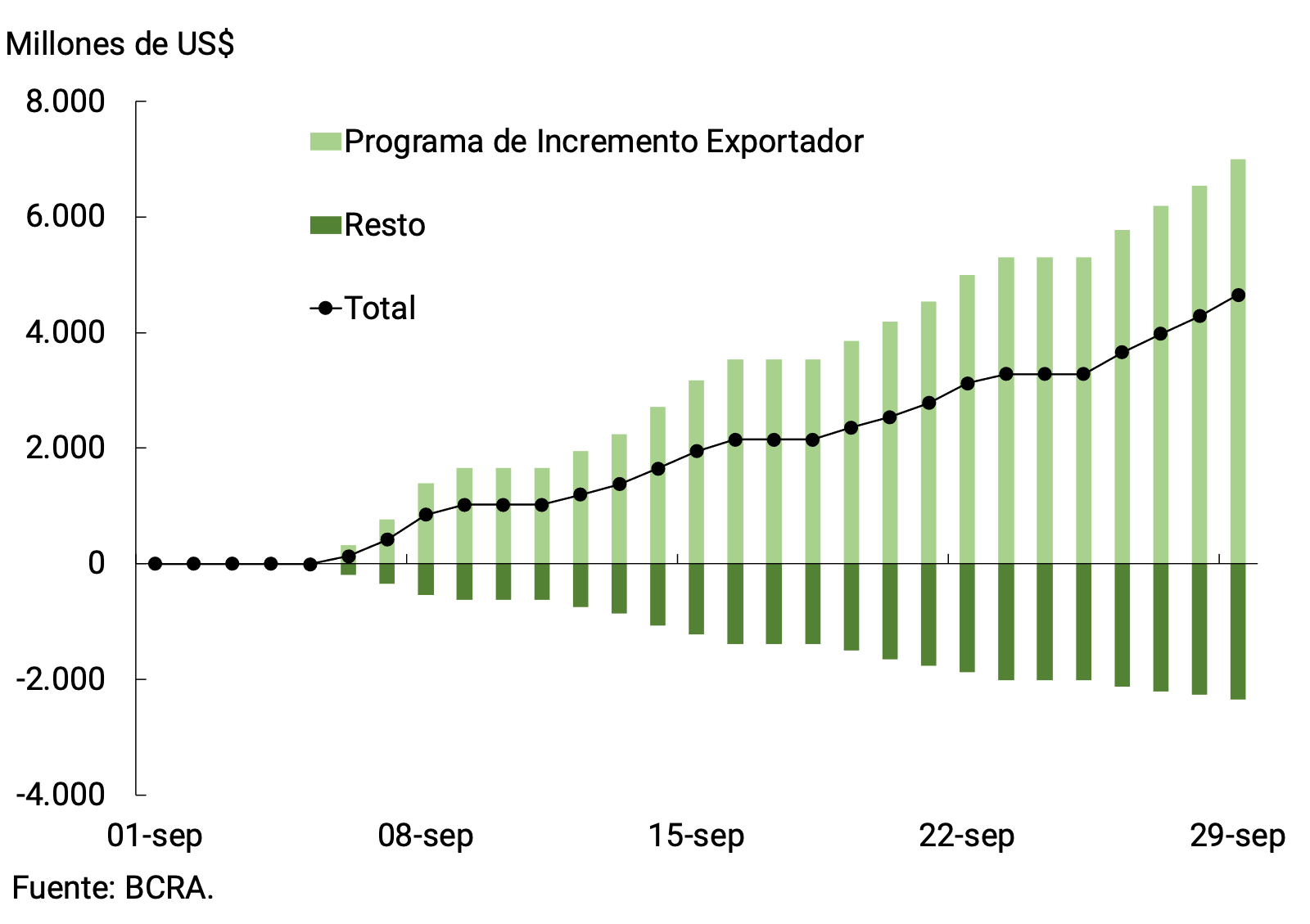

On September 5, the “Export Increase Program” came into effect, which allowed the soybean complex to liquidate foreign currency at an exceptional and transitory value of $200/US$. The BCRA acquired US$7,646 million through this mechanism and, together with the rest of the foreign exchange operations of the private sector, left a net balance of US$5,000 million in the month. These operations implied an expansion of liquidity and, in terms of monetary base, were sterilized with interest-bearing liabilities.

In terms of monetary aggregates, the funds were channeled towards interest-bearing deposits, highlighting those at interest-bearing demand and, to a lesser extent, time deposits, in both cases driven mainly by placements from the Mutual Money Market Funds (FCI MM). This behavior was influenced by the continuity in the process of raising interest rates set by the BCRA. In this way, the monetary authority seeks to tend towards positive returns in real terms of savings instruments in pesos.

Thus, the broad monetary aggregate (private M3) would have registered a monthly expansion at constant prices and adjusted for seasonality. The behavior by component was heterogeneous, with a fall in the demand for means of payment and a growth in remunerated components.

Loans in pesos to the private sector measured in real terms and without seasonality, would have registered a monthly contraction of 3.4%, accumulating three consecutive months of decline. The decrease for the month, although generalized, was more intense in the commercial segment despite the positive effect of the Financing Line for Productive Investment (LFIP). This behavior could be explained, among other things, by the cancellation of loans with the liquidity injected by operations linked to the Export Increase Program.

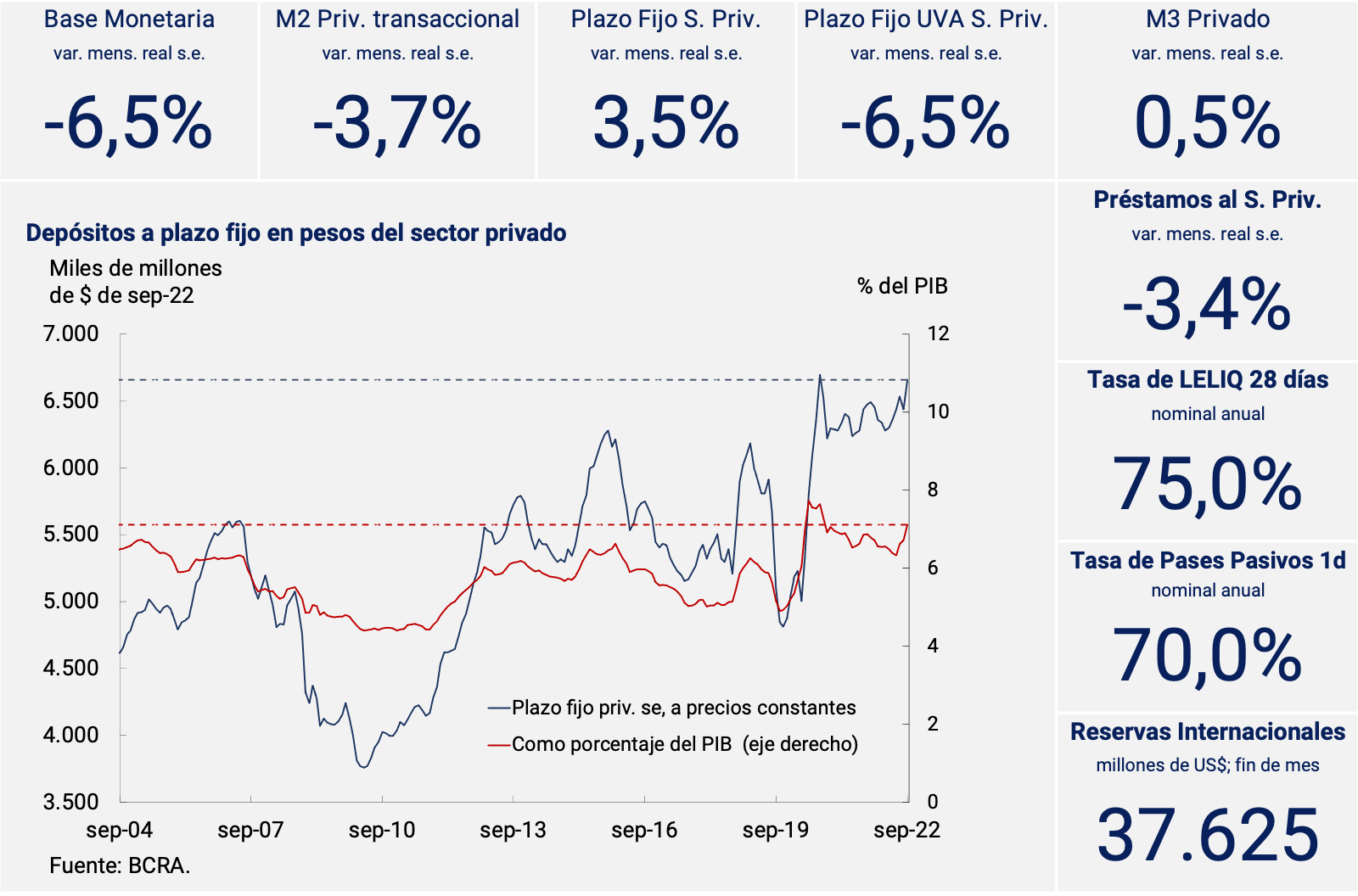

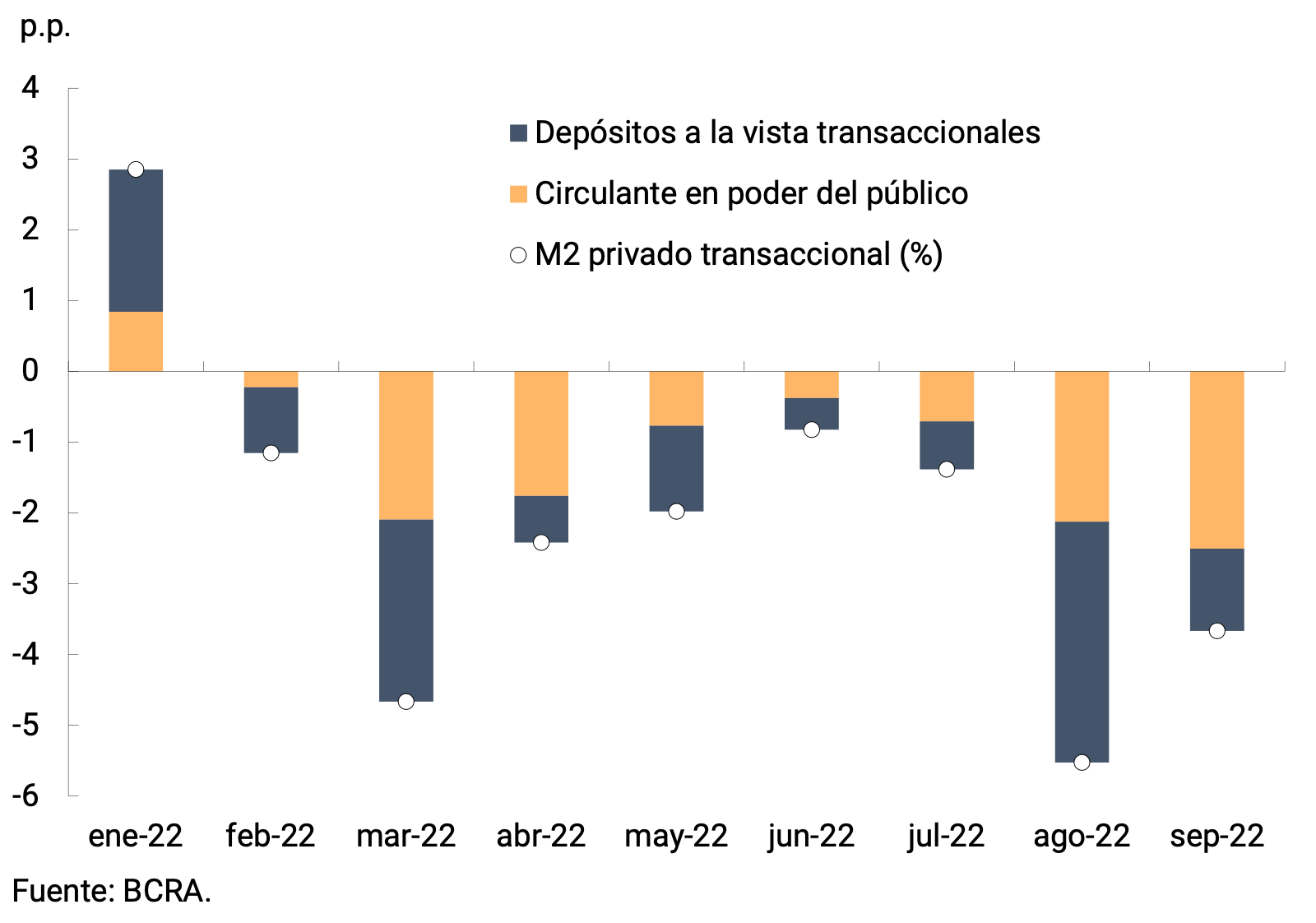

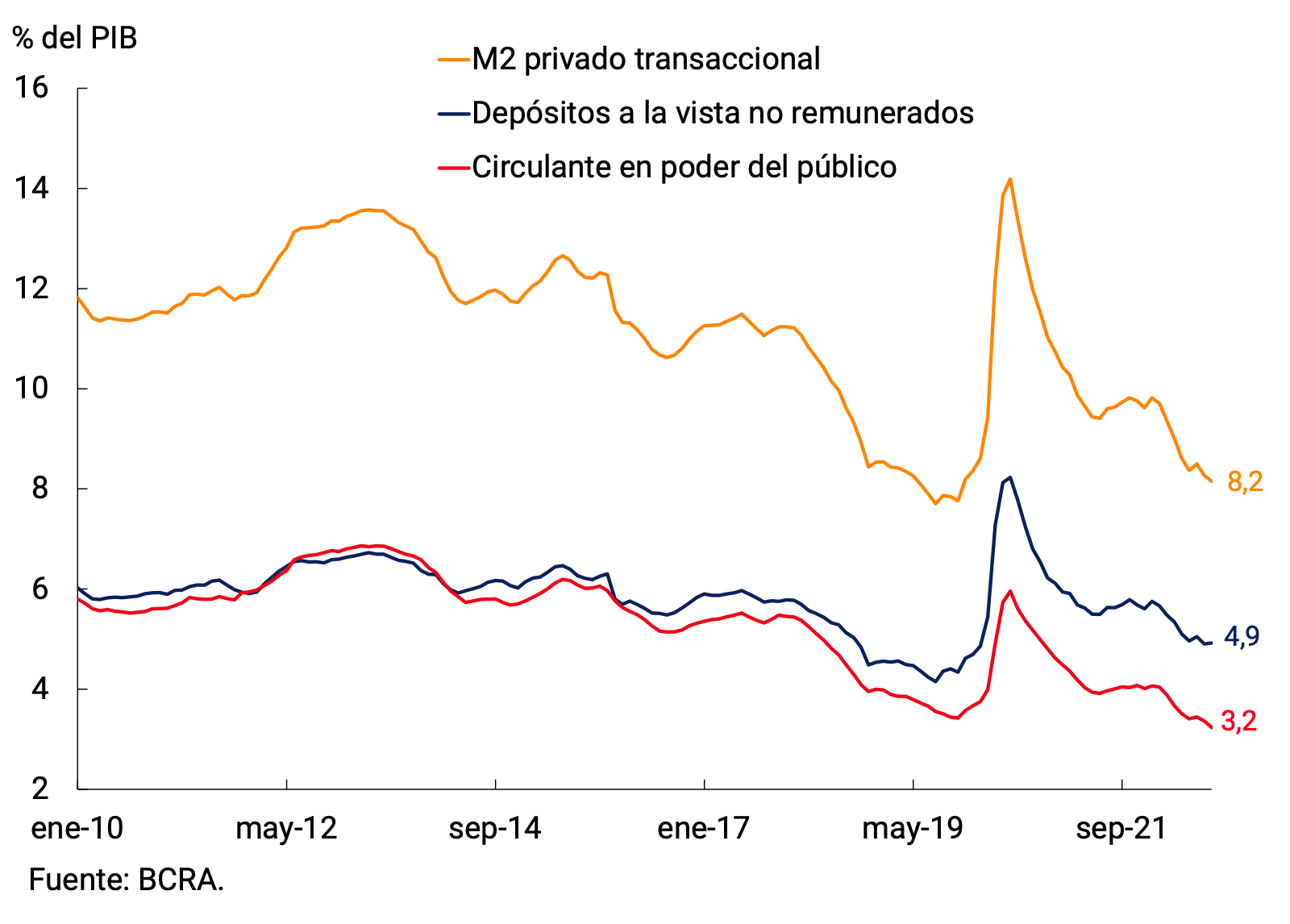

2. Payment methods

In real and seasonally adjusted terms, means of payment (private transactional M21) would have registered a contraction of 3.7% in September, recording eight consecutive months of decline (see Chart 2.1). This decrease was due to the behavior of both non-interest-bearing demand deposits and working capital held by the public. In year-on-year terms and at constant prices, the means of payment would have presented a contraction of around 17%. As a GDP ratio, private transactional M2 would have stood at 8.2%, showing a decrease (0.1 p.p.) compared to last month (see Figure 2.2). Both components of the means of payment remain in terms of GDP at around the lowest levels of the last 15 years.

Figure 2.1 | Private transactional M2 at constant

prices Contribution by component to the monthly vari. s.e.

3. Savings instruments in pesos

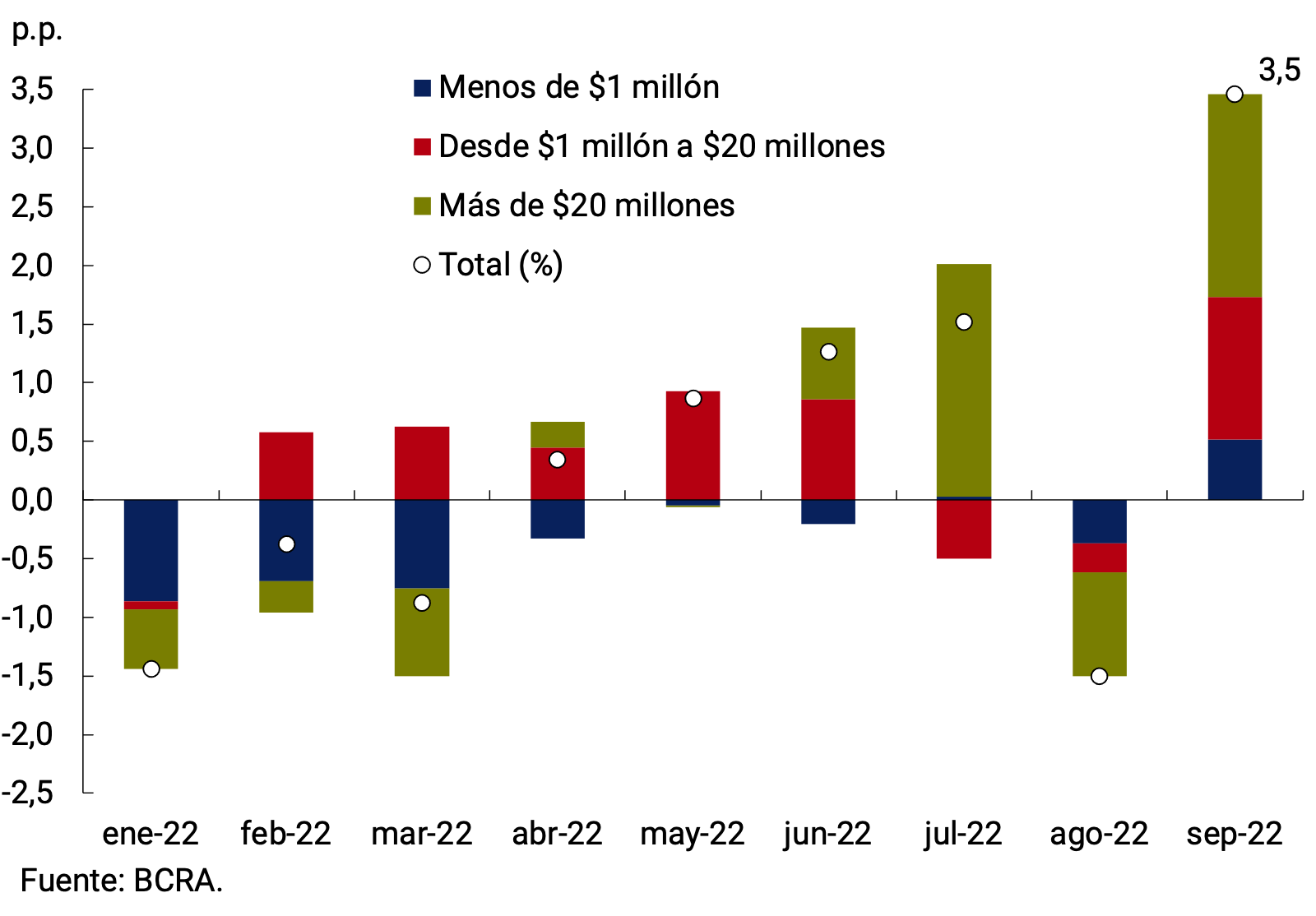

The low dynamism of transactional means of payment contrasted with the growth of savings instruments in pesos. Interest-bearing demand deposits registered an expansion of 9.9% at constant prices and without seasonality, a dynamic almost entirely explained by the holdings of Financial Services Providers (FSPs). On the other hand, fixed-term deposits in pesos of the private sector at constant prices would have registered a monthly expansion of 3.5% s.e. in September, reversing the fall of the previous month. Thus, placements at constant prices remained around the highest levels in recent decades. As a percentage of GDP, these deposits would have stood at 7.1% in September (0.4 p.p. more than in August), a figure that is also among the highest in recent years.

It should be noted that in the middle of the month the Board of Directors of the BCRA decided to raise for the ninth time this year the minimum guaranteed interest rates on fixed-term deposits2. On this occasion, it increased by 5.5 p.p. the minimum guaranteed rate for placements of individuals by up to an amount of $10 million, which became 75% n.a. (107.05% y.a.). For the rest of the depositors of the financial system3 , the interest rate rose by the same magnitude to 66.5% n.a. (91.07% y.a.). This measure is aimed at tending towards positive real returns to encourage savings in domestic currency.

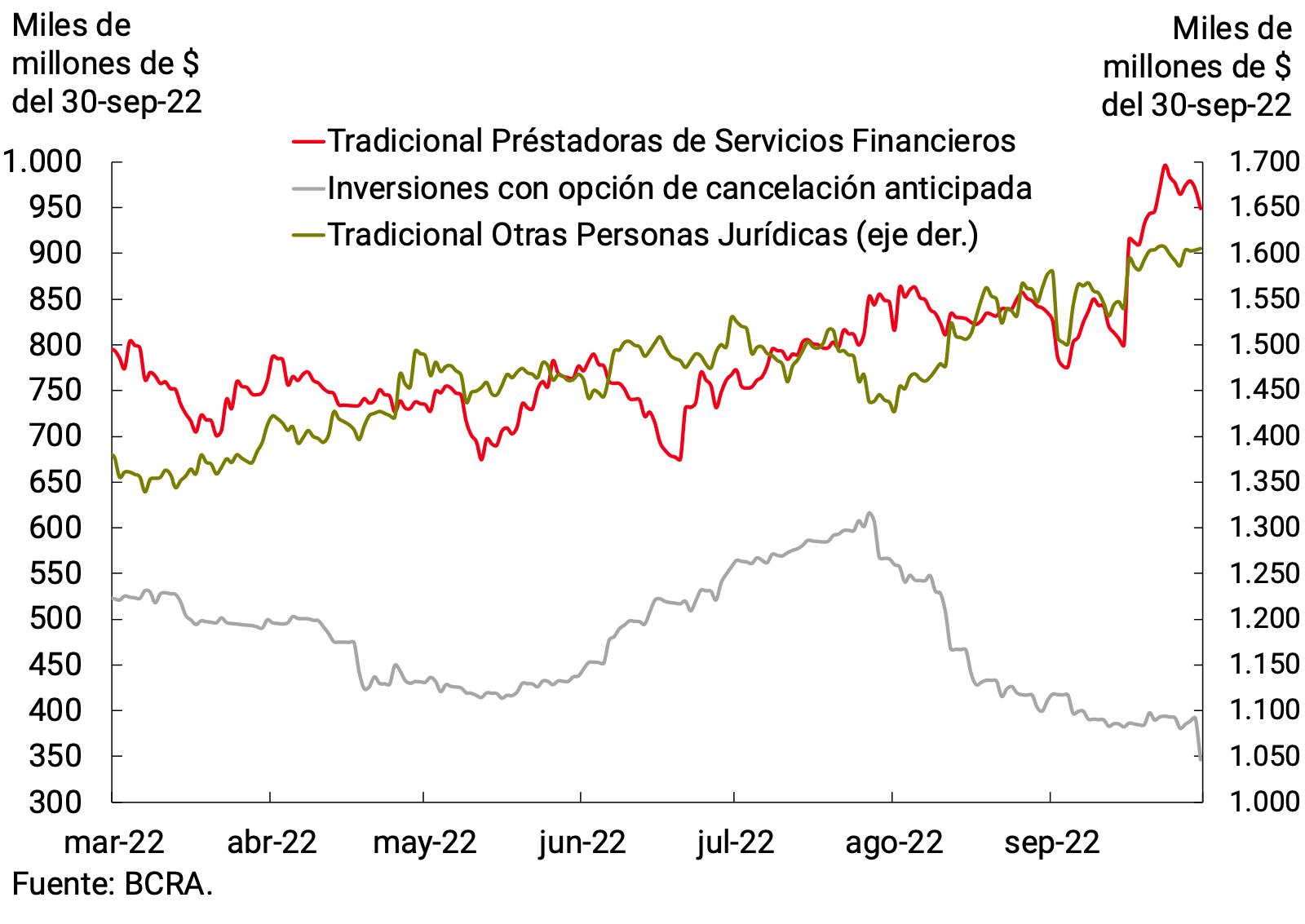

Analyzing the evolution of term placements by strata of amount, a generalized increase is verified, although the most dynamic segment was the wholesale segment (more than $20 million; see Figure 3.1). Within this type of placement, the PSFs were the ones that increased their holdings significantly, hand in hand with the growth in the equity of the Money Market Mutual Funds (FCI MM; 7.4% at constant prices), which are the main agents within the PSFs. The rest of the companies also increased their traditional fixed-term placements, although to a lesser extent. Meanwhile, investments with early cancellation options (which cannot be classified by type of holder) continued to decline (see Figure 3.2).

Figure 3.1 | Fixed-term deposits in pesos of the private

sector Var. real monthly and without seasonality by amount stratum

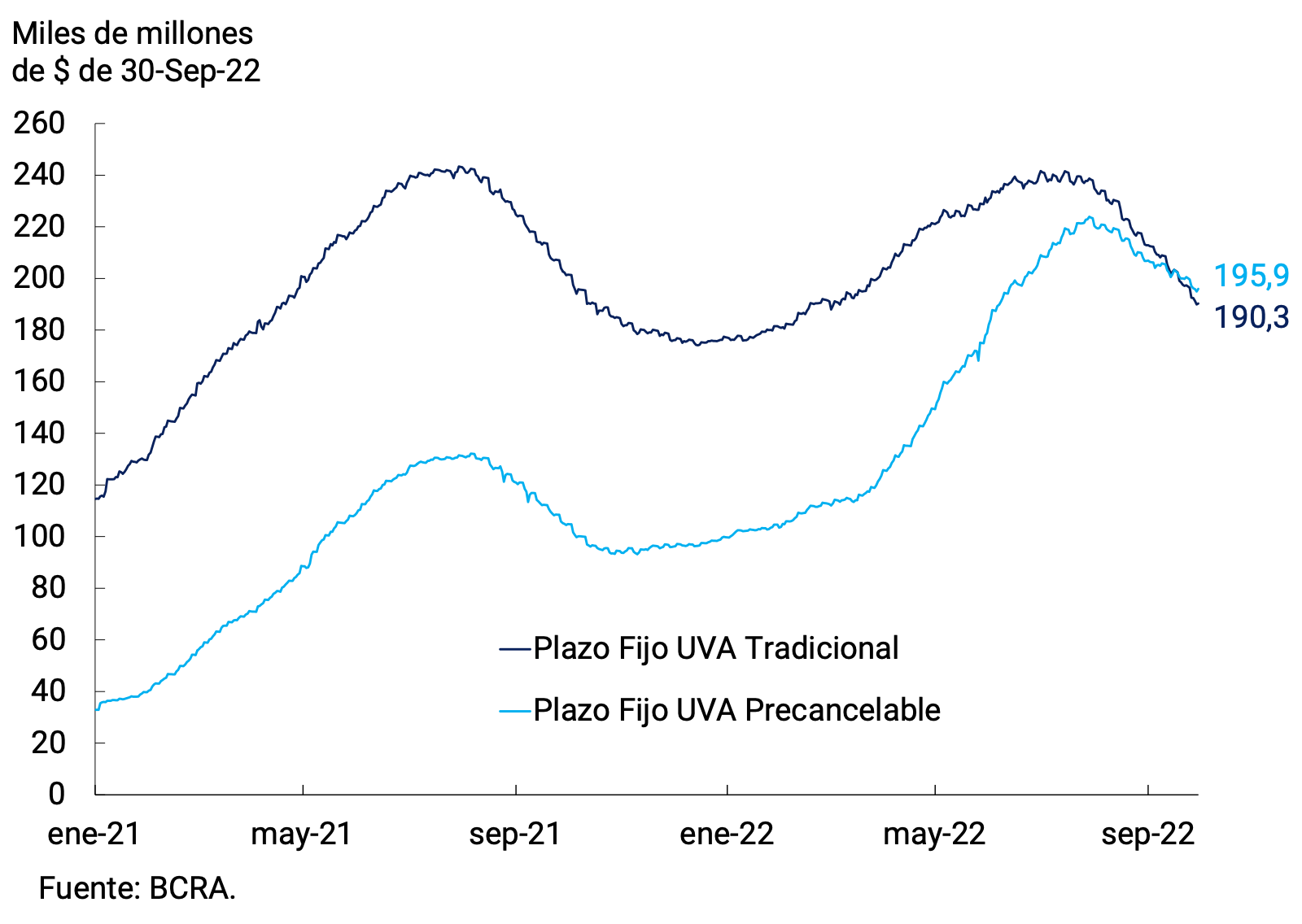

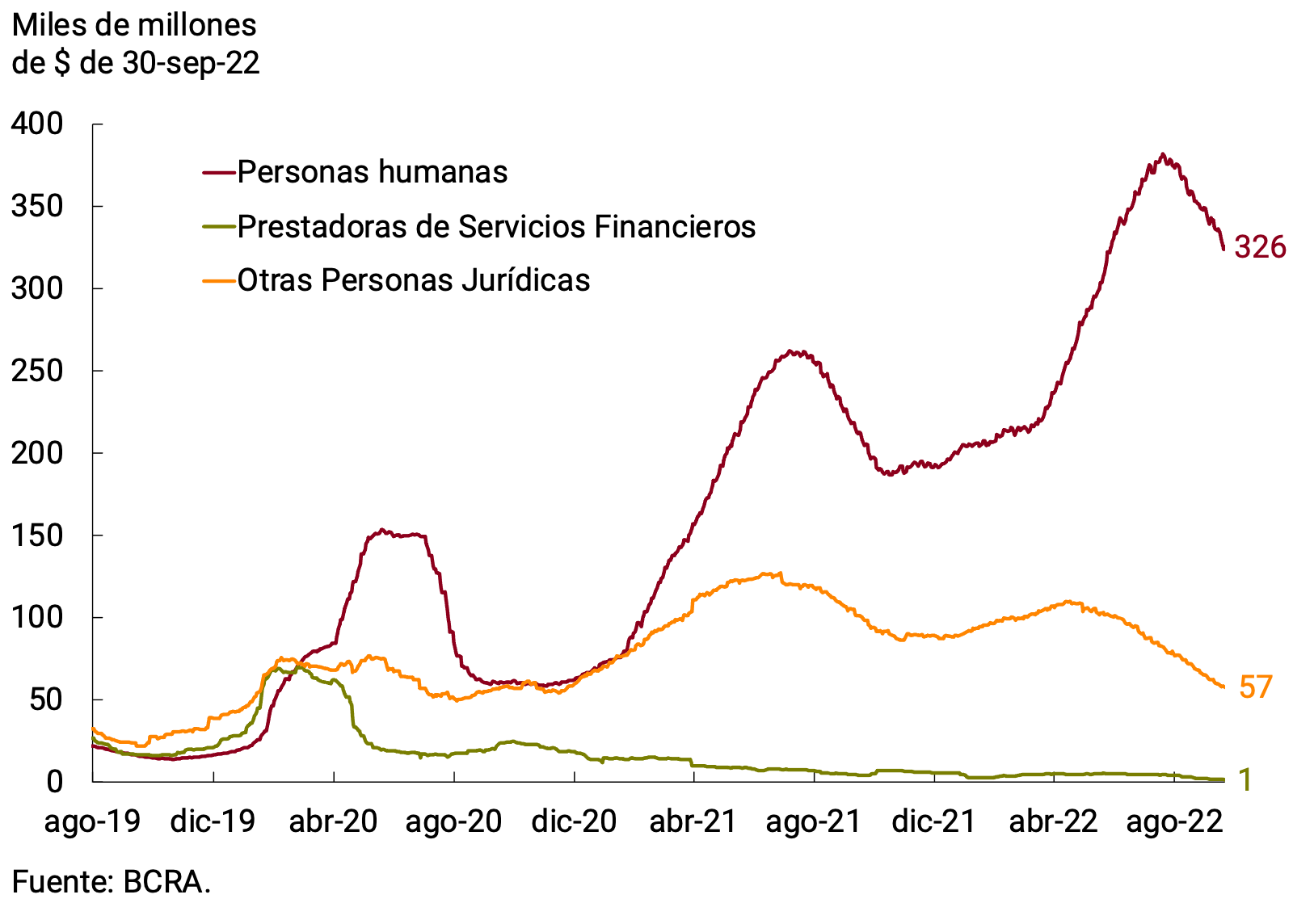

The segment of fixed-term deposits with CER adjustment presented a contraction in real terms for the second consecutive month. The decrease was verified in both traditional and pre-cancellable UVA placements, whose monthly rates of change stood at -8.4% s.e. and -4.4% s.e. respectively in real terms (see Chart 3.3). Distinguishing by type of holder within the instruments with CER adjustment, it can be seen that the fall is almost entirely explained by the dynamics of placements by individuals and companies (excluding FSPs; see Chart 3.4). All in all, deposits in UVA reached a balance of $386,200 million at the end of the month.

Figure 3.3 | Fixed-term deposits in UVA from the private

sector S.o. balance at constant prices by type of instrument

On the other hand, increases were observed in deposits adjusted according to the value of the reference exchange rate. Currently, the agricultural sector has two different types of deposits with exchange rate coverage available: a demand account, commonly known as “chacarero deposits” and on the other hand, term investments, called DIVA dollar. The first type of deposits reached a balance in the month of $90,000 million, with a more marked growth in the second half of the month. The DIVA dollar accumulated a balance of $41,800 million at the end of September, which implied an average monthly expansion of 14% s.o. at current prices in the ninth month of the year (9% real s.e.). To cover the exchange risk of these deposits, financial institutions have at their disposal the Bills with adjustment according to the value of the dollar (LEDIV).

All in all, the broad monetary aggregate, private M34, at constant prices and adjusted for seasonality, would have registered a monthly expansion in September (0.5%). In year-on-year terms, this aggregate would have experienced a decrease of 5.6%. As a percentage of GDP, it stood at 17.3%, 0.5 p.p. above the August record.

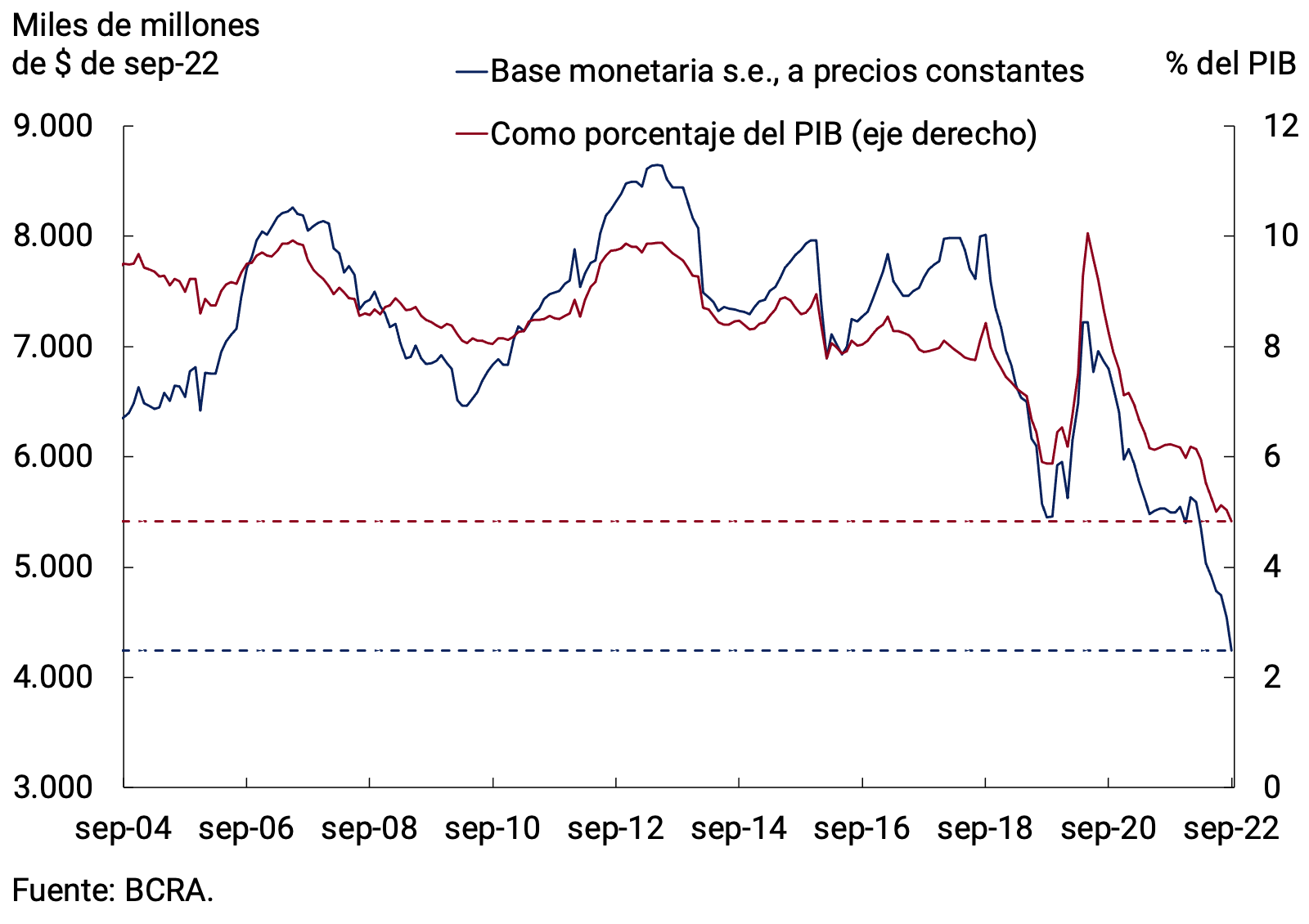

4. Monetary base

In September, the Monetary Base stood at an average of $4,179.9 billion, registering a monthly contraction of 2.5% ($107,357 million) in the original series at current prices. Adjusted for seasonality and at constant prices, it would have exhibited a contraction of 6.5% and in the last twelve months it would accumulate a fall of around 23%. In terms of GDP, the Monetary Base would stand at 4.8%, 1.2 p.p. below the December figure and the lowest value since 2003 (see Figure 4.1).

On the supply side, the only expansive factor of liquidity was the net purchase of foreign currency from the private sector that promoted the “Export Increase Program”. Most of these funds were channelled to FCI MM, which registered a marked increase in their assets. Other destinations of the funds were time deposits and demand accounts adjusted according to the official exchange rate (“Special Accounts for Exporters”). The expansion of liquidity was mainly sterilized through monetary regulation instruments, although public sector operations also had a contractionary effect.

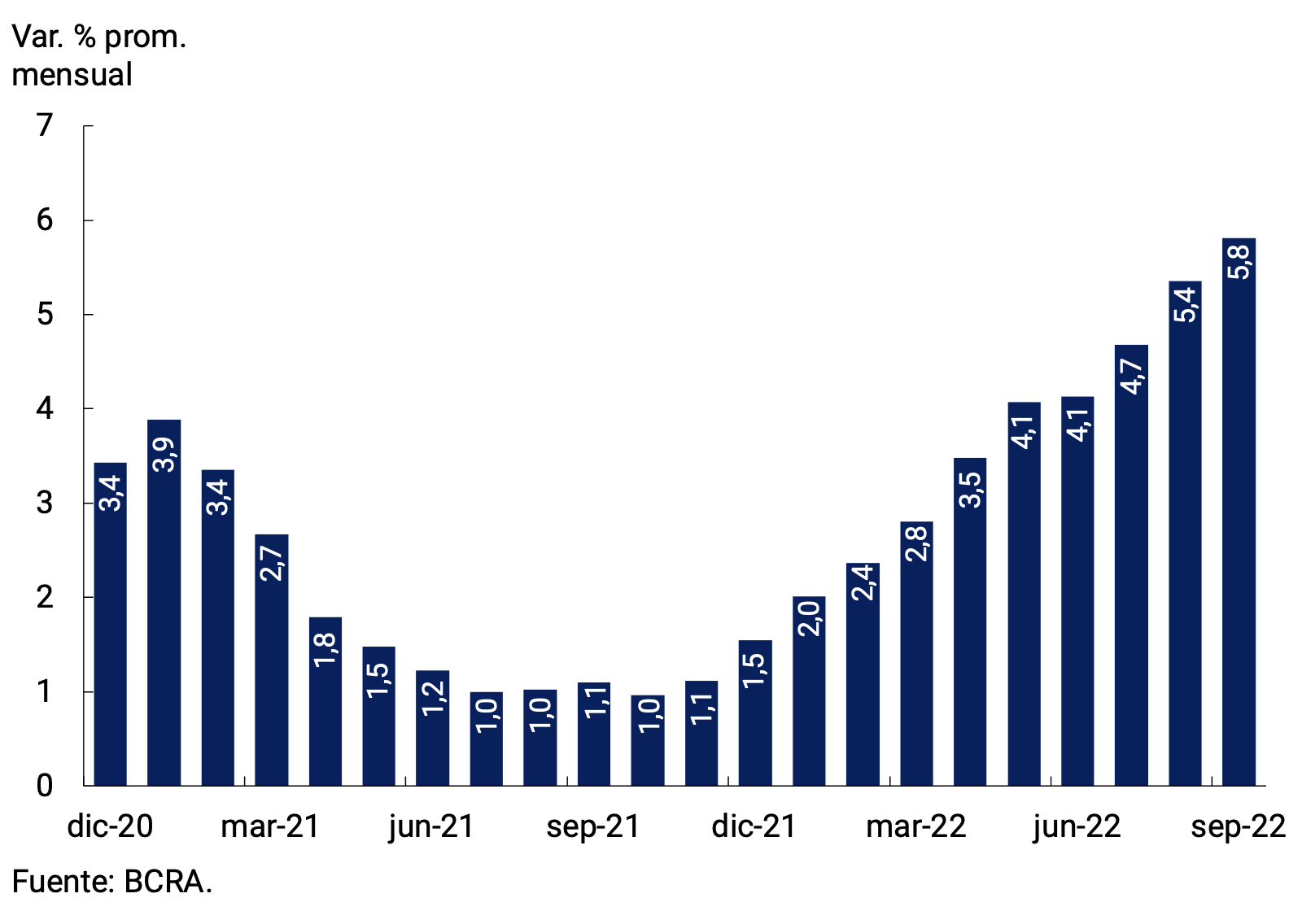

The BCRA increased its benchmark interest rates again in September, in order to tend towards positive real returns on investments in local currency and preserve monetary, exchange rate and financial stability. Thus, the interest rate of the LELIQ with a 28-day term was raised by 5.5 p.p., which stood at 75% n.a. (107.35% y.a.). For its part, the interest rate on the LELIQ with a 180-day term increased 7.5 p.p. to 83.5% n.a. (101.23% y.a.). As for shorter-term instruments, the interest rate on 1-day pass-by-passes increased by 5.5 p.p. to 70% n.a. (101.24% y.a.); Meanwhile, the interest rate on 1-day active passes rose 7 p.p. and, thus, stood at 95% n.a. (158.25% y.a.). Finally, the fixed spread of the NOTALIQ in the last auction of the month was set at 8.5 p.p.

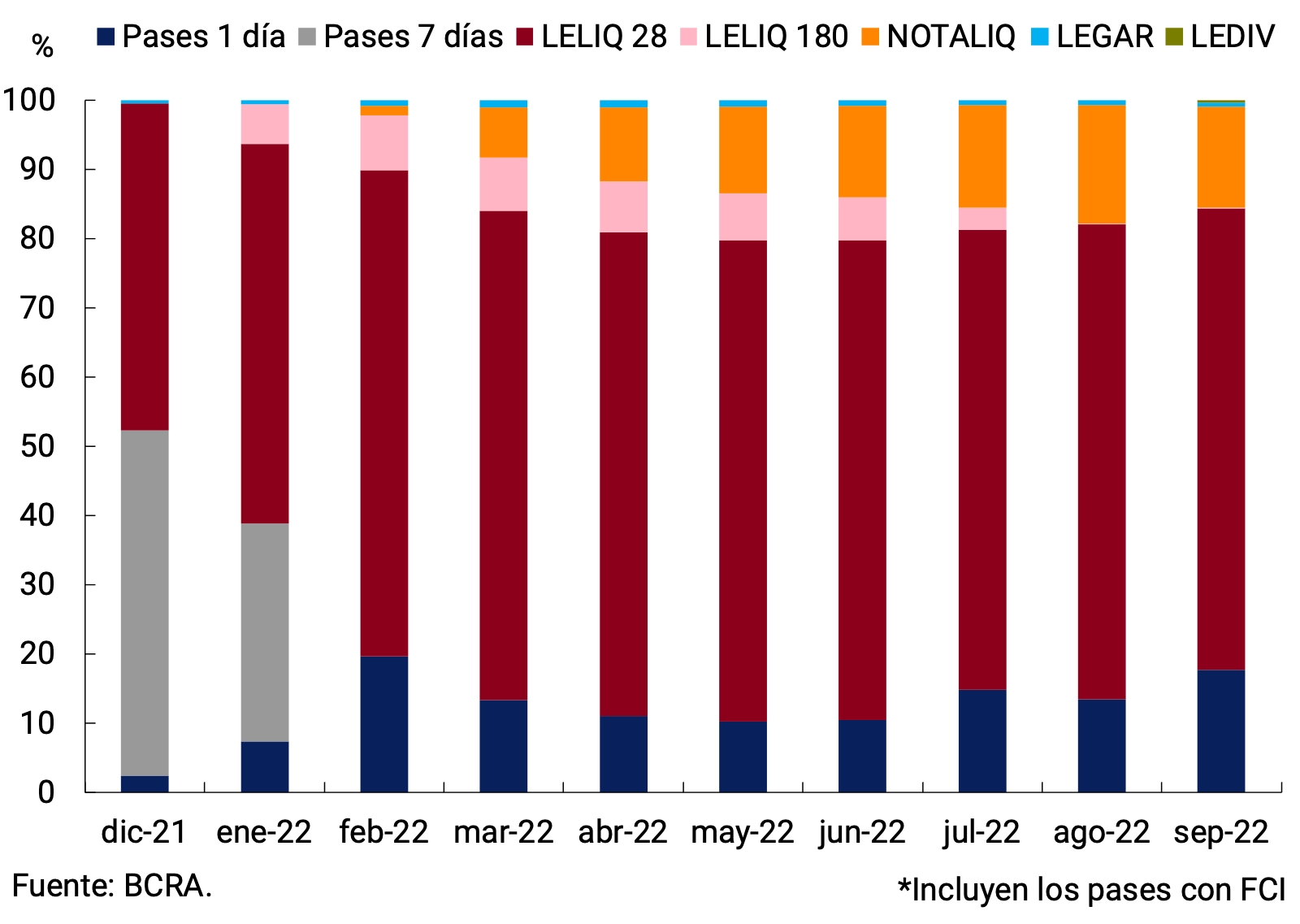

With the current configuration of instruments, in September the interest-bearing liabilities were made up of around 67% of LELIQ with a term of 28 days, while the longer-term species represented 14.7% of the total, concentrated almost entirely in NOTALIQ. On the other hand, 1-day pass-by-passes significantly increased their weight in the total of instruments, representing 17.7%, 4.2 p.p. more than the previous month. It should be noted that in September the use of bills with adjustments for exchange rate evolution (LEDIV) was implemented, and together with the LEGAR they accounted for 0.8% of the total (see Figure 4.2).

5. Loans to the private sector

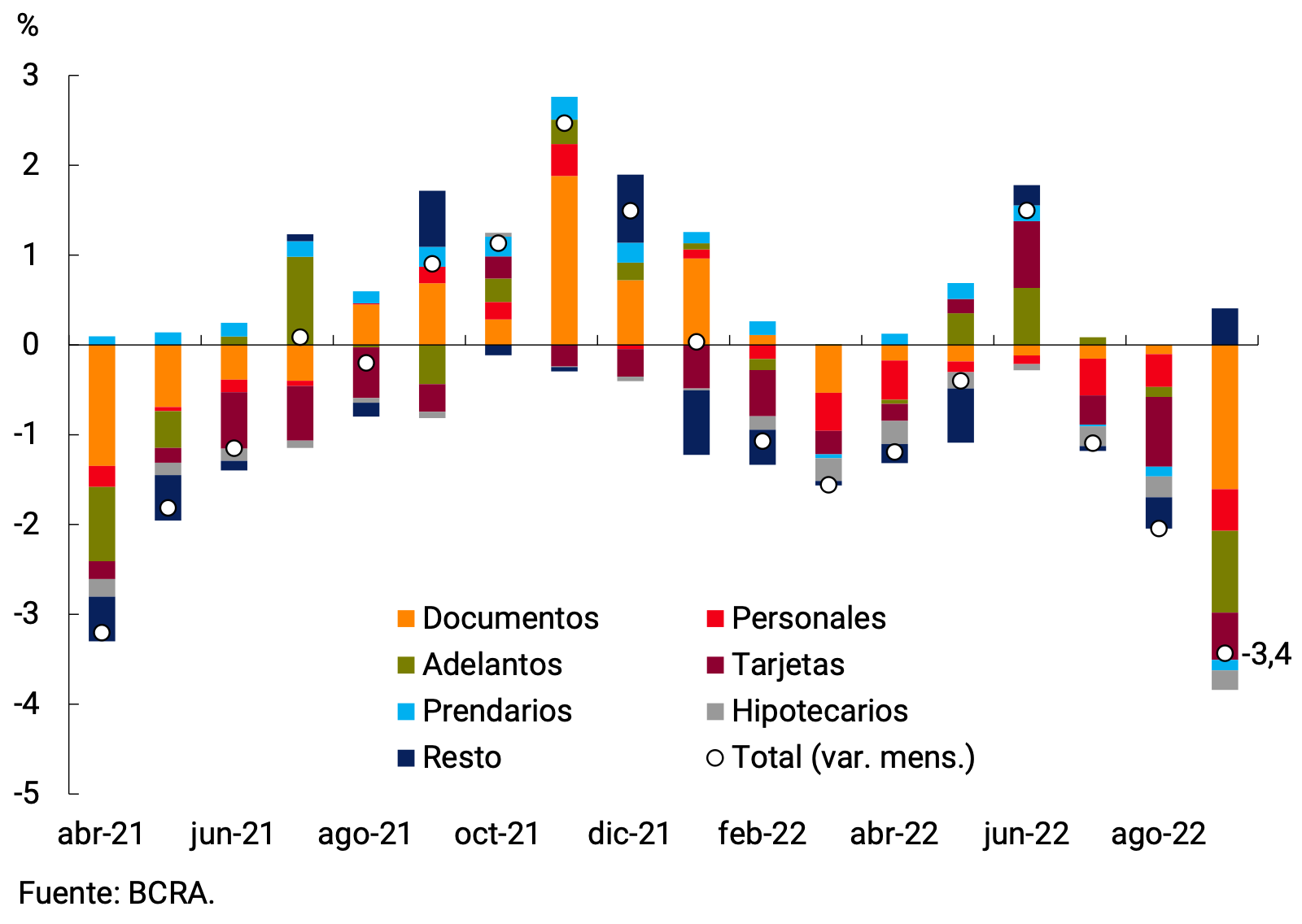

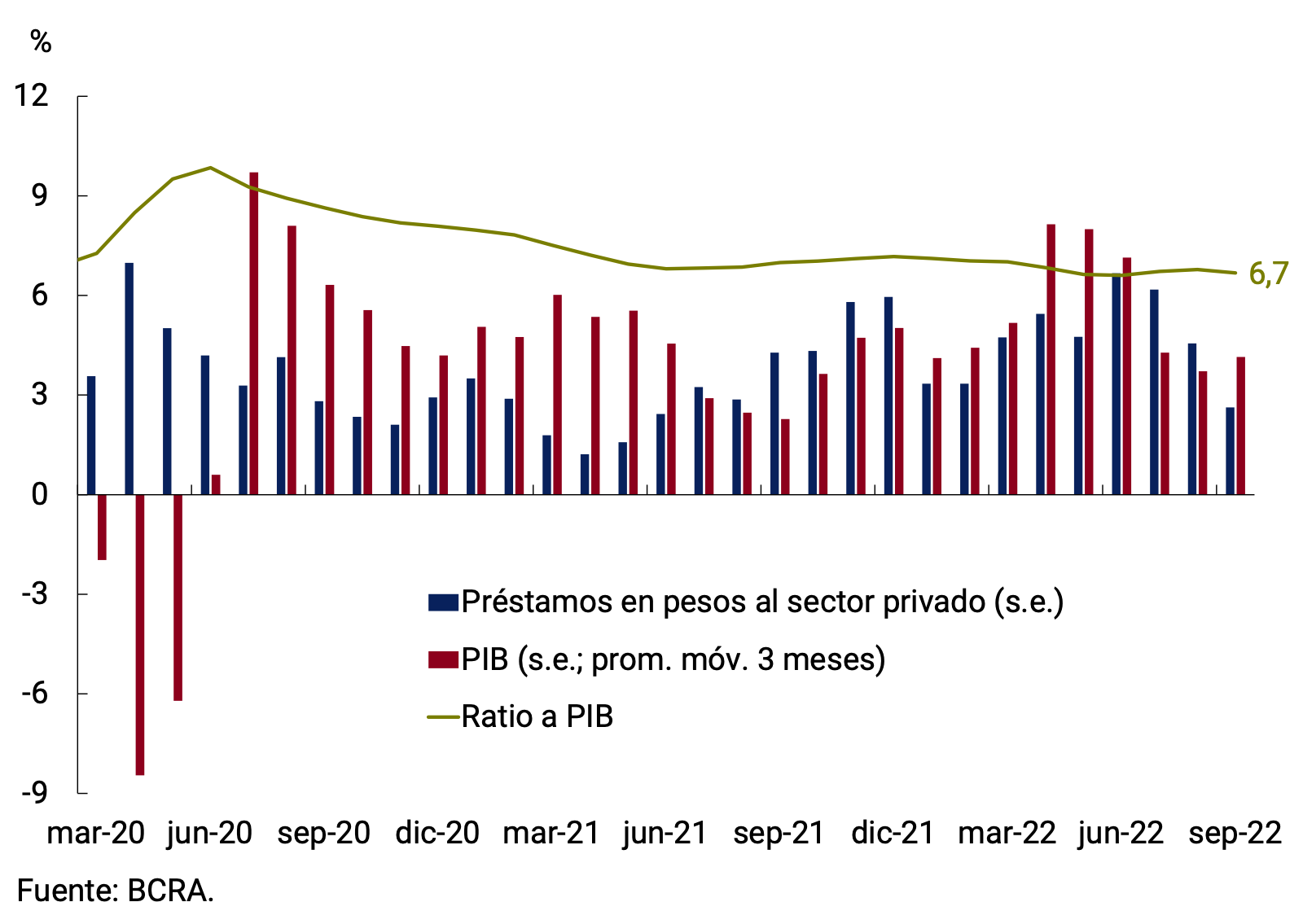

In September, loans in pesos to the private sector, measured in real terms and without seasonality, would have registered a monthly contraction of 3.4%, accumulating three consecutive months of decline. The decline for the month was broad-based at the level of large credit lines (see Figure 5.1). Thus, in the last twelve months they would have accumulated a fall of 4.3% in real terms. The ratio of loans in pesos to the private sector to GDP fell slightly in the month (0.1 p.p.) and stood at 6.7% (see Figure 5.2).

Figure 5.1 | Loans in pesos to the private

sector Real without seasonality; contribution to monthly growth

Analysing the evolution of loans by type of financing, lines mainly for commercial purposes would have exhibited a 6.3% monthly drop s.e. in real terms, being the sharpest drop since April last year. However, in the year-on-year comparison and at constant prices, they remain at a level 1.7% higher than in September 2021. Within these financings, current account advances would have fallen 8.1% s.e. in real terms (+7.0% y.o.y.). On the other hand, the financing granted through documents would have exhibited a decrease at constant prices of 6.2% s.e. (+4.9% y.o.y.), explained both by the documents with a single signature and by the discounted documents. The fall in commercial financing could be explained, among other reasons, by an application of the liquidity injected by operations linked to the Export Increase Program.

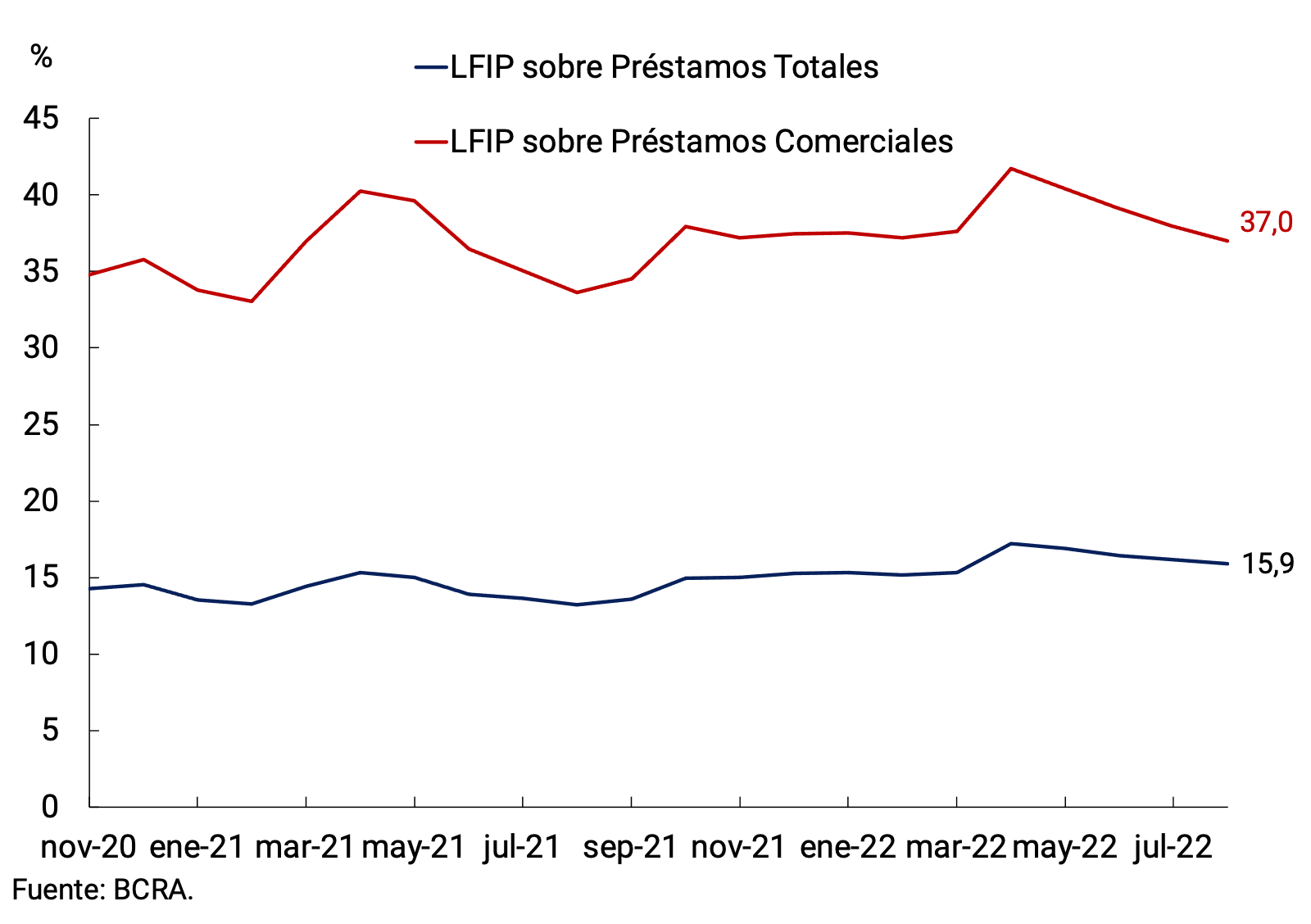

The Financing Line for Productive Investment (LFIP) continued to be the main tool used to channel productive credit to Micro, Small and Medium-sized Enterprises (MSMEs). At the end of September, loans granted under the LFIP accumulated disbursements of approximately $3.065 billion since its launch, with an increase of 7% compared to last month. It should be noted that the average balance of financing granted through the LFIP reached approximately $900,000 million in August (latest available information), of which 40.5% corresponded to investment projects and the rest to working capital. This balance represented about 16% of total loans and 37% of total commercial loans (see Figure 5.3). At the time of publication, the number of companies that accessed the LFIP amounted to 304,680. In line with the increase in the BCRA’s reference interest rates, the maximum rate of the line to finance working capital was raised from 69% to 74.5% n.a.; and that corresponding to investment projects went from 59% to 64.5% n.a. It should be noted that the validity of this line was recently renewed until March 31, 2023, under conditions similar to those of the previous edition5.

Figure 5.3 | Balance of financing granted through the LFIP in relation to loans in pesos to the private sector

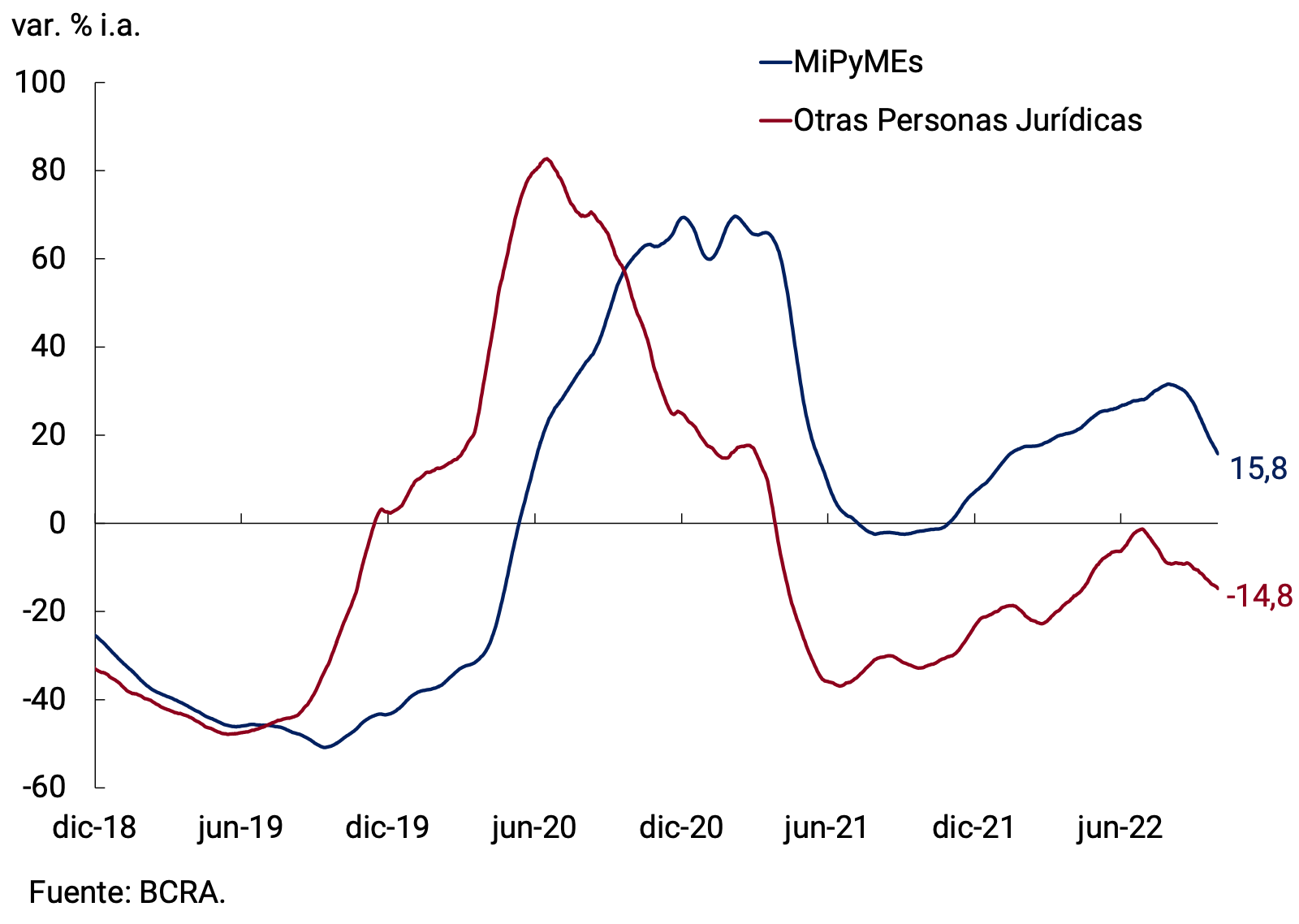

Differentiating trade credit by type of debtor, in September credit to MSMEs in real terms would have expanded at a rate of around 16% y.o.y., moderating at the margin. Meanwhile, financing for large companies would have shown a contraction of 14.8% YoY (see Figure 5.4).

Among loans associated with consumption, financing instrumented with credit cards would have registered a decrease in real terms of 1.8% s.e. during September, with the average balance being 8.4% below the level of a year ago. Personal loans would have exhibited a fall of 2.9% monthly at constant prices, with a fall of 11.2%. The interest rate on personal loans averaged 78.2% n.a. in September (113.5% y.a.), increasing 3.5 p.p. compared to the previous month.

With regard to lines with real guarantees, collateral loans would have registered a decrease of 1.7% s.e. in real terms, although they would remain 22.3% above the record of a year ago. For its part, the balance of mortgage loans would have shown a fall of 3.5% s.e. at constant prices in the month, accumulating a contraction of close to 22% in the last twelve months.

6. Liquidity in pesos of financial institutions

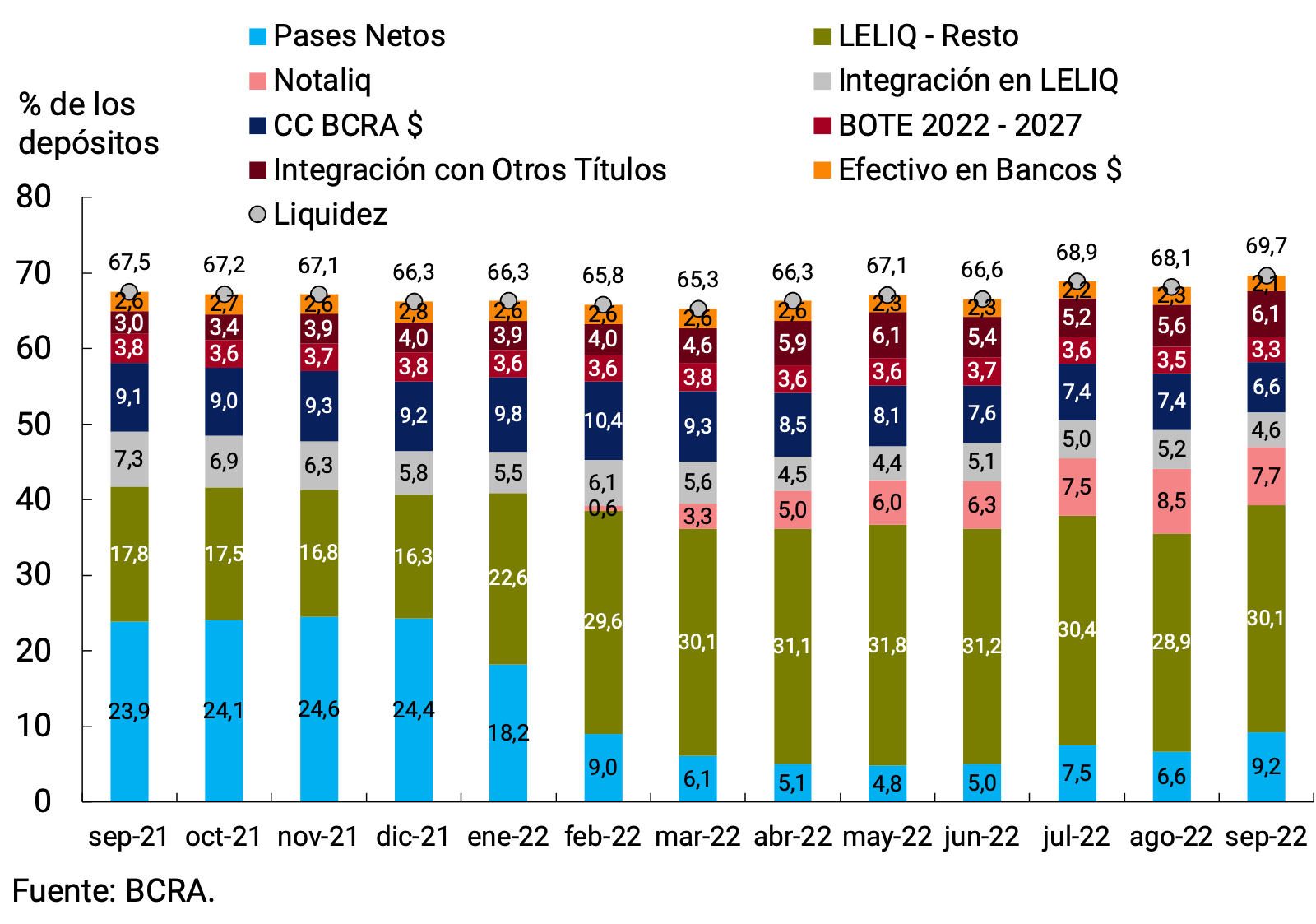

In September, ample bank liquidity in local currency6 showed an increase of 1.6 p.p. compared to August, averaging 69.7% of deposits. Thus, it remained at historically high levels. This increase was mainly driven by the BCRA’s interest-bearing liabilities (with increases in net passes and LELIQs that are not used to integrate minimum cash, partially offset by the NOTALIQ). With regard to the integration of minimum cash, there was an increase in public securities to the detriment of LELIQs and current accounts at the BCRA (see Figure 6.1).

Regarding the regulatory modifications with a potential impact on bank liquidity, it is worth mentioning that as of October, the simplification of the minimum cash regime established in June7 will come into force. In turn, it was provided that financial institutions may integrate the requirement associated with deposits in pesos in accounts of payment service providers that offer payment accounts (PSPOCP) in which the funds of their customers with “National Treasury Bonds in pesos due May 23, 2027” (BOTE 2027) are deposited in up to 45 p.p.8 Finally, the maximum term of national government securities in pesos acquired by primary subscription admitted for minimum cash integration was raised to 630 days, and it was specified that national public securities with yield in dual currency (DUAL BOND) can be used for the integration of minimum cash9.

7. Foreign currency

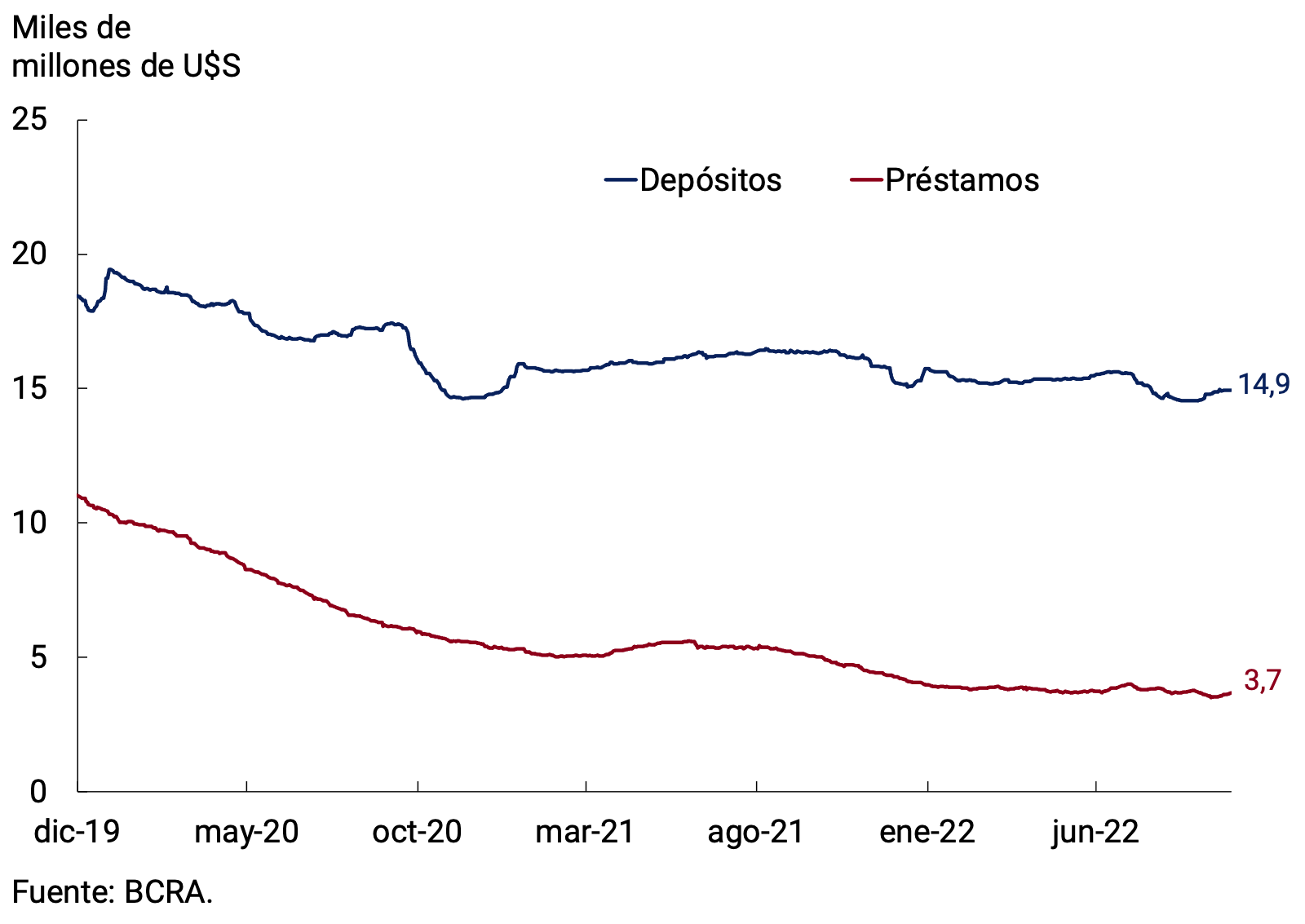

In the foreign currency segment, the main assets and liabilities of financial institutions had a mixed performance. On the one hand, private sector deposits interrupted the downward trend observed since the beginning of July and showed an increase of US$393 million in September when looking at the variation between balances at the end of the month. This variation is more limited (US$219 million) if the monthly average is analyzed, due to the statistical carryover from August. The increase was mainly explained by demand deposits of legal entities of more than US$1 million. On the other hand, the average monthly balance of loans to the private sector was US$3,594 million, which meant a drop of US$121 million compared to the previous month (see Figure 7.1).

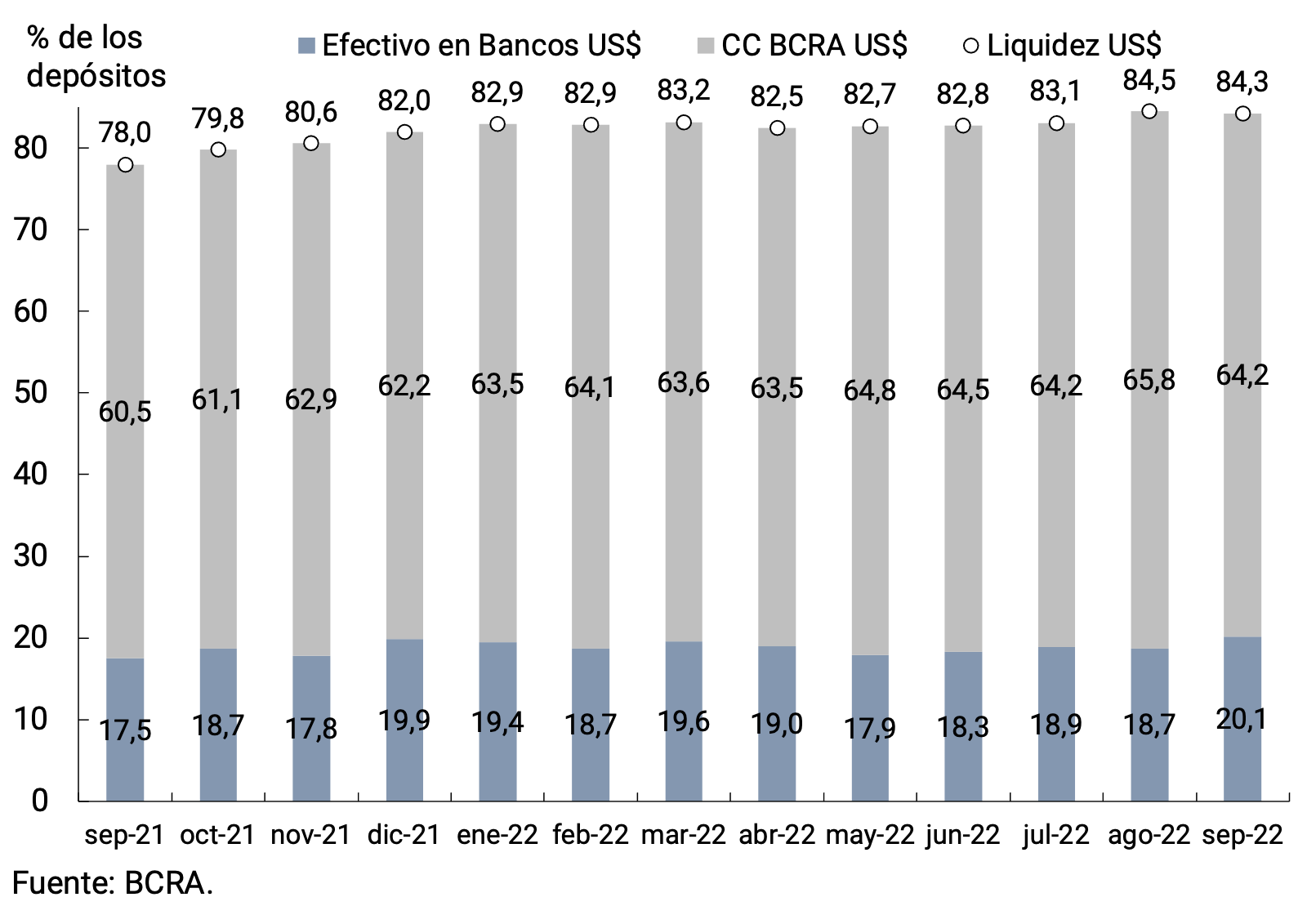

The liquidity of financial institutions in the foreign currency segment stood at 84.3% of deposits in September, just below the level of August. However, there were changes in its composition, with an increase in cash in banks that was offset by a fall in the balance of current accounts in foreign currency (see Figure 7.2).

During September, a series of regulatory modifications took place in foreign exchange matters, with which it was sought to increase the supply of foreign currency and in turn allocate it more efficiently. First, at the beginning of the month, the “Export Increase Program” was created10. Thus, exports of soybeans and their by-products that were settled between September 5 and 30 did so at an exchange rate of $200/US$11. In addition, to encourage liquidation, a minimum rate of 120% of the monetary policy rate was set for financing producers who maintain a soybean stock greater than 5% of their production12. Finally, access to the foreign exchange market was made more flexible to make payments for imports linked to various productive sectors13, while access to the official exchange and financial market was limited to other agents14.

The BCRA’s International Reserves ended September with a balance of US$37,625 million, reflecting an increase of US$891 million compared to the end of August. This increase was explained by the net purchase of foreign currency from the private sector, which totaled about US$5,000 million in the month, driven mainly by the “Export Increase Program” which contributed about US$7,600 million (see Figure 7.3). This dynamic was partially offset by payments to international organizations, among which the capital payments to the International Monetary Fund for US$2,602 million stood out. The loss on valuation of net foreign assets and, to a lesser extent, the variation in dollar balances in the current account at the BCRA contributed negatively to the monthly dynamics. It should be noted that, in the first days of October, the Executive Board of the International Monetary Fund completed the second review of the Extended Facilities Program, approving a disbursement that will impact the balance of the International Reserves next month.

Finally, the bilateral nominal exchange rate (TCN) against the U.S. dollar increased 5.8% in August to settle, on average, at $143.13/US$ (see Figure 7.4). Given that the rate of depreciation of the domestic currency accelerated throughout the month, the peak variation was somewhat higher (6.2%).

Glossary

ANSES: National Social Security Administration.

AFIP: Federal Administration of Public Revenues.

BADLAR: Interest rate on fixed-term deposits for amounts greater than one million pesos and a term of 30 to 35 days.

BCRA: Central Bank of the Argentine Republic.

BM: Monetary Base, includes monetary circulation plus deposits in pesos in current account at the BCRA.

CC BCRA: Current account deposits at the BCRA.

CER: Reference Stabilization Coefficient.

NVC: National Securities Commission.

SDR: Special Drawing Rights.

EFNB: Non-Banking Financial Institutions.

EM: Minimum Cash.

FCI: Common Investment Fund.

A.I.: Year-on-year .

IAMC: Argentine Institute of Capital Markets

CPI: Consumer Price Index.

ITCNM: Multilateral Nominal Exchange Rate Index

ITCRM: Multilateral Real Exchange Rate Index

LEBAC: Central Bank bills.

LELIQ: Liquidity Bills of the BCRA.

LFIP: Financing Line for Productive Investment.

M2 Total: Means of payment, which includes working capital held by the public, cancelling cheques in pesos and demand deposits in pesos from the public and non-financial private sector.

Private M2: Means of payment, includes working capital held by the public, cancelling cheques in pesos and demand deposits in pesos from the non-financial private sector.

Private transactional M2: Means of payment, includes working capital held by the public, cancelling cheques in pesos and non-remunerated demand deposits in pesos from the non-financial private sector.

M3 Total: Broad aggregate in pesos, includes the current currency held by the public, cancelling checks in pesos and the total deposits in pesos of the public and non-financial private sector.

Private M3: Broad aggregate in pesos, includes the working capital held by the public, cancelling checks in pesos and the total deposits in pesos of the non-financial private sector.

MERVAL: Buenos Aires Stock Market.

MM: Money Market.

N.A.: Annual nominal.

E.A.: Effective Annual.

NOCOM: Cash Clearing Notes.

ON: Negotiable Obligation.

GDP: Gross Domestic Product.

P.B.: basis points.

PSP.: Payment Service Provider.

p.p.: percentage points.

MSMEs: Micro, Small and Medium Enterprises.

ROFEX: Rosario Term Market.

S.E.: No seasonality

SISCEN: Centralized System of Information Requirements of the BCRA.

SIMPES: Comprehensive System for Monitoring Payments of Services Abroad.

TCN: Nominal Exchange Rate

IRR: Internal Rate of Return.

TM20: Interest rate on fixed-term deposits for amounts greater than 20 million pesos and a term of 30 to 35 days.

TNA: Annual Nominal Rate.

UVA: Unit of Purchasing Value

References

1 Corresponds to private M2 excluding interest-bearing demand deposits from companies and financial service providers. This component was excluded since it is more similar to a savings instrument than to a means of payment.

3 Financial Services Providers, Companies and Individuals with deposits of more than $10 million.

4 Includes the working capital held by the public and the deposits in pesos of the non-financial private sector (demand, time and others).

6 Includes current accounts at the BCRA, cash in banks, balances of net passes arranged with the BCRA, holdings of LELIQ and NOTALIQ, and public bonds eligible for reserve requirements.

9 Communication “A” 7574 and Communication “A” 7614.

10 Decree 576/2022 of the National Executive Branch and Communication “A” 7595.

11 For the difference in exchange between the official exchange rate and the rate set for the liquidations of the soybean complex, the National Treasury will integrate a non-transferable bill in dollars, with a rate equivalent to the yield on international reserves and with a term of 10 years.

Table of Contents

Contents

1. Executive Summary

2. Payment Methods

3. Savings instruments in pesos

4. Monetary base

5. Loans in pesos to the private sector

6. Liquidity in pesos of financial institutions

7. Foreign currency

The statistical closing of this report was January 8, 2024. All figures are provisional and subject to revision.

Inquiries and/or comments should be directed to analisis.monetario@bcra.gob.ar

The content of this report may be freely cited as long as the source is clarified: Monetary Report – BCRA.