Política Monetaria

Monthly Monetary Report

Agosto

2021

Monthly report on the evolution of the monetary base, international reserves and foreign exchange market.

1. Executive Summary

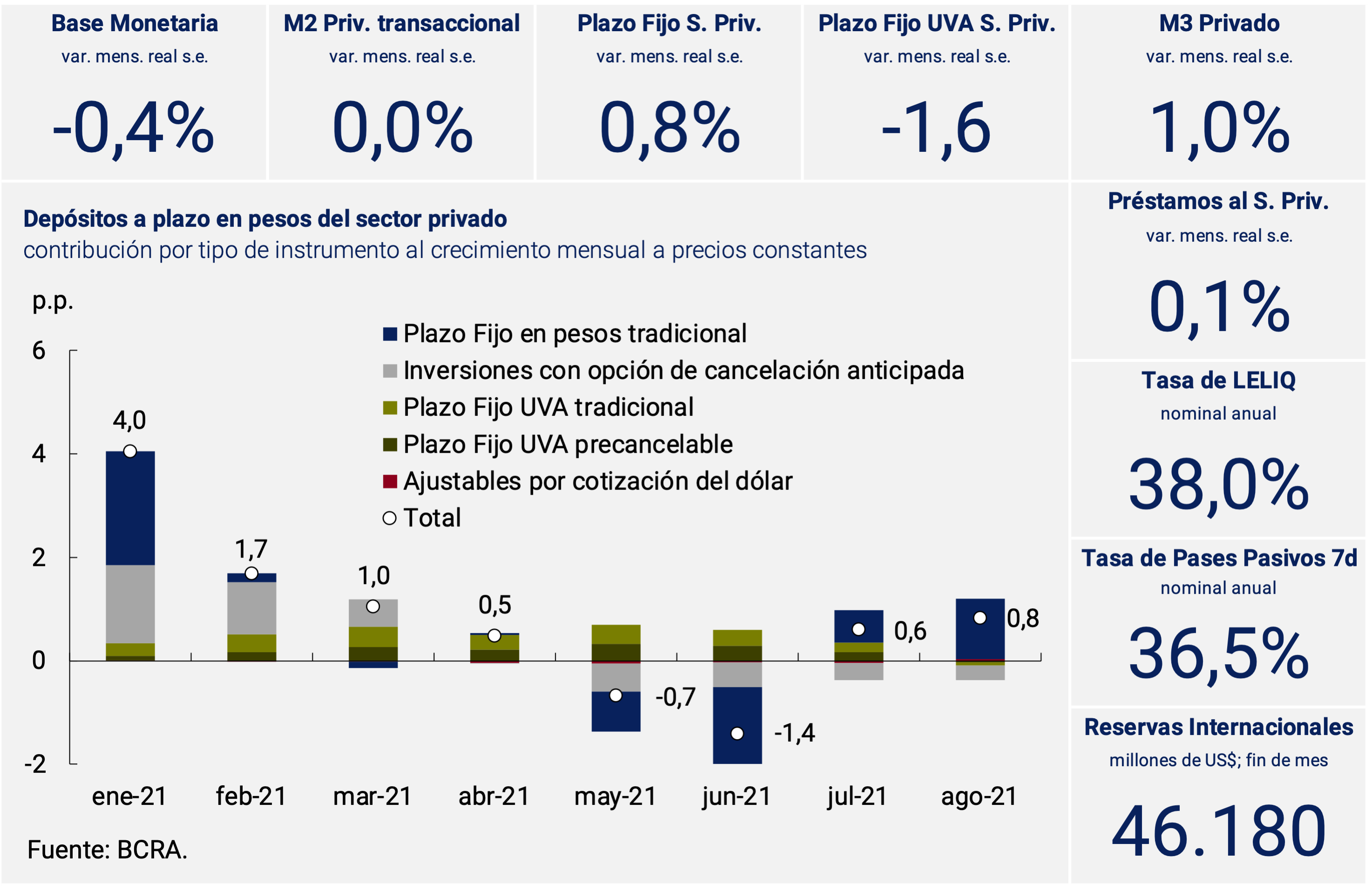

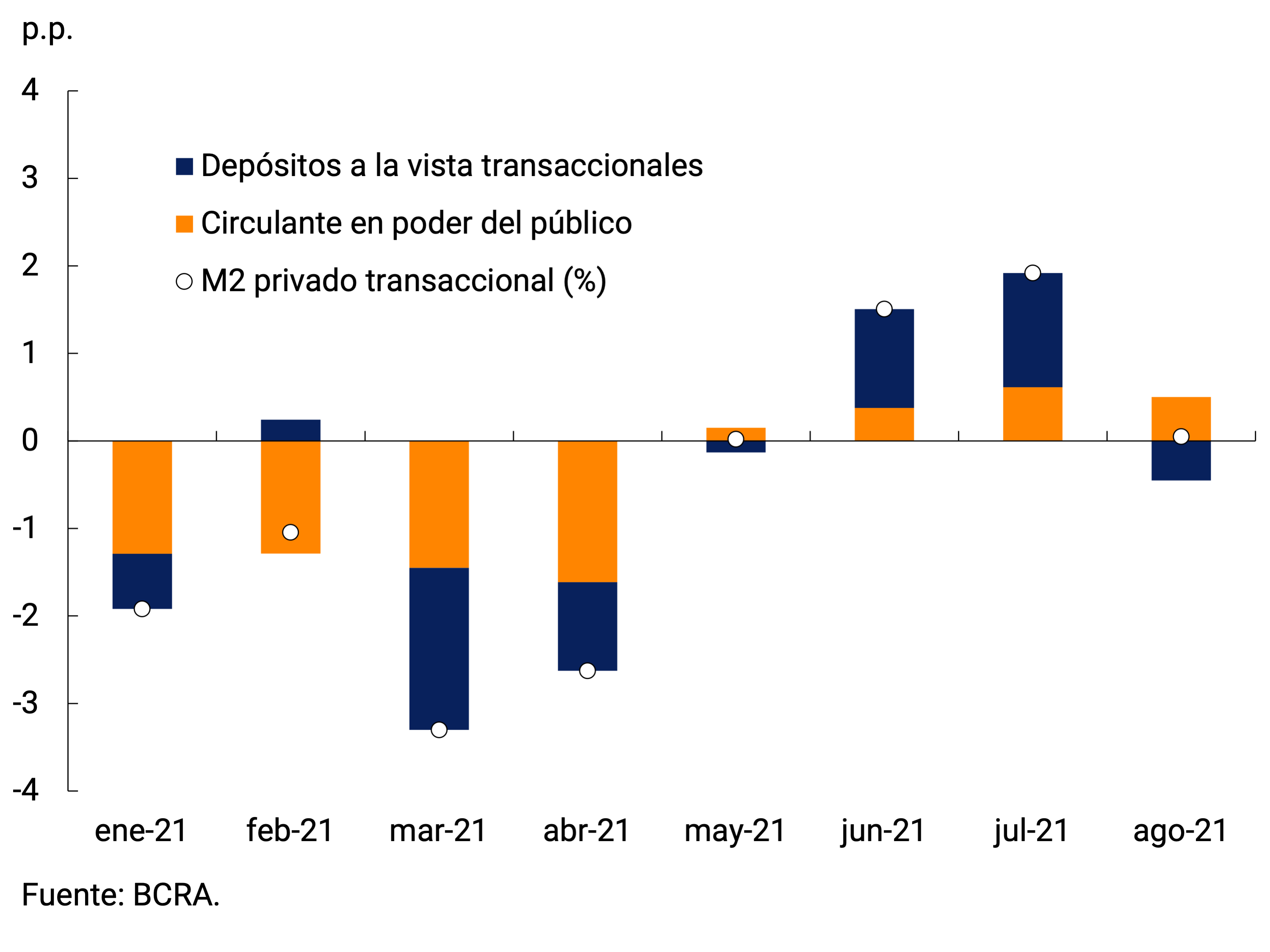

In real and seasonally adjusted terms, means of payment (private transactional M2) remained practically unchanged in August, after three consecutive months of increase. This behavior was explained by the fall in transactional demand deposits, which was offset by an increase in the working capital held by the public. The growth in working capital could be explained by the extraordinary subsidy of up to $5,000 for retirees and pensioners and their high preference for cash.

Time deposits in pesos in the private sector grew at constant prices for the second consecutive month. At the instrument level, the largest contribution came mainly from fixed-term placements in traditional pesos. Meanwhile, investments with early cancellation options and UVA deposits contributed negatively to the month’s expansion. The latter broke with an eight-month period of uninterrupted growth. This is explained by the moderation in inflation expectations, which made the interest rate differential between UVA and peso deposits practically zero.

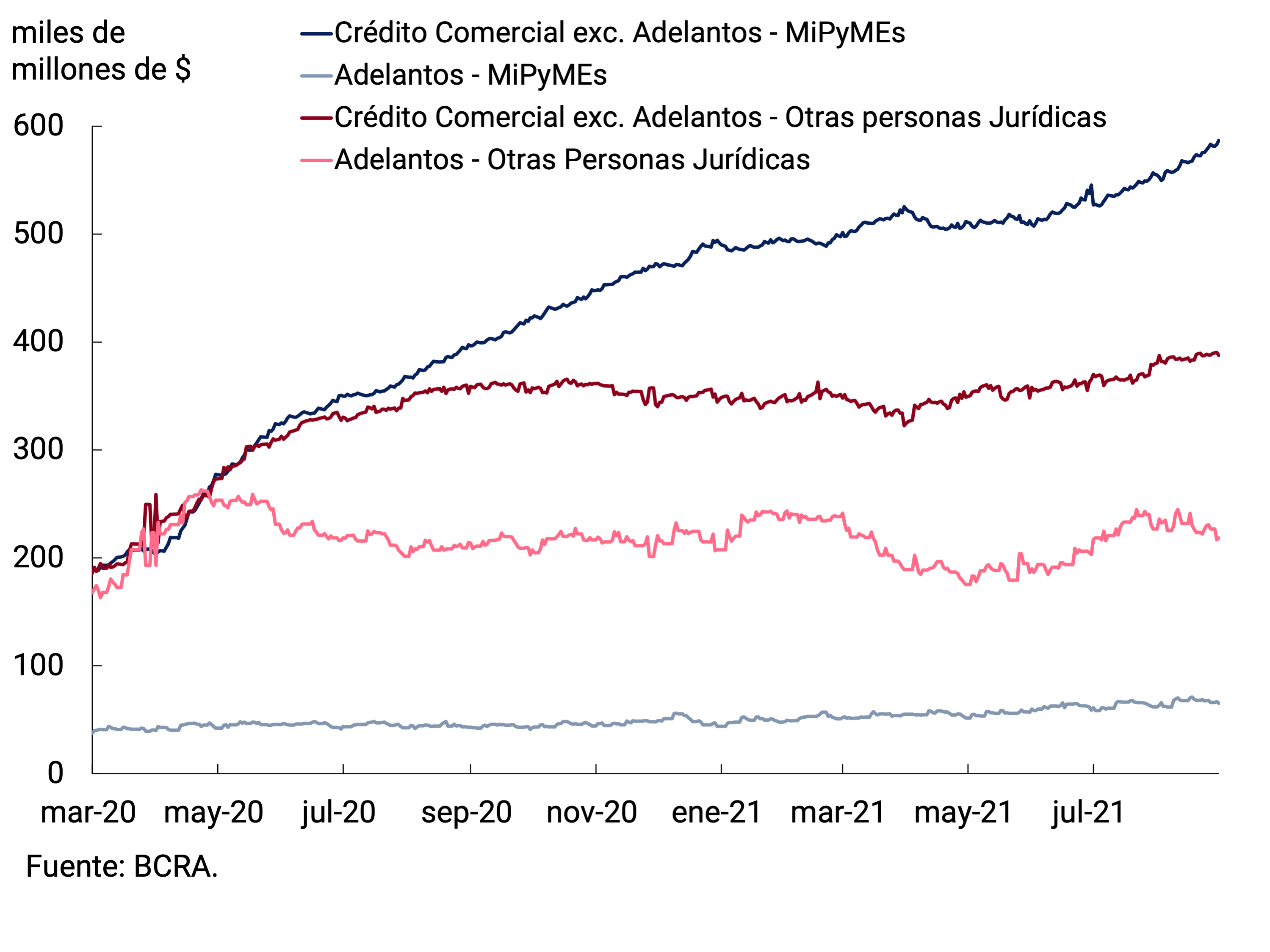

Among loans in pesos to the non-financial private sector, it stands out that commercial lines and those with collateral were the most dynamic. Among the former, shorter-term financing continued to be the main driver of growth, although longer-term loans reflected a better performance in the last month.

In the foreign currency segment, no significant changes were observed in either the assets or liabilities of financial institutions. With regard to International Reserves, in August the allocation of Special Drawing Rights (SDRs) granted by the International Monetary Fund to mitigate the effects of the pandemic was computed for about US$4,300 million.

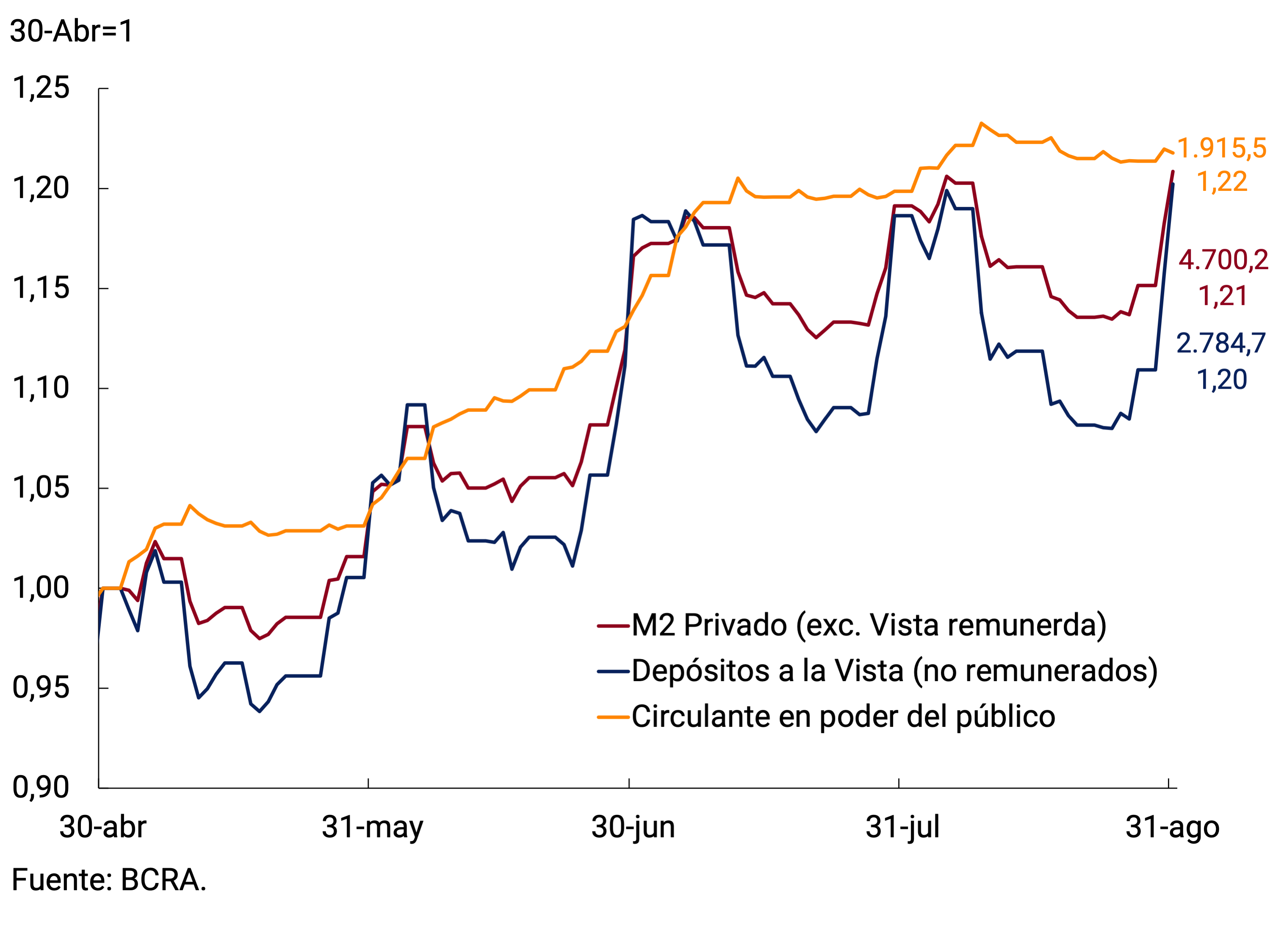

2. Payment methods

In real terms1 and seasonally adjusted (s.e.), means of payment (private transactional M22) remained stable, after two consecutive months of increases. Among its components, transactional demand deposits contributed negatively, a trend that was almost entirely offset by the positive contribution of working capital held by the public (see Figures 2.1 and 2.2). In terms of GDP, private transactional M2 remained at around 10%, standing 1.3 p.p. below the average ratio for the 2010-2019 period and -4.0 p.p. compared to the peak reached in June last year.

Transactional demand deposits registered a decrease of 0.9% s.e. at constant prices, after two consecutive months of increases. Meanwhile, the working capital exhibited a monthly increase of 1.2% s.e. at constant prices, maintaining a similar expansion rate to that of the previous month. One of the factors that has helped explain the sustained increase in the amount of money in the hands of the public since last May has been public transfers to the most vulnerable sectors of the population, which are more intensive users of cash. This particular month, together with the August salaries, the ANSES made the payment of an extraordinary subsidy of up to $5,000 to retired and pensioned people3. Despite the growth that the working capital in the hands of the public has been showing in recent months, so far this year it has accumulated a fall of around 9% at constant prices and in terms of GDP it stood at 4.2%, a value similar to that of March 2020 and 1.7 p.p. lower than the maximum reached during that year.

In this context, the BCRA continued to promote the use of digital means of payment. In fact, the creation of a QR code for the identification of commercial accounts in financial institutions and Payment Service Providers (PSPs) was arranged, which will allow users of virtual wallets to read the QR from their application and make transfers or payments virtually. This new QR differs from the existing ones because it directly identifies the merchant’s account, allowing immediate crediting via transfer and with the lowest commission in the system4.

3. Savings instruments in pesos

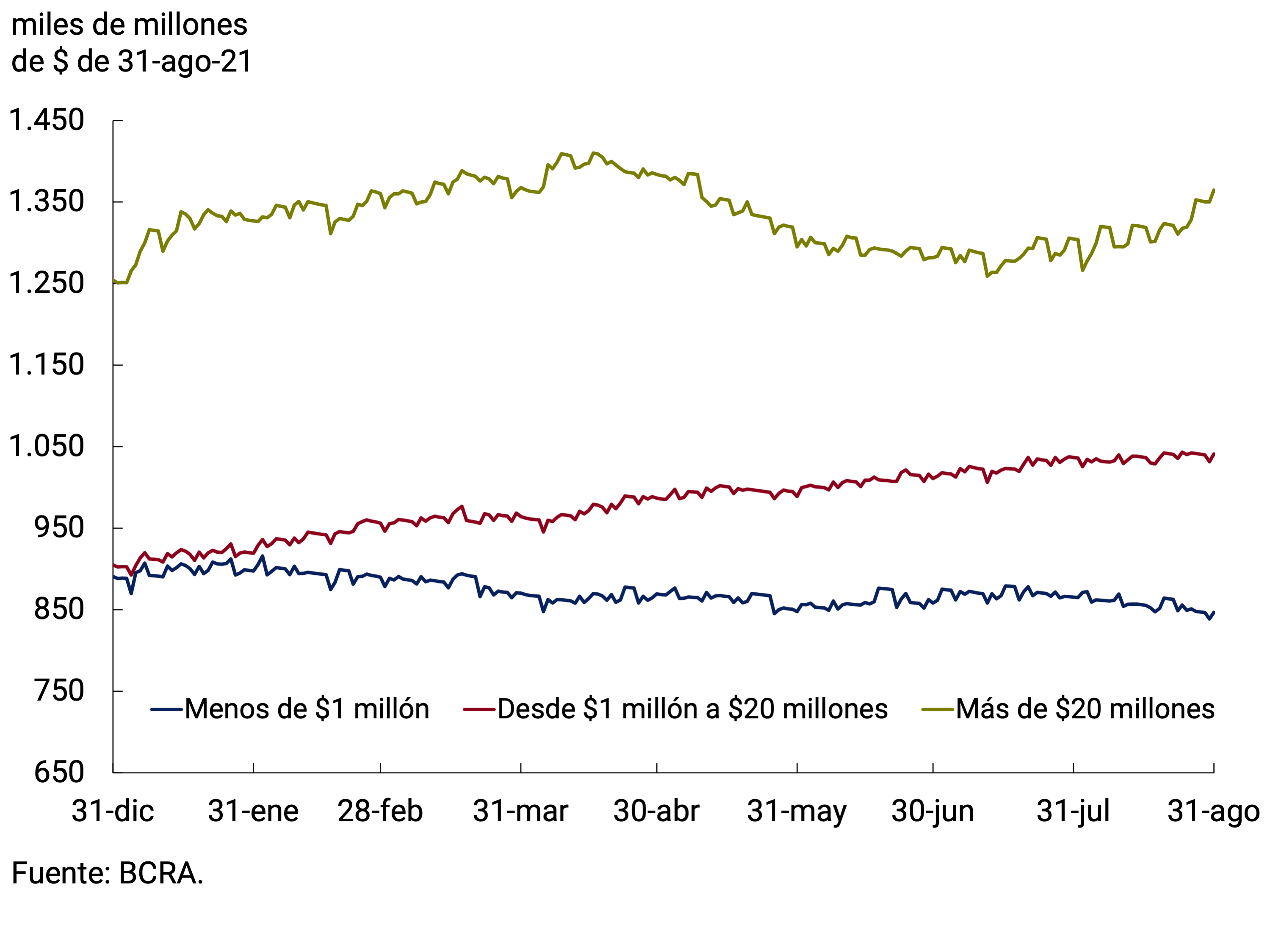

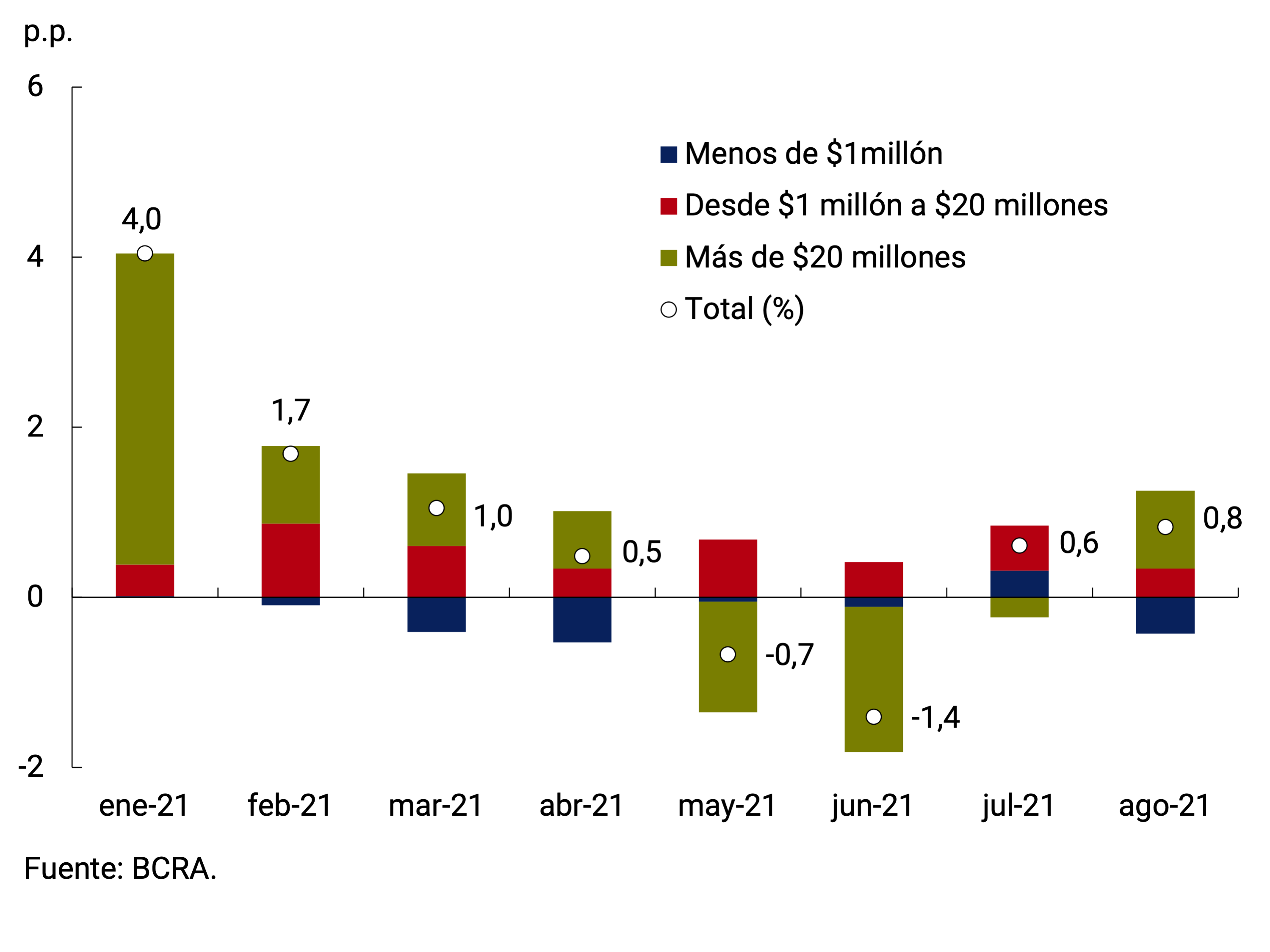

Fixed-term deposits in pesos of the private sector grew at constant prices (0.8% s.e.) for the second consecutive month. The boost came mainly from placements in the wholesale segment (more than $20 million), which since mid-July showed an upward trend (see Figure 3.1). Thus, these types of placements contributed positively to the expansion of the month, reversing the behavior observed between May and July (see Figure 3.2).

Figure 3.1 | Fixed-term deposits in pesos from the private

sector Daily balance at constant prices by amount stratum

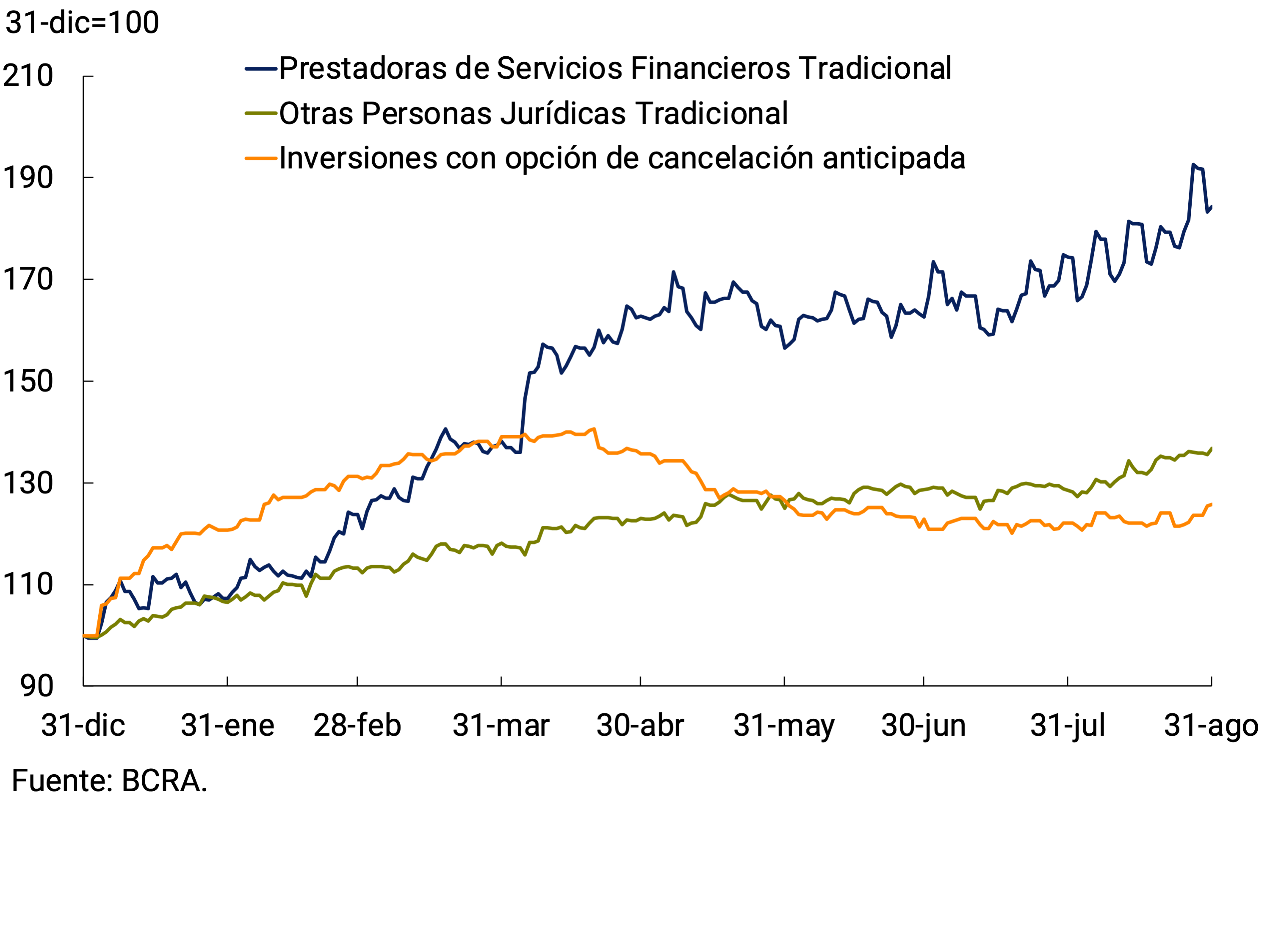

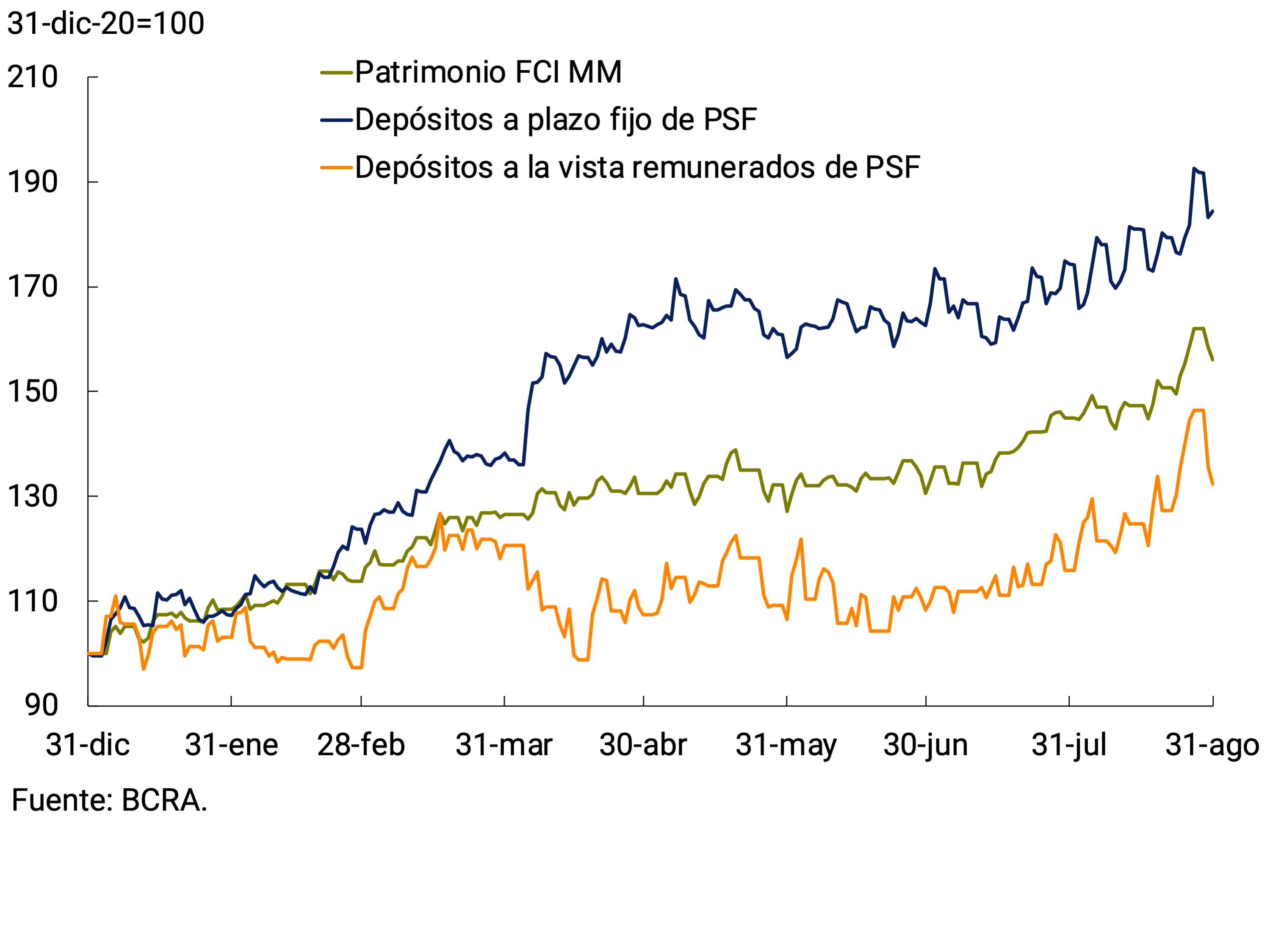

At the depositor level, the two main players in the wholesale segment – Financial Services Providers (FSPs) and corporates – increased their holdings throughout the month (see Figure 3.3). In the case of PSF placements, their growth was linked to the increase in the equity of the Mutual Funds of Money Market (FCI MM). The dynamism of these funds was also reflected in a sharp increase in interest-bearing demand deposits (see Figure 3.4). For their part, companies also placed part of their surpluses in fixed-term investments, after the period of higher salary and tax payment expenses. The increase in wholesale deposits was concentrated in traditional placements, while investments with early cancellation options remained almost unchanged. It should be noted that the TM20 interest rate of private banks stood at 33.9% n.a. in August (39.7% y.a.), around 7 p.p. and 4 p.p. above that paid to legal entities for investments with an early cancellation option and the average rate of interest-bearing demand deposits. respectively.

As for deposits of lower strata, placements of between $1 and $20 million at constant prices registered a slight expansion throughout the month, while deposits of up to $1 million showed a slight decrease. It should be noted that, within the retail segment, the drop was explained by the segments with a lower strata of amount, after having accelerated their growth in July due to the payment of the half bonus. The interest rate on time deposits of less than $1 million paid to individuals stood at an average of 36.3% n.a. (43.0% e.a.)5.

In the segment of forward instruments denominated in UVA, a downward trend was observed since the first week of the month, with a homogeneous behavior of both traditional and pre-cancelable placements (see Figure 3.5). Thus, the average monthly balance of time deposits in UVA stood at $182,114 million in August, which implied a monthly contraction at constant prices of 1.6% s.e., breaking with eight consecutive months of increases. The largest drop was concentrated in individuals, which was the type of depositor with the highest growth in the year. Placements by legal entities remained relatively stable, with a slight drop towards the end of the month (see Figure 3.6). This moderation occurred in a context in which the differential between the yield of a deposit in UVA and one in pesos became practically zero, given the lower inflation expected for the coming months.

All in all, the broad monetary aggregate (private M3)6 at constant prices would have registered an increase of 1.0% s.e. in August and in the last 12 months it would have accumulated a decrease of around 8%. In terms of Output, it remained at 18.5%, a record similar to the average recorded between 2010 and 2019.

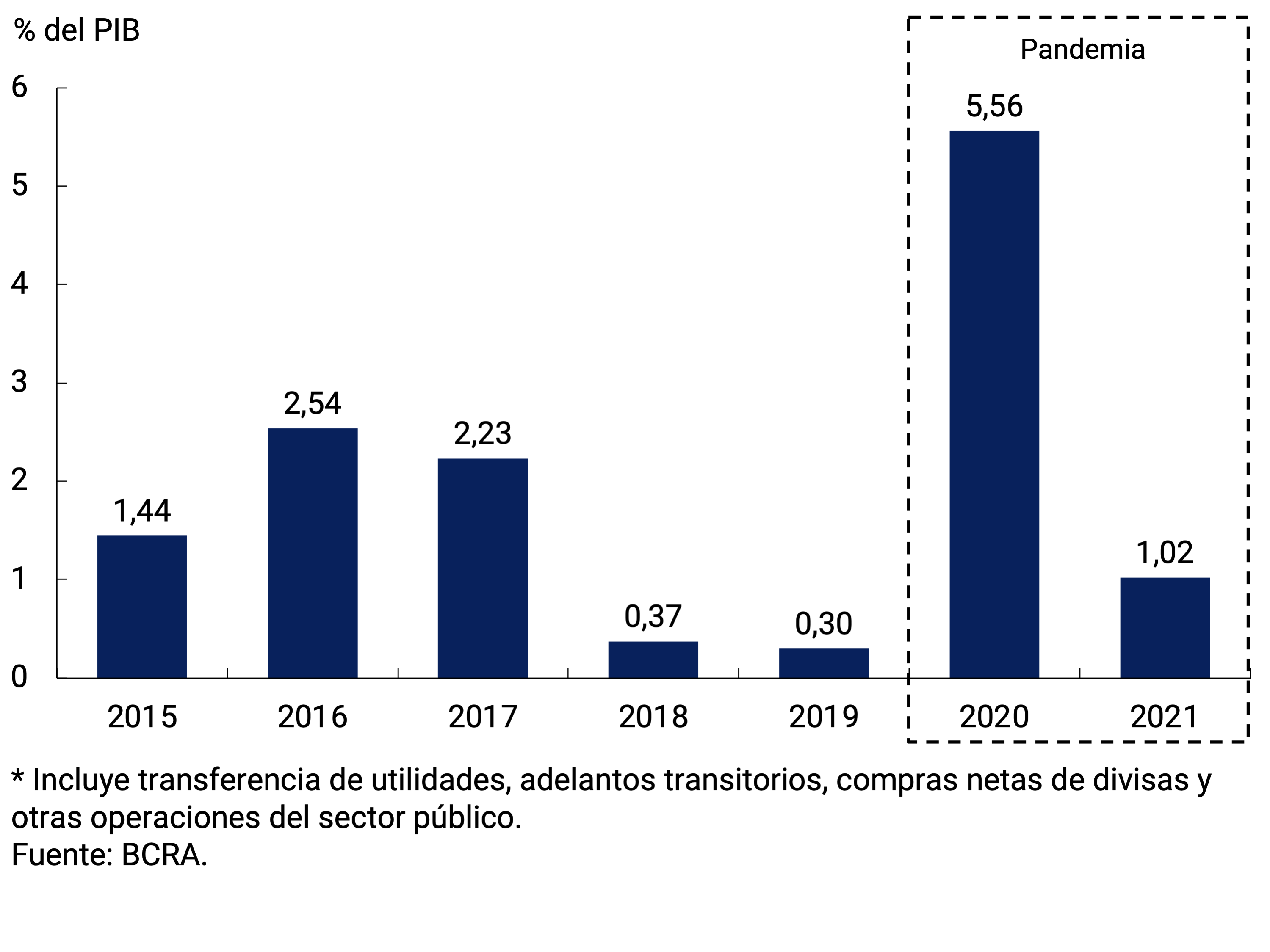

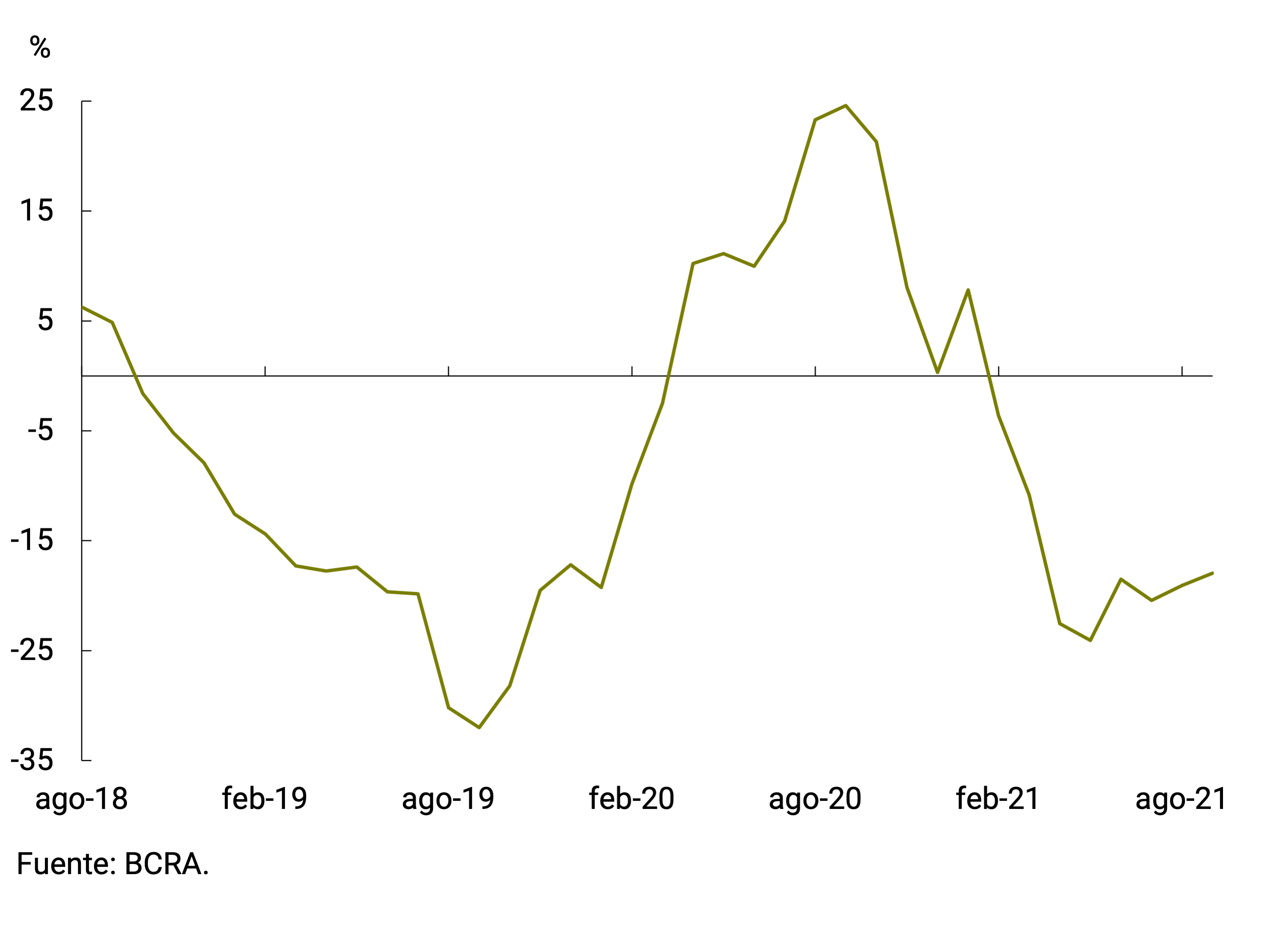

4. Monetary base

In August, the Monetary Base stood at $2,928 billion, presenting an average monthly nominal increase of 2.8% (+$79,946 million). This expansion of the Monetary Base was explained, from the supply side, by the transfer of profits to the National Treasury. However, it should be noted that public sector primary issuance so far this year was 1.0% of GDP, markedly lower than in the first year of the pandemic and in the years between 2015 and 2017 (see Figure 4.1). Purchases of foreign currency from the private sector also contributed positively to the expansion of the monetary base, although to a lesser extent. Meanwhile, monetary regulation instruments and the rest were the components that contributed negatively in the month. Thus, the year-on-year variation of the Monetary Base at constant prices stabilized in recent months around a contraction of close to 19% (see Figure 4.2).

5. Loans to the private sector

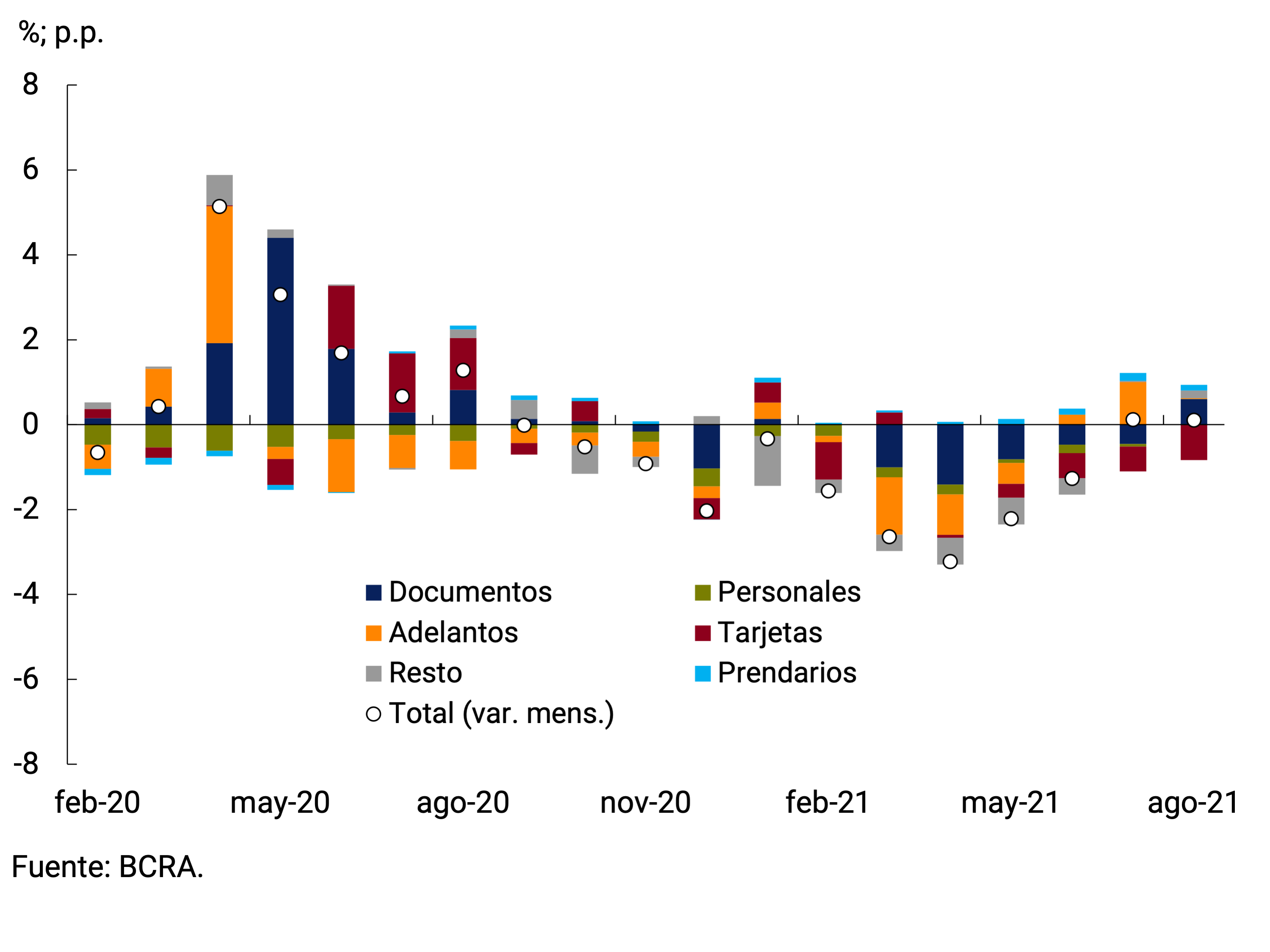

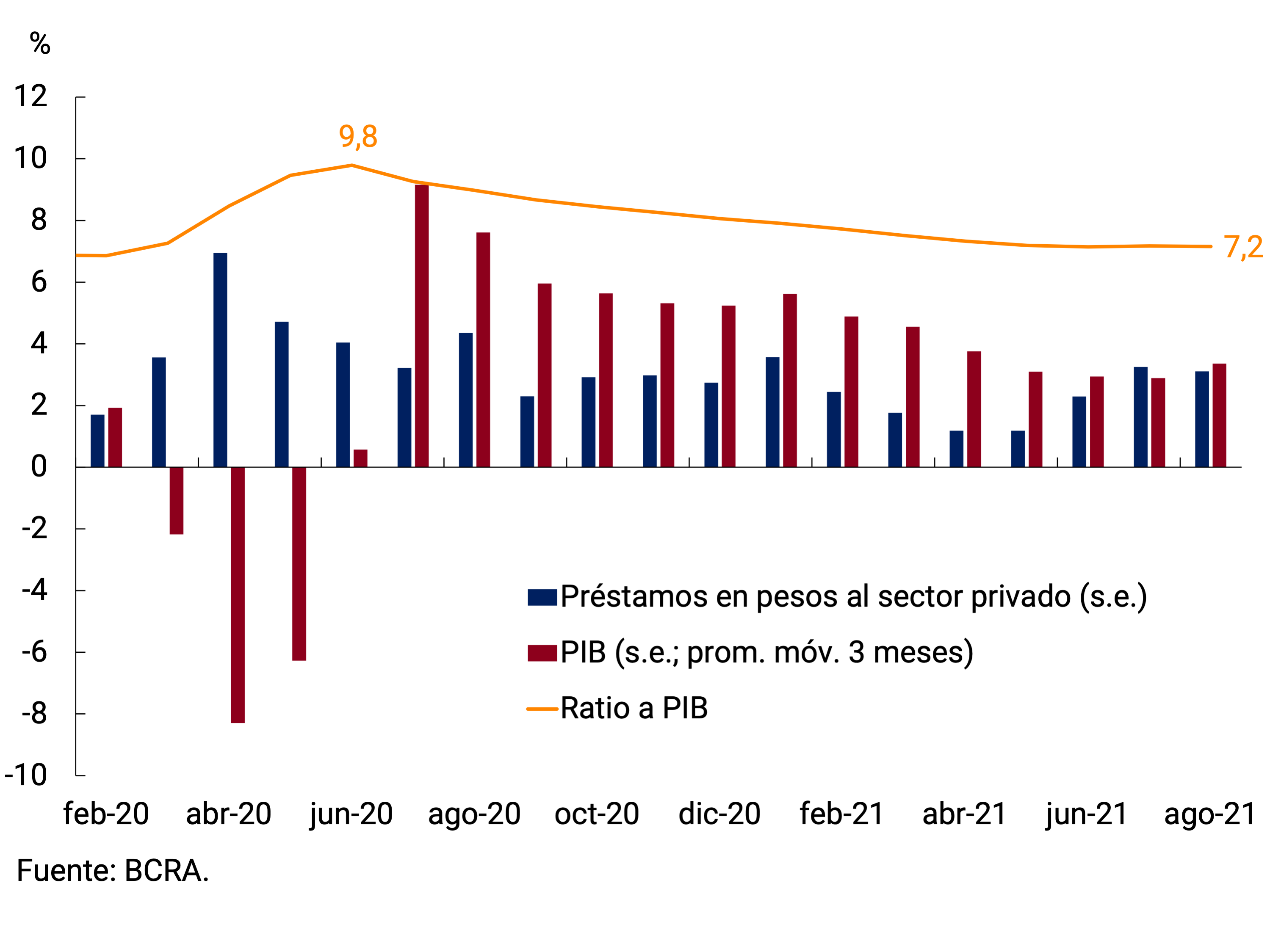

In the eighth month of the year, loans in pesos to the private sector remained relatively stable (0.1%), considering the values in real terms and without seasonality. While consumer financing contracted, commercial lines and secured loans once again showed monthly growth (see Figure 5.1). In terms of GDP, loans in pesos to the private sector remained at 7.2% (see Figure 5.2).

Figure 5.1 | Loans in Pesos to the Real Private Sector

without seasonality; contrib. to monthly growth

Commercial lines registered, as a whole, a monthly increase of 1.3% in real terms without seasonality. Shorter-term financing continued to be the main driver of growth, although longer-term loans also reflected a better performance in the last month. Thus, discounted documents showed an average monthly increase of 4.4% s.e. at constant prices, driven in large part by the Financing Line for Productive Investment (LFIP) for MSMEs (see Figure 5.3). The average interest rate applied to the discount of documents was 31.4% in August, in line with the cost of financing contemplated by LFIP7. Financing granted through current account advances was relatively stable throughout August. However, the positive carry-over of the previous month mainly explained why this line registered a monthly growth rate of 0.2% s.e. at constant prices, which was lower than that observed in the previous two months (see Figure 5.4). With respect to longer-term financing, single-signature documents cut with a period of 6 consecutive months of negative real variations, showing a rise of 0.8% s.e. in the month.

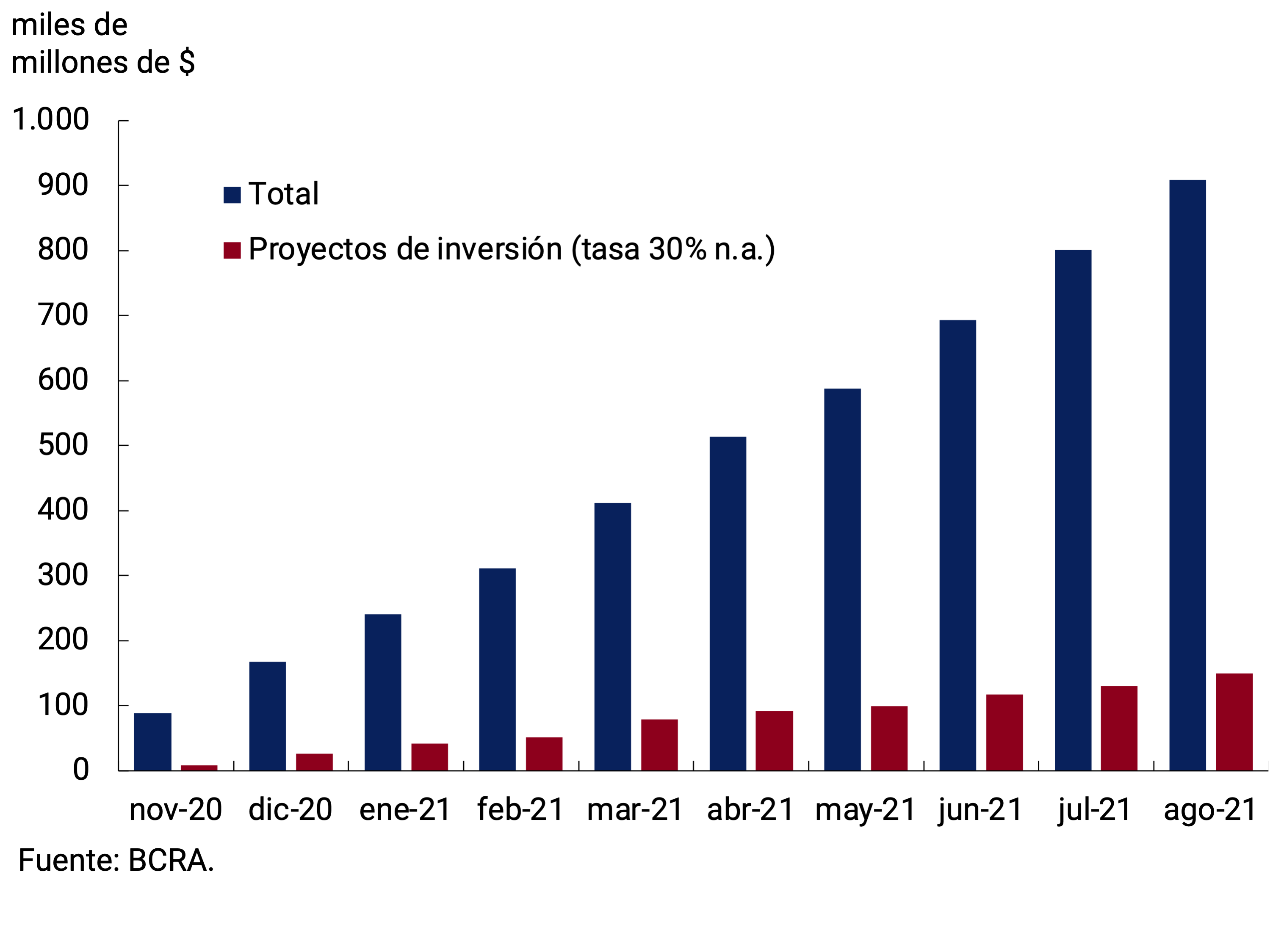

At the end of August, loans granted under the LFIP accumulated disbursements totaling approximately $908.7 billion since its implementation, which implies a growth of 13.4% compared to the end of July. As for the destinations of these funds, about 84% of the total disbursed corresponds to the financing of working capital and the rest to the line that finances investment projects (see Figure 5.5). At the time of publication, the number of companies that accessed the LFIP amounted to 165,000.

Among loans associated with consumption, credit card financing would have shown a monthly drop of 2.6% s.e. at constant prices. It should be noted that the National Government relaunched the line of credit at rate 0 for single-tax people for a maximum amount of $150,000 (depending on the category of monotax). These loans will be credited to the credit card in a single disbursement, will have a grace period of 6 months and will be repaid in 12 consecutive monthly installments (without interest)8. This line of credit, added to the expansion of the “Ahora 12” program, would give a boost to credit card financing in the coming months. For their part, personal loans remained stable in real terms, whose interest rate in August averaged 53.1% n.a. (a figure similar to that of the previous month).

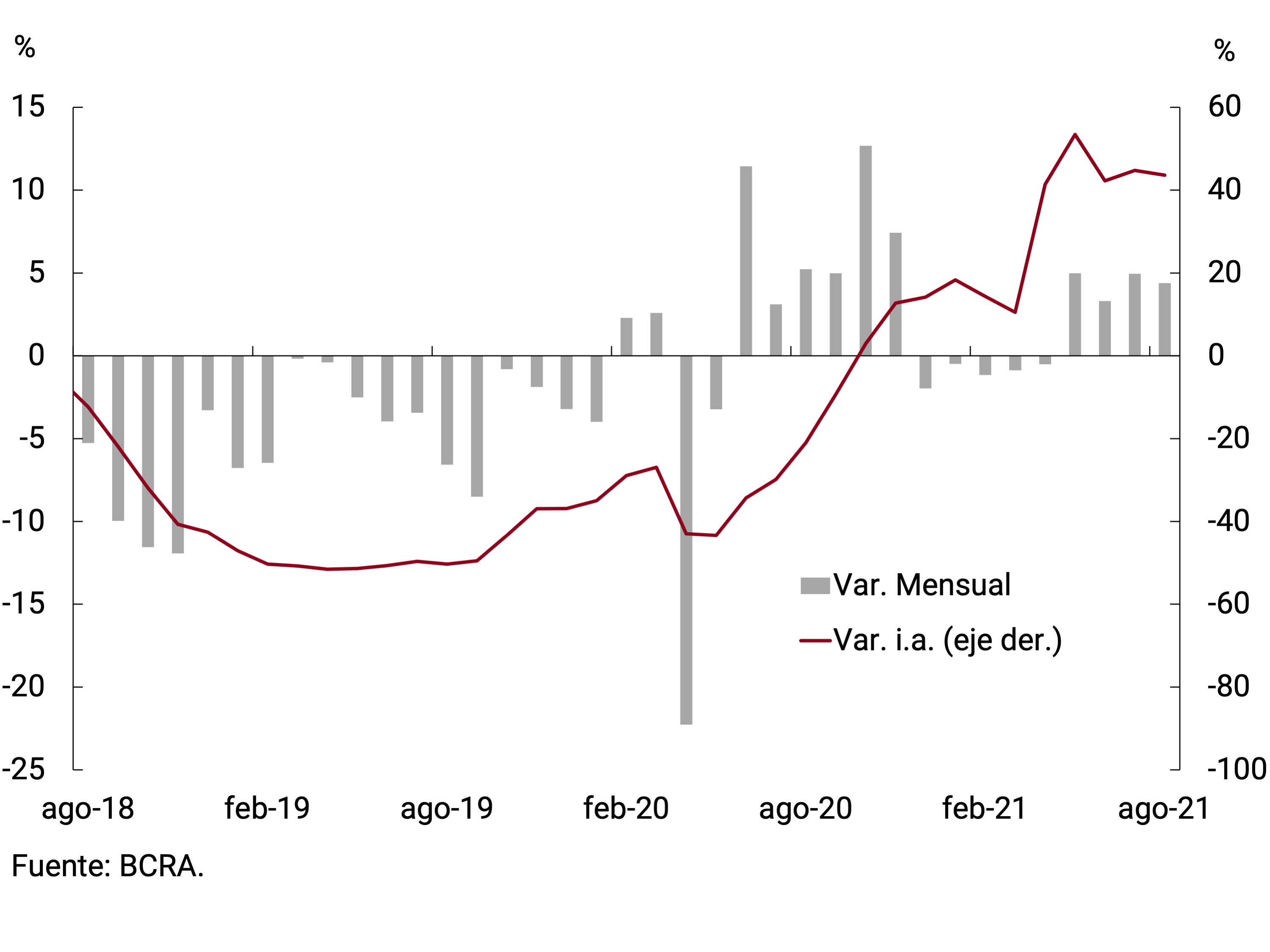

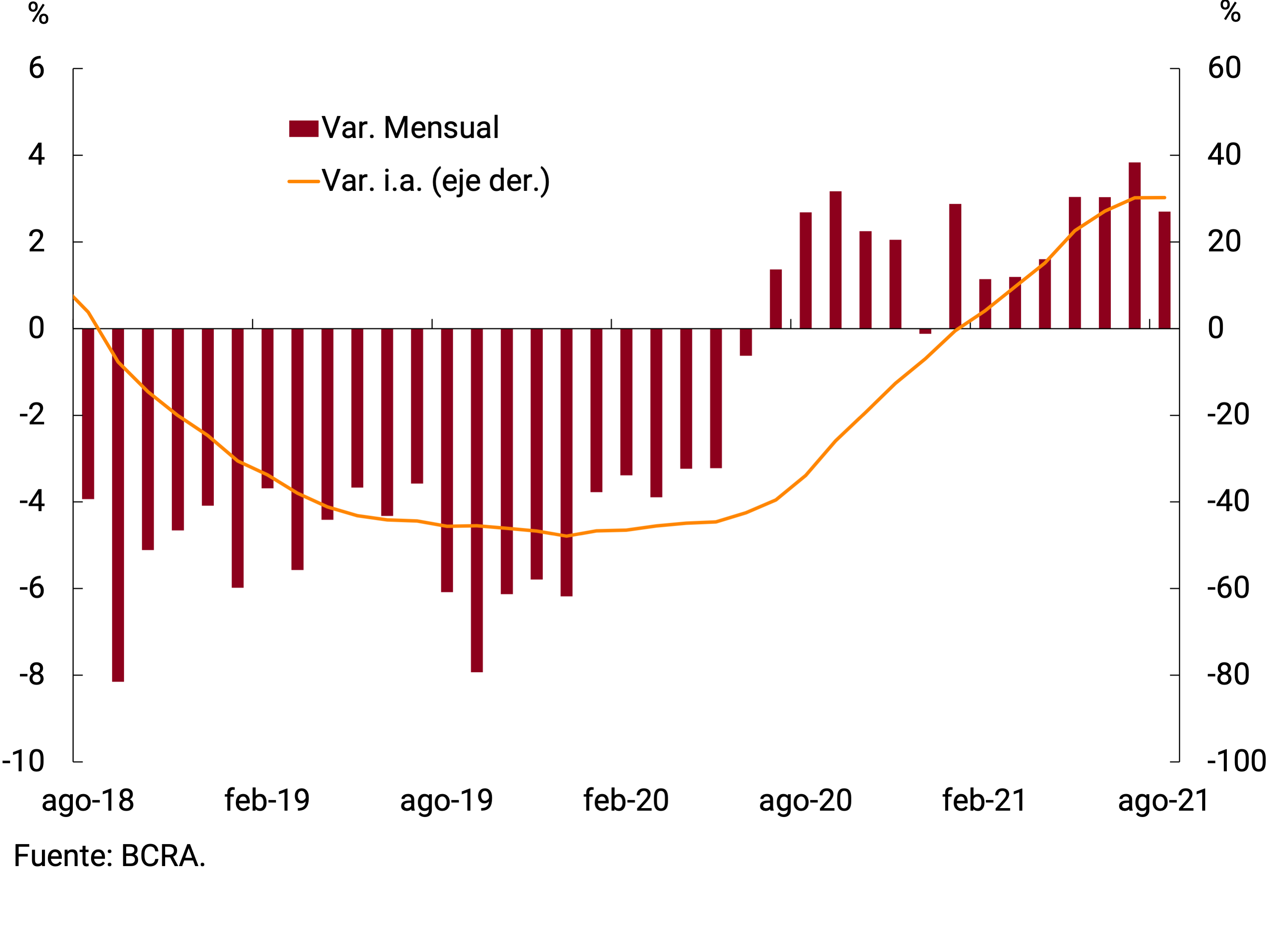

With respect to secured lines, collateral loans continued to show sustained growth in real terms. In August, the monthly expansion rate at constant prices was 2.7% s.e., 30.4% above the record for the same month of the previous year (see Figure 5.6). On the other hand, the balance of mortgage loans presented a fall of 0.8% in real terms without seasonality, accumulating a contraction of 25.5% in the last 12 months.

Figure 5.5 | Financing Productive Investment Line

Accumulated disbursed amounts; data at the end of the month

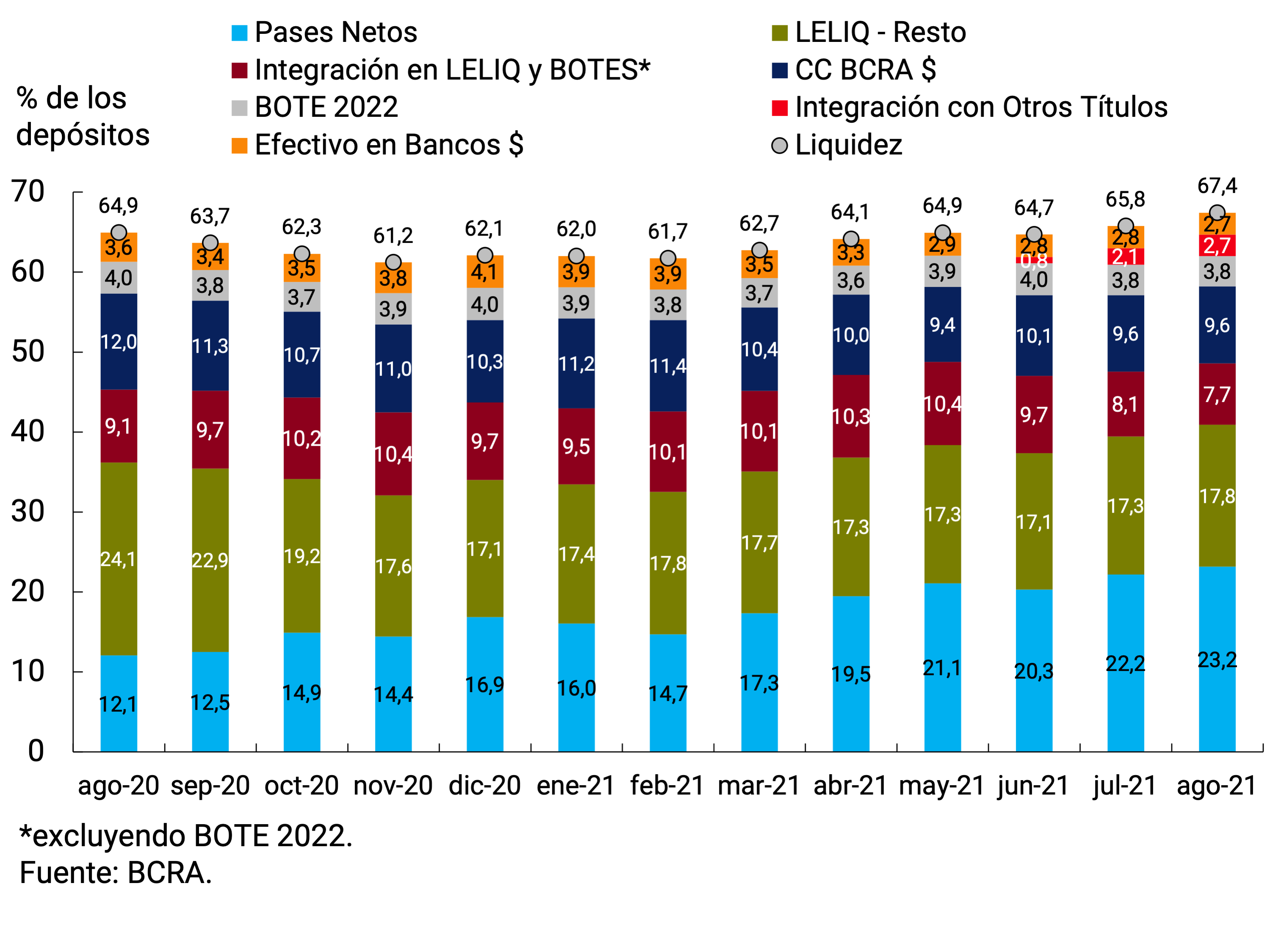

6. Liquidity in pesos of financial institutions

Ample bank liquidity in local currency9 registered an increase of 1.6 p.p. on average in the month, standing at 67.4% of deposits, remaining at high levels in historical terms (see Charts 6.1). In terms of its components, the growth in the integration of minimum cash with public securities stands out, which went from 2.1% of deposits in July to 2.7% in August. On the other hand, a decrease in integration with LELIQ was observed. There was also an increase in net passes and a fall in current accounts at the central bank. Finally, cash in banks stood at 2.7% of deposits on average for the month.

Regarding regulatory changes with an impact on bank liquidity, in September the increase in the maximum deduction for financing granted within the framework of the “Ahora 12” Program will come into force, which went from 6% to 8% of deposits10. In addition, the minimum cash requirement contemplates a reduction of the equivalent of 60% of the financing agreed through the line of credit at a 0% rate to single-tax individuals, which will also impact on September11.

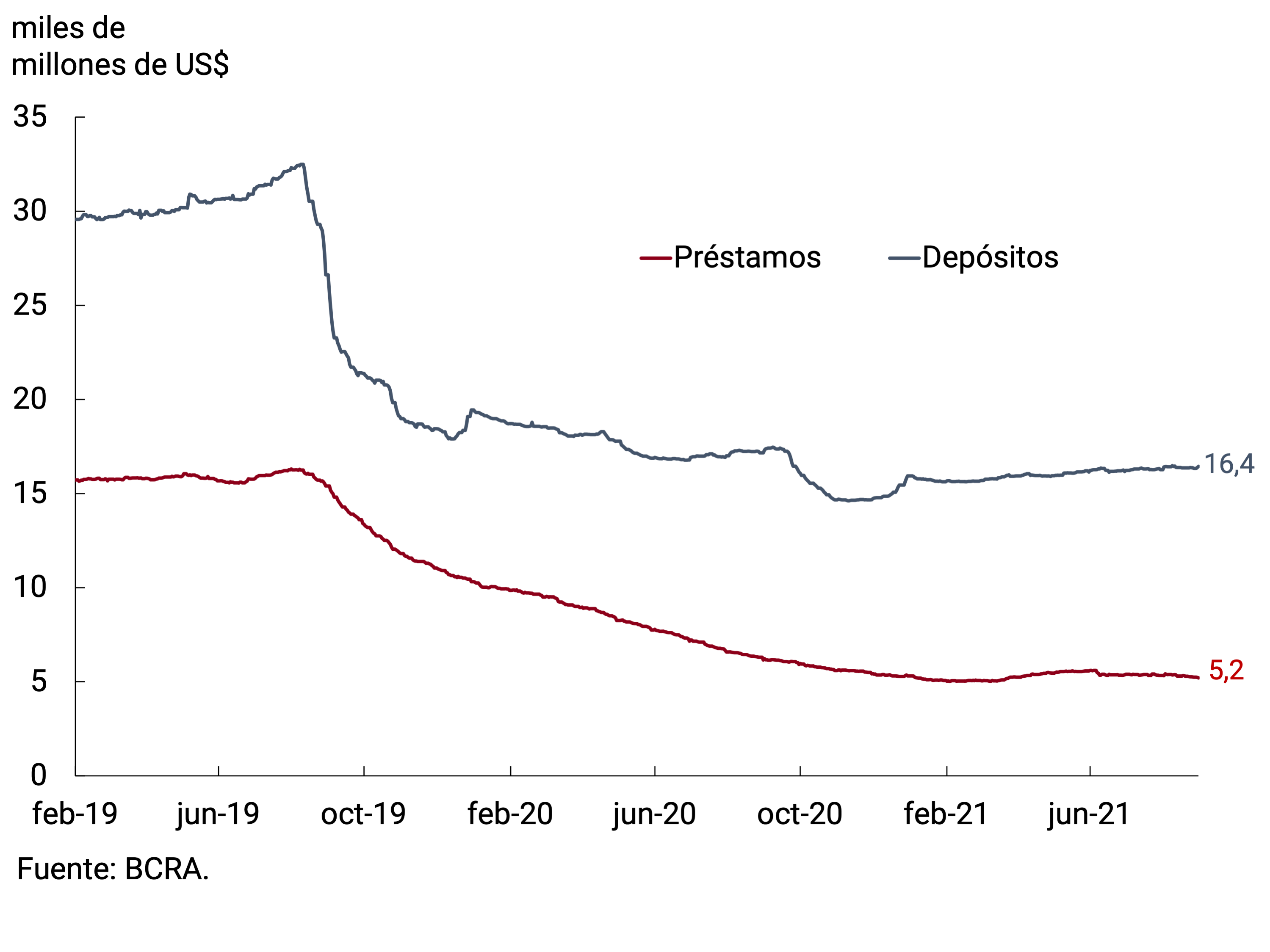

7. Foreign currency

Deposits and loans in foreign currency presented limited variations in the month of August. Thus, private sector deposits reached an average monthly balance of US$16,389 million, presenting an increase of US$101 million compared to July; meanwhile, credit to the private sector fell by US$59 million in the month, with the average monthly balance standing at US$5,312 million (see Figure 7.1).

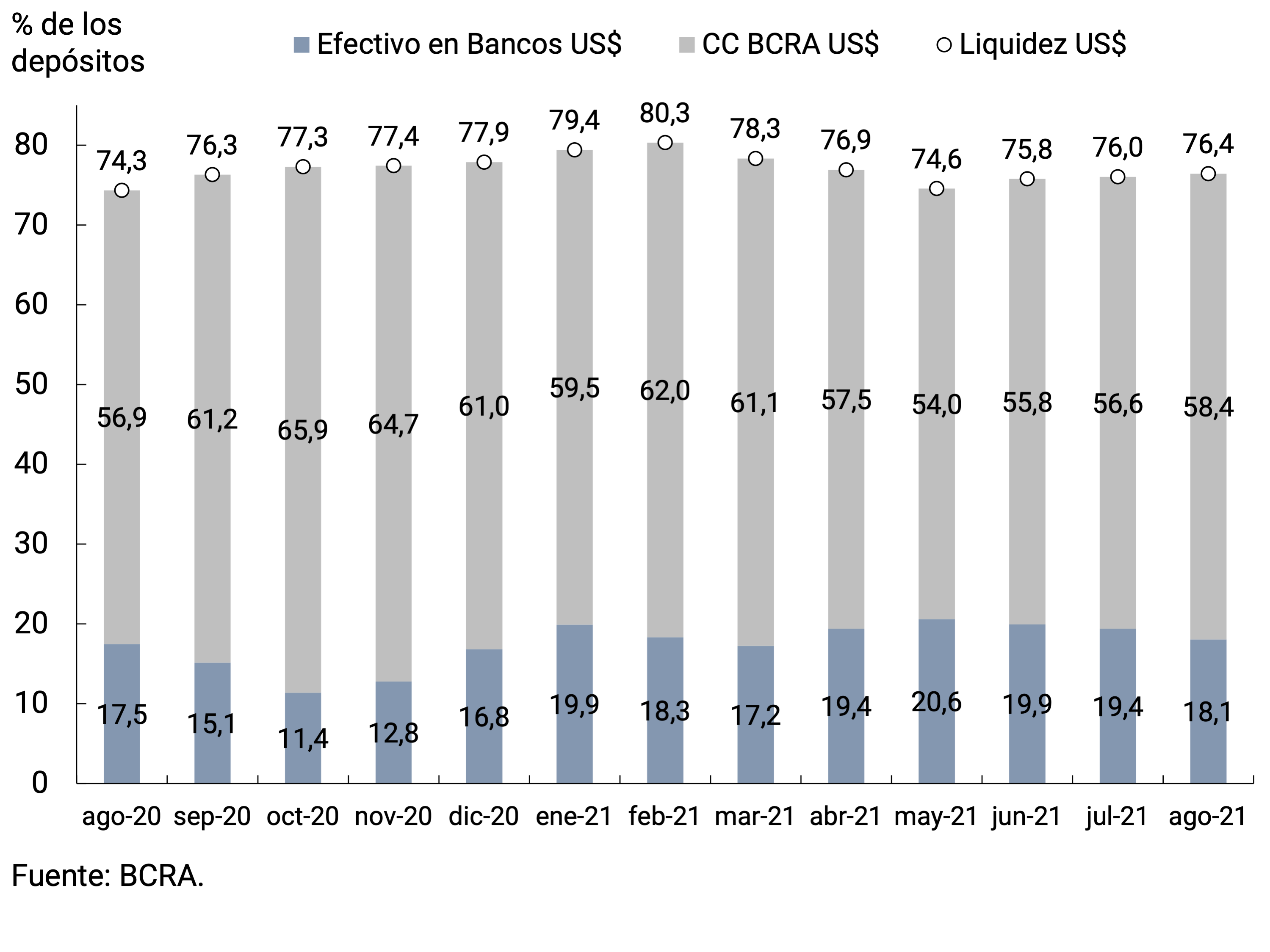

In this context, bank liquidity in foreign currency remained at high levels and averaged 76.4% of deposits, registering an increase of 0.4 p.p. compared to the previous month. This liquidity dynamic was explained by the increase in current accounts at the BCRA, which was partially offset by a fall in cash in banks, similar to what happened in June and July (see Figure 7.2).

With regard to regulatory modifications, as of August 13, transactions for the purchase and sale of securities carried out with settlement in foreign currency may not be carried out by payment in banknotes in that currency, or by deposits in custody accounts or in third-party accounts12. On the other hand, it was established that companies that obtain new financing from abroad will be able to apply it to the payment of commercial debts, being able to access the foreign exchange market without prior approval from the BCRA for debt payments of up to US$5 million for imports of goods and services. The new debt will have to be for an amount not less than the payment to be made and with an average life of no less than 2 years. Thus, the private sector has a mechanism that will allow it to regularize its external commercial liabilities through the use of new funds from financial indebtedness with the outsideworld 13.

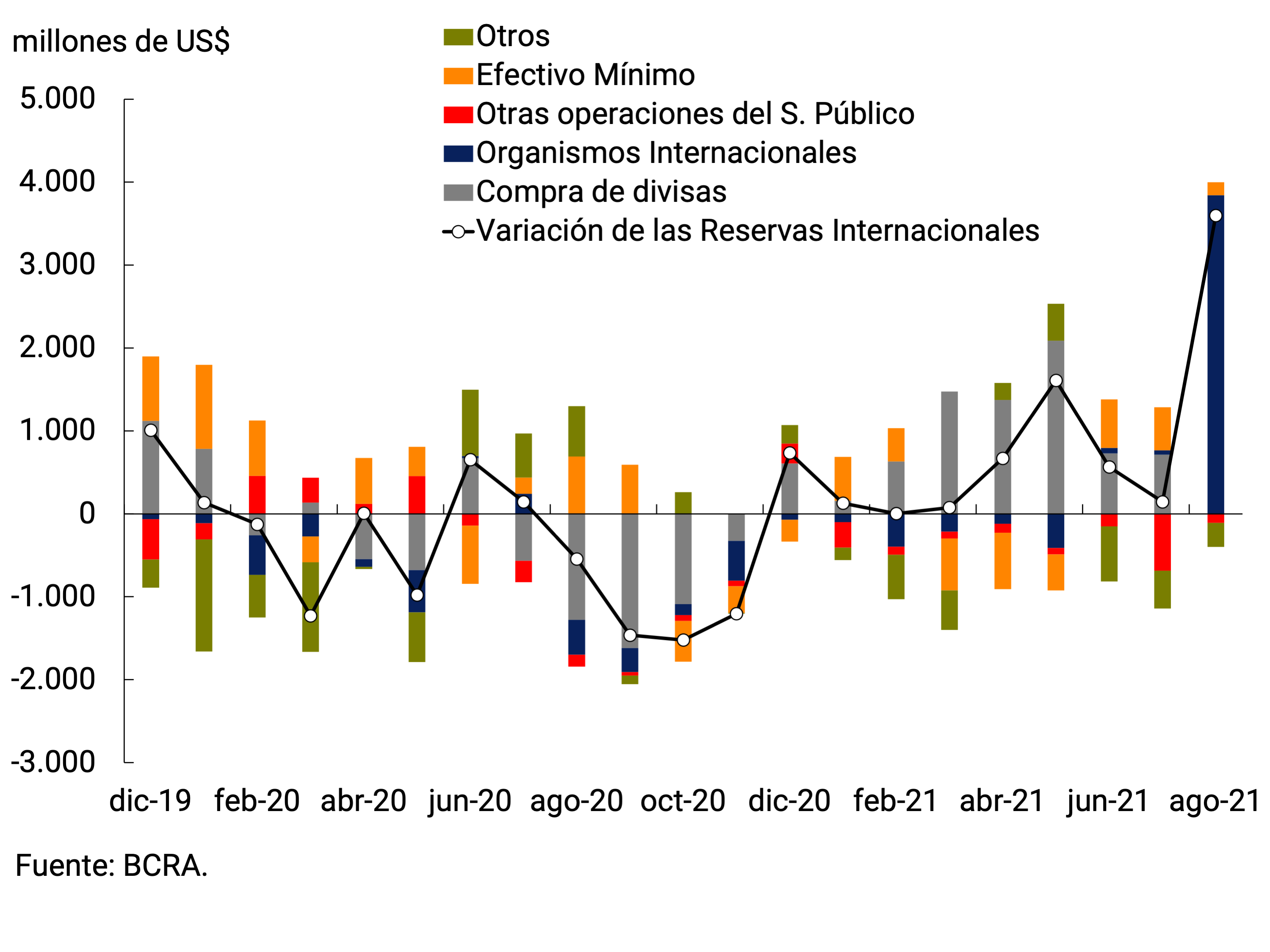

In August, the BCRA’s International Reserves reached a balance of US$46,180 million at the end of the month. On this occasion, the increase was mainly explained by the allocation of Special Drawing Rights (SDRs) granted by the International Monetary Fund to mitigate the effects of the pandemic by some US$4,300 million (see Figure 7.3).

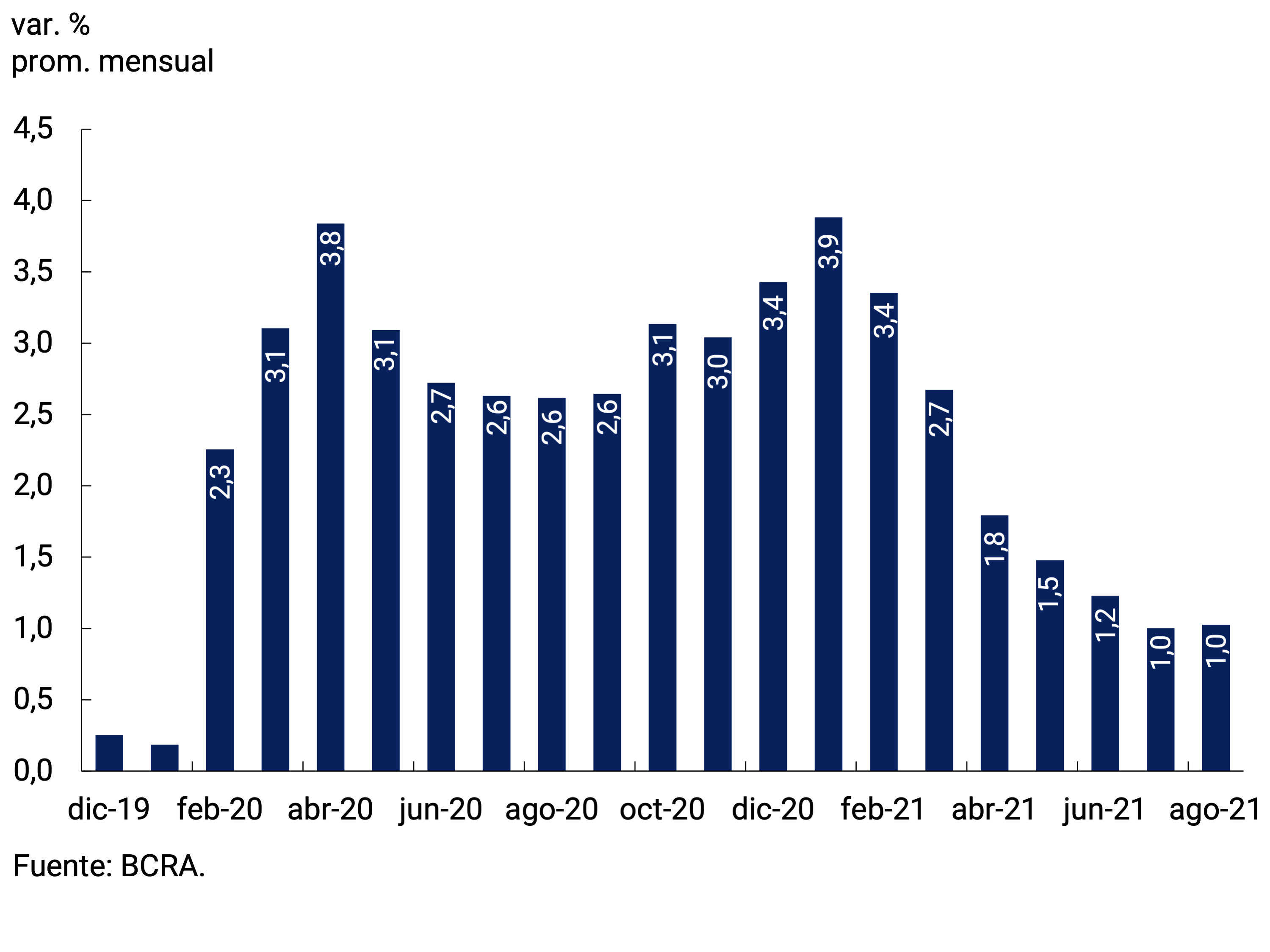

Finally, the nominal bilateral exchange rate against the U.S. dollar increased 1.0% in August, a similar expansion rate to that of July, standing at $97.20/US$ on average for the month. The slower rate of depreciation of the domestic currency in recent months seeks to contribute to the disinflation process, in a context in which the Multilateral Real Exchange Rate remains around its historical average record (see Figure 7.4).

Glossary

ANSES: National Social Security Administration.

BADLAR: Interest rate on fixed-term deposits for amounts greater than one million pesos and a term of 30 to 35 days.

BCRA: Central Bank of the Argentine Republic.

BM: Monetary Base, includes monetary circulation plus deposits in pesos in current account at the BCRA.

CC BCRA: Current account deposits at the BCRA.

CER: Reference Stabilization Coefficient.

NVC: National Securities Commission.

SDR: Special Drawing Rights.

EFNB: Non-Banking Financial Institutions.

EM: Minimum Cash.

FCI: Common Investment Fund.

A.I.: Year-on-year .

IAMC: Argentine Institute of Capital Markets

CPI: Consumer Price Index.

ITCNM: Multilateral Nominal Exchange Rate Index

ITCRM: Multilateral Real Exchange Rate Index

LEBAC: Central Bank bills.

LELIQ: Liquidity Bills of the BCRA.

LFIP: Financing Line for Productive Investment.

M2 Total: Means of payment, which includes working capital held by the public, cancelling cheques in pesos and demand deposits in pesos from the public and non-financial private sector.

Private M2: Means of payment, includes working capital held by the public, cancelling cheques in pesos and demand deposits in pesos from the non-financial private sector.

Private transactional M2: Means of payment, includes working capital held by the public, cancelling cheques in pesos and non-remunerated demand deposits in pesos from the non-financial private sector.

M3 Total: Broad aggregate in pesos, includes the current currency held by the public, cancelling checks in pesos and the total deposits in pesos of the public and non-financial private sector.

Private M3: Broad aggregate in pesos, includes the working capital held by the public, cancelling checks in pesos and the total deposits in pesos of the non-financial private sector.

MERVAL: Buenos Aires Stock Market.

MM: Money Market.

N.A.: Annual nominal

E.A.: Annual Effective

NOCOM: Cash Clearing Notes.

ON: Negotiable Obligation.

GDP: Gross Domestic Product.

P.B.: Basic points.

P.P.: Percentage points.

MSMEs: Micro, Small and Medium Enterprises.

ROFEX: Rosario Term Market.

S.E.: No seasonality

SISCEN: Centralized System of Information Requirements of the BCRA.

TCN: Nominal Exchange Rate

IRR: Internal Rate of Return.

TM20: Interest rate on fixed-term deposits for amounts greater than 20 million pesos and a term of 30 to 35 days.

TNA: Annual Nominal Rate.

UVA: Unit of Purchasing Value

References

1 The INDEC will release the inflation data for August on September 14.

2 M2 private excluding interest-bearing demand deposits from companies and financial service providers. This component was excluded since it is more similar to a savings instrument than to a means of payment.

3 Decree 481/2021.

4 See section Regulatory Summary (Com. A7346).

5 It should be noted that the average interest rate observed is slightly below the minimum guaranteed interest rate, because it includes deposits of up to $1 million of individuals who, in total, exceed one million pesos in the financial institution.

6 Includes working capital held by the public and deposits in pesos of the non-financial private sector (sight, term and others).

7 The LFIP contemplates a maximum interest rate of 30% n.a. for the financing of investment projects and 35% n.a. for working capital.

8 See Decree 512/2021 and Regulatory Summary section (Com. A7342).

9 Includes current accounts at the BCRA, cash in banks, balances of passes arranged with the BCRA, holdings of LELIQ, and bonds eligible for reserve requirements.

10 See Regulatory Summary section (Com. A7334).

11 See section Regulatory Summary (Com. A7342).

12 See section Regulatory Summary (Com. A7340).

13 See section Regulatory Summary (Com. A7348).