Política Monetaria

Monthly Monetary Report

March

2025

Monthly report on the evolution of the monetary base, international reserves and foreign exchange market.

Table of Contents

Contents

1. Executive Summary

2. Demand for money

3. Money Creation

4. Foreign currency

1. Executive Summary

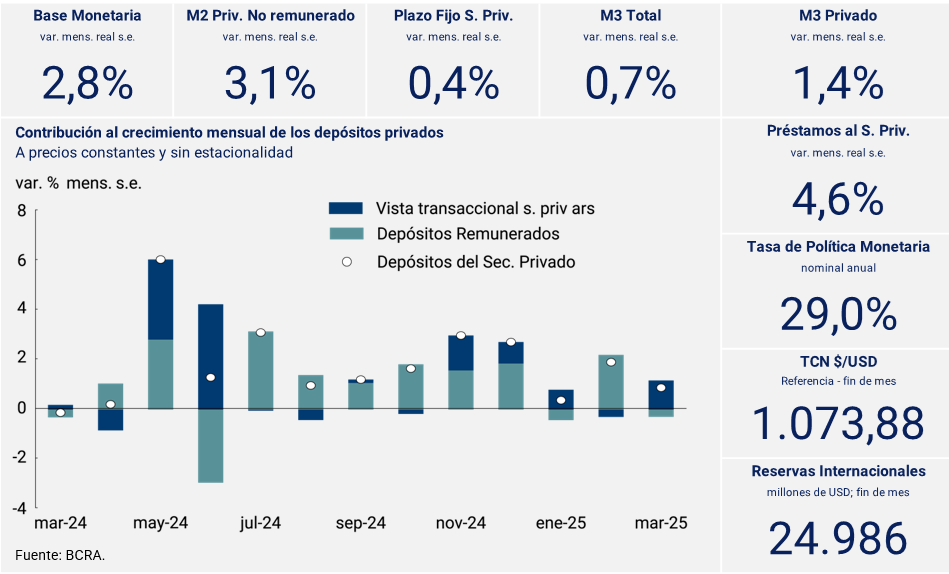

In March, the remonetization process that began in April last year continued. Although in the second half of the month there was high volatility in the financial markets associated with greater exchange rate uncertainty, the broad monetary aggregate (private M3) registered an average monthly increase of $2.9 trillion.

In real terms and without seasonality, private M3 presented a variation of 1.4% monthly average. Unlike what happened in February, the component most linked to means of payment (private transactional M2) was the one that made the greatest contribution to monthly growth, while interest-bearing deposits as a whole (fixed term and sight) contracted. Given the context of greater financial volatility, an increase in the interest rates paid for this type of placement was observed.

The increase in the quantity of money was mainly fueled by the growth of loans to the private sector. The disinflation process, based on a strong commitment to fiscal balance and monetary discipline, has driven a strong recovery in means of payment and credit to the private sector, which accumulated growth in real terms of 117.5% s.e. since the low of early 2024. In particular, growth in March was 4.6% s.e. with a generalized increase at the level of the different lines of financing.

2. Demand for money

In March, the broad monetary aggregate M3 private1showed an average increase of $2.9 trillion, in a month whose second half was characterized by high volatility in the financial markets associated with greater exchange rate uncertainty. At constant prices and adjusted for seasonality, it meant an average monthly growth of 1.4%. In year-on-year terms, private M3 exhibited real growth of 32.7% and as a percentage of GDP it would have stood at 12.8%, 1.1 p.p. above a minimum recorded in March 2024.

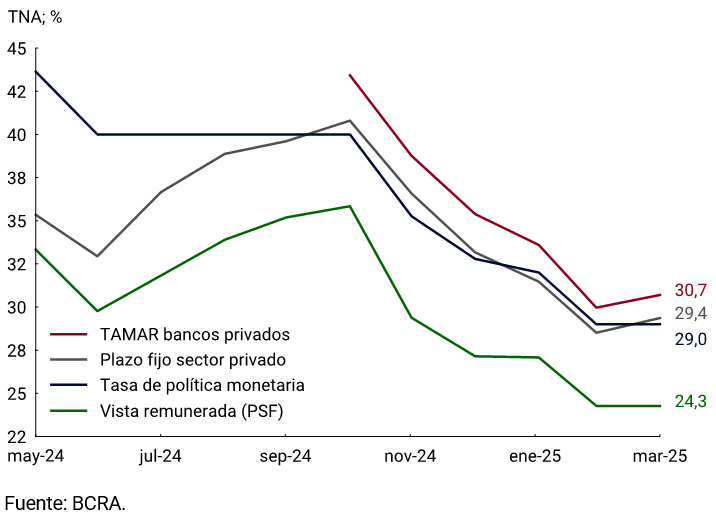

Unlike what happened in February, the component most linked to means of payment (private transactional M2) was the one that made the greatest contribution to the month’s growth. This aggregate grew by an average of 3.1% s.e. in real terms, with an increase in the working capital held by the public and in transactional demand deposits. In the interest-bearing segment, fixed-term loans moderated their monthly growth and registered an average monthly increase of 0.4% s.e. at constant prices (see Figure 2.1). The increase was driven by the holdings of individuals and legal entities (excluding Financial Services Providers). On the other hand, interest-bearing demand deposits experienced a monthly contraction in real terms of 4.6% s.e., which was explained by the carry-over effect of the previous month. In a context of greater financial volatility, passive interest rates increased. The interest rate paid on fixed-term placements to the private sector stood at an average of 29.4% n.a. in the month, 0.9 p.p. above the February figure. A similar behavior was shown by the interest rate paid in the wholesale segment (TAMAR; see Figure 2.2).

3. Money Creation

3.1. Primary creation

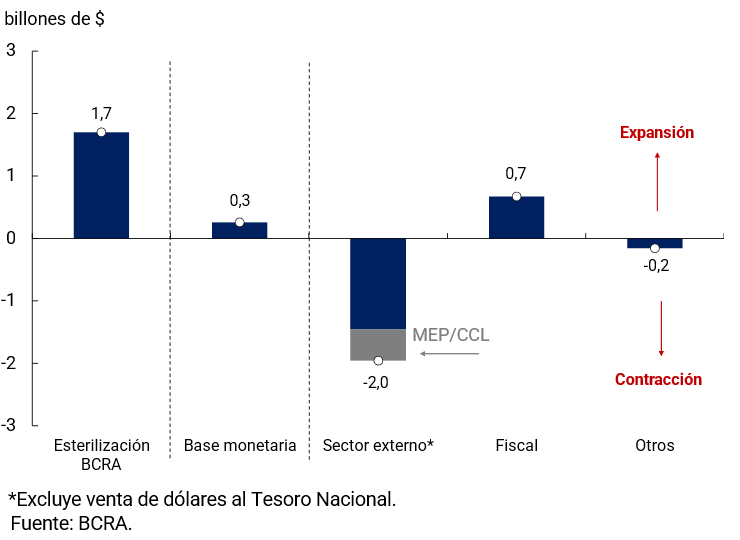

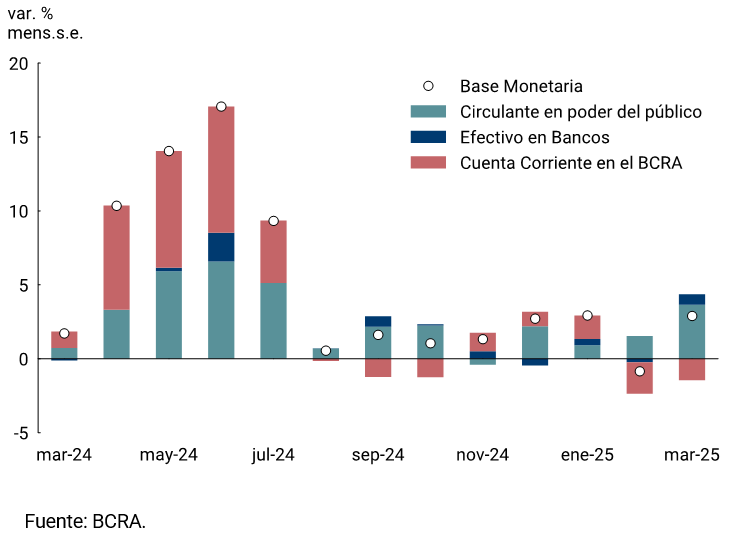

The Monetary Base registered an increase between balances at the end of the month of $0.3 trillion in March (see Figure 3.1.1). The net sale of foreign currency to the private sector was the main factor of contraction. This effect was more than offset by the disarmament of LEFI by financial institutions and public sector operations, as a whole. Regarding the latter, BONTE maturities were met during the month and also the partial renewal of public debt maturities in pesos in tenders with funds from the National Treasury’s account in pesos at the Central Bank.

At constant prices and adjusted for seasonality, the increase in the Monetary Base was 2.8% monthly average, similar to that of December and January. As for its components, the increase was concentrated in the working capital held by the public, while the current account of financial institutions at the BCRA was reduced, as a result of a lower requirement given the fall in demand deposits of the previous month. In terms of GDP, it stood at 3.9%, remaining relatively stable since July last year (see Figure 3.1.2).

For next month, an increase in the demand for the Monetary Base is expected as a result of the reduction by half of the deduction percentages associated with MSME financing, which will imply an increase in the minimum cash requirement2.

3.2. Sequential creation

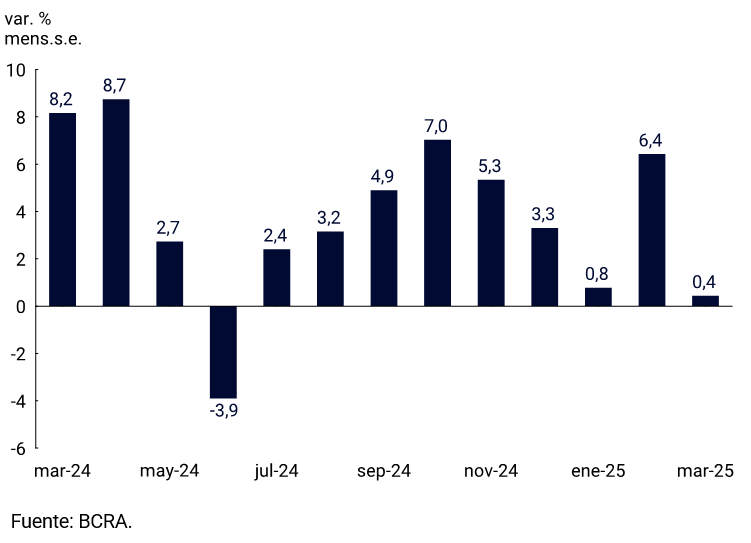

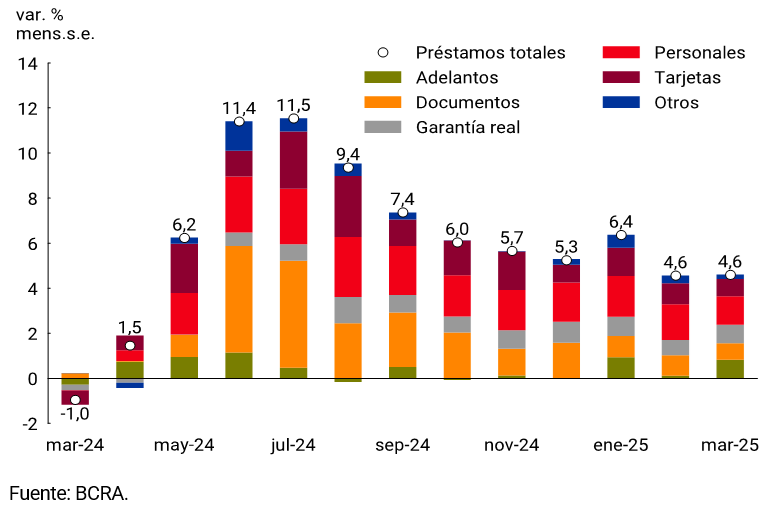

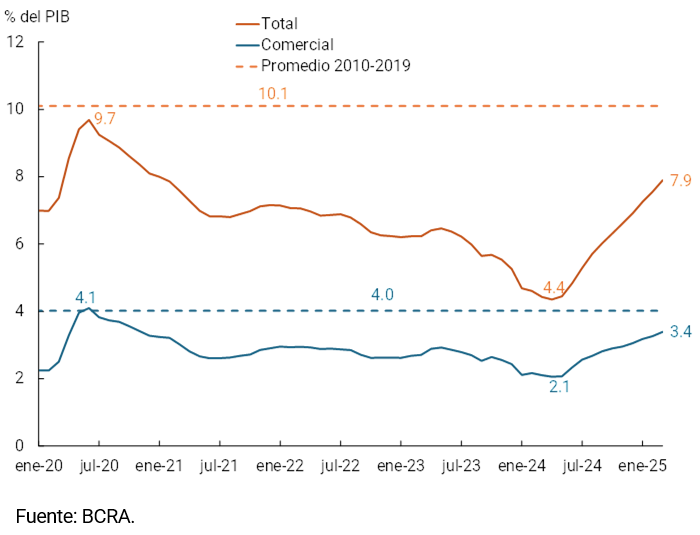

Loans in pesos to the private sector showed an average monthly growth of 4.6% s.e. at constant prices, similar to that of the previous month (see Figure 3.2.1). Thus, credit to the private sector has been growing for 12 consecutive months and accumulates a real increase of 117.5% s.e. compared to the lows of January 2024. In terms of GDP, credit would have reached 7.9%, with an increase of 3.5 p.p. compared to the floor recorded at the beginning of 2024. This is the highest level since the beginning of 2021, following the intensification of credit disintermediation in the context of strong inflationary acceleration at the end of the pandemic (see Figure 3.2.2).

Figure 3.2.1 | Contribution to var. monthly of loans in pesos to the private

sector At constant prices and without seasonality

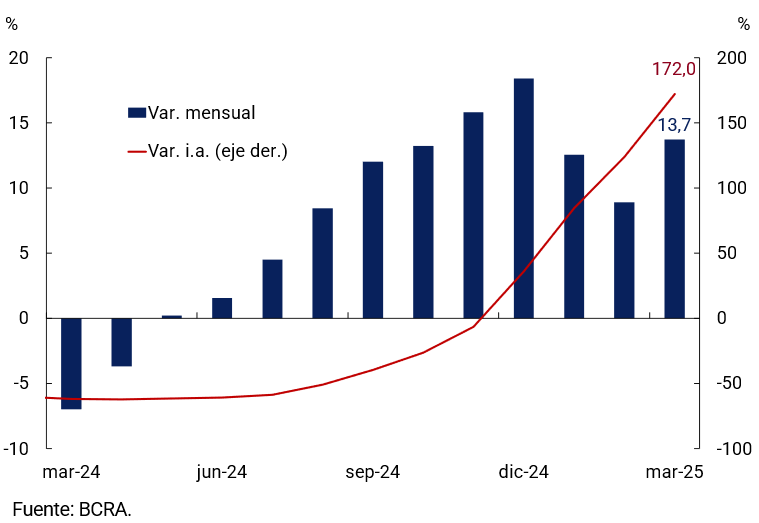

As has been happening in previous months, the expansion of the month was widespread and widespread in the different lines of credit, highlighting in particular the evolution of mortgage loans. In fact, credit for the purchase of homes grew again at double-digit rates (13.7% per month, s.e.) and has already accumulated a real increase of 164.3% in year-on-year terms (see Chart 3.2.3). Title loans also exhibited a positive performance and registered a monthly increase of 5.8% s.e. at constant prices and are already 127.9% above the level of a year ago in real terms. Overall, loans with real collateral showed an increase of 8.7% in real s.e. in March.

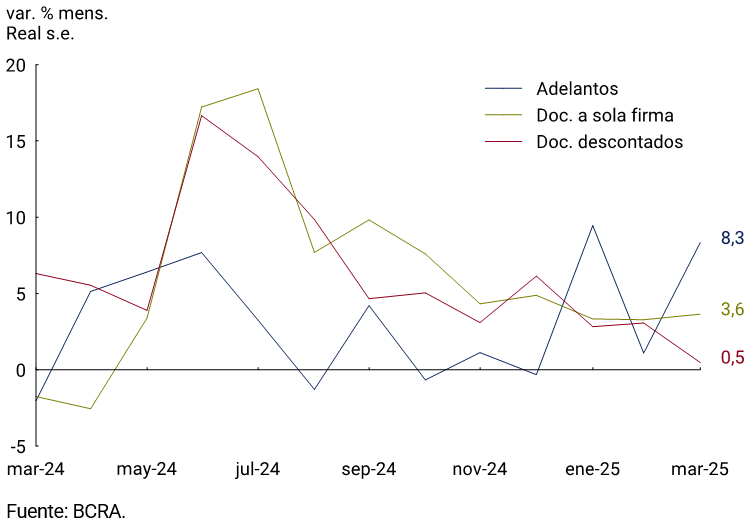

Commercial loans grew in real terms by 4.0% s.e. monthly, standing 88.9% above the March 2024 record. Advances expanded 8.3% per month s.e. in real terms, while loans instrumented through documents grew 2.5% per month s.e. at constant prices (103.5% y.o.y.). With respect to the latter, the boost came from single-signature documents, with a longer average term, whose average monthly variation was 3.6% in real terms, s.e.. Discounted documents, on the other hand, registered a slight increase (0.5% s.e.; see Figure 3.2.4).

Consumer loans continued to show great dynamism, driven by personal loans. This line of credit grew, in real terms, at a somewhat slower rate than in previous months (6.2% s.e.) and in the last 12 months they accumulated an increase of 262.3% in real terms, being the most dynamic line in that period. On the other hand, credit card financing expanded at constant prices by 2.8% per month and accumulated a year-on-year increase of 79.6%.

4. Foreign currency

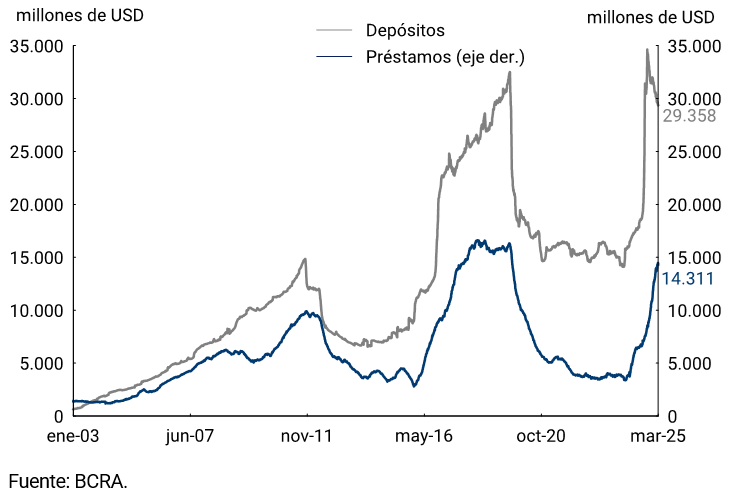

The main assets and liabilities in foreign currency of financial institutions maintained their trend of previous months. On the one hand, private sector deposits registered a drop of USD1,043 million in the month. However, the balance is at historically high levels (USD29,358 million; see Figure 4.1). On the other hand, loans to the private sector grew by USD390 million in the month, driven by trade credit. Thus, the balance reached USD14,311 million, the highest record since October 2019.

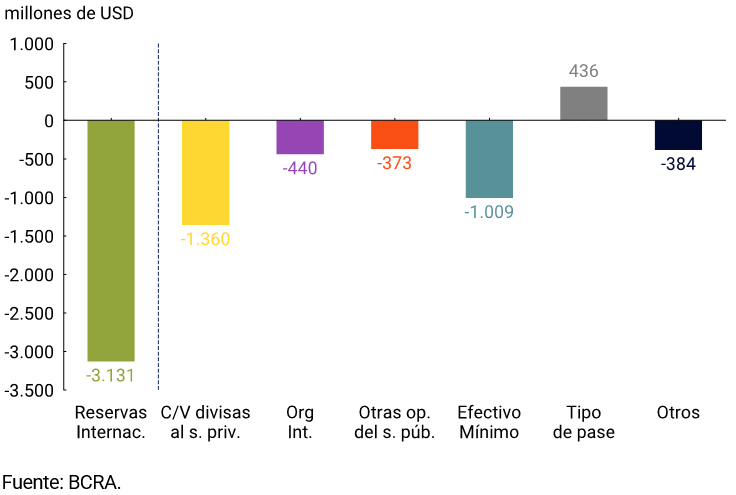

The BCRA’s International Reserves ended March with a balance of USD24,986 million, which implied a decrease of USD3,131 million compared to the previous month. In a context of greater uncertainty and pressure in the foreign exchange market, the net sale of foreign currency to the private sector accounted for just under half of the fall (USD1,360 million; see Figure 4.2). The rest was associated with the month-end movements in the minimum cash accounts in foreign currency and payments of obligations in foreign currency of the National Government.

Glossary

ANSES: National Social Security Administration.

AFIP: Federal Administration of Public Revenues.

BADLAR: Interest rate on fixed-term deposits for amounts greater than one million pesos and a term of 30 to 35 days.

BCRA: Central Bank of the Argentine Republic.

BM: Monetary Base, includes monetary circulation plus deposits in pesos in current account at the BCRA.

BOPREAL Bonds for the Reconstruction of a Free Argentina.

CC BCRA: Current account deposits at the BCRA.

CER: Reference Stabilization Coefficient.

NVC: National Securities Commission.

SDR: Special Drawing Rights.

EFNB: Non-Banking Financial Institutions.

EM: Minimum Cash.

FCI: Common Investment Fund.

IMF: International Monetary Fund.

A.I.: Year-on-year .

IAMC: Argentine Institute of Capital Markets

CPI: Consumer Price Index.

ITCNM: Multilateral Nominal Exchange Rate Index

ITCRM: Multilateral Real Exchange Rate Index

LECAP: National Treasury Bills Capitalizable in Pesos.

LFIP: Financing Line for Productive Investment.

M2 Total: Means of payment, which includes working capital held by the public, cancelling cheques in pesos and demand deposits in pesos from the public and non-financial private sector.

Private M2: Means of payment, includes working capital held by the public, cancelling cheques in pesos and demand deposits in pesos from the non-financial private sector.

Private transactional M2: Means of payment, includes working capital held by the public, cancelling cheques in pesos and non-remunerated demand deposits in pesos from the non-financial private sector.

M3 Total: Broad aggregate in pesos, includes the current currency held by the public, cancelling checks in pesos and the total deposits in pesos of the public and non-financial private sector.

Private M3: Broad aggregate in pesos, includes the working capital held by the public, cancelling checks in pesos and the total deposits in pesos of the non-financial private sector.

MSMEs: Micro, Small and Medium Enterprises.

MERVAL: Buenos Aires Stock Market.

MM: Money Market.

MLC: Free Exchange Market.

N.A.: Annual nominal.

E.A.: Effective Annual.

NOCOM: Cash Clearing Notes.

ON: Negotiable Obligation.

GDP: Gross Domestic Product.

P.B.: basis points.

PSP.: Payment Service Provider.

p.p.: percentage points.

ROFEX: Rosario Term Market.

S.E.: No seasonality

SISCEN: Centralized System of Information Requirements of the BCRA.

SIMPES: Comprehensive System for Monitoring Payments of Services Abroad.

TCN: Nominal Exchange Rate

IRR: Internal Rate of Return.

TM20: Interest rate on fixed-term deposits for amounts greater than 20 million pesos and a term of 30 to 35 days.

TNA: Annual Nominal Rate.

UVA: Unit of Purchasing Value

References

1 The private M3 includes the working capital held by the public and the deposits in pesos of the non-financial private sector (demand, time and others).

2 See Communication “A” 8159.