Política Monetaria

Monthly Monetary Report

July

2021

Monthly report on the evolution of the monetary base, international reserves and foreign exchange market.

1. Executive Summary

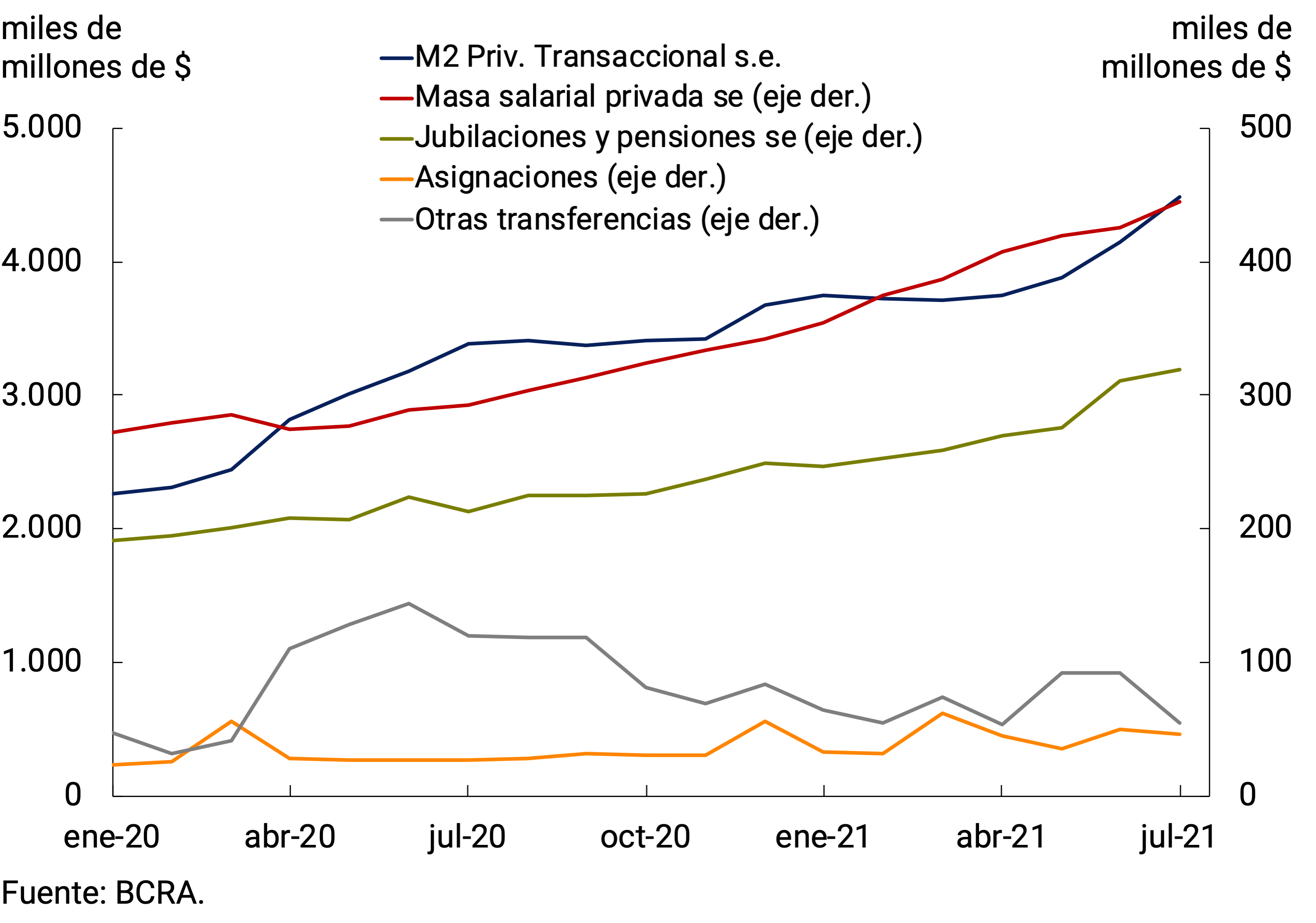

In real and seasonally adjusted terms, means of payment (private transactional M2) registered a new increase in July. In the month, the payment of the AUH supplement for those who had not received it in June, domestic tourism during the winter vacation period and the payment of the half bonus for June, which impacted between the end of June and the beginning of July, had an impact.

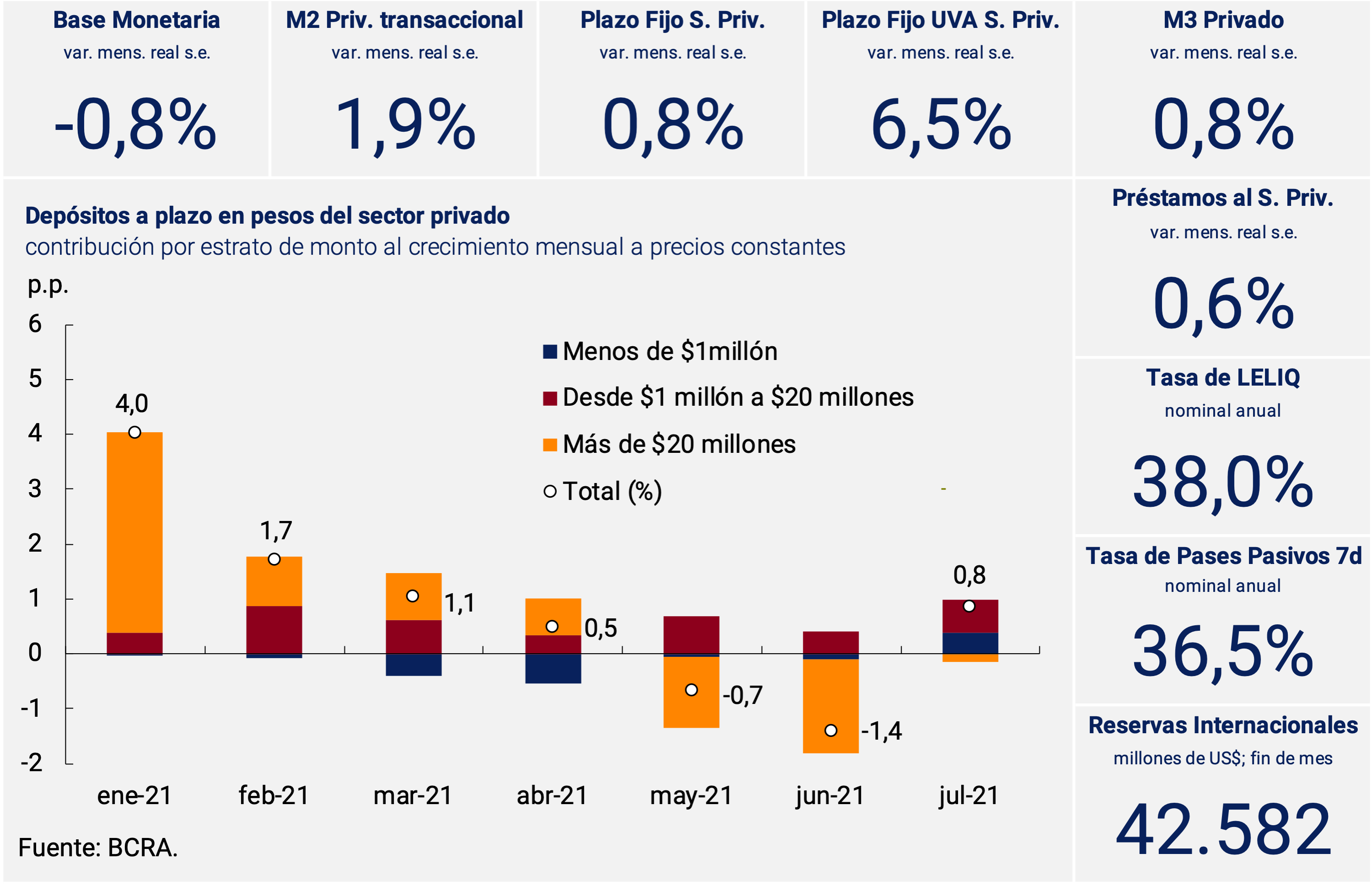

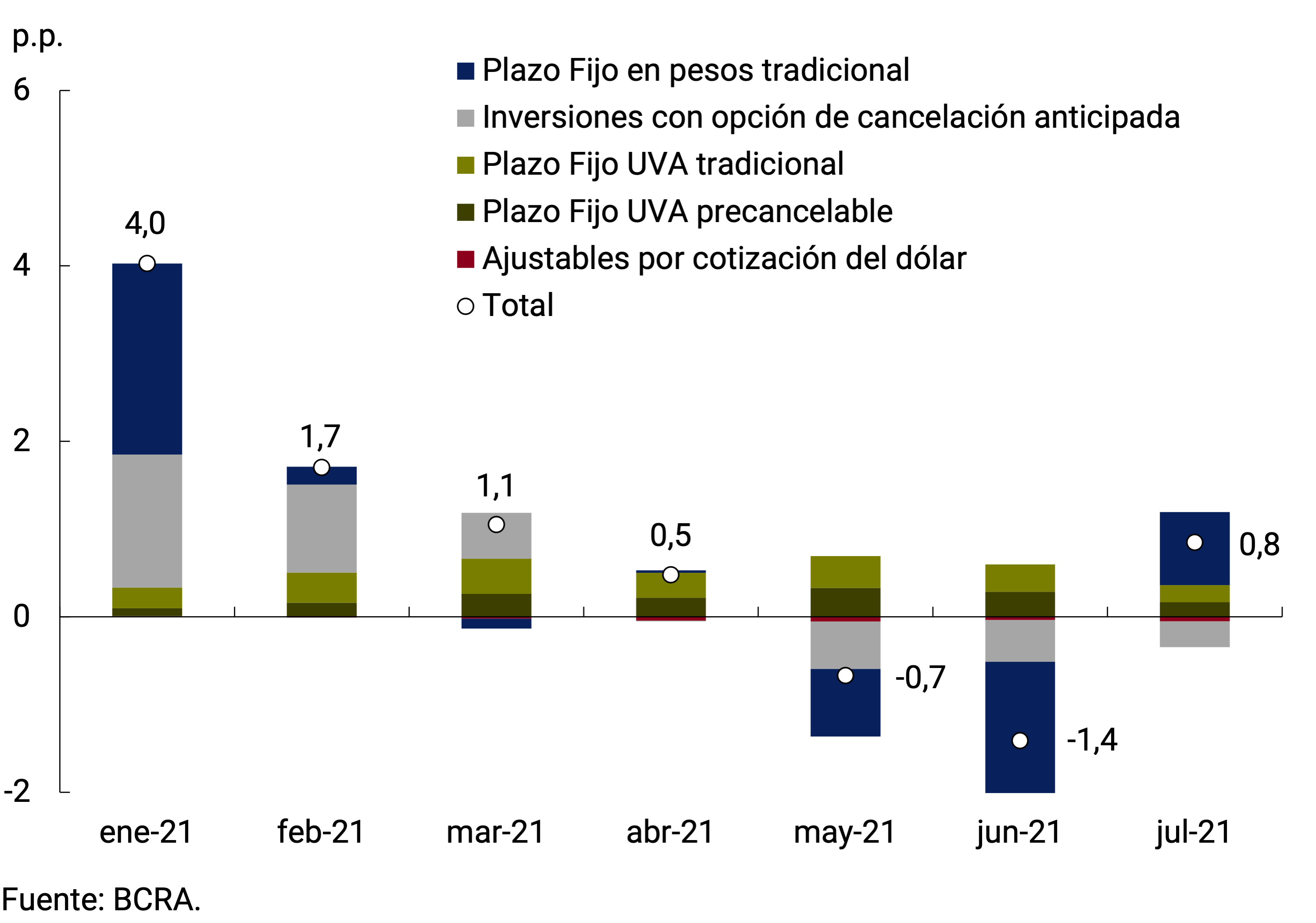

Time deposits in pesos in the private sector grew again at constant prices, breaking with two consecutive months of contractions. Wholesale term placements stabilized at constant prices and those of less than $20 million continued to grow at a rate similar to that of previous months. UVA deposits moderated their pace of expansion, in a context in which the interest rate differential between these placements and those denominated in pesos was reduced, given the expected reduction in inflation for the coming months. All in all, the broad monetary aggregate (private M3) at constant prices would have registered an expansion of 0.8% s.e. in July, accumulating a fall of around 9% y.o.y.

Loans in pesos to the non-financial private sector expanded at constant prices, breaking a period of 10 consecutive months of contractions. In particular, trade lines and, more specifically, Current Account Advances were highlighted.

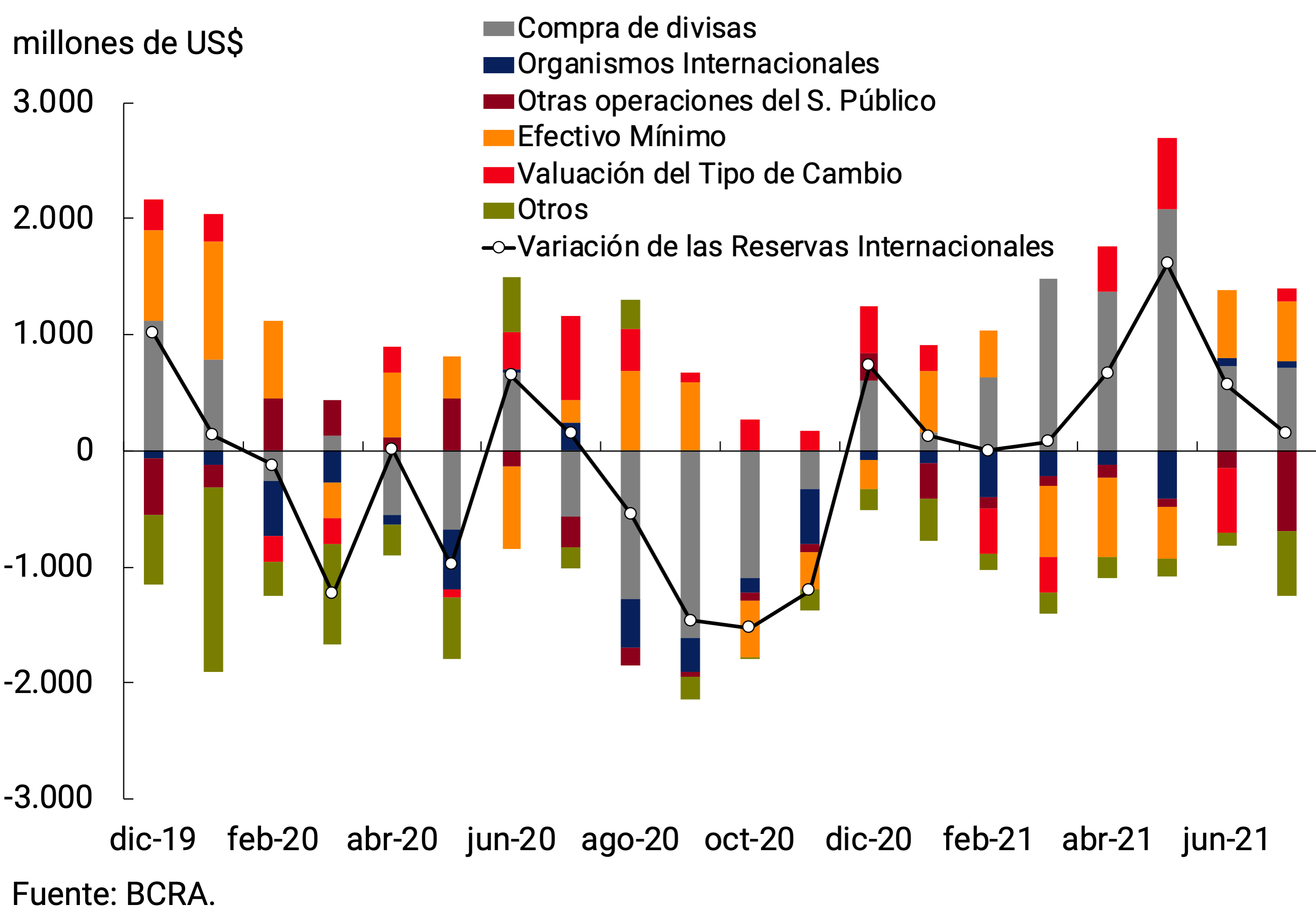

In the foreign currency segment, no significant changes were observed in either the assets or liabilities of financial institutions. Meanwhile, the BCRA continued, for the eighth consecutive month, to increase its international reserve position, with the net purchase of foreign currency being the component with the greatest positive contribution.

2. Payment methods

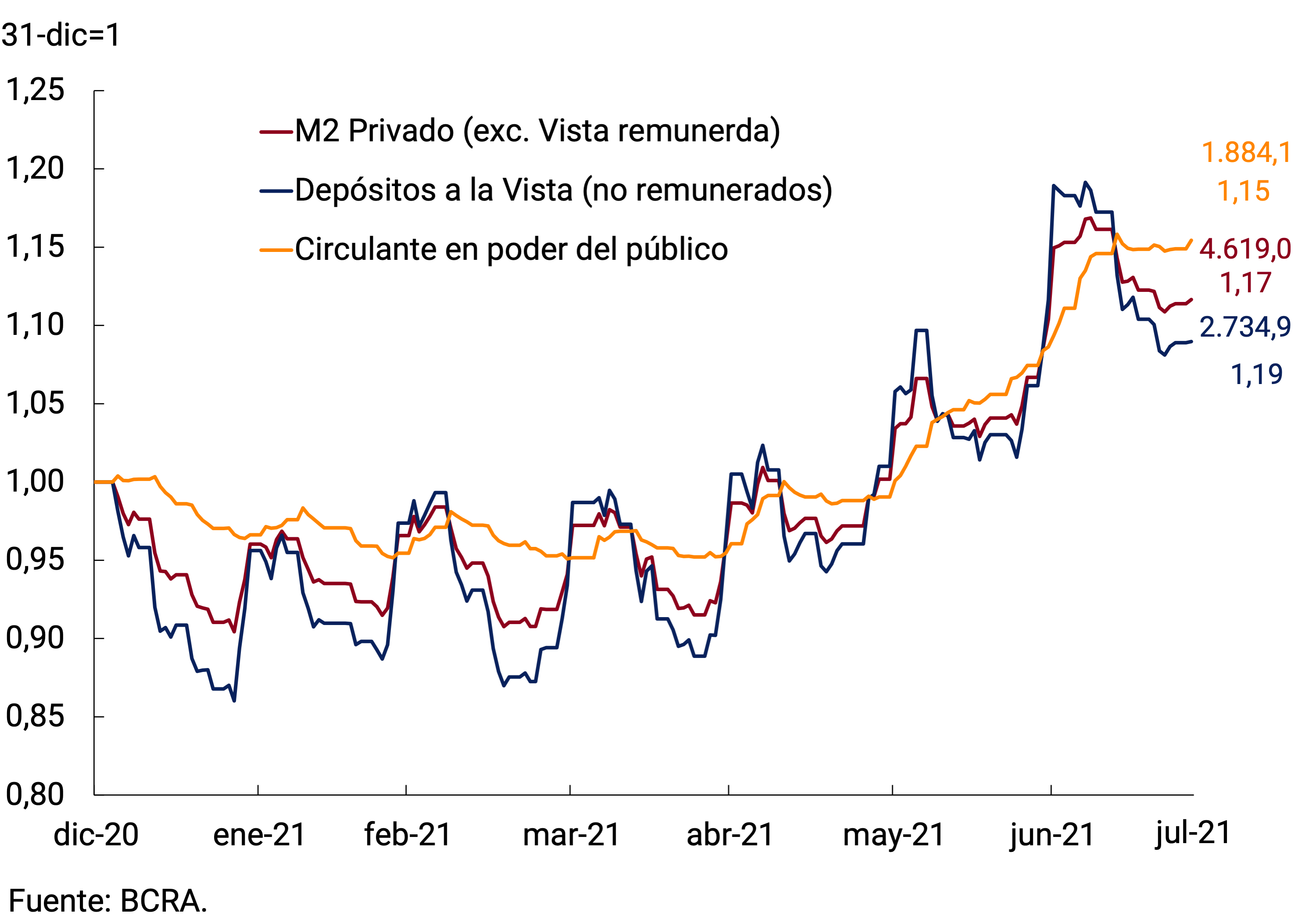

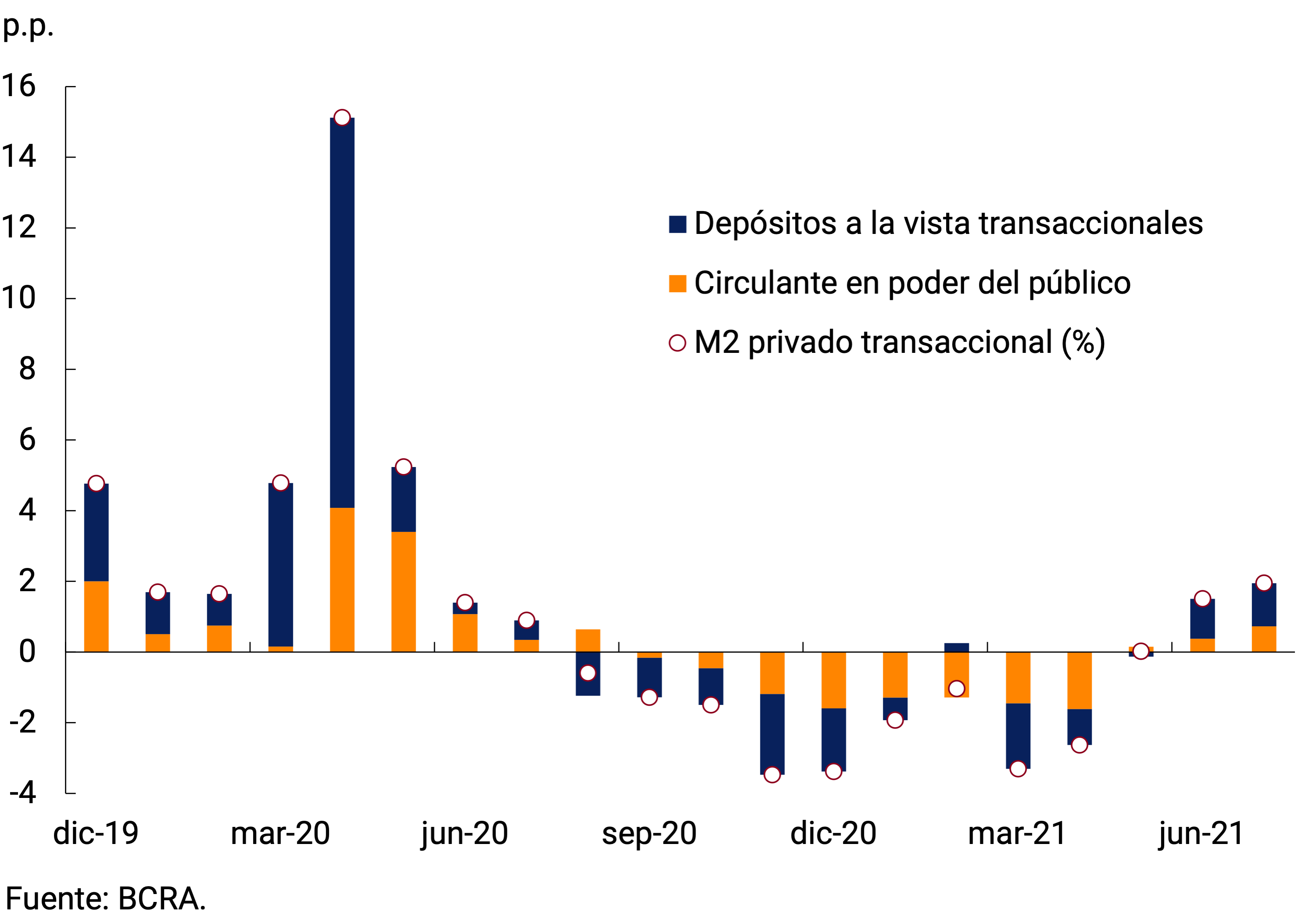

In real terms1 and seasonally adjusted (s.e.), means of payment (measured through private transactional M2 2) grew for the third consecutive month (1.9%). Among its components, both non-interest-bearing demand deposits and working capital deposits held by the public contributed positively to the month’s expansion (see Figures 2.1 and 2.2). Private transactional M2 in terms of GDP has remained in the order of 10% since March, standing 1.4 p.p. below the average ratio for the 2010-2019 period and -4.2 p.p. compared to the maximum reached in June last year.

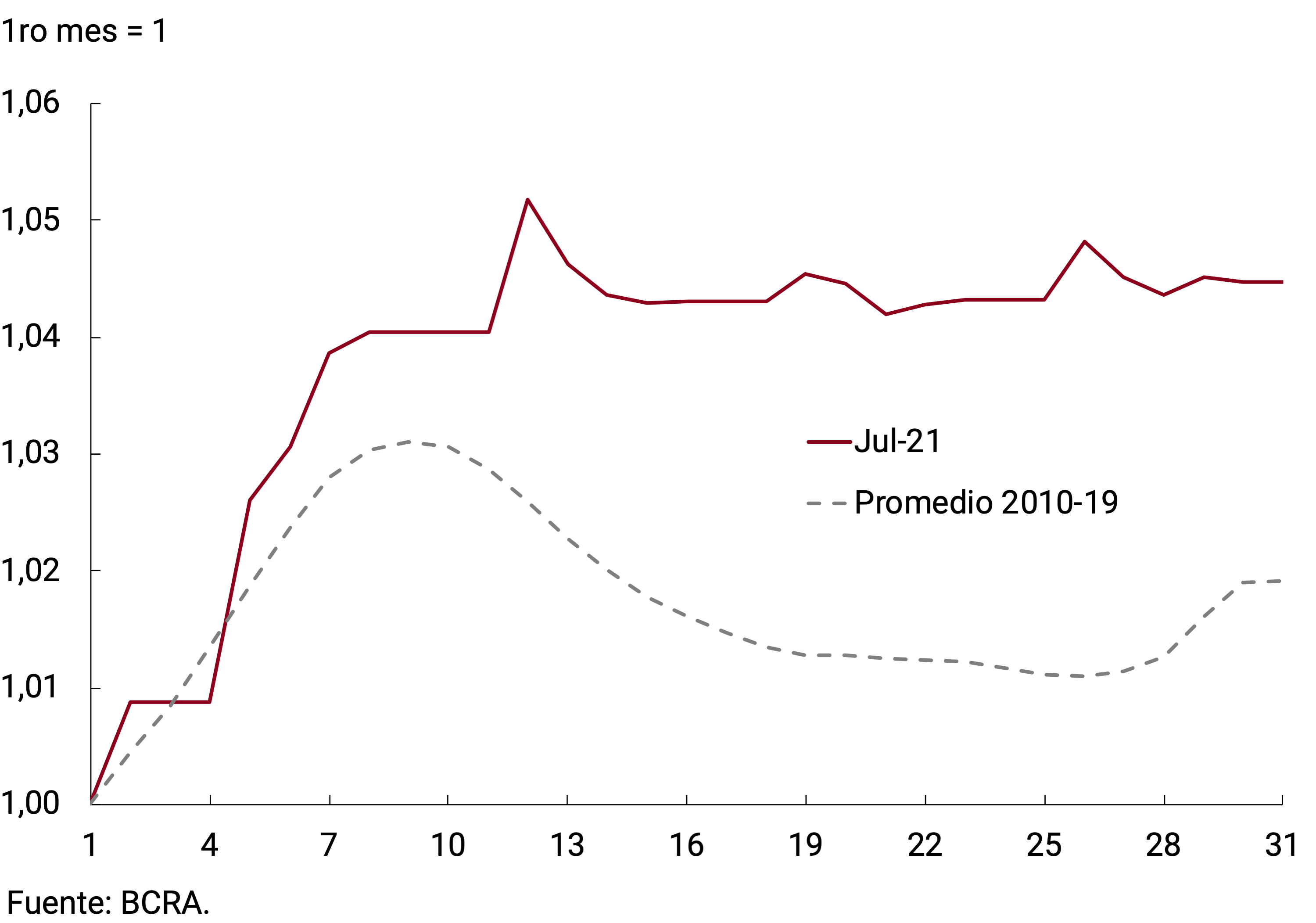

The working capital held by the public, after an initial increase, remained relatively stable in nominal terms throughout the month. In this way, it differed from its intra-month seasonal behavior for the second consecutive month, as it did not register the typical fall of the second and third weeks (see Figure 2.3). Among the reasons that help explain this behavior is the greater availability of resources for the most vulnerable sectors of the population, which have a high preference for cash. In fact, between July 8 and 22, ANSES continued to make the payment of 20% of the Universal Child Allowance supplement, which is usually made on December3, although to a smaller proportion of beneficiaries since most of them received the previous month (see Figure 2.4). In addition, in the third week of the month the winter vacation period began and, given the global health situation, tourism was mostly channeled to local destinations. Seasonally adjusted, the working capital exhibited a monthly increase of 1.8% at constant prices and so far this year accumulated a fall of around 10% in real terms. On the other hand, transactional demand deposits presented a monthly increase of 2.1% s.e. at constant prices, which was similar to that of the previous month.

3. Savings instruments in pesos

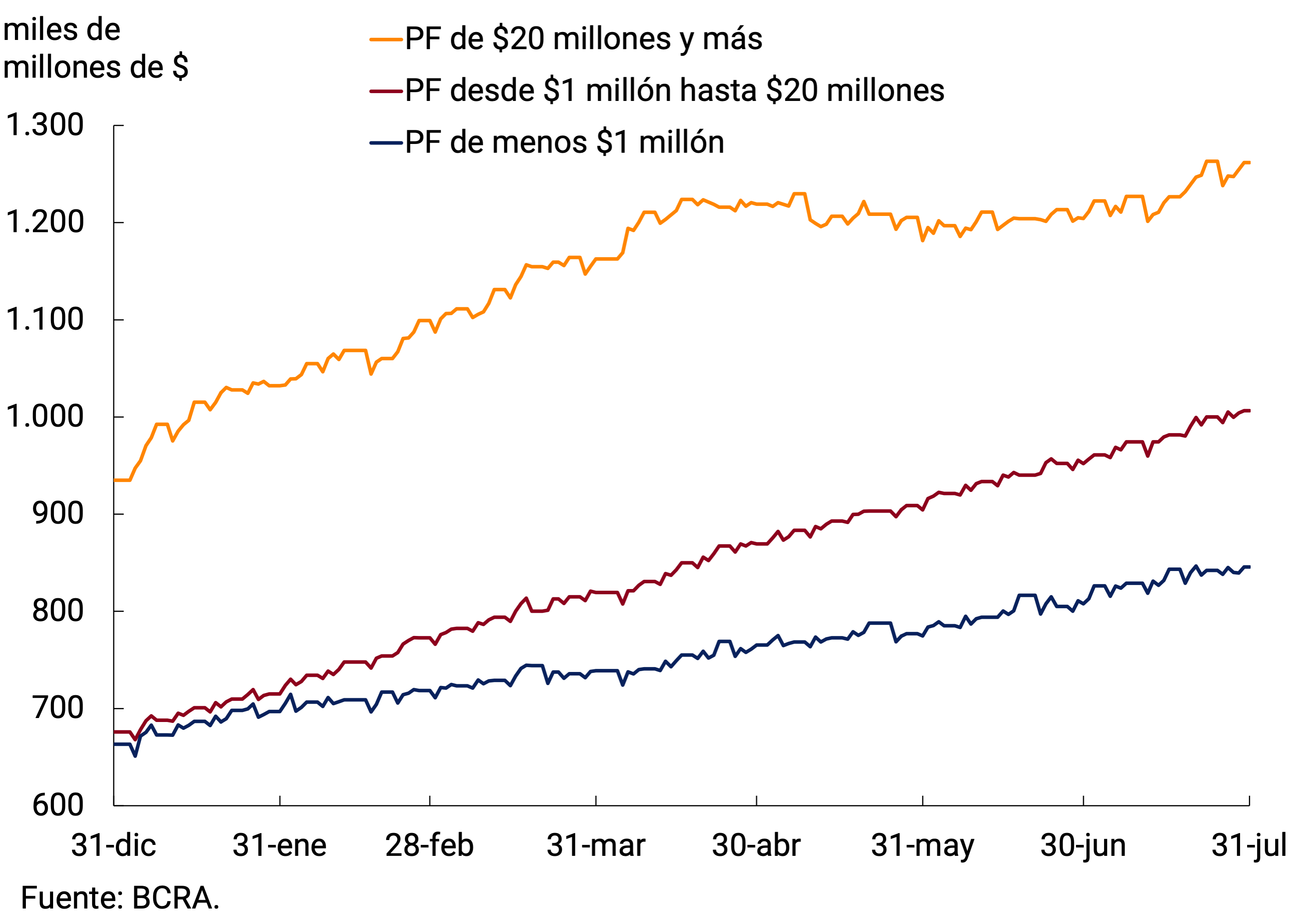

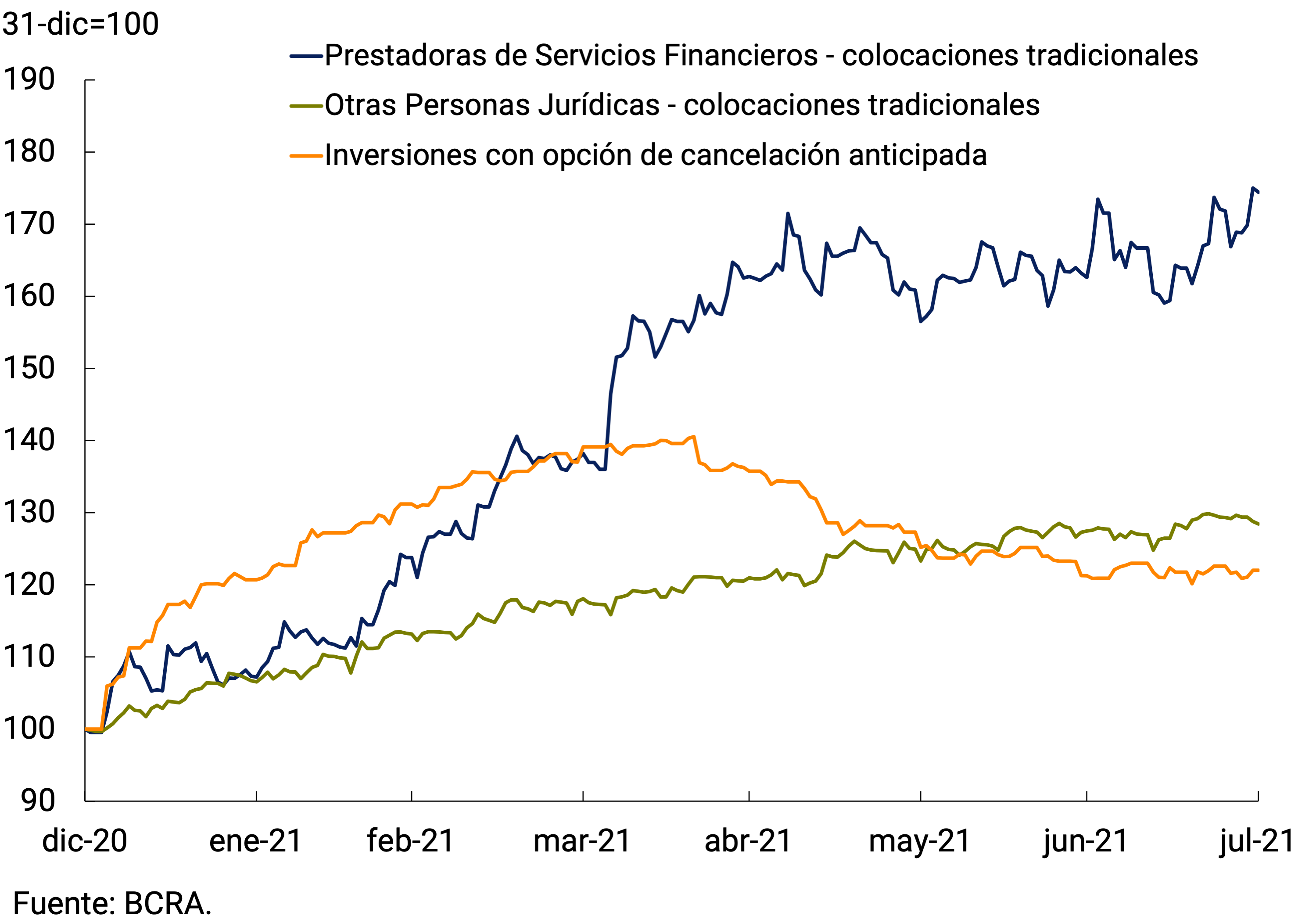

The private sector’s fixed-term deposits inpesos 4 grew at constant prices, breaking with two consecutive months of declines. This behavior was associated with the greater dynamism of placements in the wholesale segment (more than $20 million) in the second half of the month, which led to their stabilization at constant prices (see Figure 3.1). At the level of depositors, nominal growth occurred in the two main players in the wholesale segment: financial service providers (FSPs) and companies. On the side of the PSFs, an increase was observed in the assets of the Mutual Funds of Money Market (FCI MM), whose funds were channeled in part into term instruments (they also fed interest-bearing demand placements). For their part, companies also increased their holdings, although at a slower pace than PSFs, after the period of higher salary expenses, associated with the payment of the half bonus, and the payment of taxes (see Figure 3.2).

In terms of instruments, the increase in wholesale deposits was concentrated in traditional placements, while investments with early cancellation options remained practically unchanged. It should be noted that, in the traditional segment, the TM20 interest rate of private banks remained relatively unchanged in July (33.9% n.a. and 39.7% y.a.), around 8 p.p. above the interest rate paid to legal entities for investments with an early cancellation option.

Deposits of up to $20 million continued to show a similar trend to that of previous months. Specifically, placements of between $1 and $20 million continued to grow at constant prices, driven by the impositions of individuals. Meanwhile, deposits of up to $1 million continued to remain relatively stable in real terms (see Figure 3.1). It should be noted that the most dynamic stratum is the one between $750,000 and $1 million, so considering the capitalization of interest, many deposits over time cross stratum to between $1 and $20 million. The interest rate on time deposits of less than $1 million paid to individuals stood at an average of 36.3% n.a. (43.0% e.a.)5.

Figure 3.1 | Time deposits in pesos from the private

sector Daily balance at constant prices by amount stratum

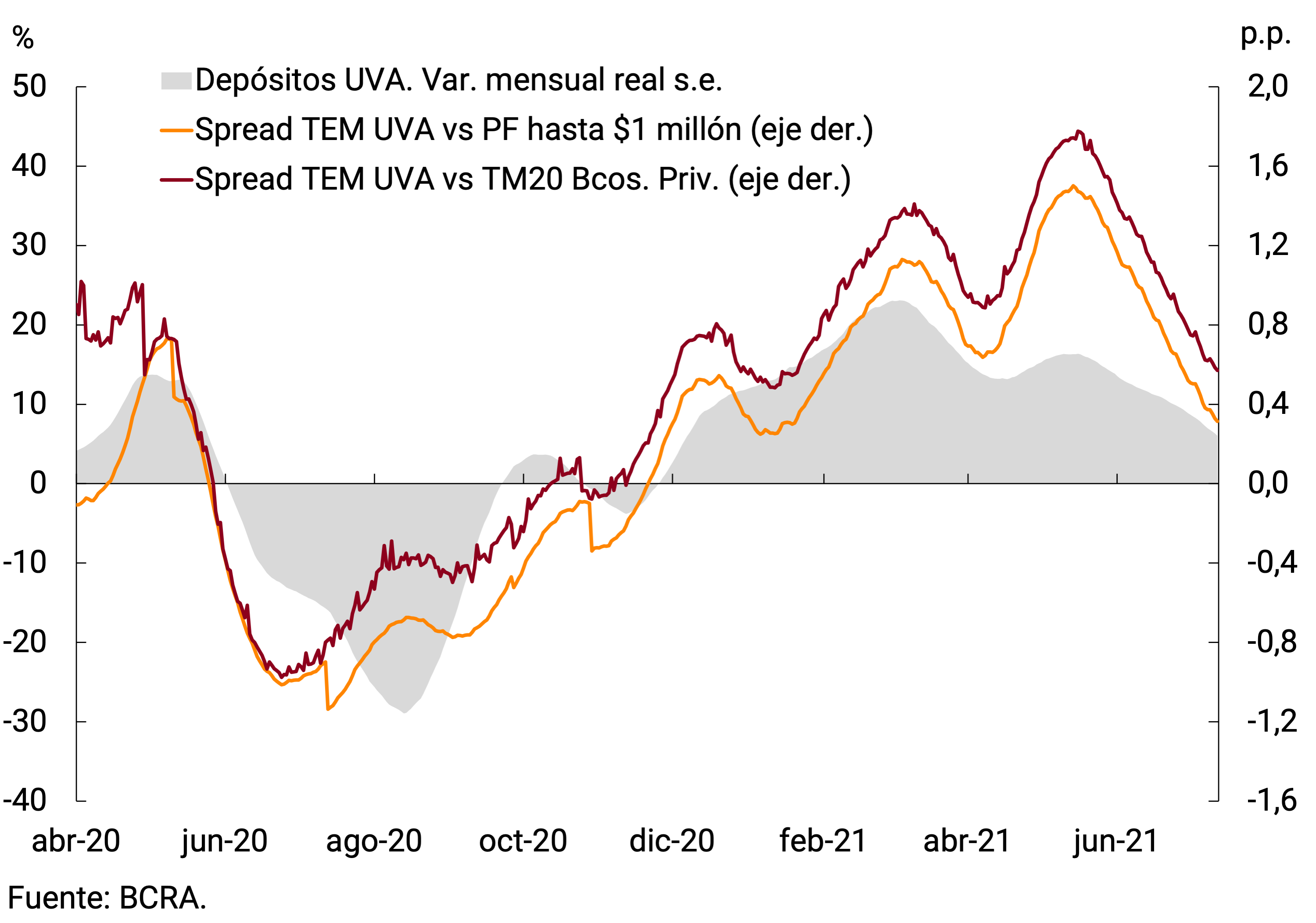

The UVA-denominated deposits segment continued to contribute to the expansion of fixed-term instruments, albeit at a slower pace than in previous months (see Figure 3.3). In fact, in July they registered a monthly increase of 6.5% s.e. in real terms, practically 10 p.p. below the average rate of expansion of the first half of the year. The month’s increase was made up of both traditional UVA placements and those with a pre-cancellation option, whose monthly expansion rates at constant prices were 5.2% and 9.1%, respectively. The moderation in the pace of expansion of this type of placement took place in a context in which the spread between the yield on a deposit in UVA and one in pesos narrowed, given the lower inflation expected in the coming months (see Figure 3.4).

All in all, the broad monetary aggregate (private M3)6 at constant prices would have registered an increase of 0.8% s.e. in July and in the last 12 months it would have accumulated a decrease of around 9%. In terms of Output, it stood at 18.4%, a record similar to the average recorded between 2010 and 2019.

4. Monetary base

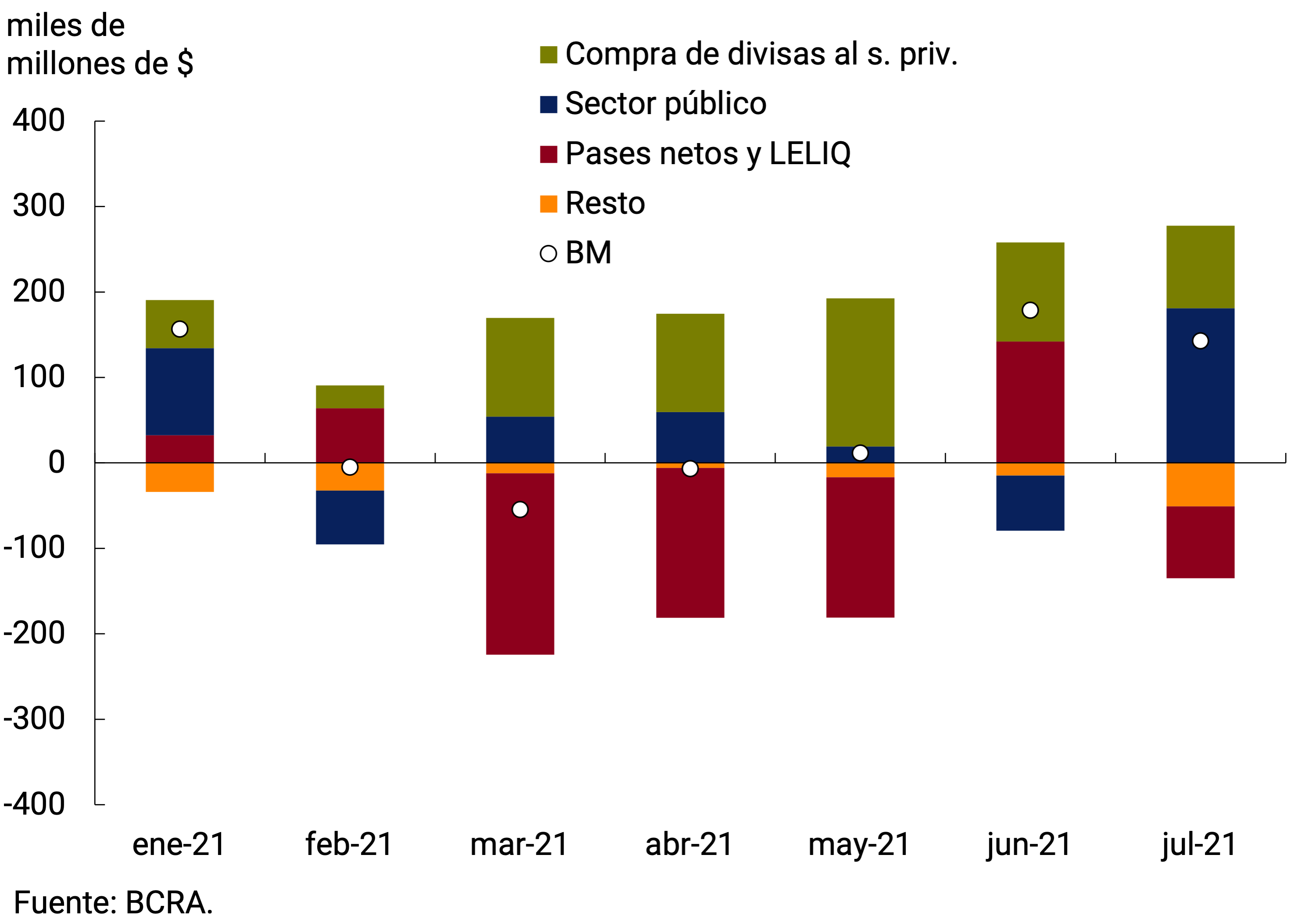

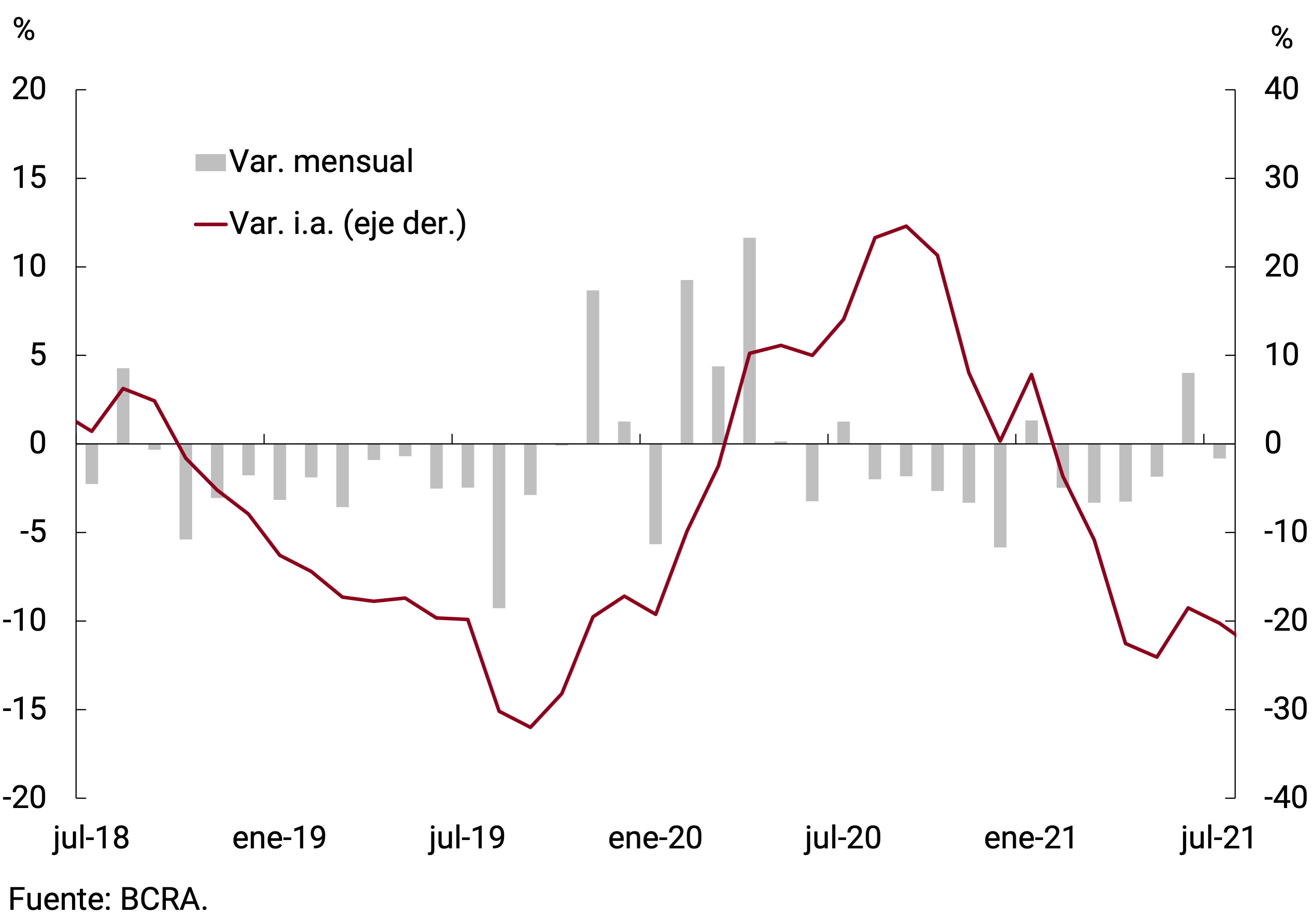

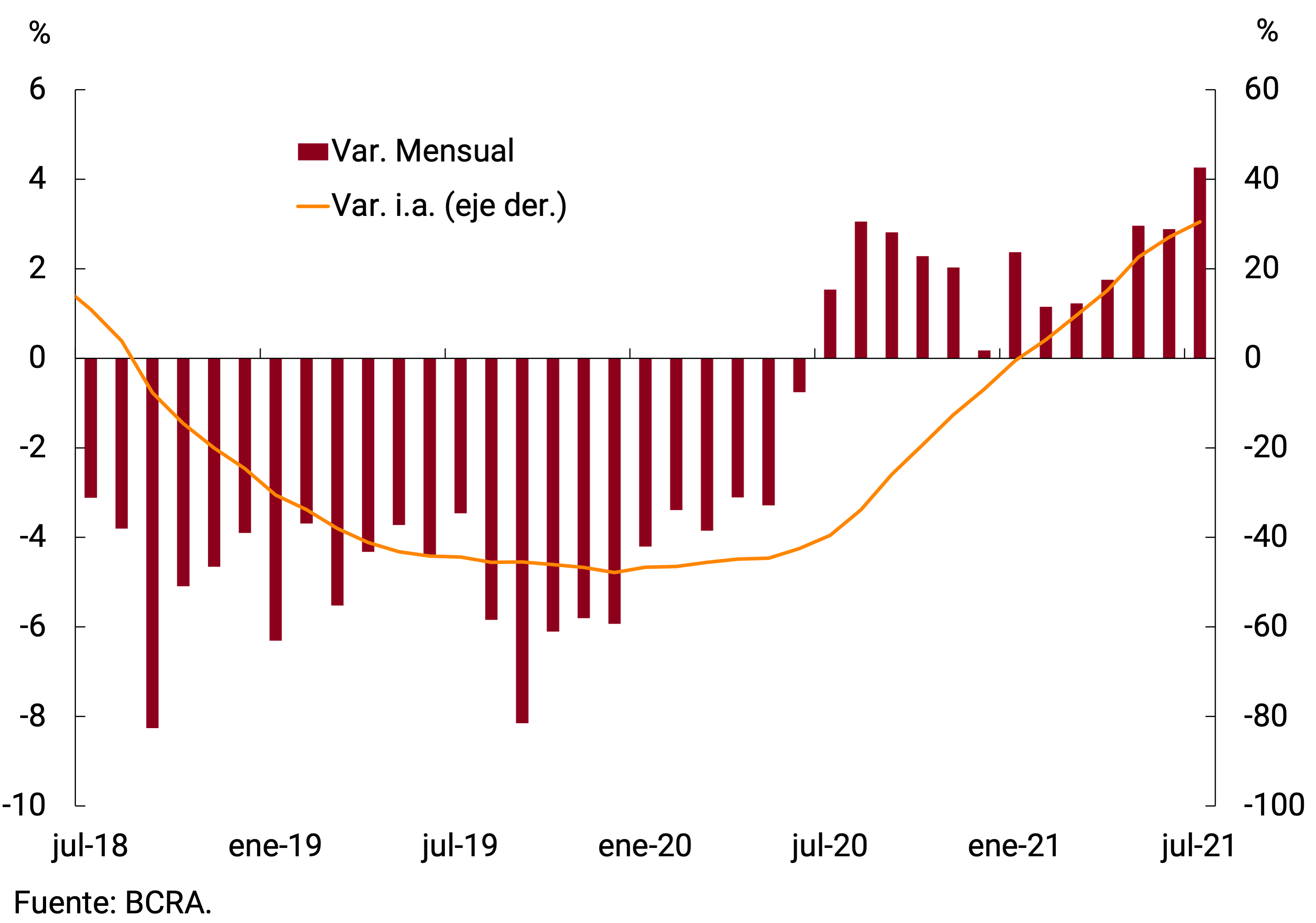

In July, the Monetary Base stood at $2,848 billion, presenting an average monthly nominal increase of 5.3% ($142,695 million). On the supply side, the expansion of the month was associated with public sector operations, mainly the transfer of profits to the National Treasury and the net purchase of foreign currency from the private sector. Part of the expansion of liquidity was sterilized through passive passes with the BCRA (see Figure 4.1). On the side of the demand for the Monetary Base, it should be noted that July has a positive seasonality associated mainly with the demand for working capital held by the public. In fact, considering the series without seasonality, the contraction in the month would have been 0.8% at constant prices, accumulating a fall of close to 20% in year-on-year terms (see Chart 4.2).

5. Loans to the private sector

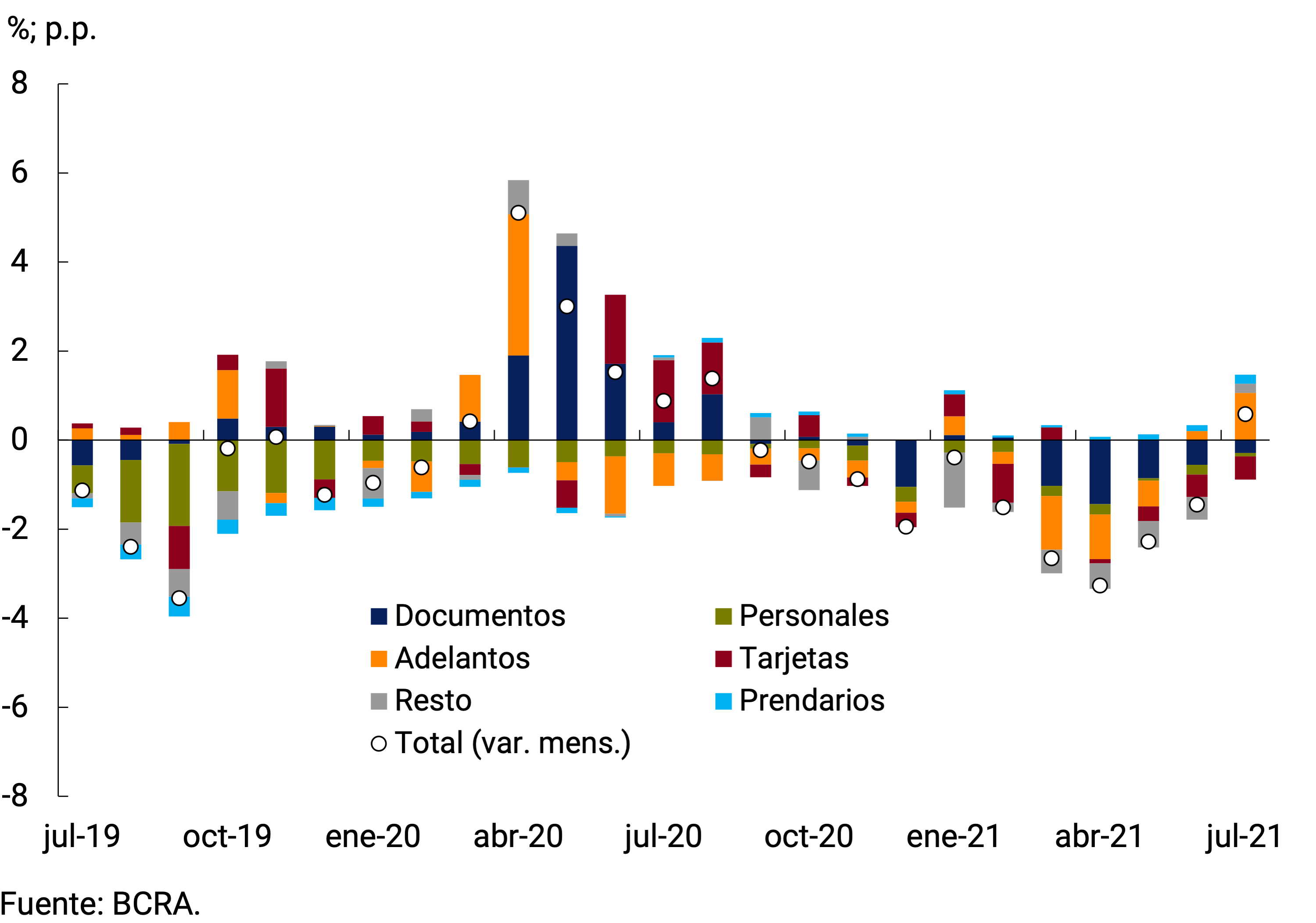

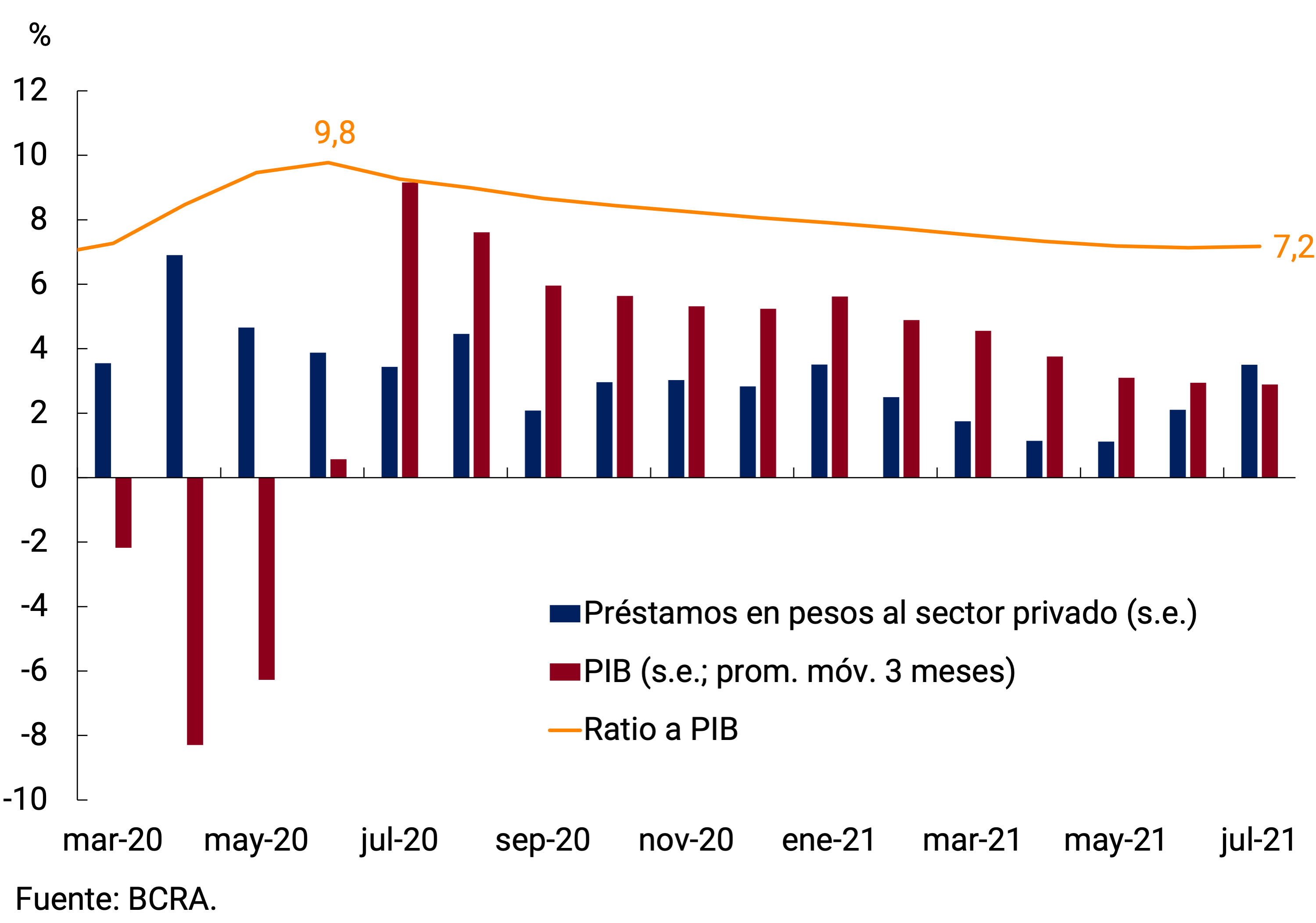

In real terms and without seasonality, loans in pesos to the private sector grew in the month (0.6%), breaking with 10 consecutive months of contractions. Among the different lines of credit, advances and, to a lesser extent, collateral loans were the ones that contributed positively to the variation of the month, being partially offset by the dynamics of consumer financing (see Chart 5.1). Loans in pesos to the private sector in terms of GDP stood at 7.2% in July (see Figure 5.2).

Figure 5.1 | Loans in Pesos to the Real Private Sector

without seasonality; contrib. to monthly growth

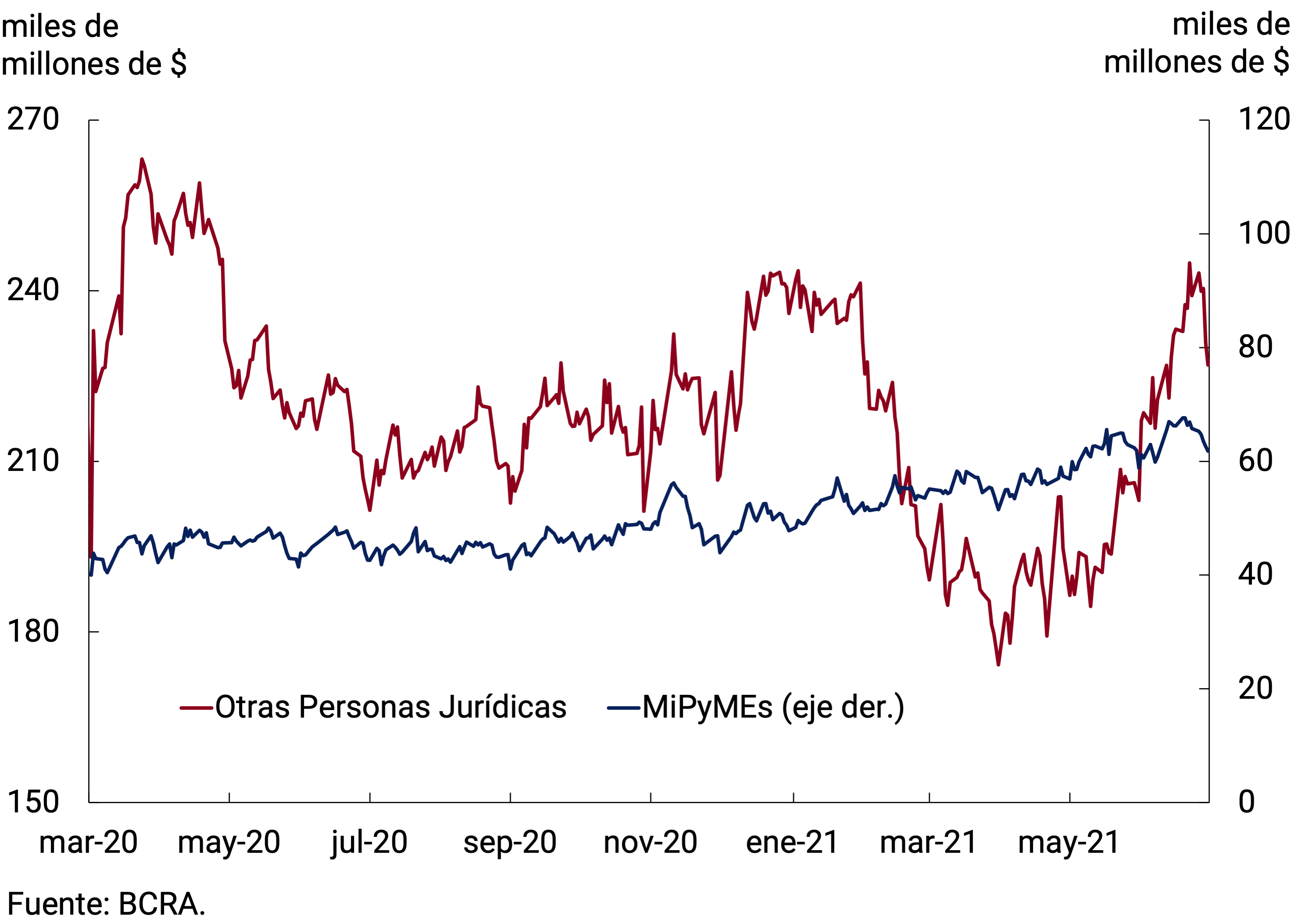

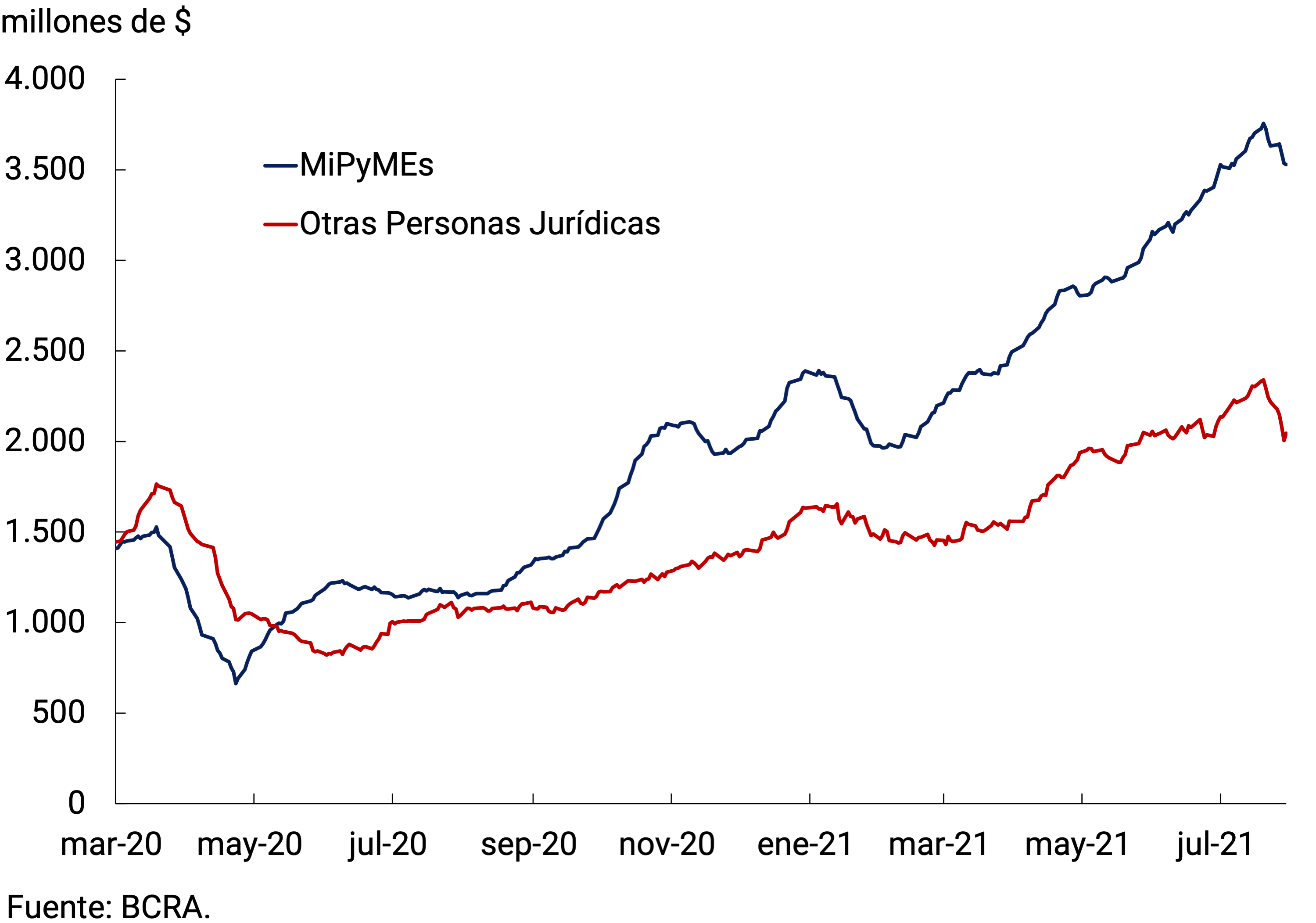

Lines with essentially commercial destinations showed an increase at constant prices, after several months of consecutive declines. The upward momentum came mainly from the shorter-term lines that grew at constant prices. In fact, current account advances showed a real increase of 11.7% s.e., driven by financing to large companies. They rebuilt their credit levels through this line, reaching at the end of July a nominal balance similar to that observed prior to the fall recorded at the beginning of last March (see Figure 5.3). Likewise, discounted documents showed a monthly growth of 5.0% s.e. at constant prices. The dynamism of the latter is associated with the Financing Line for Productive Investment (LFIP), since disbursements are mostly concentrated in the MSME segment and at rates consistent with the LFIP (see Figure 5.4). It should be noted that the LFIP contemplates a maximum interest rate of 30% n.a. for the financing of investment projects and 35% n.a. for working capital.

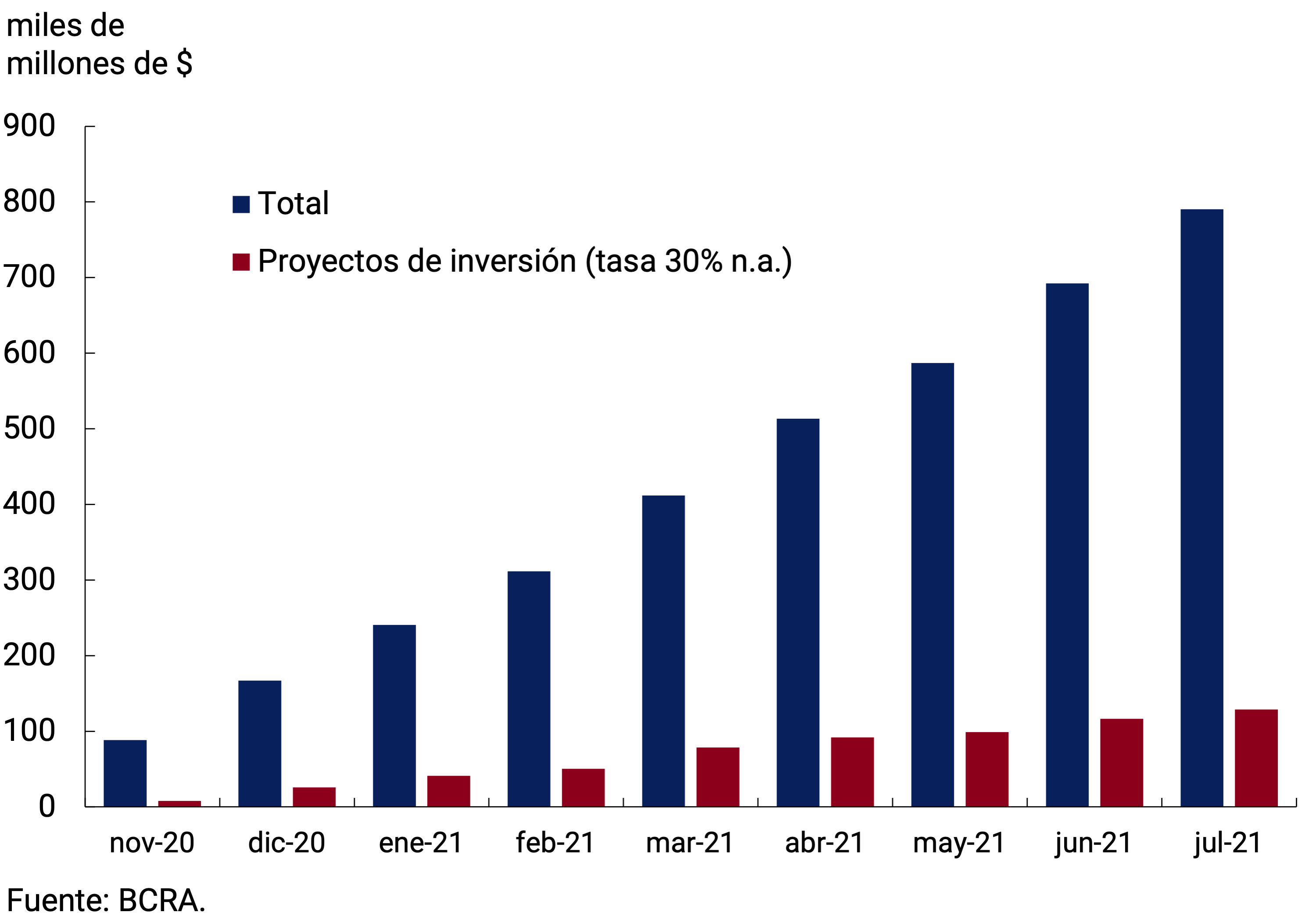

In July, loans granted under the LFIP increased by $97.9 billion, accumulating disbursements totaling approximately $790.314 billion since its implementation. With regard to the destinations of these funds, about 84% of the total disbursed corresponds to the financing of working capital and the rest to the line that finances investment projects (see Figure 5.5). At the time of publication, the number of companies that accessed the LFIP amounted to around 157,300. In July, the BCRA decided to extend the “Financing of investment projects” line to all companies, regardless of their size, that make investments aimed at increasing the productive capacity of chicken and/or pork. These sectors have a potential margin to increase their production and contribute both to the diversification of the local meat consumption basket and to the increase in net exports7.

With regard to consumer-related loans, credit card financing would have exhibited a monthly contraction in real terms of 1.6% s.e., accumulating a fall of 1.9% in the last twelve months. For their part, personal loans showed a decrease of 0.5% s.e. at constant prices, cutting in half the rate of decline of the previous month. The interest rate corresponding to personal loans, after the sharp drop experienced at the end of last month8, gradually increased in the first part of the month until returning to values close to those of mid-June. In fact, this rate registered an increase of 1.1 p.p. in the average of July and stood at 53.8% n.a.

It should be noted that the National Government decided to extend the “Ahora 12” program until January 31, 2022, with some modifications that seek to encourage consumption. Thus, the possibility of buying in 24 and 30 fixed monthly installments with credit cards was included. The maximum term of 30 installments operates exclusively for “white goods” products, such as refrigerators and washing machines, while the term of 24 installments also includes small appliances, computers, notebooks and tablets. It should be noted that all products must be of national production9.

As for lines with real collateral, collateral loans showed an average monthly increase of 4.3% in real terms and without seasonality in July, accumulating a growth of 30.5% in the last twelve months (see Chart 5.6). For its part, the balance of mortgage loans showed a decrease of 0.9% in real terms without seasonality, standing 26.9% below the record for the same month of the previous year.

Figure 5.5 | Financing Productive Investment Line

Accumulated disbursed amounts; data at the end of the month

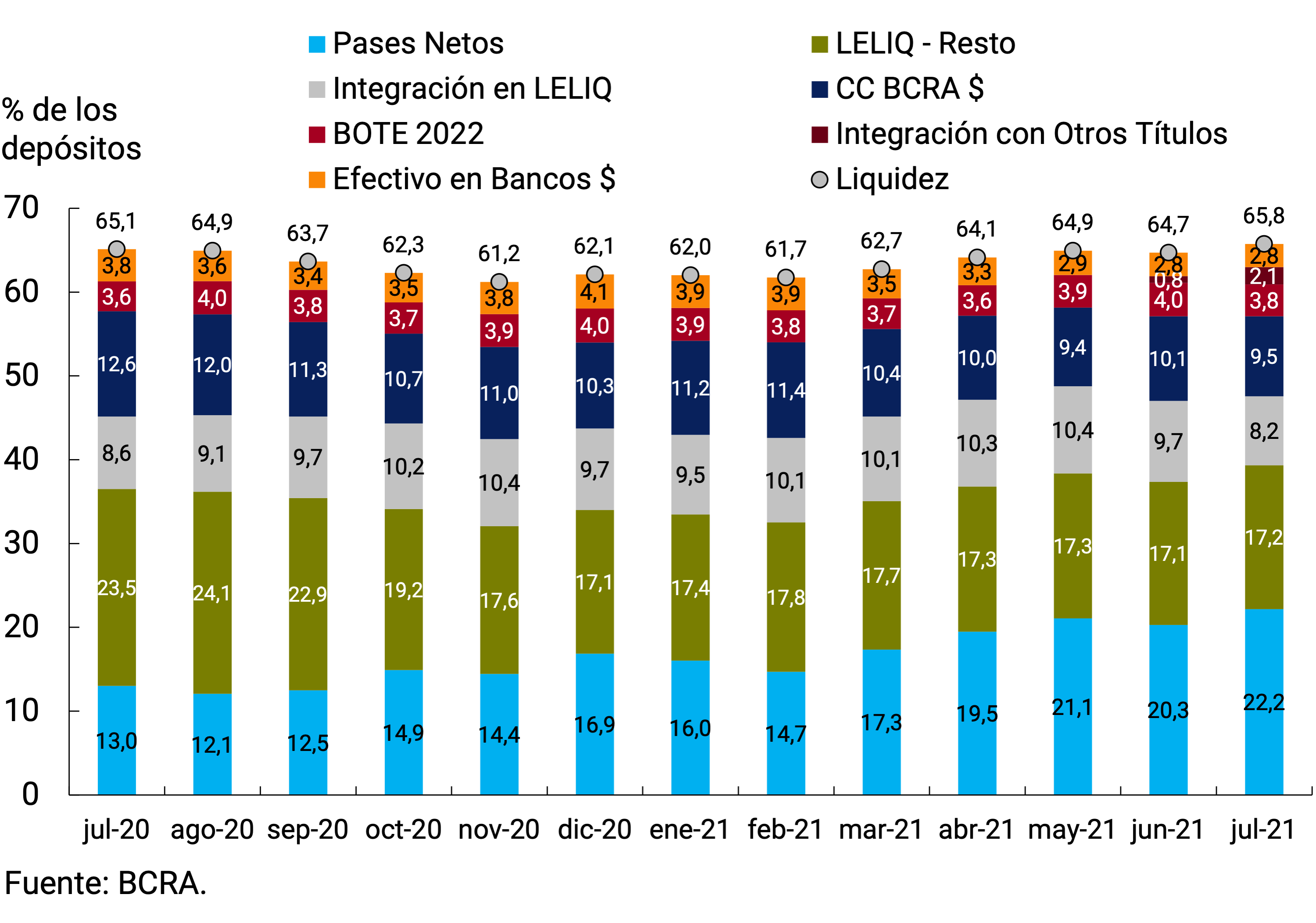

6. Liquidity in pesos of financial institutions

Ample bank liquidity in local currency10 continues to be at historically high levels. In a context in which deposits are growing at a faster rate than loans to the private sector, liquidity increased by 1.1 p.p. in July and stood at an average of 65.8% of deposits (see Figure 6.1). In terms of its components, the increase in the integration of minimum cash with public securities stands out, which went from 0.8% of deposits in June to 2.1% in July, with a counterpart to a decrease in the integration with LELIQ. It should be recalled that, since last month, financial institutions may voluntarily choose to integrate the percentage of the reserve requirements that can be integrated into LELIQ in national public securities in pesos (excluding those linked to the price of the dollar) whose residual term is at least 180 days11. In turn, there was an increase in net passes and a fall in current accounts at the central bank. Meanwhile, cash in banks remained at 2.8% of deposits on average for the month.

Among the regulatory changes of the month that have a potential impact on bank liquidity, it is worth mentioning that as of July it was provided that as of July the obligations with merchants for sales made through the use of debit and prepaid cards will be excluded from the minimum cash requirement12. In addition, effective since September, an increase was established in the maximum deduction for financing granted within the framework of the “Ahora 12” Program, which went from 6% to 8% of deposits13.

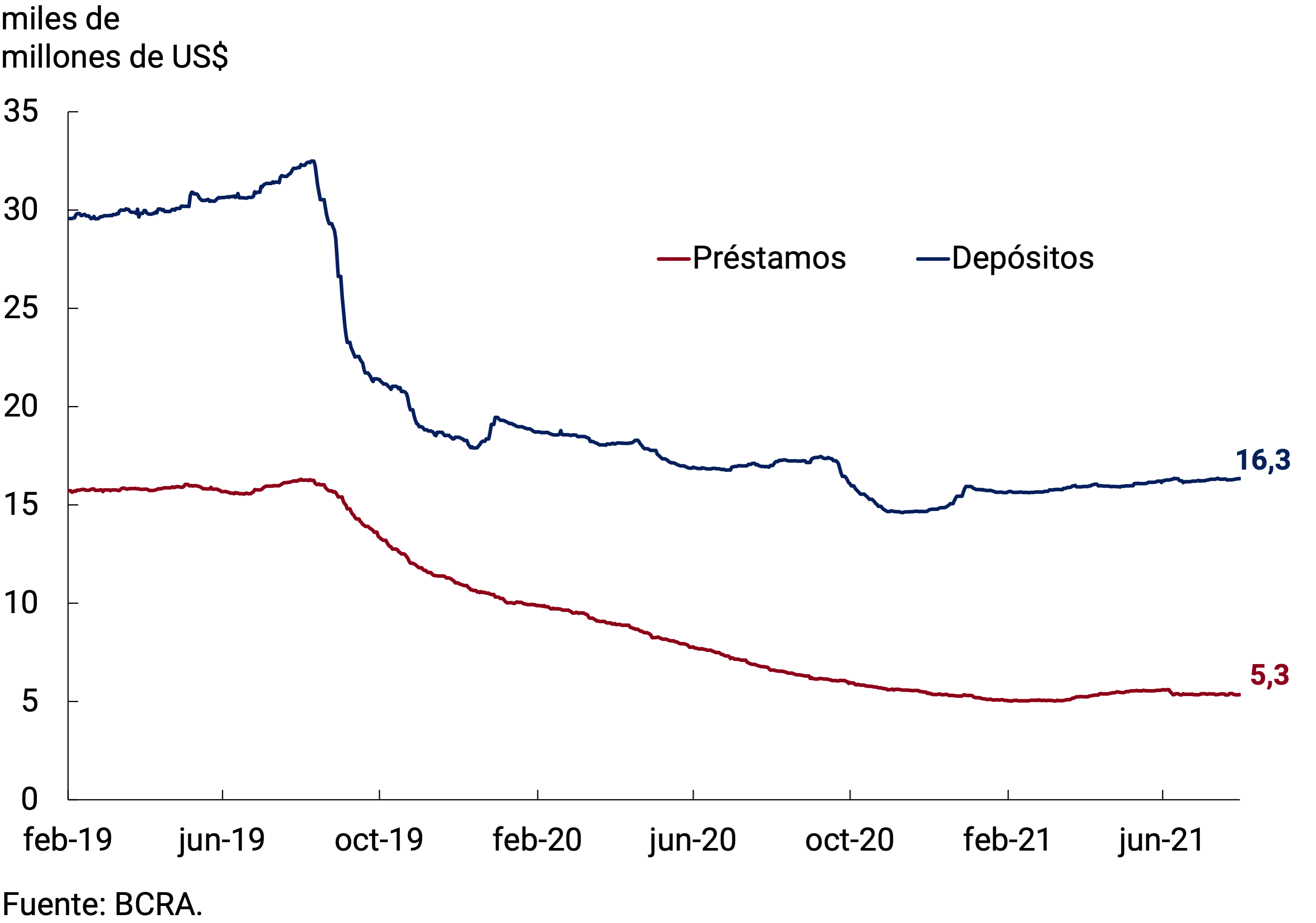

7. Foreign currency

Foreign currency deposits and loans to the private sector continued to remain relatively stable. The average monthly balance of private sector deposits stood at US$16,293 million, a slight increase compared to June (US$51 million), while credit to the private sector decreased by US$43 million in the month, with the average balance for July standing at US$5,372 million (see Figure 7.1).

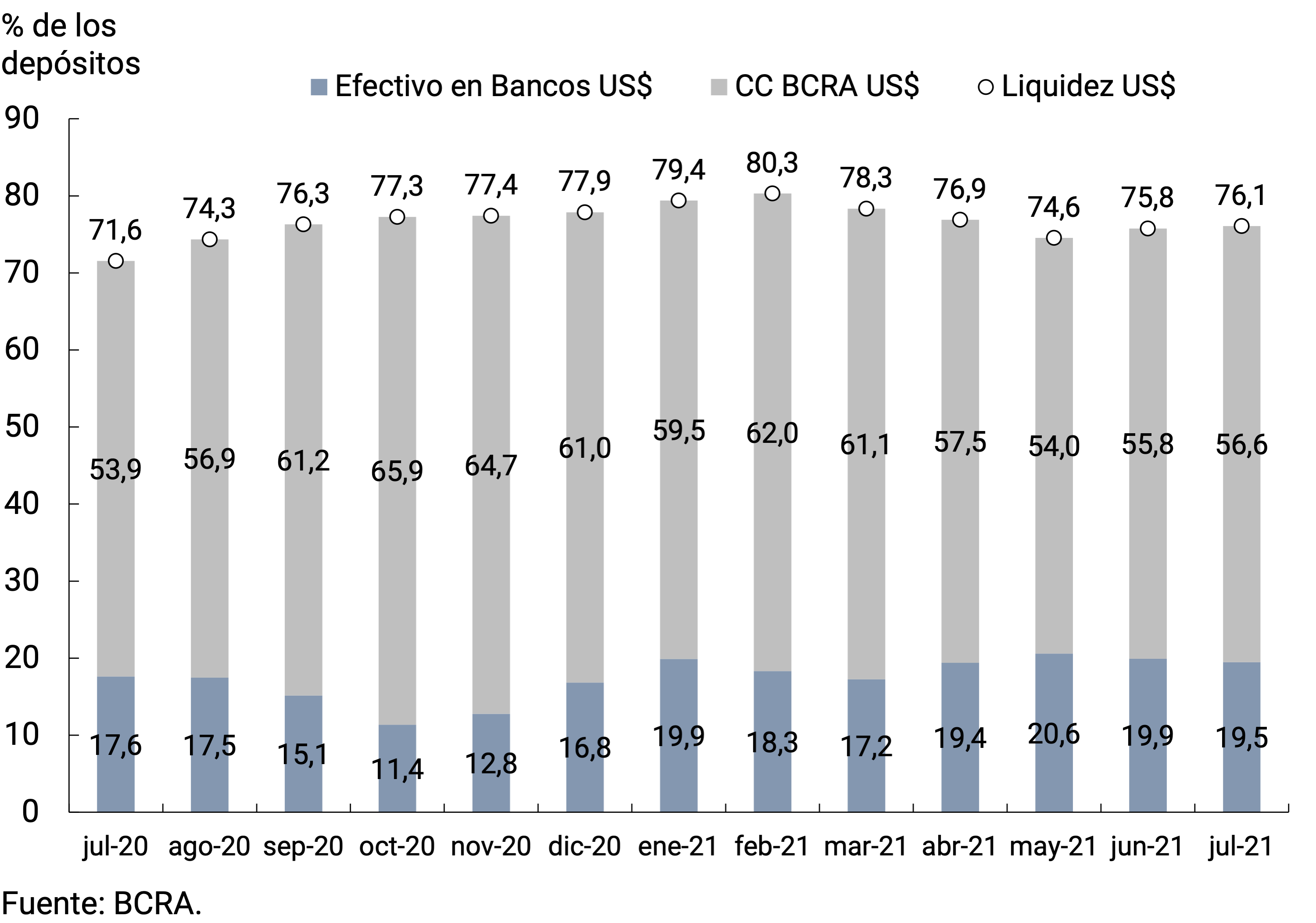

In this context, bank liquidity in foreign currency remained at relatively high levels and averaged 76.1% of deposits, registering an increase of 0.3 p.p. compared to June. This increase in liquidity was explained by the evolution of current accounts at the BCRA, which was partially offset by a fall in the share of cash in banks (see Figure 7.2).

With regard to regulatory modifications, in order to access the foreign exchange market without prior approval from the BCRA, the requirement is maintained for entities to record by means of an affidavit from the customer that neither in the previous or subsequent 90 days were or will be arranged sales in the country of securities with settlement in foreign currency or transfers to depository entities abroad. including as of July 12 the operations of exchanges of securities for other foreign assets. If the client is a legal entity, the controlled and controlling entities are considered as the same unit. To this end, in order for the transaction not to be covered by the requirement of prior conformity, the entity must also have an affidavit detailing the details of the natural or legal persons exercising a relationship of direct control over the customer14.

The BCRA’s International Reserves expanded for the eighth consecutive month, accumulating an increase of US$145 million. Thus, at the end of July they reached a balance of US$42,582 million. The main factor of expansion was again the net purchase of foreign currency from the private sector, followed by the increase in the minimum cash position of financial institutions. Meanwhile, public sector operations contributed negatively, partially offsetting the increase (see Figure 7.3).

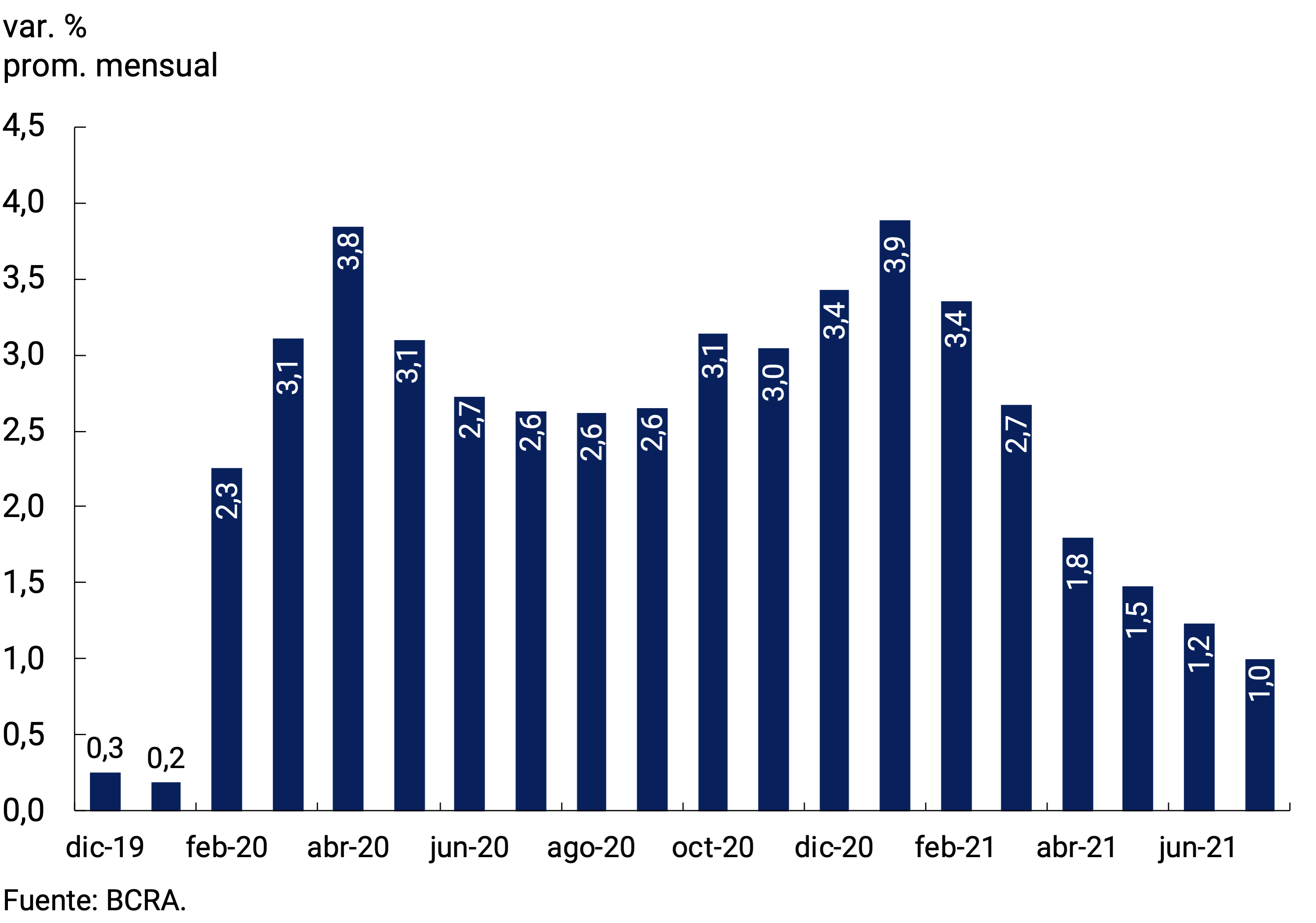

The bilateral nominal exchange rate against the U.S. dollar increased 1.0% in July, 0.2 p.p. less than in June, to settle at $96.21/US$ on average for the month. The slower rate of depreciation of the domestic currency seeks to contribute to the disinflation process (see Figure 7.4).

Glossary

ANSES: National Social Security Administration.

BADLAR: Interest rate on fixed-term deposits for amounts greater than one million pesos and a term of 30 to 35 days.

BCRA: Central Bank of the Argentine Republic.

BM: Monetary Base, includes monetary circulation plus deposits in pesos in current account at the BCRA.

CC BCRA: Current account deposits at the BCRA.

CER: Reference Stabilization Coefficient.

NVC: National Securities Commission.

SDR: Special Drawing Rights.

EFNB: Non-Banking Financial Institutions.

EM: Minimum Cash.

FCI: Common Investment Fund.

A.I.: Year-on-year .

IAMC: Argentine Institute of Capital Markets

CPI: Consumer Price Index.

ITCNM: Multilateral Nominal Exchange Rate Index

ITCRM: Multilateral Real Exchange Rate Index

LEBAC: Central Bank bills.

LELIQ: Liquidity Bills of the BCRA.

LFIP: Financing Line for Productive Investment.

M2 Total: Means of payment, which includes working capital held by the public, cancelling cheques in pesos and demand deposits in pesos from the public and non-financial private sector.

Private M2: Means of payment, includes working capital held by the public, cancelling cheques in pesos and demand deposits in pesos from the non-financial private sector.

Private transactional M2: Means of payment, includes working capital held by the public, cancelling cheques in pesos and non-remunerated demand deposits in pesos from the non-financial private sector.

M3 Total: Broad aggregate in pesos, includes the current currency held by the public, cancelling checks in pesos and the total deposits in pesos of the public and non-financial private sector.

Private M3: Broad aggregate in pesos, includes the working capital held by the public, cancelling checks in pesos and the total deposits in pesos of the non-financial private sector.

MERVAL: Buenos Aires Stock Market.

MM: Money Market.

N.A.: Annual nominal

E.A.: Annual Effective

NOCOM: Cash Clearing Notes.

ON: Negotiable Obligation.

GDP: Gross Domestic Product.

P.B.: Basic points.

P.P.: Percentage points.

MSMEs: Micro, Small and Medium Enterprises.

ROFEX: Rosario Term Market.

S.E.: No seasonality

SISCEN: Centralized System of Information Requirements of the BCRA.

TCN: Nominal Exchange Rate

IRR: Internal Rate of Return.

TM20: Interest rate on fixed-term deposits for amounts greater than 20 million pesos and a term of 30 to 35 days.

TNA: Annual Nominal Rate.

UVA: Unit of Purchasing Value

References

1 INDEC will release July’s inflation data on August 12.

2 M2 private excluding interest-bearing demand deposits from companies and financial service providers. This component was excluded since it is more similar to a savings instrument than to a means of payment.

3 Every year, the ANSES withholds 20% of the AUH that is paid at the end of the year to beneficiaries who have accredited the condition of schooling and have complied with the vaccination schedule. This time the amount is $7,083.4 per child.

4 These include fixed-term deposits in pesos and those denominated in UVA, both traditional and pre-cancelable.

5 It is worth noting that the average interest rate observed is slightly below the minimum guaranteed interest rate, because it includes deposits of up to $1 million of individuals who, in total, exceed one million pesos in the financial institution.

6 Includes working capital held by the public and deposits in pesos of the non-financial private sector (sight, term and others).

7 See section Regulatory Summary (“A” 7329).

8 The drop in the personal rate registered at the end of June was linked to a special line of credit created by a bank.

9 Resolution 753/2021 of the Ministry of Productive Development. Secretariat of Domestic Trade. https://www.argentina.gob.ar/normativa/nacional/resoluci%C3%B3n-753-2021-352524/texto .

10 Includes current accounts at the BCRA, cash in banks, balances of passes arranged with the BCRA, holdings of LELIQ, and bonds eligible for reserve requirements.

11 See section Regulatory Summary (“A” 7290).

12 See section Summary of Regulations (“A” 7318).

13 See section Summary of Regulations (“A” 7334).

14 See section Summary of Regulations (“A” 7327).