Política Monetaria

Monthly Monetary Report

February

2022

Monthly report on the evolution of the monetary base, international reserves and foreign exchange market.

1. Executive Summary

In the middle of the month, the BCRA decided to raise reference interest rates again and create a new monetary regulation instrument at a variable rate and with a term of up to 190 days (NOTALIQ). These measures aim to achieve better management of the liquidity of financial institutions, as well as to increase the average term of sterilization instruments. To guarantee the transmission of the new rates to depositors and to tend towards positive returns for savings in domestic currency, the minimum guaranteed rates of savings instruments in pesos were also modified.

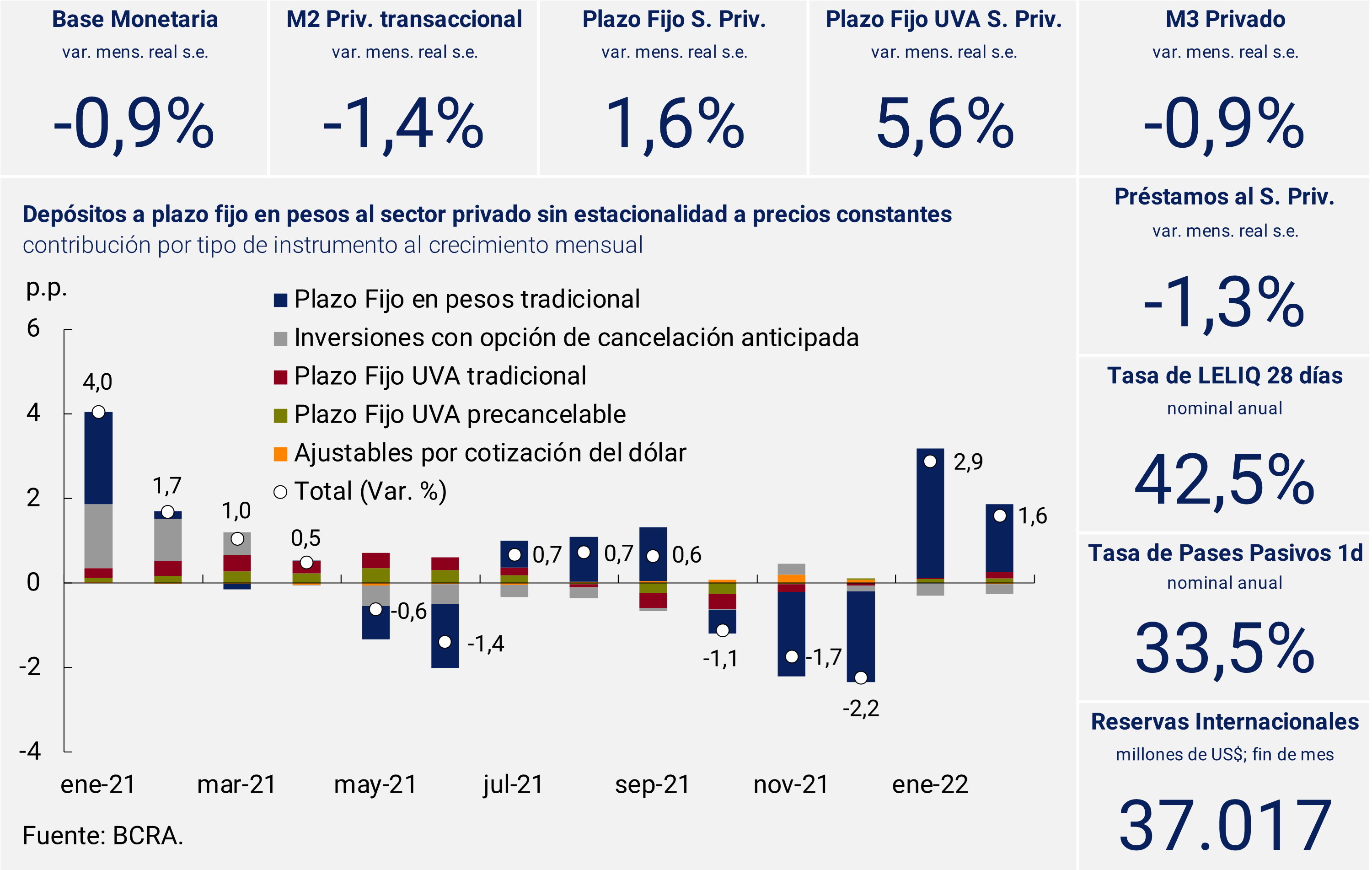

In this context, savings instruments in pesos grew at constant prices for the second consecutive month. On the other hand, the means of payment would have registered a contraction, a dynamic that was explained both by the behavior of the working capital held by the public and of the non-interest-bearing demand deposits. Thus, the broad monetary aggregate, private M3, at constant prices would have registered a monthly decrease of 0.9% s.e. in February.

On the other hand, the National Government recently submitted to the National Congress the technical agreement reached with the IMF for an extended facilitiesprogram 1 that allows the refinancing of the large obligations of 2022 and 2023 set out in the Stand-By Agreement signed in 2018. The new program seeks to continue generating conditions of stability necessary to address existing structural challenges and strengthen the foundations for sustainable and inclusive growth. The resolution of the negotiation with the IMF will help to improve the expectations of those agents who condition their vision of the sustainability of the external sector on the outcome of the negotiation, helping to contain exchange rate pressures and inflation expectations

2. Payment methods

Means of payment (private transactional M22), in real terms3 and seasonally adjusted (s.e.), would have registered a decrease of 1.4% in February. This dynamic was due to the behavior of both non-interest-bearing demand deposits and working capital deposits held by the public (see Figure 2.1). In the year-on-year comparison, and at constant prices, the transactional private M2 would be 1.0% above the level of February 2021.

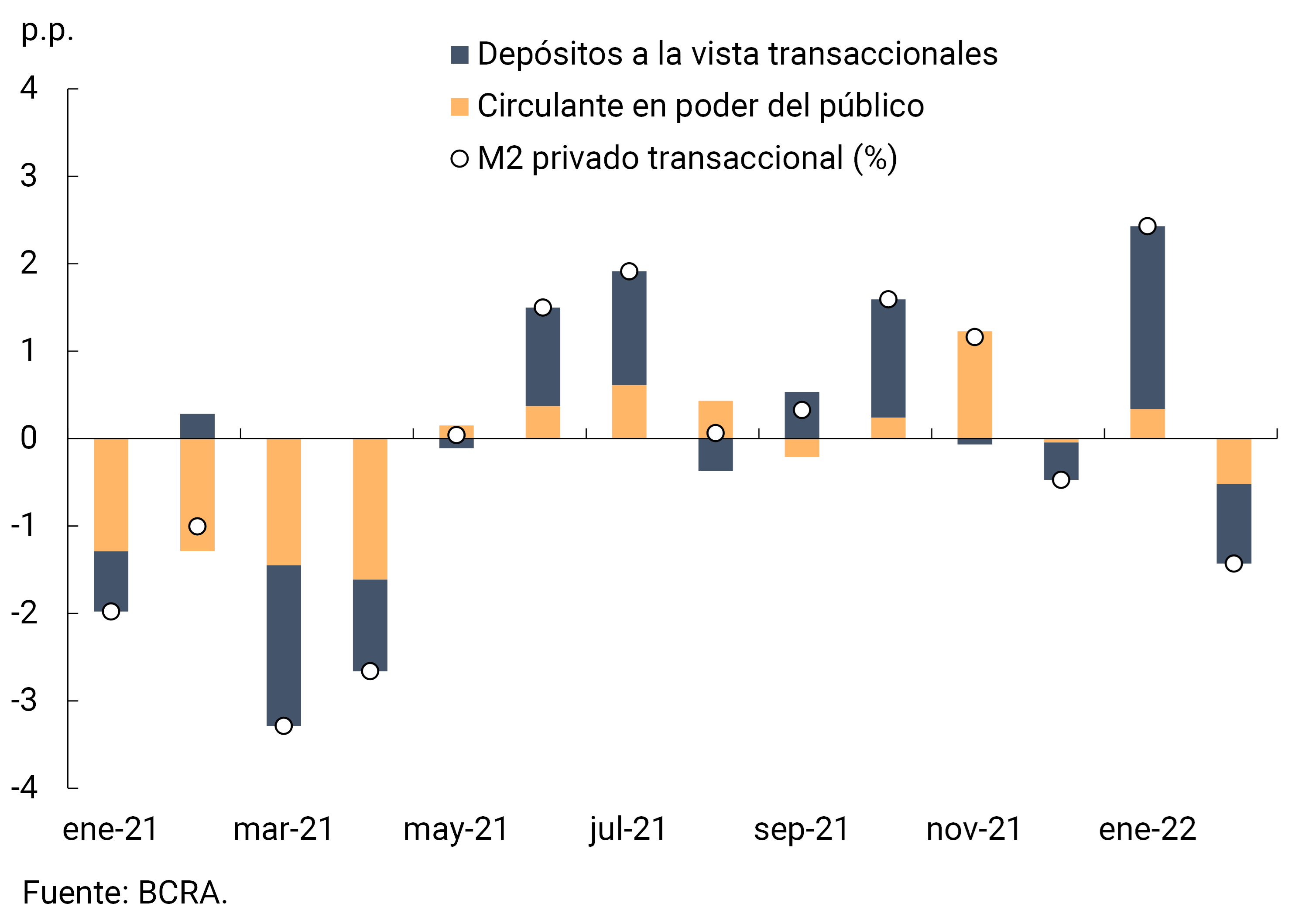

In terms of Output, the transactional private M2 would continue to be below the average record for the period 2010-2019. As already mentioned in previous editions, the low levels of money in the hands of the public are what explain this behavior. In fact, banknotes and coins in the hands of the public were positioned 1.4 p.p. below the average verified between 2010 and 2019, and at a value close to the minimum of the last 15 years (see Figure 2.2). This dynamic is being influenced by the growing use of electronic means of payment.

Figure 2.1 | Private transactional M2 at constant

prices Contribution by component to the monthly vari. s.e.

3. Savings instruments in pesos

In line with its strategy of establishing an interest rate path that tends to allow people to obtain returns in line with the evolution of inflation, in mid-February, the Board of Directors of the BCRA decided to raise again the minimum guaranteed interest rates on fixed-term deposits4. Thus, the minimum guaranteed rate for placements of individuals for up to an amount of $10 million was increased from 39% n.a. to 41.5% n.a. (50.40% n.a.). For the rest of the depositors in the financial system5 , the interest rate also rose by 2.5 p.p. to 39.5% (47.5% y.a.).

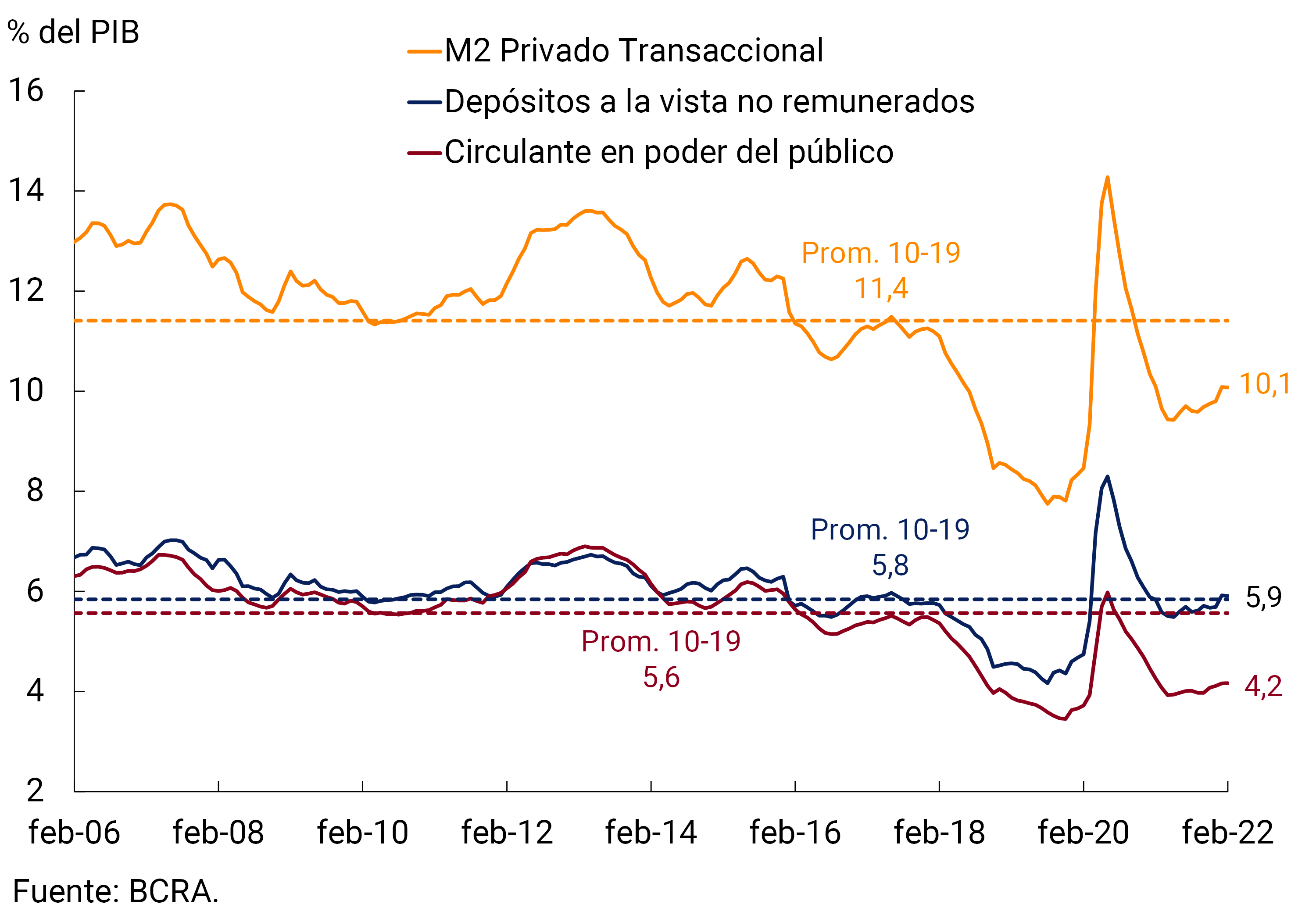

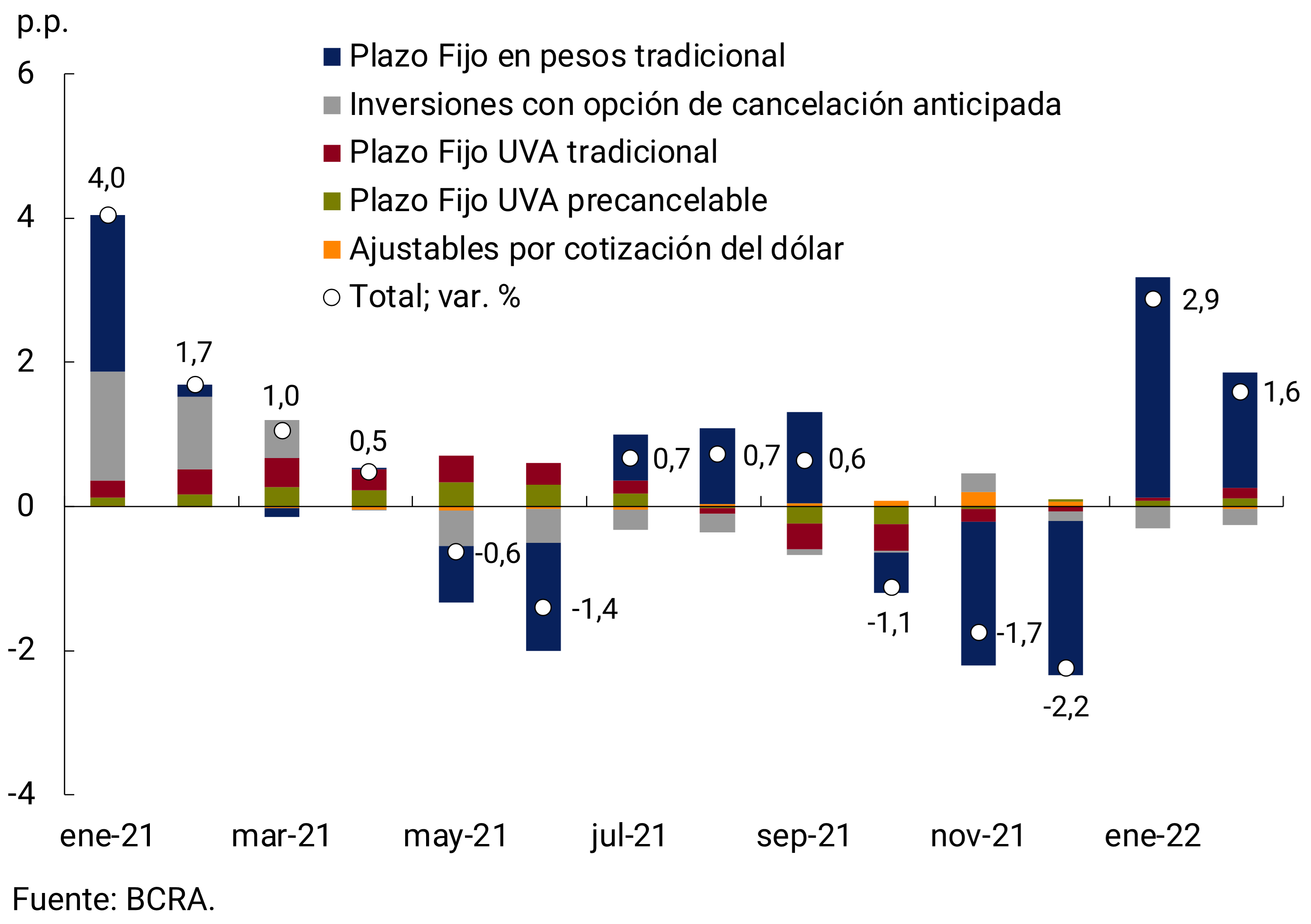

In this context, the private sector’s fixed-term deposits in pesos registered, for the second consecutive month, a positive monthly expansion rate in real terms (1.6% s.e.). Thus, term loans continued to expand in terms of GDP (0.2 p.p.) to 6.8%. Thus, February’s figure was 1.3 p.p. above the average record of 2010-2019 and 1.2 p.p. below the maximum of mid-2020.

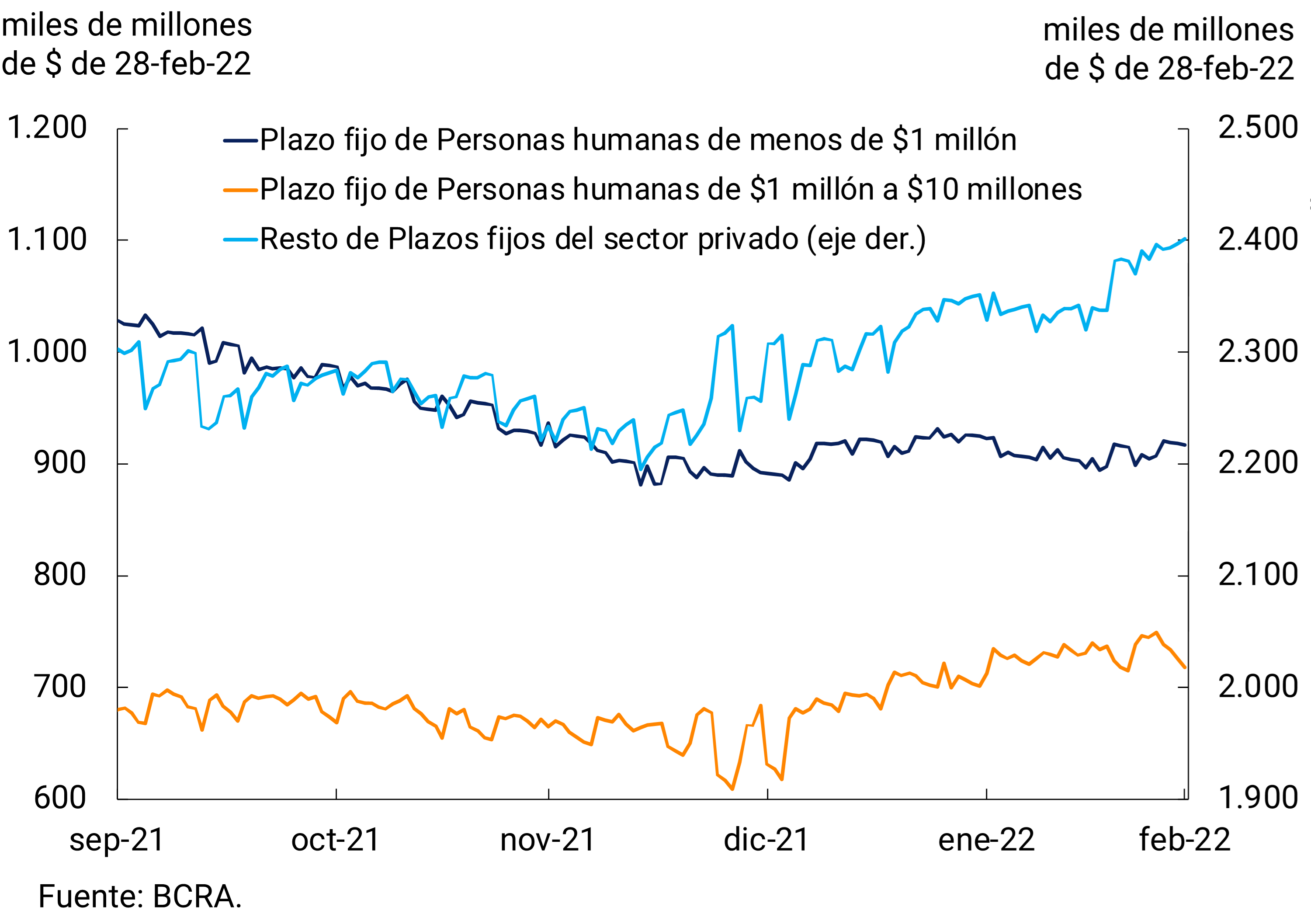

The growth of the month was mainly explained by the placements of individuals, highlighting the segment between $1 and $10 million (see Figure 3.1). It should be noted that this stratum was the one that experienced the largest interest rate hike since the BCRA began to raise reference interest rates in early January (it accumulated a 7.5 p.p. increase). Meanwhile, time deposits of individuals for less than $1 million grew at a slower rate than prices. The rest of the deposits of the non-financial private sector (those constituted by legal entities, regardless of the amount, and by individuals with placements of more than $10 million) registered a slight increase in real terms.

With regard to the instrumentation of time deposits of legal entities, companies (excluding Financial Services Providers (FSPs)) increased their holdings of fixed-term instruments, after the relative stability observed throughout 2021 (see Figure 3.2). With regard to FSPs, a portfolio rebalancing was observed, with an increase in term holdings to the detriment of demand loans. This behavior occurred in a context in which the BCRA raised interest rates on time deposits and relative stability in the equity of the Mutual Funds for Money Market Investments (FCI MM), which are the main agents within the PSFs. Finally, Investments with early cancellation option, which cannot be classified by type of holder, presented a systematic fall in the month.

Figure 3.1 | Private sector fixed-term depositsBalance at constant prices by type of depositor and amount stratum

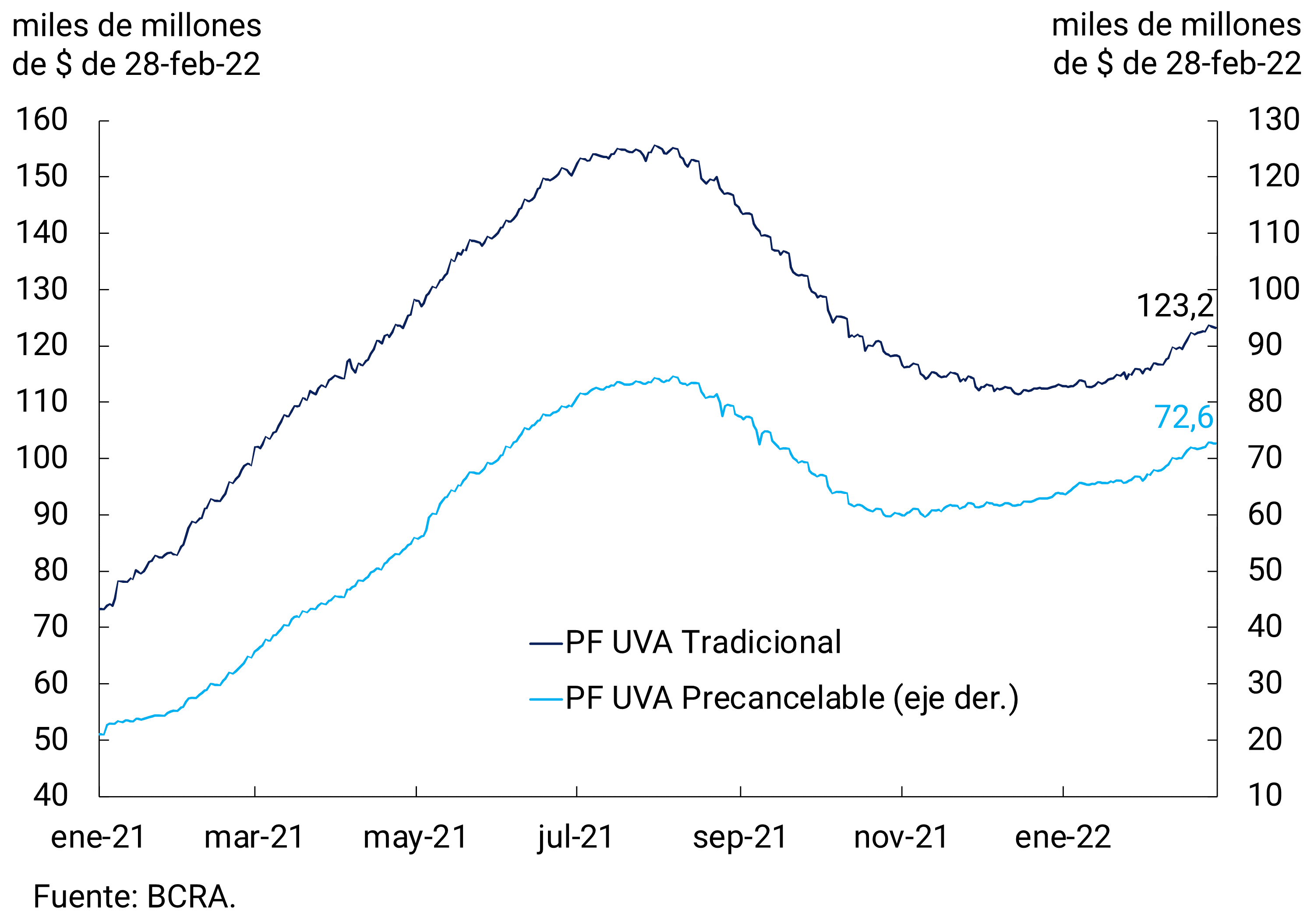

At the instrument level, once again a preference was observed for longer-term assets. Thus, traditional fixed-term deposits continued the growing trend that began in mid-December, driven by placements denominated in pesos. On the other hand, traditional deposits adjustable by CER remained without significant variations at constant prices. Meanwhile, investments with an early cancellation option showed a decline in the same period (see Figure 3.3). In particular, CER adjustable pre-cancellable deposits stabilized from mid-January, after two months of showing a slight upward trend (see Figure 3.4).

Figure 3.3 | Fixed-term deposits in pesos of the private

sector Contribution by type of instrument to the monthly var. s.e.

However, the broad monetary aggregate, private M36, at constant prices would have registered a monthly decrease of 0.9% s.e. in February. Meanwhile, in year-on-year terms, this aggregate would have experienced an increase of 1.8%. As a percentage of GDP, it would have remained at 18.6%, a record slightly higher than the average observed between 2010 and 2019.

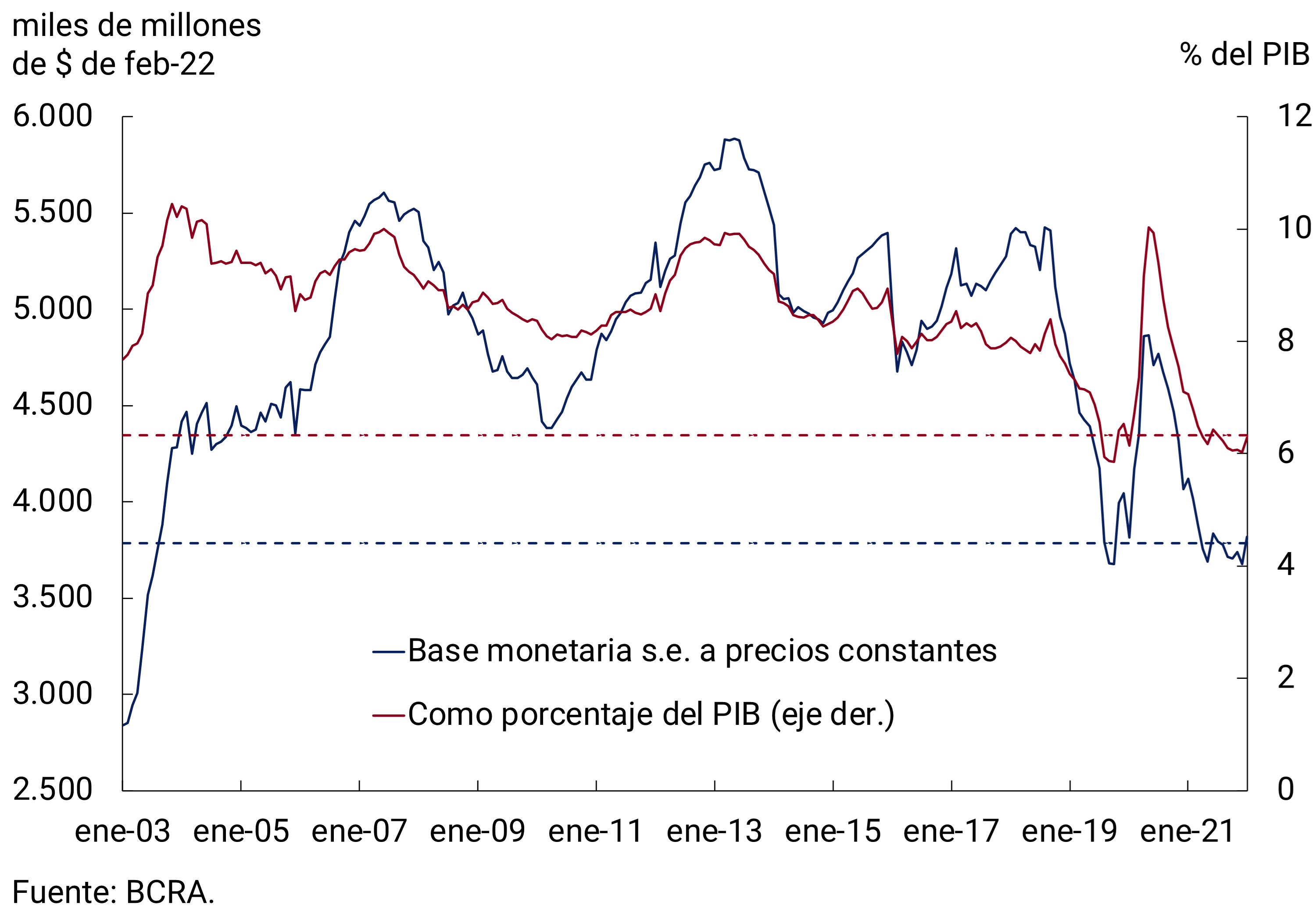

4. Monetary base

In February, the Monetary Base stood at an average of $3,751 billion, which meant a monthly increase of 1.8% (+$65,310 million) in the original series at current prices. Thus, it registered the lowest expansion in the last five months. Adjusted for seasonality and inflation, the Monetary Base would have contracted by almost 1%, registering in year-on-year terms a contraction of around 5%. As a GDP ratio, the Monetary Base would stand at 6.3%, a figure similar to that of the end of 2019 and around the lowest values since 2003 (see Figure 4.1).

On the supply side, the monthly expansion of the monetary base was mainly explained by the dismantling of the 7-day passes by financial institutions. This was in response to the reduction in the interest rate of this instrument within the framework of the reconfiguration of monetary policy instruments carried out by the BCRA at the beginning of January7. This expansionary effect more than compensated for the absorption of liquidity through the rest of the monetary regulation instruments (see Figure 4.2). On the other hand, public sector operations and purchases of foreign currency from the private sector had a contractionary effect in the month.

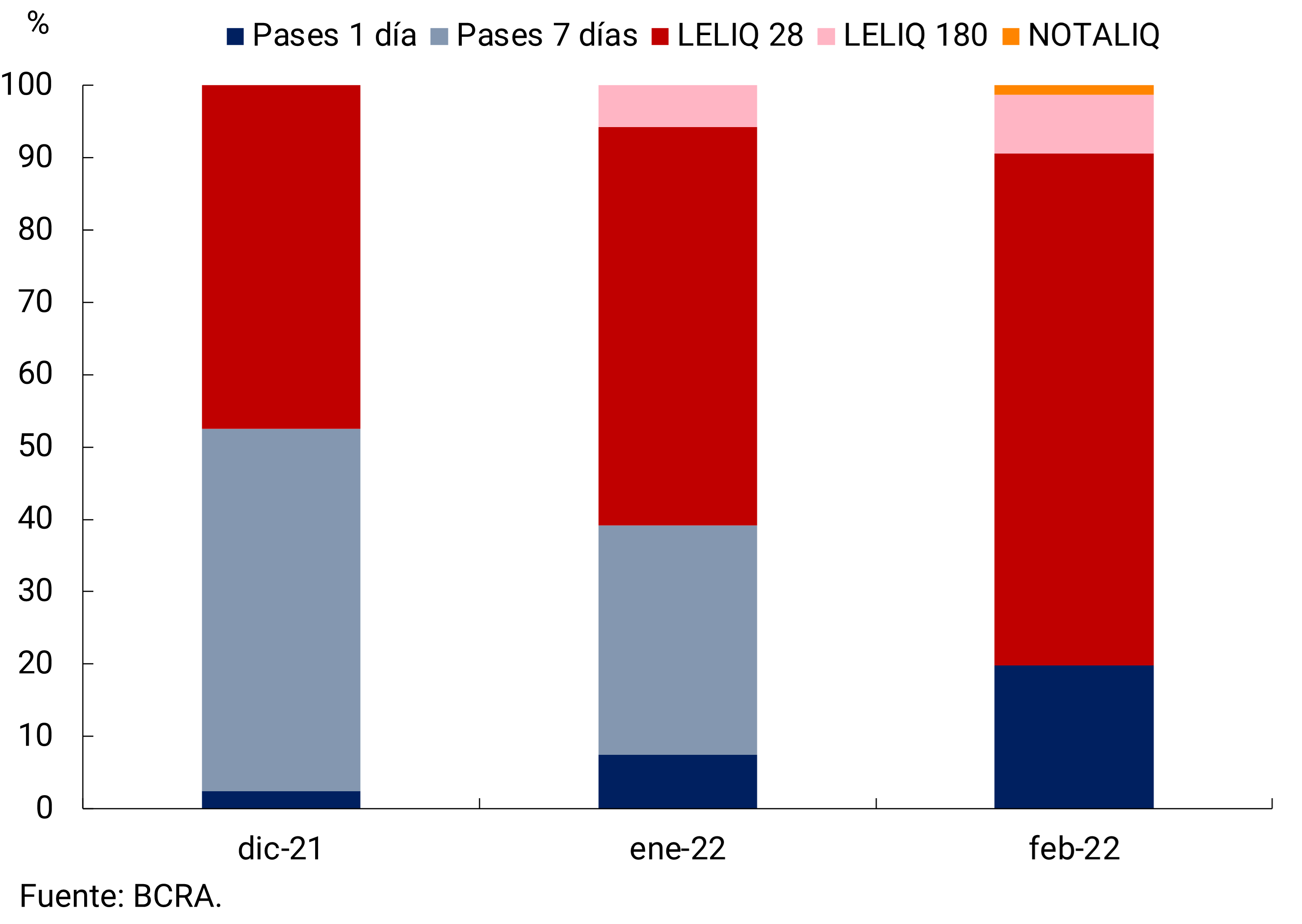

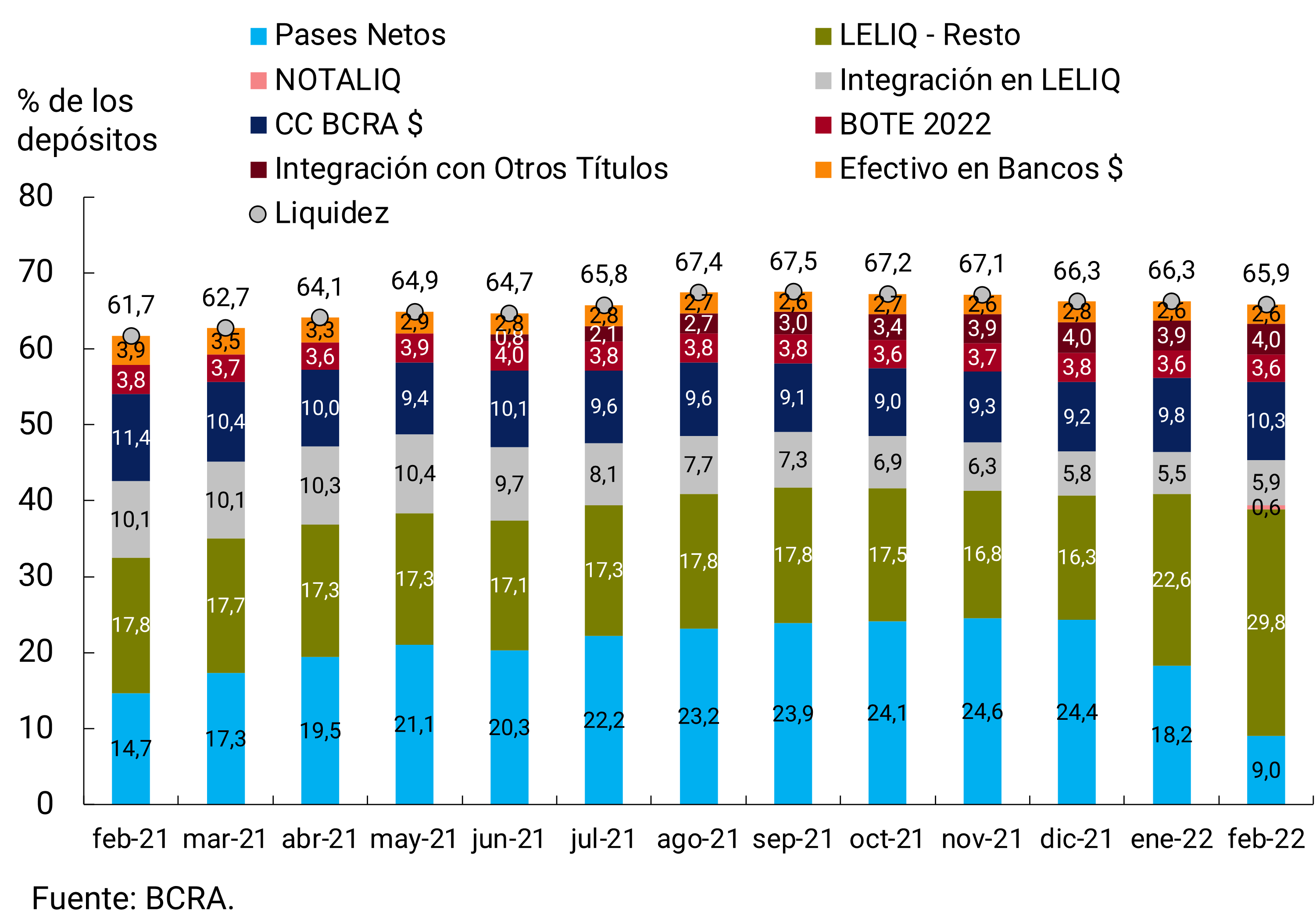

With regard to interest-bearing liabilities, and in line with the objectives and plans set for 2022, the BCRA decided to raise reference interest rates and create a new monetary regulation instrument. These measures aim to achieve better management of the liquidity of financial institutions, as well as to increase the average term of sterilization instruments. Thus, the interest rate of the 28-day LELIQ increased by 2.5 p.p. to 42.5% n.a. (51.96% y.a.). The rate of the 180-day LELIQ was raised by 3 p.p. to 47% n.a. (52.61% y.a.). As for the instruments intended to absorb the short-term liquidity of the entities, the interest rate on 1-day passive passes increased 1.5 p.p. to 33.5% n.a. (39.77% y.a.). It should be noted that the interest rate on 1-day active passes was also modified, which stood at 44.2% n.a. (55.54% y.a.). At the same time, the creation of the Liquidity Notes (NOTALIQ) at a variable rate was arranged, which are auctioned once a week8. These bills have a term of up to 190 days and their interest rate is defined as the average of the Monetary Policy Rate (LELIQ at 28 days) during the life of the Note plus a fixed spread that is reported to the market on the day of the auction9. In this way, financial institutions will be able to opt for this new instrument, which captures changes in the Monetary Policy Rate, or for the 180-day LELIQ depending on their expectations regarding the evolution of the Monetary Policy Rate.

With the current configuration of instruments, in February the remunerated liabilities were made up of around 80% by LELIQ (considering both species). In particular, those with a shorter term accounted for just over 70% of the total, while those placed with a 180-day maturity had a share of 8%. The rest corresponded mainly to 1-day passes, while there was an incipient participation of the NOTALIQ (see Figure 4.3).

These changes in the relative composition of the monetary regulation instruments made it possible to continue with the policy of extending the terms of interest-bearing liabilities initiated by the BCRA at the beginning of the administration with the change of the term of the shorter LELIQ from 7 to 28 days in February 2020. In fact, the average residual term of the total stock of LELIQ was approximately 30 days, practically double the average term observed in 2020 and 2021 (see Figure 4.4).

5. Loans to the private sector

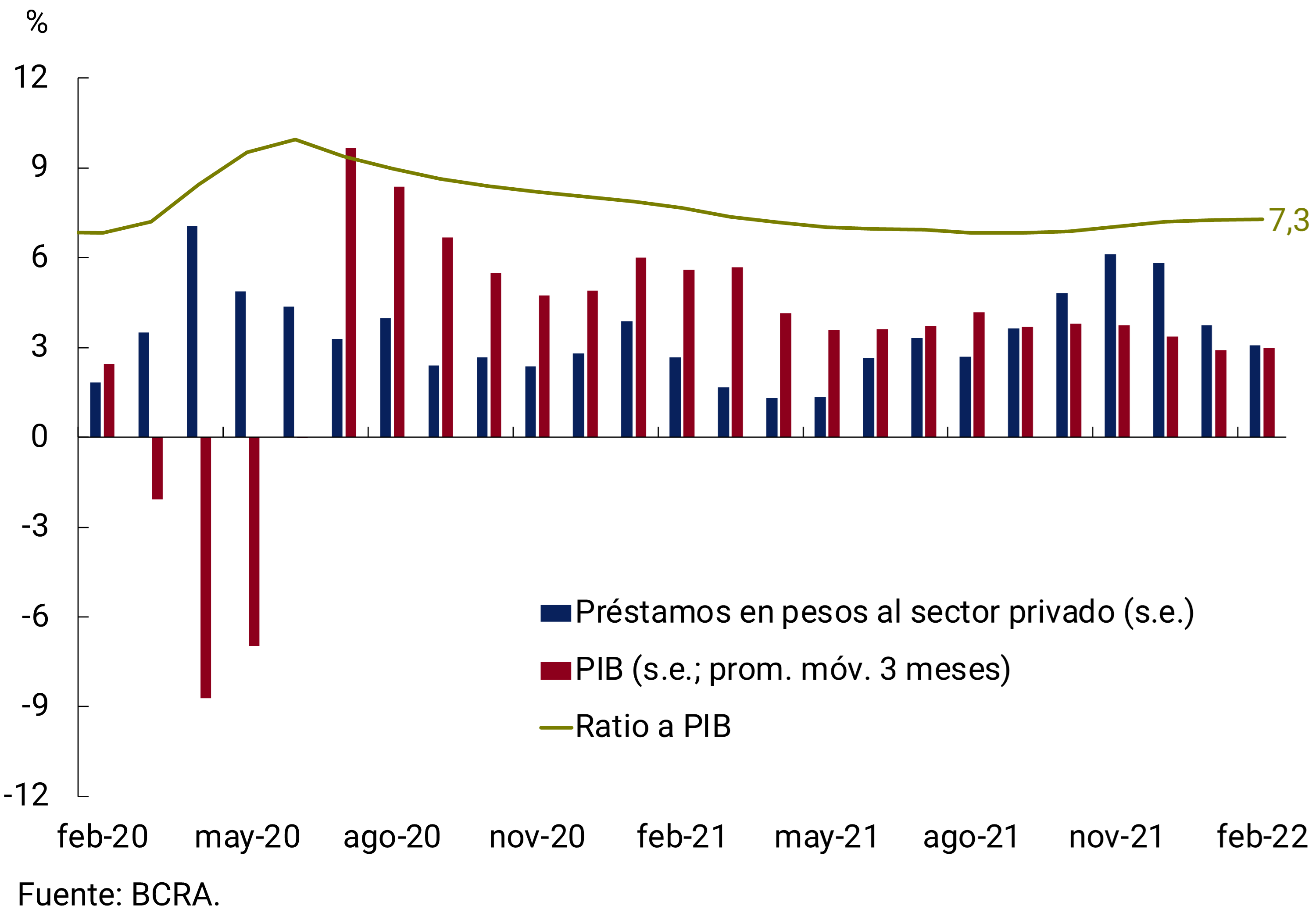

Loans in pesos to the private sector, in real terms and without seasonality, would have registered a monthly contraction of 1.3% in February, after five months of uninterrupted growth. The decrease for the month was generalized to most of the financing lines (see Figure 5.1). The ratio of loans in pesos to the private sector to GDP in February would have stood at 7.3%, a value similar to that of previous months (see Figure 5.2).

Figure 5.1 | Loans in pesos to the Real Private

Sector without seasonality; contribution to monthly growth

Lines with essentially commercial destinations would have exhibited, as a whole, a monthly contraction of 0.4% s.e. at constant prices, after 7 months of positive real variations. Within these financings, a heterogeneous behavior was observed. On the one hand, the shorter-term lines contributed negatively to the monthly change. In fact, financing granted through current account advances registered a monthly fall of 1.2% s.e. at constant prices and discounted documents showed a contraction of 3% s.e. in real terms. Meanwhile, single-signature documents, which have a longer average life, registered a 1.5% increase s.e. in real terms during the month, partially offsetting the fall.

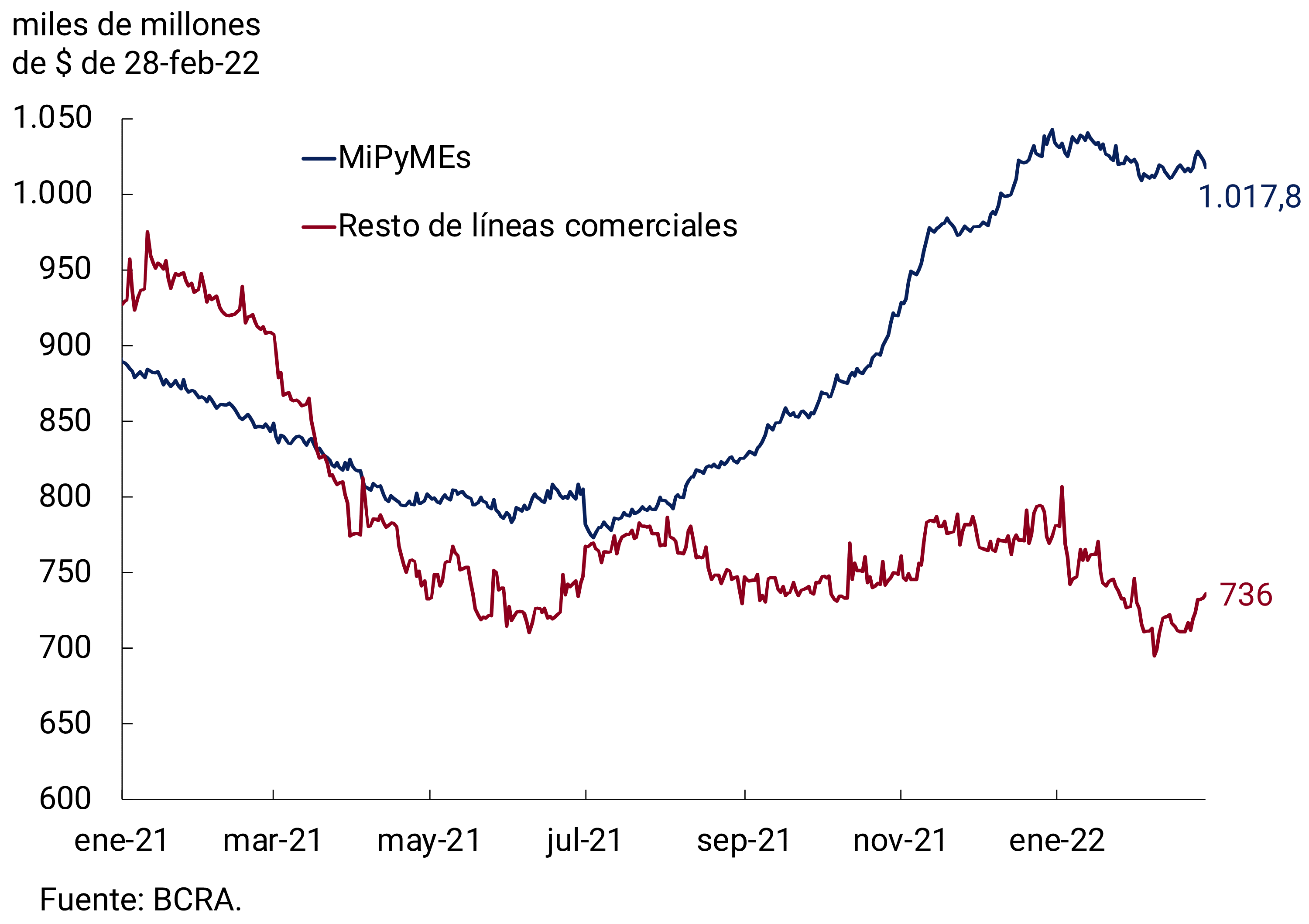

The contraction of commercial lines was largely explained by the negative statistical drag left by January, a month in which the demand for financing by companies tends to decrease in response to lower activity during the summer recess. Indeed, when we analyze the composition of commercial loans by type of debtor, it can be seen that both the balance of loans to MSMEs and large companies stopped falling in February and remained relatively stable (see Figure 5.3)

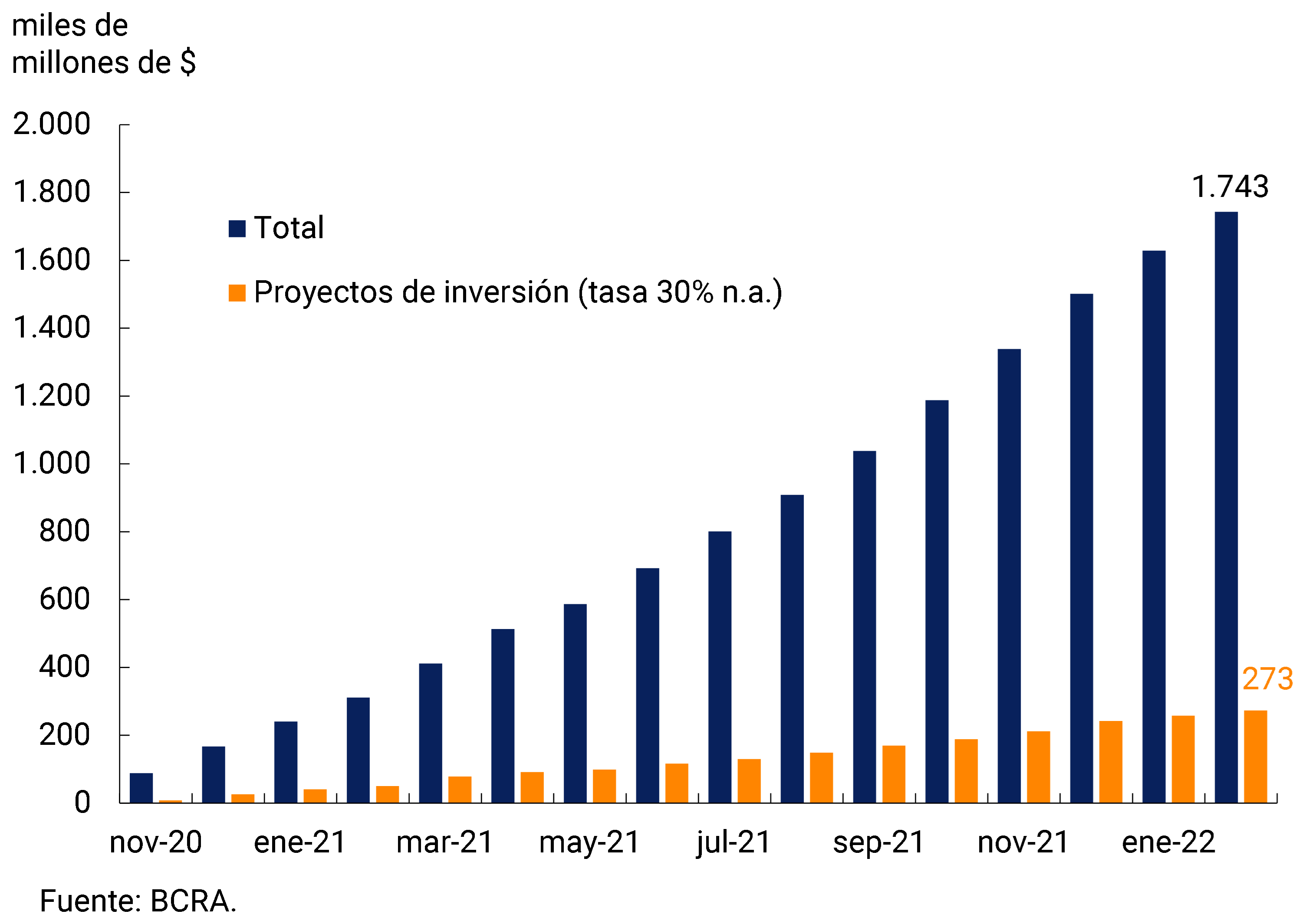

The Financing Line for Productive Investment (LFIP) continued to be the main vehicle through which loans to Micro, Small and Medium-sized Enterprises (MSMEs) were channeled. At the end of February, loans granted under the LFIP accumulated disbursements of approximately $1,743 billion since its inception, with an increase of 7% compared to last month (see Figure 5.4). As for the destinations of these funds, around 84% of the total disbursed corresponds to the financing of working capital and the rest to the line that finances investment projects. At the time of publication, the number of companies that accessed the LFIP amounted to 219,000. The favorable conditions of access to the line allowed that, in year-on-year terms and at constant prices, credit to MSMEs maintained a positive expansion rate (18.4%), unlike what happened with financing to large companies, which registered a contraction (-22.4%).

Among loans associated with consumption, financing instrumented with credit cards would have exhibited a new decrease in real terms during February (-2.5% s.e.), standing 11.6% below the level of a year ago. Meanwhile, personal loans would have shown a 1% monthly drop at constant prices, interrupting the recovery process that they had been showing in the last 5 months. The interest rate on personal loans increased by about 1 p.p. on average in February and amounted to 55.8% n.a.

As for the lines with real guarantee, collateral loans once again showed the greatest dynamism among all the lines, completing a period of 20 months of growth at constant prices. In February, they would have shown a monthly increase of 2.4% s.e. at constant prices, accumulating an expansion of 45.8% in the last twelve months. On the other hand, the balance of mortgage loans would have fallen 2.1% in real terms and without seasonality in February, which would represent a fall of 13.1% in the last 12 months.

6. Liquidity in pesos of financial institutions

In February, ample bank liquidity in local currency10 averaged 65.9% of deposits, a figure similar to that of January. In this way, it remained at historically high levels. The composition of bank liquidity continued to change in line with regulatory changes introduced in January. On the one hand, the extension of the limits for LELIQ subscription (up to the average stock of fixed terms in the private sector in the previous month) led LELIQs that are not counted for the integration of minimum cash to increase their participation in terms of deposits by 7.2 p.p. On the other hand, there was a drop of 8.2 p.p. in passive passes. In turn, the NOTALIQs that began to be tendered in February were incorporated, although their participation in deposits is still limited (see Figure 6.1).

With regard to the reserve requirement regime, it should be noted that as of February, a reduction in the percentage of Ahora 12 financing admitted for minimum cash integration came into force, going from 50% to 40% of new financing11.

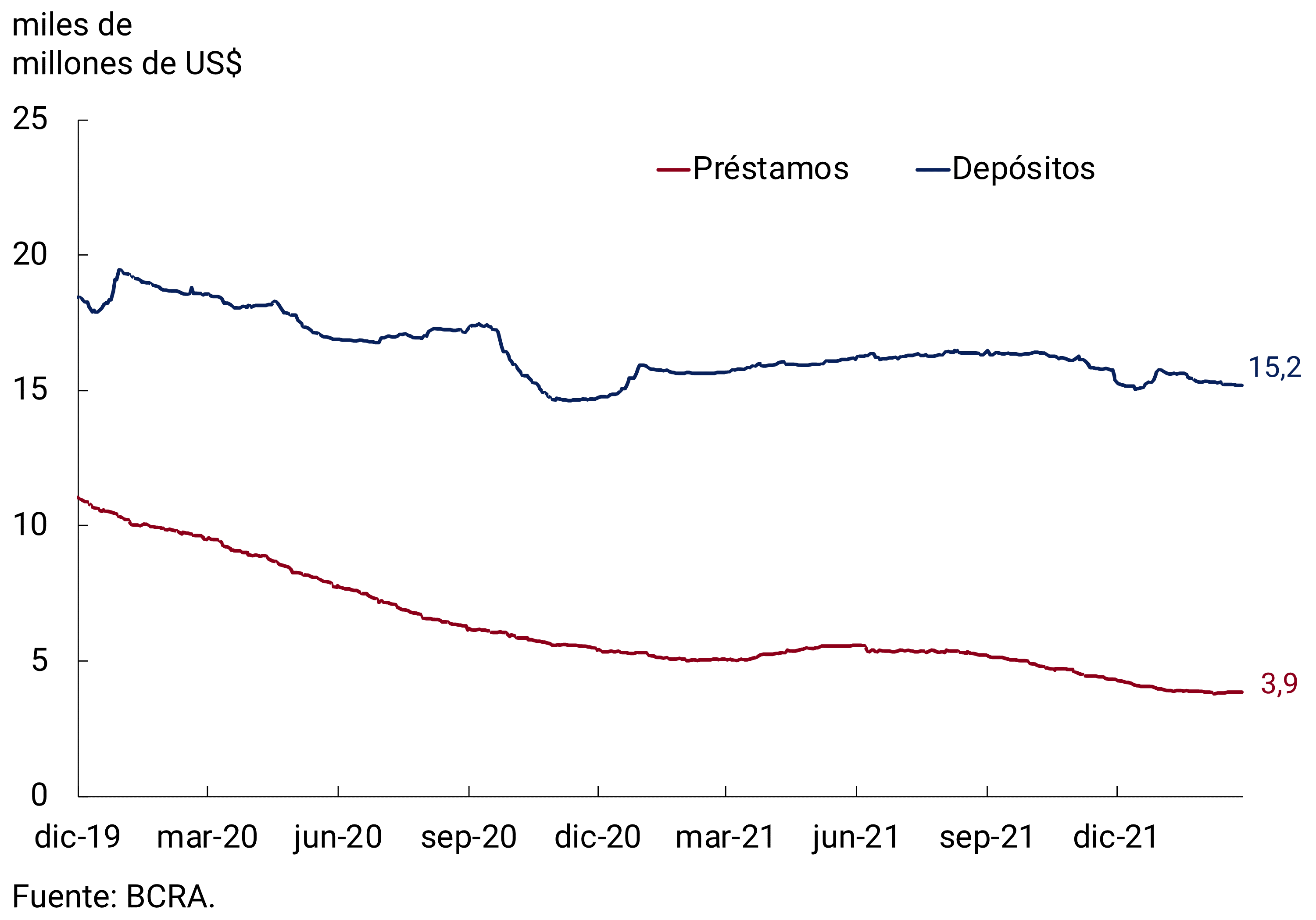

7. Foreign currency

In the foreign currency segment, the main assets and liabilities of financial institutions registered negative variations, although of a limited magnitude. Private sector deposits registered an average monthly decrease of US$290 million, partly explained by the carry-over effect of the previous month. This behavior was linked to the evolution of demand deposits of individuals in the segment between US$ 50,000 and US$ 250,000. Thus, the average monthly balance of private sector deposits stood at US$15,249 million in February. Loans to the private sector accumulated their ninth consecutive decline, albeit with a moderation at the margin. In particular, on average, there was a decrease of US$62 million, so that the average monthly balance was US$3,845 million. The decrease in financing was concentrated in single-signature documents, which represent practically all loans in foreign currency.

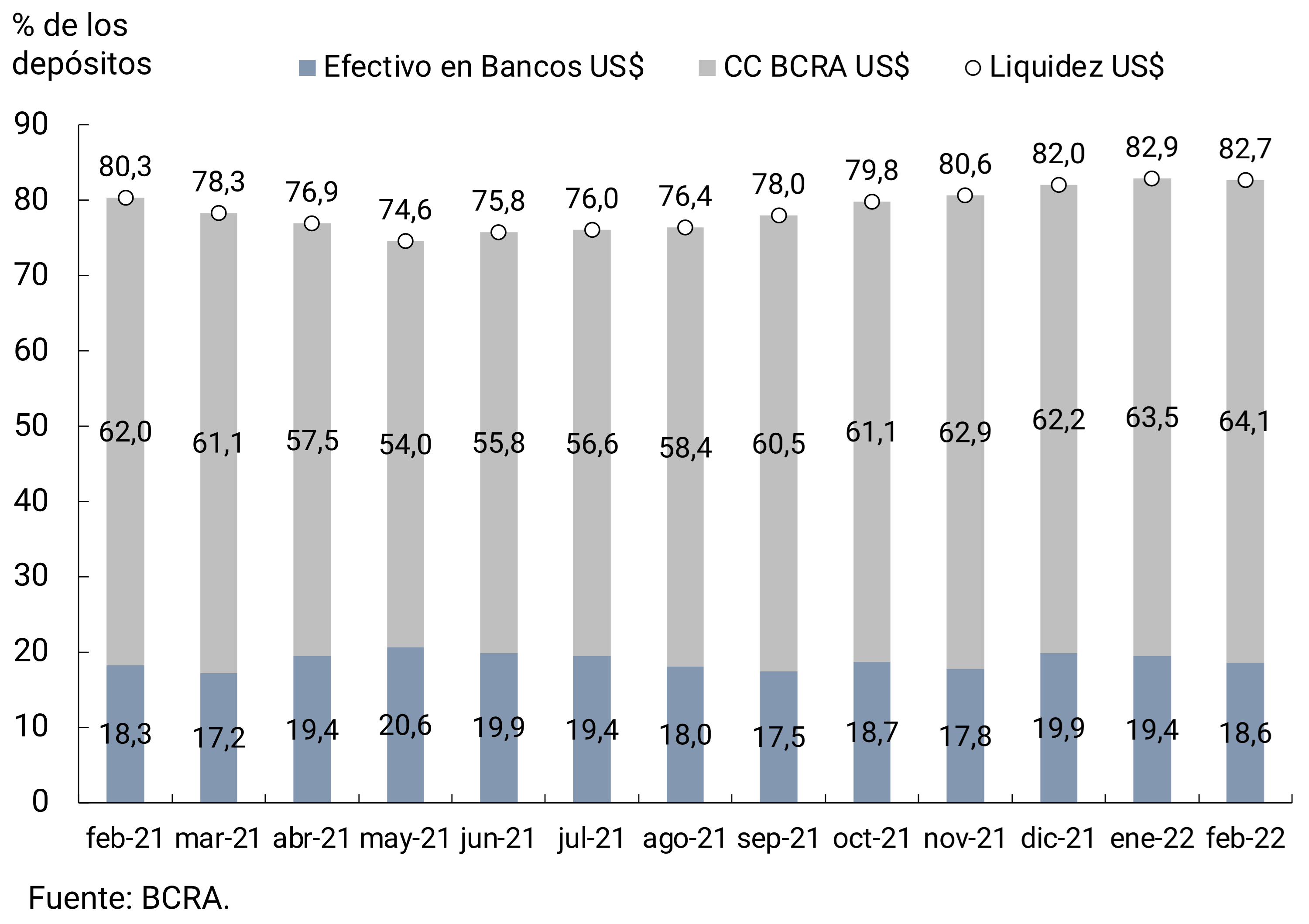

Bank liquidity in foreign currency remained at high levels. In fact, in February it averaged 82.7% of deposits. Thus, it remained at a value similar to that of the previous month and, in terms of its components, there were no significant changes either (see Figure 7.2).

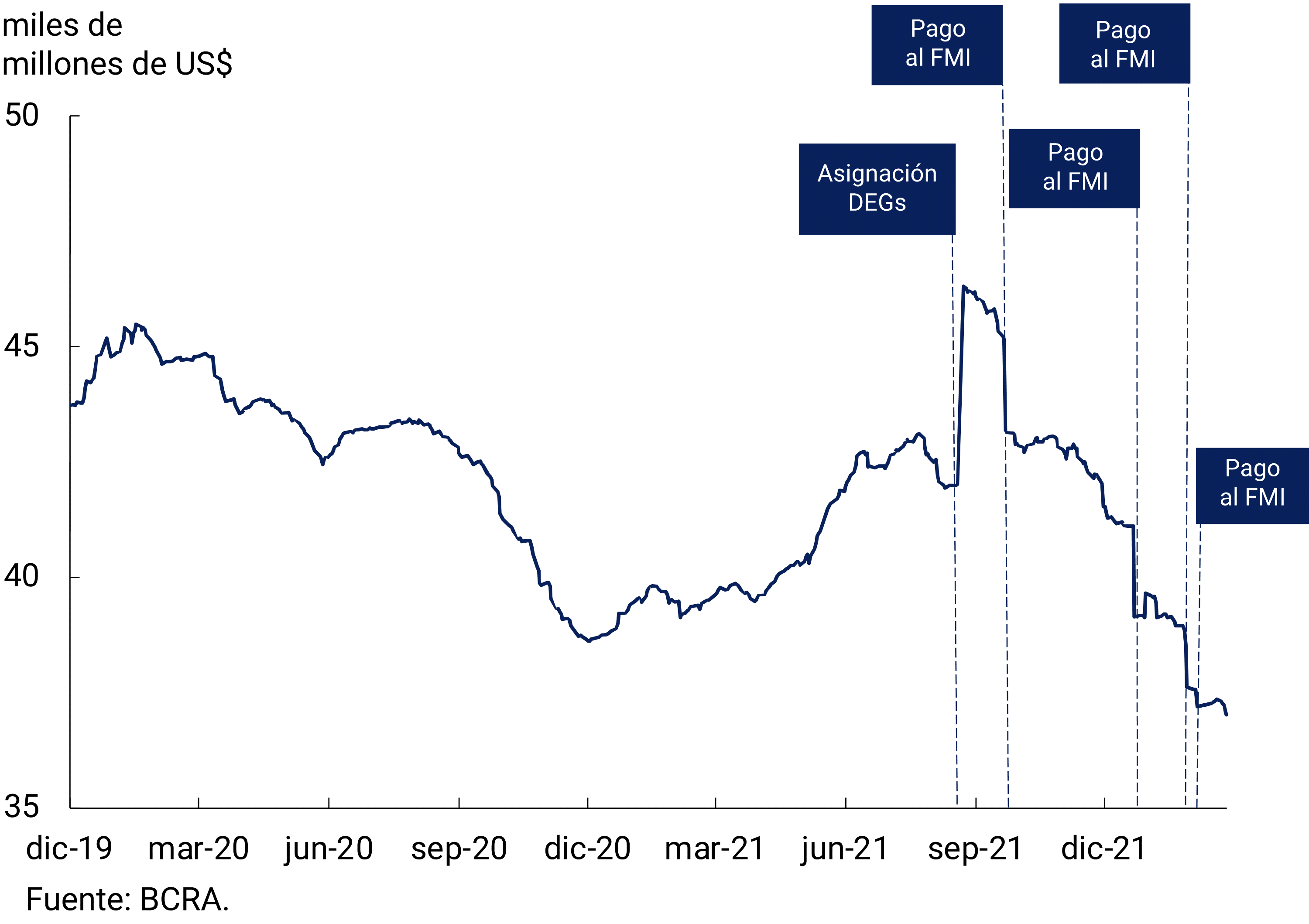

The BCRA’s International Reserves ended February with a balance of US$37,017 million, reflecting a fall of US$572 million compared to the end of January (see Figure 7.3). Among the factors that explained this decrease is the interest payment to the International Monetary Fund (IMF) of US$367 million at the beginning of the month. The rest of the fall was mainly explained by payments in foreign currency from the National Government to other International Organizations and other debt payments.

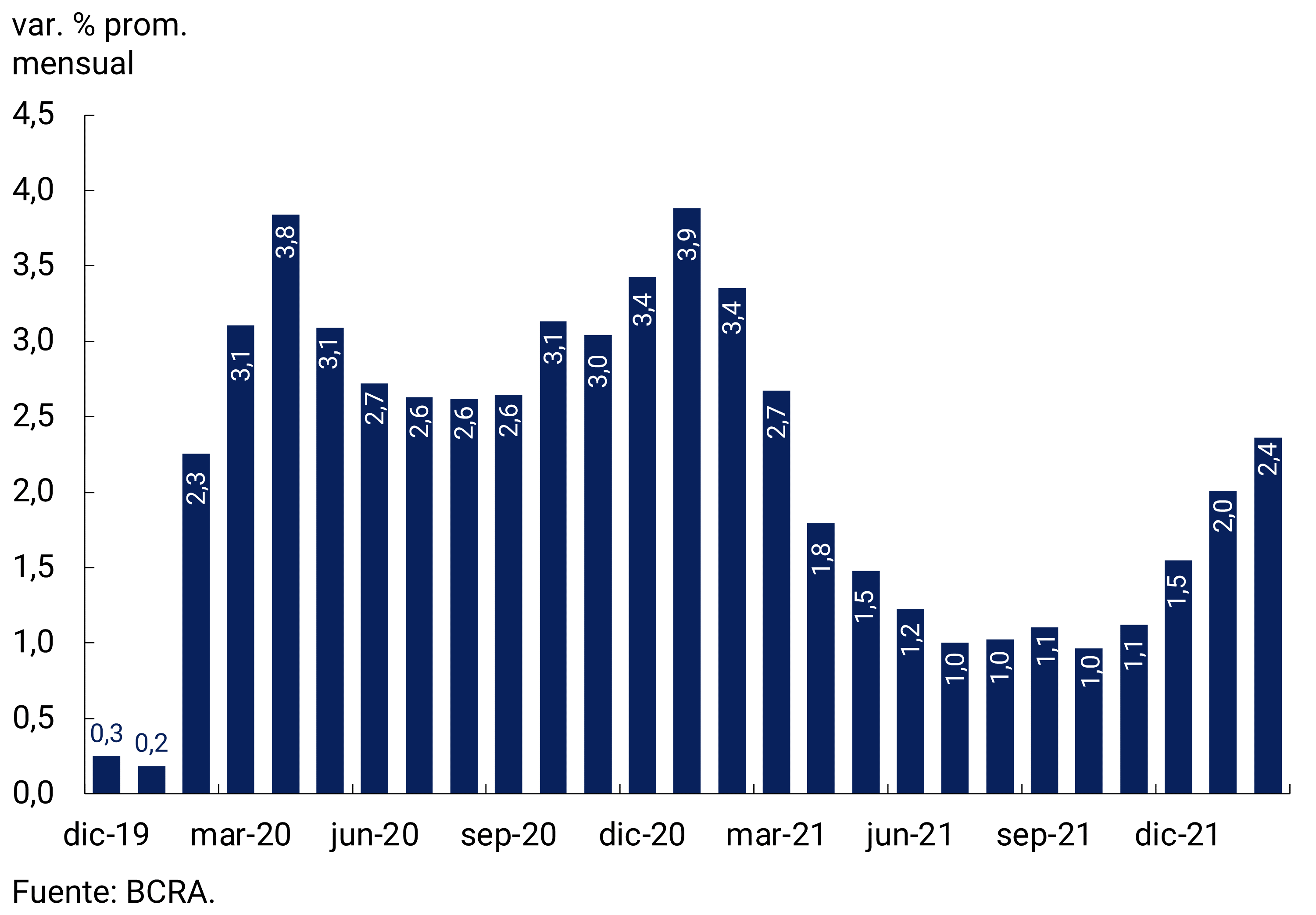

Finally, the bilateral nominal exchange rate (TCN) against the U.S. dollar increased 2.4% in February to settle, on average, at $106.38/US$ (see Figure 7.4). In this way, the rate of depreciation of the domestic currency gradually converges to levels more compatible with the inflation rate. The greater dynamism of the TCN, added to the dynamics presented by the quotations of the main trading partners, allowed the Multilateral Real Exchange Rate Index (ITCRM) to remain at competitive levels during February. Thus, it seeks to strengthen the position of International Reserves, based on the genuine income of foreign currency from the external sector.

Glossary

ANSES: National Social Security Administration.

BADLAR: Interest rate on fixed-term deposits for amounts greater than one million pesos and a term of 30 to 35 days.

BCRA: Central Bank of the Argentine Republic.

BM: Monetary Base, includes monetary circulation plus deposits in pesos in current account at the BCRA.

CC BCRA: Current account deposits at the BCRA.

CER: Reference Stabilization Coefficient.

NVC: National Securities Commission.

SDR: Special Drawing Rights.

EFNB: Non-Banking Financial Institutions.

EM: Minimum Cash.

FCI: Common Investment Fund.

A.I.: Year-on-year .

IAMC: Argentine Institute of Capital Markets

CPI: Consumer Price Index.

ITCNM: Multilateral Nominal Exchange Rate Index

ITCRM: Multilateral Real Exchange Rate Index

LEBAC: Central Bank bills.

LELIQ: Liquidity Bills of the BCRA.

LFIP: Financing Line for Productive Investment.

M2 Total: Means of payment, which includes working capital held by the public, cancelling cheques in pesos and demand deposits in pesos from the public and non-financial private sector.

Private M2: Means of payment, includes working capital held by the public, cancelling cheques in pesos and demand deposits in pesos from the non-financial private sector.

Private transactional M2: Means of payment, includes working capital held by the public, cancelling cheques in pesos and non-remunerated demand deposits in pesos from the non-financial private sector.

M3 Total: Broad aggregate in pesos, includes the current currency held by the public, cancelling checks in pesos and the total deposits in pesos of the public and non-financial private sector.

Private M3: Broad aggregate in pesos, includes the working capital held by the public, cancelling checks in pesos and the total deposits in pesos of the non-financial private sector.

MERVAL: Buenos Aires Stock Market.

MM: Money Market.

N.A.: Annual nominal

E.A.: Annual Effective

NOCOM: Cash Clearing Notes.

ON: Negotiable Obligation.

GDP: Gross Domestic Product.

P.B.: basis points.

p.p.: percentage points.

MSMEs: Micro, Small and Medium Enterprises.

ROFEX: Rosario Term Market.

S.E.: No seasonality

SISCEN: Centralized System of Information Requirements of the BCRA.

TCN: Nominal Exchange Rate

IRR: Internal Rate of Return.

TM20: Interest rate on fixed-term deposits for amounts greater than 20 million pesos and a term of 30 to 35 days.

TNA: Annual Nominal Rate.

UVA: Unit of Purchasing Value

References

1 Visit the following links

https://www.argentina.gob.ar/noticias/el-gobierno-argentino-cerro-el-acuerdo-con-el-staff-del-fondo-monetario-internacional-y-se

https://www.imf.org/en/News/Articles/2022/03/03/pr2256-argentina-imf-and-argentine-authorities-reach-staff-level-agreement-on-an-eff.

2 M2 private excluding interest-bearing demand deposits from companies and financial service providers. This component was excluded since it is more similar to a savings instrument than to a means of payment.

3 INDEC will release February’s inflation data on March 15.

5 Financial Services Providers, Companies and Individuals with deposits of more than $10 million.

6 Includes working capital held by the public and deposits in pesos of the non-financial private sector (sight, term and others).

7 See Monthly Monetary Report for January 2022.

9 The variable interest rate is computed as the simple daily average of the Monetary Policy Rate (MPR) from one business day prior to the issuance of the NOTALIQ to one business day before the maturity date plus a spread that is reported on the day of the auction.

10 Includes current accounts at the BCRA, cash in banks, balances of net passes arranged with the BCRA, holdings of LELIQ, and bonds eligible for reserve requirements.