Política Monetaria

Monthly Monetary Report

February

2023

Monthly report on the evolution of the monetary base, international reserves and foreign exchange market.

Table of Contents

Contents

1. Executive Summary

2. Payment Methods

3. Savings instruments in pesos

4. Monetary base

5. Loans in pesos to the private sector

6. Liquidity in pesos of financial institutions

7. Foreign currency

The statistical closing of this report was January 8, 2024. All figures are provisional and subject to revision.

Inquiries and/or comments should be directed to analisis.monetario@bcra.gob.ar

The content of this report may be freely cited as long as the source is clarified: Monetary Report – BCRA.

1. Executive Summary

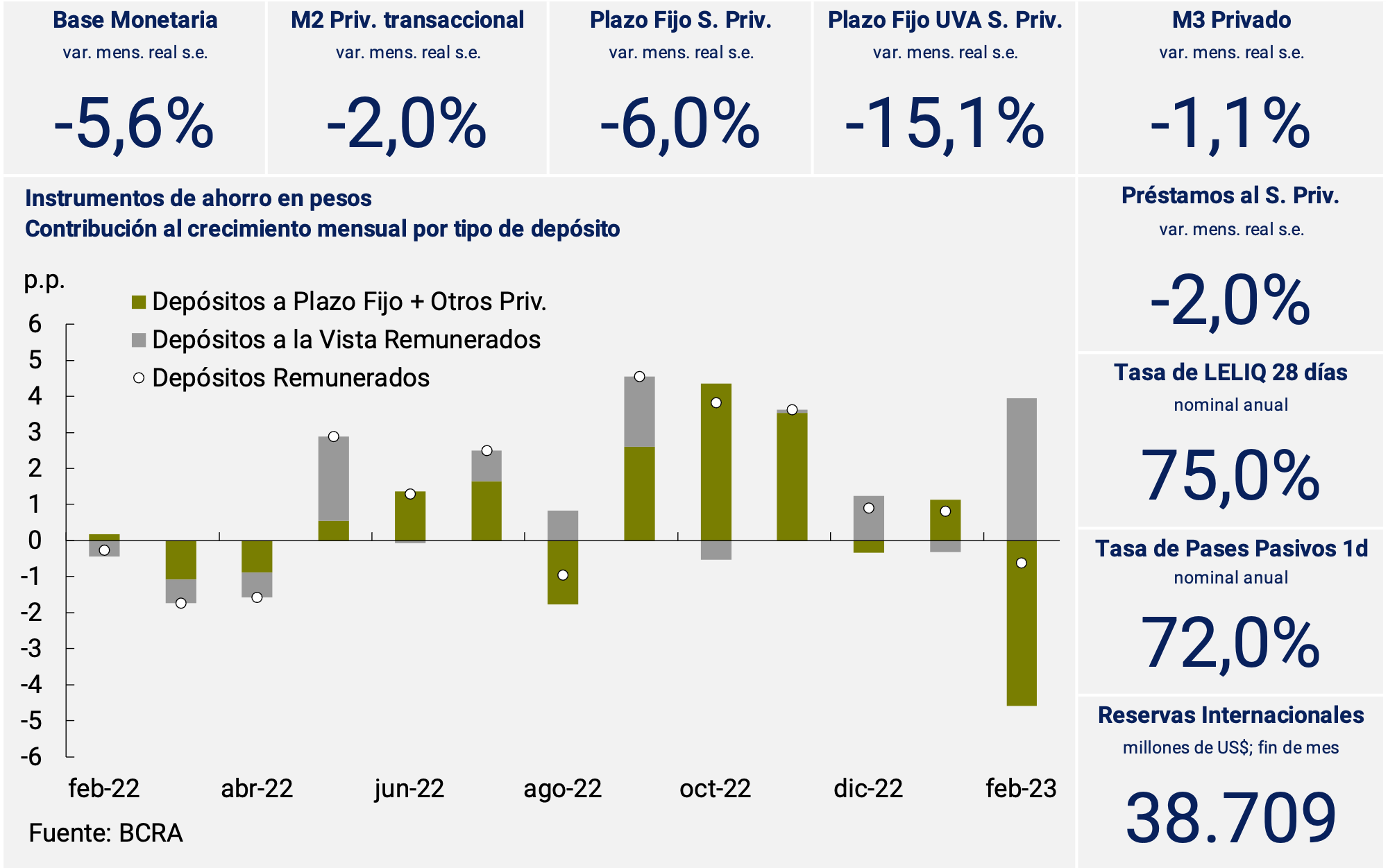

The broad monetary aggregate (private M3) at constant prices and without seasonality would have registered a contraction in the second month of the year, which was explained both by the behavior of means of payment and fixed-term deposits.

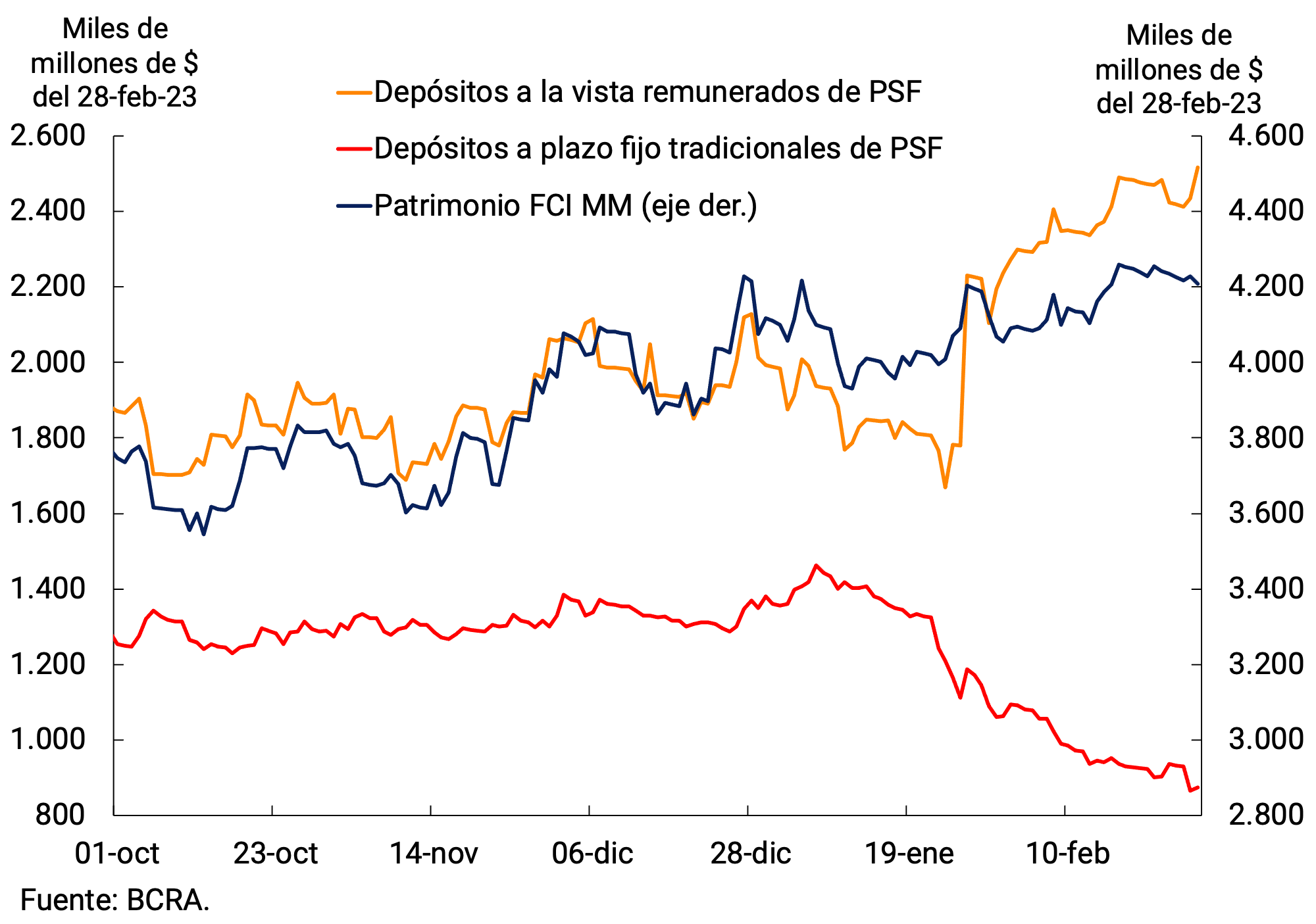

The fall in fixed-term deposits in pesos in the private sector was concentrated in the wholesale segment and was explained by a portfolio rebalancing of the Money Market Mutual Funds (FCI MM), which channeled their funds into interest-bearing demand deposits. The change in the composition of the assets of the FCI MM occurred in a context in which the yield of demand placements, for these agents, became at levels similar to that of fixed-term placements.

Despite the fall recorded in the month, fixed-term deposits continue to be around the highest values in recent decades and at a record similar to the maximum of the pandemic in terms of Output.

Finally, loans to the private sector at constant prices and without seasonality would have registered a new monthly contraction. The Financing Line for Productive Investment allowed credit to MSMEs in terms of GDP to remain above the pre-pandemic record and above its historical average.

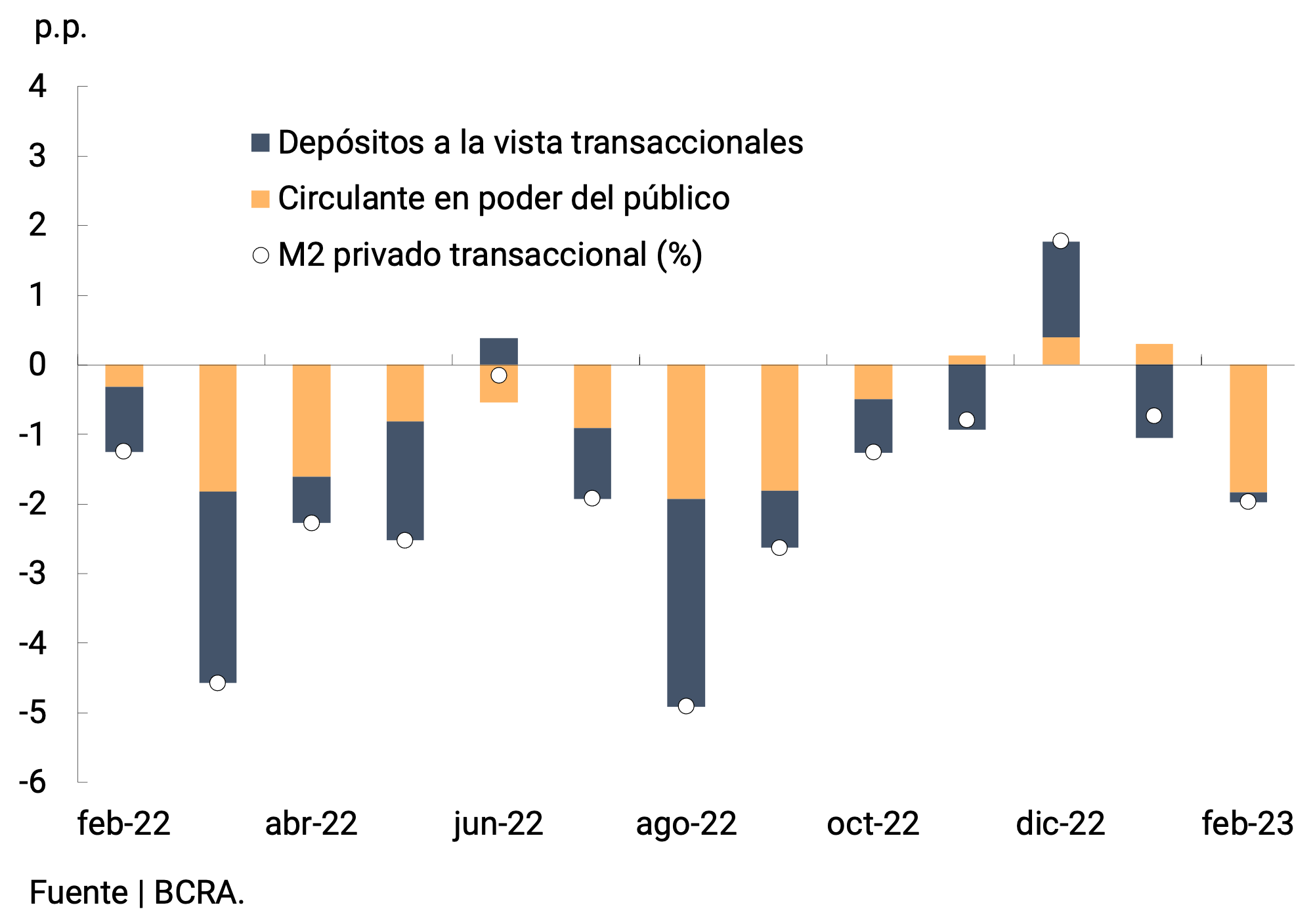

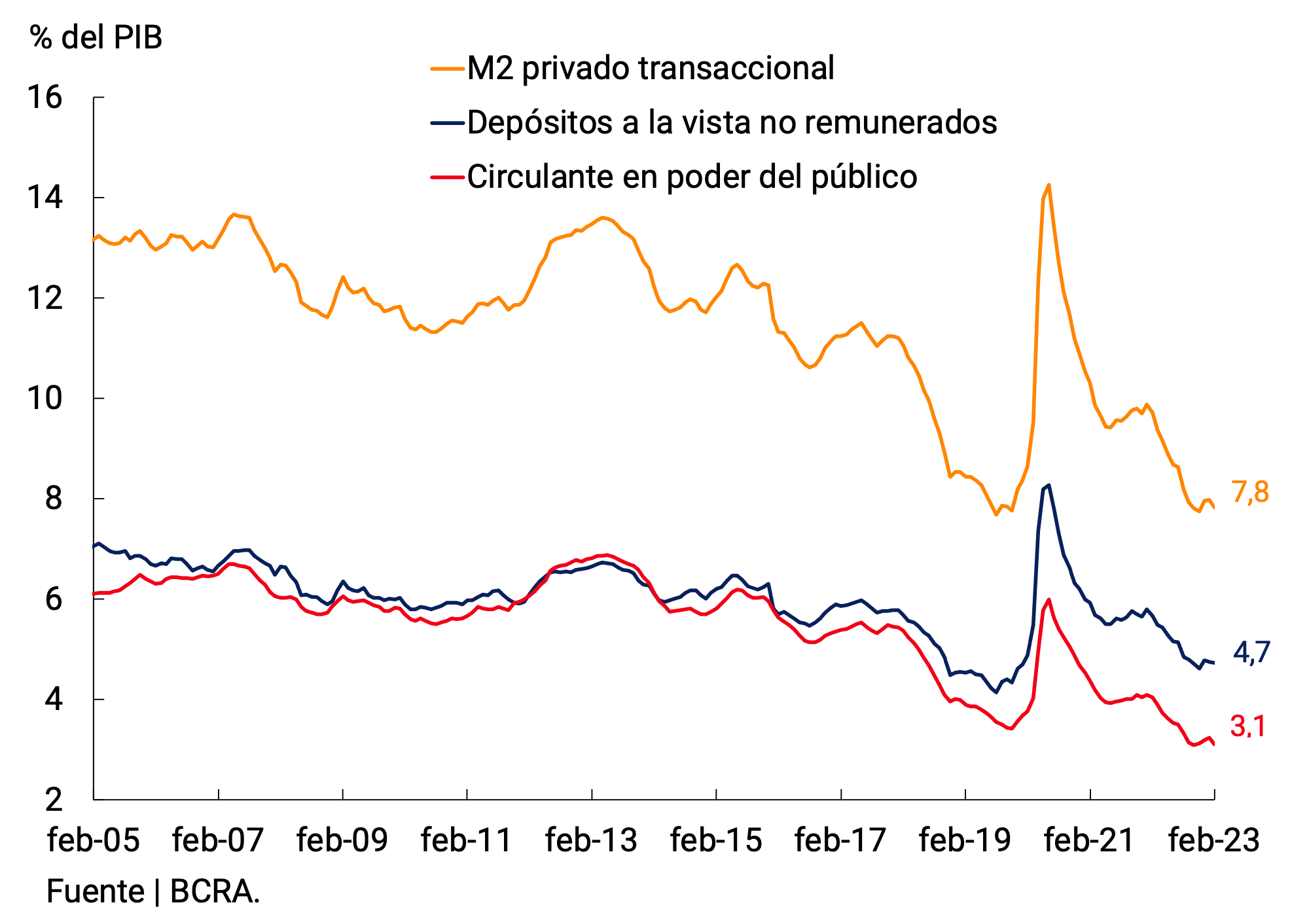

2. Payment methods

Means of payment (private transactional M21), in real and seasonally adjusted terms (s.e.), would have registered a decrease of 2.0% in February. This dynamic was mainly due to the behavior of working capital held by the public, while non-interest-bearing demand deposits registered a slight negative contribution to the variation for the month (see Chart 2.1). In the year-on-year comparison, and at constant prices, the transactional private M2 would be 20% below the level of February 2022. As a Product ratio, means of payment would have stood at 7.8%, showing a decrease (0.2 p.p.) compared to the previous month (see Graph 2.2). Both components of the means of payment remain in terms of GDP at around the lowest levels of the last 20 years.

Figure 2.1 | Private transactional M2 at constant

prices Contribution by component to the monthly vari. s.e.

3. Savings instruments in pesos

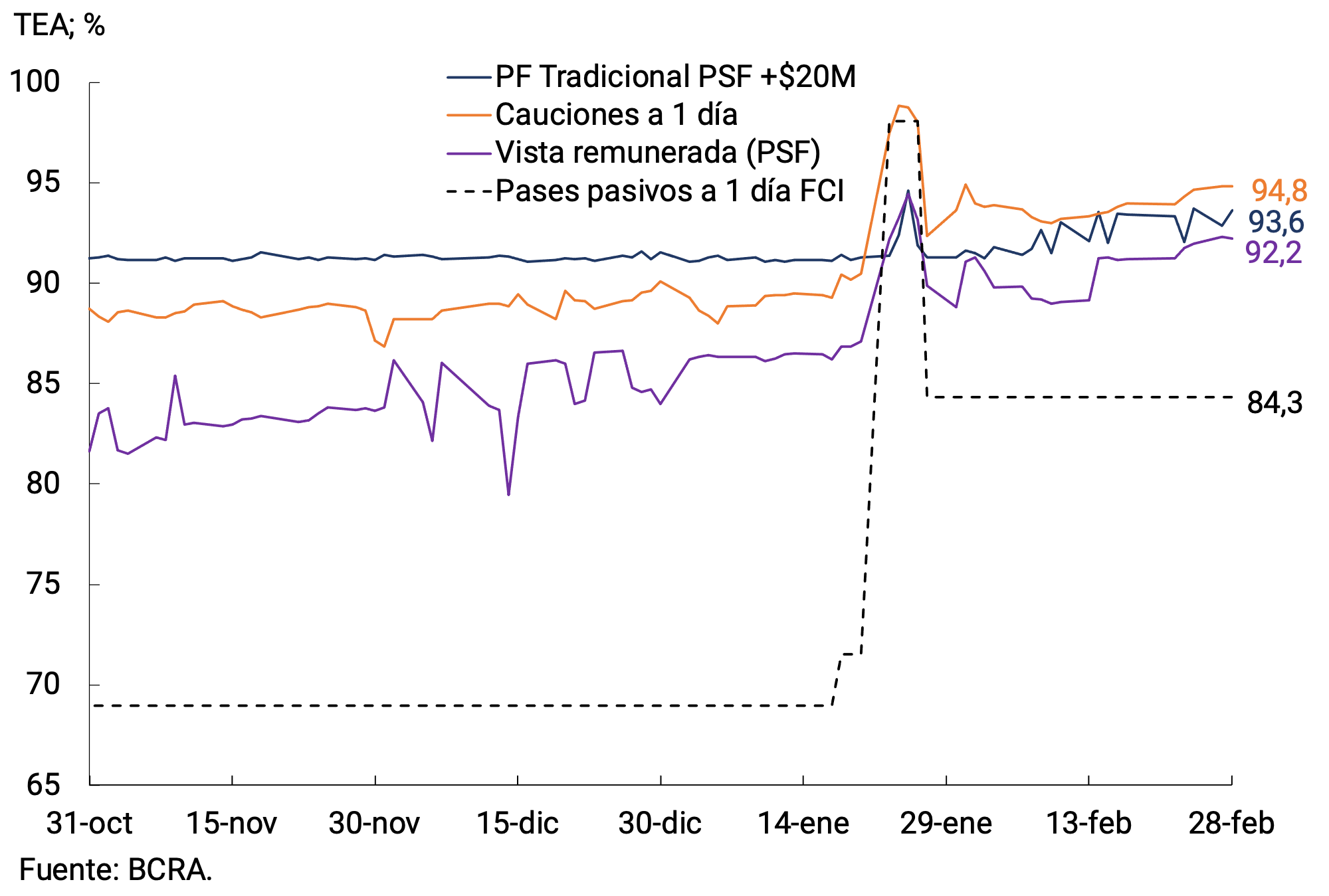

The Board of Directors of the BCRA decided to maintain unchanged the minimum guaranteed interest rates on fixed-term deposits in the second month of the year, noting 5 consecutive periods without modification2. The decision was made considering that the real return on investments in local currency remains in positive territory and the short-term outlook for inflation. Thus, the minimum guaranteed rate for placements of individuals for up to an amount of $10 million remained at 75% n.a. (107.05% e.a.), while for the rest of the depositors of the financial system the interest rate persisted at 66.5% n.a. (91.07% e.a.)3.

Fixed-term deposits in pesos of the private sector would have registered a contraction of 6.0% s.e. in February at constant prices. Even though term placements showed a decrease in the month, at constant prices they still remained around the highest levels in recent decades. As a percentage of GDP, these deposits would have stood at 7.3% in February (0.4 p.p. less than in January).

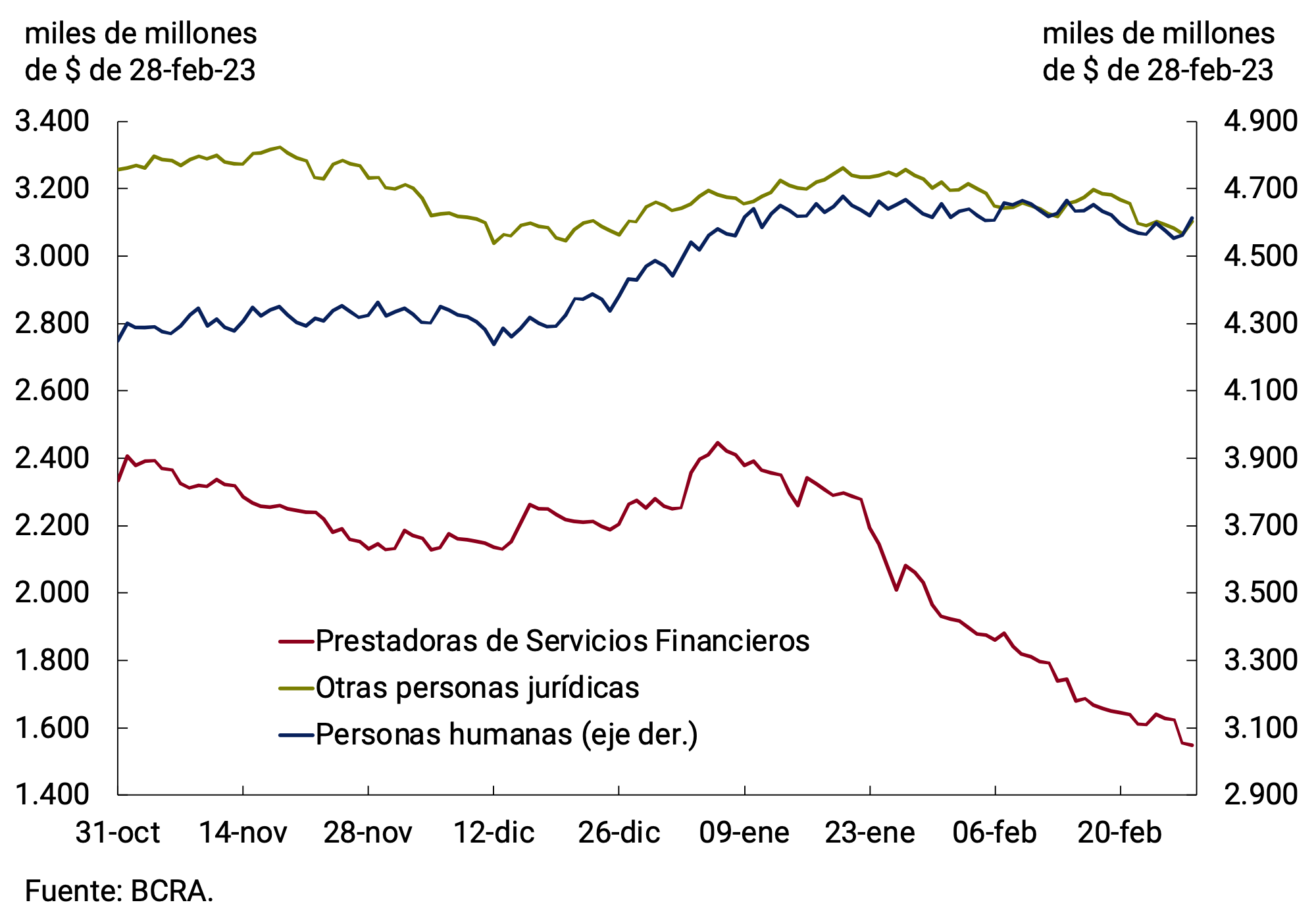

The Financial Services Providers (FSPs) explained the monthly fall in fixed-term instruments. The Money Market FCIs, which are the main agents in terms of movement of deposits within the PSFs and operate mainly in the segment of more than $20 million, carried out a rotation in the composition of their portfolio in favor of shorter-term interest-bearing instruments. This led to a fall in its positions in term placements and an increase in interest-bearing demand deposits (22.4% at constant prices), which in mid-February already represented approximately 65% of its portfolio (see Figure 3.1). This portfolio rebalancing occurred in a context in which the performance of demand loans for these agents was at levels similar to that of fixed-term loans (see Figure 3.2).

The rest of the companies (excluding PSFs), which also operate in the wholesale segment, registered a slight decrease in their holdings. On the other hand, individuals, who operate mostly in the segment of less than $20 million, maintained their holdings without major changes (see Figure 3.3).

The rest of the companies (excluding PSFs), which also operate in the wholesale segment, registered a slight decrease in their holdings. On the other hand, individuals, who operate mostly in the segment of less than $20 million, maintained their holdings without major changes (see Figure 3.3).

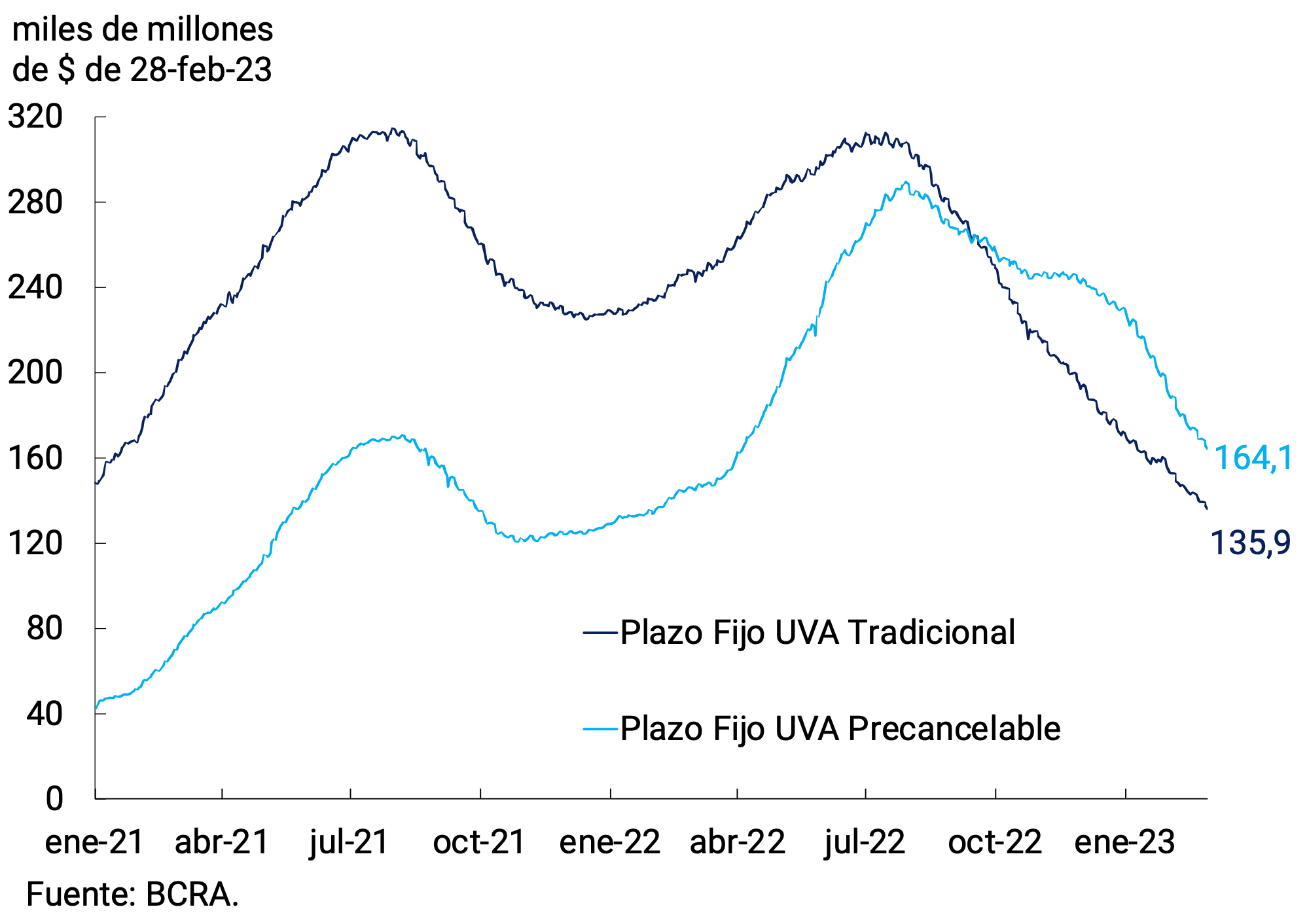

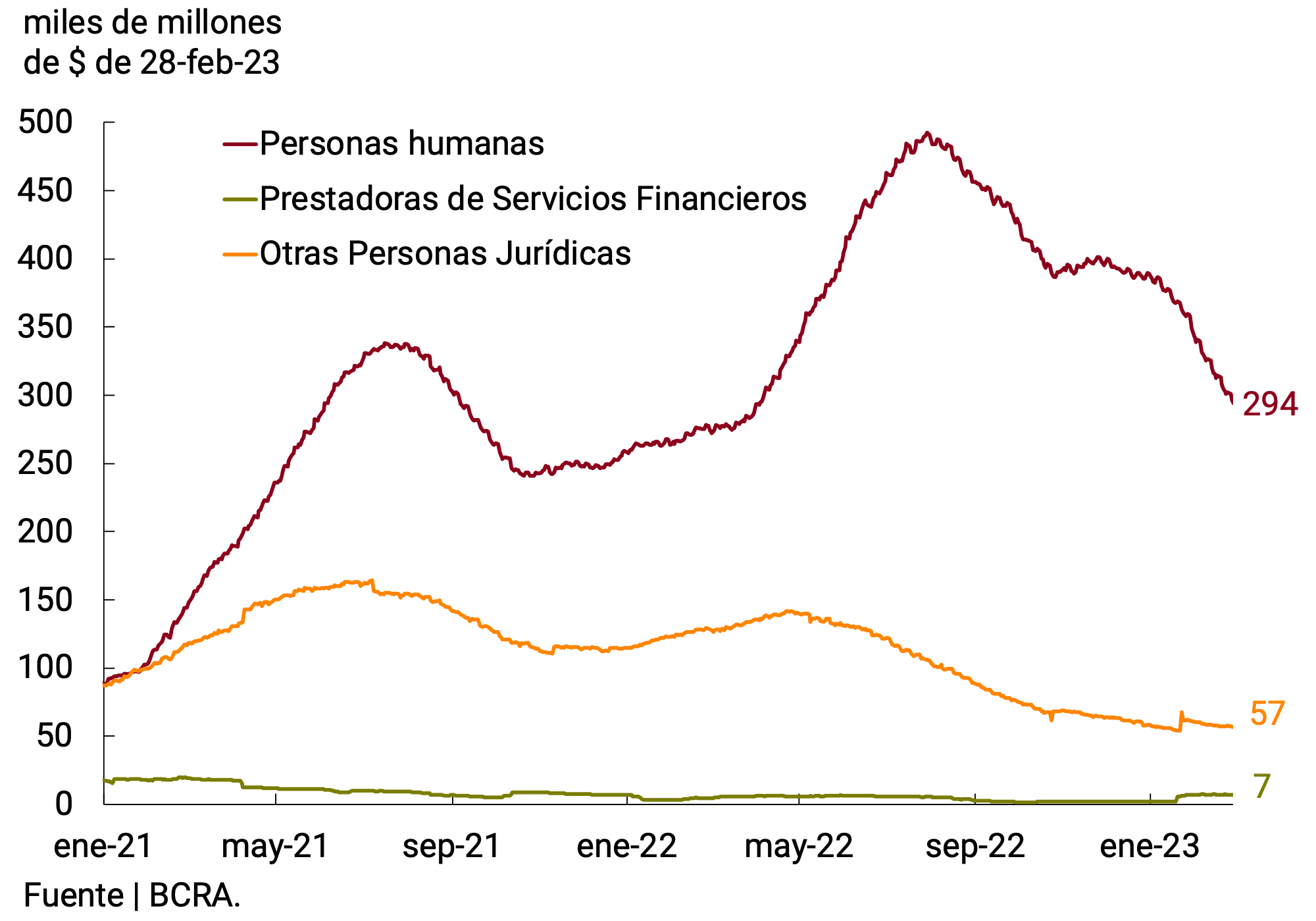

The segment of fixed-term deposits adjustable by CER exhibited a new contraction in real terms, accumulating 7 consecutive months of declines. The decrease was verified in both traditional and pre-cancellable UVA placements, whose monthly rates of change were -11.8% s.e. and -17.6% s.e. respectively (see Figure 3.4). Differentiating by type of holder, it can be seen that the fall was almost entirely explained by the dynamics of placements by individuals, which account for about 85% of the total (see Figure 3.5). All in all, UVA deposits reached a balance of $300,000 million at the end of February, which represented 3.5% of the total of term instruments denominated in domestic currency.

Figure 3.4 | Fixed-term deposits in UVA of the private

sector Balance at constant prices by type of instrument

All in all, the broad monetary aggregate, private M3, at constant prices and adjusted for seasonality, would have exhibited a monthly fall of 1.1% in February. 4 In the year-on-year comparison, this aggregate would have experienced a decrease of 3.2% and as a percentage of GDP it would have stood at 17.5%, 0.2 p.p. below the previous month’s record and at a level similar to the 2010-19 average.

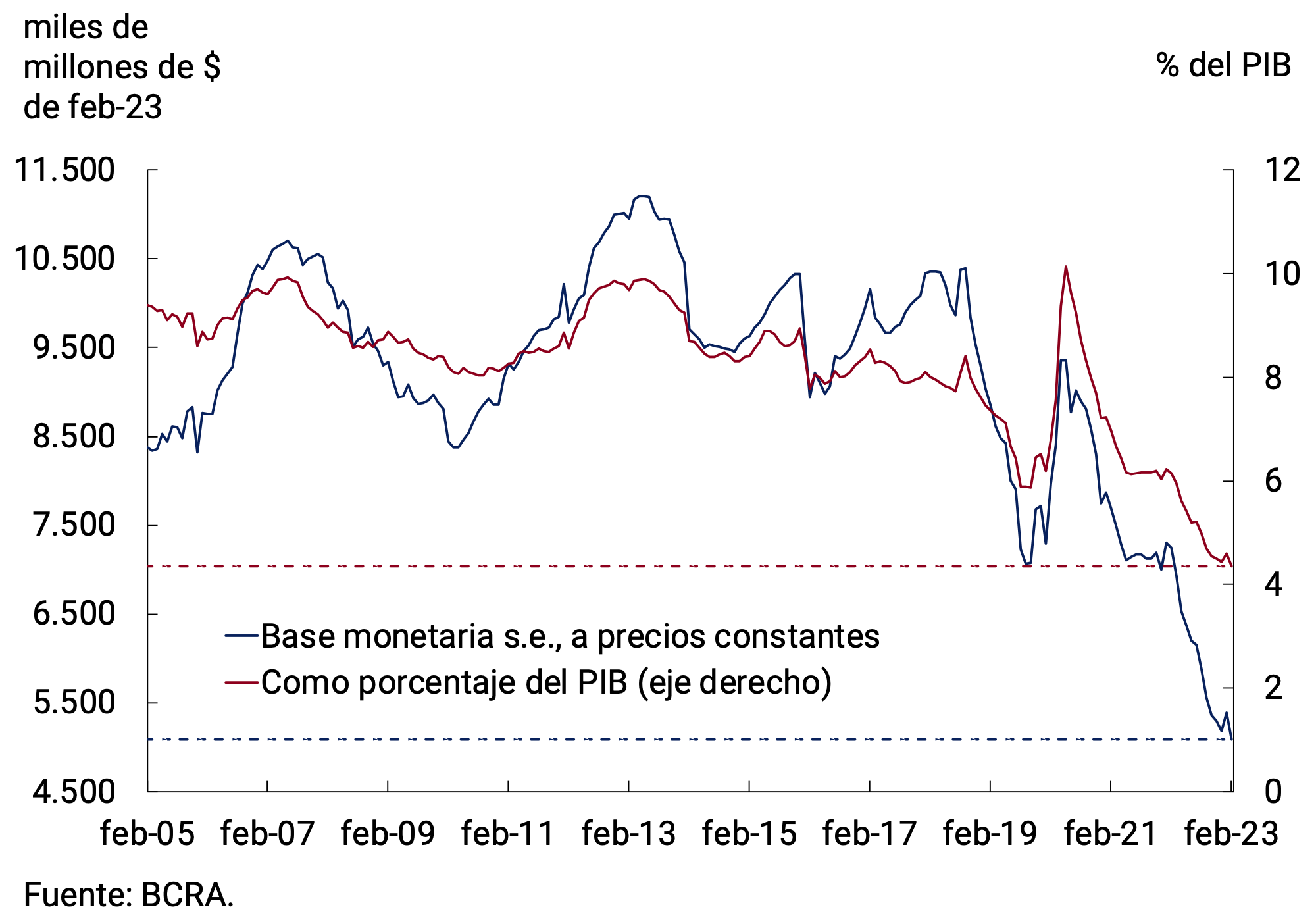

4. Monetary base

The Monetary Base stood at an average of $5,242.2 billion in February, which implied a monthly contraction of 0.9% ($49,072 million) in the original series at current prices. Adjusted for seasonality and at constant prices, it would have exhibited a contraction of 5.6% and in the last twelve months it would accumulate a fall of the order of 30%. In terms of GDP, the Monetary Base would stand at 4.4%, 0.2 p.p. below the value recorded the previous month and around the lowest values since the exit from convertibility (see Chart 4.1).

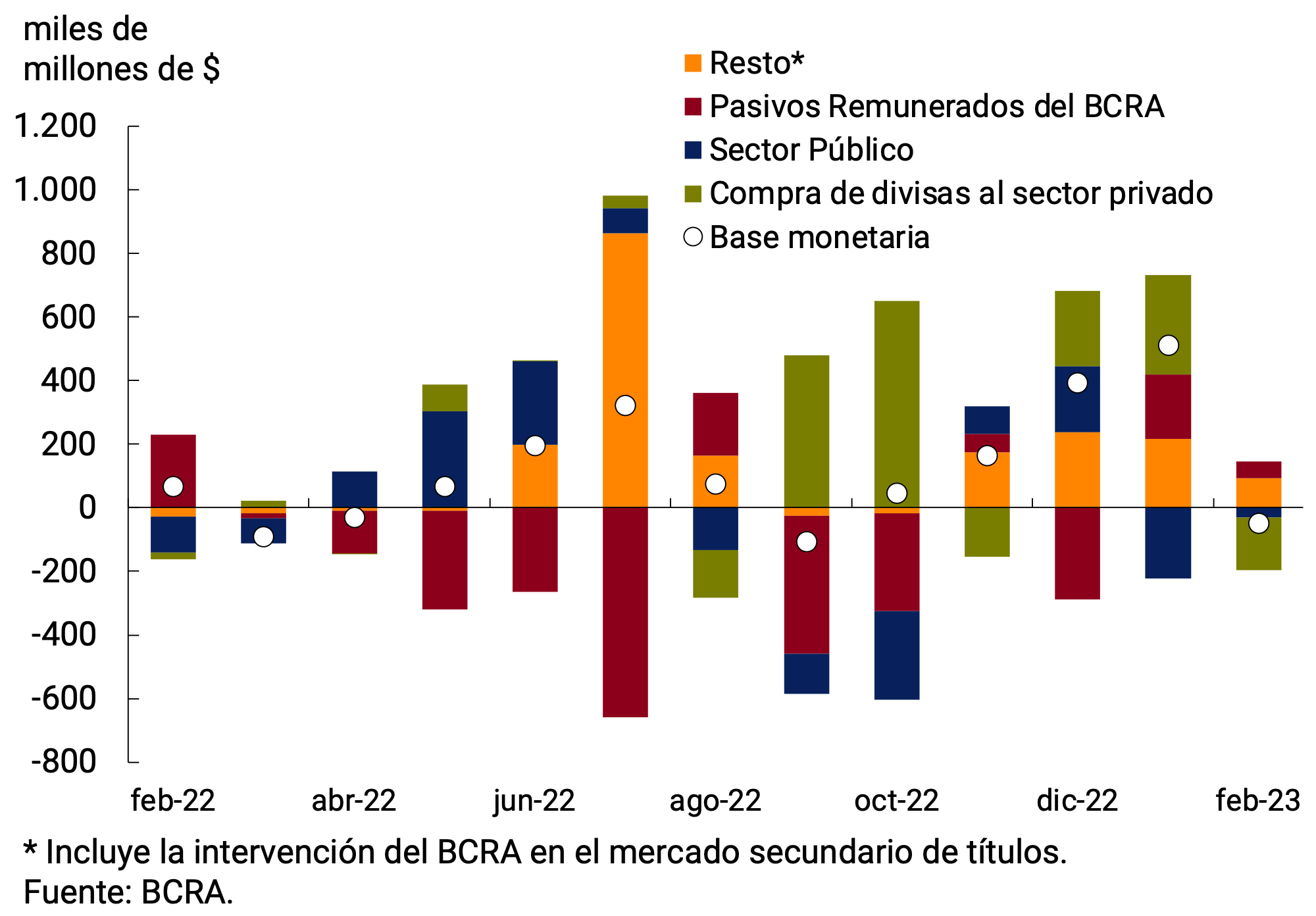

On the supply side, among the factors that contributed positively to the monthly variation of the monetary base are the BCRA’s purchases in the secondary market of public securities, which the BCRA continued to carry out with the aim of limiting the excessive volatility of the market of public debt securities, and the effect of the interest on the BCRA’s monetary regulation instruments. These effects were more than offset by the contractionary effect of net foreign exchange sales to the private sector and, to a lesser extent, public sector operations (see Figure 4.2).

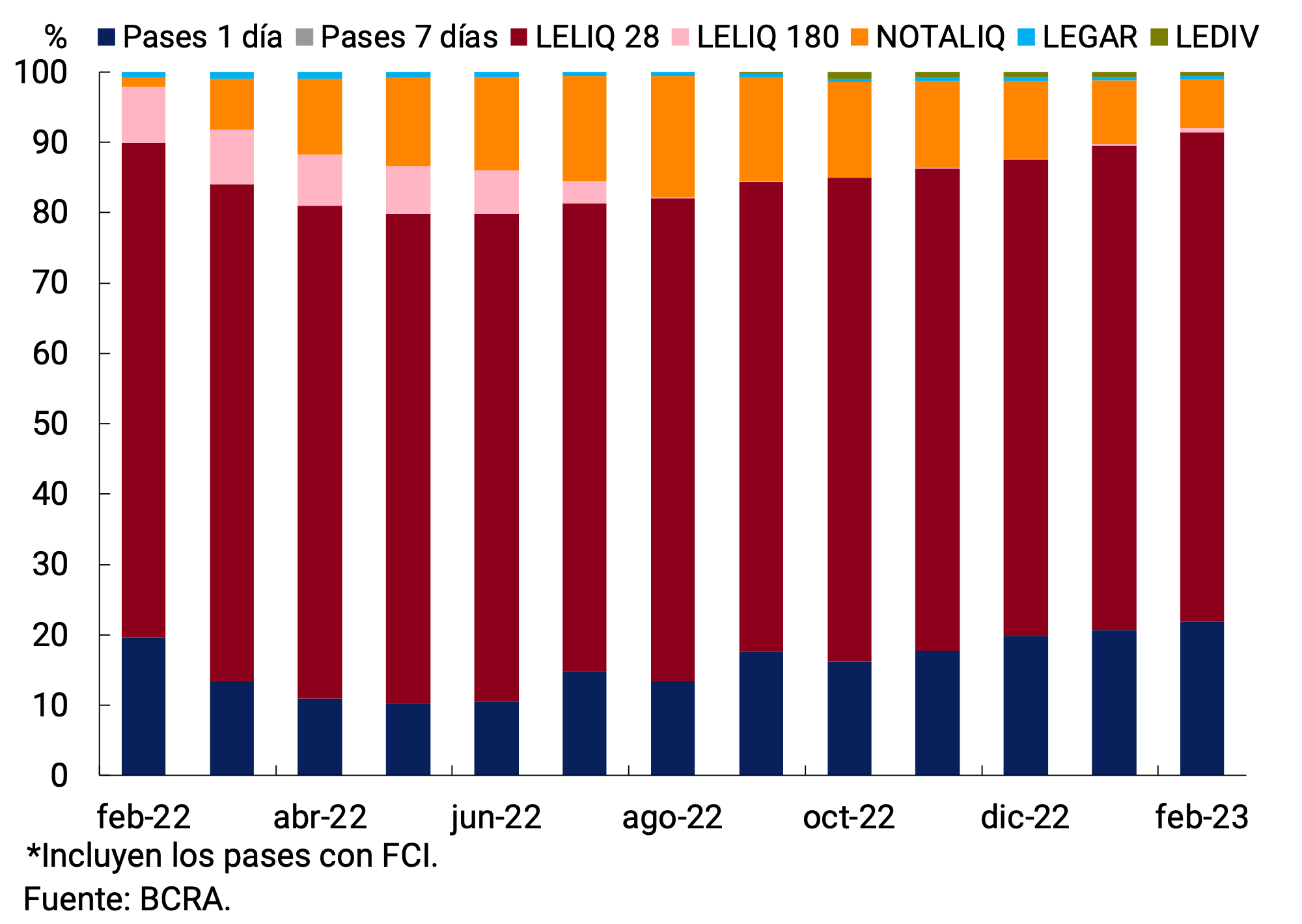

The BCRA kept its benchmark interest rates unchanged in February , considering that they continue to be in positive territory in real terms. Thus, the interest rate on the 28-day LELIQ remained at 75% n.a. (107.35% y.a.), while the interest rate on the 180-day LELIQ remained at 83.5% n.a. (101.23% y.a.). As for shorter-term instruments, the interest rate on 1-day pass-by-passes stands at 72% n.a. (105.3% y.a.); while the interest rate on 1-day active passes stands at 97% n.a. (163.5% y.a.). Finally, the spread of the NOTALIQ in the last auction of the month was set at 8.5 p.p.

With the current configuration of instruments, in February the remunerated liabilities were conformed, on average, to around 70% by LELIQ with a 28-day term. The longer-term species accounted for 7.5% of the total, almost entirely concentrated in NOTALIQ. Meanwhile, 1-day pass-by-passes increased their share of total instruments, representing 21.9% of the total (1.2 p.p. more than the previous month). The rest was made up of LEDIV and LEGAR, which slightly decreased their participation compared to January (see Figure 4.3).

5. Loans to the private sector

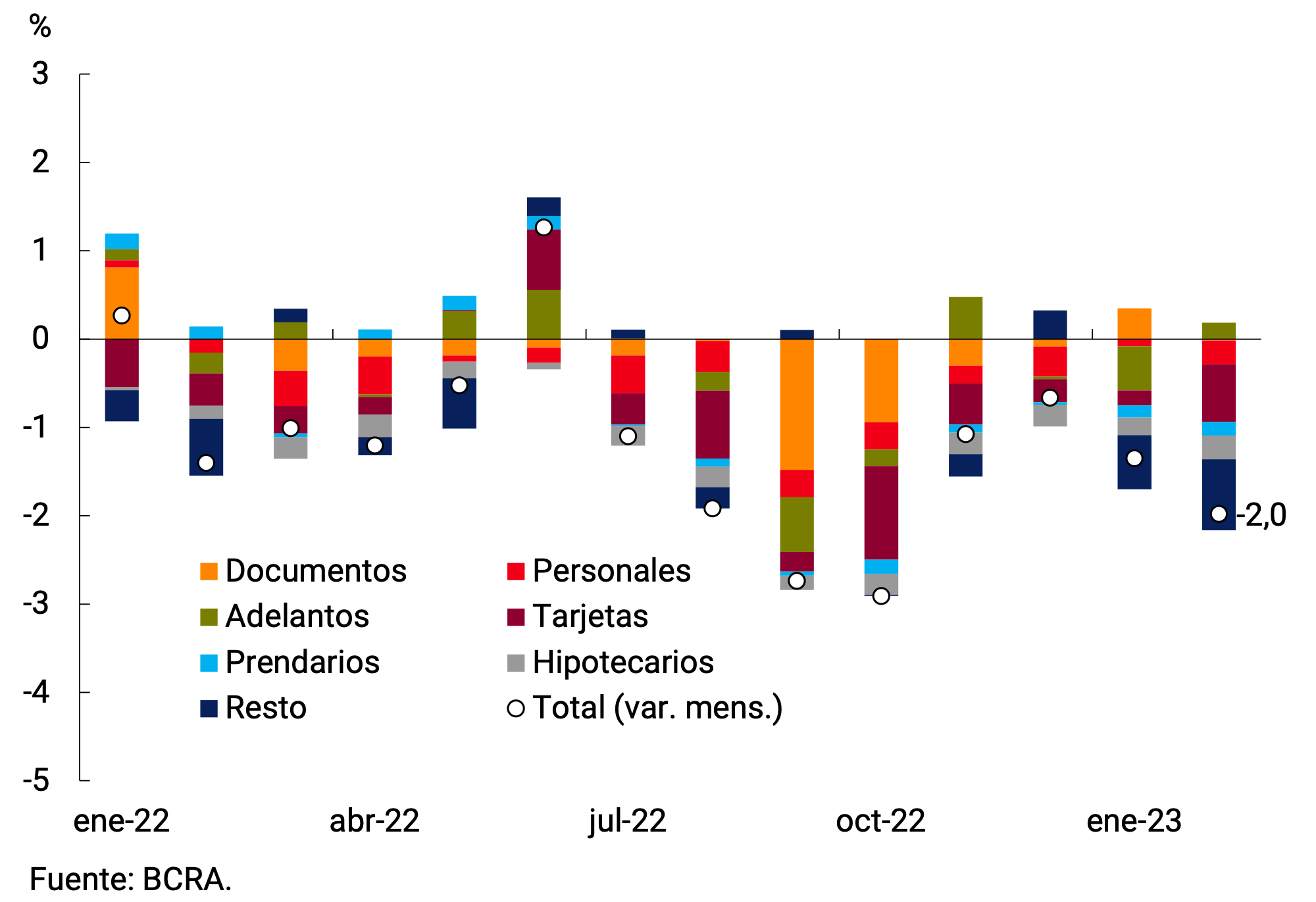

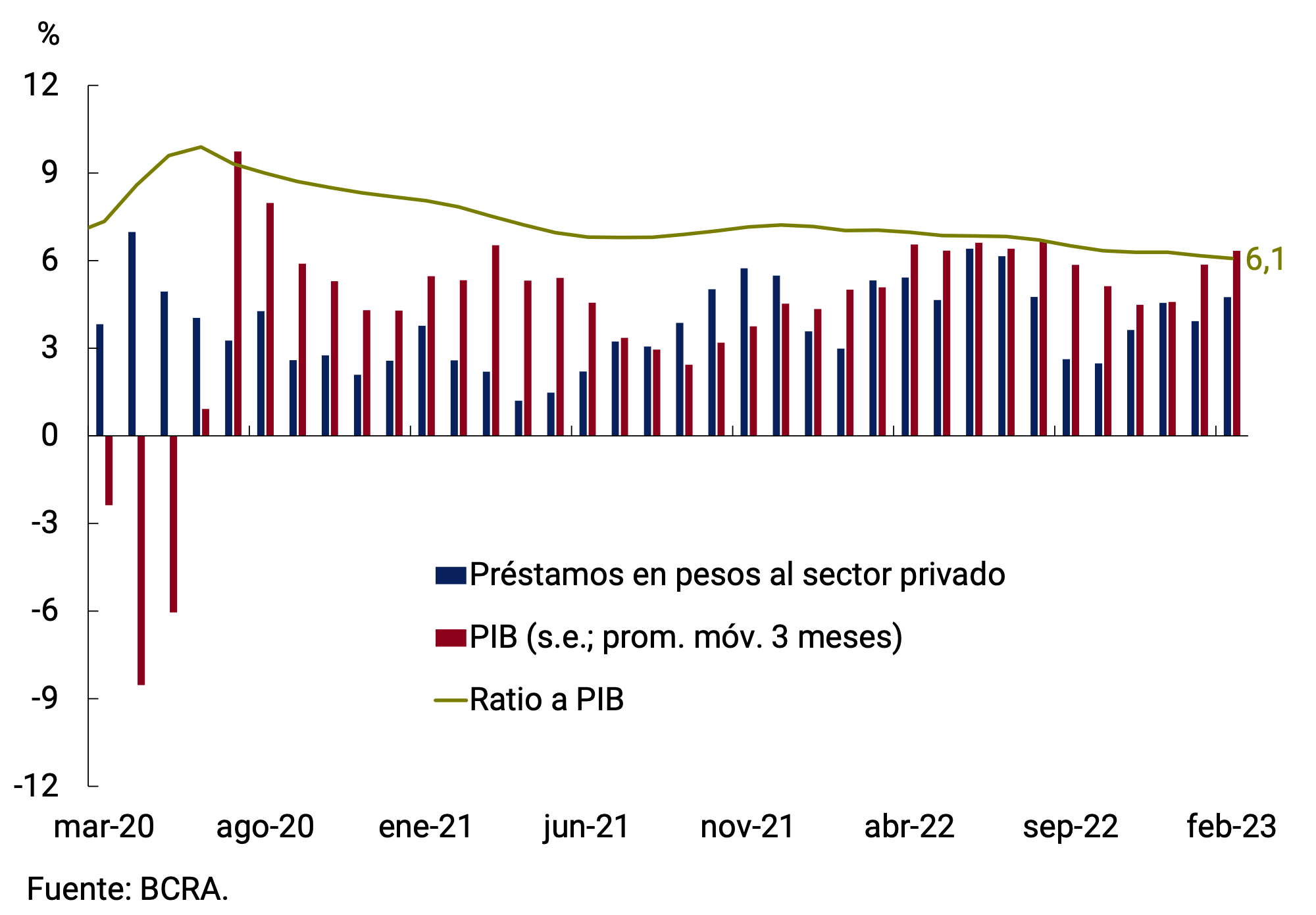

In February, loans in pesos to the private sector measured in real terms and without seasonality would have registered a monthly fall of 2.0%, accumulating eight consecutive months of contraction. The decline occurred in virtually all funding lines with the exception of advances (see Figure 5.1). In the last 12 months, bank financing has accumulated a fall of 14.2% in real terms. Thus, loans in pesos to the private sector measured in terms of current GDP fell in the month and stood at 6.1% (see Figure 5.2).

Figure 5.1 | Loans in pesos to the private

sector Real without seasonality; contribution to monthly growth

When observing the evolution of loans by type of financing, lines mainly for commercial purposes showed, in real terms, a decrease of 0.3% per month s.e. and 11.8% y.o.y. Financing granted through advances would have exhibited an increase at constant prices of 1.7% s.e. in the month. This dynamic was offset by the behavior of documents and other commercial loans, which would have registered a fall compared to January of 0.1% s.e. and 5.8% s.e., respectively.

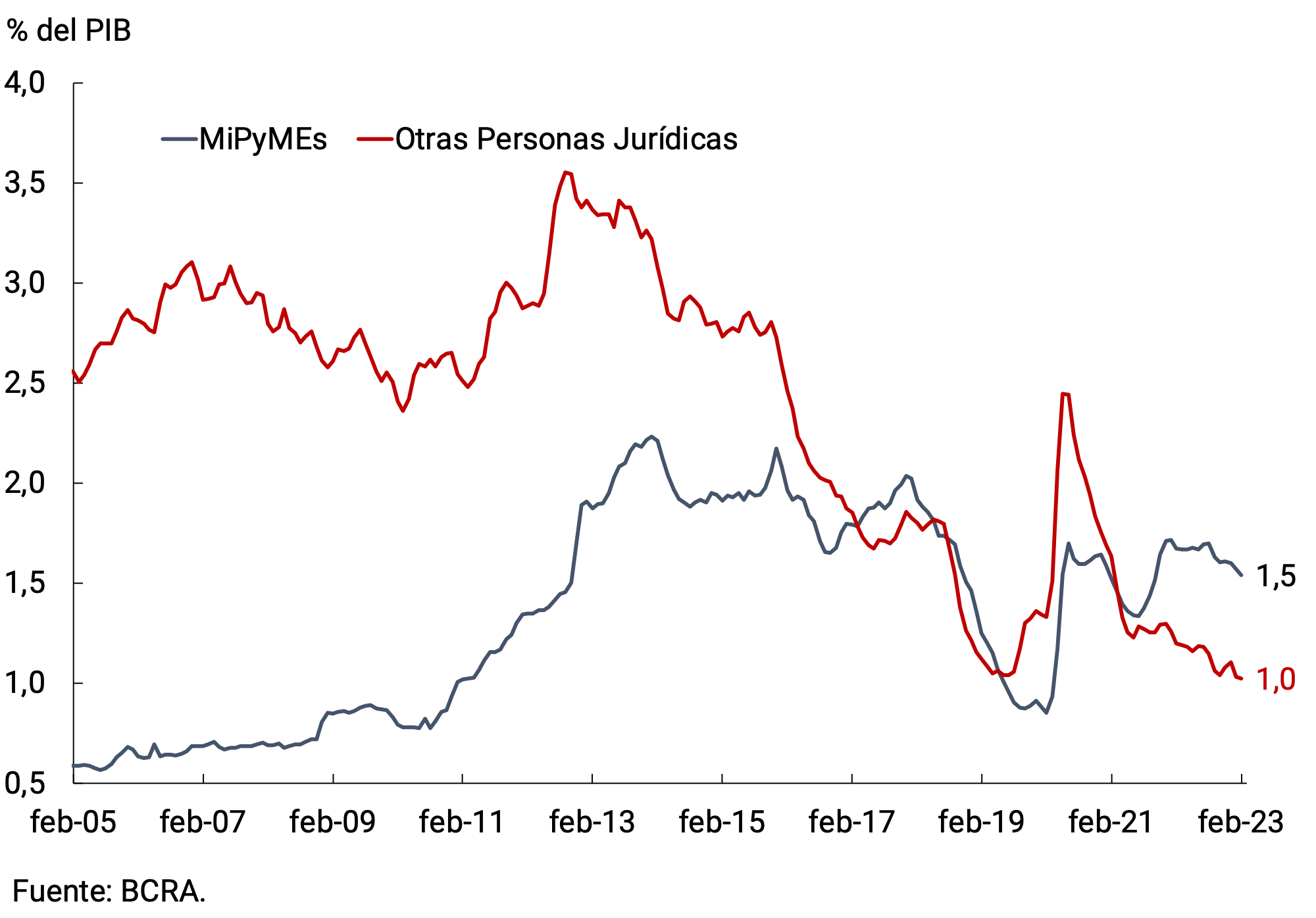

Distinguishing commercial credit by type of debtor, so far this year, there has been a contraction in financing to MSMEs in the order of 9% YoY at constant prices and 16% YoY for large companies. However, in terms of GDP, credit to relatively smaller companies was above the pre-pandemic record and above its historical average. By contrast, for large firms, the credit-to-GDP ratio is at an all-time low (see Figure 5.3).

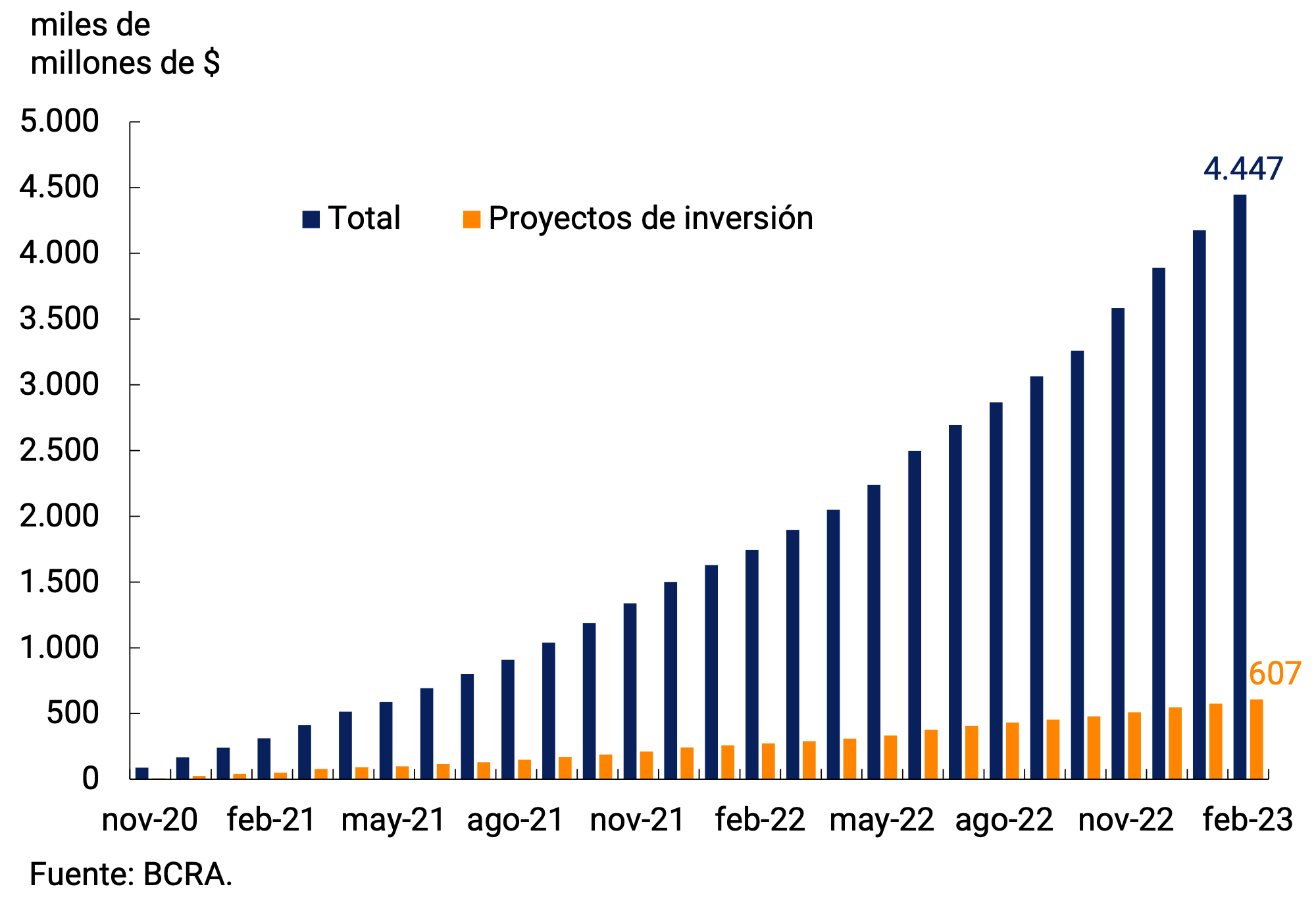

The Financing Line for Productive Investment (LFIP) continued to be the main tool used to channel productive credit to Micro, Small and Medium-sized Enterprises (MSMEs). At the end of February, loans granted under the LFIP accumulated approximately $4.447 billion since its launch, an increase of 6.5% compared to last month (see Figure 5.4). On the other hand, of the total financing granted through the LFIP, 13.7% corresponds to investment projects and the rest to working capital. It should be noted that the average balance of financing granted through the LFIP reached approximately $1,288 billion in January (latest available information), which represents about 18.7% of total loans and 44.9% of total commercial loans.

Among loans associated with consumption, financing instrumented with credit cards would have shown a decrease in real terms of 2.2% s.e. in February (-12.4% y.o.y.). Likewise, personal loans would have exhibited a fall of 1.7% s.e. per month and would already be 18.8% below the level recorded a year ago. During February, the interest rate corresponding to personal loans was on average 79.7% n.a. (116.4% y.a.), with an increase of 0.4 p.p. compared to the previous month.

With regard to lines with real collateral, collateral loans would have registered a decrease in real terms of 2.3% s.e. and are 4.7% below the level of a year ago. For its part, the balance of mortgage loans would have shown a decrease of 4.8% s.e. at constant prices in the month, accumulating a contraction of 34.5% in the last twelve months.

6. Liquidity in pesos of financial institutions

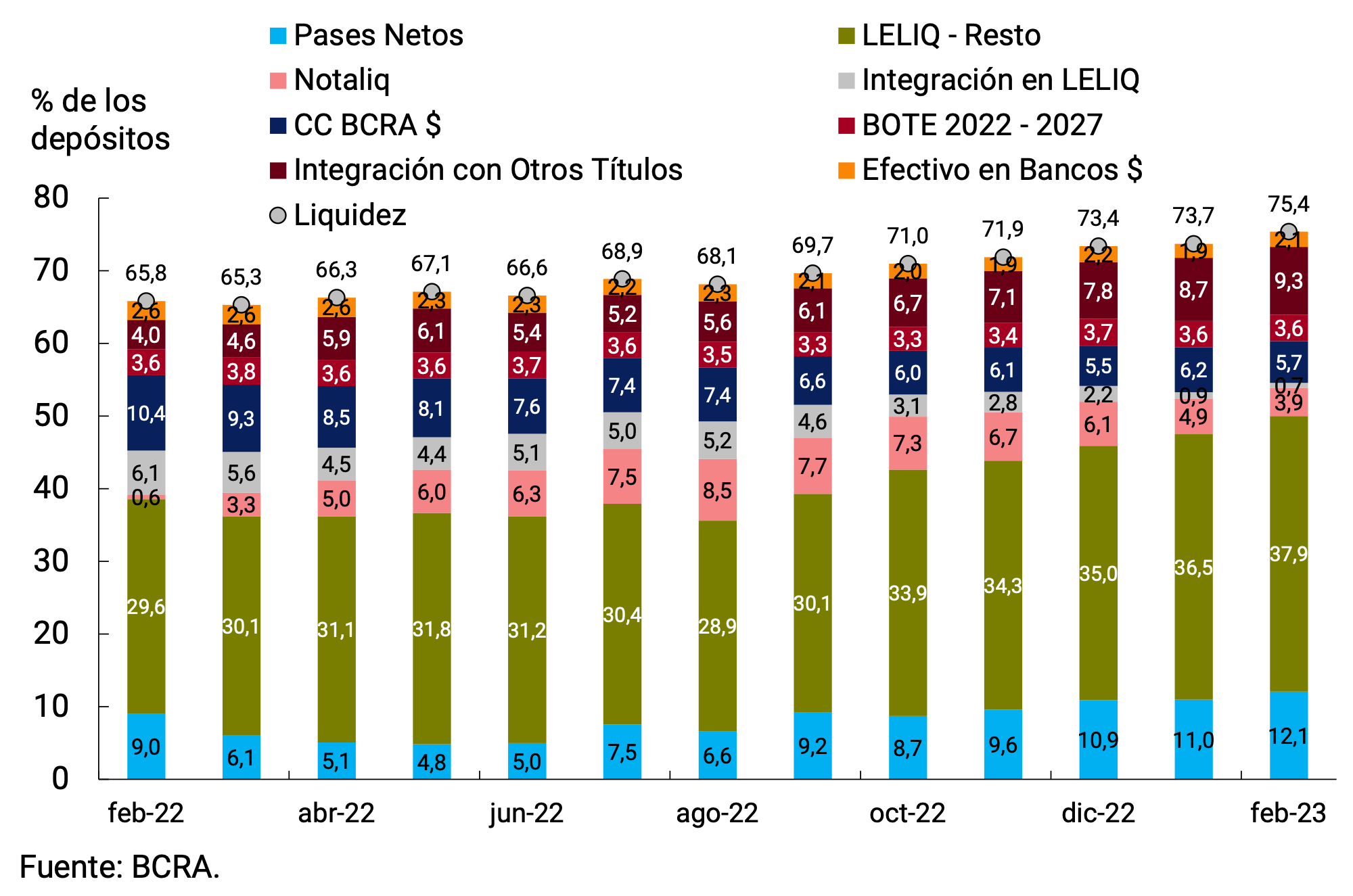

In February, ample bank liquidity in local currency5 showed an increase of 1.7 p.p. compared to January, averaging 75.4% of deposits. Thus, it remained at historically high levels. The increase was mainly explained by the LELIQ, passive passes and integration with public securities, partially offset by the NOTALIQ and current accounts at the Central Bank.

7. Foreign currency

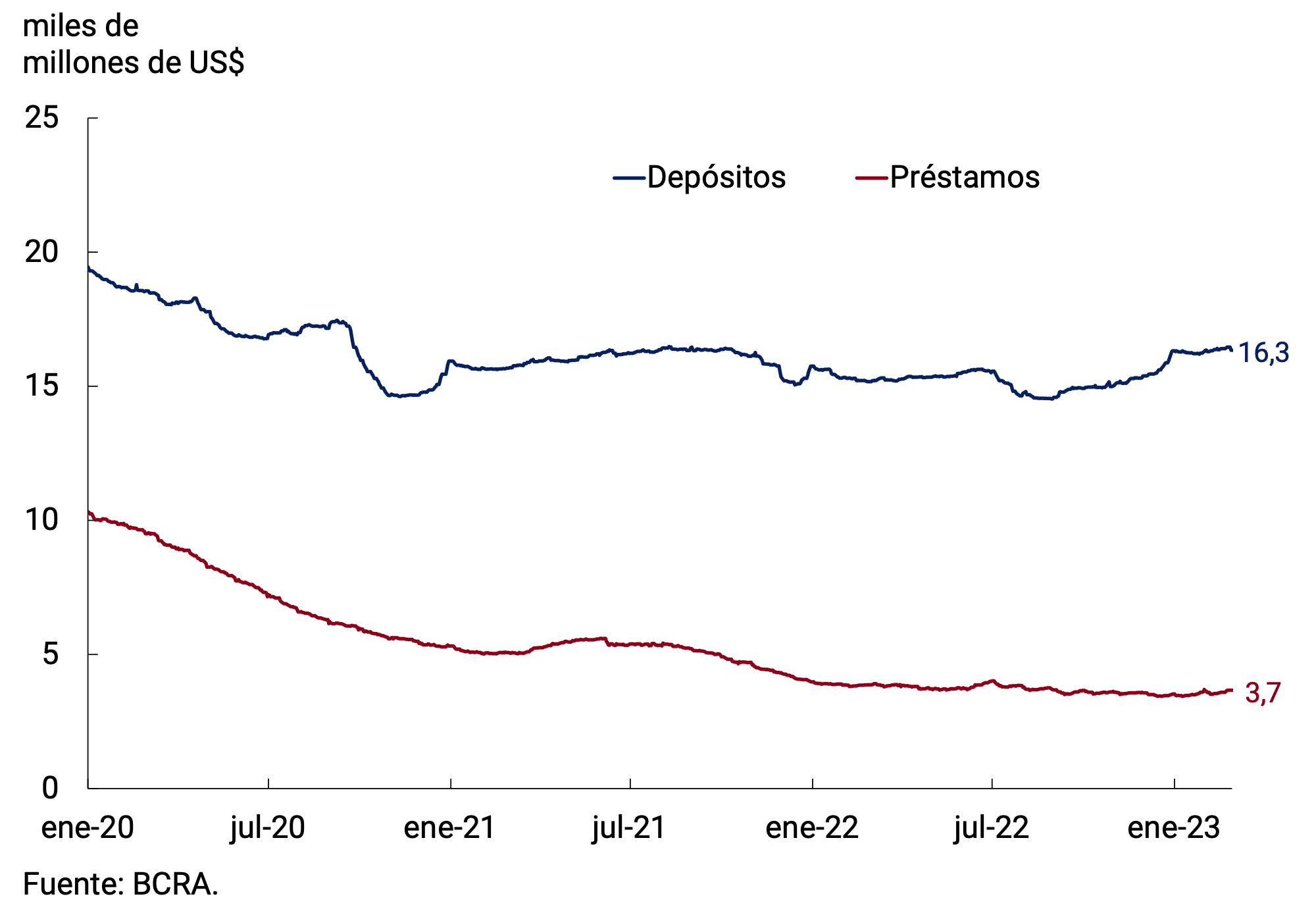

In the foreign currency segment, the main assets and liabilities of financial institutions registered limited variations. The balance of private sector deposits averaged US$16,374 million in the month, which implied an increase of US$115 million compared to January. For its part, the average monthly balance of loans to the private sector in foreign currency was US$3,589 million, thus registering an increase of US$84 million compared to the previous month (see Figure 7.1).

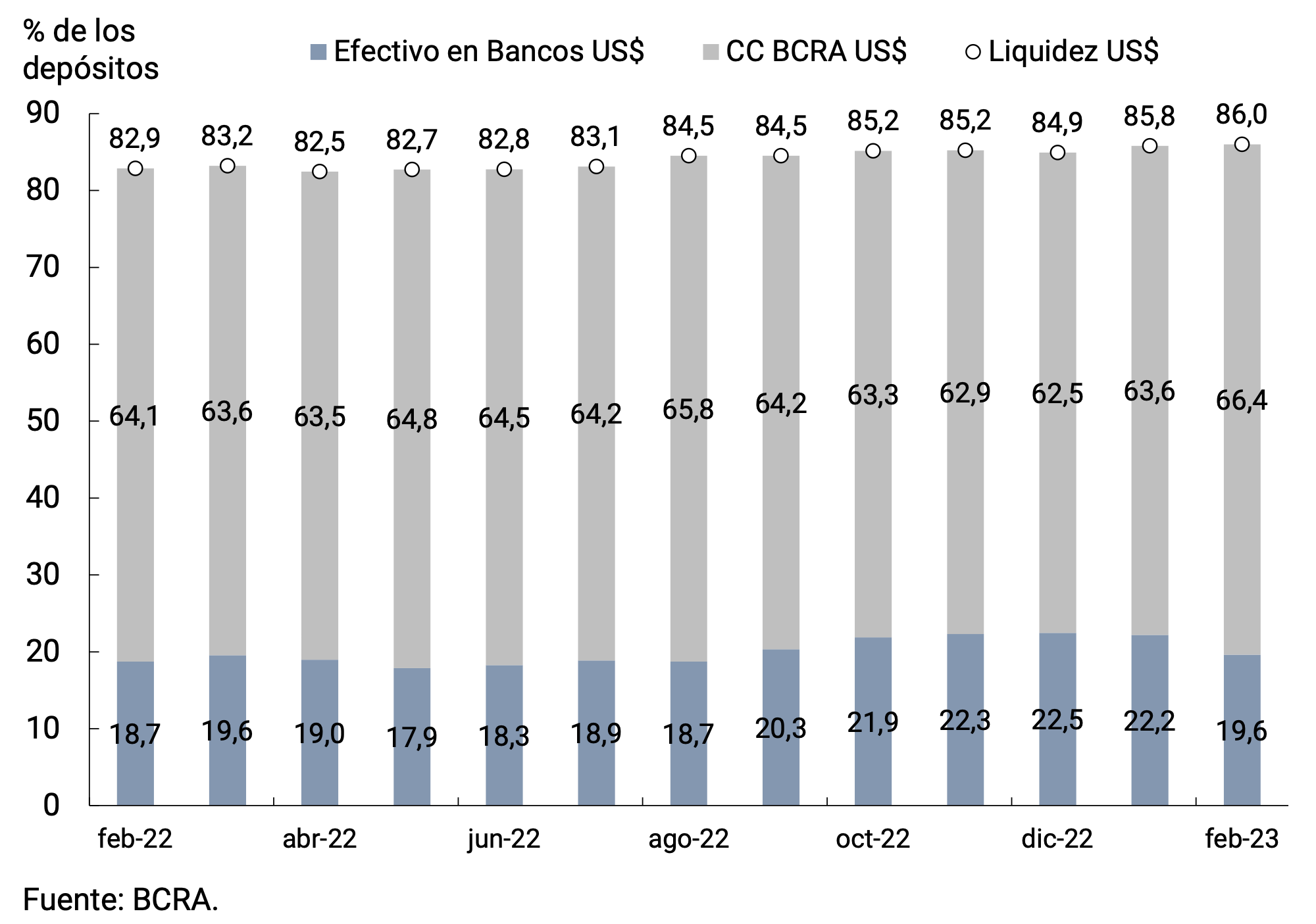

The liquidity of financial institutions in the foreign currency segment experienced an increase of 0.2 p.p. compared to the January average, standing at 86% of deposits and remaining at historically high levels. The increase was explained by current accounts in foreign currency at the BCRA, and was partially offset by cash in banks (see Figure 7.2).

During February, some regulatory modifications were made in exchange matters. Thus, in order to allocate foreign currency more efficiently, access to the foreign exchange market for the payment of imports was made more flexible in the case of certain tariff items related to fruits and vegetables6.

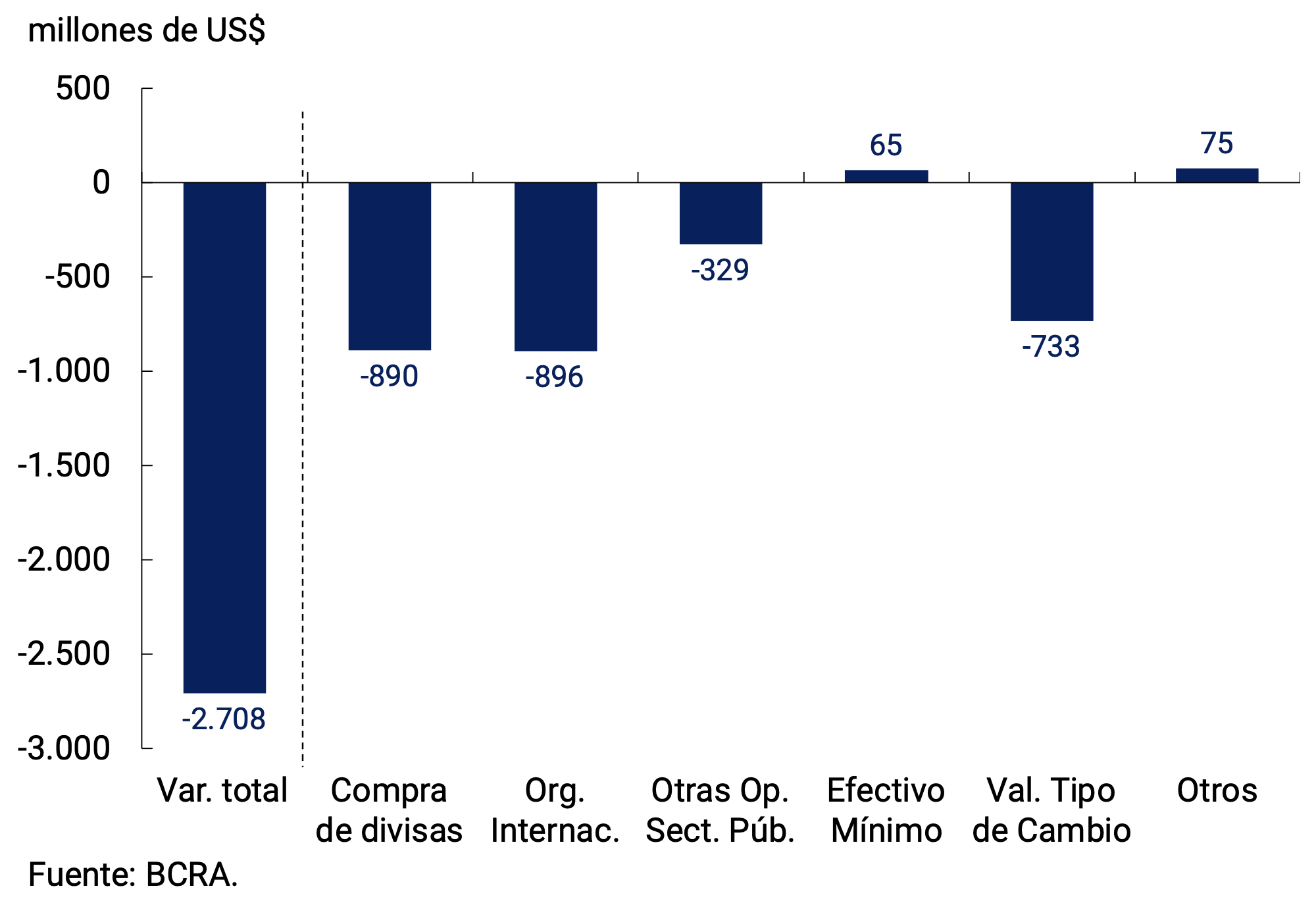

The BCRA’s International Reserves reached a balance of US$38,709 million at the end of February, registering a decrease of US$2,708 million in the month. Among the factors that explain this fall are payments to international organizations (mainly interest payments to the International Monetary Fund of about US$700 million), net sales of foreign currency, and losses on valuation of net foreign assets (see Figure 7.3).

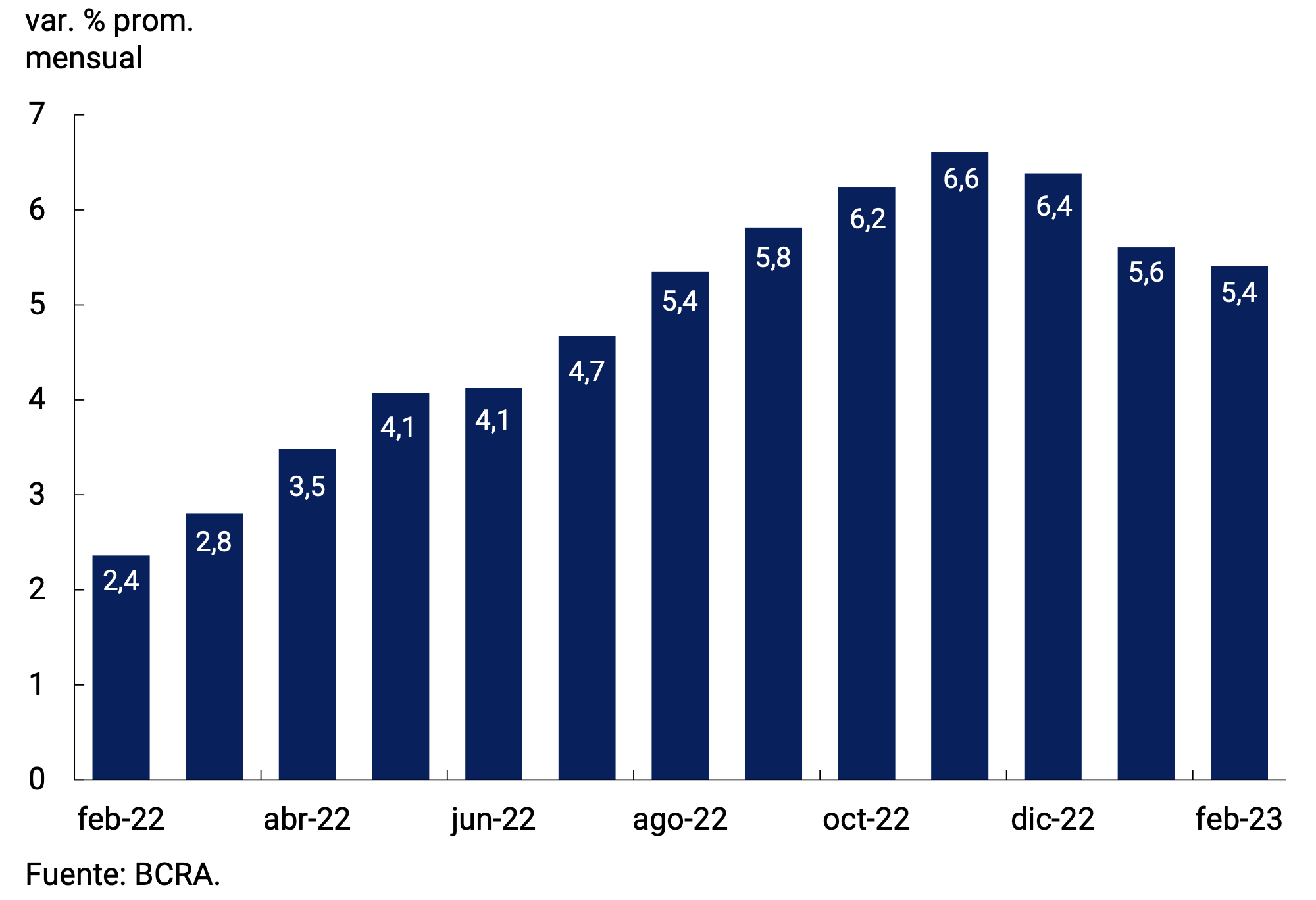

Finally, the bilateral nominal exchange rate (TCN) against the U.S. dollar increased 5.4% in February to settle, on average, at $191.97/US$ (see Figure 7.4). In this way, the BCRA continued to slow down the pace of depreciation of the domestic currency.

Figure 7.3 | Variation in the balance at the end of the month of International Reserves

: Explanation factors. February 2023

Glossary

ANSES: National Social Security Administration.

AFIP: Federal Administration of Public Revenues.

BADLAR: Interest rate on fixed-term deposits for amounts greater than one million pesos and a term of 30 to 35 days.

BCRA: Central Bank of the Argentine Republic.

BM: Monetary Base, includes monetary circulation plus deposits in pesos in current account at the BCRA.

CC BCRA: Current account deposits at the BCRA.

CER: Reference Stabilization Coefficient.

NVC: National Securities Commission.

SDR: Special Drawing Rights.

EFNB: Non-Banking Financial Institutions.

EM: Minimum Cash.

FCI: Common Investment Fund.

A.I.: Year-on-year .

IAMC: Argentine Institute of Capital Markets

CPI: Consumer Price Index.

ITCNM: Multilateral Nominal Exchange Rate Index

ITCRM: Multilateral Real Exchange Rate Index

LEBAC: Central Bank bills.

LELIQ: Liquidity Bills of the BCRA.

LFIP: Financing Line for Productive Investment.

M2 Total: Means of payment, which includes working capital held by the public, cancelling cheques in pesos and demand deposits in pesos from the public and non-financial private sector.

Private M2: Means of payment, includes working capital held by the public, cancelling cheques in pesos and demand deposits in pesos from the non-financial private sector.

Private transactional M2: Means of payment, includes working capital held by the public, cancelling cheques in pesos and non-remunerated demand deposits in pesos from the non-financial private sector.

M3 Total: Broad aggregate in pesos, includes the current currency held by the public, cancelling checks in pesos and the total deposits in pesos of the public and non-financial private sector.

Private M3: Broad aggregate in pesos, includes the working capital held by the public, cancelling checks in pesos and the total deposits in pesos of the non-financial private sector.

MERVAL: Buenos Aires Stock Market.

MM: Money Market.

N.A.: Annual nominal.

E.A.: Effective Annual.

NOCOM: Cash Clearing Notes.

ON: Negotiable Obligation.

GDP: Gross Domestic Product.

P.B.: basis points.

PSP.: Payment Service Provider.

p.p.: percentage points.

MSMEs: Micro, Small and Medium Enterprises.

ROFEX: Rosario Term Market.

S.E.: No seasonality

SISCEN: Centralized System of Information Requirements of the BCRA.

SIMPES: Comprehensive System for Monitoring Payments of Services Abroad.

TCN: Nominal Exchange Rate

IRR: Internal Rate of Return.

TM20: Interest rate on fixed-term deposits for amounts greater than 20 million pesos and a term of 30 to 35 days.

TNA: Annual Nominal Rate.

UVA: Unit of Purchasing Value

1 Corresponds to private M2 excluding interest-bearing demand deposits from companies and financial service providers. This component was excluded since it is more similar to a savings instrument than to a means of payment.

2 The rates currently in force are those established by Communication “A” 7527.

3 The rest of the depositors are made up of Legal Entities and Individuals with deposits of more than $10 million.

4 Private M3 includes working capital held by the public and deposits in pesos of the non-financial private sector (demand, term and others).

5 Includes current accounts at the BCRA, cash in banks, balances of net passes arranged with the BCRA, holdings of LELIQ and NOTALIQ, and public bonds eligible for reserve requirements.