Política Monetaria

Monthly Monetary Report

December

2023

Table of Contents

Contents

1. Executive Summary

2. Payment Methods

3. Savings instruments in pesos

4. Monetary base

5. Loans in pesos to the private sector

6. Liquidity in pesos of financial institutions

7. Foreign currency

The statistical closing of this report was January 8, 2024. All figures are provisional and subject to revision.

1. Executive Summary

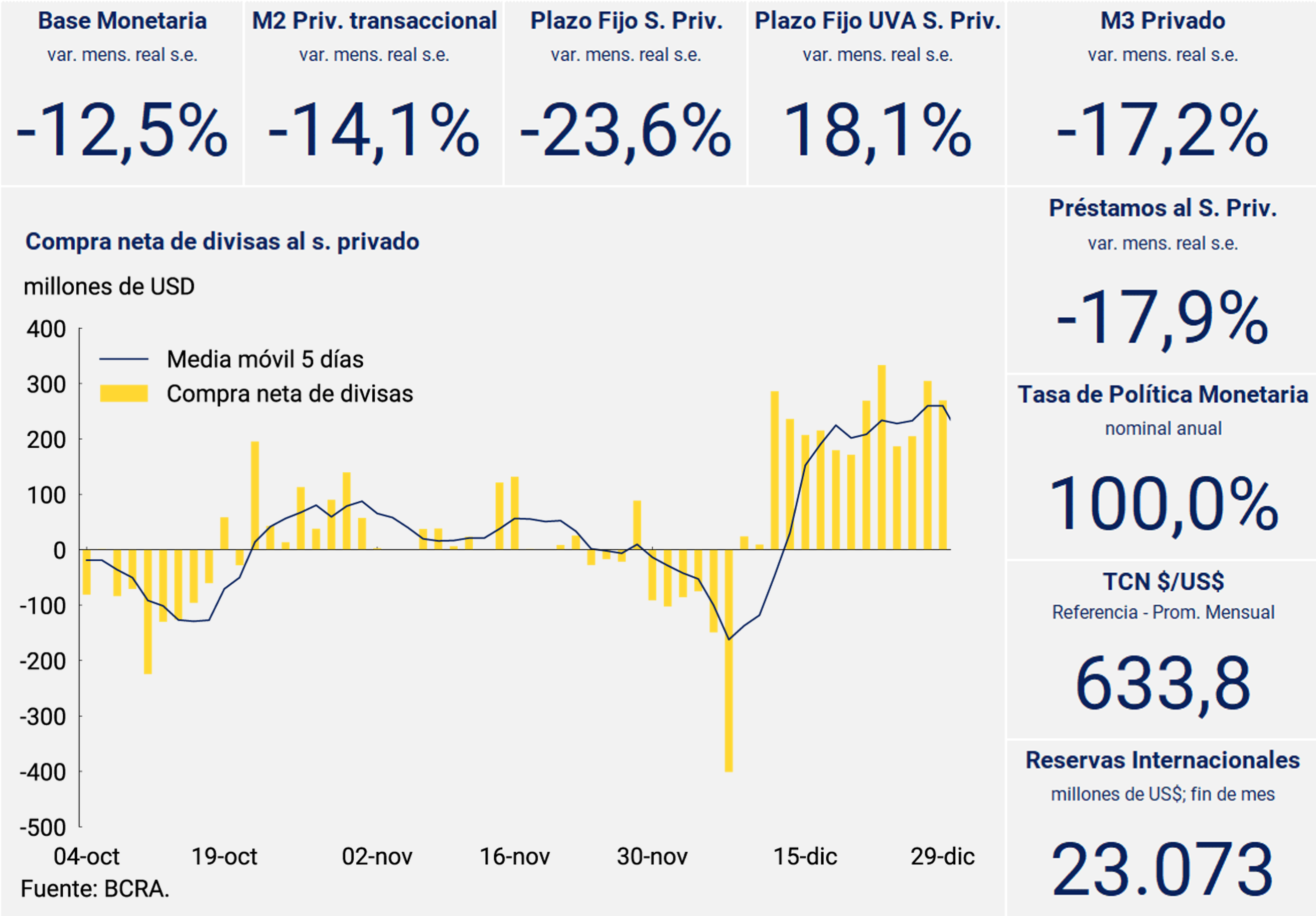

On December 12, the Ministry of Economy presented the economic program of the new administration, whose cornerstone is to eliminate the fiscal deficit and its financing through the monetary issuance of the BCRA, as well as the strong expansion of remunerated liabilities resulting from sterilization operations. Another central element of the new program is the elimination of distortions, restrictions and bureaucratic obstacles and the correction of relative prices (especially the exchange rate), as a prerequisite for stabilizing the economy.

In December, the BCRA moved in this direction. In this sense, LELIQ was no longer tendered, and passive passes became the main monetary policy instrument whose interest rate was established at 100% n.a. Regarding liquidity injection operations, the BCRA announced that it will stop financing the Treasury monetarily, although it will continue to offer the possibility of making active passes and puts on public debt instruments to the extent that the stability of financial conditions requires it.

On the external front, the establishment of a new exchange rate of $800/USD in the Free Exchange Market (MLC) was announced. Temporarily, and until the commitment and visibility of the fiscal effort are fully appreciated, the adjustment of the exchange rate will play the role of complementary anchor in inflation expectations. Likewise, new conditions were defined for access to the MLC for the payment of imports, while the system of payment for these was simplified. In order to give predictability to the payments associated with the stock of commercial debt, the new Bonds for the Reconstruction of a Free Argentina (BOPREAL) began to be tendered. In this context, between December 13 and the end of the month, the BCRA’s net foreign exchange purchase and sale with the private sector left a positive balance of USD2,863 million.

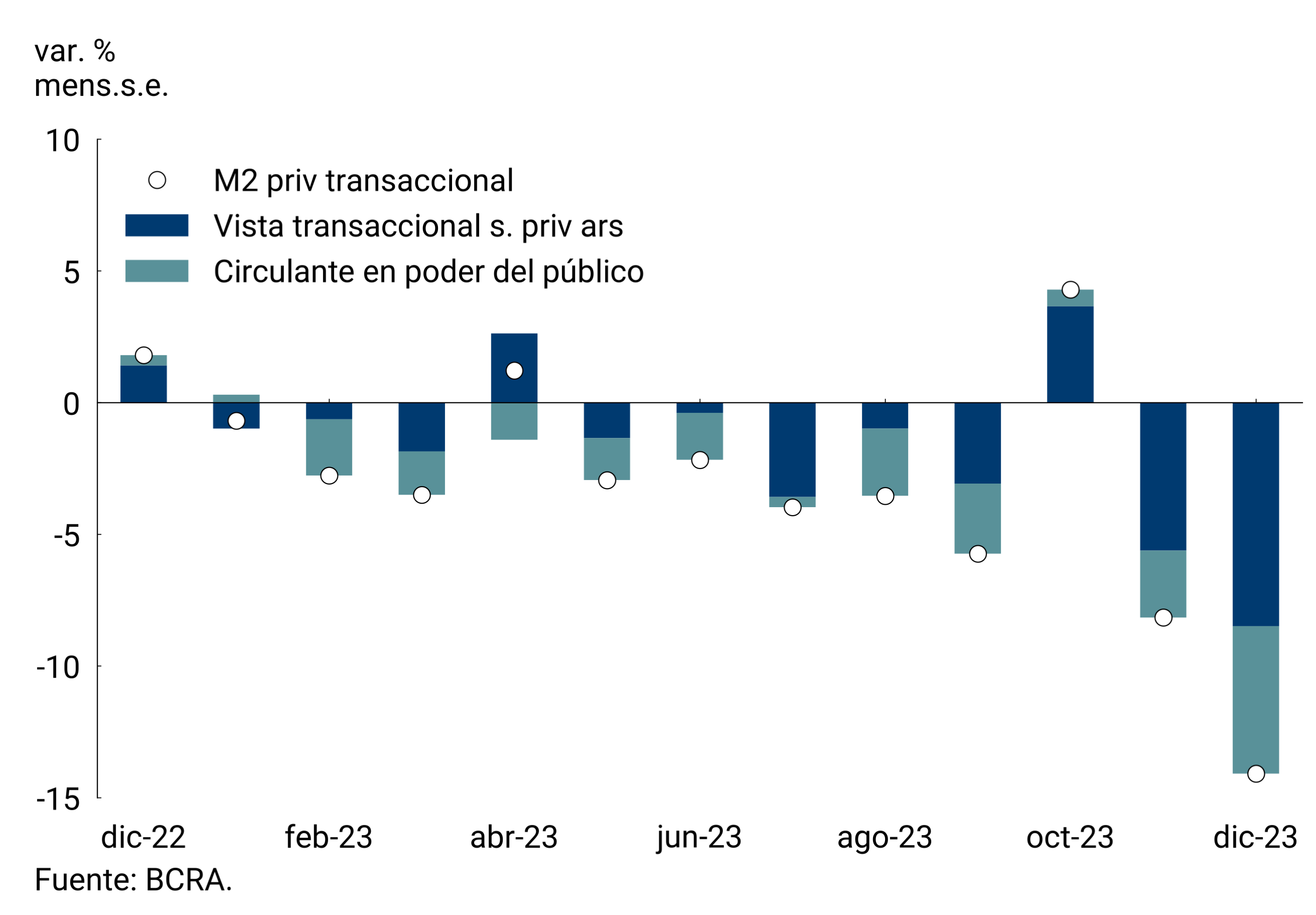

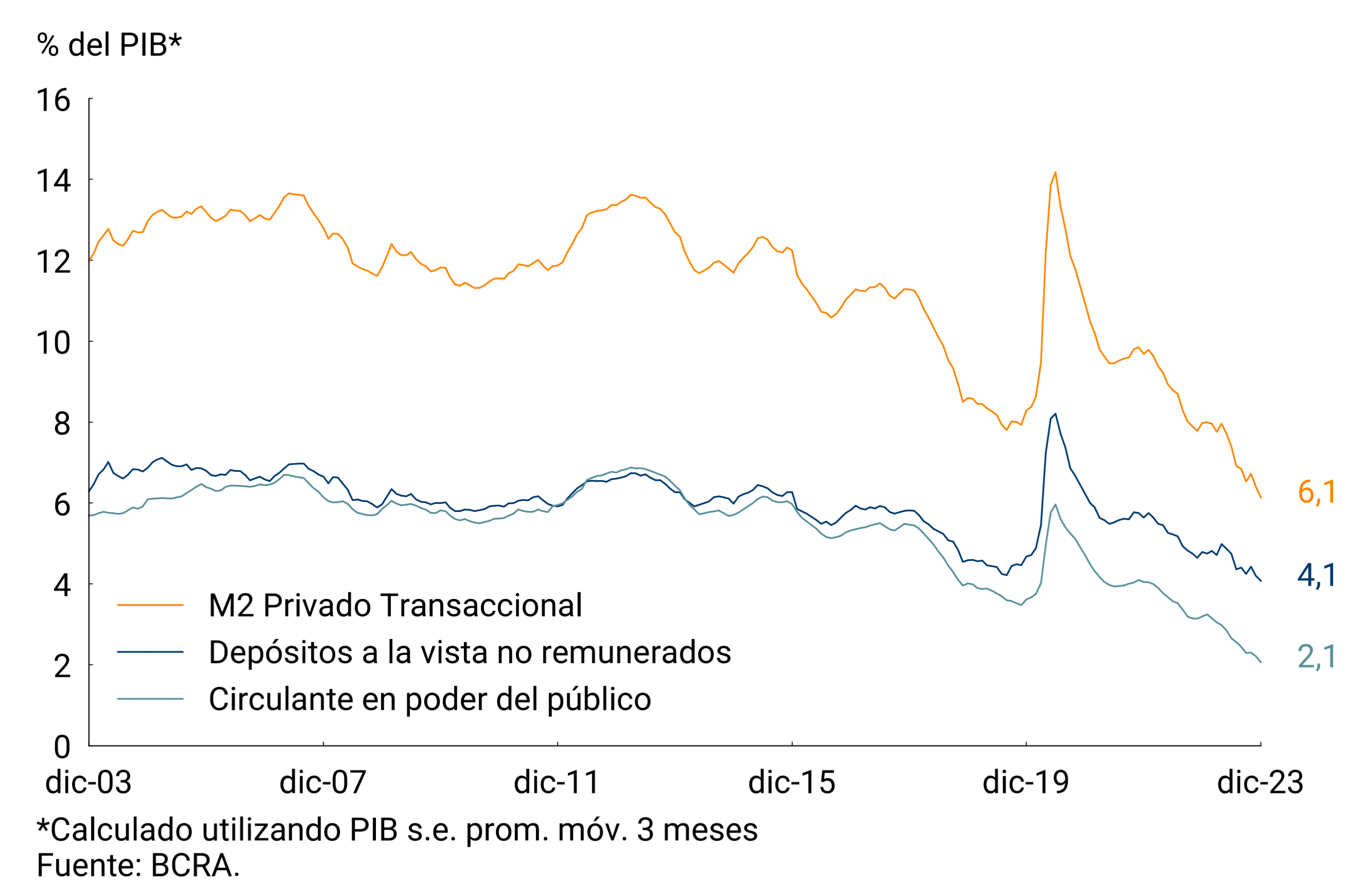

2. Payment methods

In real and seasonally adjusted terms (s.e.), means of payment (private transactional M21) would have registered a decrease of 14.8% in December. The marked acceleration of inflation from the second half of 2023 is taking means of payment to the lowest levels observed in the last 20 years. Thus, private transactional M2 would have accumulated a fall of around 35.4% in the year (see Figure 2.1). As a GDP ratio, means of payment stood at 6.1%, the lowest recorded in the last 2 decades (see Figure 2.2). At the component level, both the working capital held by the public and demand deposits reached new historical lows, standing at 2.1% and 4.1% in terms of GDP, respectively. As the existing imbalances in the economy are resolved, a gradual recovery in the demand for real balances is expected from the low levels to which previous trends led them in the last stage.

Figure 2.1 | Private transactional M2 at constant

prices Contribution by component to the monthly vari. s.e.

3. Savings instruments in pesos

In the context of the definition of a new monetary and exchange rate policy framework2 and given the significant surplus of liquidity and high inflation, the Board of Directors of the BCRA considered it prudent to maintain for the time being a guaranteed minimum interest rate for fixed-term deposits3. In line with the readjustment of the monetary policy interest rate, the monetary authority reduced the minimum guaranteed interest rate for all holders of the non-financial private sector, setting it at 110% n.a., which implies an effective monthly yield of 9%.

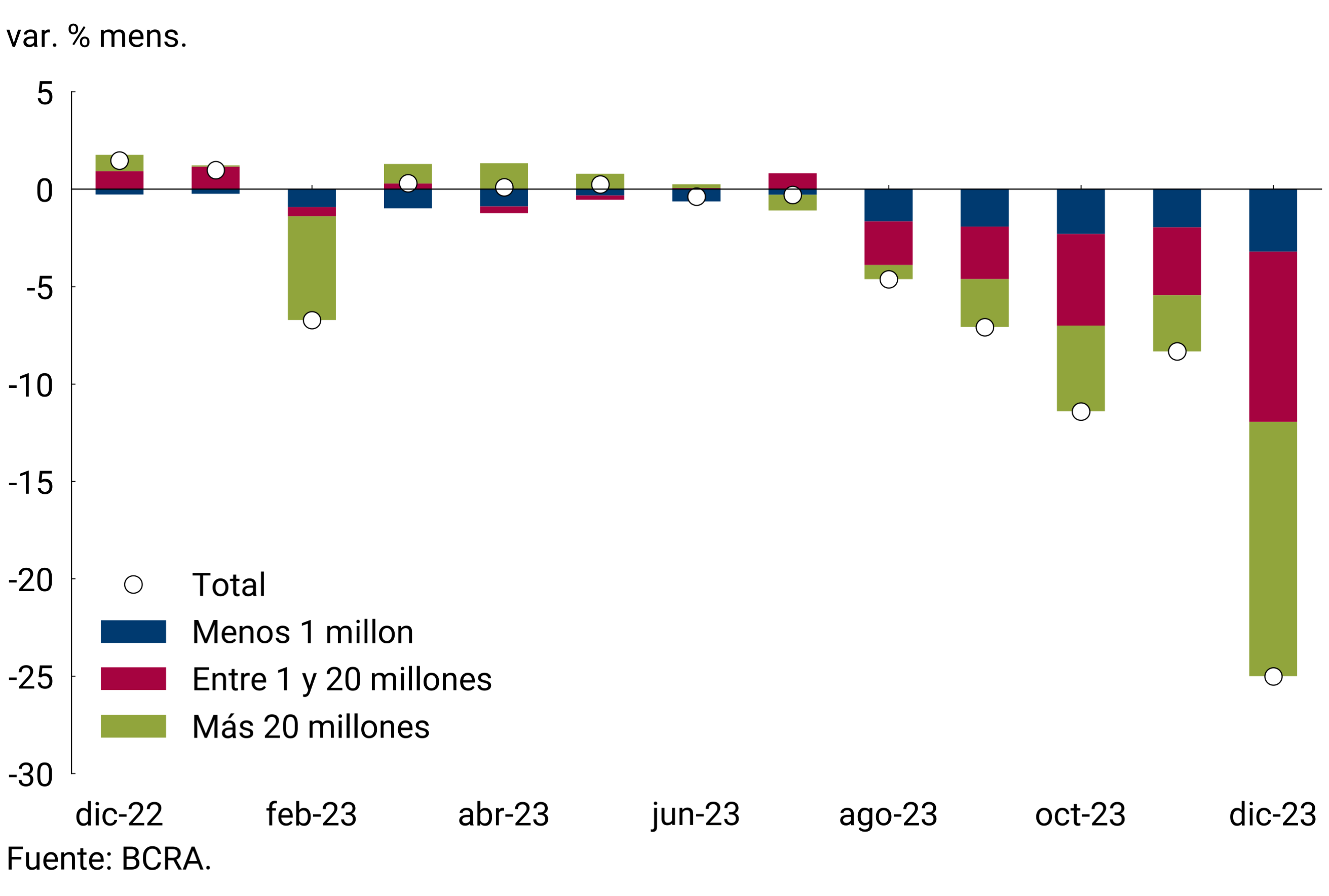

The private sector’s fixed-term deposits in pesos, as well as the means of payment, exhibited a systematic fall in recent months due to the effect of inflationary acceleration, which gained dynamism in December due to the sincerity of the exchange rate and other prices that were repressed. Fixed-term placements would have experienced a monthly contraction of 23.6% s.e. at constant prices in December and, in this way, would accumulate a drop of around 48.2% in 2023. In this way, the balance of these placements at constant prices was reduced to the lowest levels of the last 20 years. As a percentage of GDP, they would have stood at 4.7% in December, which would imply a decrease of 0.8 p.p. compared to the previous month.

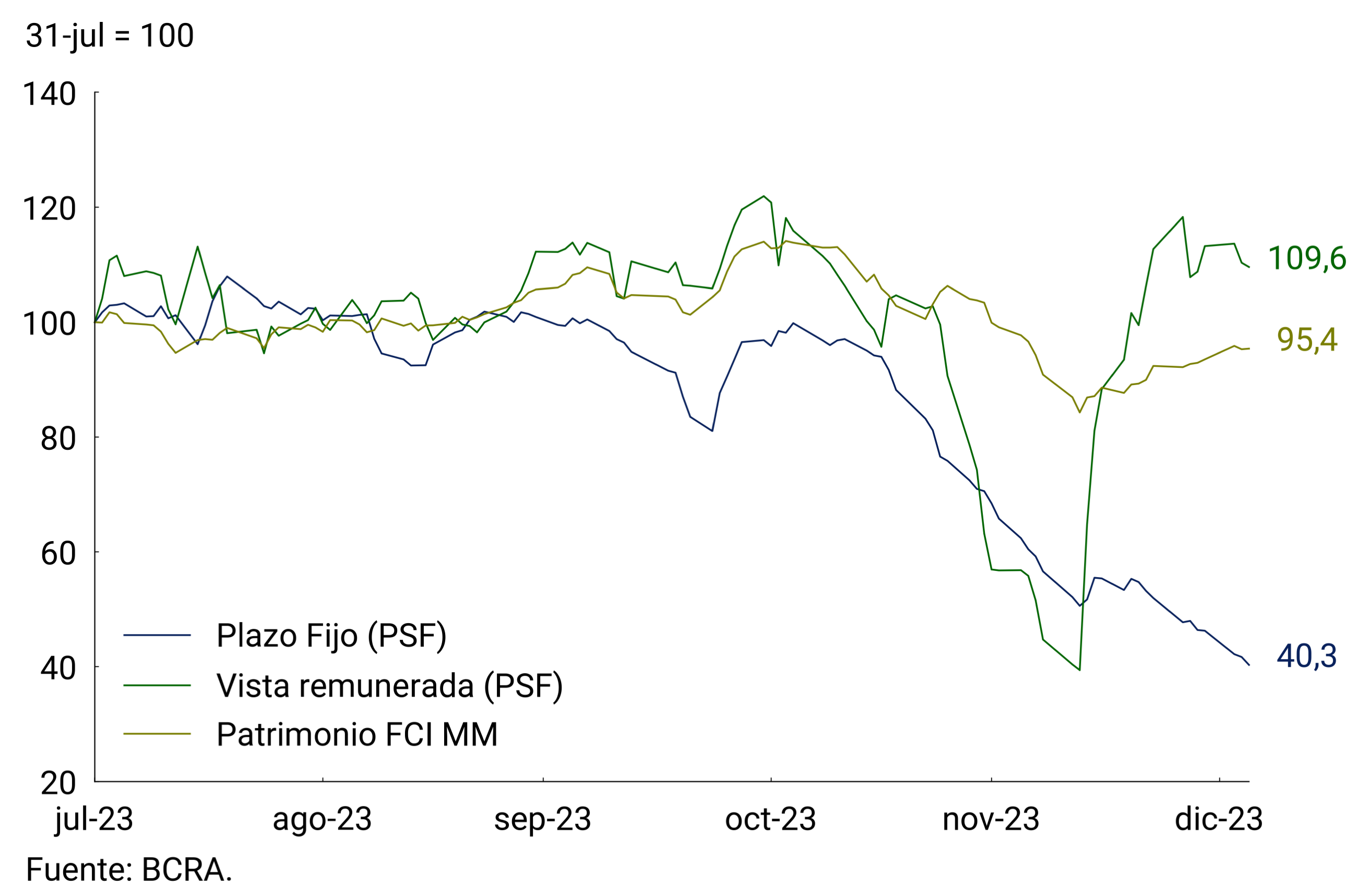

Analyzing the evolution at constant prices of term placements by strata of amount, a generalized decrease is verified (see Figure 3.1). The largest contractions were recorded in the wholesale segment (more than $1 million) and, in particular, in the segment of more than $20 million. Within this last segment, the behavior of Financial Services Providers (FSPs) had an influence. The PSF also dismantled paid demand placements. The counterpart of these lower levels of deposits was an increase in the position of passive passes with the BCRA of the Mutual Funds for Money Investment (FCI MM), it should be noted that these are the main actors within the PSFs. This behavior was explained by two factors: a portfolio rotation towards shorter-term placements and a preference for passive passes, since they paid a slightly higher interest rate. The latter was reversed from a change in the BCRA’s rate policy, whose objective is to achieve a higher level of financial intermediation and a lower relative share of interest-bearing liabilities within the assets of the financial system. Despite the recovery shown in the second half of the month, the remunerated view of PSFs presented an average monthly contraction of 16.8% s.e. at constant prices (see Chart 3.2).

Figure 3.1 | Time deposits in pesos in the private

sector Contribution to the real monthly var. by amount stratum

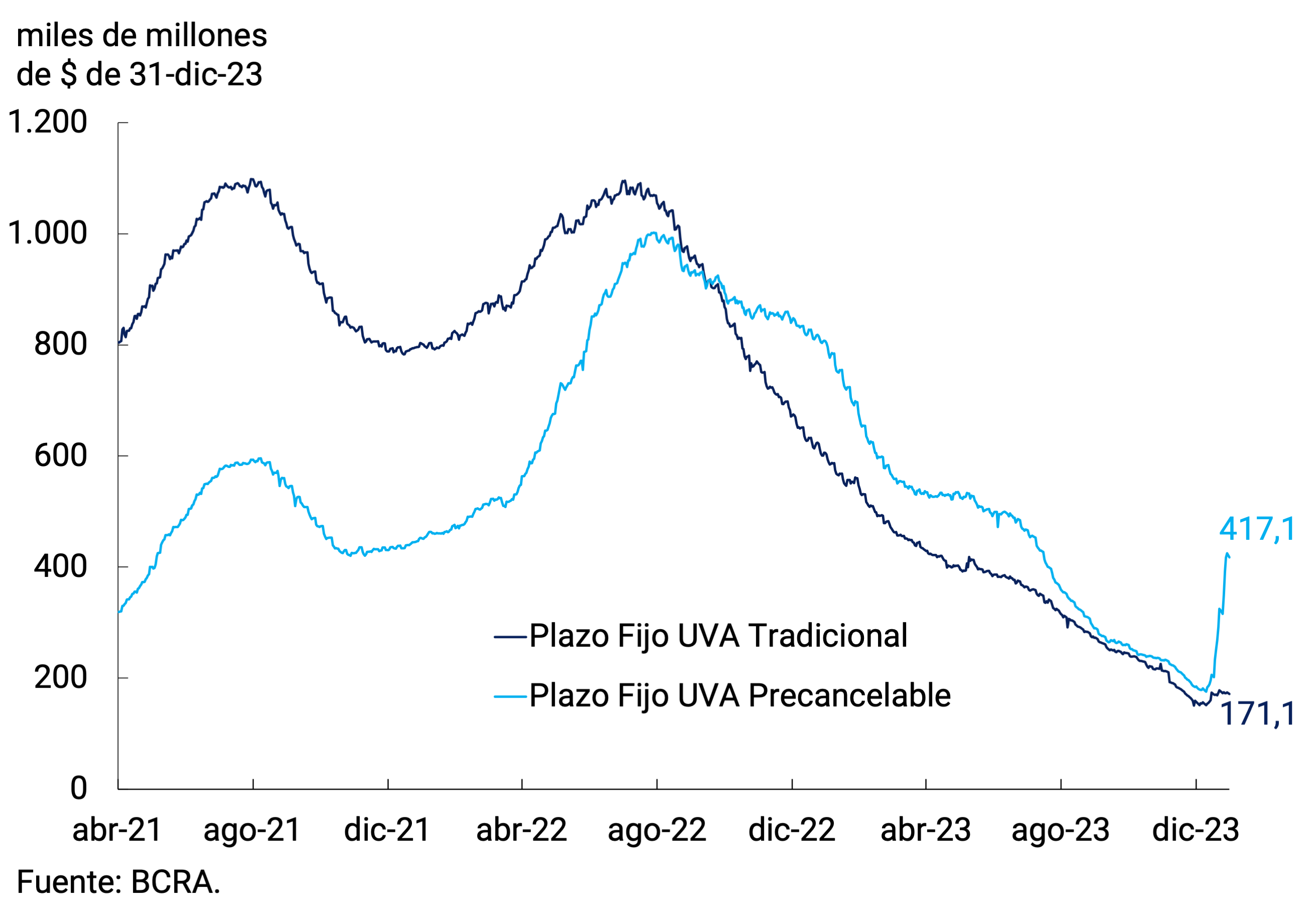

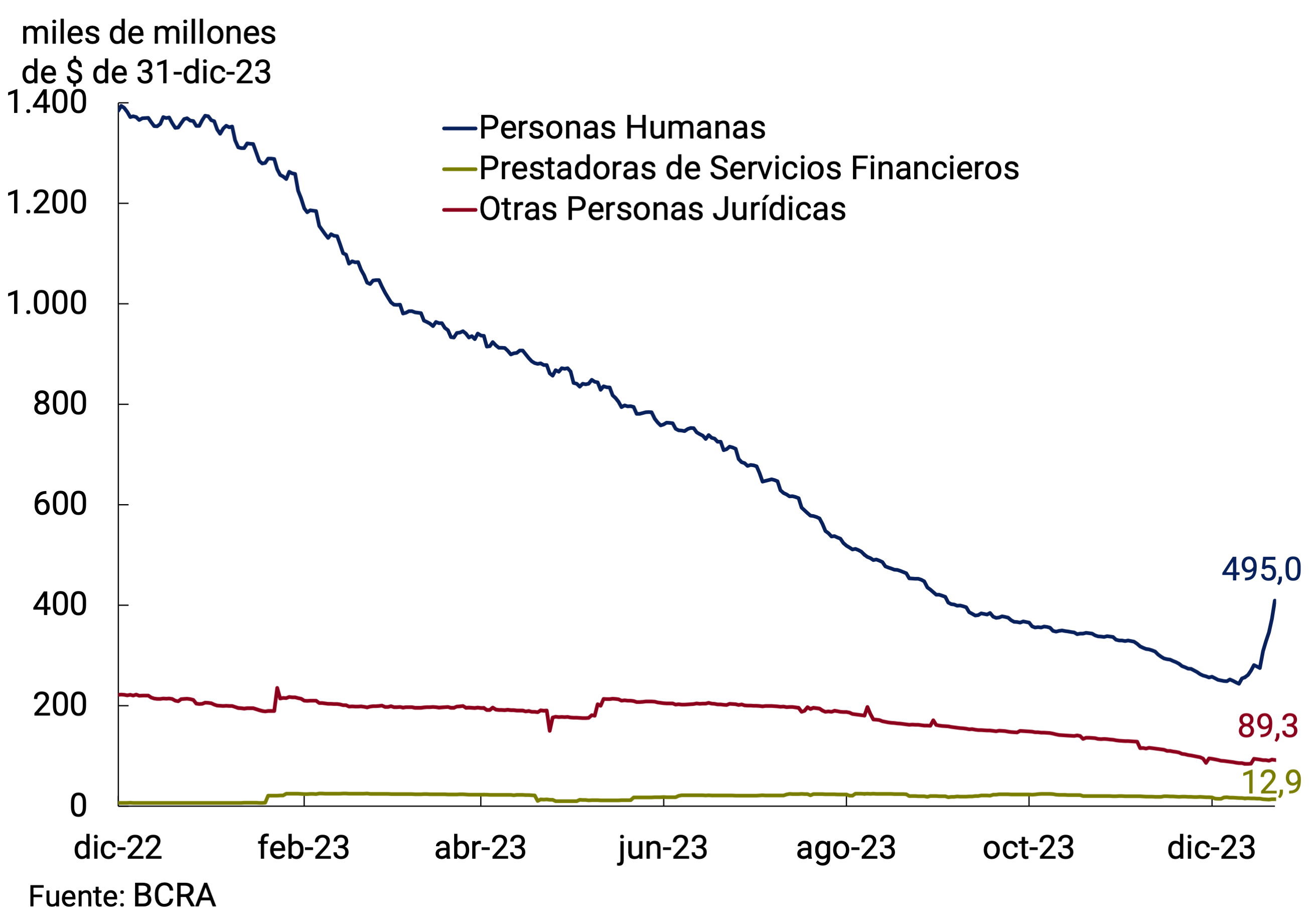

The segment of fixed-term deposits adjustable by CER reversed a trend of 16 consecutive months of contraction and registered a growth of 18.1% in real terms in December. The increase was concentrated in the second half of the month, being more marked in the pre-cancelable segment (see Figure 3.3). In fact, this type of placement experienced an average monthly variation of 35.2% s.e. at constant prices; meanwhile, the variation between balances at the end of the month was 127.2%. It should be noted that towards the end of the month it was decided to extend the minimum term for UVA deposits with an early cancellation option from 90 days to 180 days and it was established that entities must offer the instrument for up to $5 million per customer (being able to accept higher amounts)4. On the other hand, placements in traditional UVA grew 7.5% between November 30 and December 31, although on average they presented a drop (-1.7%) due to the carry-over effect of the previous month. Distinguishing by type of holder, the increase was mainly due to the dynamics of placements by individuals, which represent 83% of the total (see Figure 3.4). All in all, the balance of deposits in UVA reached $588,217 million at the end of December, which is equivalent to 4.4% of the total of term instruments denominated in domestic currency.

Figure 3.3 | Fixed-term deposits in UVA of the private

sector Balance at constant prices by type of instrument

Thus, the broad monetary aggregate, private M35, at constant prices and adjusted for seasonality would have exhibited a monthly fall of 17.2% in December. In the year-on-year comparison, this aggregate would have registered a decrease of 36.8% and as a percentage of GDP it would have stood at 13.3%, 1.1 p.p. below the previous month’s record.

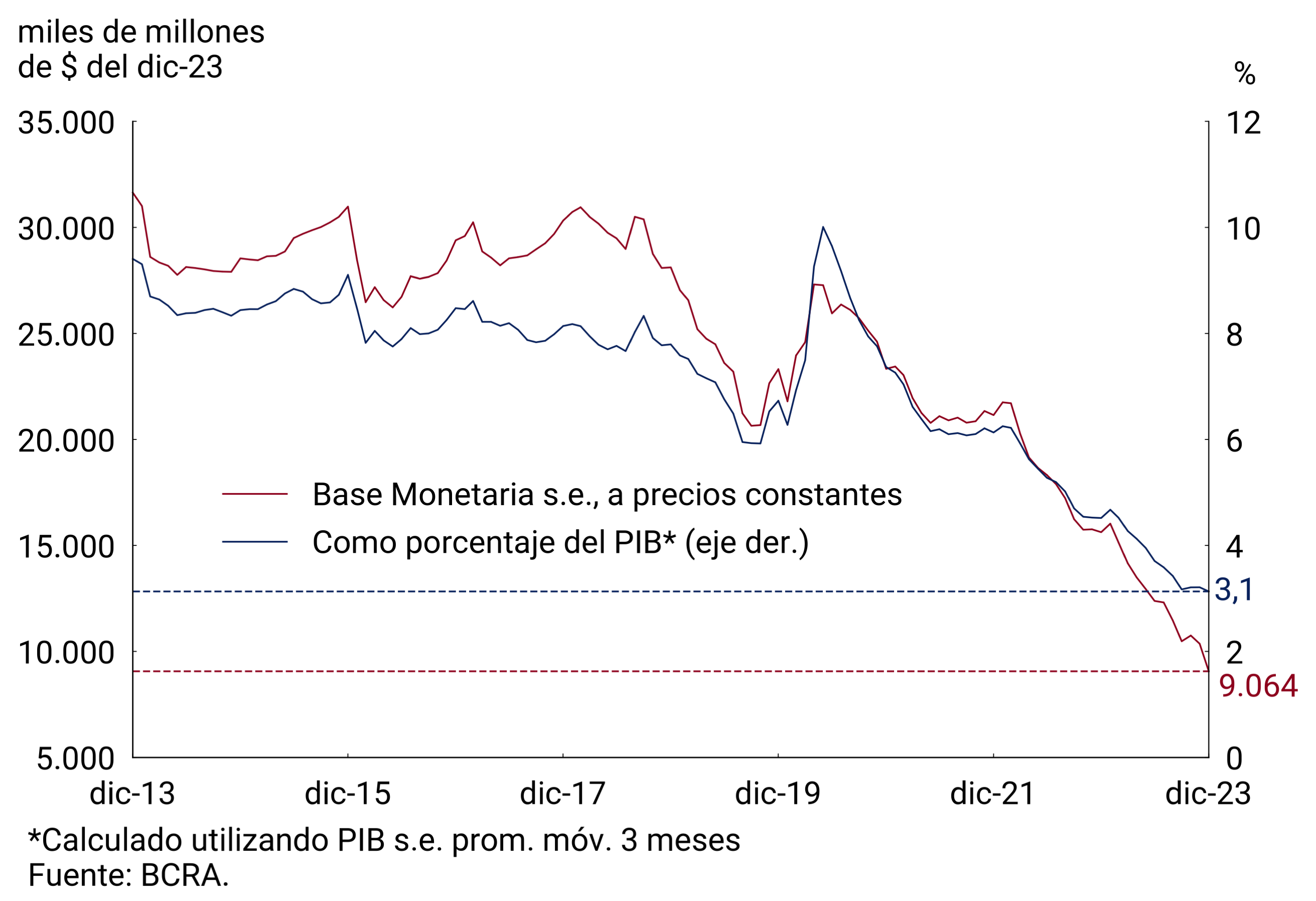

4. Monetary base

In December, the average balance of the Monetary Base was $9.2 trillion, which implied a monthly expansion of 18.1% ($1,412 billion) at current prices. It should be noted that the Monetary Base presents a positive seasonality in December, so if we correct it for this effect and measured at constant prices, it would have exhibited a contraction of 12.5% in the month and, in the year, it would have accumulated a fall of 42%. As a GDP ratio, the Monetary Base would stand at 3.1%, slightly decreasing compared to November’s figure, and remains among the lowest records in the last 20 years (see Figure 4.1).

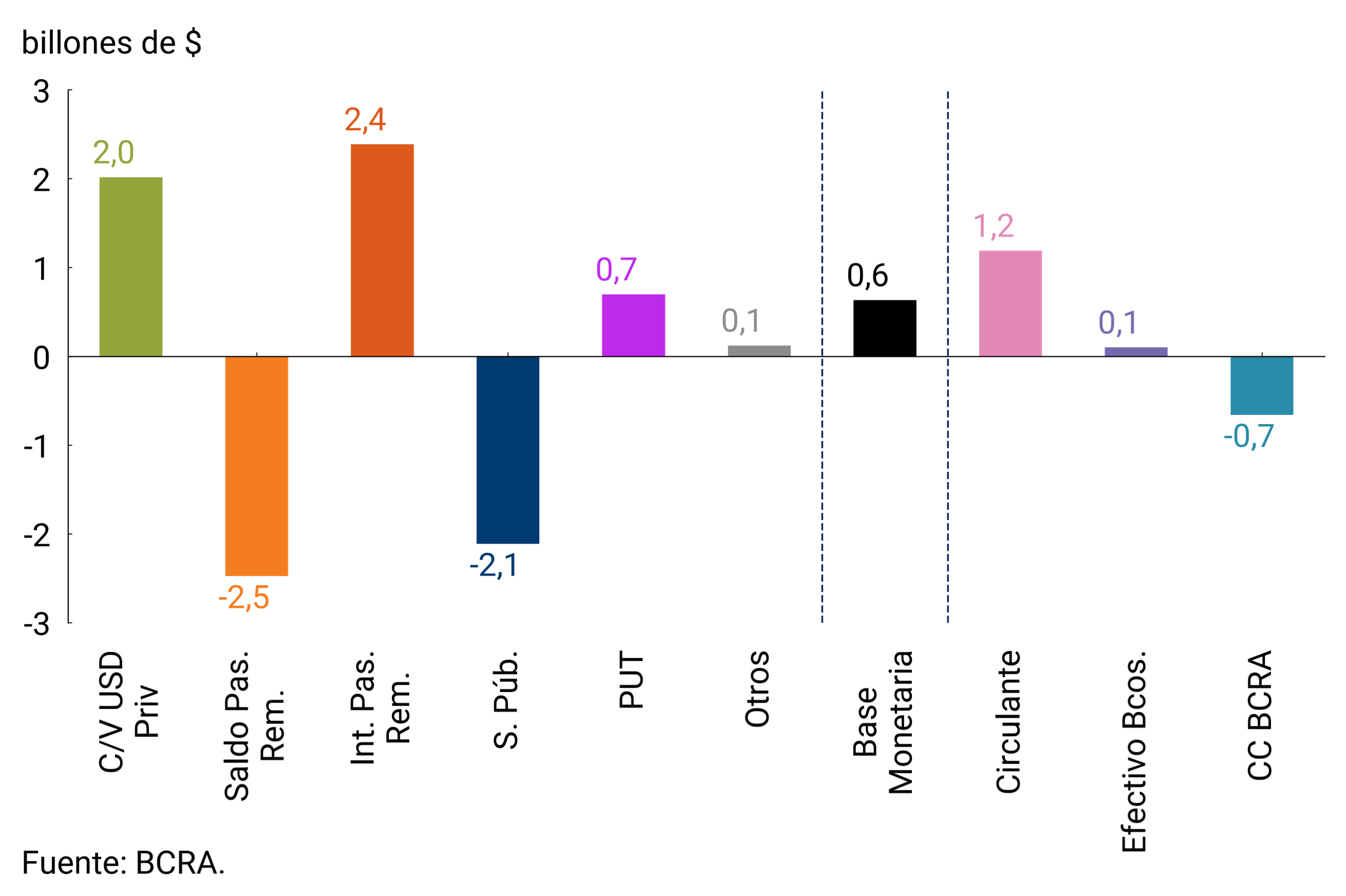

Throughout the month, the behavior of the Monetary Base was not homogeneous, and the same was observed in that of the supply factors that explained its behavior. Thus, prior to December 10, there was an expansion of the Monetary Base by $1.2 trillion, mainly explained by the dismantling of remunerated liabilities and, in part, by the executions of put option contracts on National Government securities. These expansion factors were partially offset by the net sale of foreign currency to the private sector. From December 11 onwards, a contraction of the Monetary Base was observed, explained by the repurchase of public securities in the BCRA’s portfolio carried out by the National Treasury and the contractionary effect of interest-bearing liabilities. These factors were partially offset by the expansion associated with net purchases of foreign currency from the private sector. However, in December there was an expansion among month-end balances of the Monetary Base of $634,462 million (see Figure 4.2).

The Board of Directors of the BCRA has taken several measures with the purpose of simplifying the monetary policy rate signal and strengthening the transmission of interest rates in the economy to the rest of the economy. Thus, in order to rationalize its liquidity management scheme, the BCRA decided to stop holding LELIQ tenders as of December 18, with passive pass operations becoming its main instrument for absorbing monetary surpluses. Until January 11, the date of the last expiration of LELIQ, its gradual dismantling will be observed.

In this context, a transfer of funds from LELIQ at 28 days to passive passes at 1 day was verified. Thus, the latter increased their participation in the total of instruments, reaching a representativeness of 85% with balances at the end of the month. On the other hand, the LELIQ with a 28-day term represented, at the end of the month, 6% of the total, reducing their relative share. LEDIV and LEGAR closed November representing 9% of total interest-bearing liabilities. The longer-term species, NOTALIQ, accounted for only 0.1% of the balance.

Regarding monetary policy instruments, on December 13 the BCRA decided to reduce the rate of 1-day pass-through from 126% to 100% n.a. (171.5% y.a.). Thus, the interest rate on 1-day passes for FCI stood at 85% n.a. (133.7% y.a.), while the interest rate on 1-day active passes remained at 160% n.a. (393.6% y.a.). The reduction in the interest rate paid on interest-bearing liabilities will make it possible to contain the endogenous growth of these instruments and generate incentives for banks to act as financial intermediaries again.

These measures are part of the new approach to monetary policy, aimed at achieving monetary stability and reducing inflation, simultaneously addressing the two main sources of monetary issuance: the direct and indirect financing of the fiscal deficit and the quasi-fiscal deficit of the BCRA itself.

5. Loans to the private sector

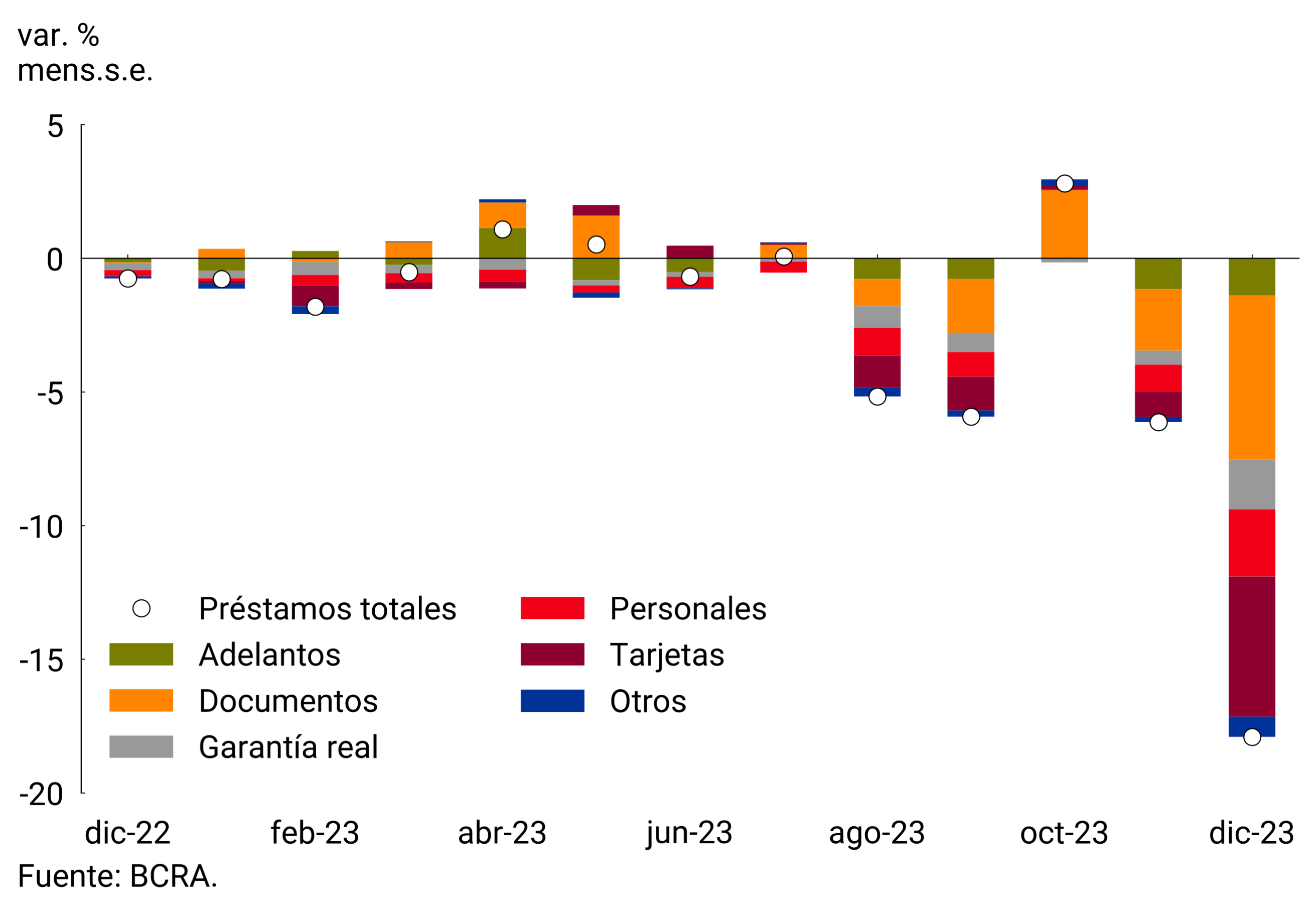

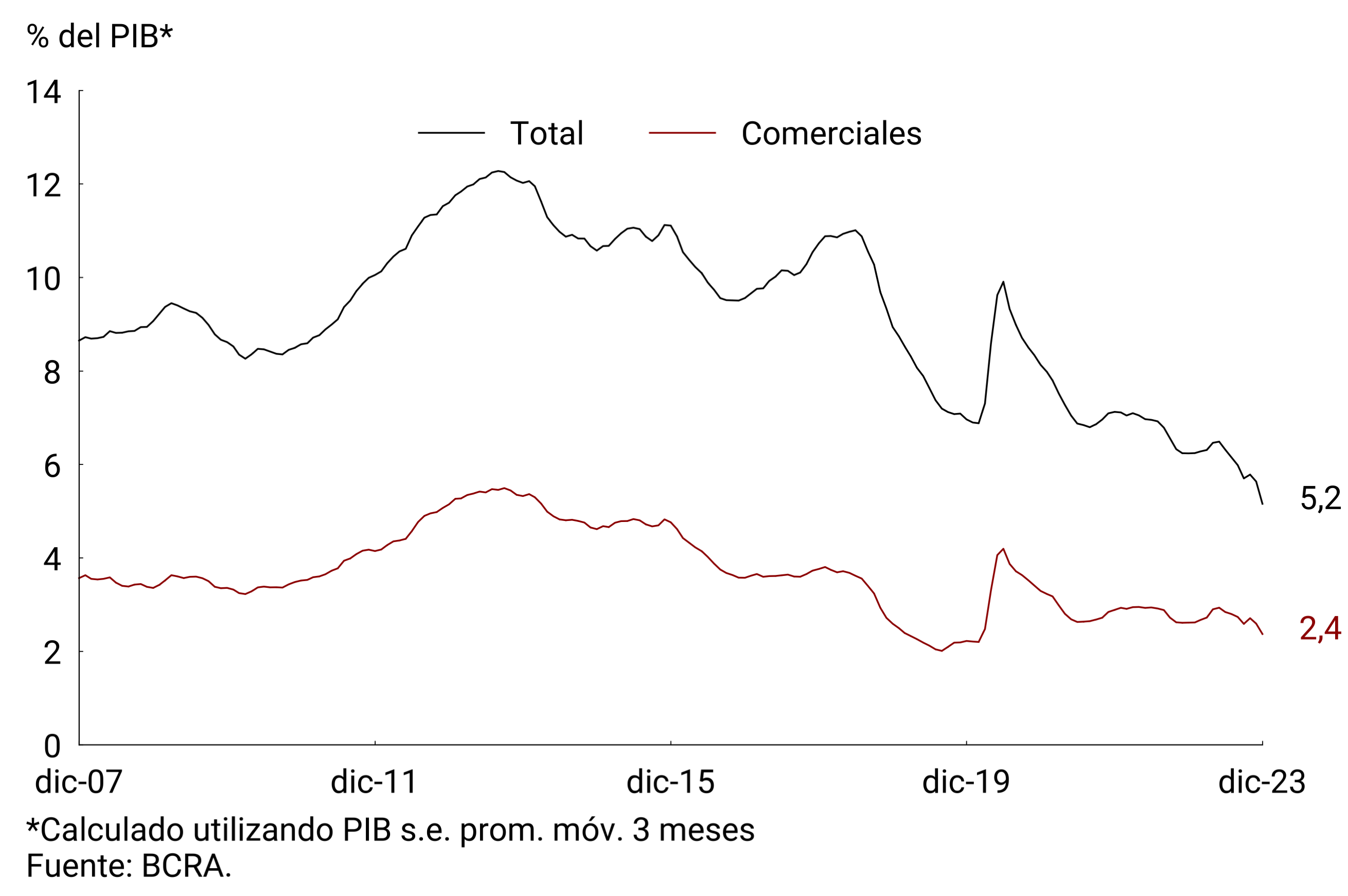

Loans in pesos to the private sector in real terms, as well as aggregate loans, were affected by the inflationary acceleration process that began in 2022 and by the financial disintermediation of recent years. Specifically, in the last month of 2023, loans to private sector registered a contraction of 17.9% monthly and 30.7% y.o.y. At the level of large lines of credit, the fall was generalized by type of financing (see Figure 5.1). As a percentage of GDP, loans in pesos to the private sector would stand at 5.2%, a level 1.3 p.p. lower than the figure for May when the rate of decline began to deepen (see Figure 5.2).

Figure 5.1 | Loans in pesos to the private

sector Real without seasonality; contribution to monthly growth

Commercial lines would have shown a sharp decrease, with a monthly drop of -17.7% s.e. in real terms and would be -24.1% below the level of December 2022. By instruments, loans granted through documents would have contracted in December 19.6% s.e. and would be 16.4% below their level a year ago. Within these lines, single-signature documents, with a longer average term, would have registered a decrease of 18.5% s.e. Meanwhile, discounted securities would have fallen 20.5% s.e. in the month. On the other hand, advances would have contracted 13.8% s.e. monthly and 36.8% y.o.y.

Consumer loans would have registered a drop of 17.7% s.e. at constant prices during the month and would accumulate a fall of 33.1% in the last year. Financing instrumented with credit cards would have fallen in real terms by 17.0% s.e. in the month, while personal loans would have fallen 19.2% s.e. in the same period. In year-on-year terms, these loans registered variations of -27.0% and -44.8% at constant prices, respectively.

With regard to lines with real collateral, in real terms and without seasonality, collateral loans would have registered a decrease of 17.5% s.e., bringing the year-on-year fall to 38.1%. Meanwhile, the balance of mortgage loans would have shown a monthly decrease of 19.6% s.e. (-51.9% y.o.y.).

6. Liquidity in pesos of financial institutions

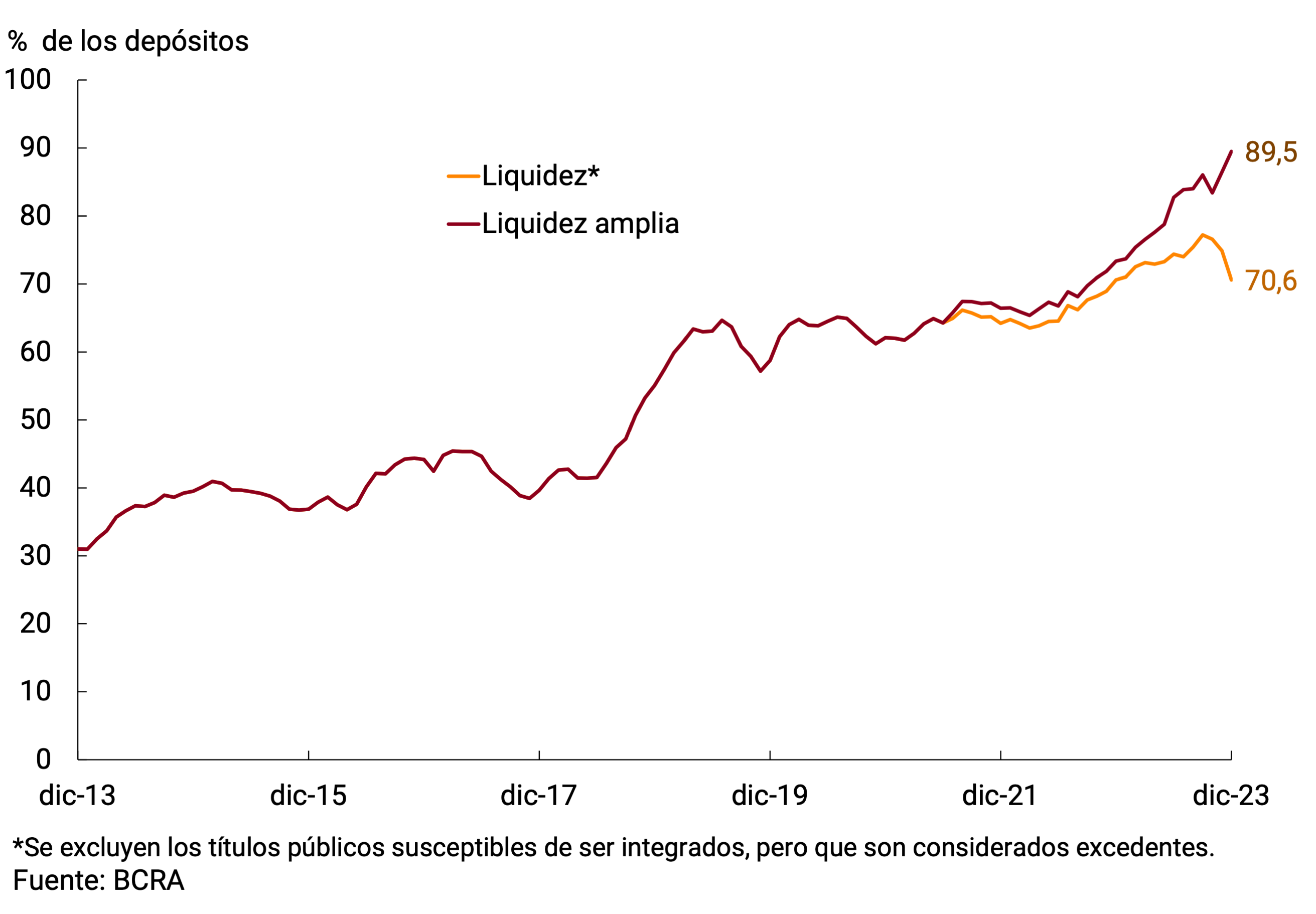

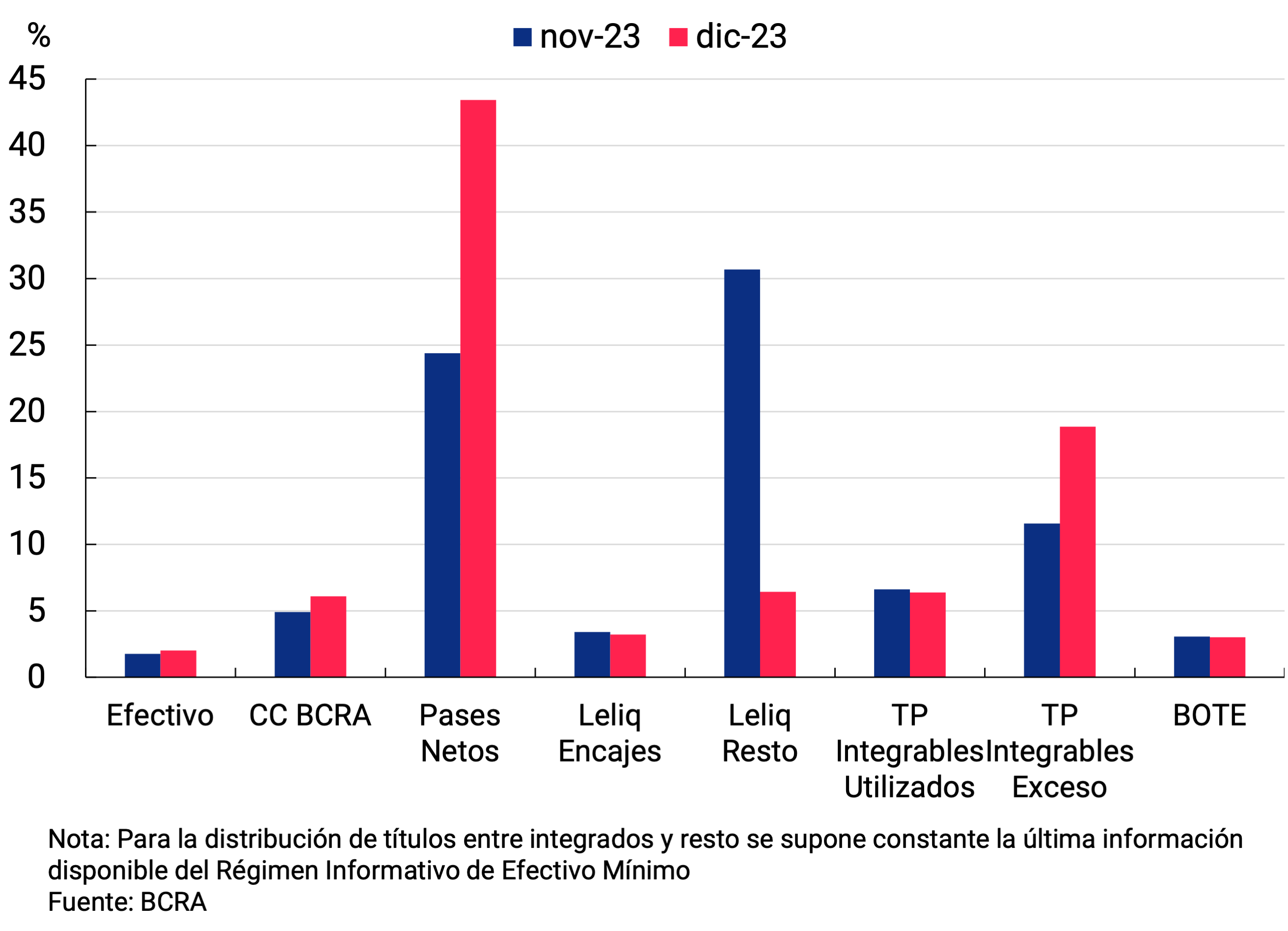

In December, ample bank liquidity in local currency6 increased by 3 p.p. compared to the previous month, averaging 89.5% of deposits (see Figures 6.1 and 6.2). The increase in liquidity was mainly explained by the greater holding of public securities, both integrated and non-integrated. In turn, financial institutions chose to maintain a larger than usual surplus position in their current accounts at the BCRA, whose relative share increased by 1.2 p.p. This change in the composition of the liquidity of the financial system was associated with the BCRA’s policy of ceasing to place LELIQ and establishing a rate scheme that seeks to generate incentives for intermediation instead of taking interest-bearing liabilities.

Regarding the regulatory changes, it is worth mentioning that the maximum term of national government securities in pesos acquired by primary subscription admitted for minimum cash integration was increased to 760 days as of December 207. On the other hand, it was provided that those securities that can be sold to the BCRA through the mechanism of put option contracts and that are tendered as of December 18, 2023 will not count for the purposes of the credit fractionation limit to the public sector8.

7. Foreign currency

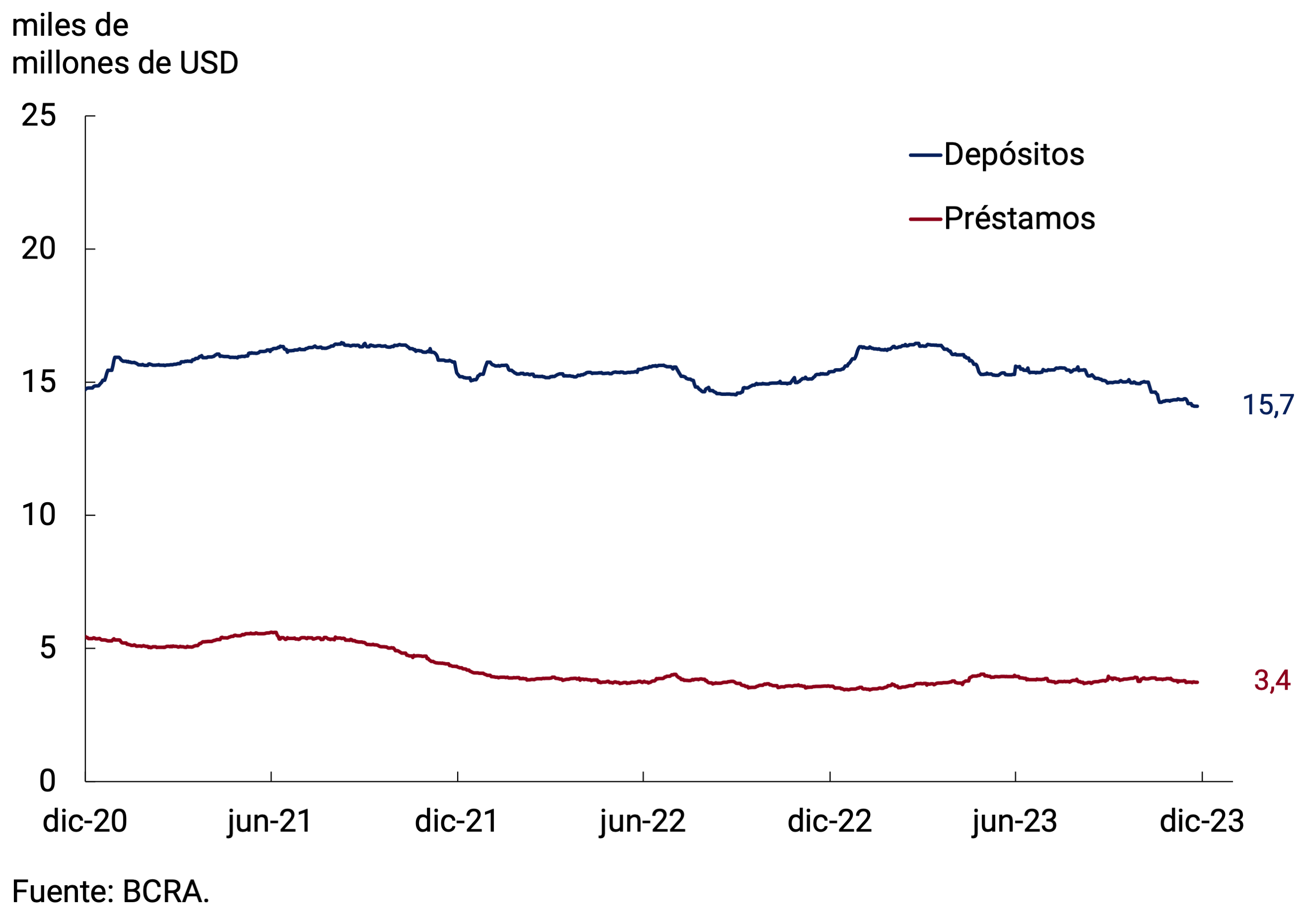

In the foreign currency segment, the main assets and liabilities of financial institutions had a mixed performance. On the one hand, private sector deposits rose by USD1,567 million in the month and ended December with a balance of USD15,704 million. The rise in foreign currency deposits in December was mainly explained by the seasonal increase at this time of year, given the exemption from the payment of personal assets on such deposits. On the other hand, the balance of loans to the private sector fell by USD244 million and ended the month at USD3,431 million (see Figure 7.1).

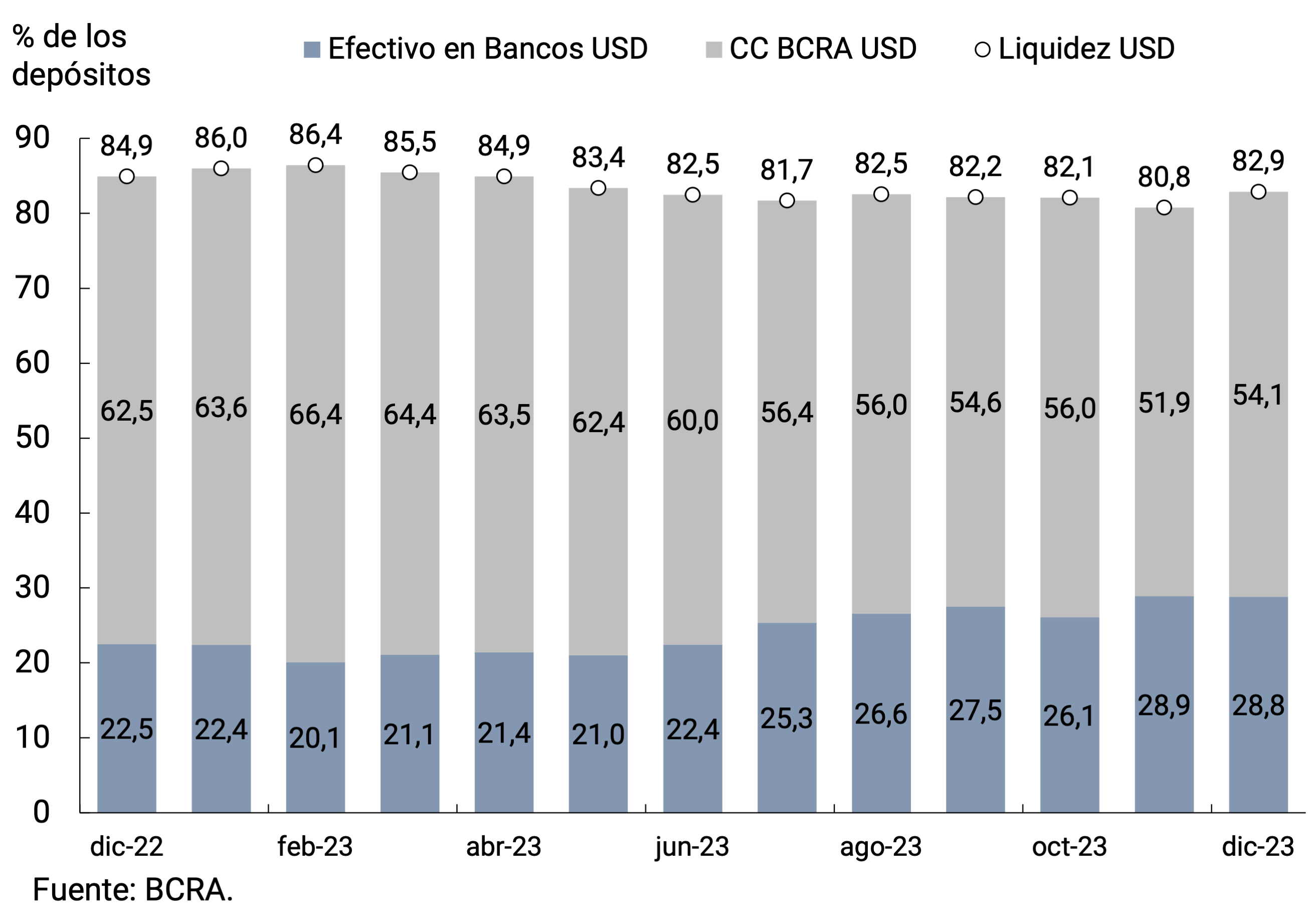

The liquidity of financial institutions in the foreign currency segment increased by 2.1 p.p. to an average of 82.9% of deposits, remaining at historically high levels. In terms of composition, there was an increase in current accounts at the BCRA to the detriment of cash in banks (see Figure 7.2).

The BCRA defined new conditions both for the settlement of foreign currency and for the payment of imports of goods and services in the Free Exchange Market (MLC), with the aim of normalizing a market that was operating in a dysfunctional manner due to the levels of accumulated commercial debt9. Thus, the system of payments for imports of goods and services was simplified, eliminating all requirements linked to obtaining authorizations through the Import System of the Argentine Republic (SIRA), and the requirement of the AFIP’s Single Foreign Trade Account Certificate was also abolished. At the same time, differentiated payment terms were established according to the tariff position of the different imported goods and services, with the aim of administering foreign exchange during the coming months, characterized by the low seasonality of exports10.

On the other hand, in order to provide predictability to the payments associated with the stock of accumulated commercial debt of importers, the BCRA began to offer new instruments made up of three series of Bonds for the Reconstruction of a Free Argentina (BOPREAL) to importers of goods and services with commercial debts for operations with customs registration or service effectively provided until December 12. Those who subscribe to the bonds corresponding to the longest term offered by the BCRA will be able to access the foreign exchange market from February 1 to pay said debt, for the amount established in regulation11. Finally, the rule that prevented more than one transfer per month on accounts in foreign currency was annulled12.

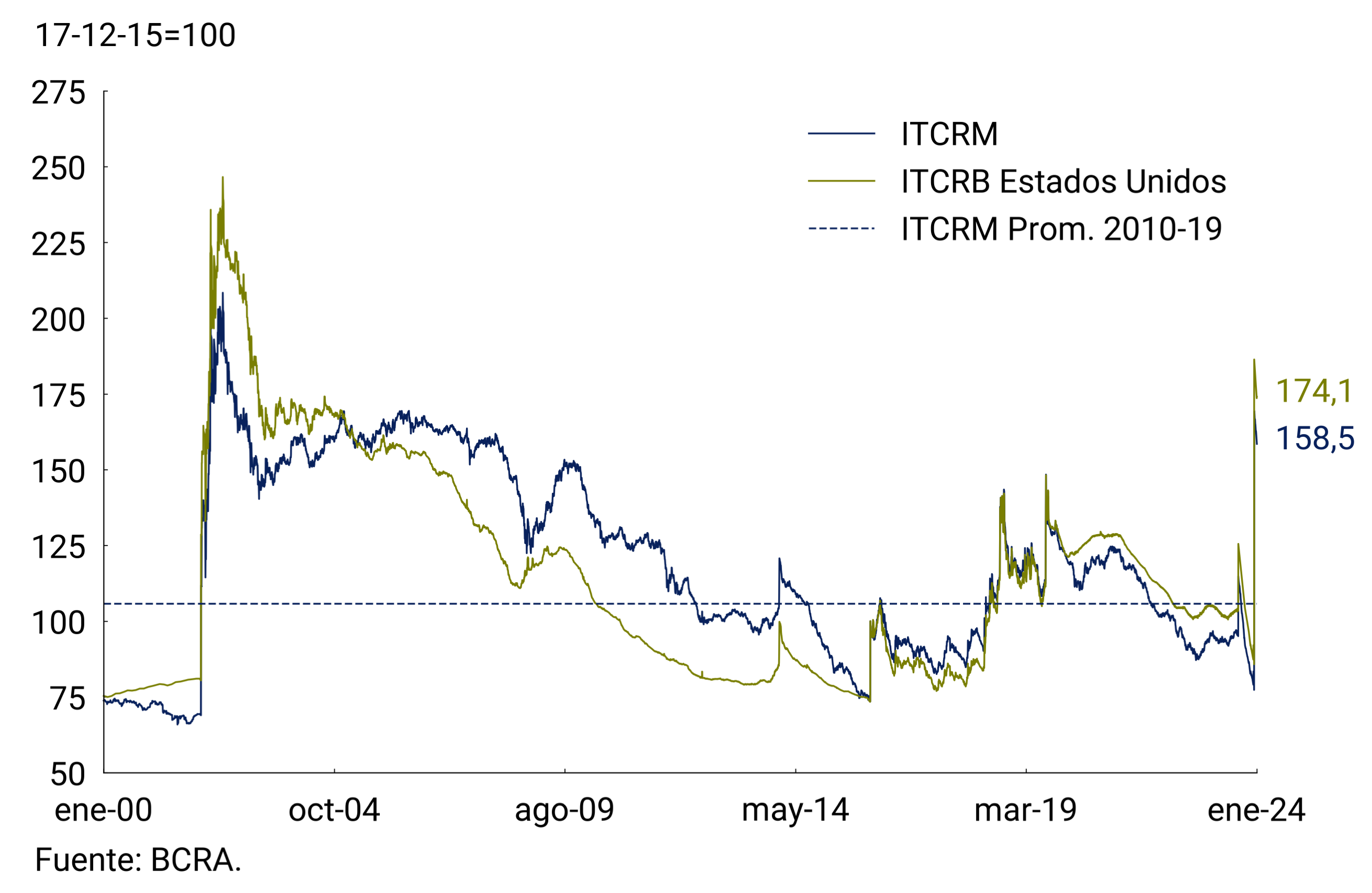

As part of the transition to a regime that ensures macroeconomic stability, the new administration decided to correct the bilateral nominal exchange rate (TCN) against the U.S. dollar, bringing it to $800/USD. In addition, a sliding trail of 2% per month was established. The adjustment of the exchange rate will play the role of a complementary anchor for inflation expectations, until the commitment and visibility of the fiscal effort are fully appreciated. Thus, the Multilateral Real Exchange Rate Index (ITCRM) reached levels similar to those recorded between 2004 and 2007 (see Figure 7.3).

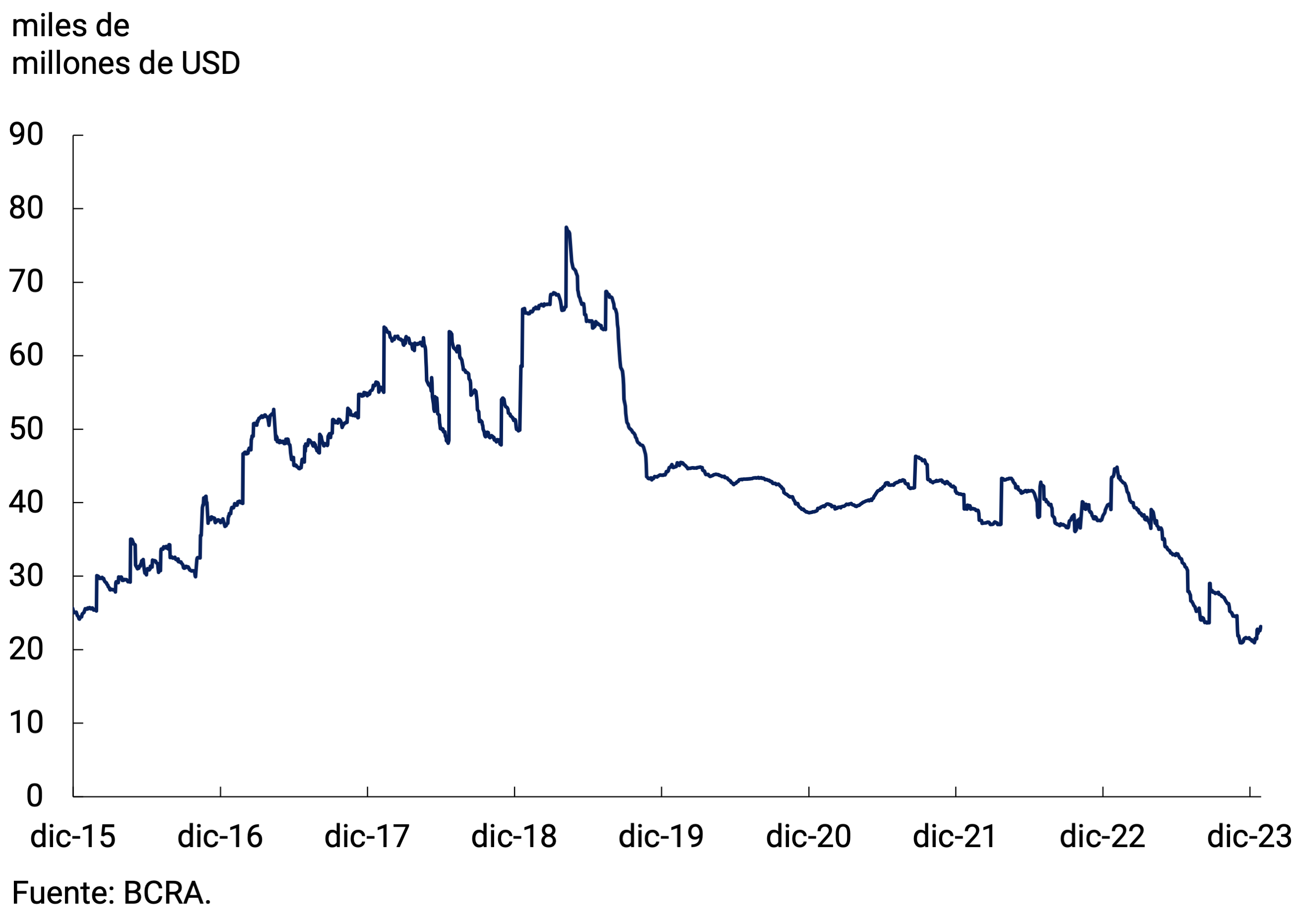

The BCRA’s International Reserves ended December with a balance of USD23,073 million, registering an increase of USD1,560 million compared to the end of November (see Chart 7.4). This dynamic was influenced by the exchange rate correction and the reduction in the gap with respect to financial exchange rates, which allowed the BCRA to make net purchases of foreign currency for almost USD2,900 million in the last 12 days of the year. Finally, it should be noted that on December 21, a payment was made to the IMF for USD919 million, which was met with a loan from CAF.

Glossary

ANSES: National Social Security Administration.

AFIP: Federal Administration of Public Revenues.

BADLAR: Interest rate on fixed-term deposits for amounts greater than one million pesos and a term of 30 to 35 days.

BCRA: Central Bank of the Argentine Republic.

BM: Monetary Base, includes monetary circulation plus deposits in pesos in current account at the BCRA.

CC BCRA: Current account deposits at the BCRA.

CER: Reference Stabilization Coefficient.

NVC: National Securities Commission.

SDR: Special Drawing Rights.

E.A.: Effective Annual.

EFNB: Non-Banking Financial Institutions.

EM: Minimum Cash.

FCI: Common Investment Fund.

A.I.: Year-on-year .

IAMC: Argentine Institute of Capital Markets

CPI: Consumer Price Index.

ITCNM: Multilateral Nominal Exchange Rate Index

ITCRM: Multilateral Real Exchange Rate Index

LEBAC: Central Bank bills.

LELIQ: Liquidity Bills of the BCRA.

LFIP: Financing Line for Productive Investment.

M2 Total: Means of payment, which includes working capital held by the public, cancelling cheques in pesos and demand deposits in pesos from the public and non-financial private sector.

Private M2: Means of payment, includes working capital held by the public, cancelling cheques in pesos and demand deposits in pesos from the non-financial private sector.

Private transactional M2: Means of payment, includes working capital held by the public, cancelling cheques in pesos and non-remunerated demand deposits in pesos from the non-financial private sector.

M3 Total: Broad aggregate in pesos, includes the current currency held by the public, cancelling checks in pesos and the total deposits in pesos of the public and non-financial private sector.

Private M3: Broad aggregate in pesos, includes the working capital held by the public, cancelling checks in pesos and the total deposits in pesos of the non-financial private sector.

MERVAL: Buenos Aires Stock Market.

MM: Money Market.

N.A.: Annual nominal.

NOCOM: Cash Clearing Notes.

ON: Negotiable Obligation.

GDP: Gross Domestic Product.

P.B.: basis points.

PSP.: Payment Service Provider.

p.p.: percentage points.

MSMEs: Micro, Small and Medium Enterprises.

ROFEX: Rosario Term Market.

S.E.: No seasonality

SISCEN: Centralized System of Information Requirements of the BCRA.

SIMPES: Comprehensive System for Monitoring Payments of Services Abroad.

TCN: Nominal Exchange Rate

IRR: Internal Rate of Return.

TM20: Interest rate on fixed-term deposits for amounts greater than 20 million pesos and a term of 30 to 35 days.

TNA: Annual Nominal Rate.

UVA: Unit of Purchasing Value

References

1 Corresponds to private M2 excluding interest-bearing demand deposits from companies and financial service providers. This component was excluded since it is more similar to a savings instrument than to a means of payment.

2 New monetary and exchange rate policy framework

3 The interest rates currently in force are those established by communication “A” 7922.

4 See Communication “A” 7929.

5 The private M3 includes the working capital held by the public and the deposits in pesos of the non-financial private sector (demand, time and others).

6 Includes current accounts at the BCRA, cash in banks, balances of net passes arranged with the BCRA, holdings of LELIQ and NOTALIQ, and public bonds eligible for reserve requirements.

7 Communication “A” 7923.

8 Communication “A” 7921.

9 Communication “A” 7935.

10 Communication “A” 7917.

11 Communications “A” 7918, “A” 7925 and “A” 7935.

12 Communication “A” 7933.