Política Monetaria

Monthly Monetary Report

Diciembre

2021

Monthly report on the evolution of the monetary base, international reserves and foreign exchange market.

1. Executive Summary

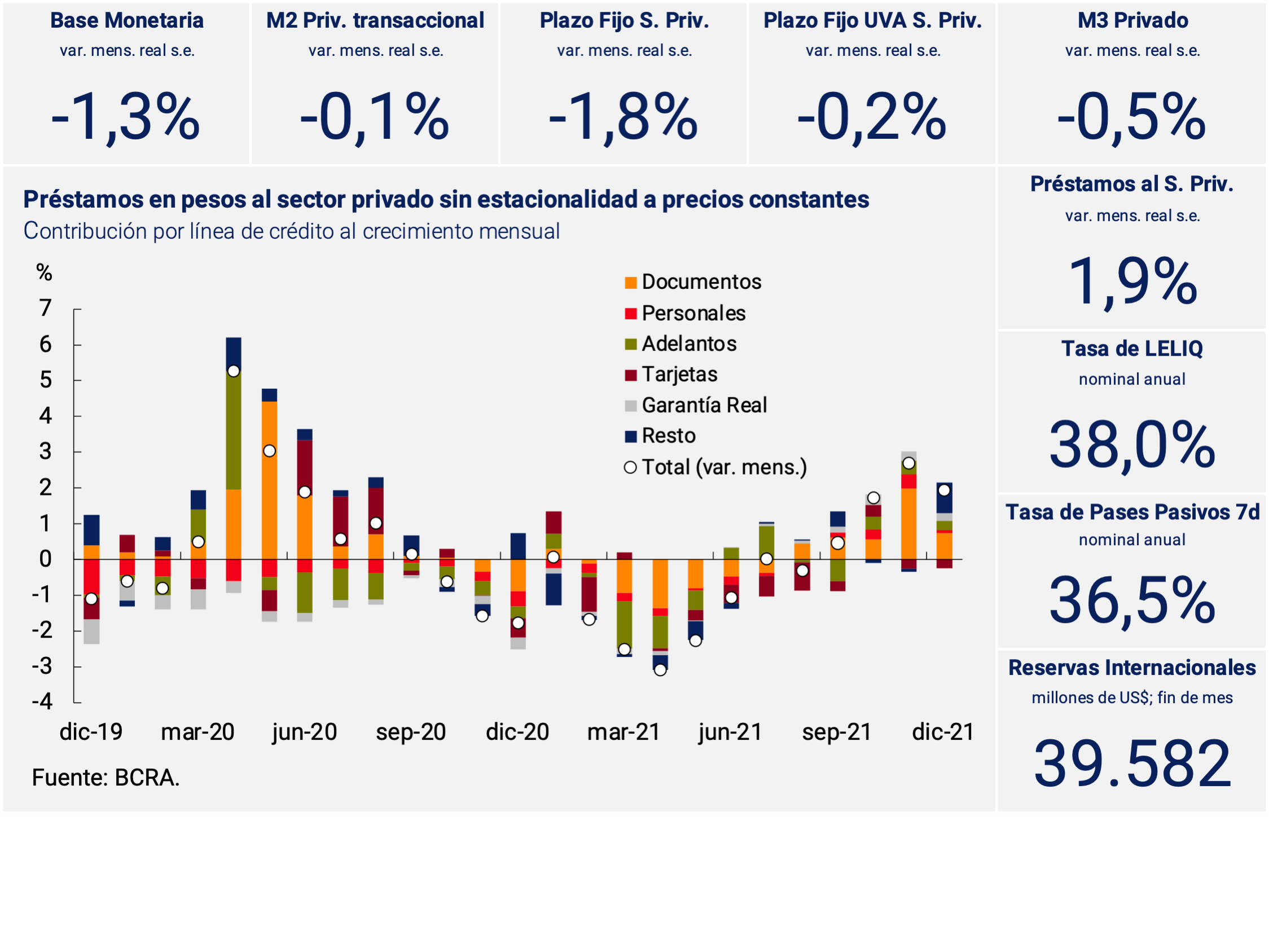

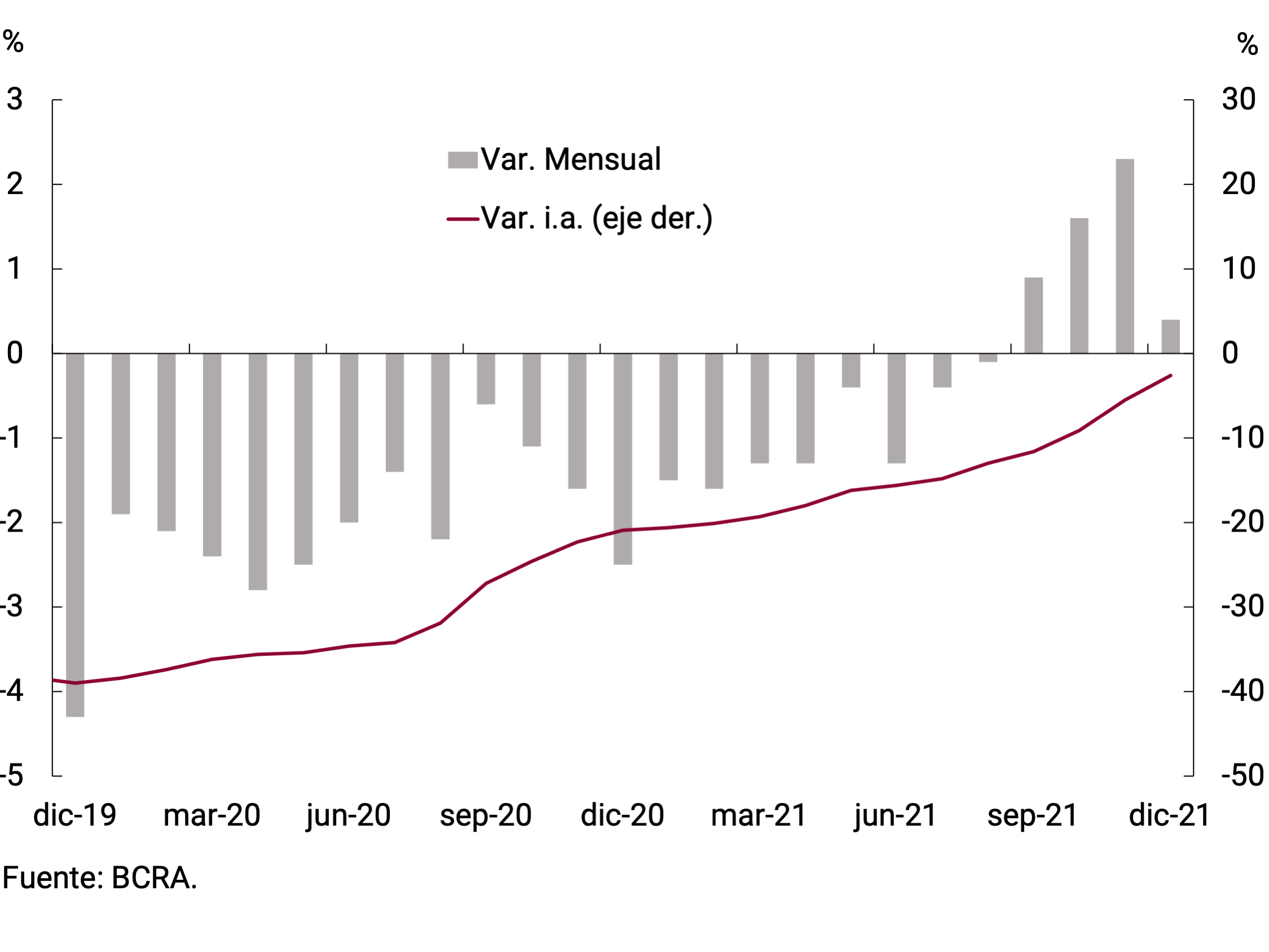

In real and seasonally adjusted terms, the means of payment (private transactional M2) would have remained practically unchanged compared to November. Fixed-term deposits in pesos would have exhibited a new contraction in real terms in the month. All in all, private M3 would have registered a contraction of 0.5% s.e. in real terms and ended the year only 0.7% above the December 2020 figure at constant prices.

The Monetary Base ended the year at $3,360 billion (7.8% monthly and 40% YoY). At constant prices, it fell 9.3% YoY and in terms of GDP it is estimated that it ended the year at 6.2%.

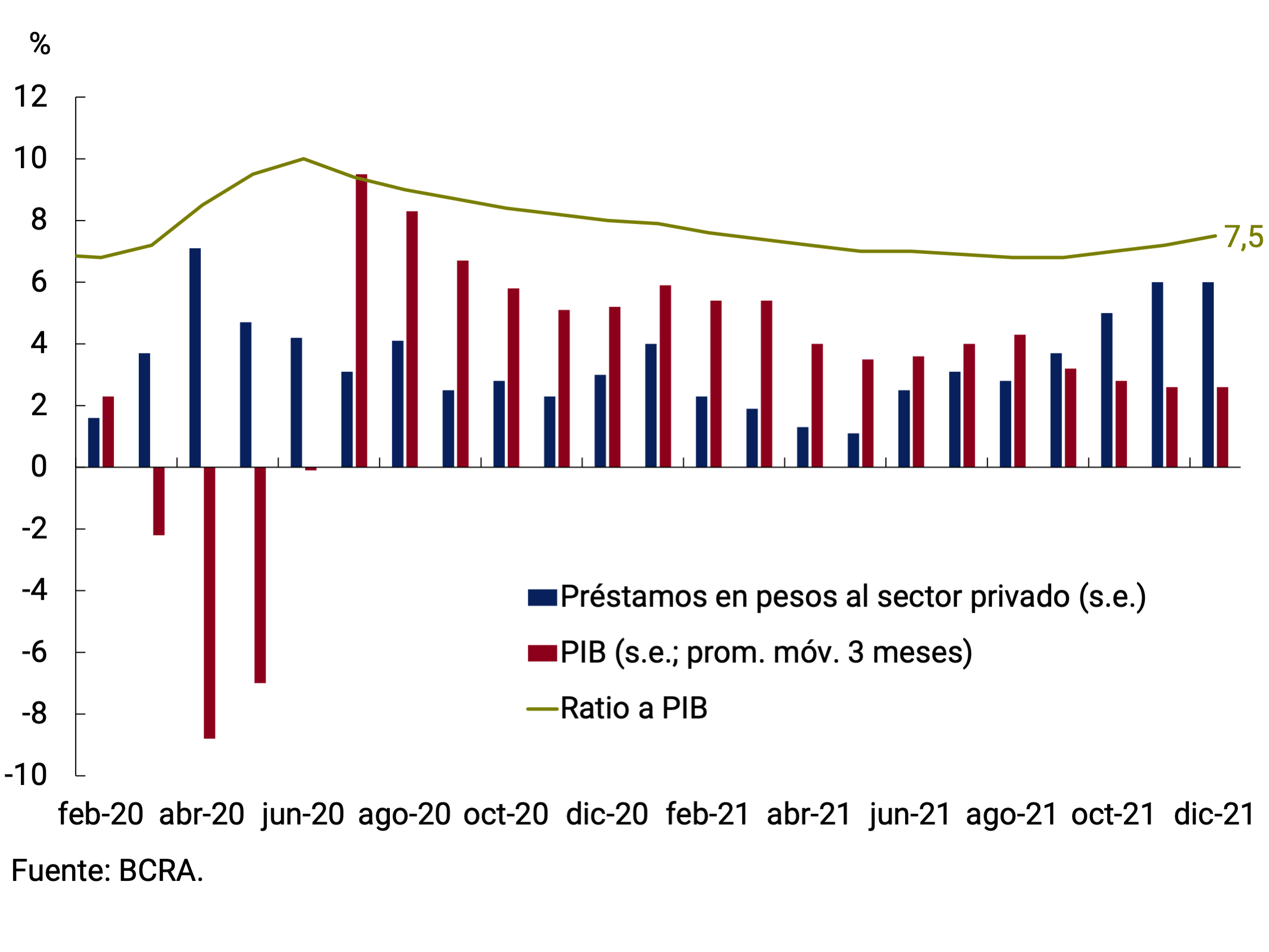

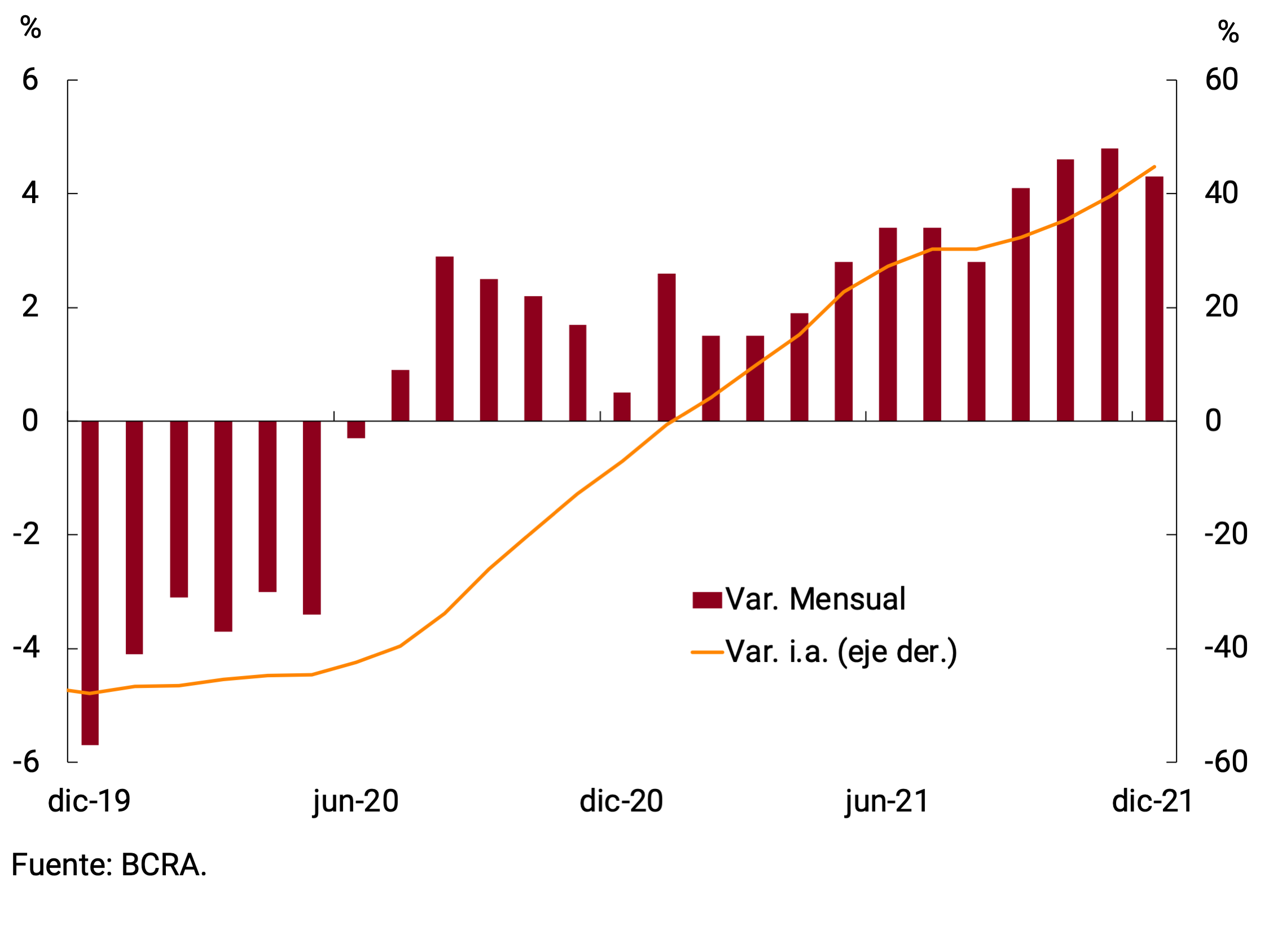

Loans in pesos to the private sector showed real expansion (1.9% s.e.) in December, their fourth consecutive increase. Commercial lines and pledges were particularly highlighted. The increase in financing for productive purposes was once again generalized by type of debtor (MSMEs and large companies). Loans to the private sector ended the year with a contraction at constant prices of 4.1% y.o.y. and would have stood at 7.5% of GDP in December.

The BCRA, at the first board meeting in January, reconfigured its monetary policy instruments to accompany the recovery process and reinforce monetary stability. In this context, the limit on LELIQ holdings was readjusted, the reference interest rates were raised and new instruments were created in order to increase the average term of sterilization. These adjustments are in line with the Objectives and Plans set by the BCRA for 2022.

2. Payment methods

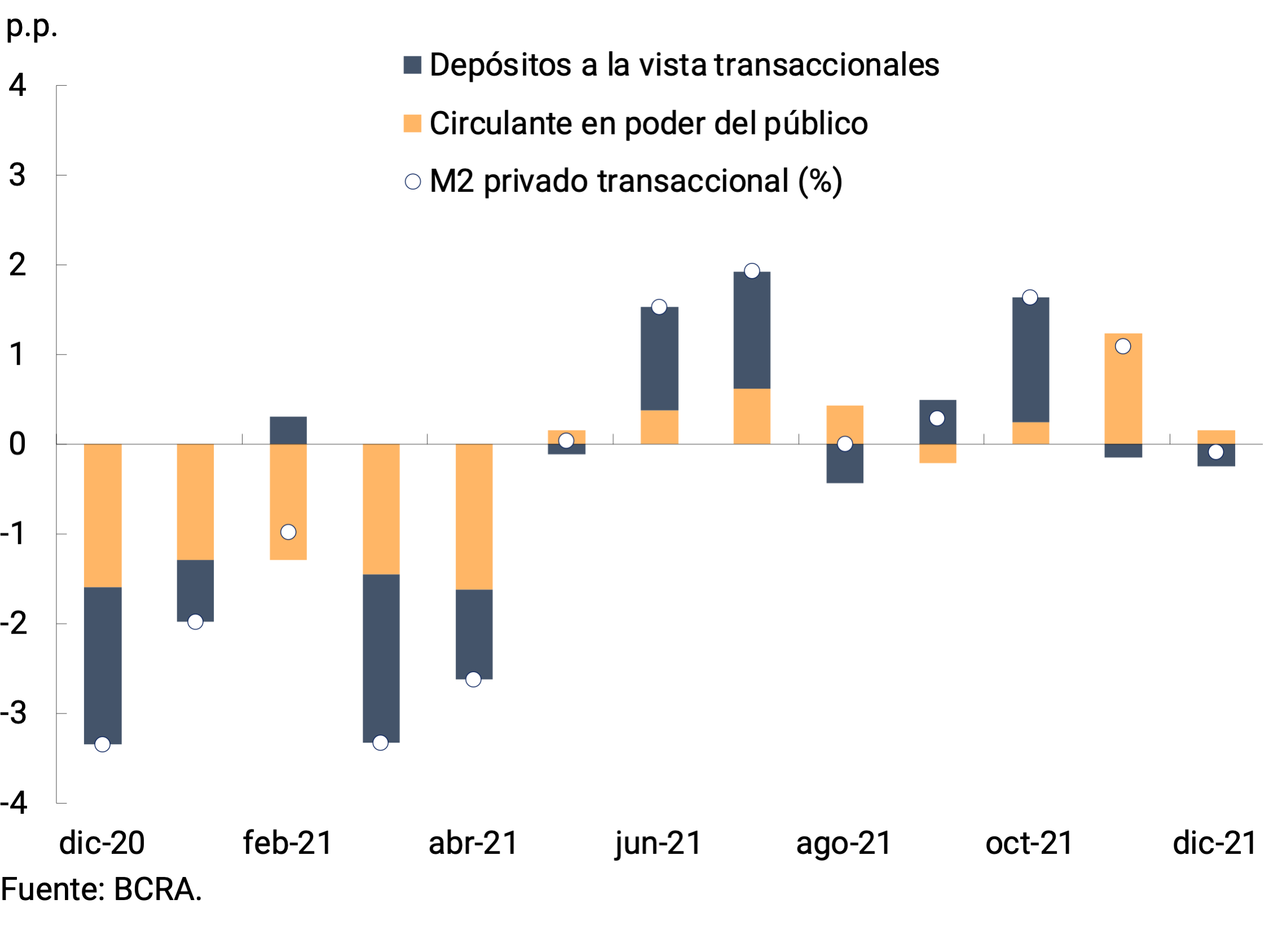

In real terms1 and seasonally adjusted (s.e.), means of payment (private transactional M22) remained practically unchanged in December (-0.1%), after having grown since the middle of the year. At the component level, there was a fall in non-interest-bearing demand deposits (-0.4% s.e., contributing -0.24 p.p. to the variation in private transactional M2), which was partially offset by an increase in working capital held by the public (0.4% s.e., with a contribution of 0.15 p.p. to the variation in means of payment; see Chart 2.1).

Figure 2.1 | Private transactional M2 at constant

prices Contribution by component to the monthly vari. s.e.

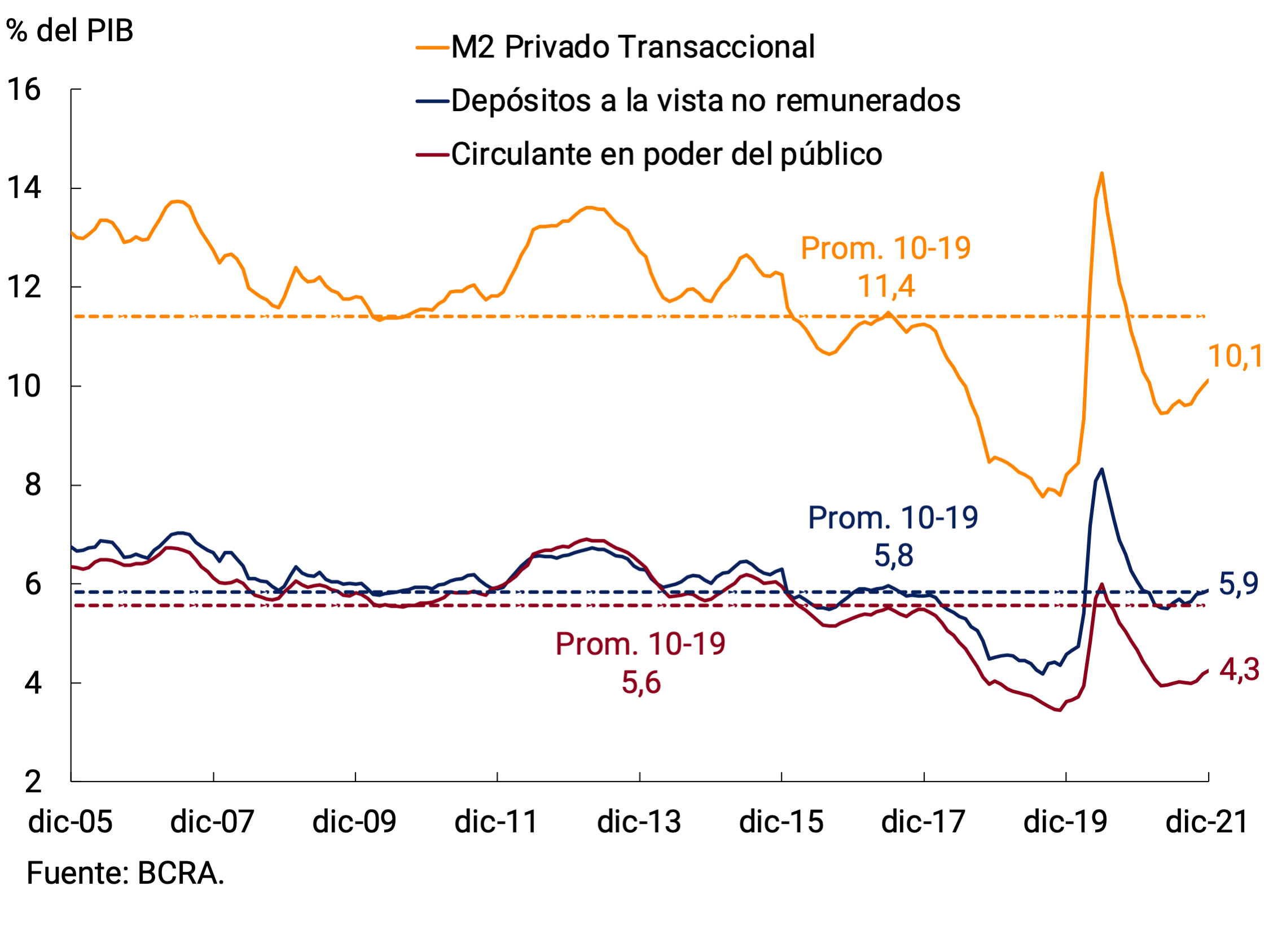

In December, private transactional M2 would have stood at 10.1% of GDP, closing the year at a record similar to that observed in previous months and below the average ratio for the 2010-2019 period. It should be noted that the low level of means of payment in terms of GDP is mainly explained by the dynamics of the working capital held by the public, since the transactional view was around its historical average. Thus, banknotes and coins in the hands of the public were 1.3 p.p. below the average recorded between 2010 and 2019 and at a value close to their lowest in the last 15 years (see Figure 2.2).

3. Savings instruments in pesos

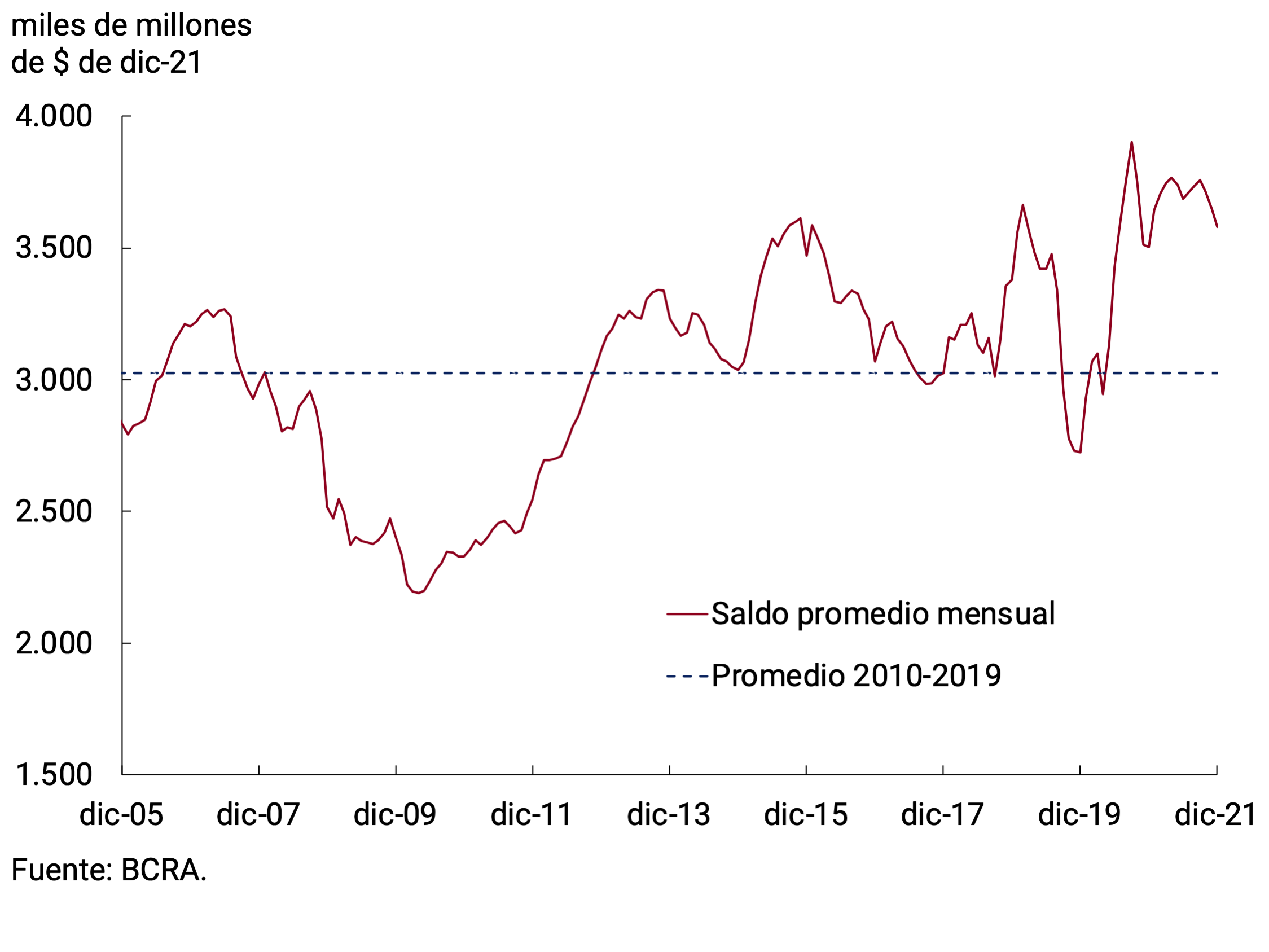

In December, fixed-term deposits in pesos of the private sector would have registered a monthly contraction at constant prices of 1.8% s.e. Even though forward placements showed a drop in the month, at constant prices they still remained at levels considerably higher than those of the average record of 2010-2019 (see Figure 3.1).

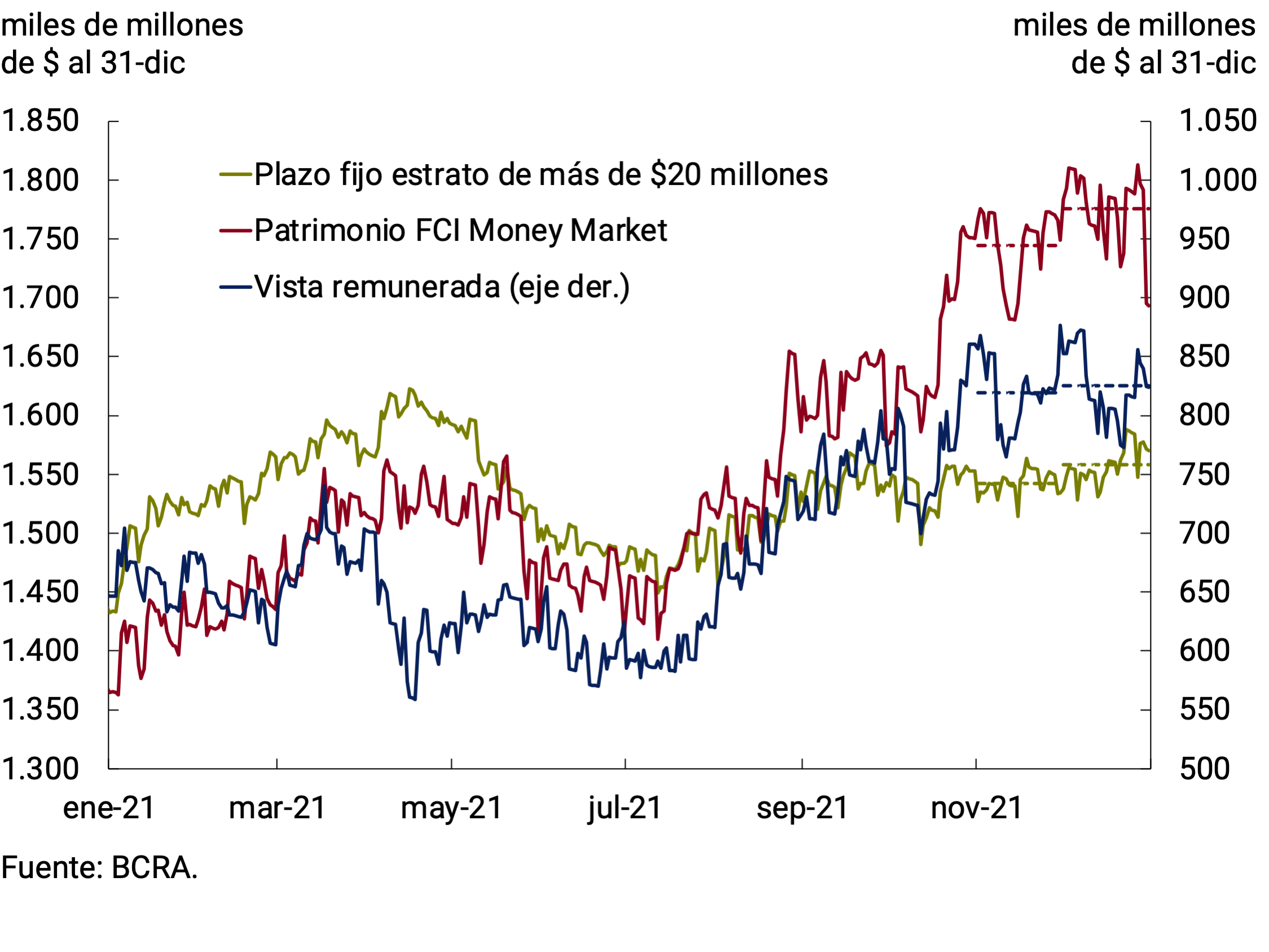

The month’s decrease was mainly concentrated in placements of lower strata. Thus, retail fixed-term deposits (less than $1 million) would have continued to show a downward trend in real terms. It should be noted that the interest rate on time deposits of less than $1 million paid to individuals stood at an average of 36.3% n.a. (43.0% y.a.). Likewise, placements of between $1 and $20 million at constant prices would also have exhibited a monthly drop, although of a smaller magnitude. However, the behavior was not homogeneous throughout the month, given that both segments presented greater dynamism during the second half of the month. This change in behavior was associated with the higher disposable income of families when collecting Christmas bonuses. On the other hand, the deposits of the wholesale stratum (more than $20 million) at constant prices would have remained relatively stable during the last month of the year. The behavior of this amount stratum was explained by the traditional placements of the two main players in the segment: companies and Financial Services Providers (FSPs). Among the latter, the Mutual Funds for Money Market (FCI MM) stand out, representing more than 90% of the total, whose assets showed a slight increase in the month. These funds, unlike in previous months, were mainly channeled into term placements (see Figure 3.2). It should be noted that the return on time deposits of more than $20 million remained without significant changes in the period under analysis. In fact, the TM20 of private banks stood at 34.0% n.a. (39.8% y.a.).

Figure 3.2 | Fixed-term deposits of more than $20 million, equity of the FCI MM and interest-bearing

view Balance at constant prices

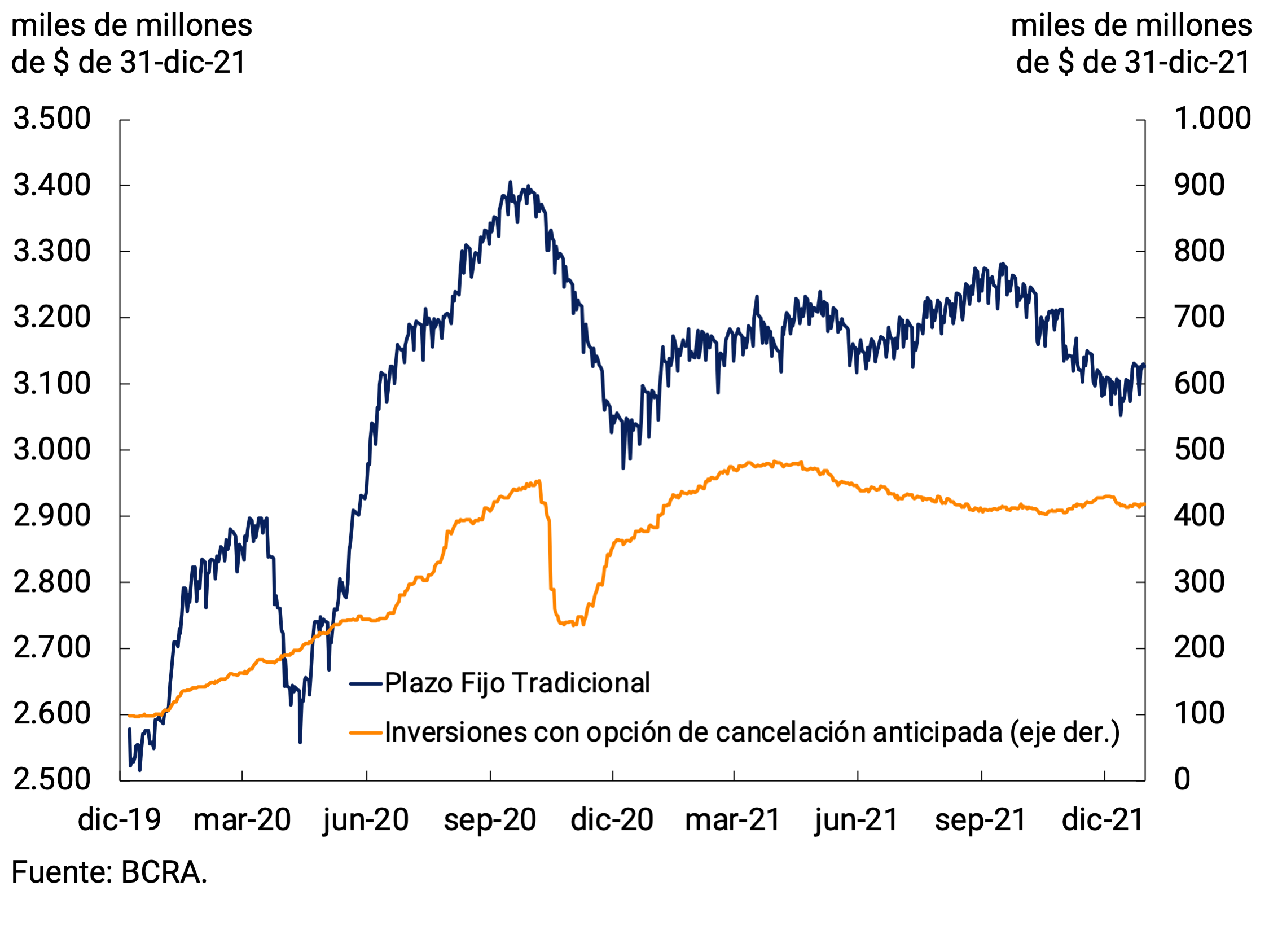

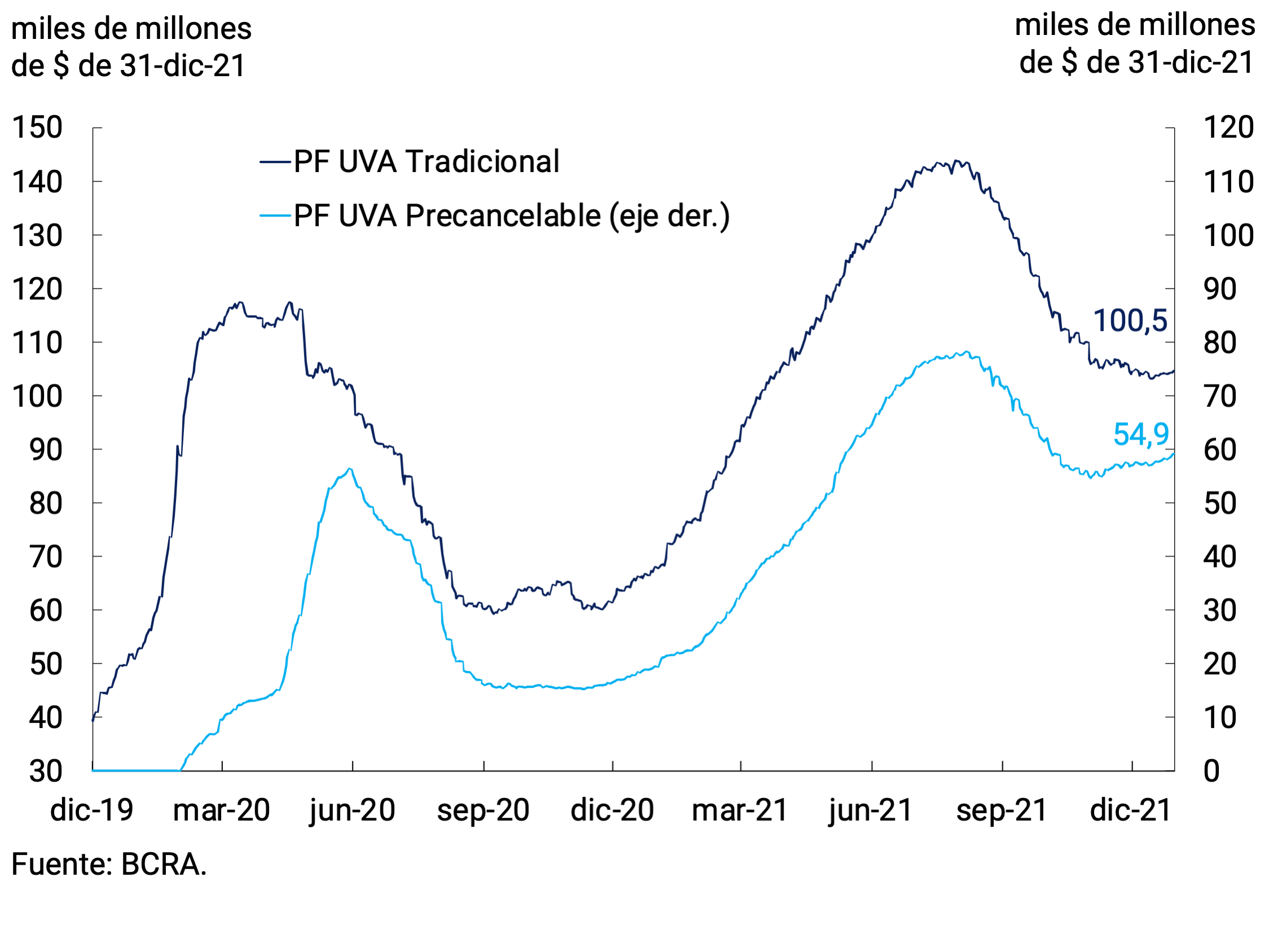

Regarding instruments, a bias was observed to prefer those less liquid. Thus, while traditional fixed-term deposits showed a slight increase throughout the month at constant prices, those with an early cancellation option exhibited a slight drop in the same period (see Figure 3.3). The lower dynamism of pre-cancellable fixed-term deposits was mainly verified in placements denominated in pesos, since those adjustable by CER continued their upward trend that began at the beginning of November (see Figure 3.4).

All in all, the broad monetary aggregate, private M33, at constant prices would have registered a contraction of 0.5% s.e. in December, after five consecutive months of positive variations. In the year-on-year comparison, this aggregate would have experienced a slight increase (0.7%). In terms of Output, it would stand at 18.8%, 5.4 p.p. below the maximum of 2020.

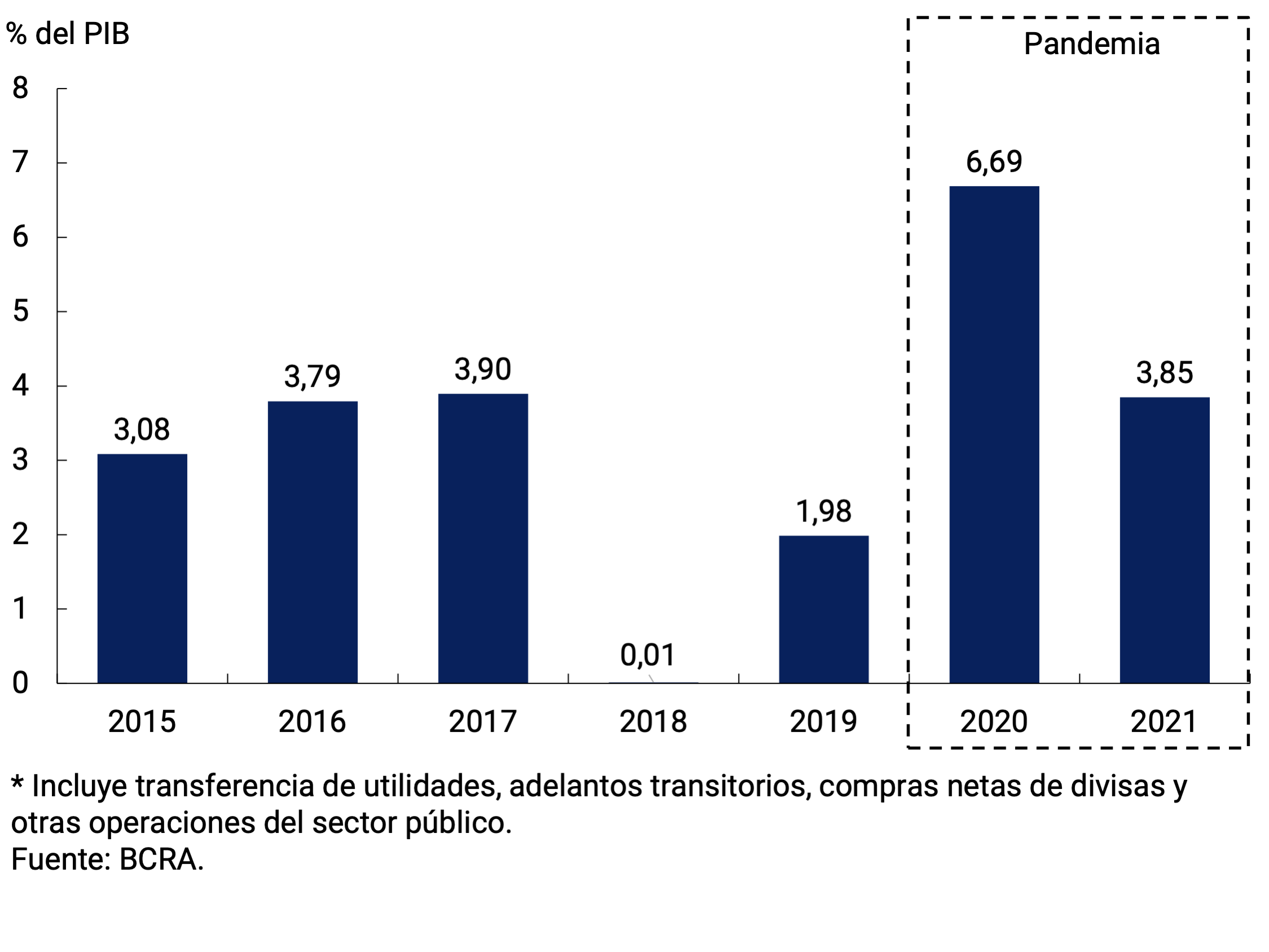

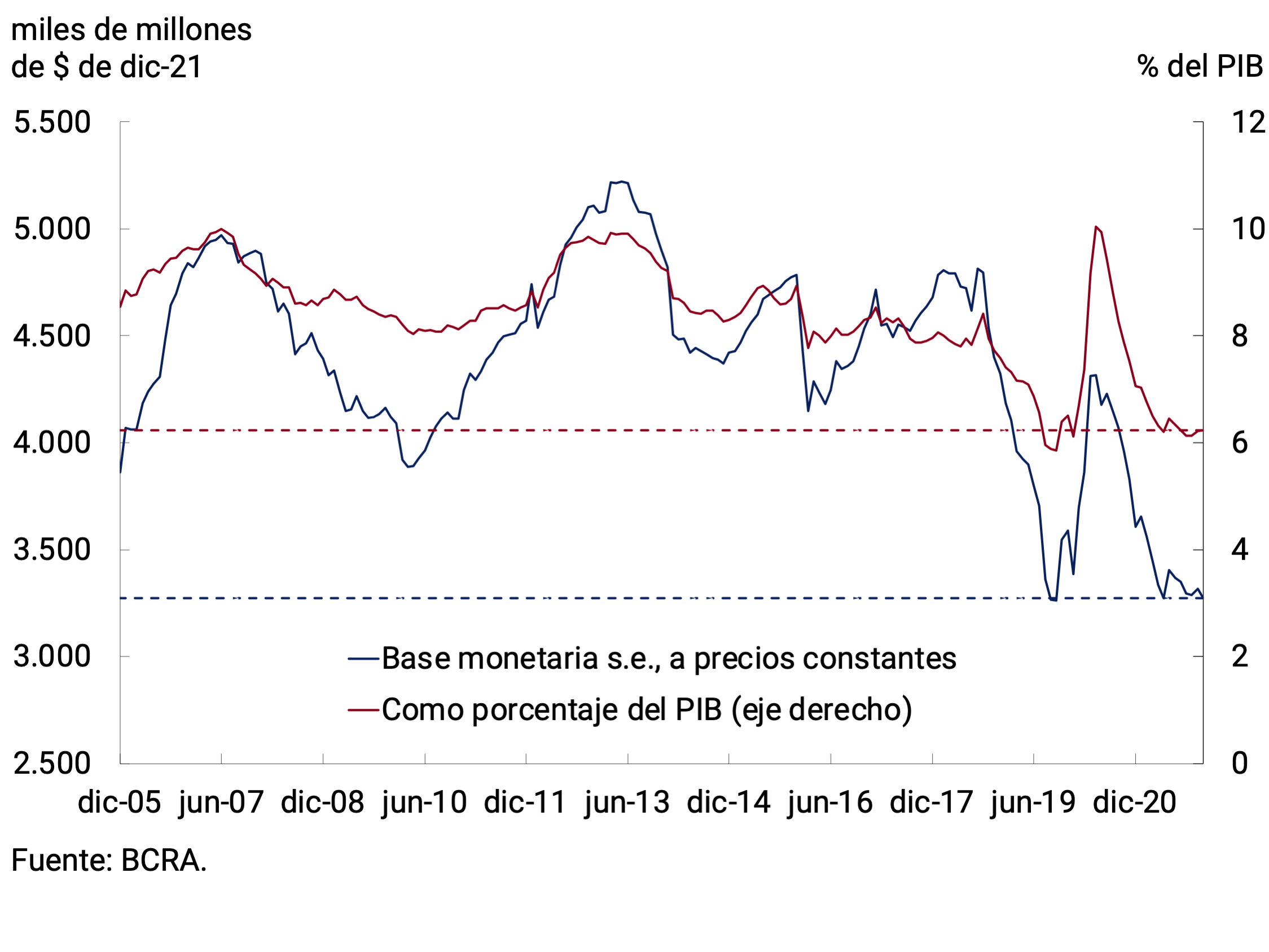

4. Monetary base

In December, the Monetary Base stood at $3,394 billion, which implied an average monthly nominal increase of 7.8% (+$246,384 million). It should be noted that the Monetary Base presents a positive seasonality in December, so if we correct it for this effect, growth in the last month of the year was 2.7% per month. The expansion in the month was mainly explained by public sector operations. In the year to date, primary expansion linked to the public sector would have represented 3.85% of GDP, a figure close to that of 2015 to 2017 and markedly lower than that of the first year of the pandemic (see Figure 4.1). Throughout the year, the purchase of foreign currency from the private sector was also a factor in the expansion of the Monetary Base. These expansionary factors were partially sterilized through monetary regulation instruments (passive passes and LELIQ) and other operations. Thus, the Monetary Base verified an expansion of 40% nominal in the year, which implied a contraction in real terms of the order of 9.3%. In terms of GDP, the Monetary Base would have stood at 6.2%4, a value similar to that of the end of 2019 (see Figure 4.2).

5. Loans to the private sector

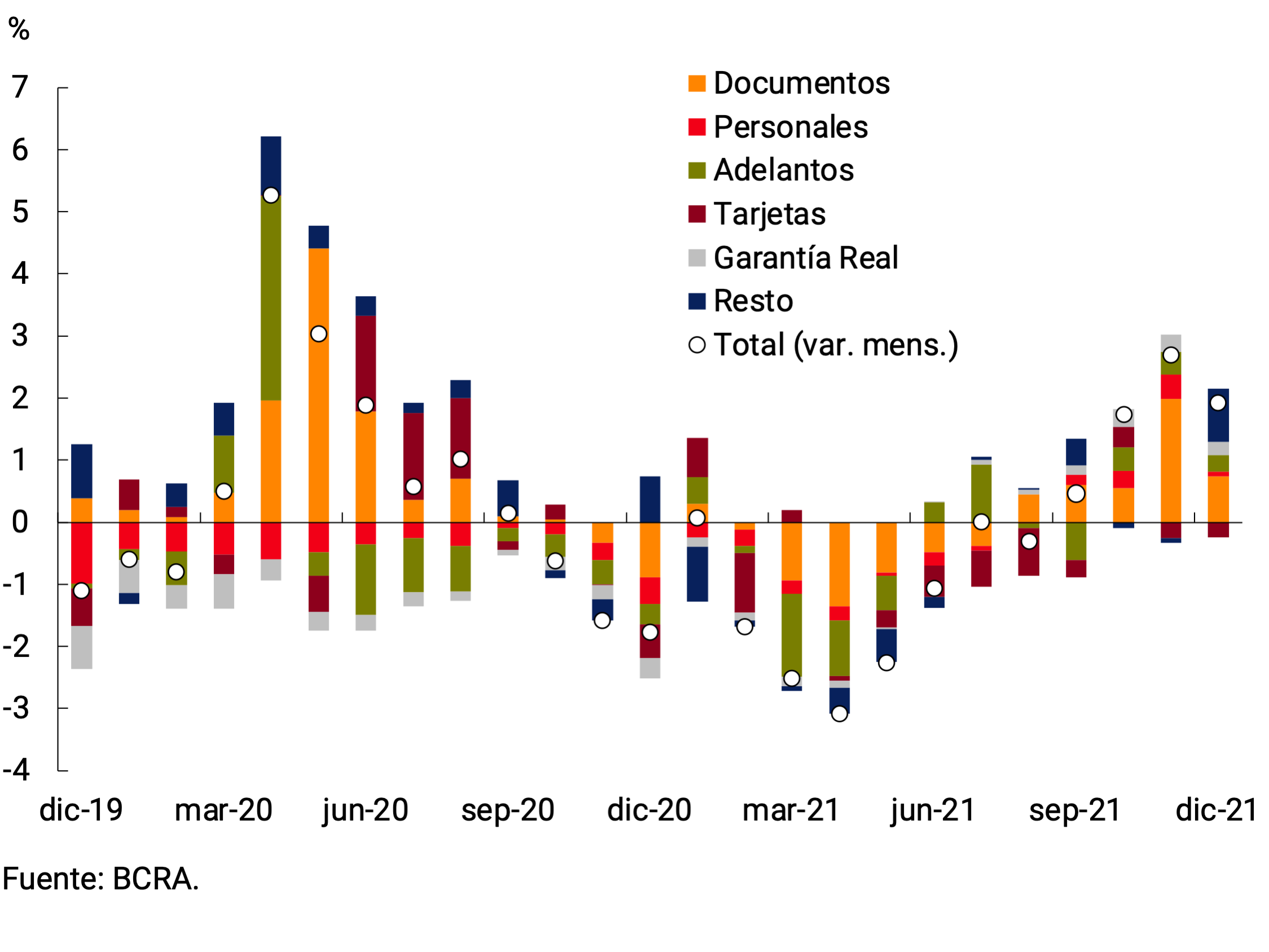

Loans in pesos to the private sector, in real terms and without seasonality, would have registered a monthly expansion of 1.9% in December, thus accumulating 4 consecutive months of increase. Among the different lines of credit, commercial lines and collateral loans stood out (see Figure 5.1). Measured in terms of GDP, bank financing in pesos to the private sector amounted to 7.5% in December, 0.3 p.p. above the value recorded in the previous month (see Figure 5.2).

Figure 5.1 | Loans in pesos to the Real Private

Sector without seasonality; contribution to monthly growth

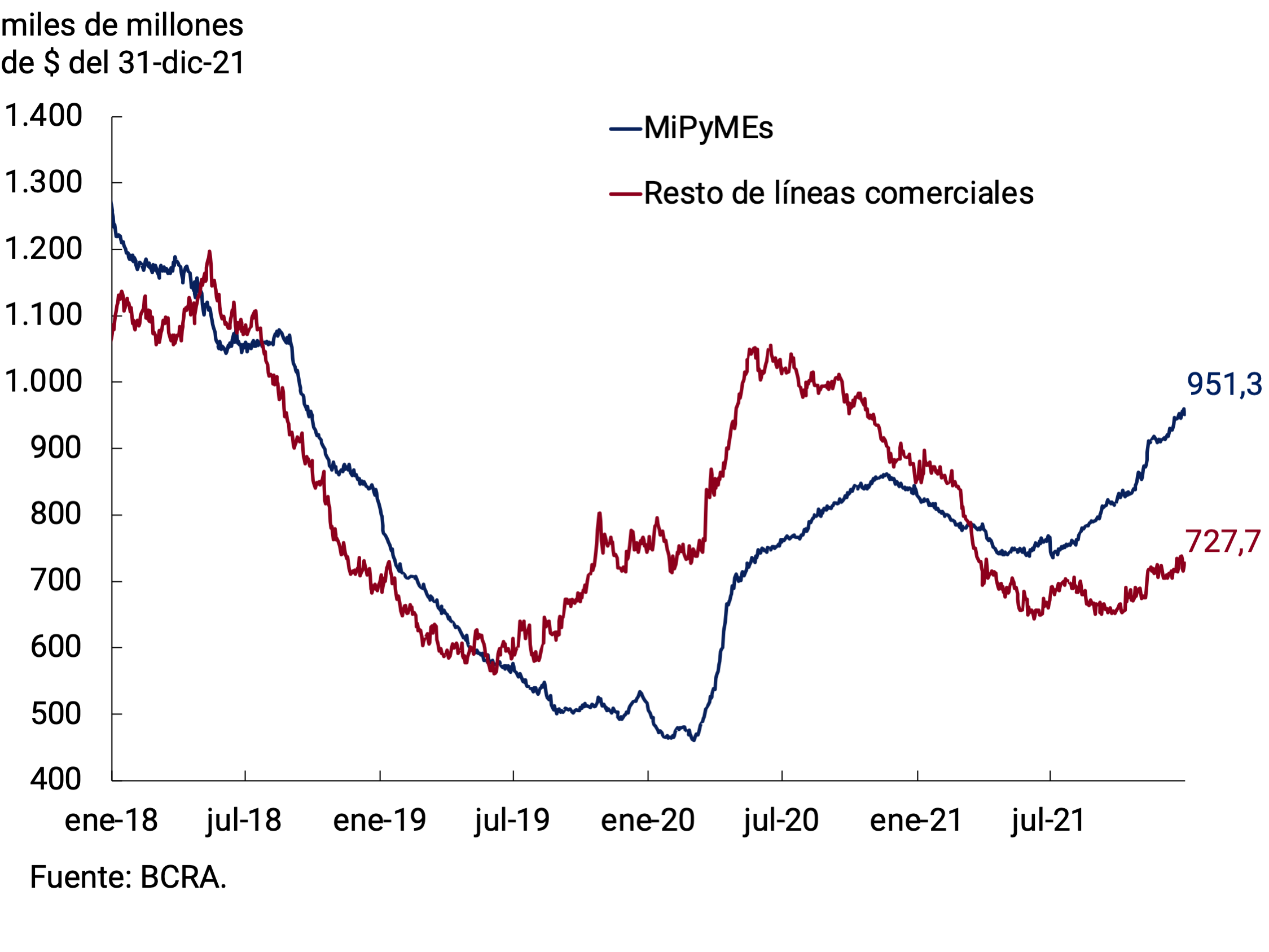

Commercial lines would have grown 2.4% monthly at constant prices and adjusted for seasonality, in a month in which the leading indicators of activity showed positive signs. These financings were again driven by the lines instrumented through documents, which showed a real increase of 3.0% s.e. The growth of single-signature documents, which have a longer average term, would have been 4.7% s.e. and that of discounted documents of 0.9% s.e. (which implied a slowdown compared to previous months), in both cases at constant prices. Meanwhile, current account advances grew at a rate similar to that of documents (2.7% s.e. at constant prices), although with a smaller contribution to the growth of total loans. When we analyze the composition of commercial loans by type of debtor, it can be seen that both financing to MSMEs and to large companies explain the monthly growth (see Figure 5.3).

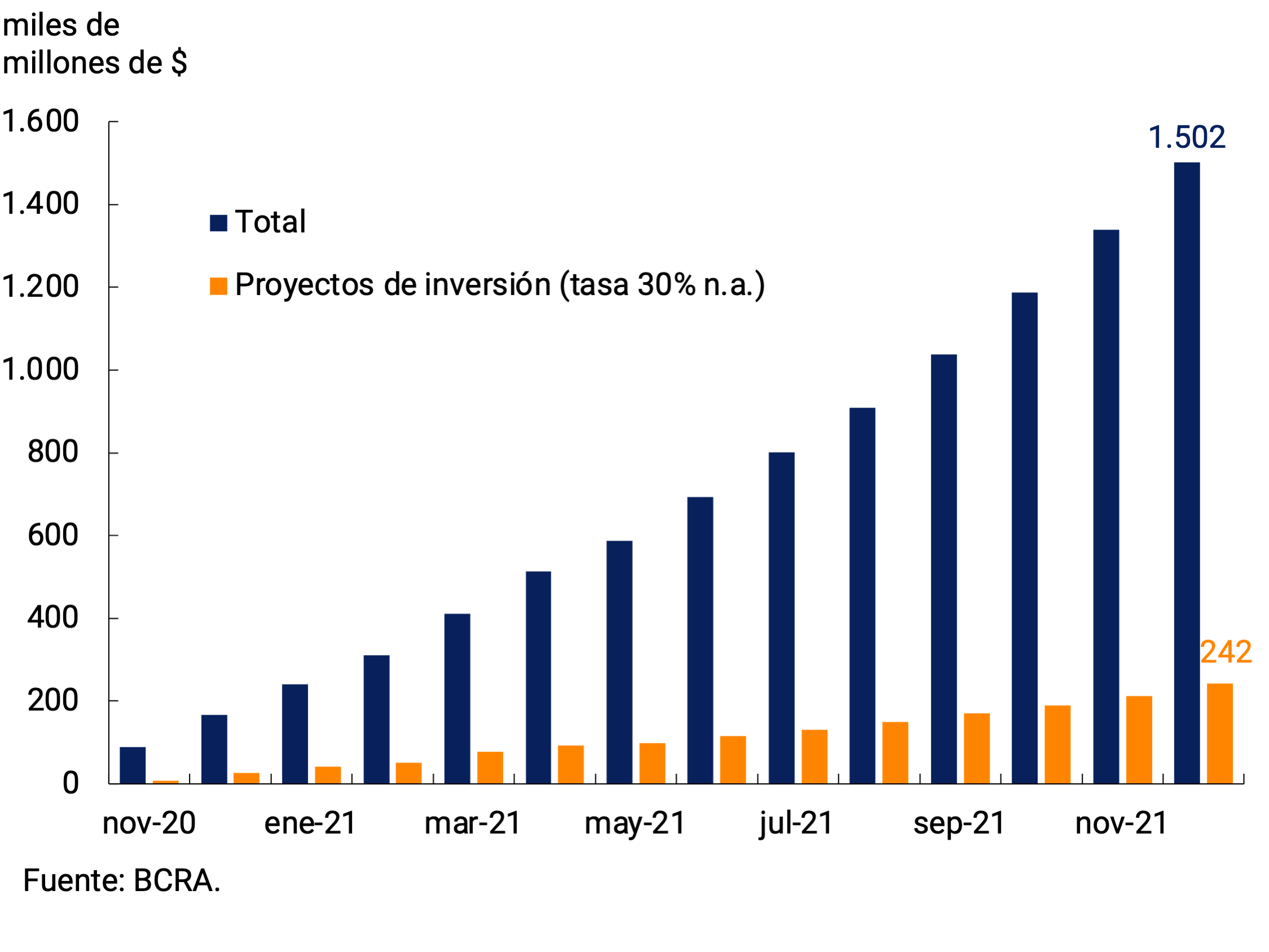

The growth that commercial credit has been exhibiting in recent months is linked, in part, to the Financing Line for Productive Investment (LFIP) for MSMEs. At the end of December, loans under the LFIP had accumulated disbursements of approximately $1.502 billion since its inception (see Figure 5.4). Loans granted through the line increased 12% compared to the record at the end of November. Regarding the destinations of these funds, approximately 84% of the total disbursed corresponds to the financing of working capital and the rest to the line that finances investment projects. So far, more than 209 thousand companies have accessed loans within the framework of the LFIP.

Among loans associated with consumption, financing instrumented with credit cards would have exhibited a new decrease in real terms during December (-0.8% s.e.). Meanwhile, personal loans would have grown 0.4% monthly at constant prices, continuing with the recovery process that they have been showing in the last 4 months (see Chart 5.5). The interest rate corresponding to personal loans increased 1.2 p.p. on the December average and amounted to 53% n.a.

As for the lines with real collateral, collateral loans once again showed the highest growth among all the lines and have now accumulated 18 months of real growth (see Figure 5.6). In the last month of 2021, they would have shown a monthly increase of 4.3% s.e. at constant prices, accumulating an expansion of 44.8% in the last twelve months. On the other hand, the balance of mortgage loans remained practically stable in real terms and without seasonality in the month, which would represent a drop of 15.4% in the last 12 months.

6. Liquidity in pesos of financial institutions

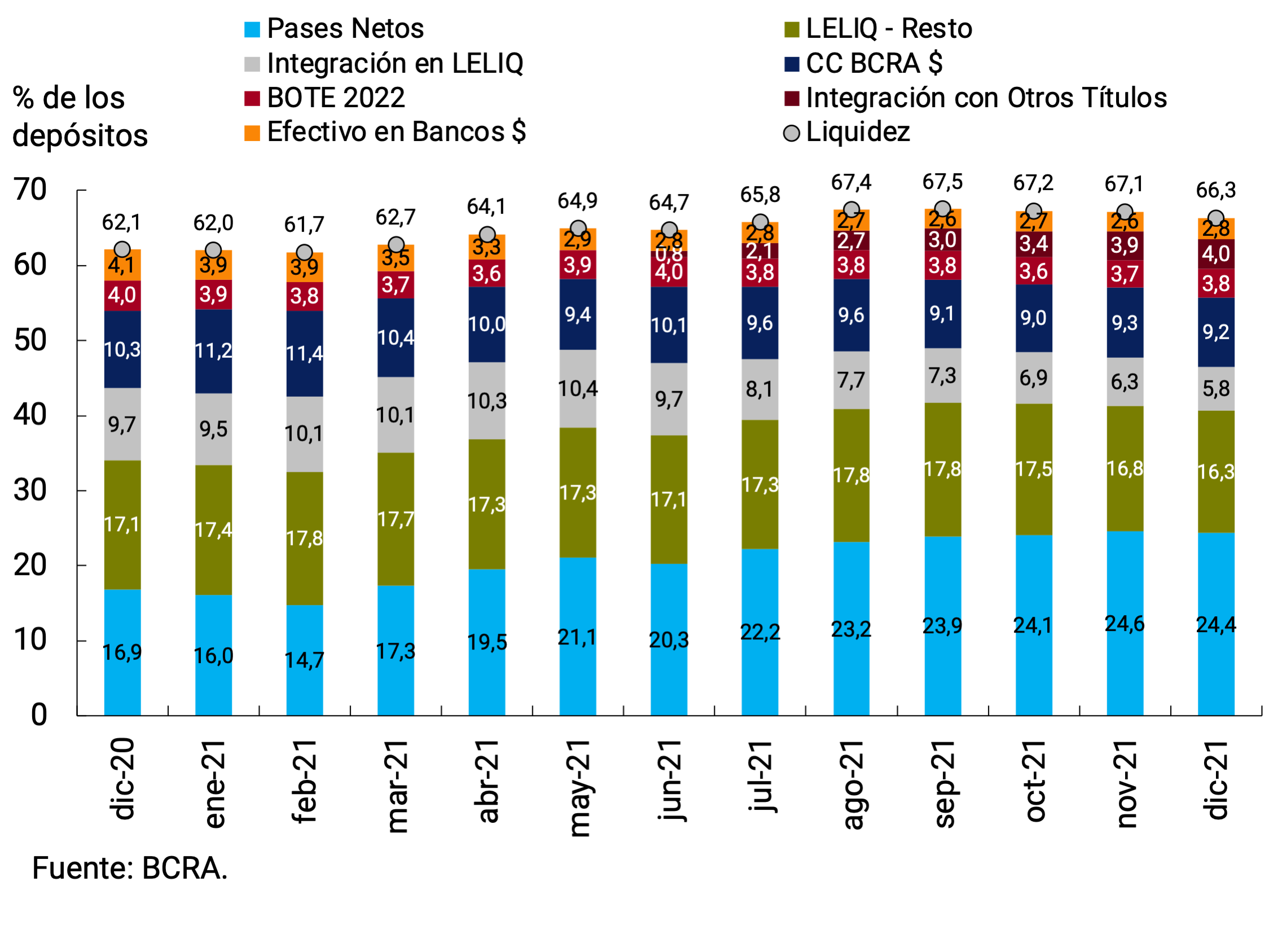

In December, ample bank liquidity in local currency5 averaged 66.3% of deposits, 0.8 p.p. below what was observed in November, remaining at historically high levels. In terms of its composition, integration with public securities continued to grow at the expense of integration into LELIQ. For the month, there was a 0.2 p.p. drop in net pass-throughs, and a 0.2 p.p. increase in cash in banks (see Figure 6.1).

7. Foreign currency

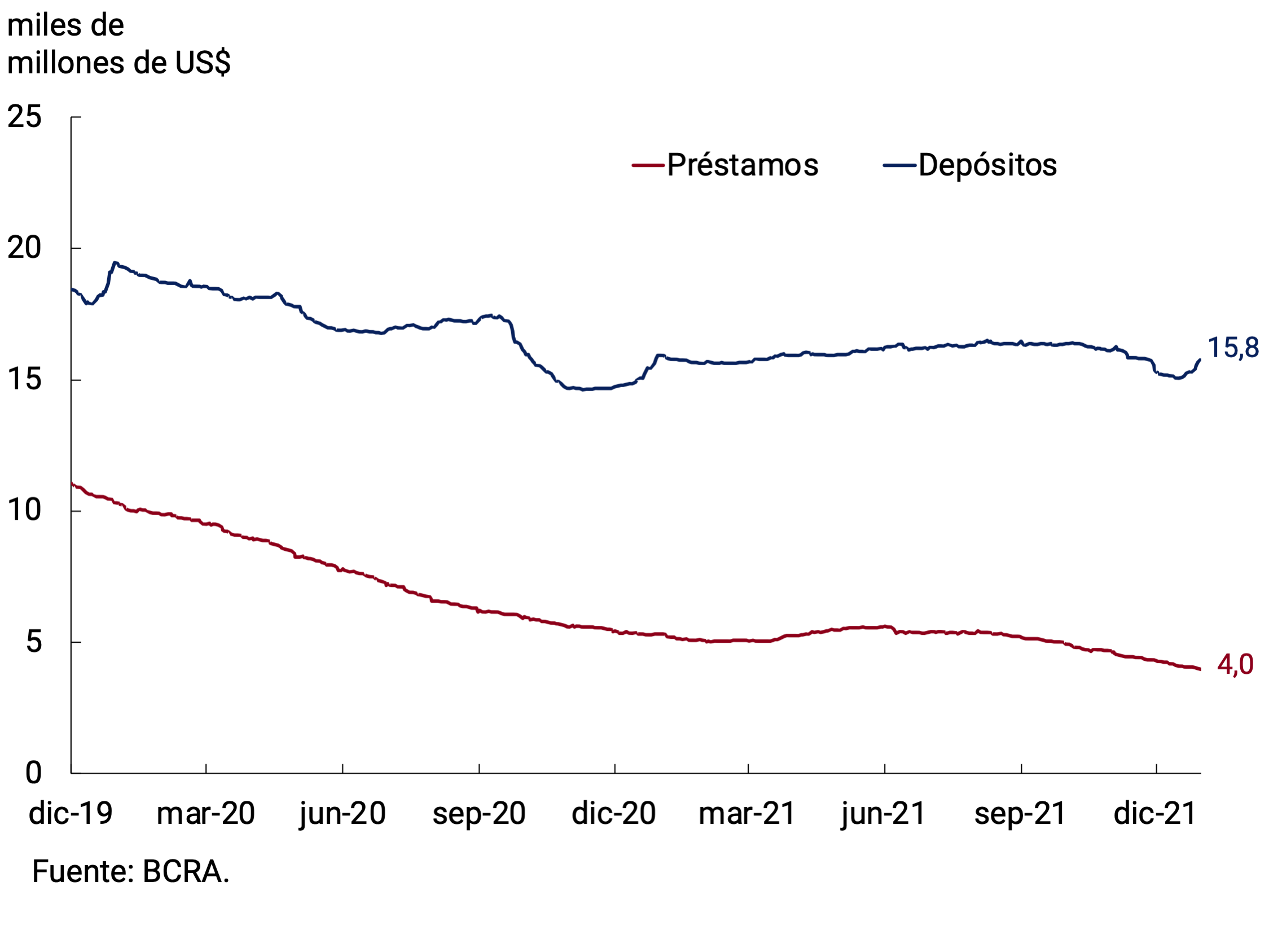

In the foreign currency segment, the average balance of private sector deposits registered a contraction of US$640 million compared to November. However, in the peak variation of the month, an expansion of US$393 million was observed, so the fall in the average for the month was mainly due to the statistical carryover from November. This growth within December was explained by the exemption from the payment of the tax on personal assets of demand balances, both in pesos and in foreign currency. Thus, the balance of private sector deposits in foreign currency closed the year at US$15,752 million (see Figure 7.1). Loans to the private sector in foreign currency continued to show a downward trend throughout the month. In fact, the average monthly balance of the latter stood at US$4,127 million, which implied a decrease of US$309 million compared to November. The fall was concentrated in financing instrumented through single-signature documents.

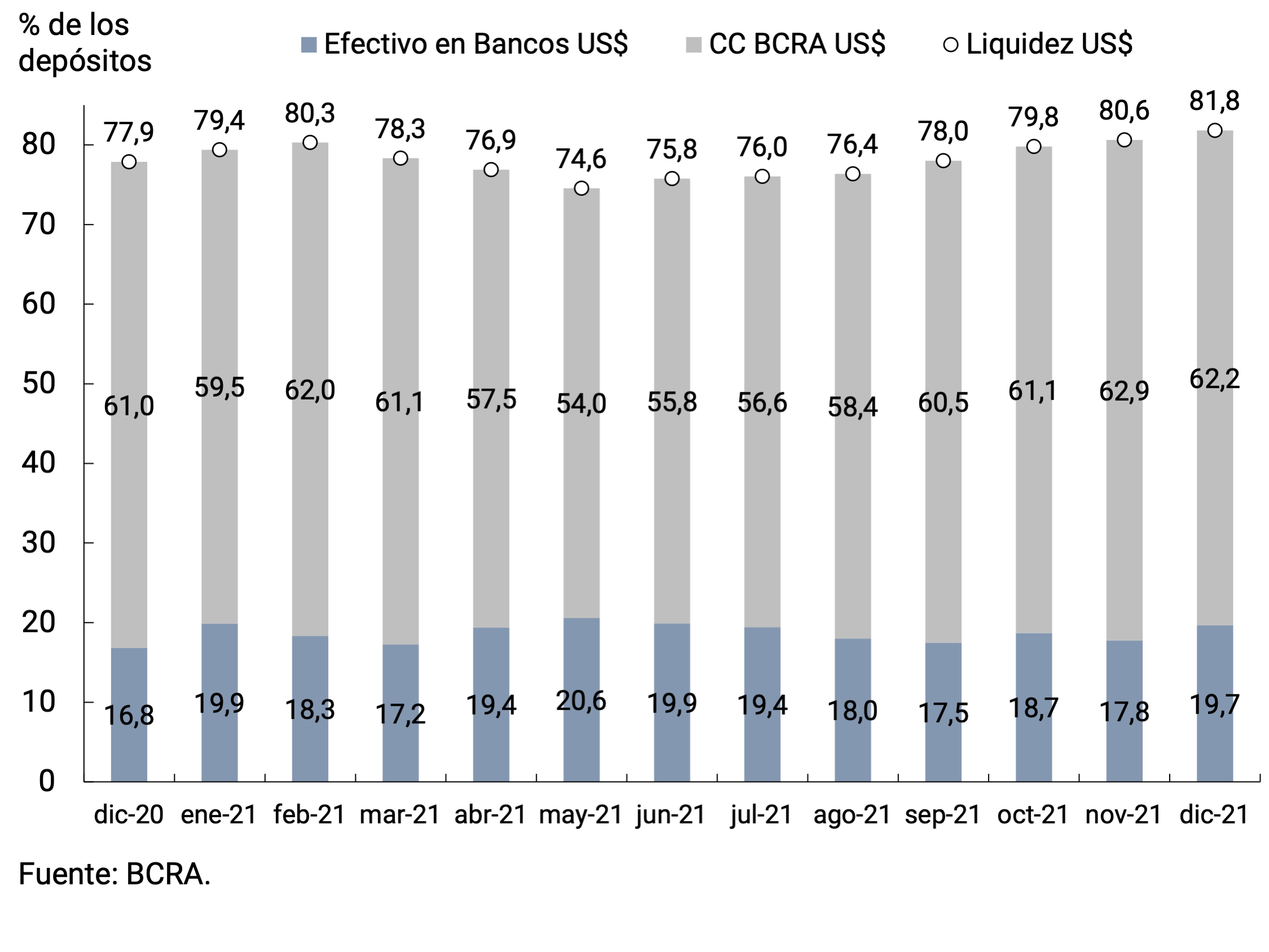

In this context, bank liquidity in foreign currency increased again for the seventh consecutive month, averaging 81.8% of deposits in December. This increase was explained by cash in banks and was partially offset by a fall in current accounts at the Central Bank (see Figure 7.2).

For its part, during December some regulatory modifications took place in foreign exchange matters. On the one hand, the provisions that expired at the end of the year on the payment of imports of goods and refinancing of debt securities in foreign currency and other financial liabilities were extended for six months; On the other hand, the mechanism of availability of foreign currency provided for exporters who register increases in their exports in 2022 compared to the previous year was maintained. At the same time, in order to make it easier for the private sector to renegotiate its liabilities, the limit amount and the permitted uses with respect to the cancellation of commercial debts with new financial indebtedness abroadwere extended 6. Finally, taking into consideration the particular characteristics of large investments, which need to have a period of maturation and financing that makes their effective implementation possible, Decree 836/2021 was regulated, which provided better conditions for access to the foreign exchange market for companies that make investments aimed at expanding the country’s export capacity7.

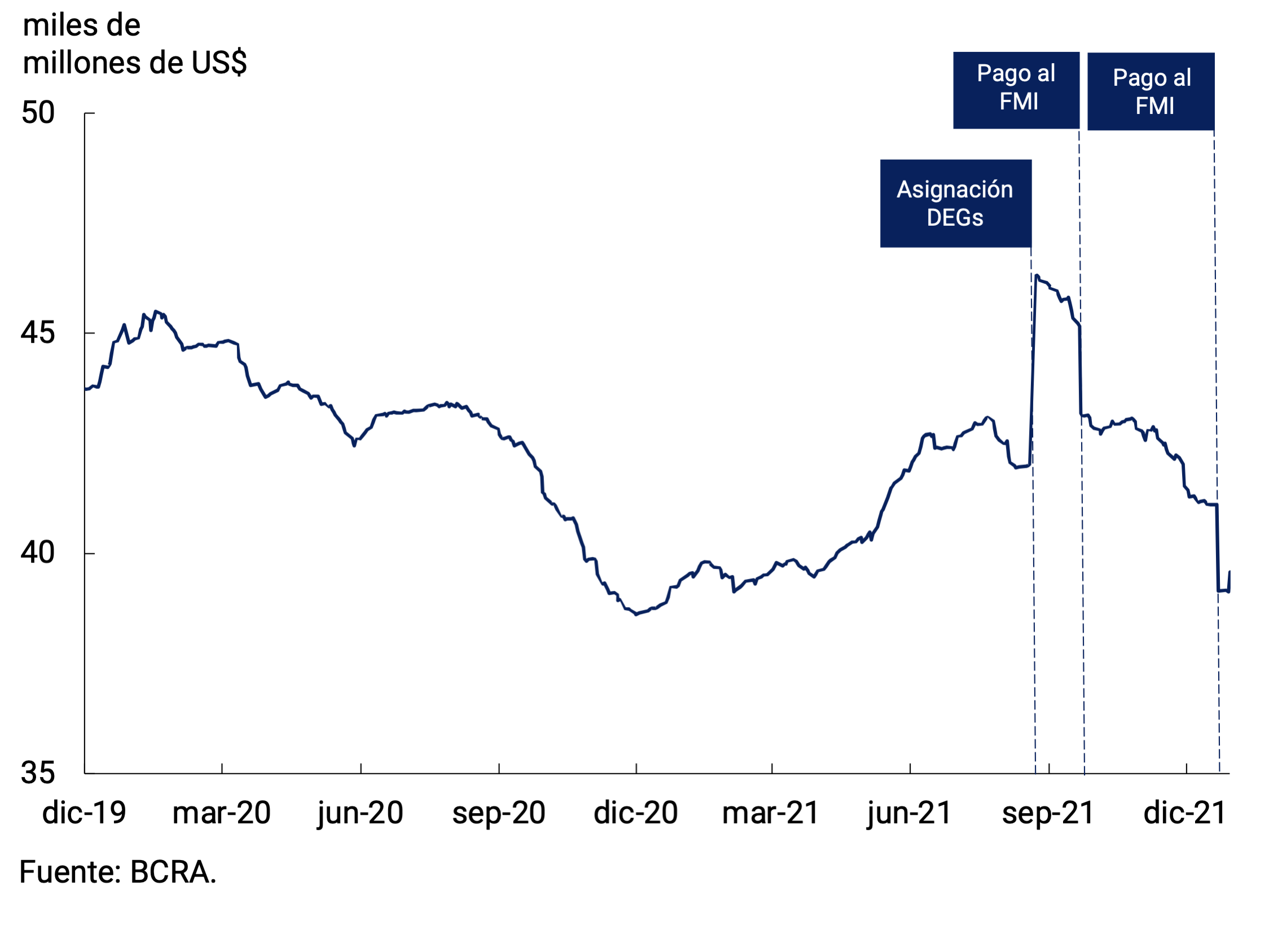

The BCRA’s International Reserves ended December with a balance of US$39,582 million, reflecting a decrease of US$1,947 million compared to the end of November (see Figure 7.3). It should be noted that most of the fall observed in the month was due to the capital payment made to the IMF within the framework of the Stand-By Agreement (SBA) for some US$1,850 million. Thus, International Reserves accumulated an increase of US$195 million in the year.

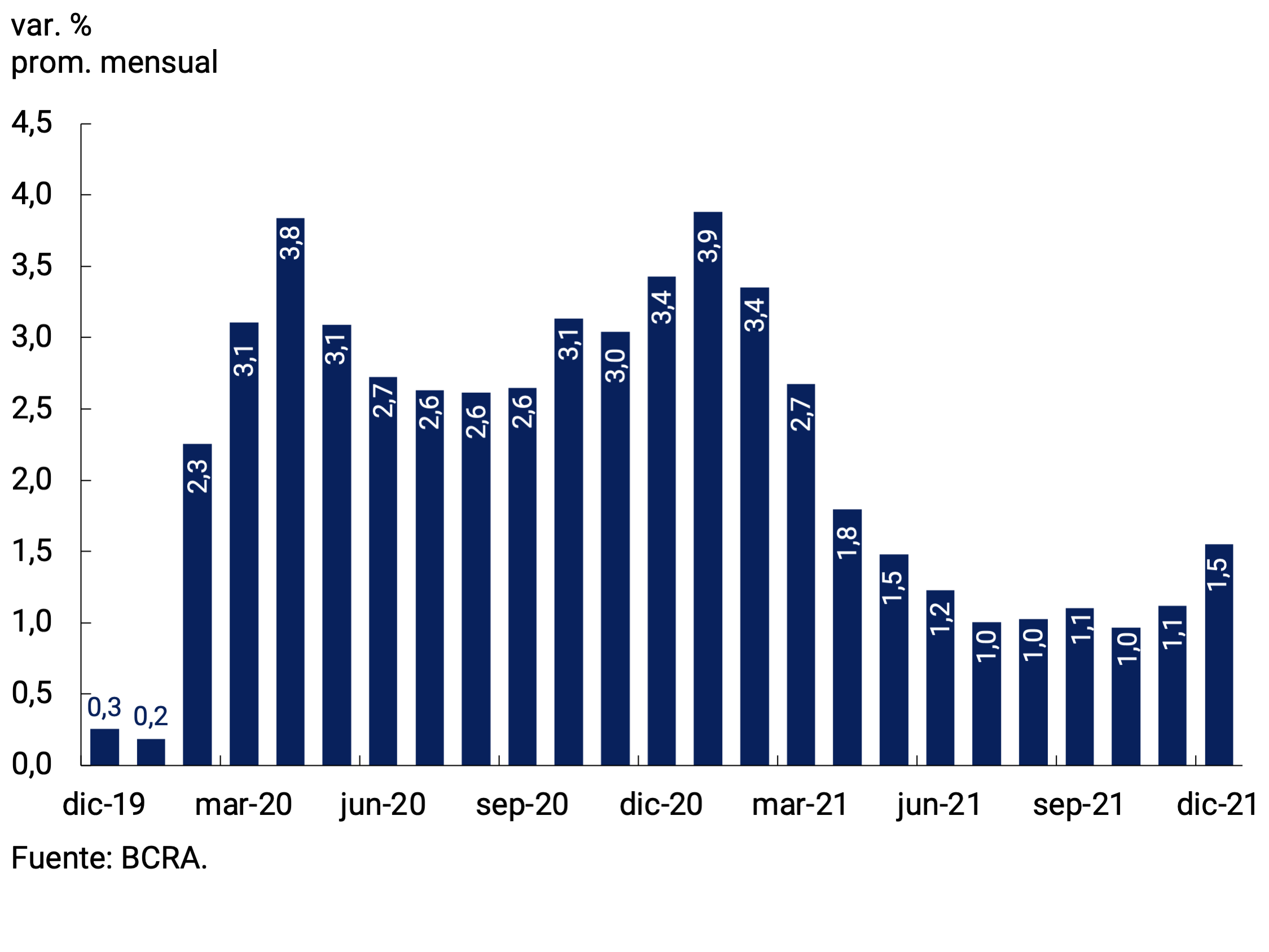

Finally, once the uncertainty linked to the electoral process was overcome and considering the evolution of the real exchange rate, an attempt was gradually made to advance an adjustment in the rate of depreciation of the domestic currency. Thus, the nominal bilateral exchange rate against the U.S. dollar depreciated 1.5% in December to settle, on average, at $101.88/US$ (see Figure 7.4.

Glossary

ANSES: National Social Security Administration.

BADLAR: Interest rate on fixed-term deposits for amounts greater than one million pesos and a term of 30 to 35 days.

BCRA: Central Bank of the Argentine Republic.

BM: Monetary Base, includes monetary circulation plus deposits in pesos in current account at the BCRA.

CC BCRA: Current account deposits at the BCRA.

CER: Reference Stabilization Coefficient.

NVC: National Securities Commission.

SDR: Special Drawing Rights.

EFNB: Non-Banking Financial Institutions.

EM: Minimum Cash.

FCI: Common Investment Fund.

A.I.: Year-on-year .

IAMC: Argentine Institute of Capital Markets

CPI: Consumer Price Index.

ITCNM: Multilateral Nominal Exchange Rate Index

ITCRM: Multilateral Real Exchange Rate Index

LEBAC: Central Bank bills.

LELIQ: Liquidity Bills of the BCRA.

LFIP: Financing Line for Productive Investment.

M2 Total: Means of payment, which includes working capital held by the public, cancelling cheques in pesos and demand deposits in pesos from the public and non-financial private sector.

Private M2: Means of payment, includes working capital held by the public, cancelling cheques in pesos and demand deposits in pesos from the non-financial private sector.

Private transactional M2: Means of payment, includes working capital held by the public, cancelling cheques in pesos and non-remunerated demand deposits in pesos from the non-financial private sector.

M3 Total: Broad aggregate in pesos, includes the current currency held by the public, cancelling checks in pesos and the total deposits in pesos of the public and non-financial private sector.

Private M3: Broad aggregate in pesos, includes the working capital held by the public, cancelling checks in pesos and the total deposits in pesos of the non-financial private sector.

MERVAL: Buenos Aires Stock Market.

MM: Money Market.

N.A.: Annual nominal

E.A.: Annual Effective

NOCOM: Cash Clearing Notes.

ON: Negotiable Obligation.

GDP: Gross Domestic Product.

P.B.: Basic points.

P.P.: Percentage points.

MSMEs: Micro, Small and Medium Enterprises.

ROFEX: Rosario Term Market.

S.E.: No seasonality

SISCEN: Centralized System of Information Requirements of the BCRA.

TCN: Nominal Exchange Rate

IRR: Internal Rate of Return.

TM20: Interest rate on fixed-term deposits for amounts greater than 20 million pesos and a term of 30 to 35 days.

TNA: Annual Nominal Rate.

UVA: Unit of Purchasing Value

References

1 INDEC will release December’s inflation data on January 13.

2 M2 private excluding interest-bearing demand deposits from companies and financial service providers. This component was excluded since it is more similar to a savings instrument than to a means of payment.

3 Includes the working capital held by the public and the deposits in pesos of the non-financial private sector (sight, term and others).

4 This ratio was calculated as the non-seasonality value of the Monetary Base of Dec-21 as a percentage of the estimated average value of nominal GDP without seasonality of the last quarter of the year.

5 Includes current accounts at the BCRA, cash in banks, balances of net passes arranged with the BCRA, holdings of LELIQ, and bonds eligible for reserve requirements.