Política Monetaria

Monetary Policy Report (IPOM)

Third quarter

2022

This quarterly publication aims to analyze the national and international economic situation, assess the dynamics of inflation and its prospects, and explain in a transparent manner the fundamentals of monetary policy decisions.

Table of Contents

Chapters

- 1. Monetary policy: assessment and outlook

- 2. International context

- 3. Economic Activity and Employment

- 4. External Sector

- 5. Public Finance

- 6. Pricing

- 7. Monetary Policy

Sections

Summary

1. Monetary policy: assessment and outlook

In recent months, global economic activity has slowed and the risks of a recession have increased. Inflation remained at record levels compared to recent decades despite the contractionary bias that sustained monetary policy in most countries. In this environment of less economic dynamism, the prices of agricultural raw materials and metals returned to their levels prior to the war in Ukraine. Financial conditions for developing countries became more adverse: the U.S. dollar tended to appreciate while the yield on financial assets of advanced countries rose and the risk differential of emerging countries increased, implying higher external financing costs for the latter. Going forward, the outlook will continue to depend on the extent to which contractionary monetary policies will affect economic activity and global financial stability and on the ability of China’s COVID-0 policy to disrupt the normal functioning of global value chains.

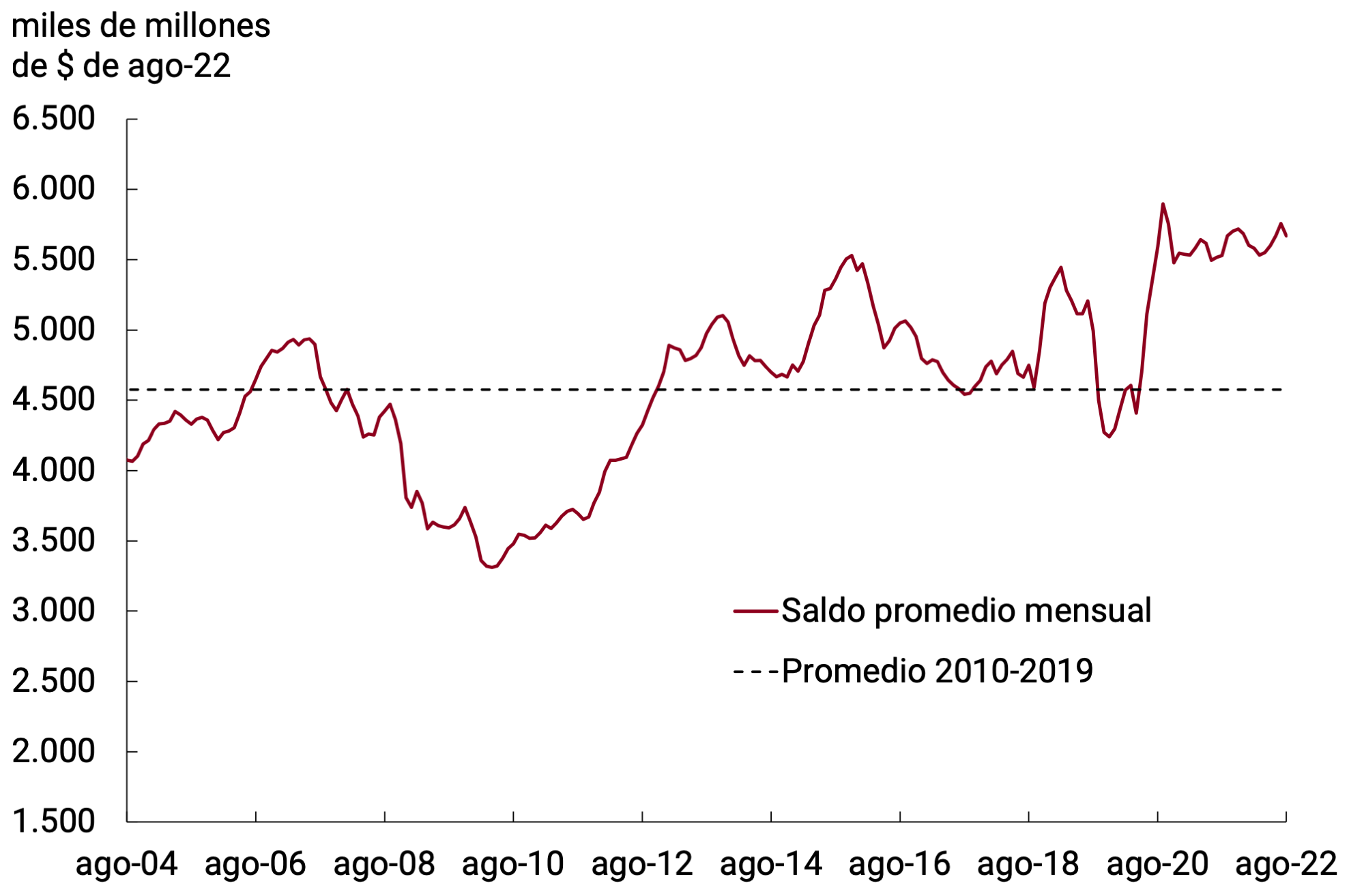

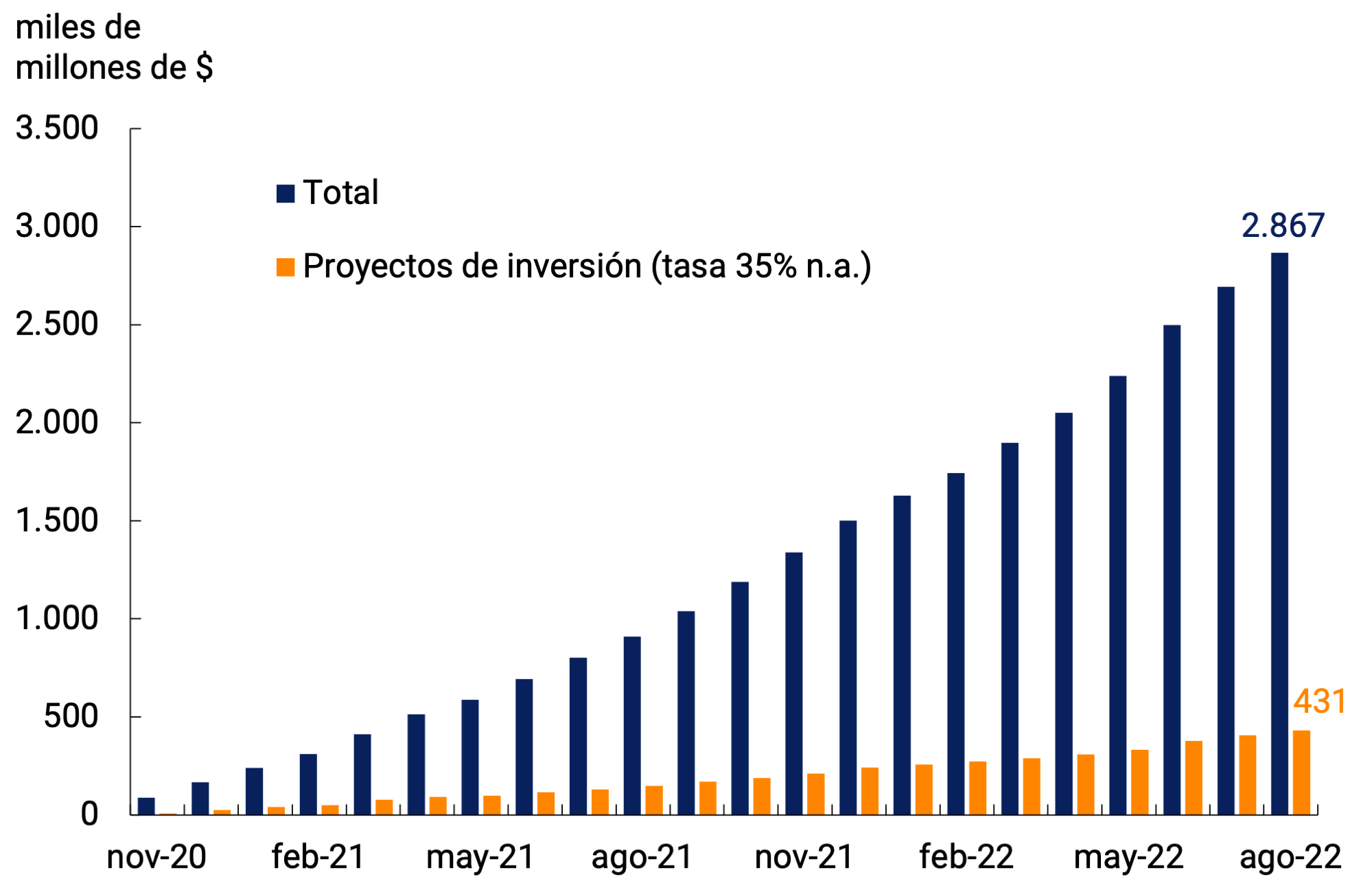

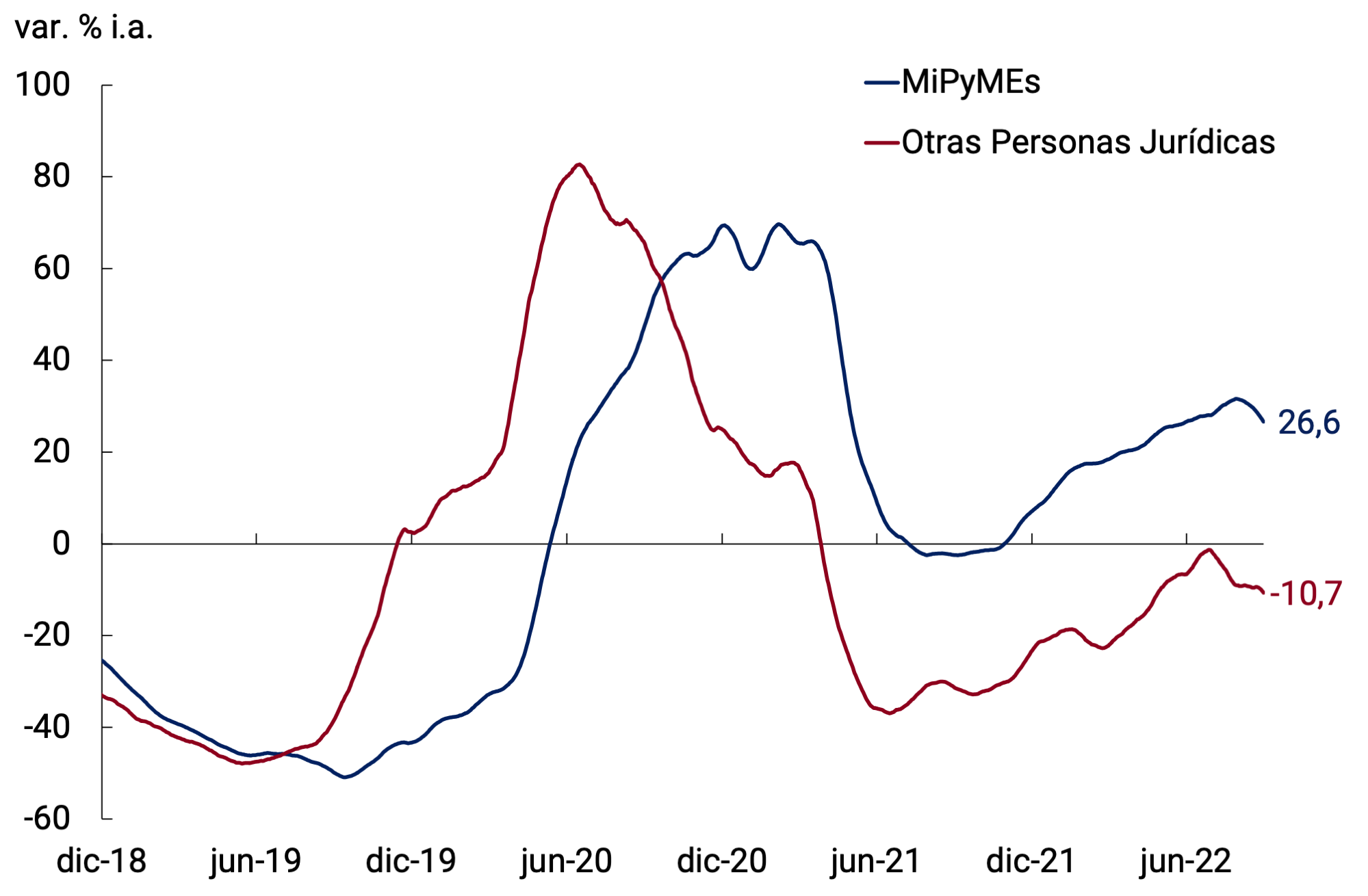

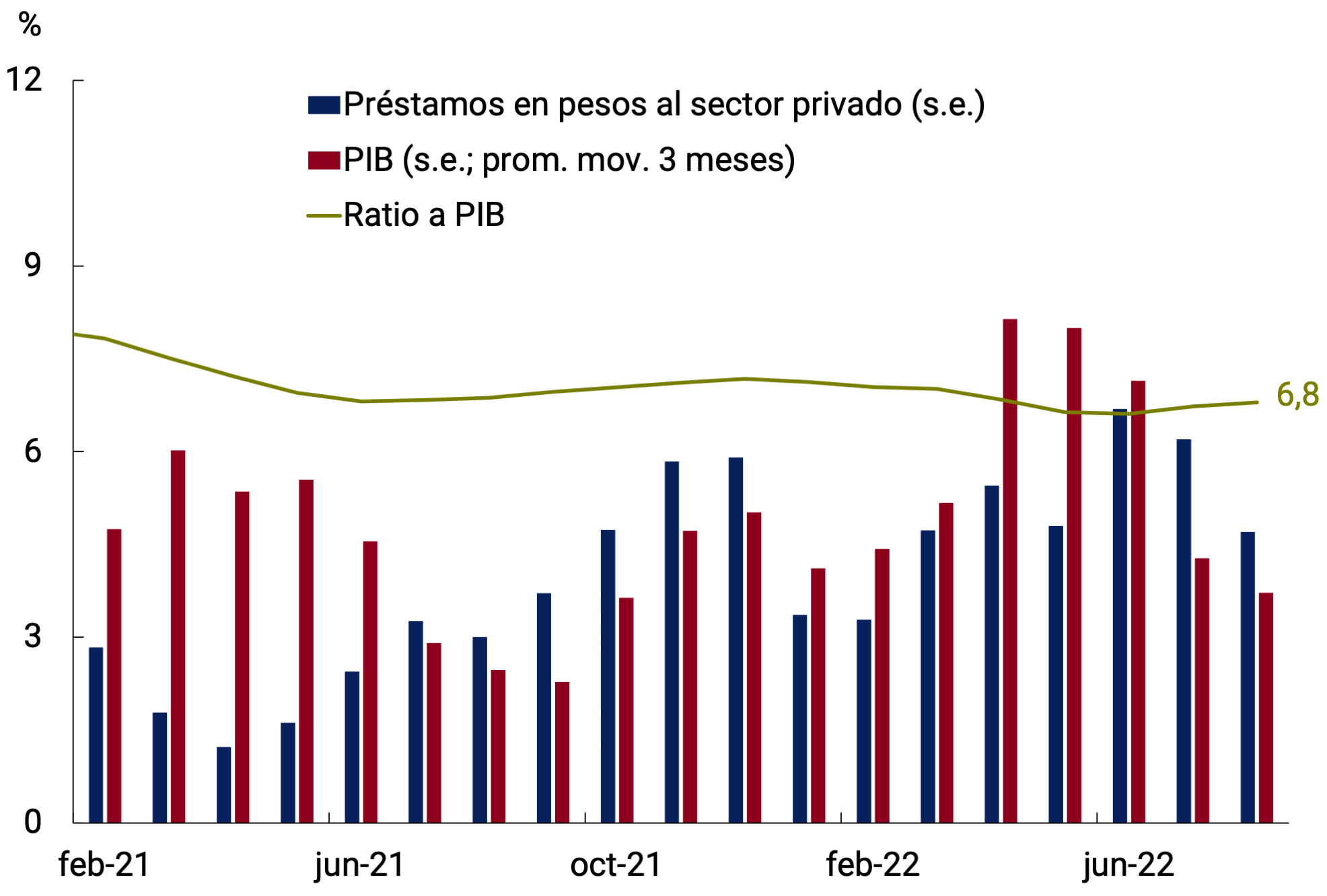

Economic activity in Argentina continued to expand during the second quarter. Despite the impact of the lower harvest due to drought conditions on agricultural production, GDP grew 1% s.e. Although the leading indicators for July and August indicate a slowdown in growth during the third quarter, it is estimated that activity will resume its growth path in the latter part of the year and at the beginning of next year, in a context of lower financial volatility and greater exchange rate stability. In this macroeconomic environment, the BCRA maintained its credit policy focused on productive development. The Productive Investment Financing Line (LFIP) continued to be the main tool used to channel productive credit to MSMEs under favorable conditions. Since its implementation, and until August 2022, loans granted under the LFIP accumulated disbursements of approximately $2.87 trillion. At the end of August, approximately 300,000 companies had accessed loans under the LFIP. The average balance since the renewal of the LFIP, with data available as of July, stood at $875,000 million, which represented about 38% of commercial loans and 16% of total credit to the private sector. It should be noted that the validity of this line was recently renewed until March 31, 2023, under conditions similar to that of the previous renewal.

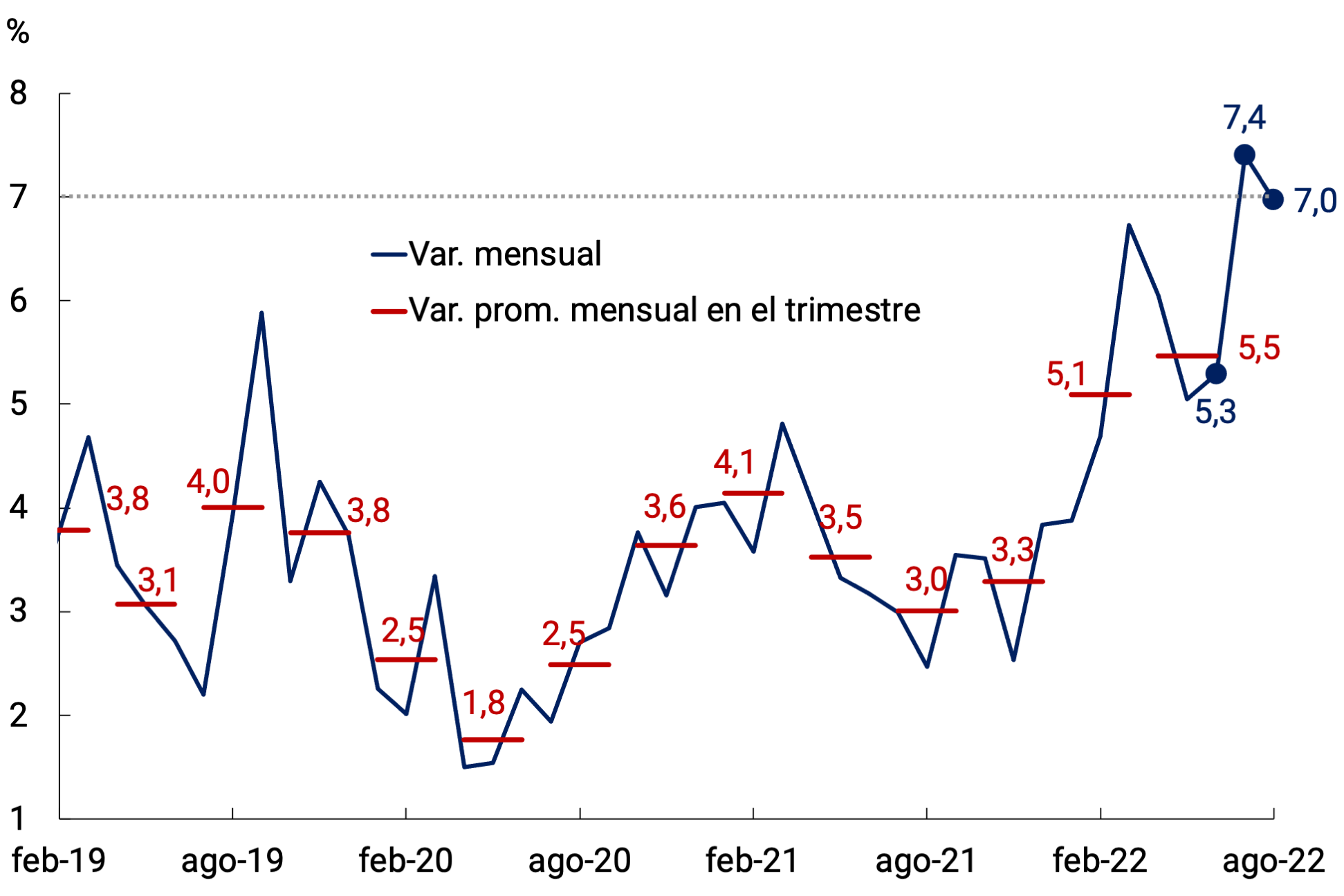

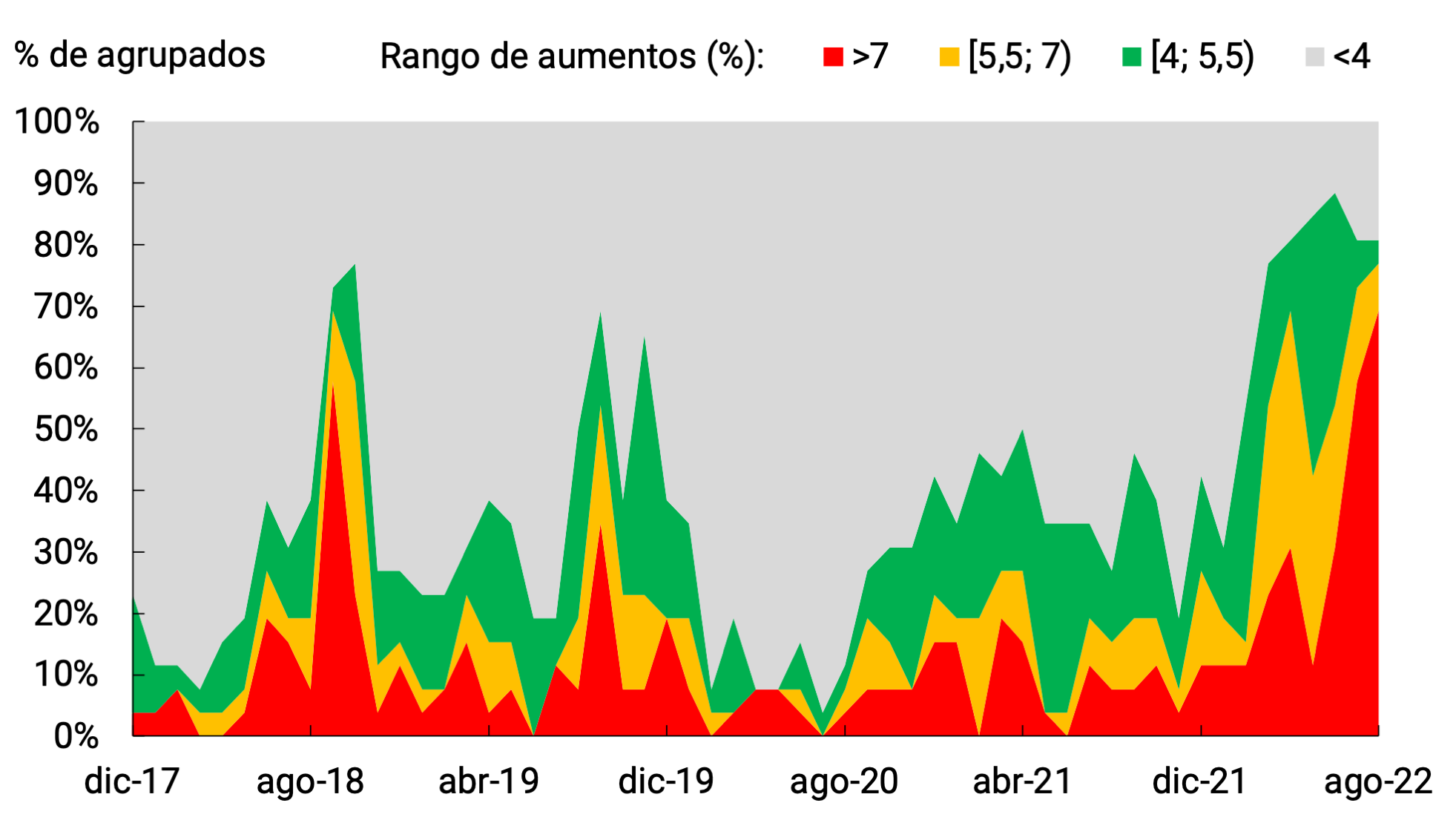

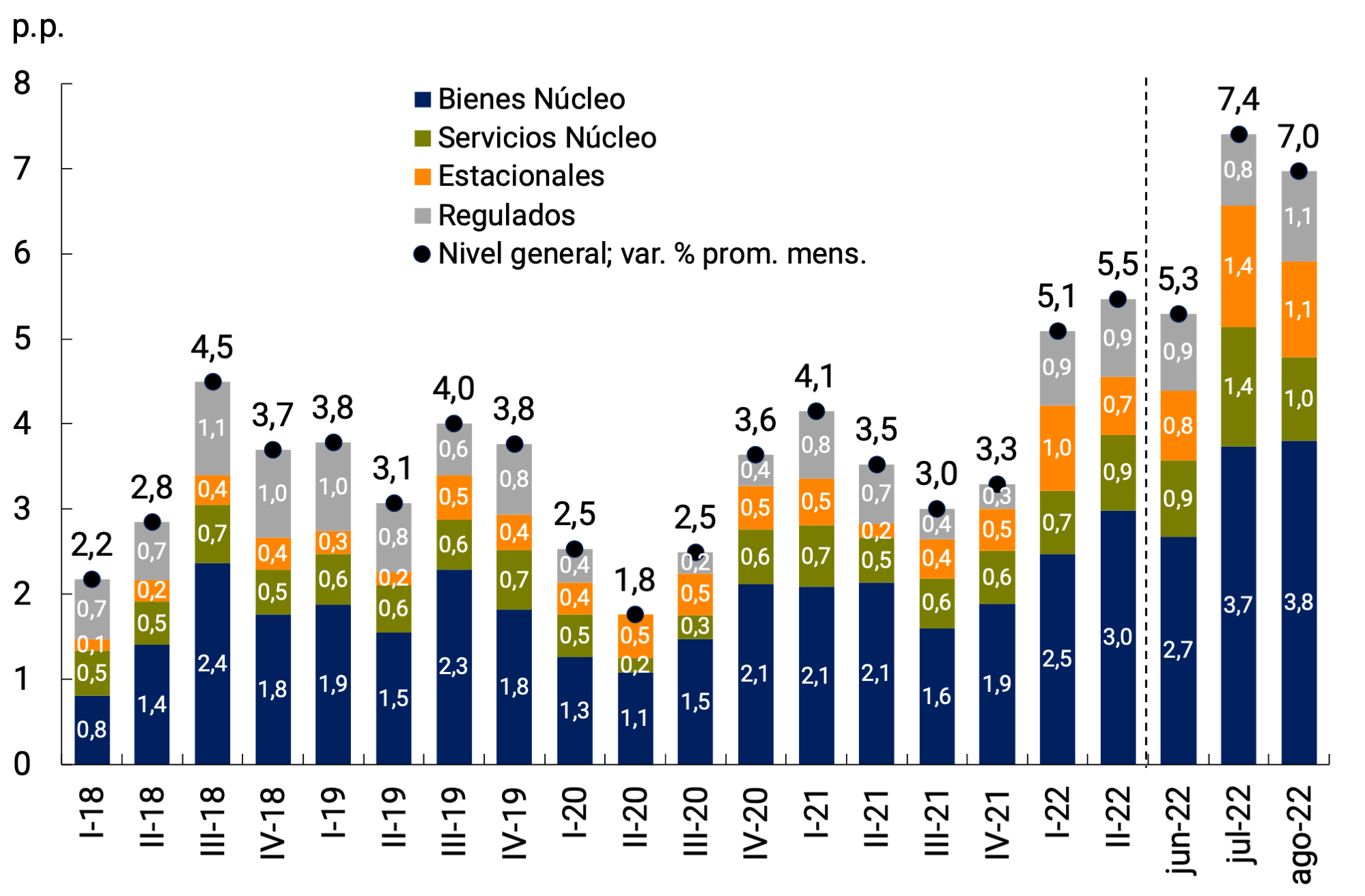

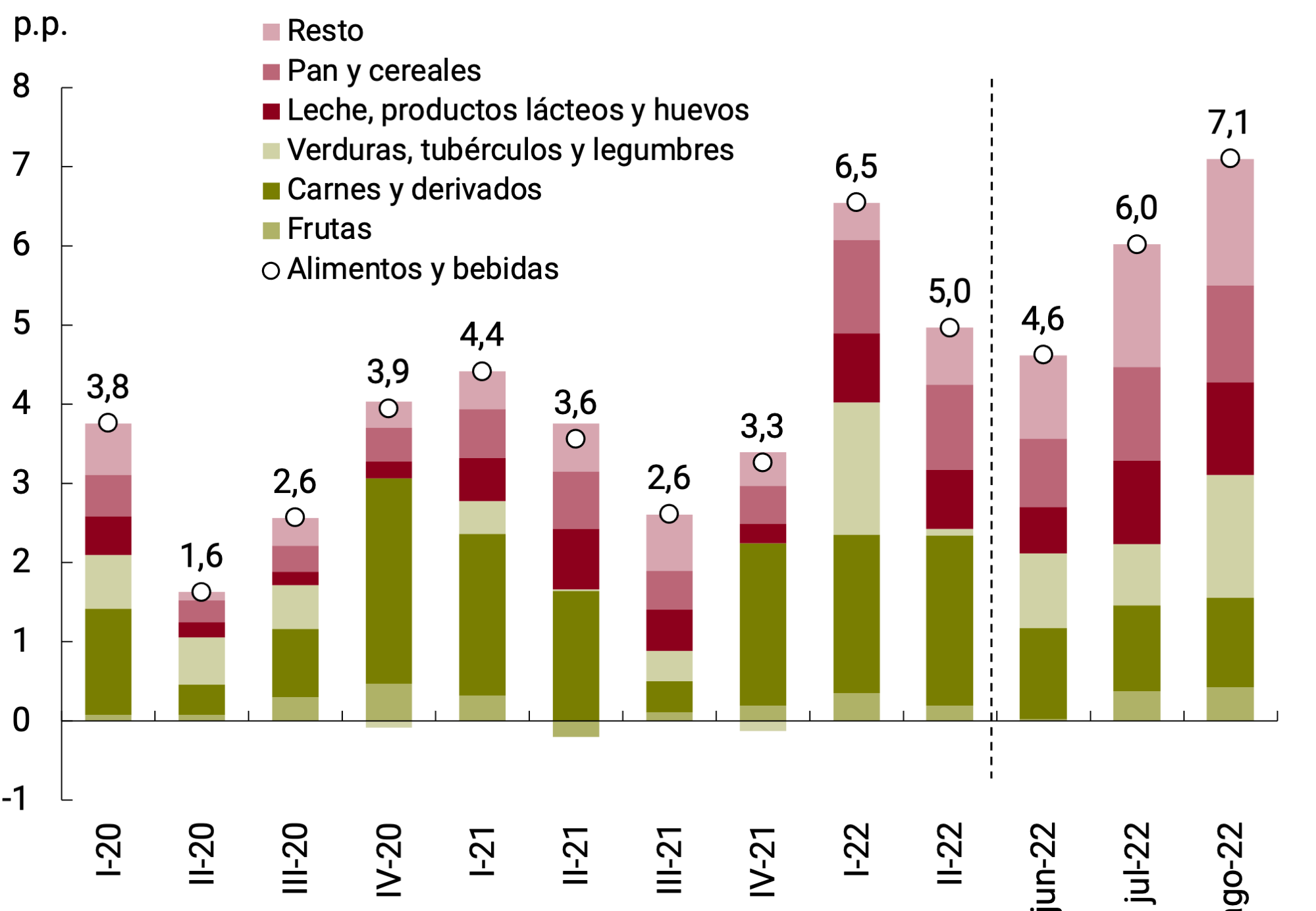

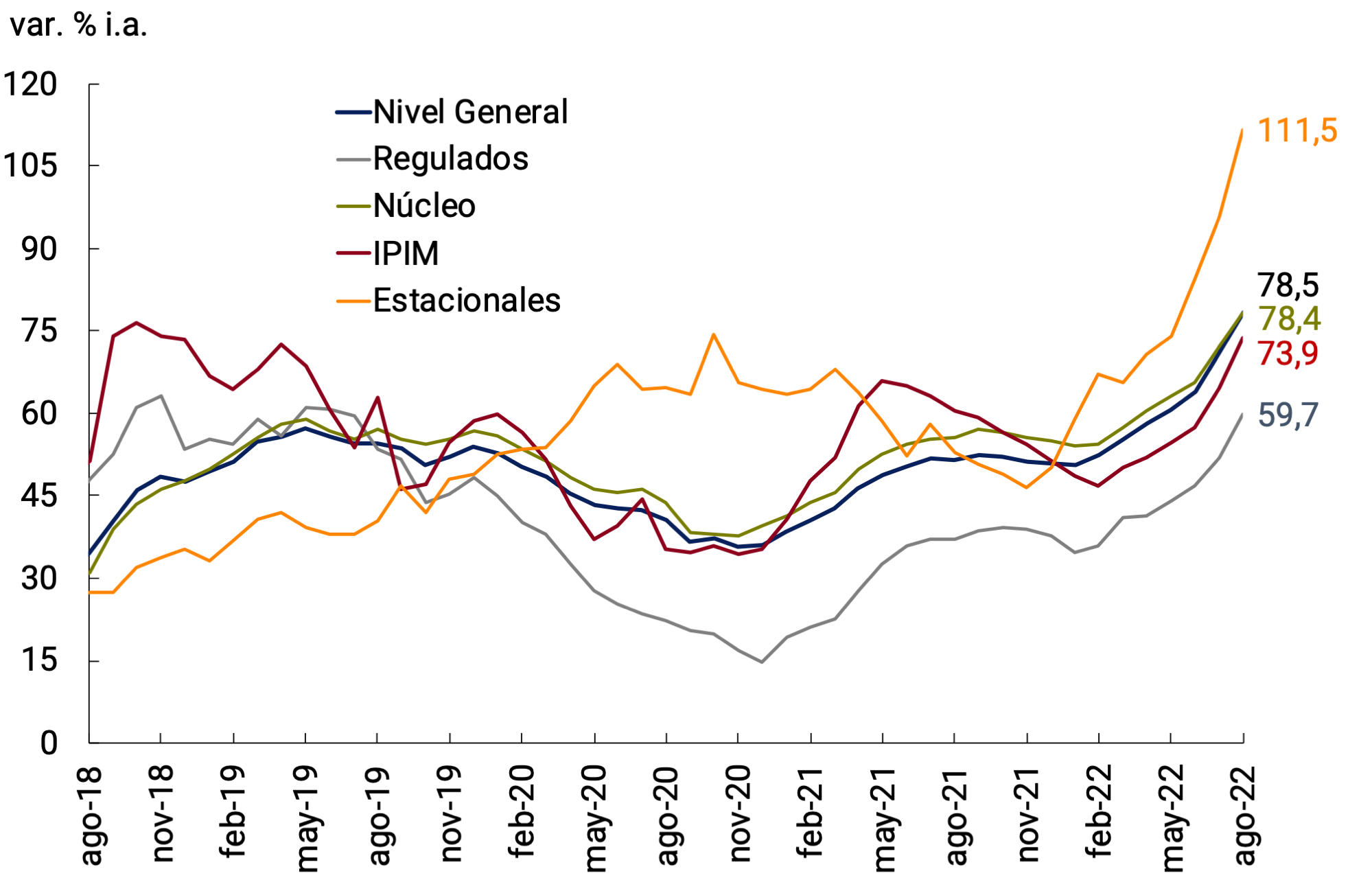

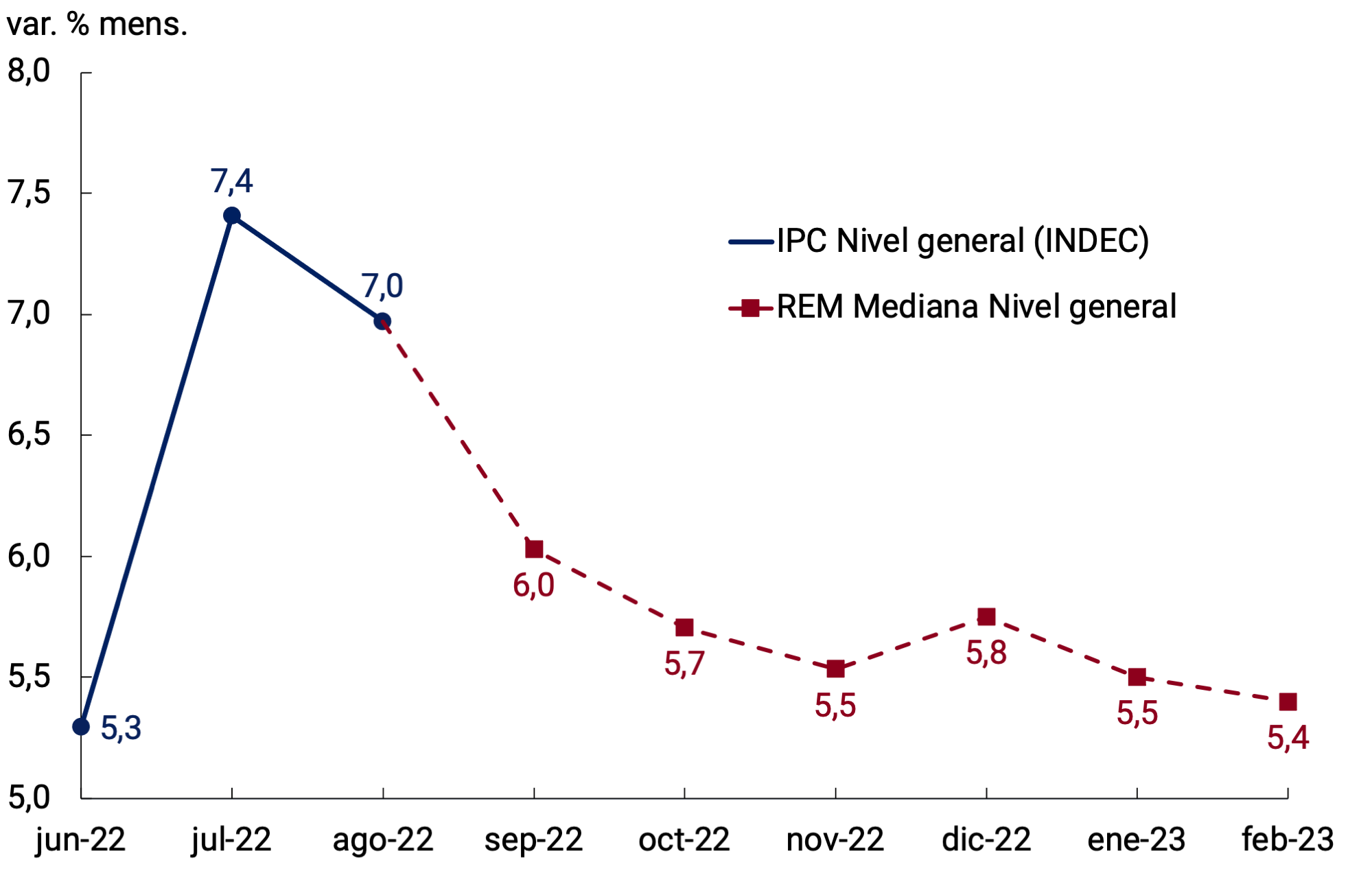

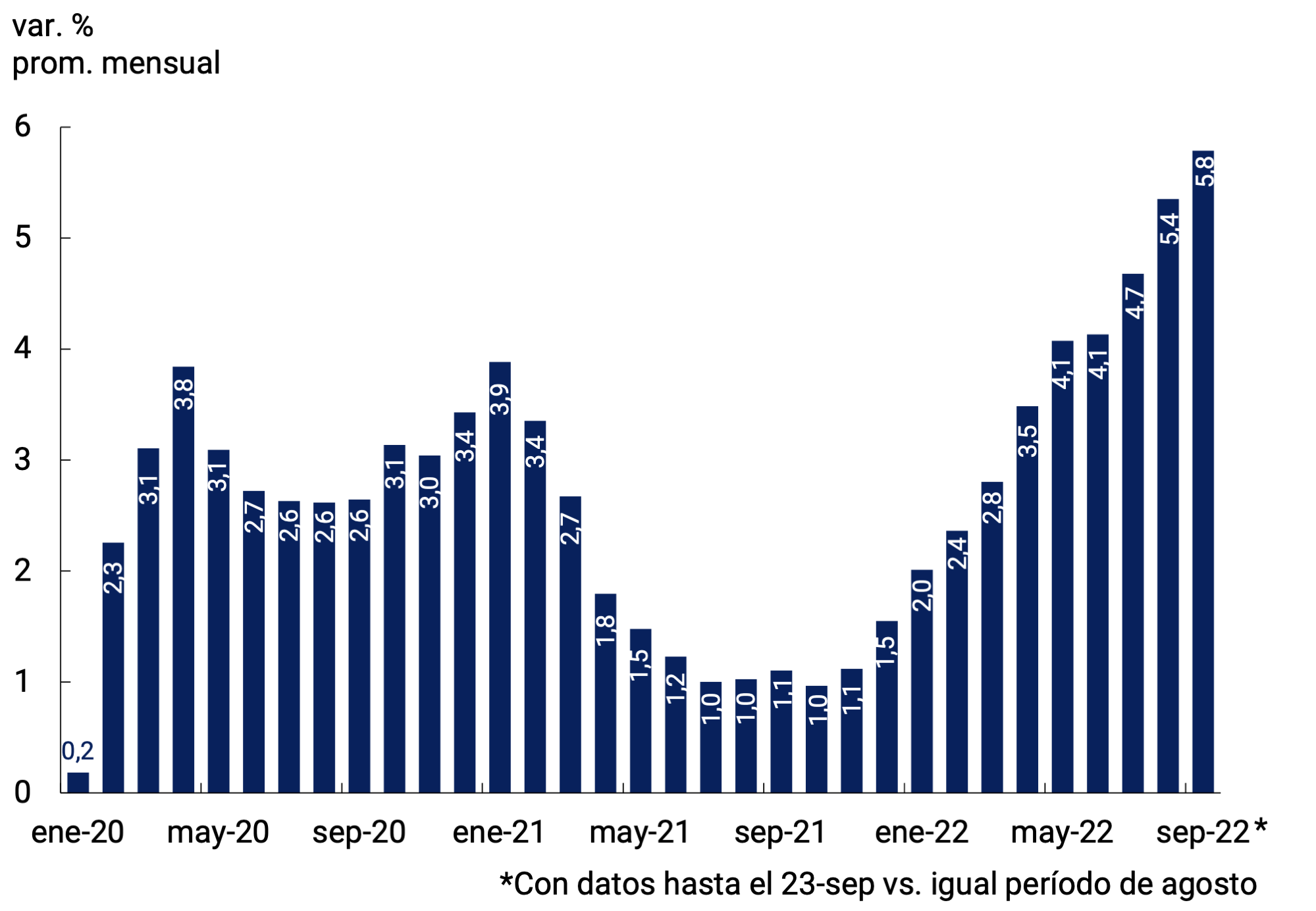

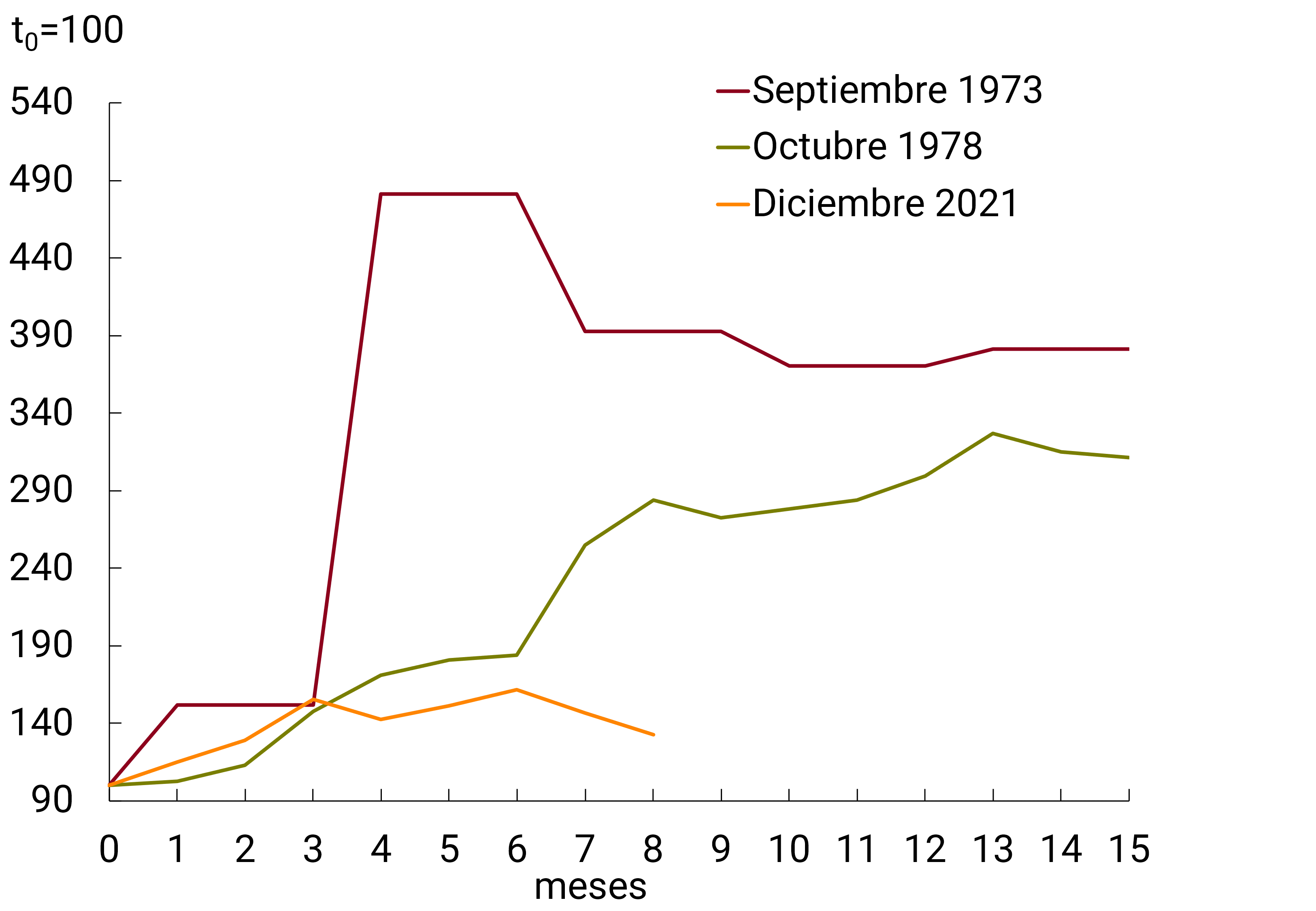

The incipient downward trend in monthly inflation rates that had been observed in May and June was interrupted in July when prices rose 7.4% monthly (+2.1 p.p. compared to June). In this sense, there were price increases in a large number of goods and services simultaneously, with a level of dissemination and coordination that is usually only verified in episodes of jumps in the official exchange rate. This inflationary acceleration occurred in an environment of intense financial volatility that led to greater exchange rate uncertainty and, consequently, an increase in inflation expectations. The year-on-year inflation rate also rose to 78.5% in August.

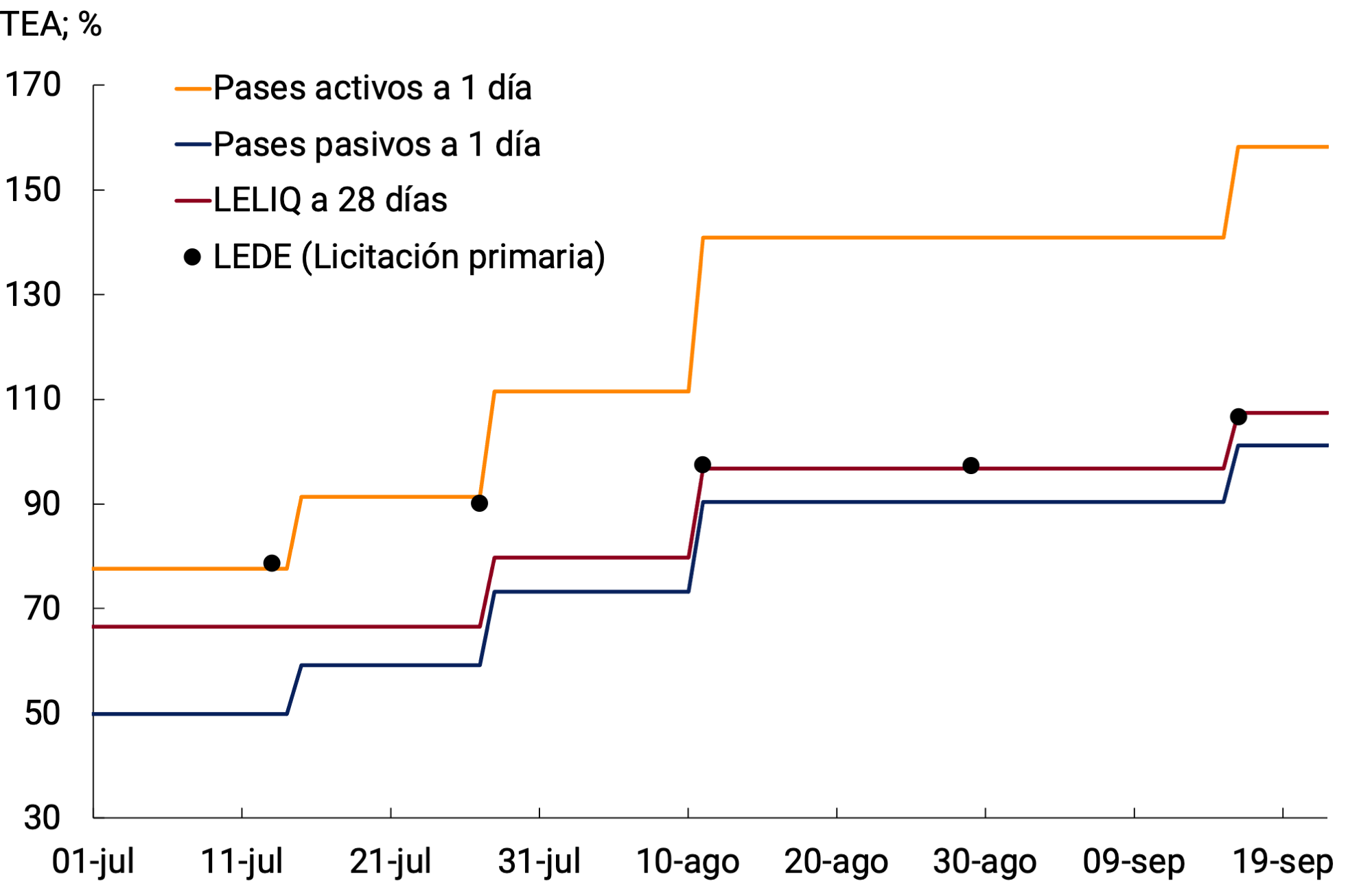

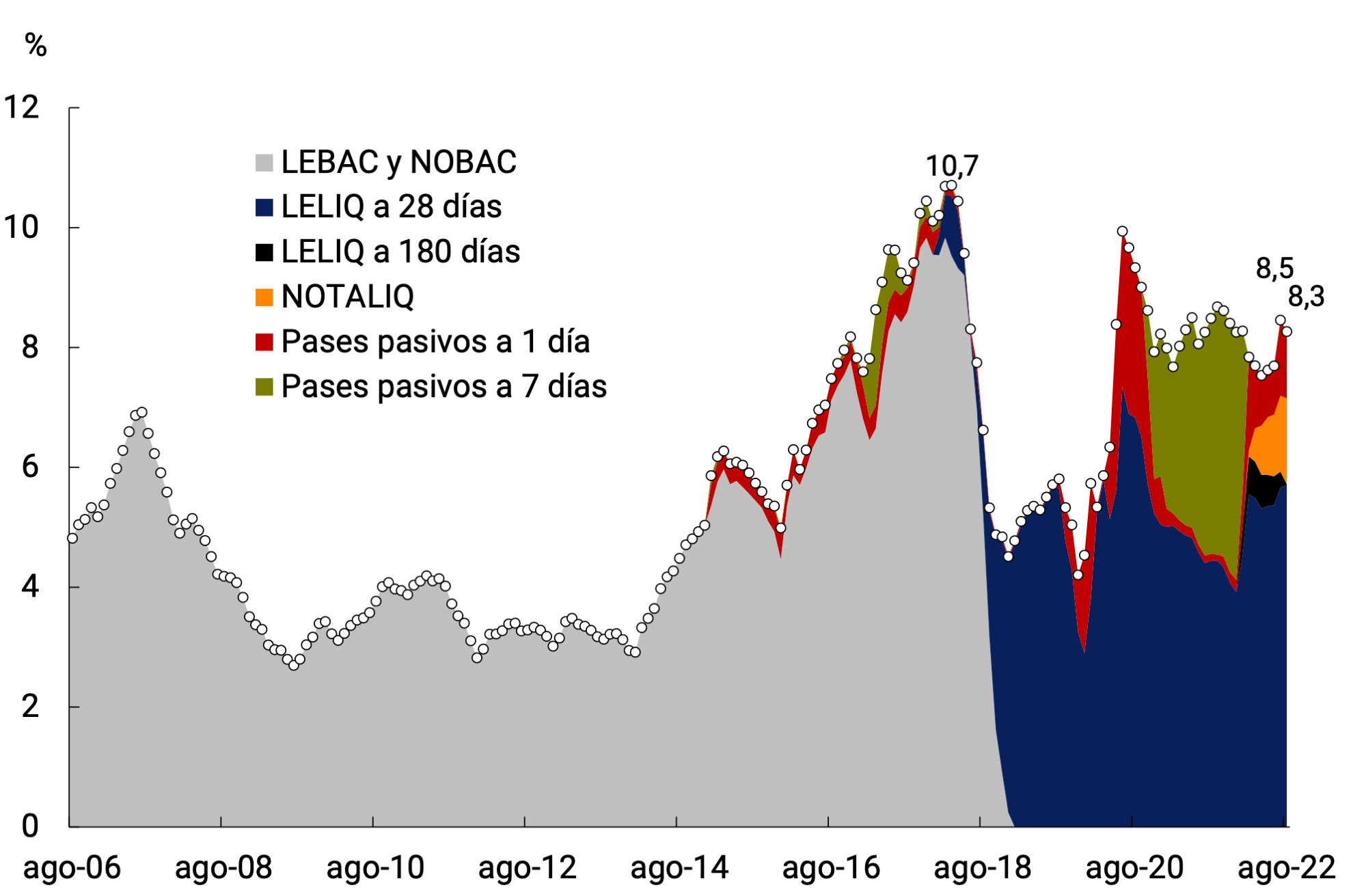

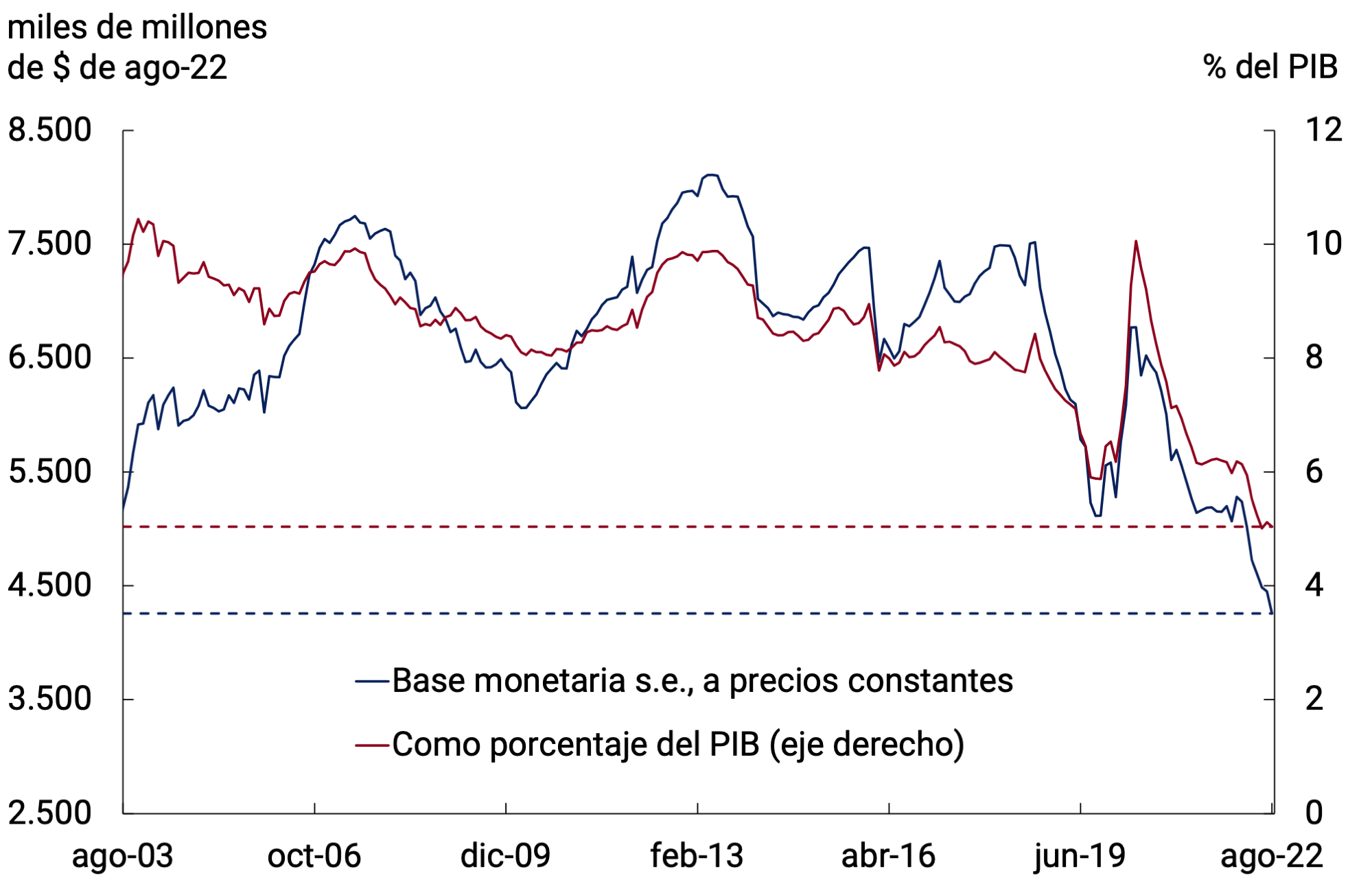

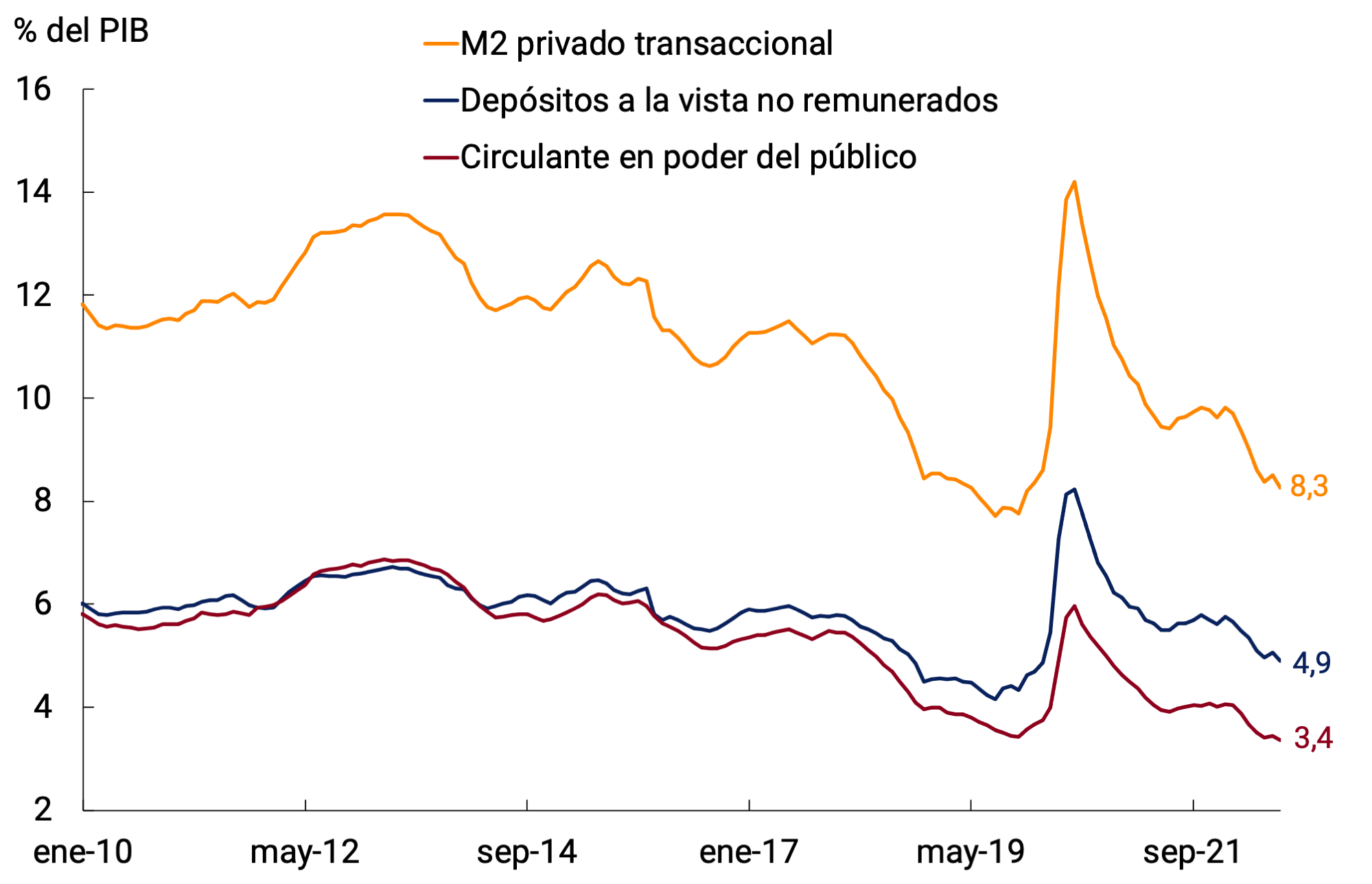

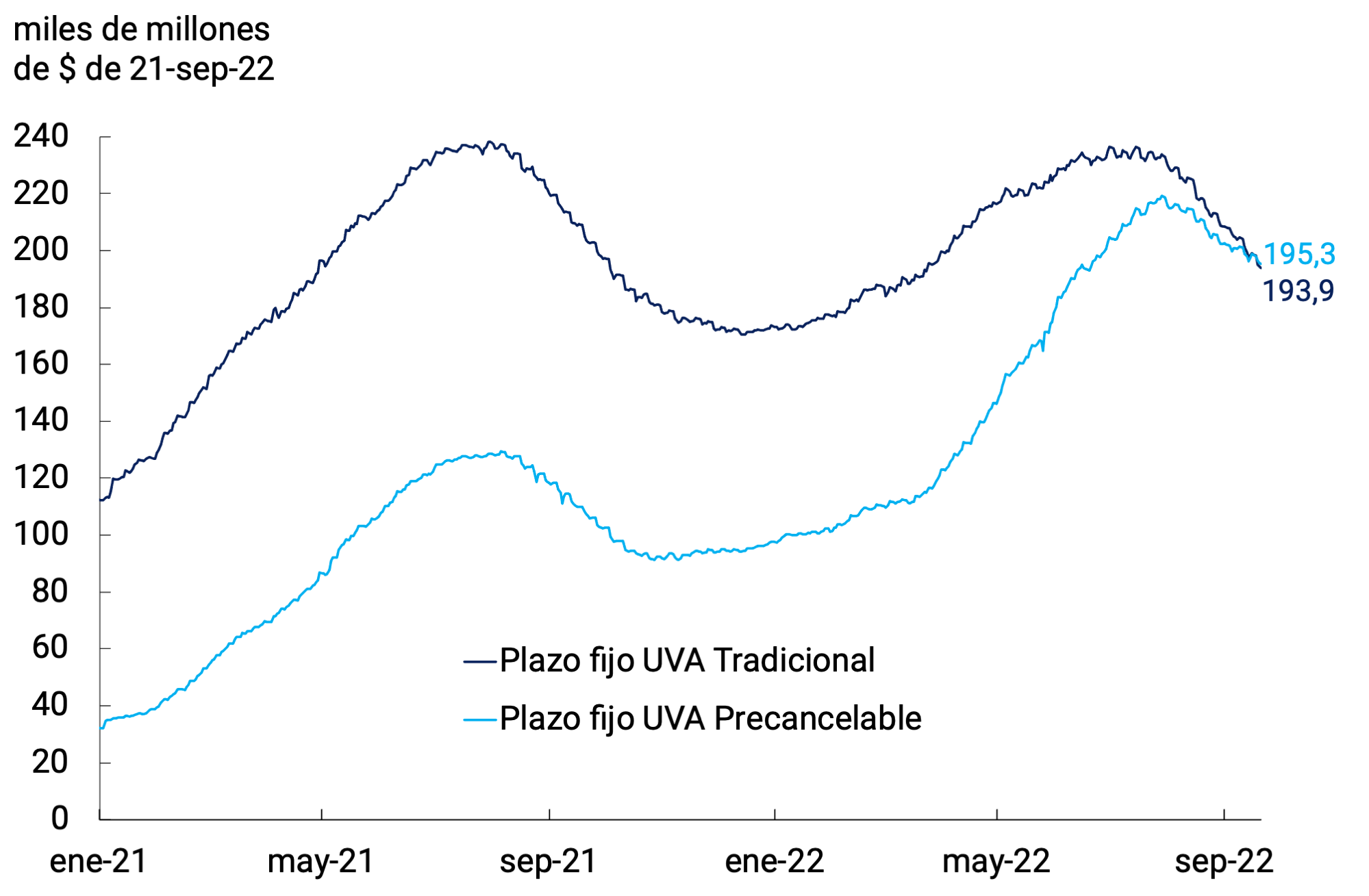

In this context, the BCRA adopted a series of measures to address financial volatility and contain inflation. Primarily, and in line with the policies enunciated last December in the “2022 Objectives and Plans”, reference interest rates were raised on several occasions, accelerating the normalization of monetary policy to converge towards positive real interest rates, with the aim of preserving exchange rate and financial stability. Thus, the interest rate of the 28-day LELIQ remained at 75% n.a. (107.3% e.a.), which implied an increase of 26 p.p. since the previous report. Likewise, it was sought that investments in domestic currency also tend towards positive real returns, reinforcing the transmission channel of monetary policy through the increase of the minimum regulated rates on term placements. Since the end of June, the floor for placements of individuals for up to $10 million increased 22 p.p. to 75% n.a. (107.1% y.a.), while for the rest of the term placements the minimum guaranteed rate rose 16.5 p.p. to 66.5% n.a. (91.1% y.a.).

It is worth remembering that, in an economy like Argentina’s, with a relatively small credit channel, the rise in interest rates acts mainly by encouraging savings in pesos. Its anti-inflationary action therefore largely involves contributing to exchange rate and financial stability, and must be complemented with other economic policy instruments to reduce inflationary inertia.

At the same time, the BCRA sought to reduce financial volatility by using its ability to intervene through open market operations, reaffirming its commitment to operate on the yield curve of public debt in local currency. The BCRA arranged its participation in the secondary market for securities issued by the National Government as of July with a residual term of more than 15 days, buying at rates similar to those of the last auctions, plus a maximum spread of 2%. This action was complemented by a deepening of coordination efforts with the Ministry of Economy of the Nation so that the BCRA’s interest rate structure presents reasonable spreads with National Treasury bills. The BCRA seeks to gradually converge in the medium term towards managing the economy’s liquidity through open market operations (OMA) with Treasury bills and other short-term securities denominated in local currency. This type of mechanism is similar to that used in other countries and is a convenient alternative to reduce the quasi-fiscal cost of monetary policy. To achieve this, the local capital market must assume an increasing importance in the financing of economic actors, the public and private sectors.

On the exchange rate front, the BCRA continued to calibrate the rate of change of the nominal exchange rate so that it is in line with domestic inflation, with the aim of maintaining adequate levels of external competitiveness. The latter was complemented by the improvement of the current regulatory framework in the foreign exchange market, seeking to promote an efficient allocation of foreign currency. Among the measures to encourage foreign exchange income, the policy aimed at the sale of the soybean harvest stood out. The “Export Increase Program” recently came into force, which promotes the liquidation of soybean exports and their by-products between September 5 and 30 from an exchange rate of $200 per dollar. The oilseeds and cereals sector liquidated US$5,300 million through this mechanism at the close of this report. For the demand for foreign currency, the validity of the exchange regulations that favor stability was extended, and exceptions and particular regulatory frameworks were incorporated for the payments of imports linked to certain productive activities, with the aim of responding to the extraordinary needs of foreign currency to meet energy imports, among other measures.

Having recently reached agreement at the technical level between the IMF and the Argentine authorities on the second review of the Extended Facilities Program, at the close of this report its approval by the executive board of the multilateral credit agency was still pending. The review updated local macroeconomic performance in an adverse international context, maintained the existing primary deficit targets of 2.5% of GDP in 2022 and 1.9% of GDP in 2023 and the reserve accumulation targets for the 2022-2023 biennium, for a cumulative amount of US$9,800 million. The monetary policy framework that the BCRA has been implementing since the beginning of the year was also reaffirmed, with a focus on an interest rate policy that ensures nominal returns in line with inflation and a path of the official exchange rate that preserves the levels of external competitiveness of the economy. Likewise, a structural agenda is consolidated that includes actions to strengthen the BCRA’s balance sheet, design a roadmap for the gradual relaxation of exchange controls, and other aspects of the National Government’s policy such as the fight against tax evasion and money laundering, including efforts to promote information exchanges and international cooperation mechanisms.

After the increase in the monetary policy interest rate, the successful exchange of short-term instruments of the public debt, the initiatives aimed at consolidating the process of reducing the fiscal deficit and monetary financing, and the new price agreement programs, both the National Government and the BCRA will continue to adopt measures to lower inflation. As for the BCRA, it will conduct its monetary policy by adjusting interest rates to keep them in positive territory in real terms and without granting net transitory advances to the National Treasury for the remainder of the year, remaining below the target committed to the IMF, managing liquidity to preserve monetary balance and maintaining the crawling peg exchange rate scheme to preserve external competitiveness.

2. International Context

Global economic activity continued to slow from the previous IPOM, increasing risks of a recession, while inflationary pressures have intensified. The rise in interest rates in advanced countries has increasingly impacted financial activity and conditions, while high energy prices persist, accentuated by the war in Ukraine. The partial revival of supply and recessionary risk have pushed agricultural commodity and metal prices back to their pre-conflict levels. Global supply chains are tending to normalise, but their continuity depends to a large extent on the evolution of COVID-19 in China, where mobility restrictions have been maintained throughout the year.

In response to inflation, most central banks in advanced countries have accentuated the contractionary bias of monetary policy. Developing countries face more adverse financial conditions: not only have advanced-country asset yields risen and the US dollar appreciated, but the risk spread of emerging countries has also widened. This tightening has negatively interacted with commodity prices. Going forward, the outlook will continue to depend on how persistent high inflation is, and the extent to which monetary tightening affects global economic activity and financial stability.

2.1. COVID-19: milder new wave, but the risk of restrictions in China continues due to their global economic impact

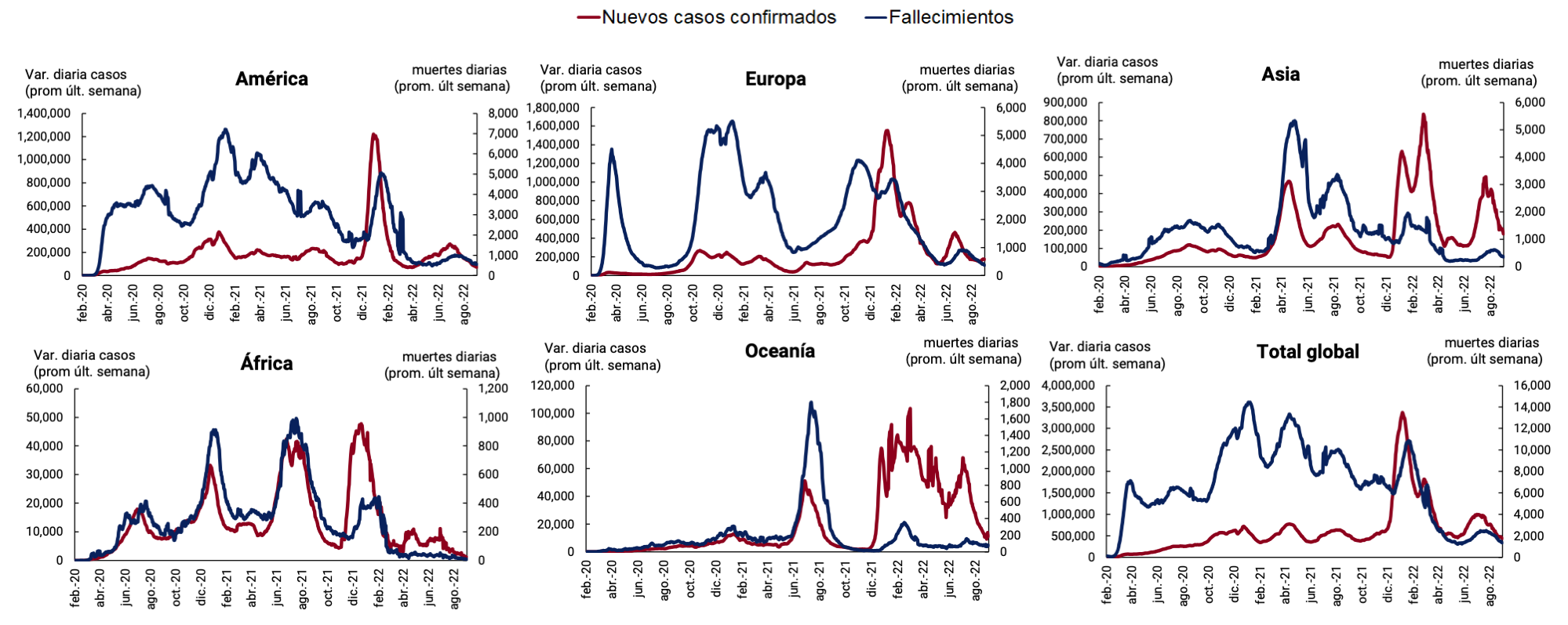

Since the last IPOM, a new global wave of COVID-19 infections has taken place, driven by the BA.4 and BA.5 subvariants of the Omicron strain. It was far from reaching the severity of the one that began last December with the emergence of the Omicron variant, both in terms of its intensity and duration and the number of deaths.

In this new phase of the spread of the disease, the curve of global infections reached a peak of 7.75 million per week at the end of July, more than doubling those recorded fifty days ago. Since then, the weekly number of infected people globally began to fall, reaching around 3.14 million at the end of September, returning to the lows recorded at the beginning of the current wave (see Figure 2.1). Deaths from COVID-19 increased throughout this phase, going from 9,200 accumulated in seven days at the beginning of June to a maximum of 17,700 (+92%) in the first half of August, and then falling back to 10,600 deaths per week so far in September.

Figure 2.1 | New cases and deaths from COVID-19

Source: BCRA based on data from the World Health Organization.

The recent spread of the Coronavirus was initially driven by Europe, North America and South America. Subsequently, when these regions reached their peaks in mid-July, new cases in Asia began to accelerate significantly, led by Japan and South Korea, becoming the epicenter of the wave. Having reached their maximum values in the first half of August, weekly infections in Asia began their decline, adding to the trend that the rest of the regions had been exhibiting for a month.

Globally, the mortality rate consolidated at levels close to 0.25%, much lower than those recorded during 2021, which exceeded 1.5% for almost the entire year, with maximums of 2.7%. These values reflect the effectiveness of vaccines and progress in immunization campaigns. In fact, information from September shows that 67.68% of the world’s population has received at least one dose and 62.22% the complete initial schedule. However, wide gaps in coverage remain between high- and upper-middle-income countries and low-income countries. In the former, between 74% and 79% of its population is fully vaccinated while, in the latter, they barely reach 17%. The differences are even more marked when comparing booster doses, which are very important to face the new variants of the Coronavirus. High-income countries have applied 57 doses per 100 inhabitants, upper-middle-income countries 48 and low-income countries only 1.30 per 100 inhabitants.

During July and early August, China experienced a rise in cases, reaching a peak of 21,000 weekly infections in mid-August. These values are well below the 185,000 that it registered in the wave it experienced last April and are very low in relation to its population. However, after the relaxation of mobility restrictions in the second quarter, following its COVID 0 policy, the government increased restrictions again weeks ago in several major cities, whose effect on the global economy is still difficult to measure.

2.2. The global economy showed a slower pace of expansion in the second quarter, with a further downward revision of growth forecasts for this year

During the second quarter, the three factors that affected the global economy in the first months of 2022 were maintained, with varying intensity: the war in Ukraine, with its impact on economic activity and commodity prices; the restrictions on mobility in China to deal with the pandemic, with its effect on international trade and global supply chains; and, with increasing weight, the contractionary monetary cycle of the US Federal Reserve (Fed), with its consequences on economic activity and global financial conditions.

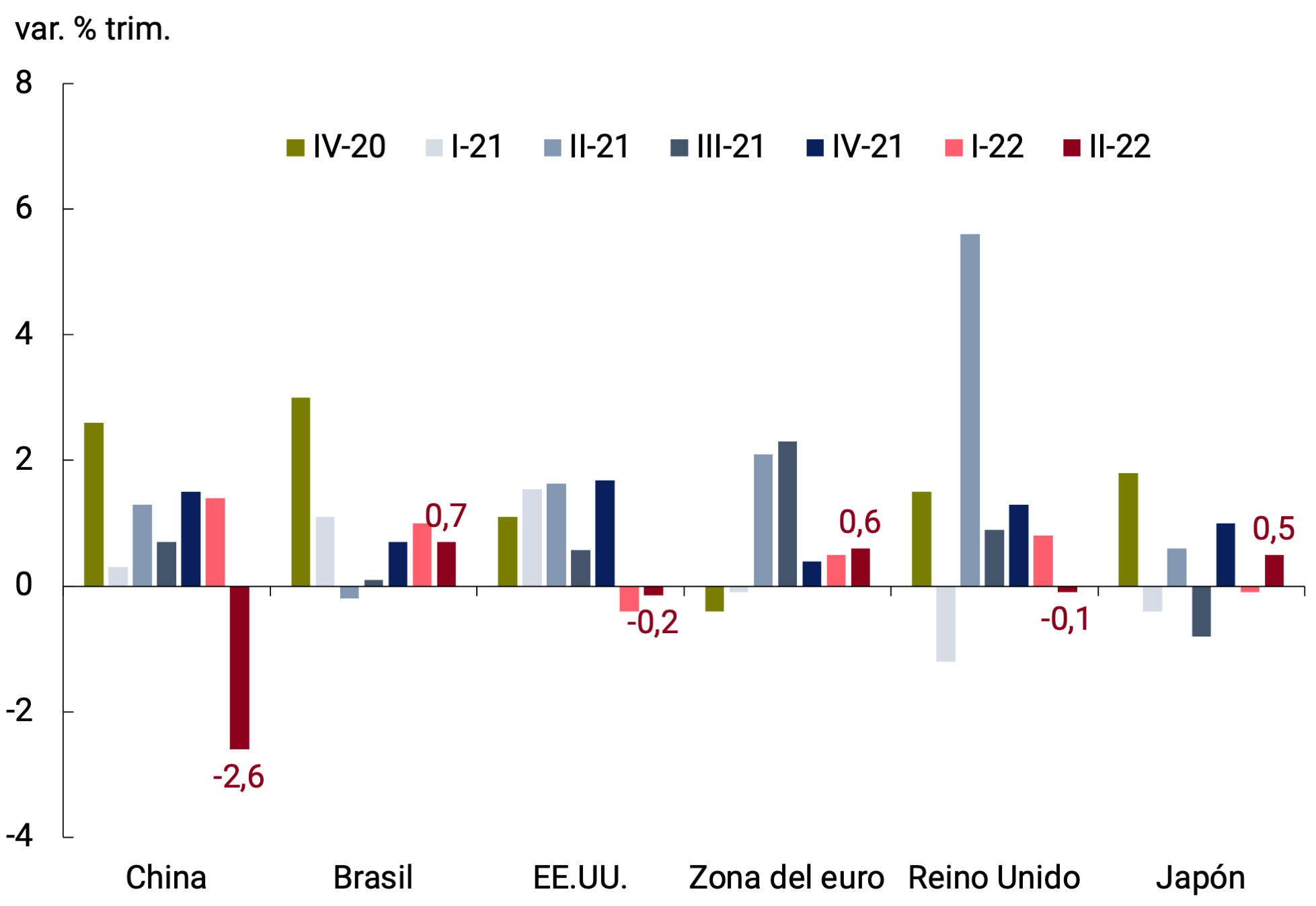

In the United States, output fell again in the second quarter (-0.2% qoq/s), surprising market forecasts that foresaw a return to growth (see Figure 2.2a). Investment in inventories was the main factor behind the GDP contraction, followed by residential investment and government spending. Business fixed investment and household consumption grew, but at a slower quarterly rate, while net trade made a positive contribution for the first time in two years. This dynamic generated a debate about whether the US economy would have entered a recession: it meets the technical criterion of two consecutive quarters of falling GDP, but the labor market continues to be strong, with non-agricultural job creation well above pre-pandemic levels (528 thousand new jobs in July compared to an average of 164 thousand in 2019) and the unemployment rate at a minimum level that is not it had been recorded since the end of the sixties (3.5% in July).

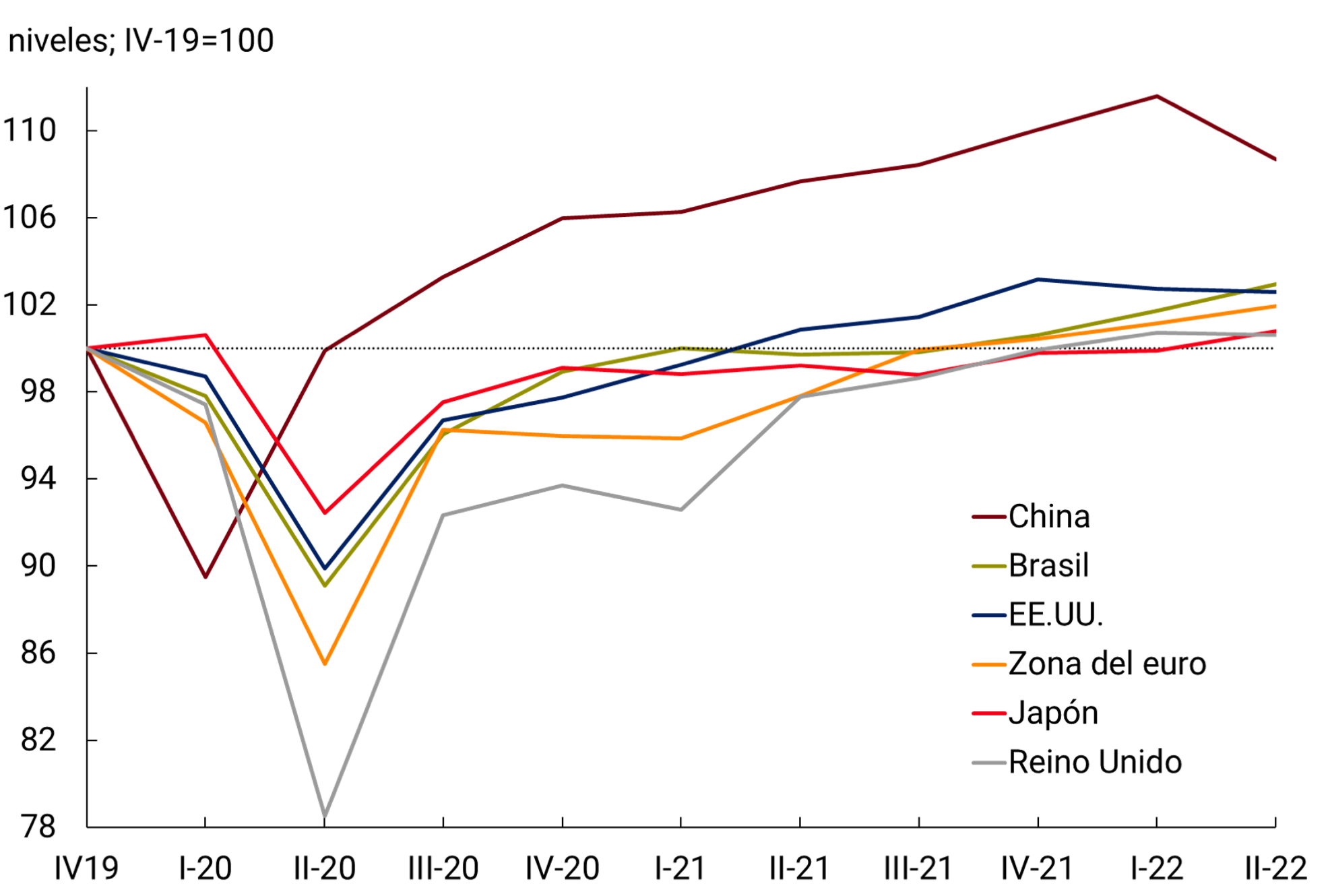

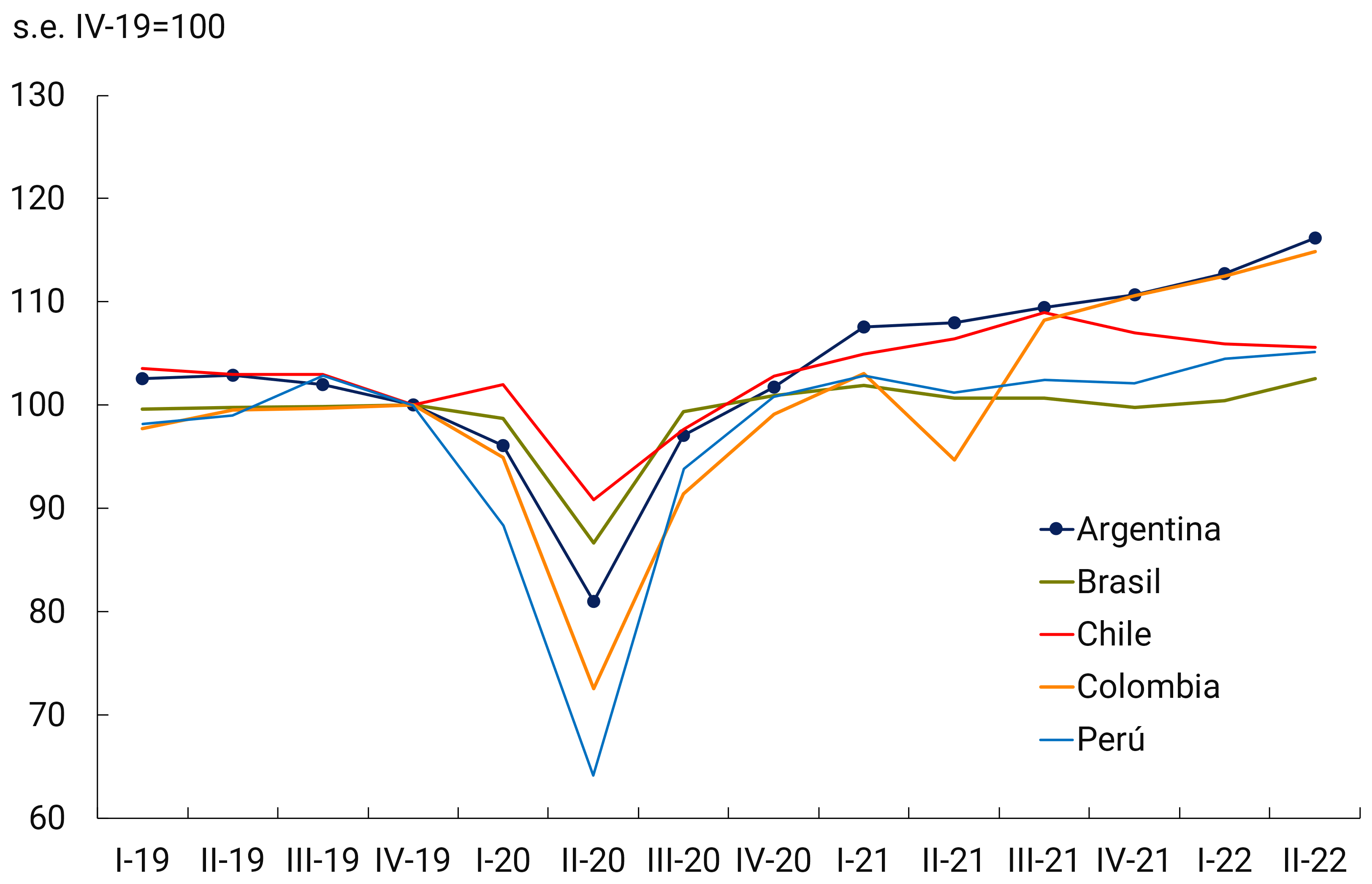

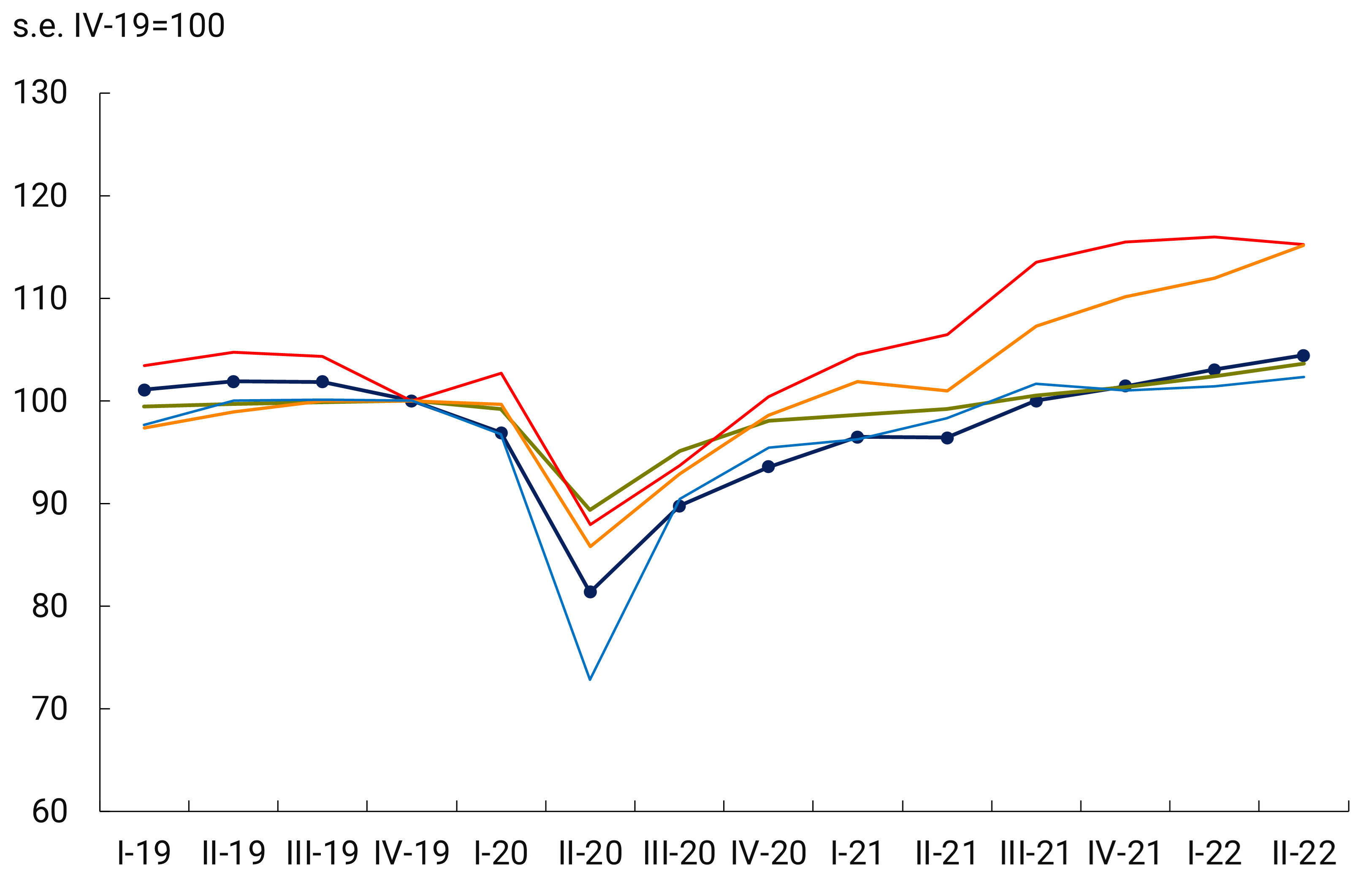

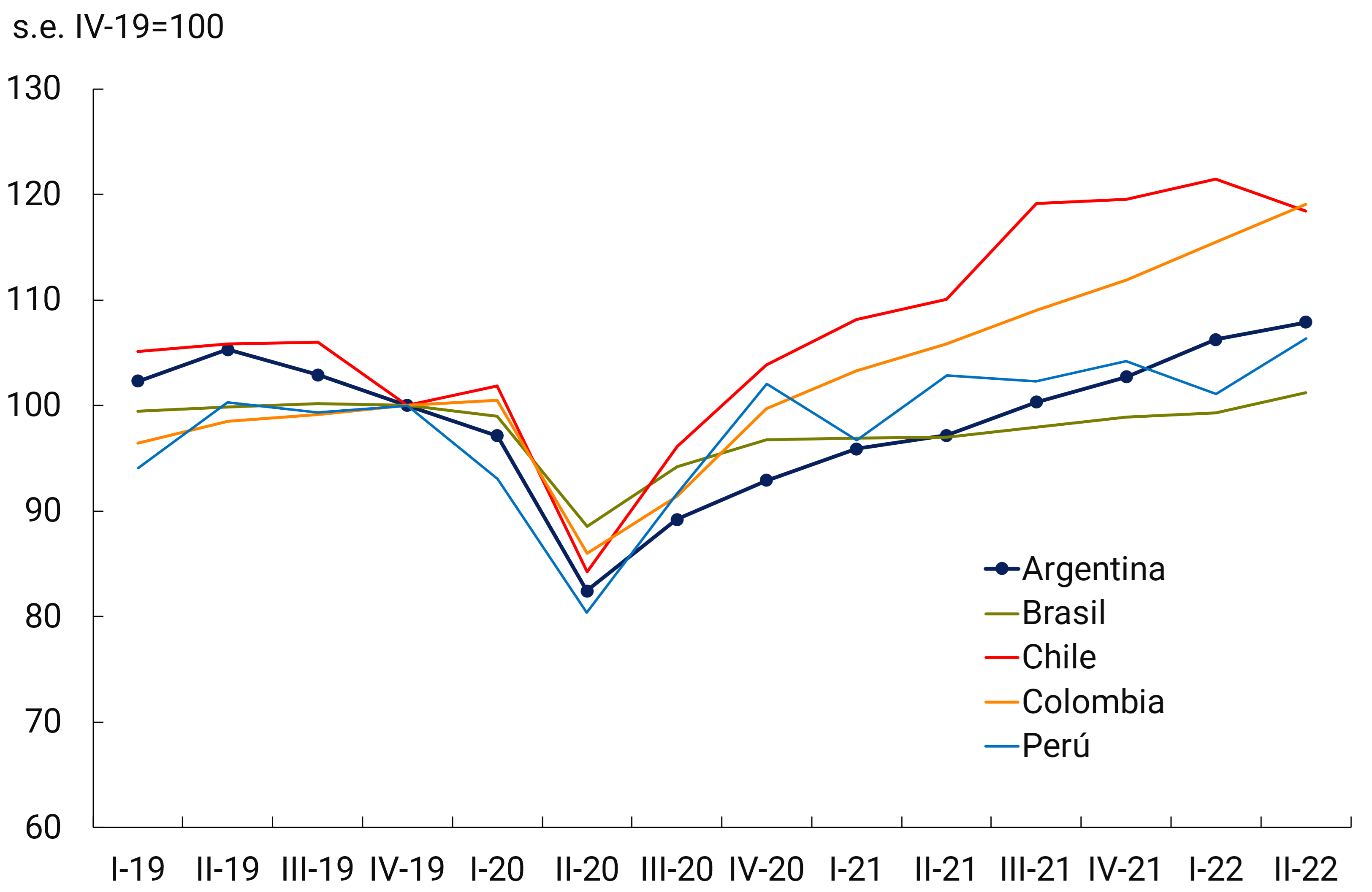

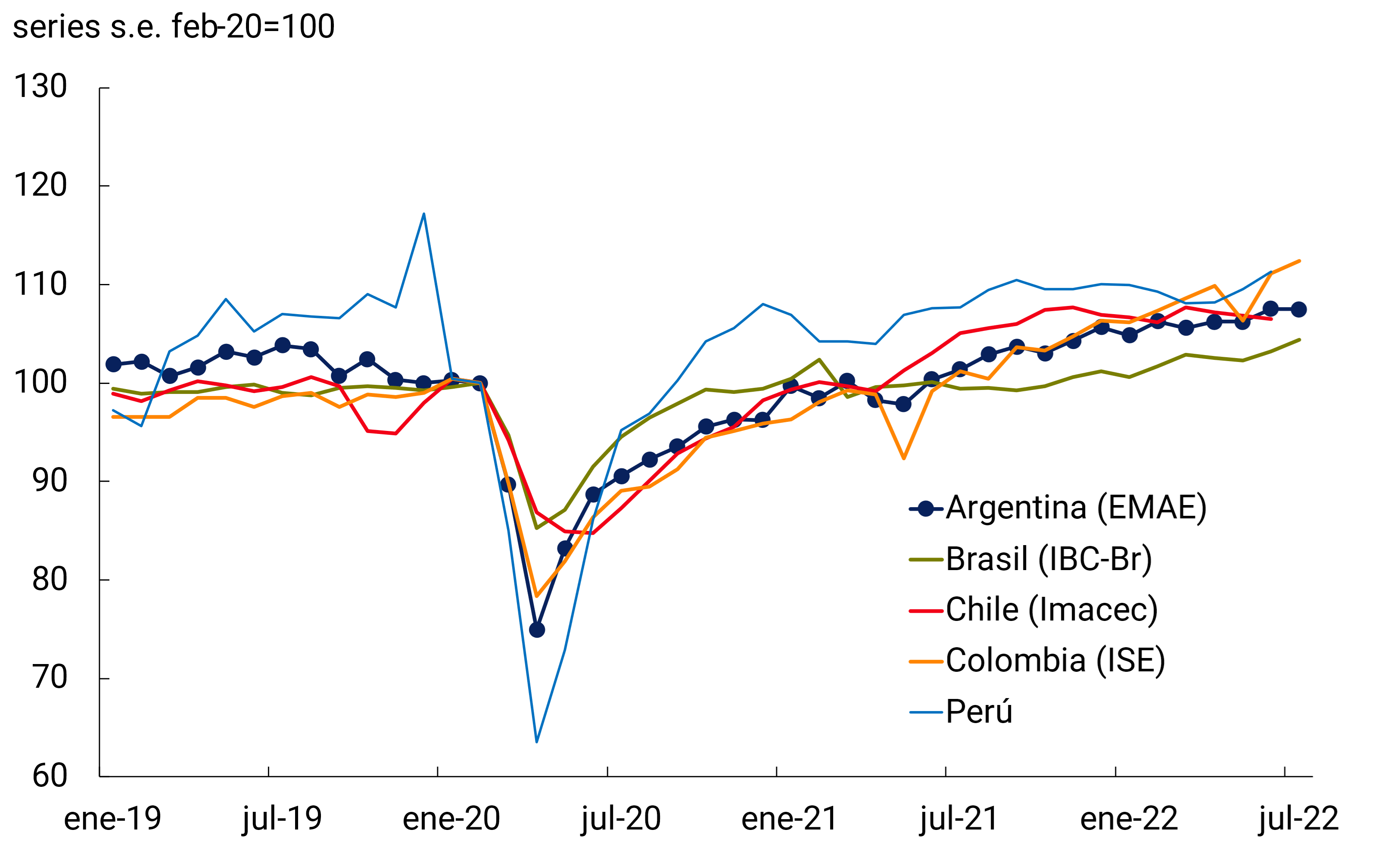

In China, GDP felt the full impact of the COVID 0 policy, with a sharp contraction in the second quarter (-2.6% QoQ/S), while in the United Kingdom, the economy also fell after four quarters of expansion (-0.1% QoQ/S) (see Figure 2.2a). On the other hand, growth remained in the euro area (+0.8% quarter-on-quarter s.e.), although with a more negative outlook for the coming months due to doubts about the supply of Russian energy, in Brazil (+1.2% quarter-on-quarter s.e.), and returned in Japan with the reopening of the economy in the face of the drop in COVID-19 cases (+0.9% quarter-on-quarter s.e.). Two and a half years after the start of COVID-19, the aforementioned economies, except China, have not managed to exceed their pre-pandemic levels by more than 3% (see Figure 2.2b).

Figure 2.2 | Evolution of GDP in selected countries (real GDP without seasonality)

Source: BCRA based on data from national statistics institutes.

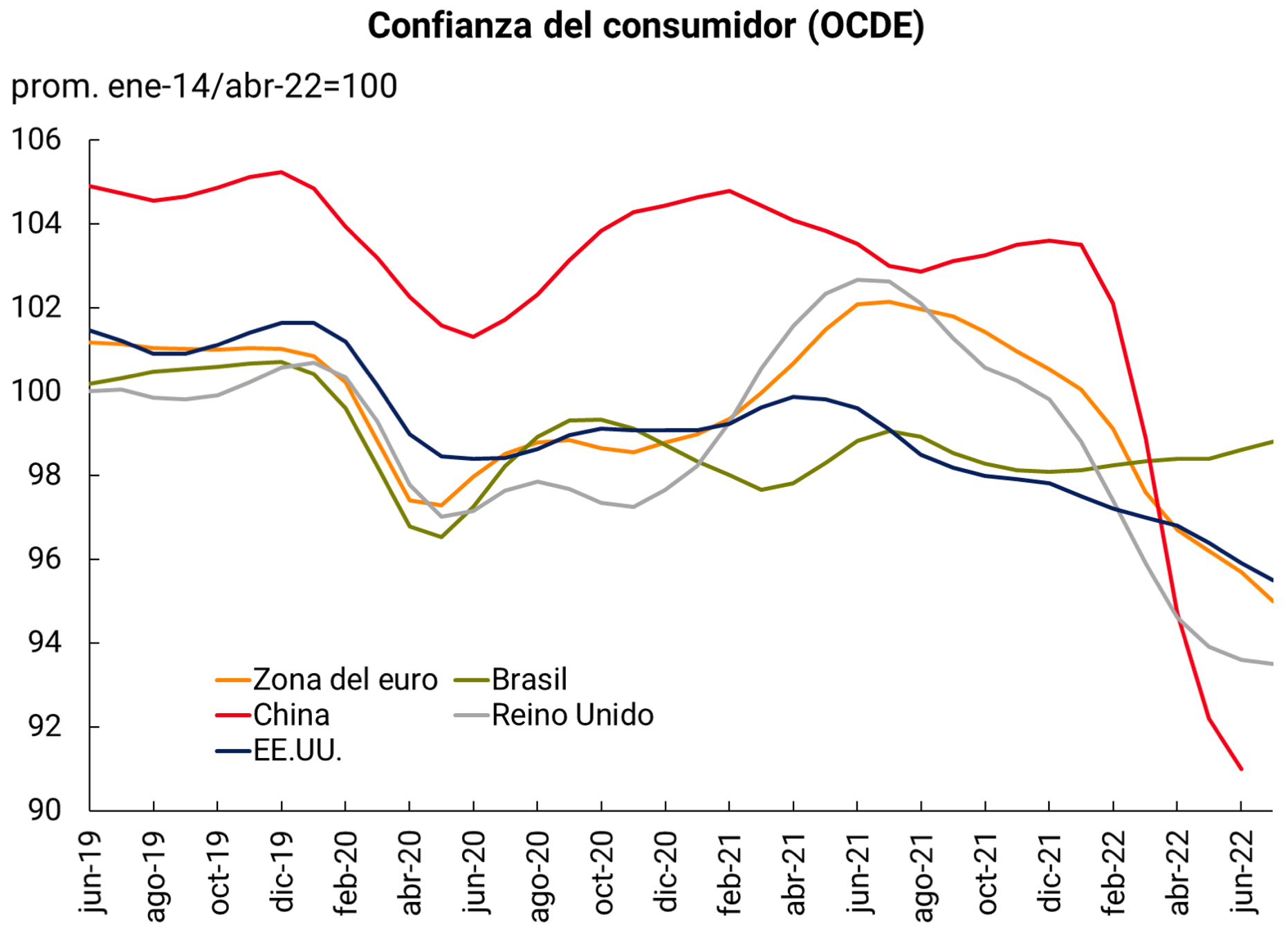

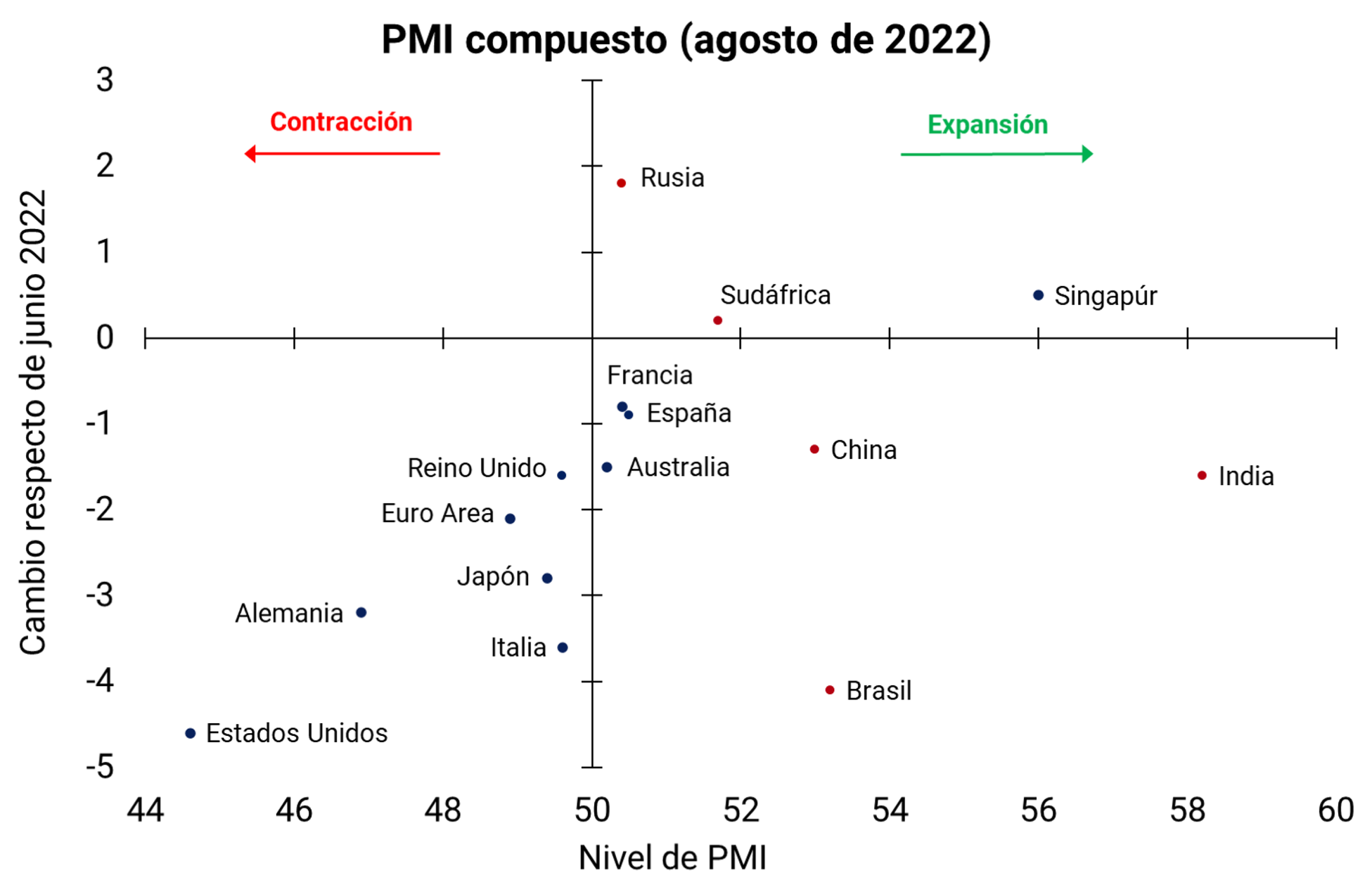

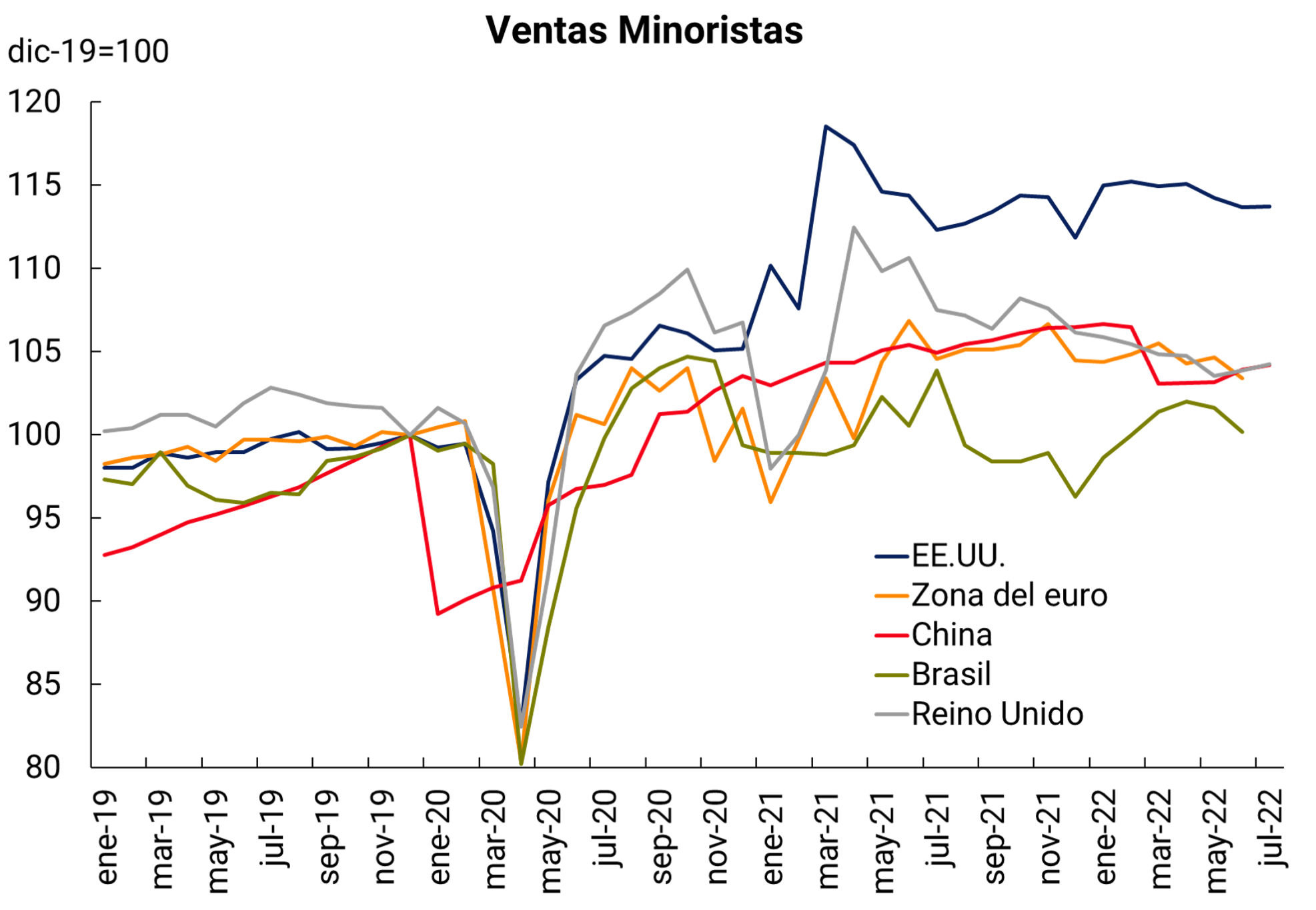

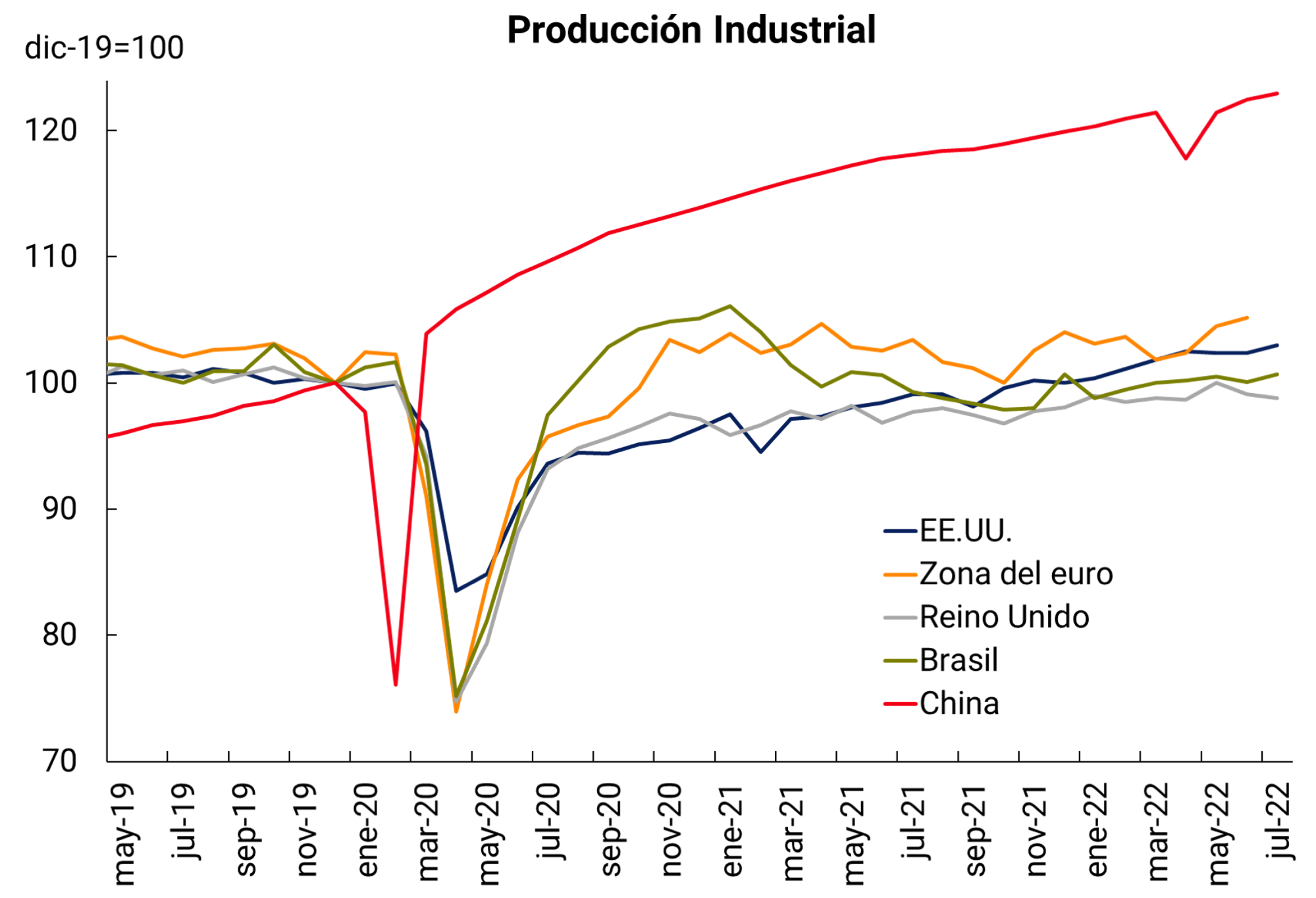

The main forward-looking indicators suggest lower global economic activity in the third quarter. Starting in June, consumer confidence continued to fall in the euro area, the United Kingdom, and the United States, reaching historic lows in July, while purchasing managers’ indicators (PMIs) continued to decline in July and August, moving into the economic contraction zone (below 50) mainly in advanced countries (see Figure 2.3). 1 Industrial production fell in the United Kingdom and the euro area in July and in the United States in August (see Figure 2.3). In China, although the economy showed signs of recovery in July and August with the easing of mobility restrictions during the drop in cases that took place in June, activity indicators show less dynamism than that recorded in the months prior to the second quarter. The particular tightening of restrictions since August in response to the increase in infections is likely to weaken the performance of the economy.

Source: BCRA based on data from IHS Markit, OECD, Trading Economics and Bloomberg.

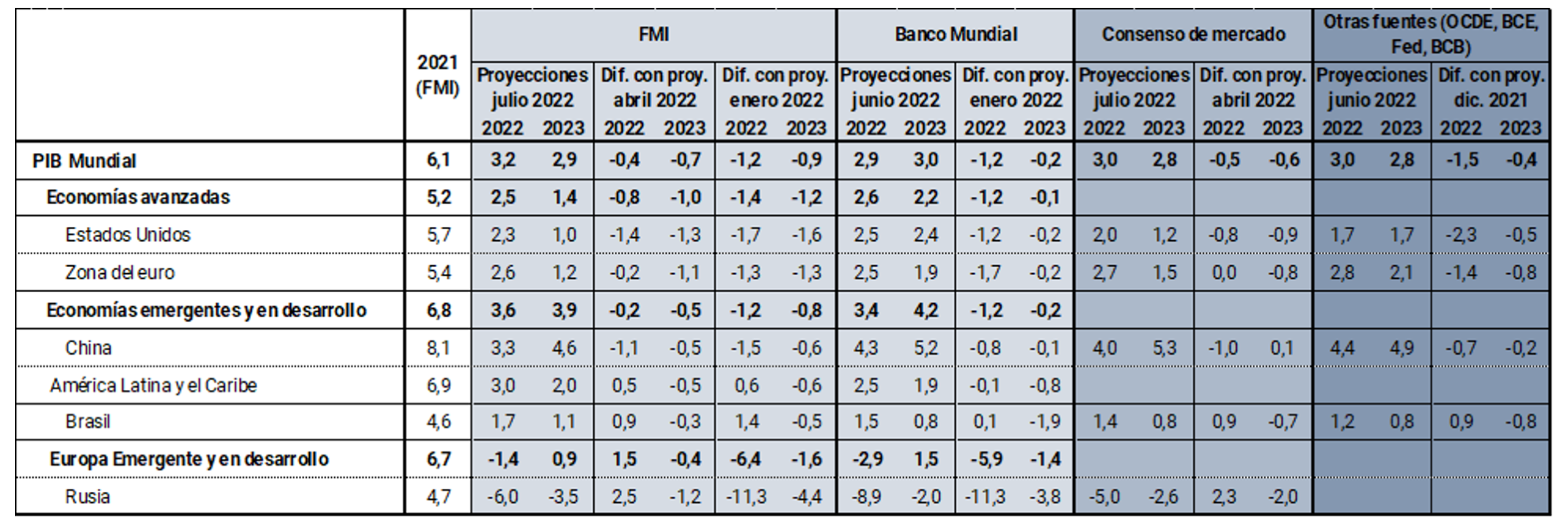

Global growth forecasts continued to decline. Like the World Bank in June, the IMF lowered its global growth projection for this year from 3.6 percent in April to 3.2 percent in its July report (see Table 2.1). According to the international organization, lower growth earlier this year, the reduction in household purchasing power and contractionary monetary policy prompted a downward revision of 1.4 p.p. in the United States for 2022. In China, new lockdowns and the deepening of the real estate crisis have caused growth to be revised downwards by 1.1 p.p. While in Europe, significant downgrades in forecasts reflect the side effects of the war in Ukraine and tighter monetary policy. In 2023, the IMF expects anti-inflationary monetary policy to have an impact on activity levels, with global output growing by just 2.9% (with a downward revision of 0.7 p.p.). The market consensus also agrees in forecasting lower global activity for the rest of the year. On the other hand, the IMF raised its global inflation forecast due to food and energy prices, as well as persistent supply chain imbalances, and forecasts that it will reach 6.6% in advanced economies and 9.5% in emerging market and developing economies this year: upward revisions of 0.9 and 0.8 p.p., respectively.

Table 2.1 | Economic activity projections 2022-2023

Source: IMF (WEO), World Bank, Reuters (market consensus) and other sources: OECD (world and China), European Central Bank (euro area), US Federal Reserve (United States), Central Bank of Brazil – Focus Survey (Brazil).

2.3. Inflation at record levels in recent decades drives the continuity of contractionary policies

The factors that have driven inflation in recent months remain: the increase in commodity prices accentuated by the war and COVID-19 outbreaks in certain parts of China that affected global value chains. In this context, the monetary authorities continued to take contractionary measures, although with a different speed between developed and emerging countries.

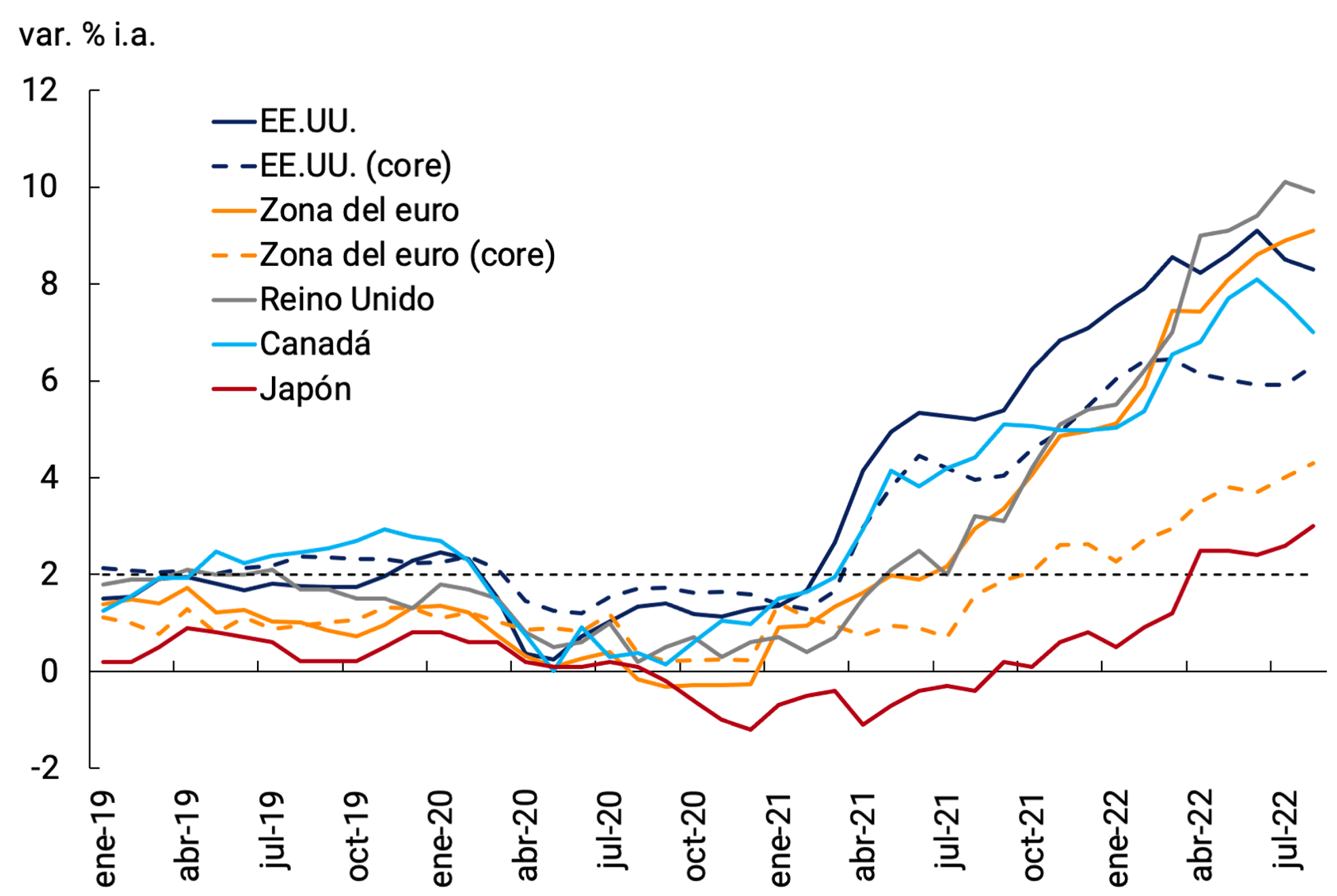

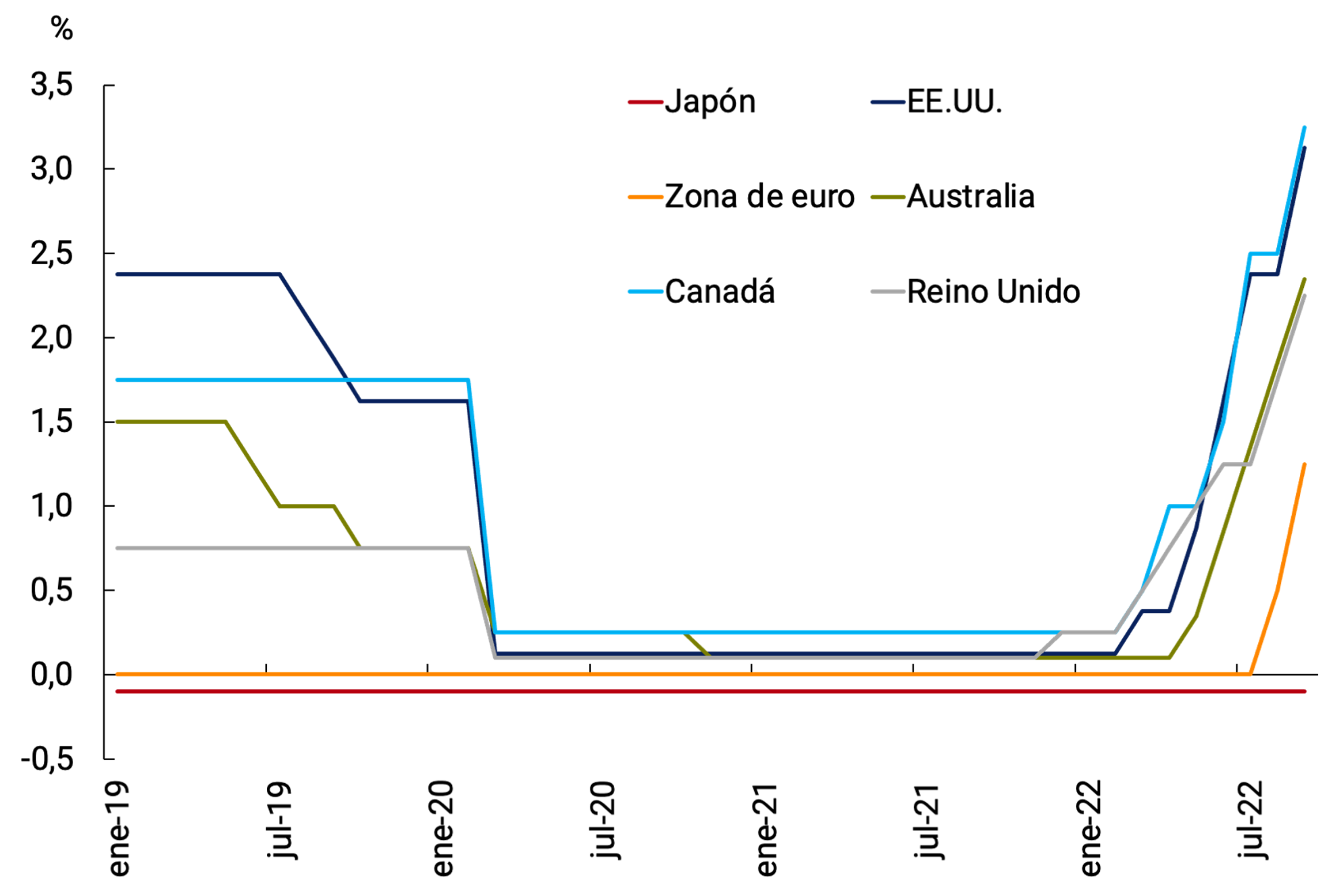

Figure 2.4 | Inflation and monetary policy rates of major advanced economies

Source: BCRA based on data from the respective central banks.

Inflation rates in the major advanced countries remain very high (see Figure 2.4). Inflation in the US stands at 8.3%, in the euro area at 9.1%, in the UK at 9.9%, in Japan at 3.% and in Canada at 7%. Inflation reached record values in recent decades in Europe (the most affected by the war in Ukraine), and for the rest of the advanced countries there is a slowdown at the margin, except in Japan. Core inflation continued to rise with second-round effects in Europe and the US.

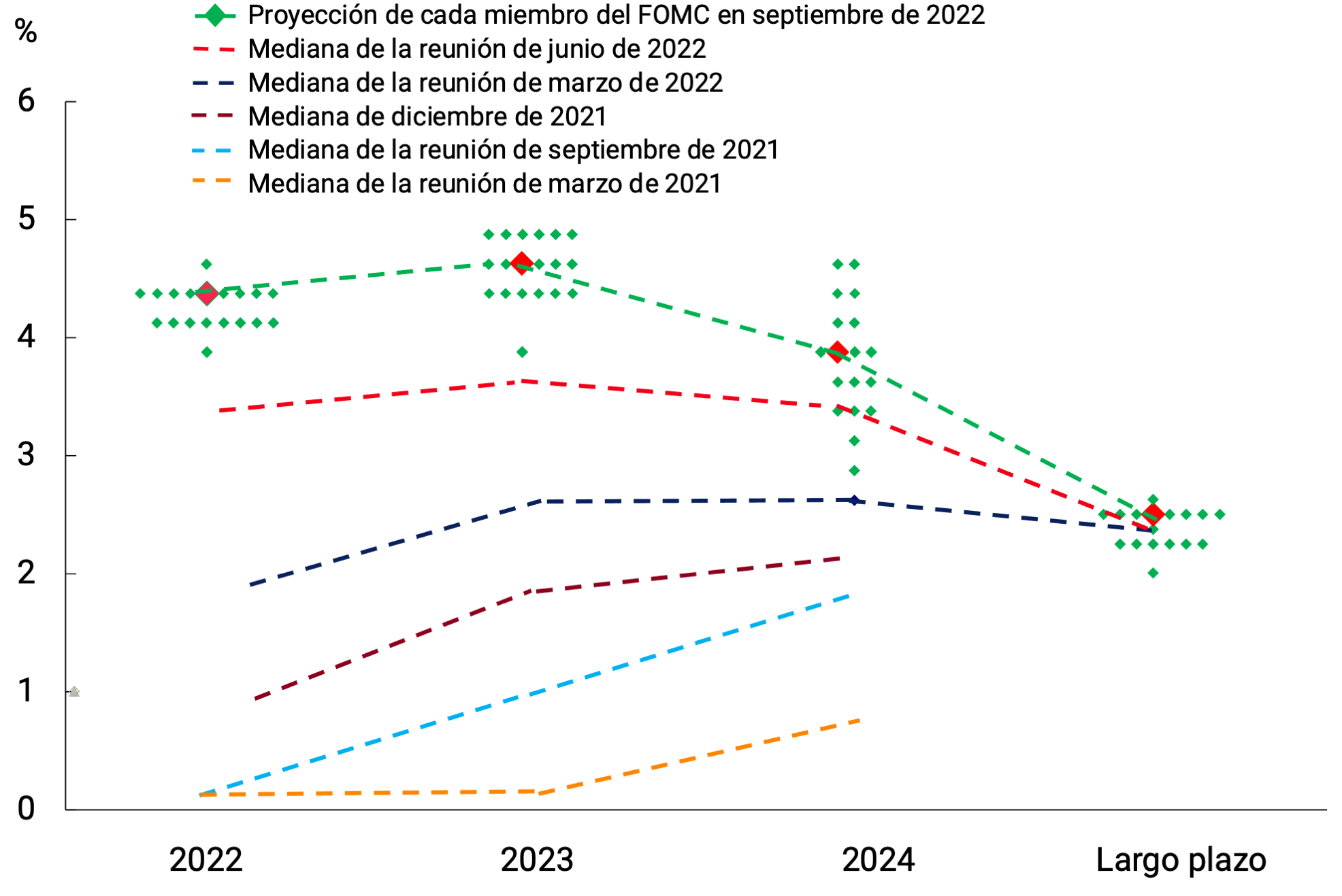

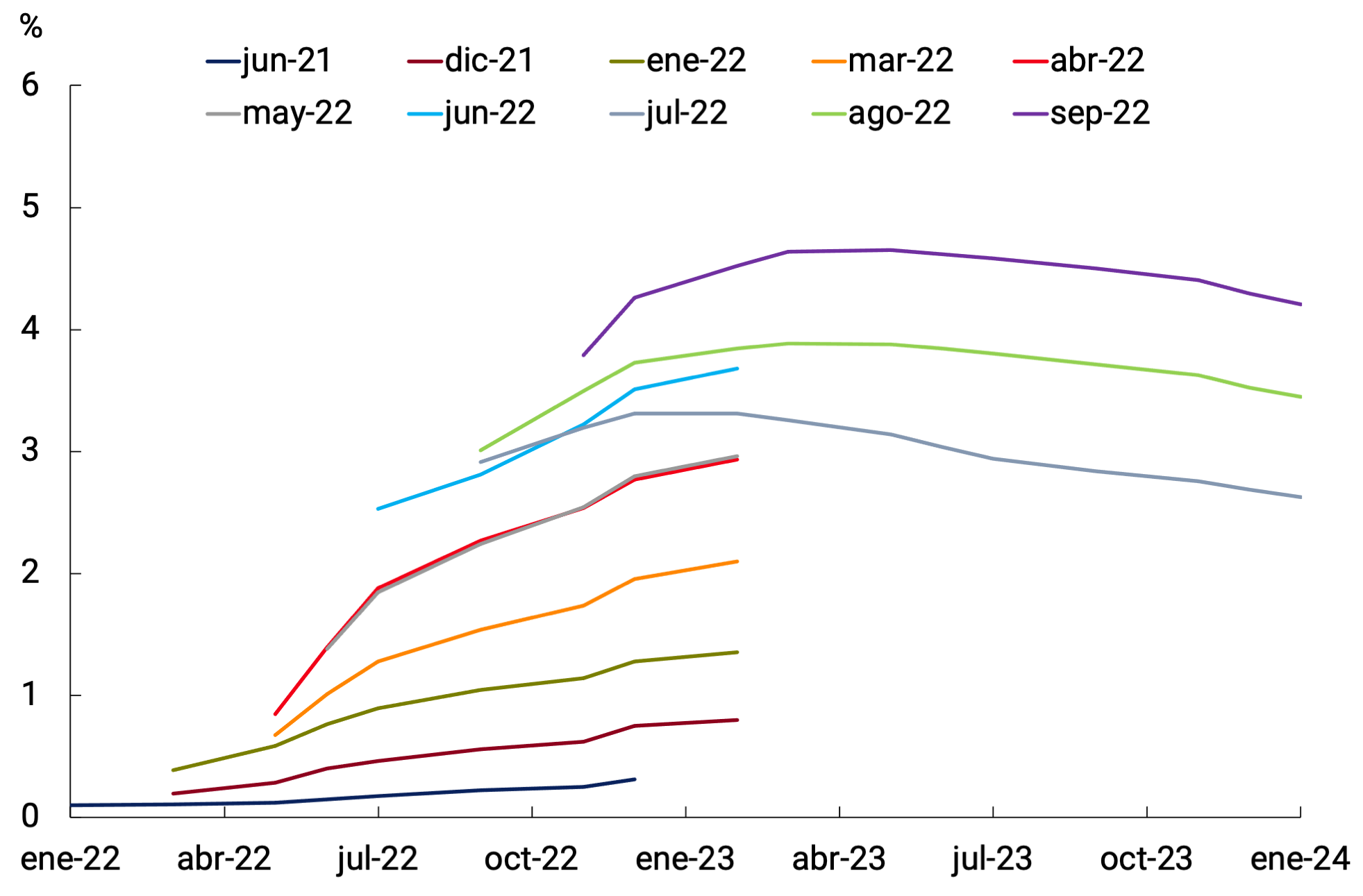

Figure 2.5 | Fed Fed Funds Rate Target Projection

Source: BCRA based on data from the US Federal Reserve and Bloomberg.

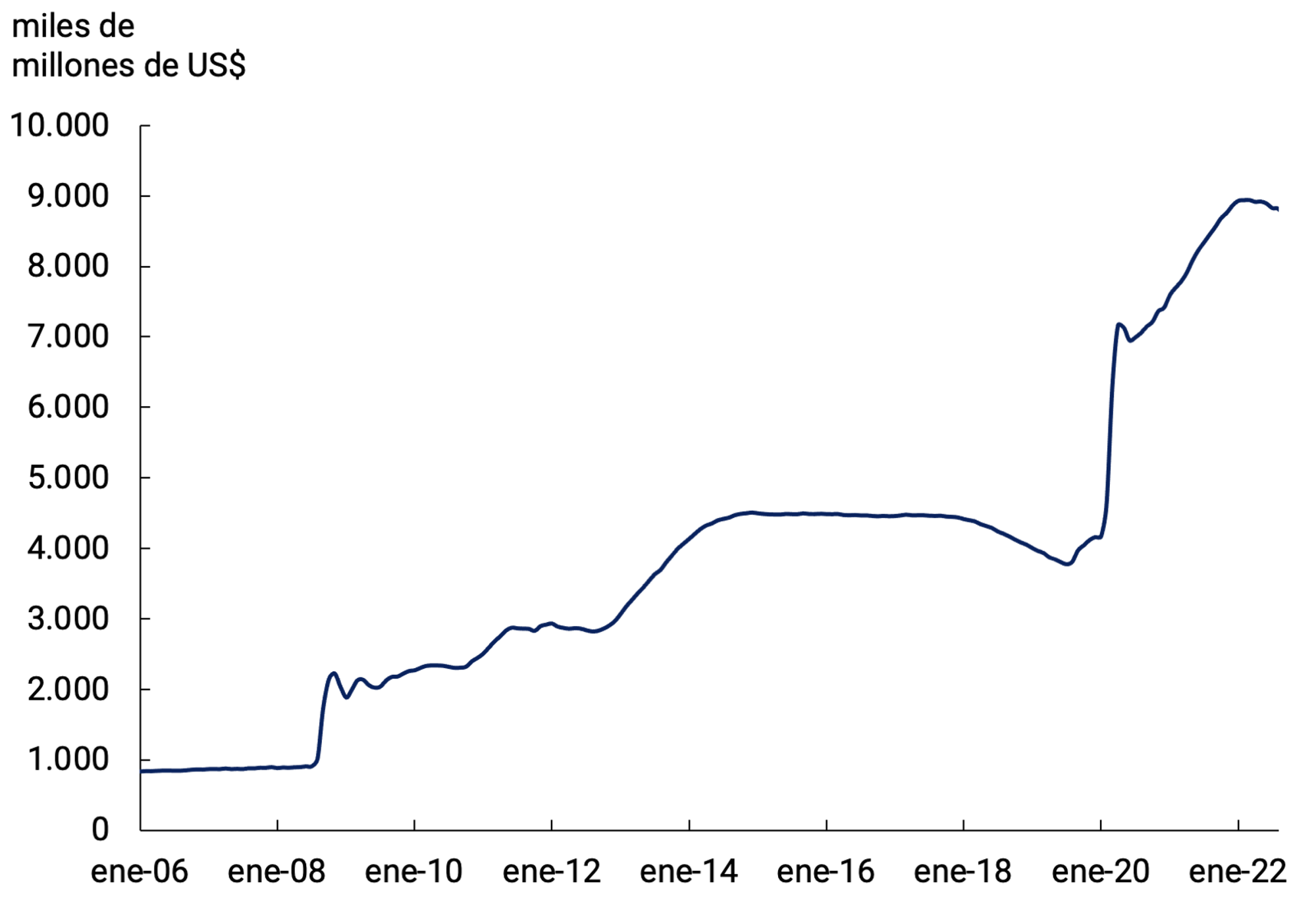

Against this backdrop, most central banks in advanced economies accelerated the pace of their contractionary measures. The U.S. Federal Reserve (Fed) increased its monetary policy interest rate (MPR) by 0.75 p.p. for the third consecutive time. Along with this, in one of the speeches widely followed by the market (Jackson Hole symposium), the Fed chairman took a very contractionary stance that impacted the Fed’s MPR futures curve. The same happened with the Fed chairman’s speech after the announcement of the increase in the MPR for September (see Figure 2.5). In addition, since September (as it had announced months ago) the Fed accelerated the pace of reduction of its assets to a speed that is at least three times higher than it reached in mid-2019 (prior to the liquidity problem in the treasury bond market, see Figure 2.6).

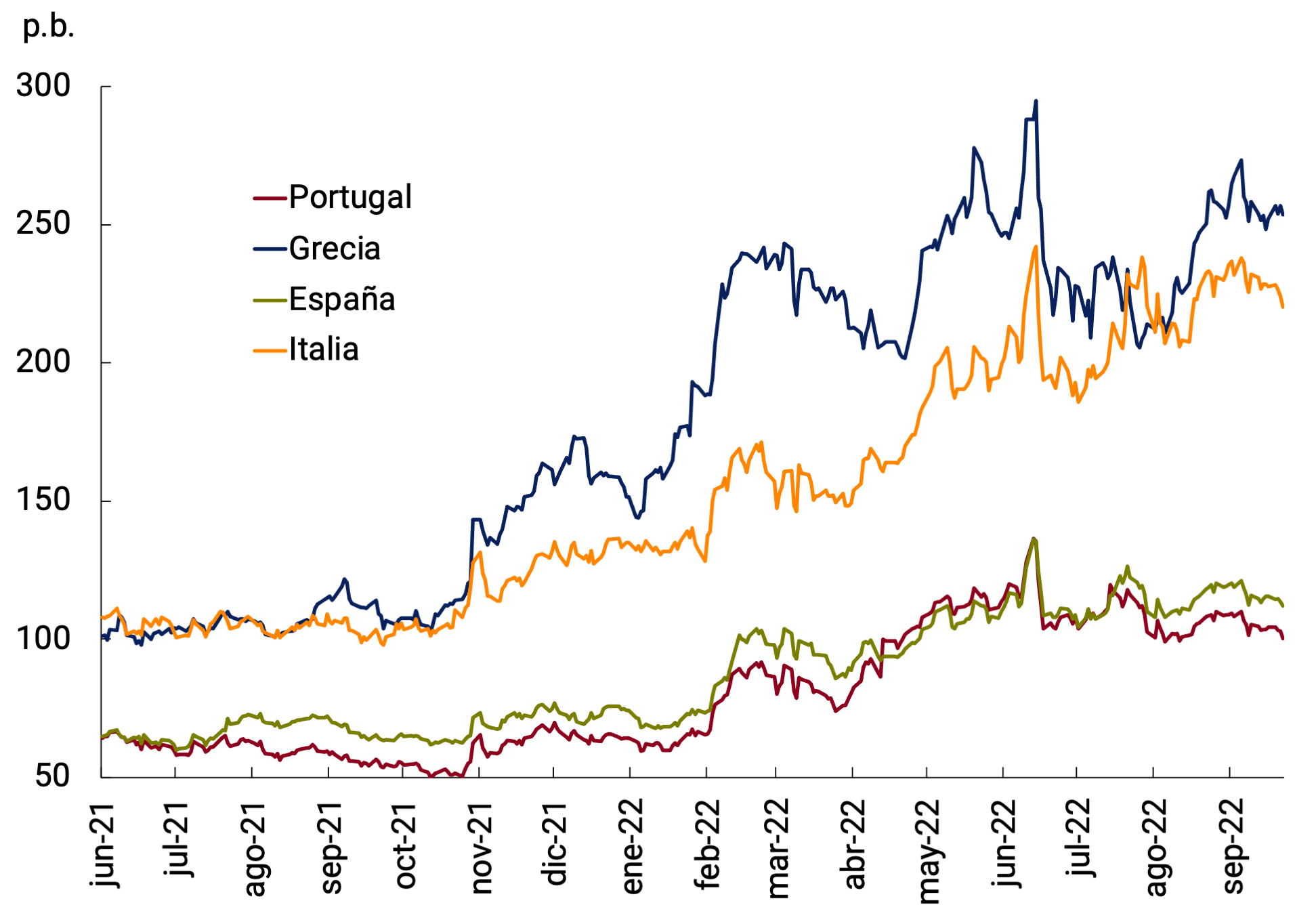

The European Central Bank (ECB) ceased, after eight years, to have the rate of its deposit facility in negative territory, raising it by 1.25 p.p. (0.5 p.p. at the July meeting and 0.75 p.p. at the September meeting), in the same magnitude as its MPR, and the rate of its lending facility, with further increases of at least 0.5 p.p. expected in the coming meetings. In July, it had ended its asset purchase program. But at the same time, the Transmission Protection Instrument (TPI) was approved: the ECB will be able to make purchases in the secondary market of bonds issued in jurisdictions whose financing conditions deteriorate without being justified by the fundamentals of the country’s economy. The scale of TPI purchases will depend on the severity of these risks and will not be restricted ex ante.

Meanwhile, the Bank of England raised its MPR (known as the bank rate) for the seventh consecutive time to 2.25%, its highest level since 2009. The Bank of Canada raised its MPR by one percentage point to 3.25%. The Bank of Japan was the only exception, as it continued its expansionary monetary policy (see Figure 2.4).

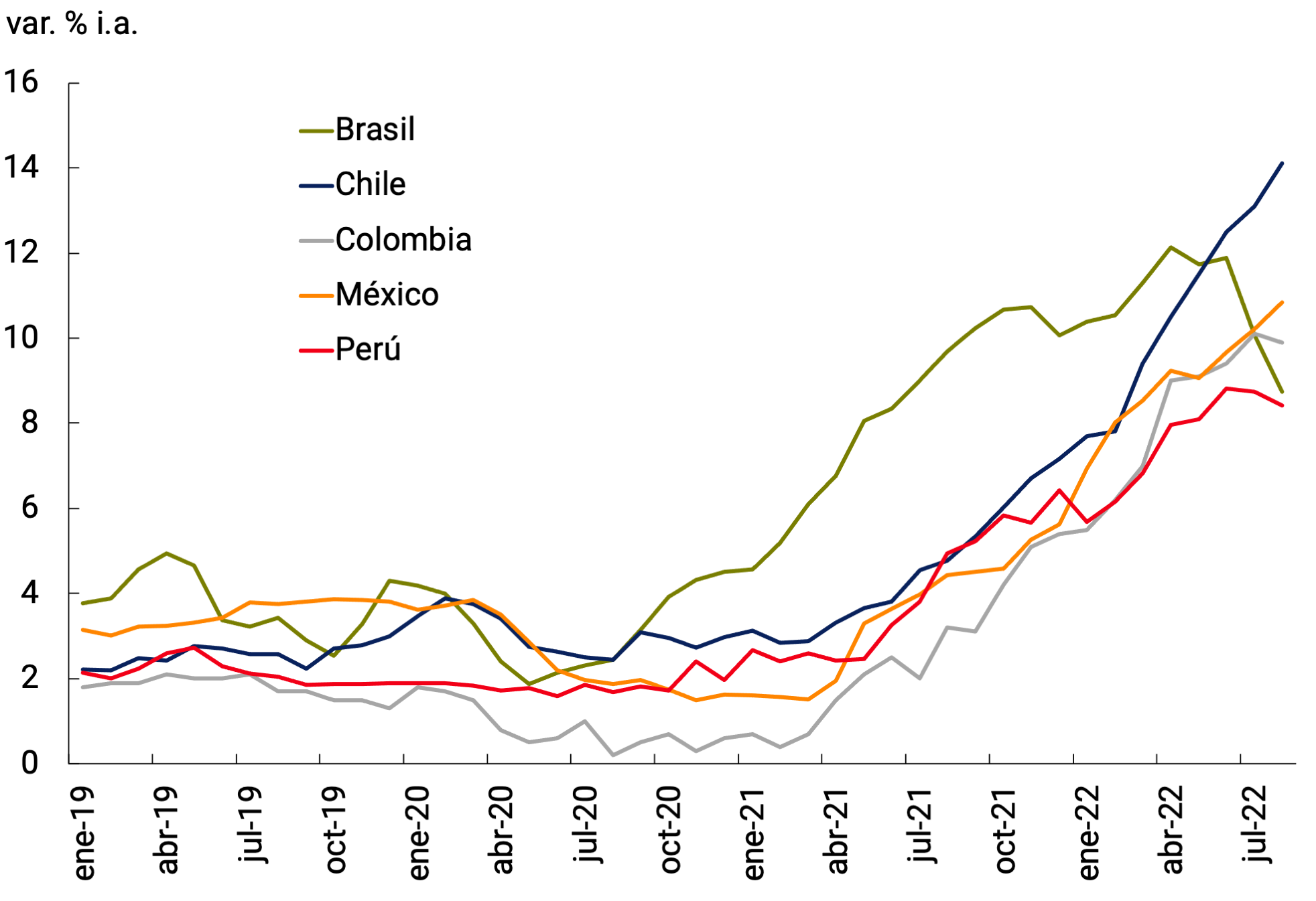

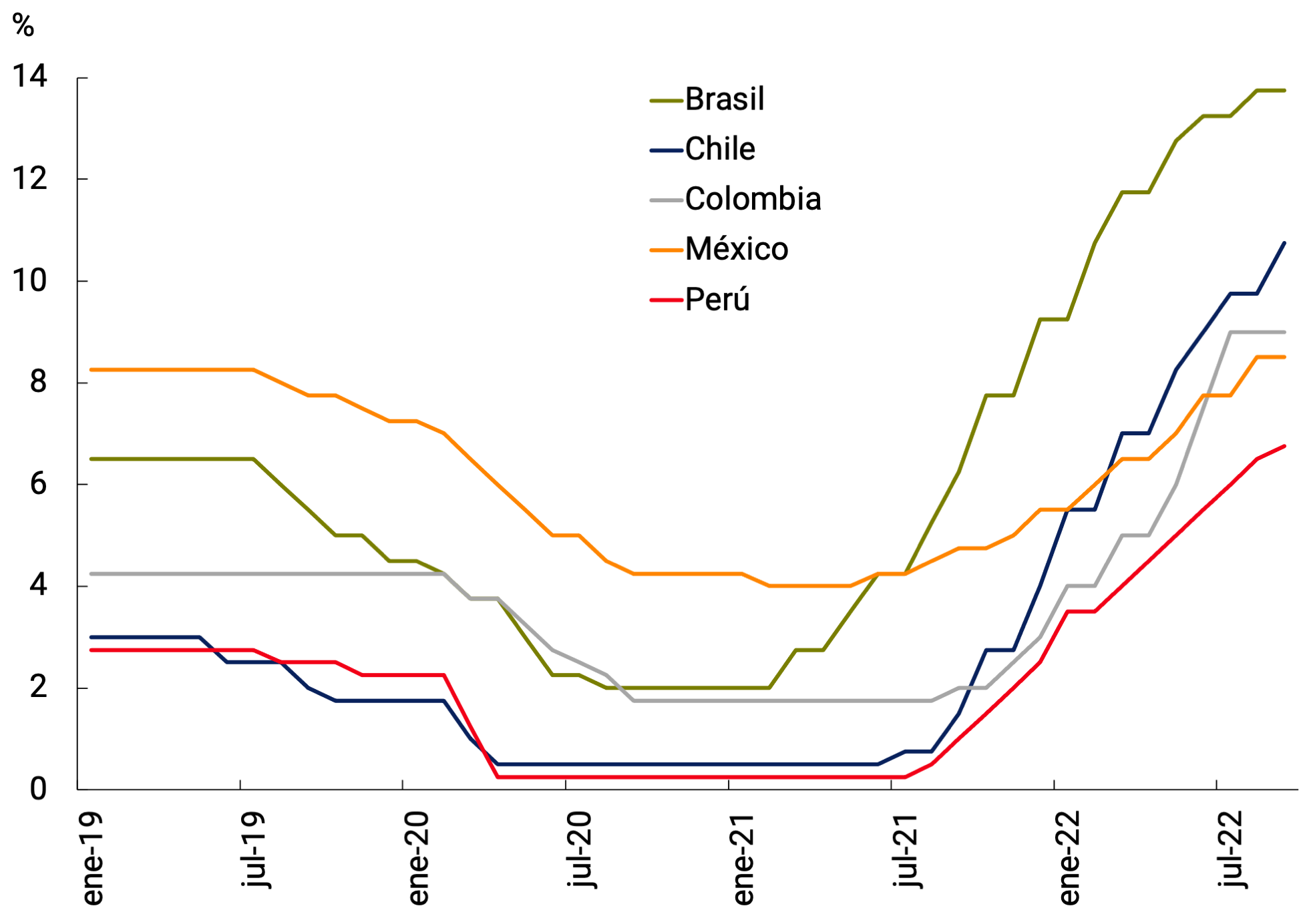

The inflation rate in emerging economies continued to rise and the monetary authorities of these economies continued to take contractionary measures, with the exception of Turkey. In the particular case of Latin American economies, inflation also reached record levels in decades, with the exception of Peru and Brazil, which registered a slight drop in the margin (in the latter case after a tax cut), but remains at levels well above the inflation target. In this context, the region’s central banks were no exception. Those that had started raising their MPR earlier and whose inflation fell (Brazil and Peru) paused or slowed down the implementation of contractionary policies (Brazil and Peru, in that order), while those that started later maintained very significant levels of increases in their MPR (see Figure 2.7).

Figure 2.7 | Inflation rate (left) and monetary policy (right) of emerging economies in Latin America

Source: BCRA based on data from official statistics institutes and the Central Bank of Brazil.

In the case of Chile, its central bank, in order to facilitate the adjustment of the Chilean economy to changing internal and external conditions, decided to implement a program of foreign exchange intervention and preventive provision of liquidity in dollars, for an amount of up to US$25,000 million from July 18 to September 30, 2022. In the case of foreign exchange intervention, he announced: 1) sale of spot dollars for an amount of up to US$10,000 million; 2) sale of foreign exchange hedging instruments for an amount of up to US$10,000 million; and 3) a currency swap program for an amount of up to US$5,000 million. Towards the end of September, the monetary authority announced that the foreign exchange intervention program had achieved its objectives, and, therefore, it will reduce its intervention in that market.

2.4. Global financial conditions tighten

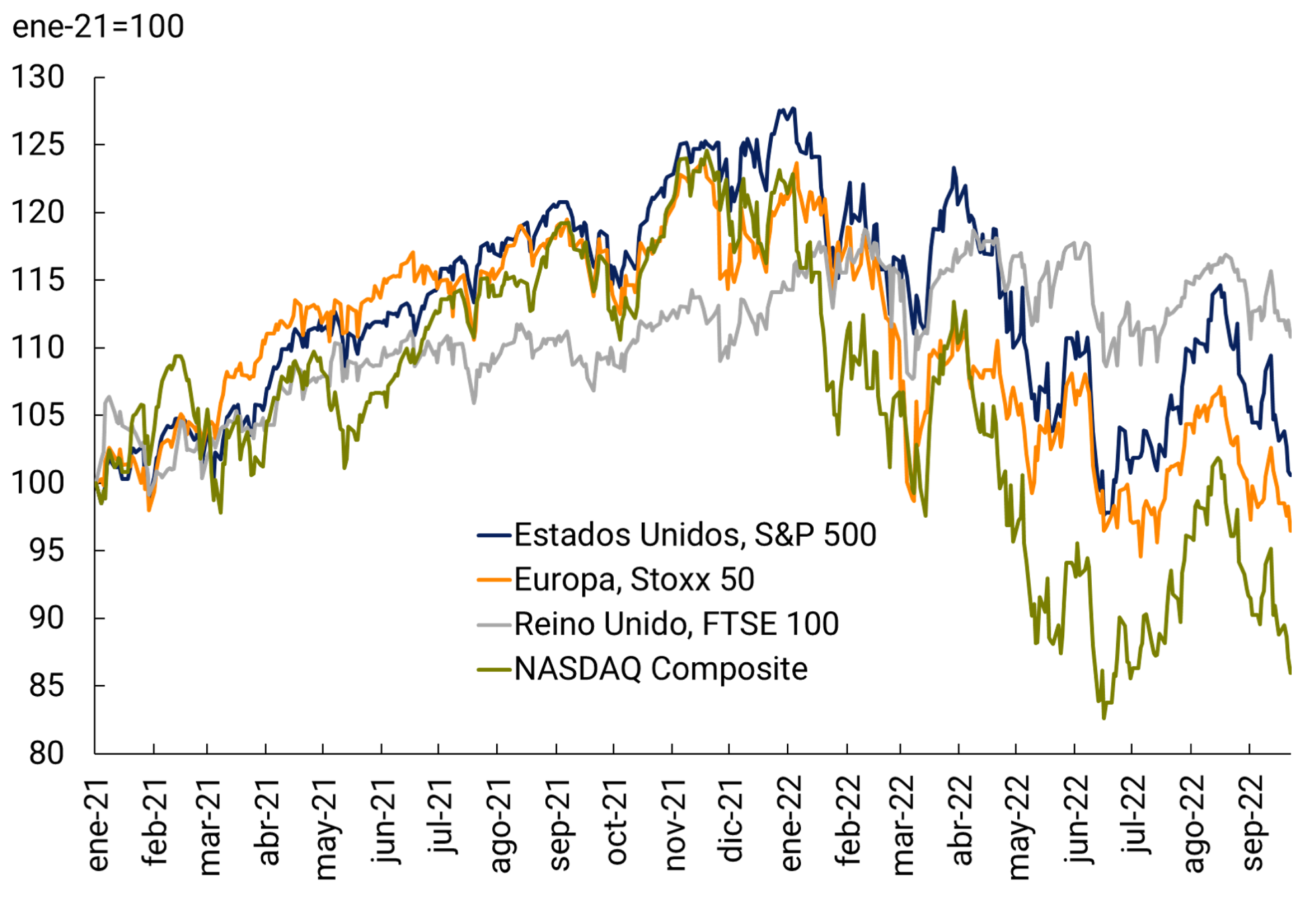

The markets performed determined by expectations of interest rate movements by the central banks of advanced countries, especially the Fed. Since the end of June, the stock markets began to rise, anticipating less monetary tightening in the face of the risk of a recession, and already discounting interest rate cuts in 2023. In the face of clarifications from the Fed, marking that this scenario was unrealistic, the stock markets returned to a downward trend. Both Europe’s S&P 500 and Stoxx 50 are down 20% for the year (see Figure 2.8a).

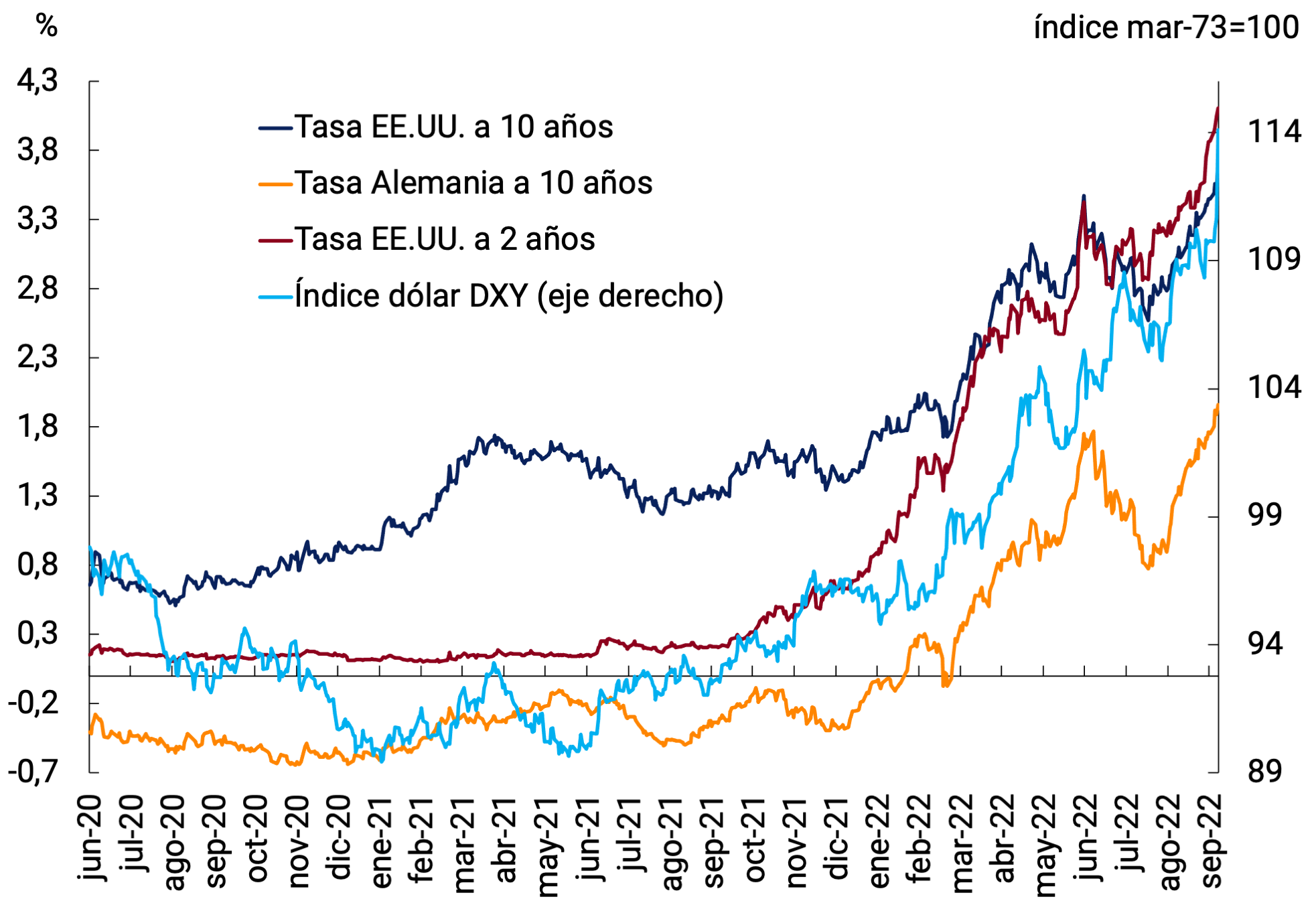

As a mirror of the aforementioned movements, interest rates on 10-year bonds, both in the US and Germany, fell on expectations of less tightening by central banks, only to rise again in recent weeks. Thus, the 10-year rate of the US stands at 3.69%, 105 bps above the previous IPOM close. The US dollar continued to appreciate, setting highs against the yen and the euro. Against a basket of currencies, the dollar appreciated 16% for the year, reaching its highest level in 20 years (see Figure 2.8b). All of the above implies tougher financial conditions for developing countries.

Figure 2.8 | Asset

index

Source: BCRA based on Bloomberg data.

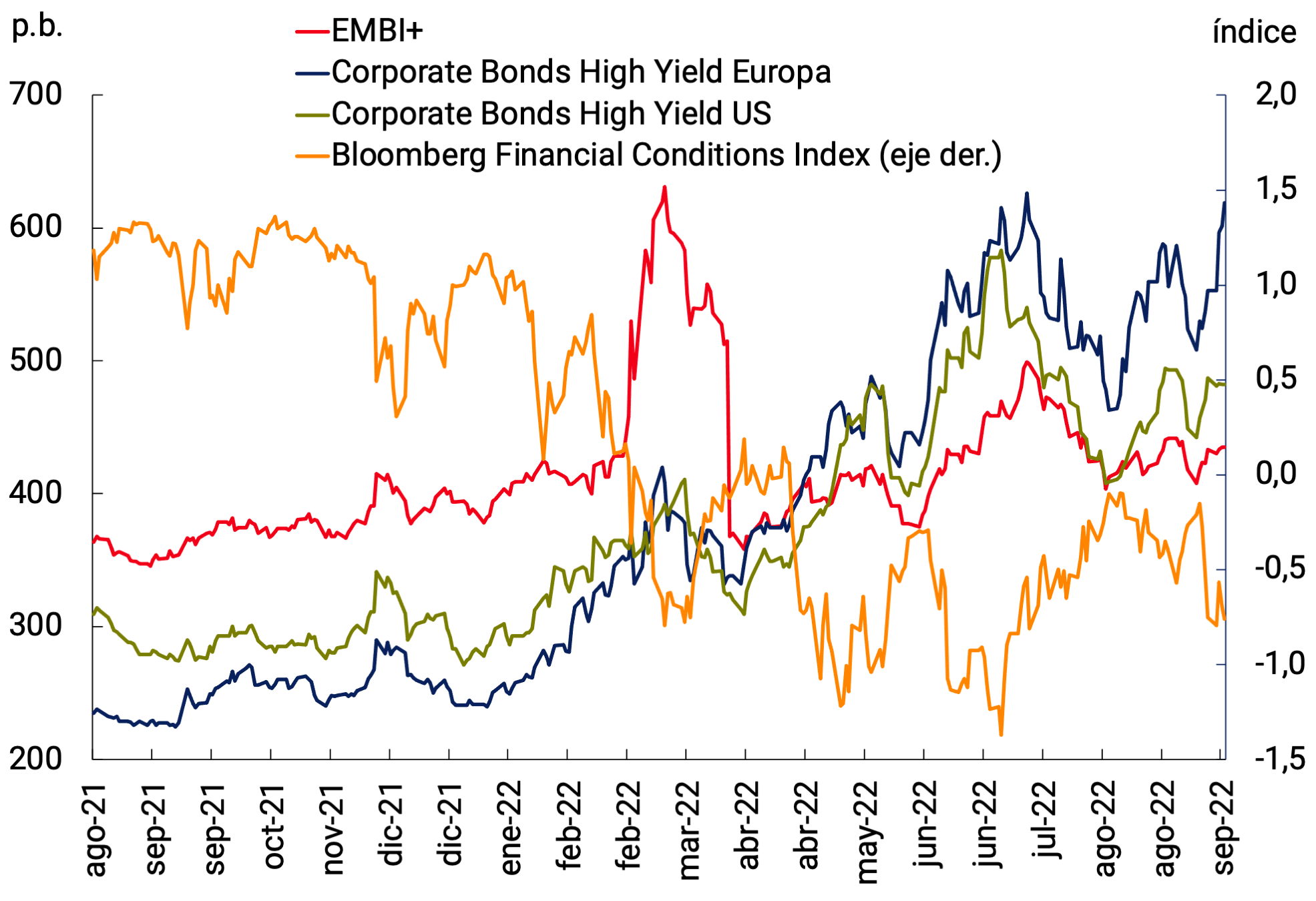

This further tightening was reflected in the returns on developing-country financial assets, with increases in sovereign spreads (as measured by the EMBI+) and also in assets that are substitutes for developing-country assets in investment portfolios, such as advanced-country high-yield corporate bonds (see Figure 2.9a). Capital outflows from emerging countries continued in the quarter. In addition, bond yields of riskier European countries rose (see Figure 2.9b), prompting the ECB to take steps to control it (see previous section).

Figure 2.9 | Asset Markets

Source: BCRA based on Bloomberg data.

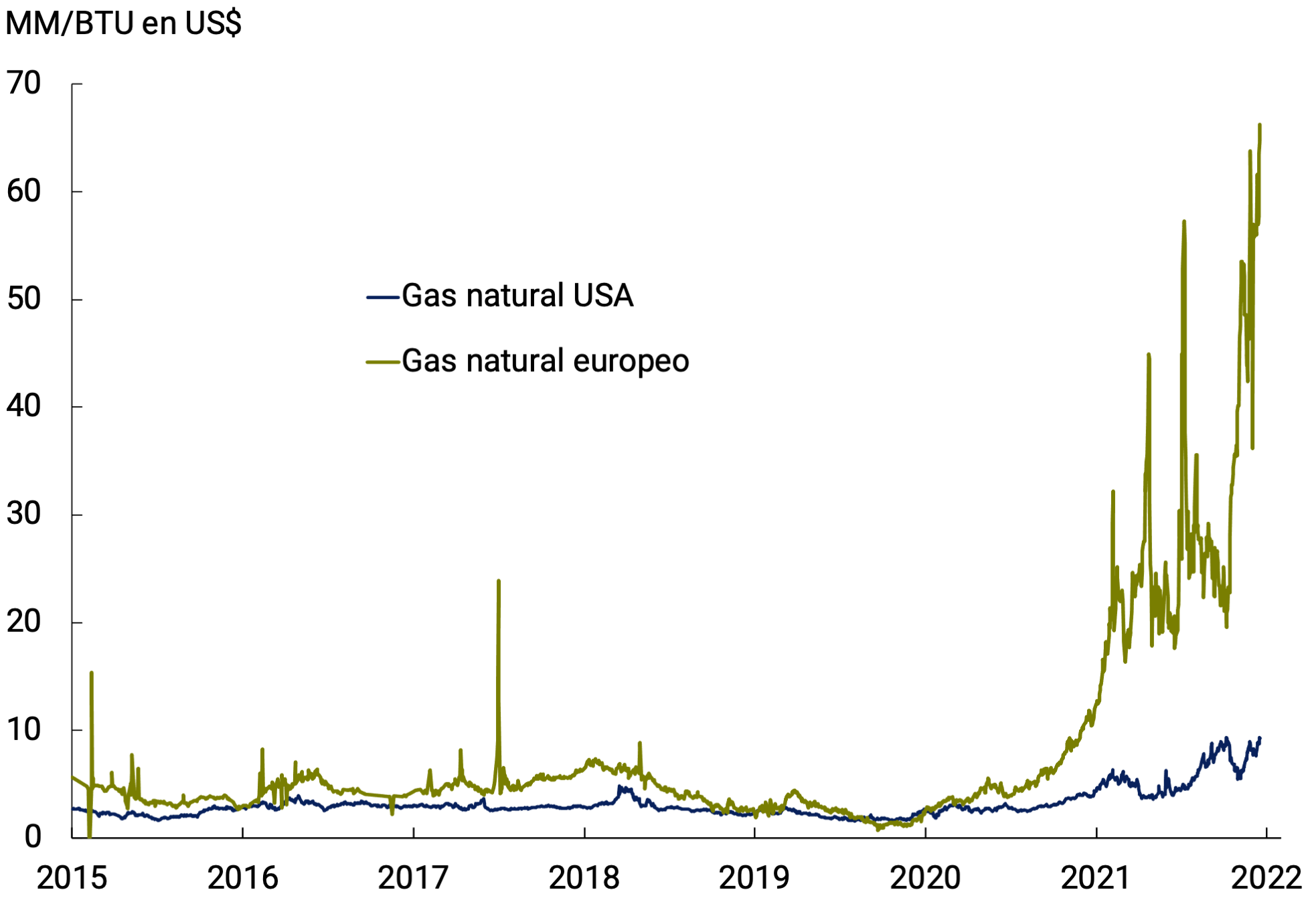

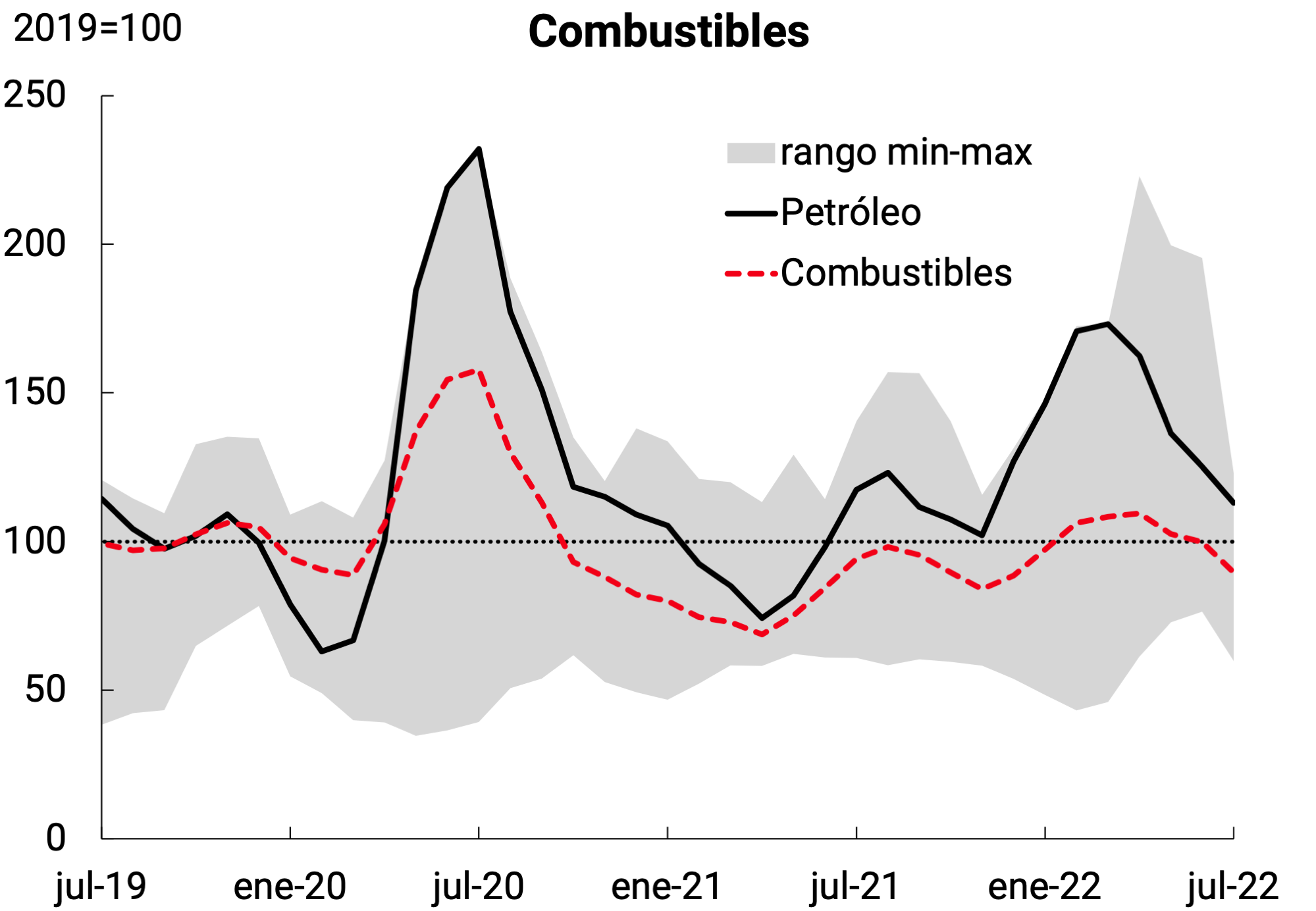

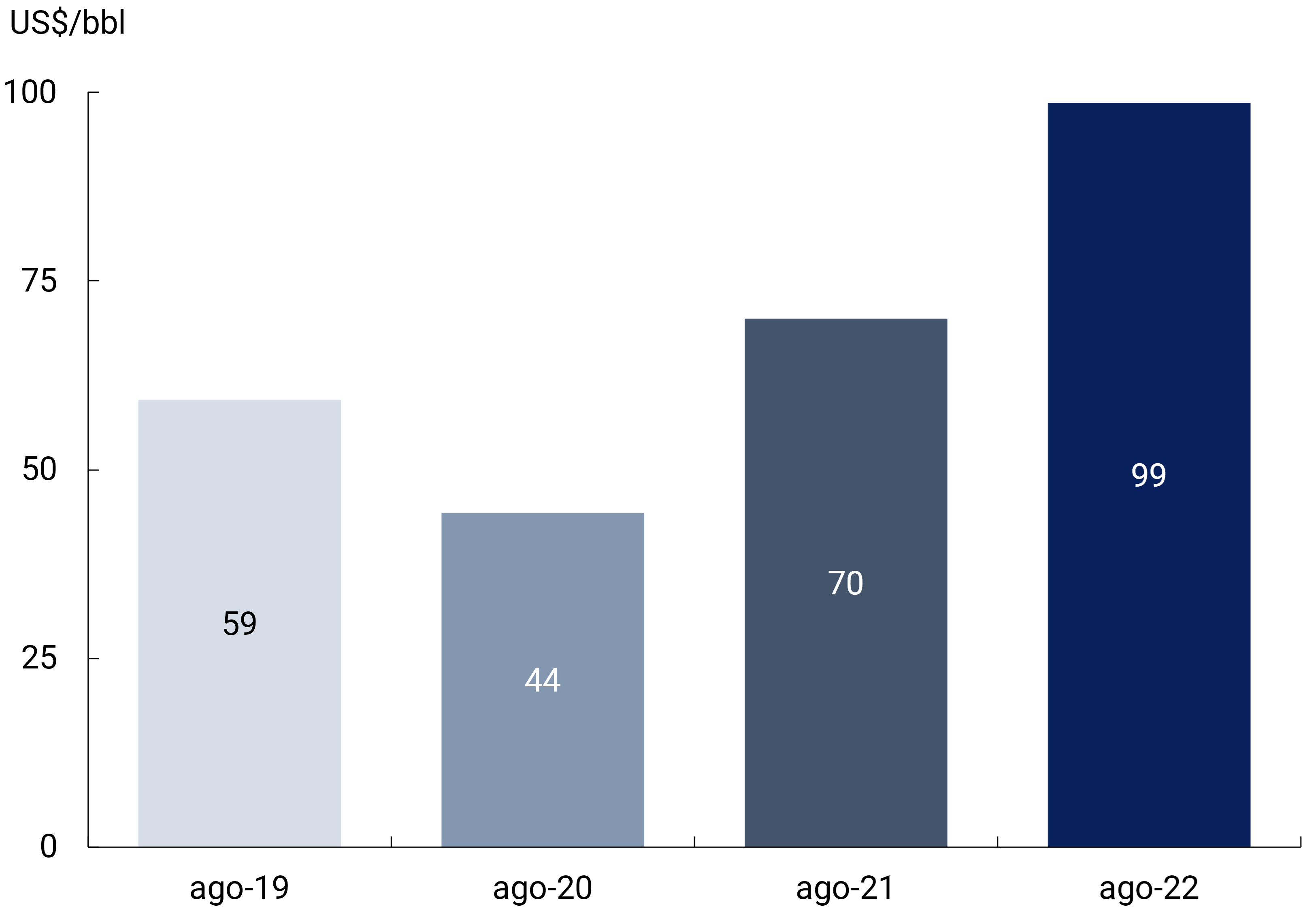

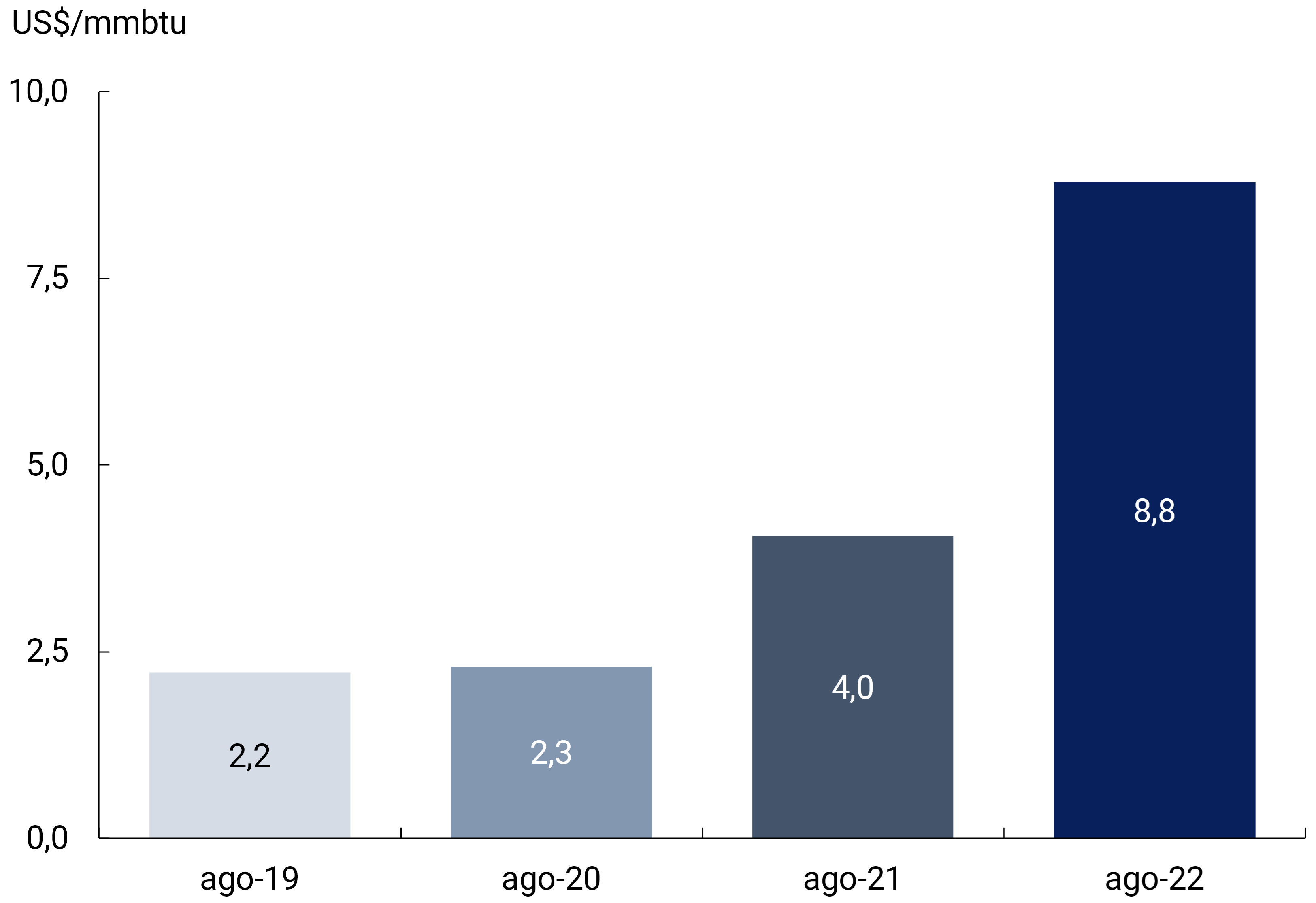

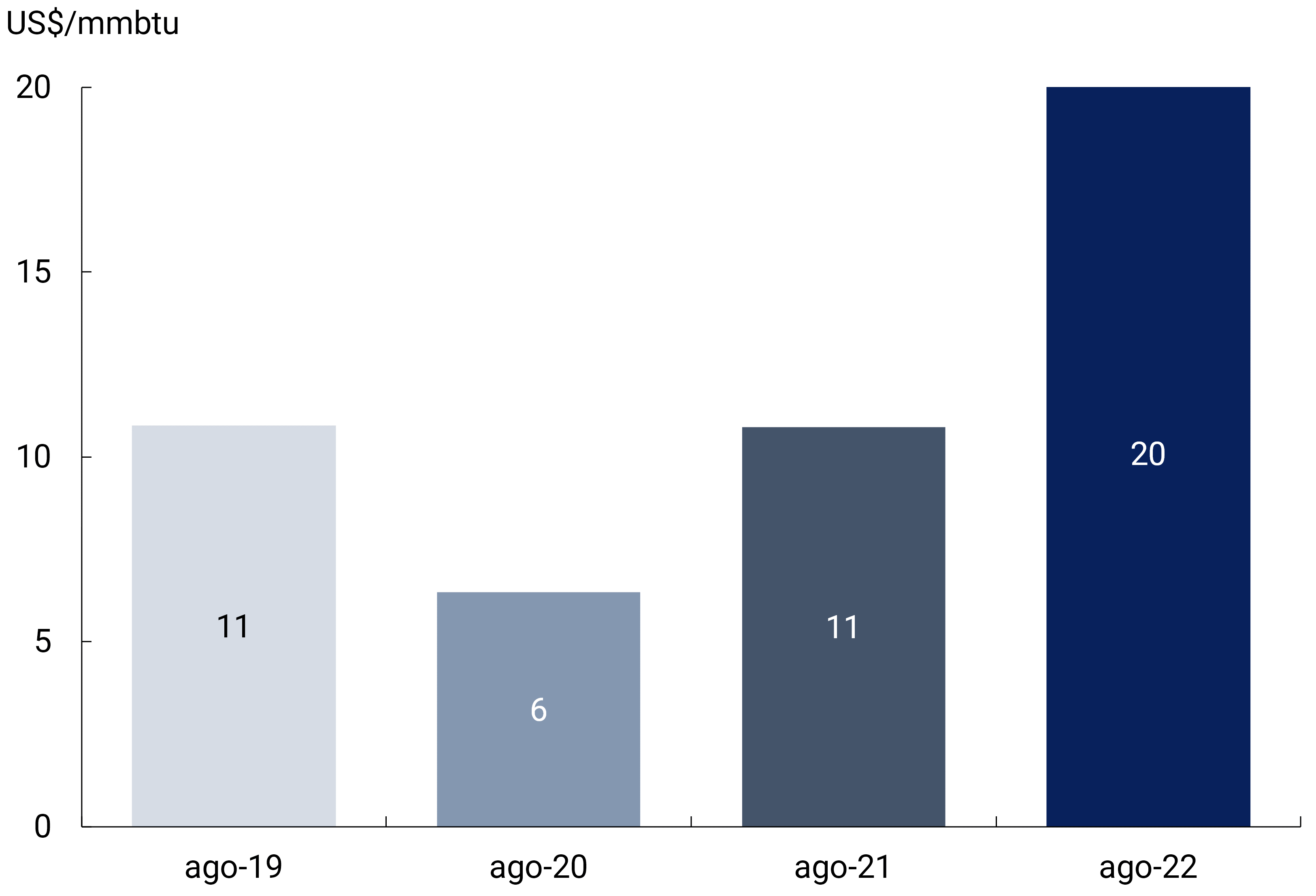

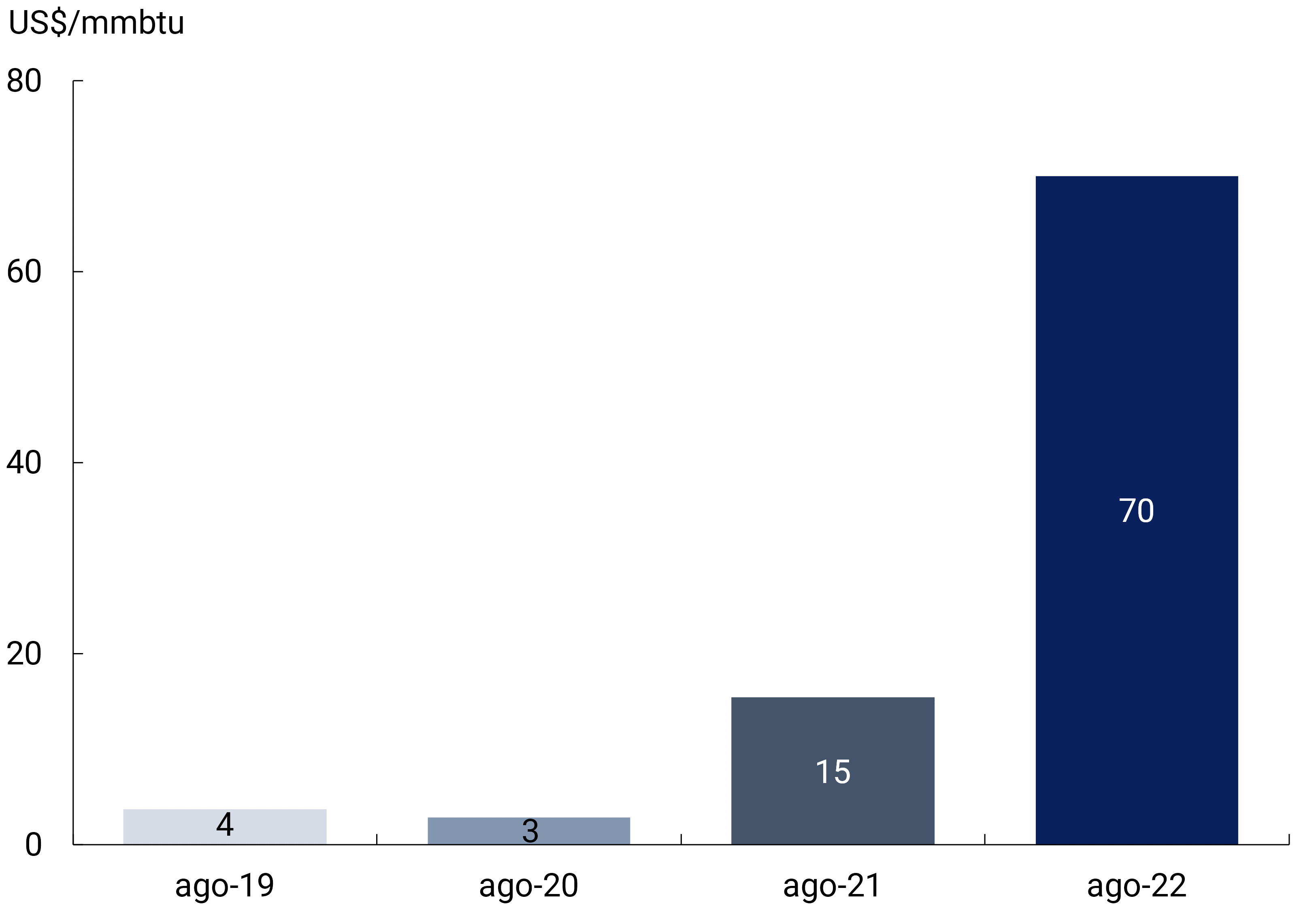

2.5. Commodity prices fell sharply in the last quarter except for energy

Commodity prices tended to return to pre-war levels, mainly affected by the risk of a global recession. Energy commodities were an exception, and continued to suffer from the volatility derived from the conflict. WTI crude oil had three consecutive months of decline, after having reached US$116 per barrel on May 30, currently trading at US$83 due to fears of a global economic slowdown that could be generated by the Fed’s interest rate hike, hurting fuel demand. A hotter-than-usual summer in Europe, the sanctions imposed on Russia and the latter’s decision to provide only 20% of the usual gas supply through the Nord Stream pipeline had a strong impact on both the level and volatility of the gas price, which reached a record price of US$66 billion BTU on August 18 in the European wholesale gas market in the United States. Bass. This price differential with the North American market led to a redirection of gas exports from the United States, where the domestic price reached a 15-year high of US$8.78 per MM BTU on August 22 (see Figure 2.10a).

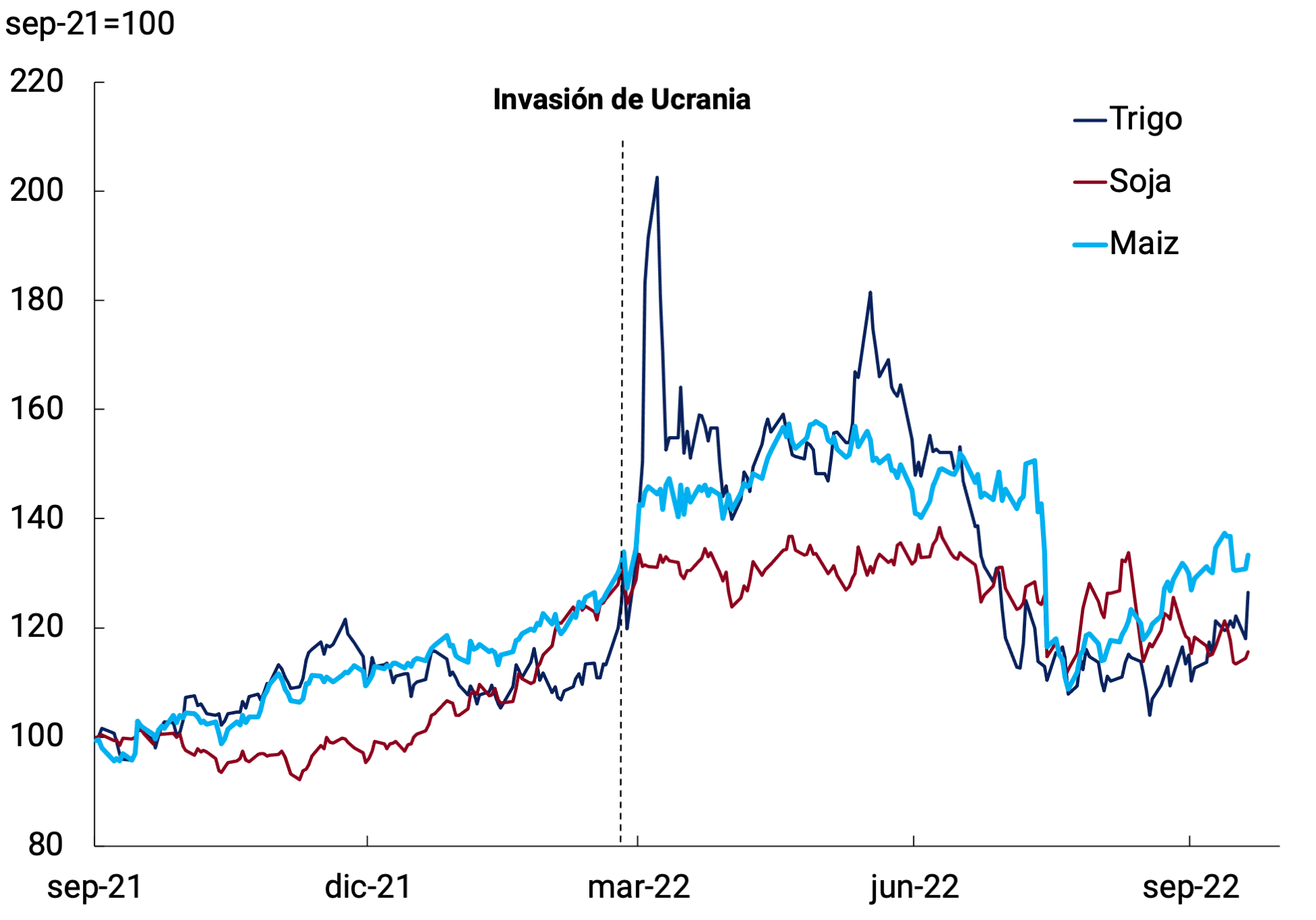

Following the agreement reached between Russia and Ukraine under the auspices of the UNon July 22, the 20 million tons of Ukrainian grain that had accumulated in ports since the conflict began began to be gradually released. Wheat and corn, which reached US$523 and US$321 per tonne respectively at the height of the conflict, are currently trading at US$327 and US$272 per tonne, bringing the prices of both cereals back to values at the beginning of the year, prior to the conflict in Ukraine. Soybeans, on the other hand, decreased in price in the last quarter after several countries revised their production forecasts towards record harvests, such as Russia, or simply higher, such as in the United States. In addition, demand did not generate enough pressure on the price due to uncertainty about the world economy. Soybeans are currently trading at US$543, which represents February values of this year (see Figure 2.10b). Going forward, the entry of grains into the international market that have accumulated in Ukrainian port silos since the invasion began on February 24 could be a determining factor in avoiding a new price rise. On the other hand, the price of energy commodities , particularly gas, could have structural or long-term repercussions, providing greater volatility, which could persist even after the end of the war.

Figure 2.10 | Selected Commodity Prices

Source: BCRA based on Bloomberg data.

2.6. In summary

The global economy has slowed, and the risks of a recession have increased. At the same time, rising inflation has triggered a more pronounced monetary contraction in advanced countries, while developing countries had already been raising interest rates. Global financial conditions are more adverse for emerging countries (higher rates, appreciated dollar and higher risk spreads); and interact with commodity prices that are at levels prior to the war, except for the sharp rise in energy. Although global supply chains are becoming regularized, their continuity depends on the evolution of the pandemic in China. The balance of risks points to lower global activity and tighter financial conditions, depending on how much monetary policy continues to tighten in advanced economies in the face of persistent inflation.

Back to top

3. Economic Activity and Employment

In the second quarter of 2022, GDP grew above expectations at the beginning of the year. The activity of the non-agricultural sectors as a whole more than compensated for the negative impact that the lack of rainfall caused on the economic performance of the soybean and corn complex.

As expected, the particularly dynamic sectors during the first half of 2022 have been the services that had fallen the most during 2020 and that as a whole have already managed to recompose their pre-pandemic levels. Also noteworthy is the evolution of some primary activities such as Mining and Fishing, which far exceed the highs of the end of 2017, and those of Industry, Commerce and Construction, which were the ones with the greatest impact on the post-pandemic recovery.

From the point of view of demand, the investment rate reached an all-time high and some acceleration was observed in the growth rate of private consumption, which was lagging behind.

With a statistical drag of 5.3 percentage points (p.p.) left by the growth observed in the second quarter, the growth of economic activity would have stopped in July and August, in a context of greater financial volatility and inflationary acceleration. It is expected that the set of monetary and fiscal policy measures recently adopted within the framework of the goals committed to the IMF will strengthen macroeconomic stability and improve the perception of risks to fiscal sustainability, a necessary condition for resuming the path of economic growth.

3.1. Economic activity grew above expectations during the second quarter of 2022 and deteriorated from July with the increase in financial volatility

GDP registered a growth of 1% quarterly without seasonality (s.e.) in the second quarter (6.9% y.o.y.), significantly above the estimates of the main market analysts, who expected a fall of 0.7% according to the median of the REM corresponding to the June survey. This deviation from expected growth was mainly explained by the outstanding performance of those services that had been greatly affected by the pandemic and the less damage compared to what was estimated three months ago, of the drought on agricultural production.

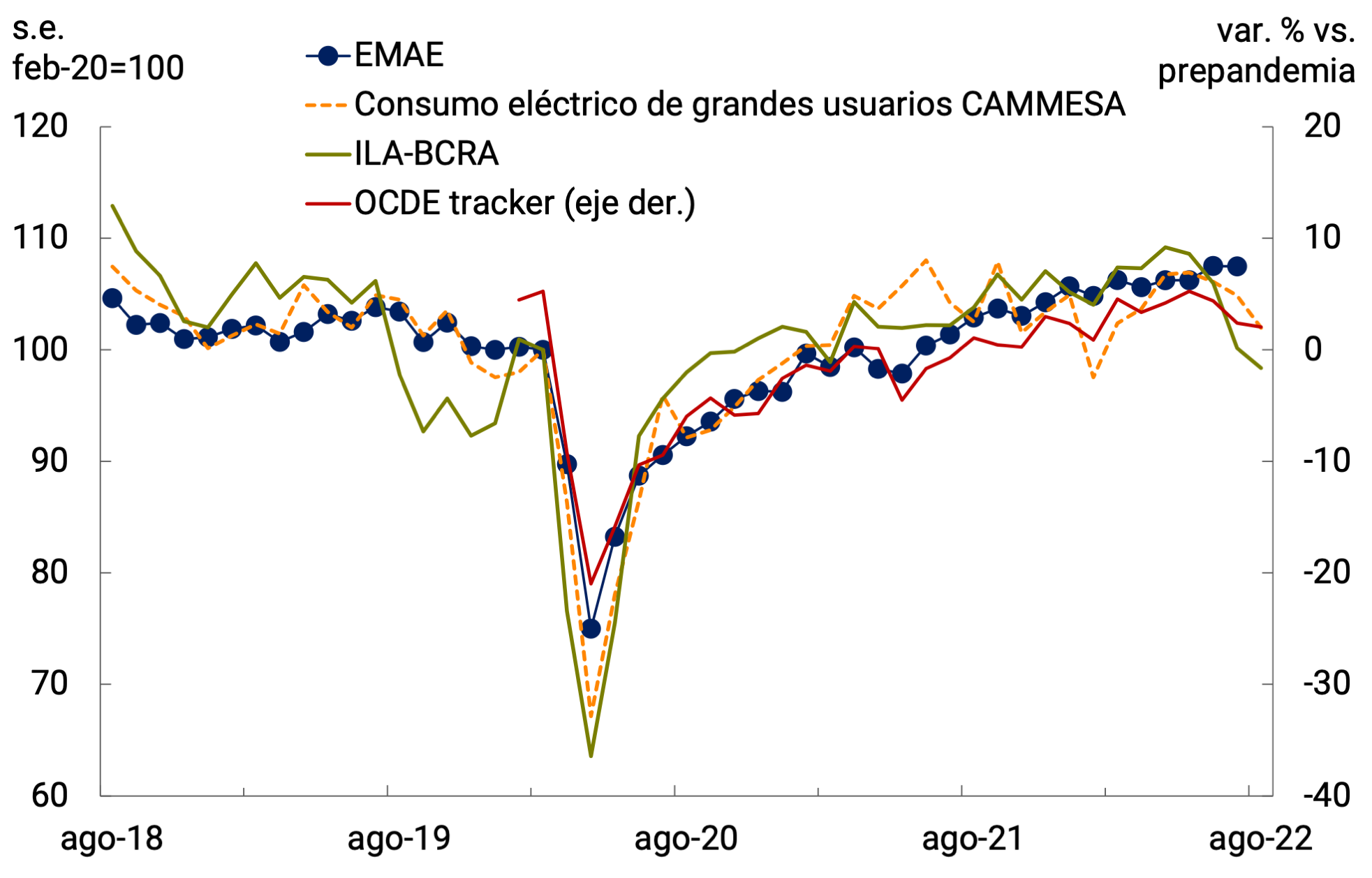

In a particularly challenging local and international context, July saw an increase in volatility in financial markets and heightened fears about the future of economic policy. The Monthly Estimator of Economic Activity (EMAE) remained stagnant in July at the level of the previous month. Compared to the same month in 2021, it increased in July by 5.6% y.o.y., while in the January-July average the accumulated growth was 6.4%.

It should be noted that, in July, both the Leading Activity Indicator (ILA-BCRA) and the activity indicator prepared by the OECD – based on Internet searches through Google – had shown deteriorations3. In August, the leading indicators showed a contraction compared to July, so a deterioration in the performance of activity during the third quarter is expected compared to the second quarter (see Figure 3.1).

Figure 3.1 | Monthly indicators of economic

Source: BCRA based on data from INDEC, CAMMESA and OECD.

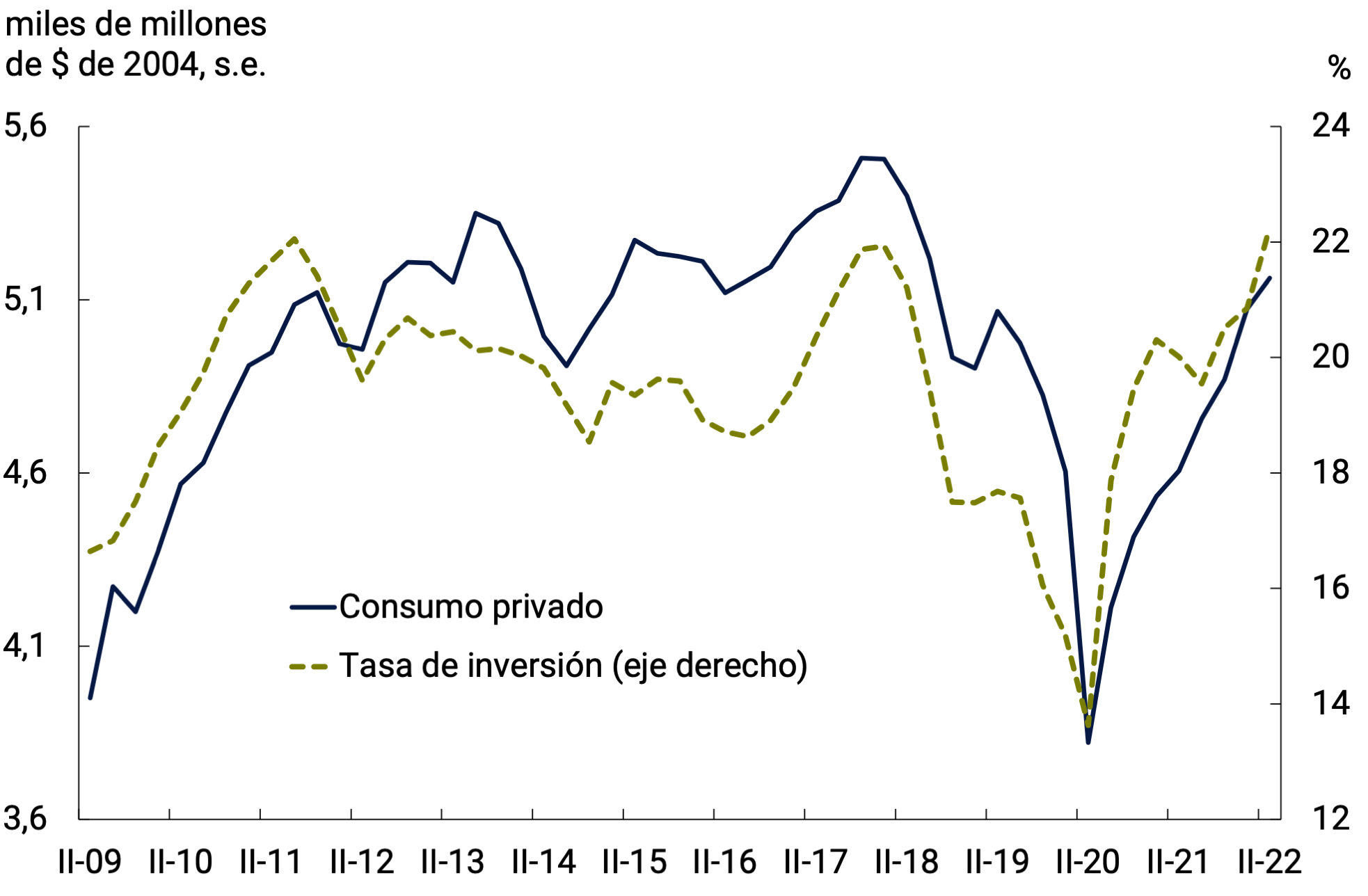

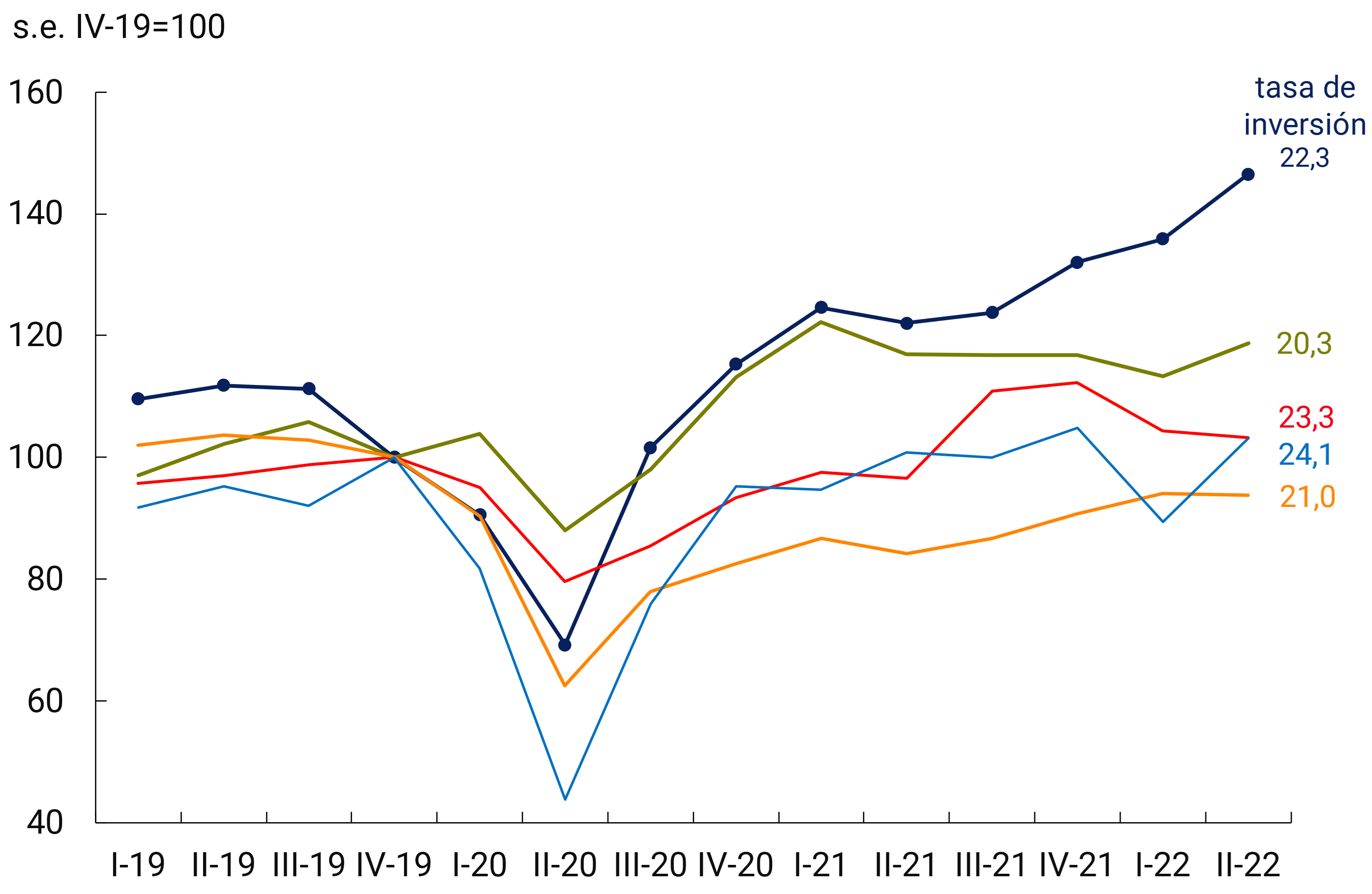

The investment rate was at its highest since 1993 in the second quarter while private consumption responded to the increase in the wage bill

From the point of view of expenditure, the increase in GDP of 1% qoq s.e. during the second quarter of 2022 was explained by the performance of domestic demand – total domestic expenditure on consumption and investment – which continued to increase significantly (2.8% qoq s.e.) mainly due to the effect of investment4, which registered a 7.8% qoq increase s.e. (18.8% y.o.y.) and contributed 1.6 p.p. to the quarterly variation of the Product. Private Consumption grew 1.8% quarter-on-quarter (10.7% YoY) and Public Consumption, 0.2% quarter-on-quarter (5.3% YoY). The external sector was neutral in terms of its contribution to the quarterly variation in GDP during the second quarter of 2022. Exports of goods and services, which had been declining, increased 3.5% qoq s.e. (9.3% y.o.y.) while imports attenuated their rate of increase to 2.9% qoq s.e. (23.1% y.o.y.).

In historical perspective, the investment rate measured at constant prices and calculated on seasonally adjusted series stood at 22.3% of GDP in the second quarter of 2022, the highest since the first quarter of 1993. As for Private Consumption, the level of the second quarter was lower than the maximum of the fourth quarter of 2017 (-6.3% s.e.) and was similar to that observed at the beginning of 2019 (see Figure 3.2).

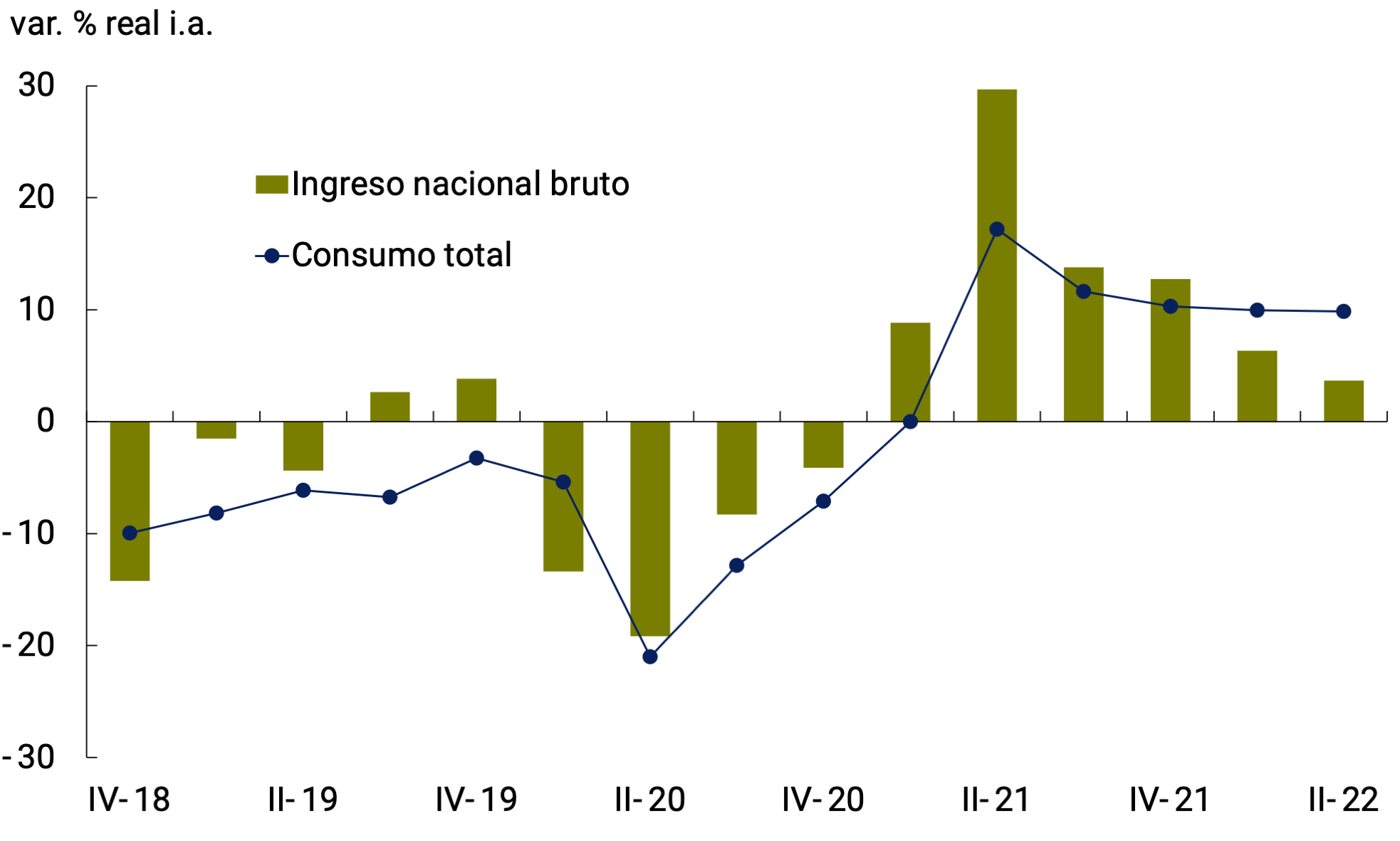

It is worth mentioning that consumption-savings decisions and consequently the savings-investment identity, were strongly altered with respect to their traditional determinants, both during the worst moment of the pandemic and in the subsequent recovery. From the second quarter of 2020 to the fourth quarter of 2021, National Income grew above Total Consumption measured in real terms5, i.e. an increase in Gross National Savings was observed that supported the increase in Consumption in 2022 (see Figure 3.3 and Section 2 / The post-pandemic recovery in the main economies of South America).

In 2021, the recovery in total consumption had been driven by the mass of non-wage income. The collapse in consumption during the worst moment of the pandemic – the second quarter of 2020 – was also fundamentally explained by the drastic fall in this mass of income, highlighting that the magnitude of the real fall in the Remuneration of Salaried Work (RTA) in that period of confinement was lower than that observed in the fourth quarter of 2018 and the first quarter of 2019. With data for the first quarter of 2022 and estimates for the second, the RTA, which accounts for the evolution of both employment and wages, would have increased at an average rate of 67% y.o.y., similar to that of national income, while total consumption increased 77.6% y.o.y. in nominal terms and implicit prices of private consumption increased 62% y.o.y.

Figure 3.3 | National Income and Total

The deflator of Income and Total Consumption used is the IPI of Private Consumption.

Source: BCRA based on INDEC data.

This performance of national savings was reflected in the external accounts. The Current Account deteriorated over the course of 2022 in a context of less favorable terms of trade, and a negative contribution of Net Exports to the change in Output during the third quarter is expected (see Chapter 4. External Sector).

3.1.2. Several productive sectors exceeded the maximum levels of activity at the end of 2017, while industry and commerce have grown the most compared to the pre-pandemic period

In the second quarter of 2022, services once again showed a better economic performance than goods. Overall, the goods-producing sectors grew 1% quarter-on-quarter (4% y.o.y.) while services grew at a rate of 1.4% qo-o-y (8.5% y.o.y.).

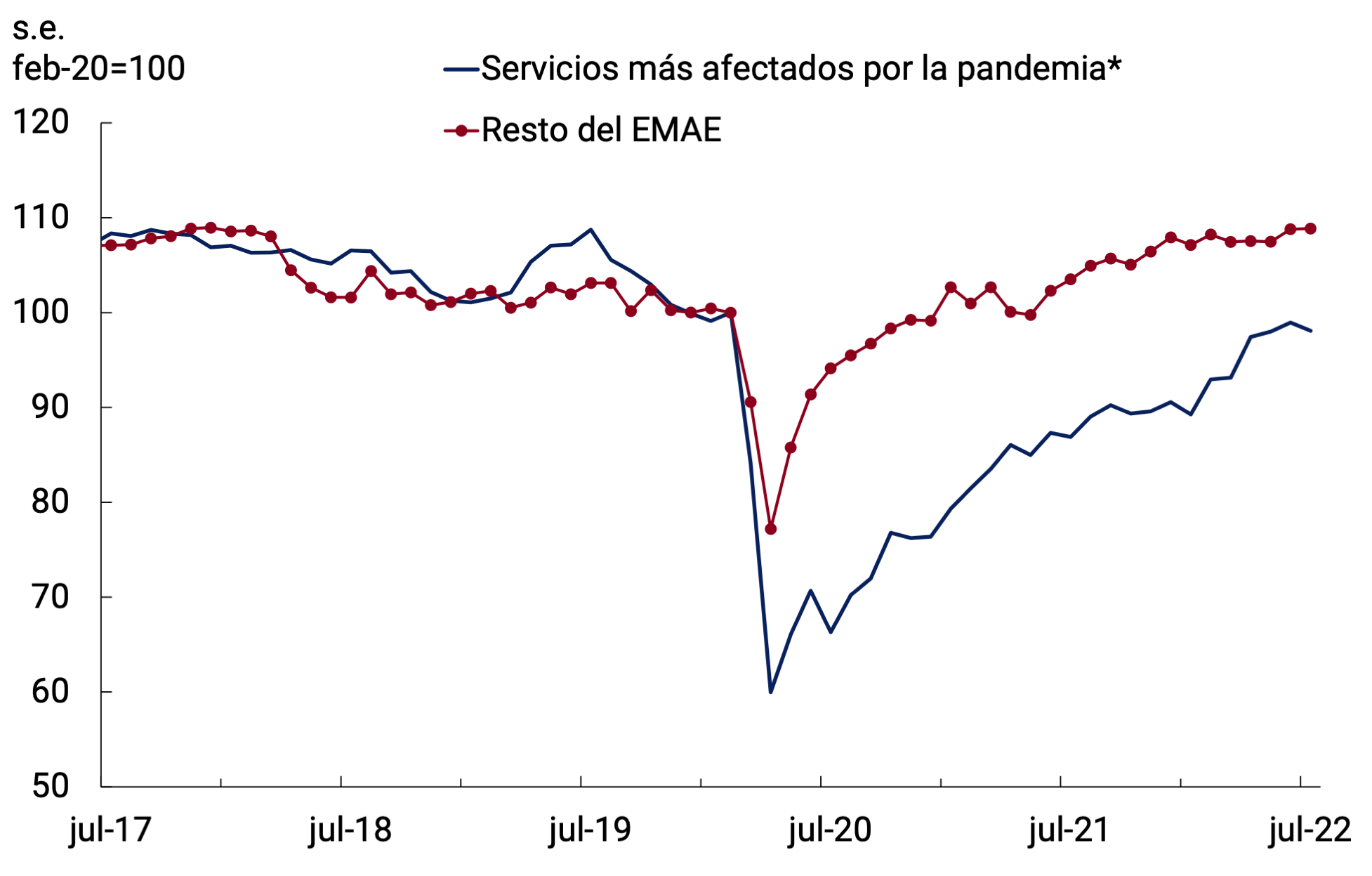

The recent economic performance of the group composed of those services that had had more difficulties in operating normally during the confinement period, which was close to the level recorded in February 2020, stands out. This set of sectors is closely associated with the social mobility that cultural, recreational and leisure activities entail, sports, personal care, among others, and are the ones that showed the greatest dynamism during the last months. The rest of the productive sectors remained at levels very close to the highs of late 2017, around 9% above the pre-pandemic level (see Figure 3.4).

Figure 3.4 | Services most affected by the pandemic and the rest of the EMAE*

Transport and communications, Hotels and restaurants and Other community services.

Source: BCRA based on INDEC data.

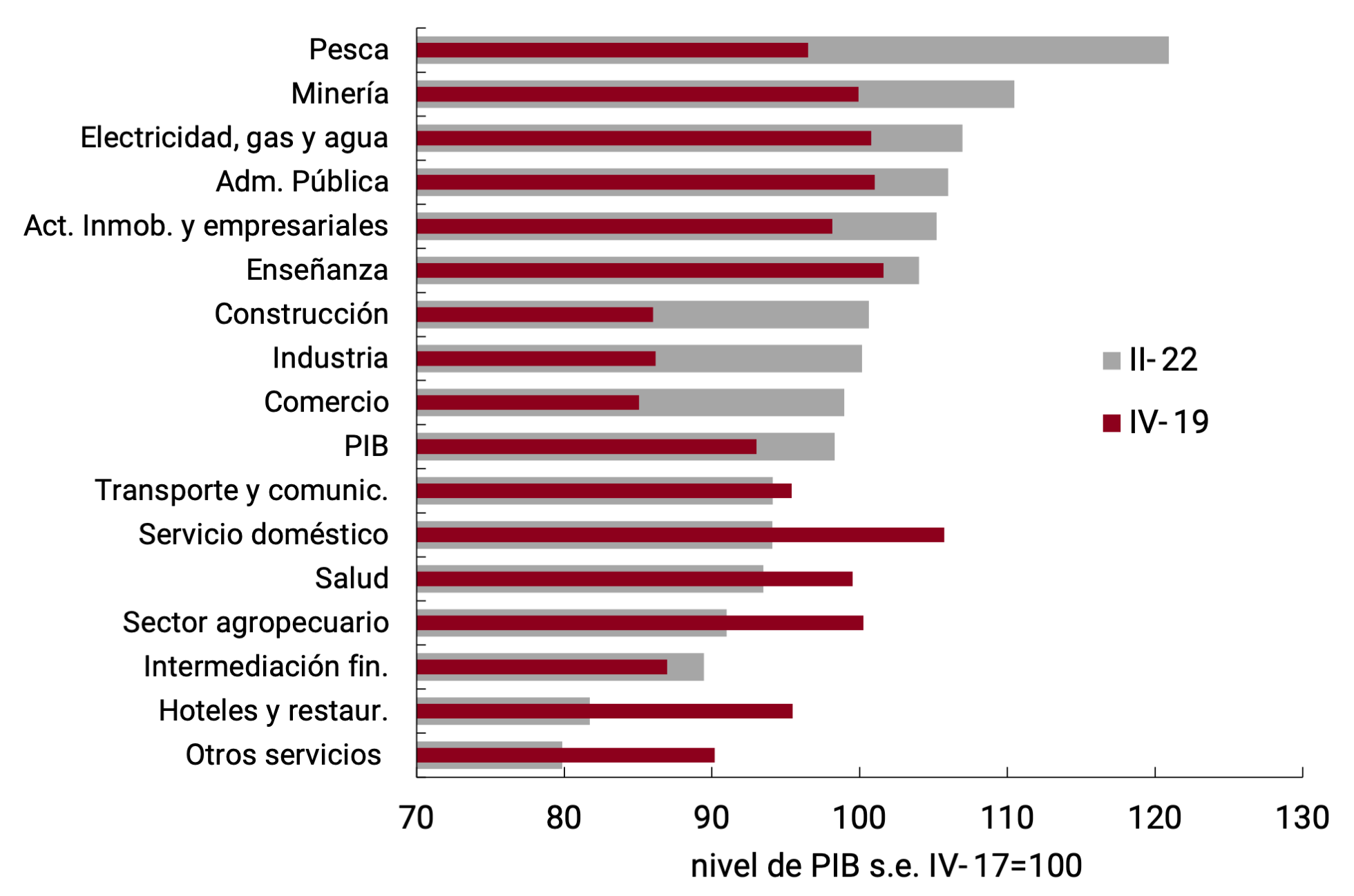

When looking at the seasonally adjusted level of activity of each productive sector during the second quarter of 2022, compared to that corresponding to the fourth quarter of 2017 and also to the quarter prior to the start of the pandemic (the fourth quarter of 2019), a great heterogeneity is observed in the behavior of aggregate supply. where 8 of the 16 items that make up GDP exceeded the maximums reached in the fourth quarter of 2017 (see Figure 3.5).

The segments with the highest economic growth with respect to those two periods were Fishing and Mining – driven by the activity of Vaca Muerta – which exceeded their levels at the end of 2017 by more than 10%. Industry and commerce, two very relevant sectors with high demand for employment, reached the maximum levels of 2017 and have the particularity of presenting the highest rates of increase compared to the pre-pandemic (16.2% and 16.3% s.e., respectively). Particularly in the second quarter of 2022, both items presented increases of more than 3% quarterly s.e.

As for those most affected by the pandemic, both Other Community Services and Hotels and Restaurants continue to operate still far from the levels of activity recorded at the end of 2017 despite the strong improvements exhibited in the most recent months. The drought-affected agricultural sector, domestic service and health also show an unfavourable trajectory compared to these maximums.

3.1.3. The labour market maintained its growth rate during the second quarter of 2022

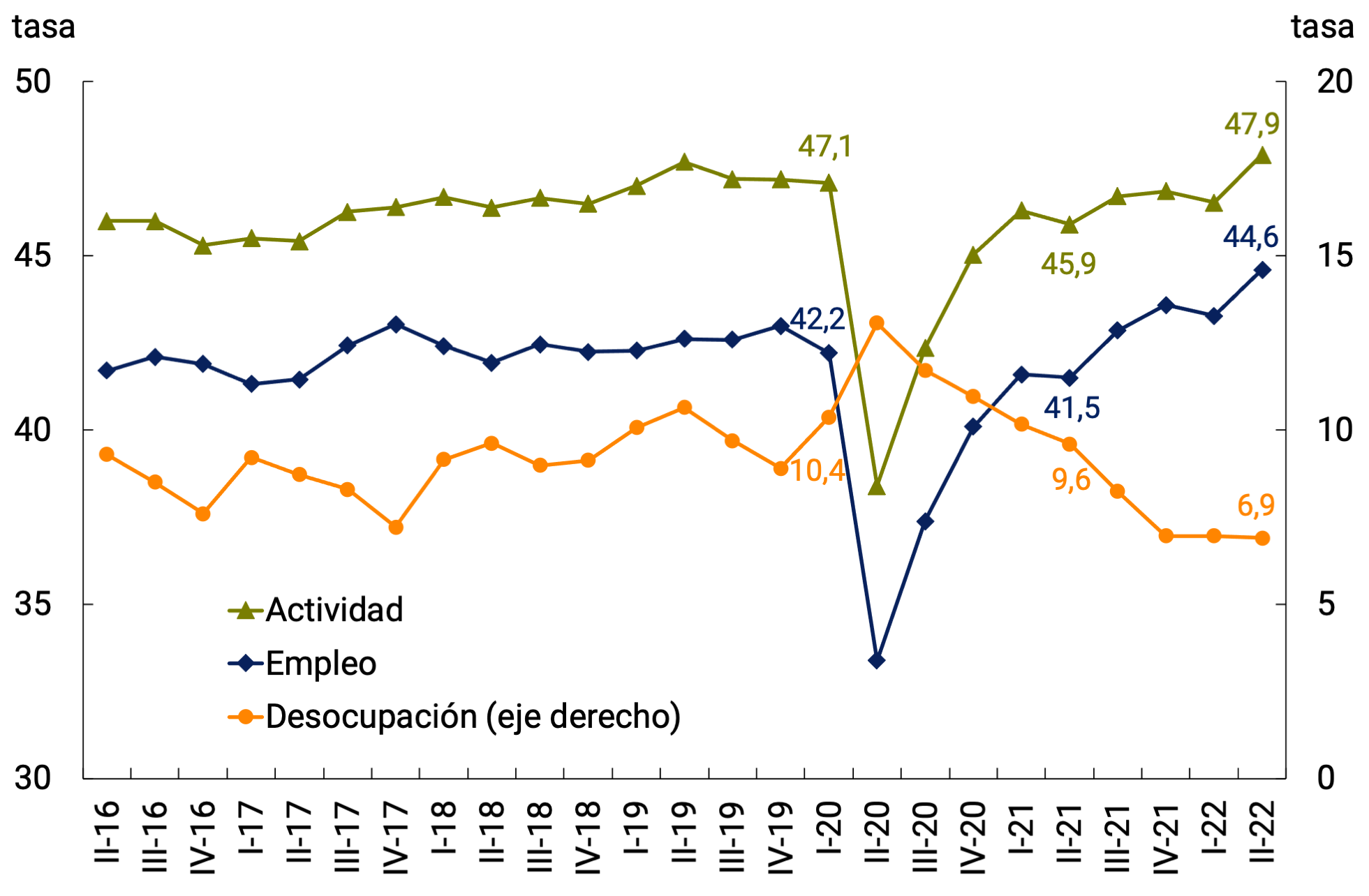

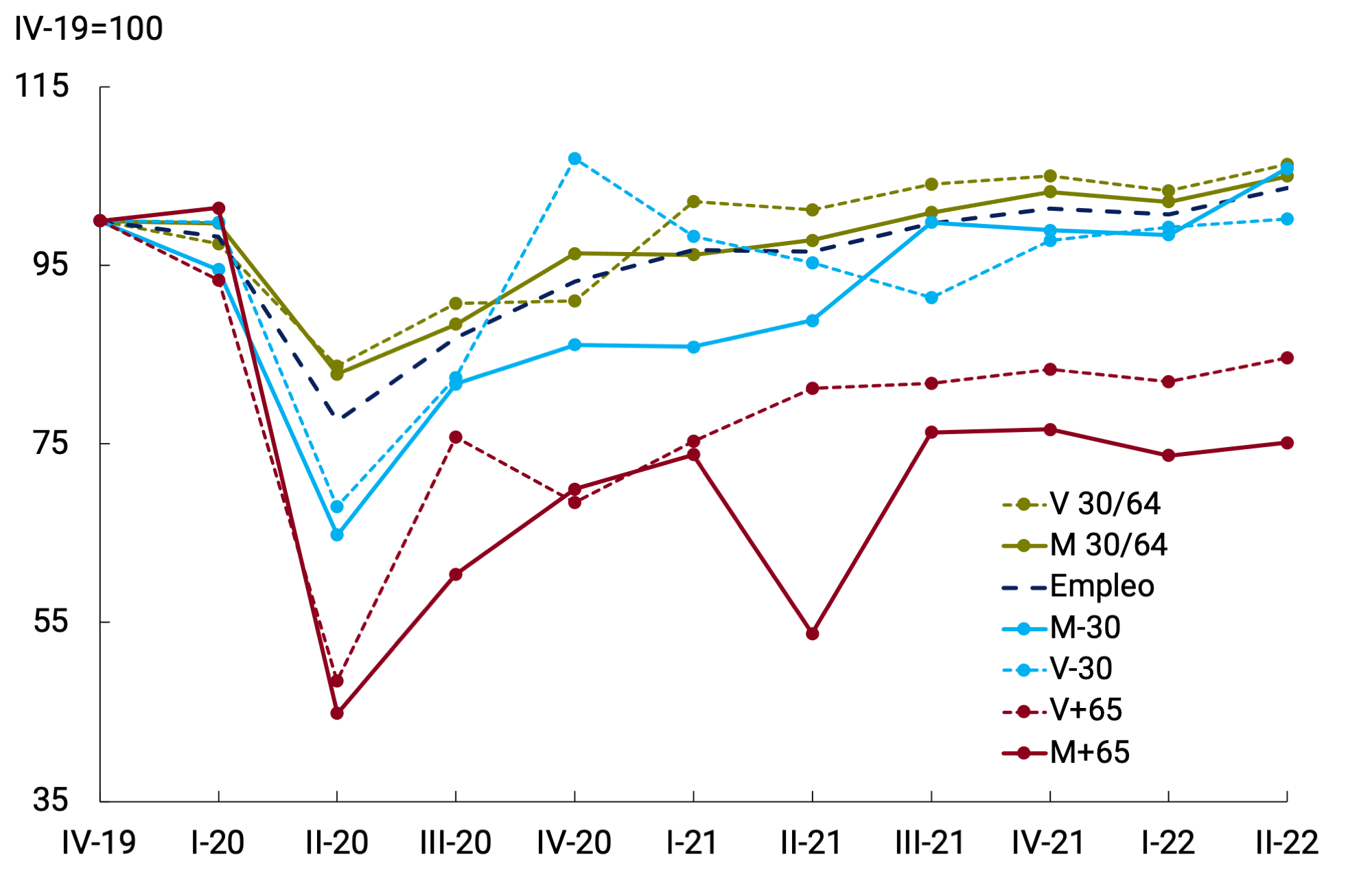

According to data from the Permanent Household Survey (EPH), in the second quarter of 2022 both the employment rate (44.6%, +3.1 p.p. y.o.y.) and the activity rate (47.9%, +2.0 p.p. y.a.) showed significant growth compared to what was observed in the first quarter of 2022 and were at the highest value since the beginning of the new EPH series in the second quarter of 2016. For its part, the open unemployment rate stood at 6.9%, piercing the 7.0% recorded in the previous two quarters and reaching its lowest value since 2016 (see Figure 3.6).

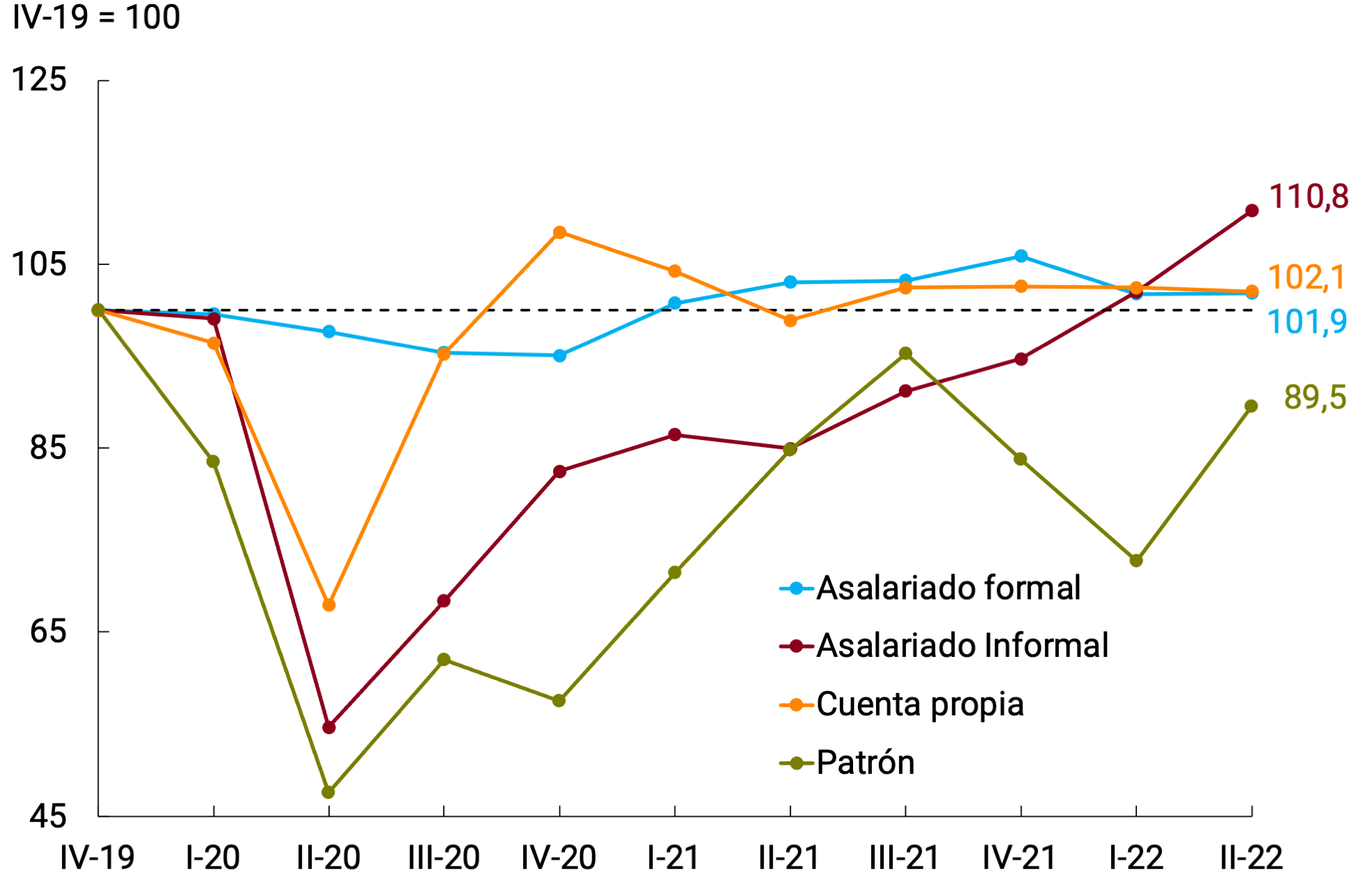

As for the evolution of the different occupational categories, self-employment remained relatively stable compared to the previous two quarters. The “employers” category recovered, after two sharp declines in the immediately preceding quarters, but has not yet managed to return to pre-pandemic levels. Within salaried employment, formal workers6 remained stable compared to the previous quarter, while informal workers7 grew for the fourth consecutive quarter, becoming the most dynamic labor category in the last two years (see Figure 3.7). These trajectories have led to a composition of employment in which the less formal categories have begun to gain greater weight to the detriment of registered salaried employment.

Figure 3.7 | Evolution of employment by job category and by age group and gender

With regard to the age range and gender, it continues to be observed that the category of people over 65 years of age, both women and men, is the only one that has not yet managed to recover after the impact of the pandemic. In the case of young people (under 30 years of age), women showed a good performance in the second quarter of 2022, significantly exceeding the levels of the fourth quarter of 2019, while men are at that level. Both women and men between 30 and 64 years of age who had previously exceeded the pre-pandemic level showed a favorable evolution during the second quarter of 2022.

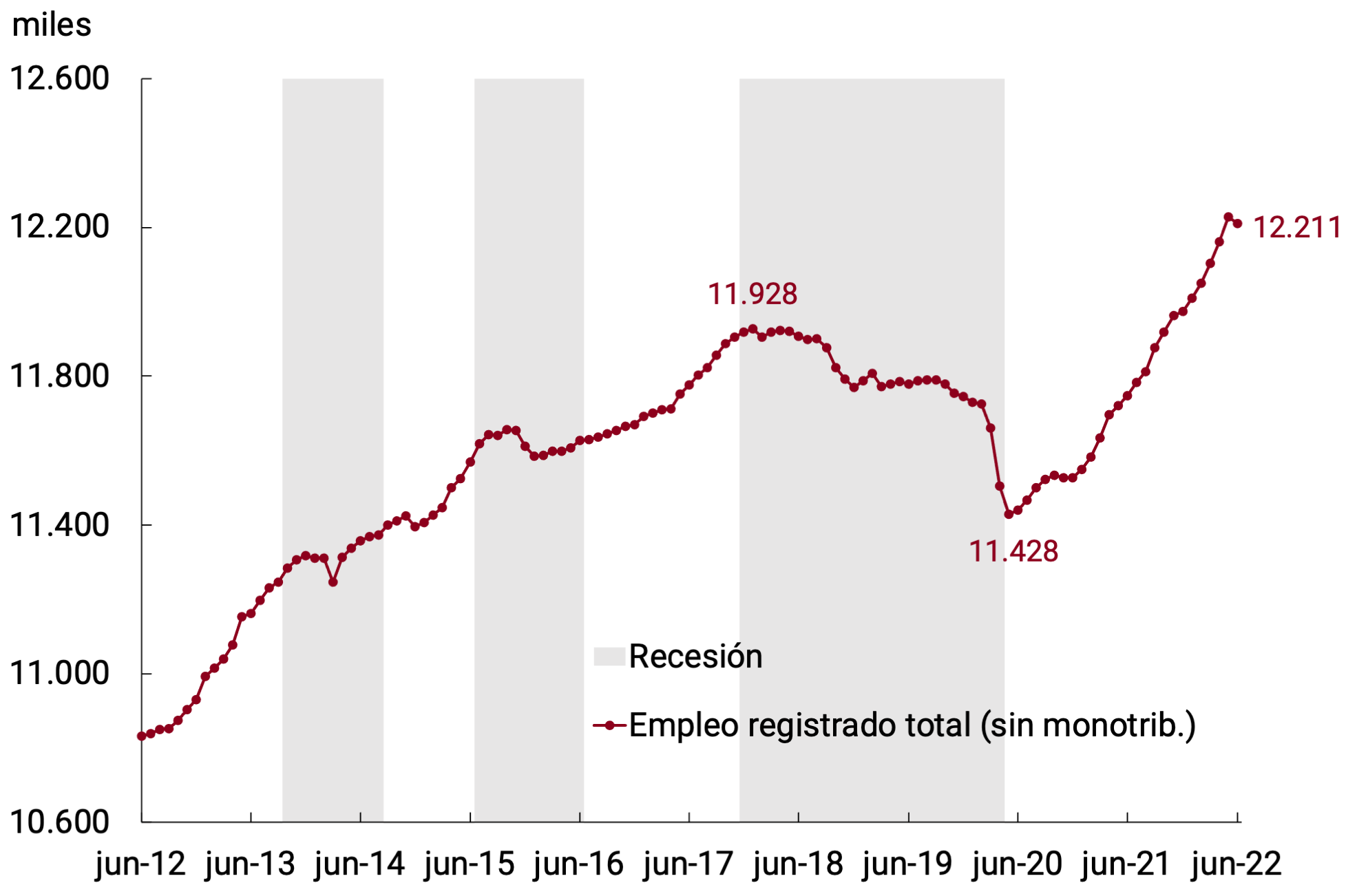

According to the Ministry of Labor, Employment and Social Security (MTEySS), registered employment continued to grow during the second quarter of 2022, accentuating the process that began in June 2020. In this way, total registered employment (without social monotax) continues to be around historical maximum levels. The pace of expansion during the second quarter of 2022 remained relatively stable compared to previous quarters, expanding at 0.3% per month on average (see Figure 3.8).

Figure 3.8 | Total registered employment (without social monotax)

Source: BCRA based on data from MTEySS.

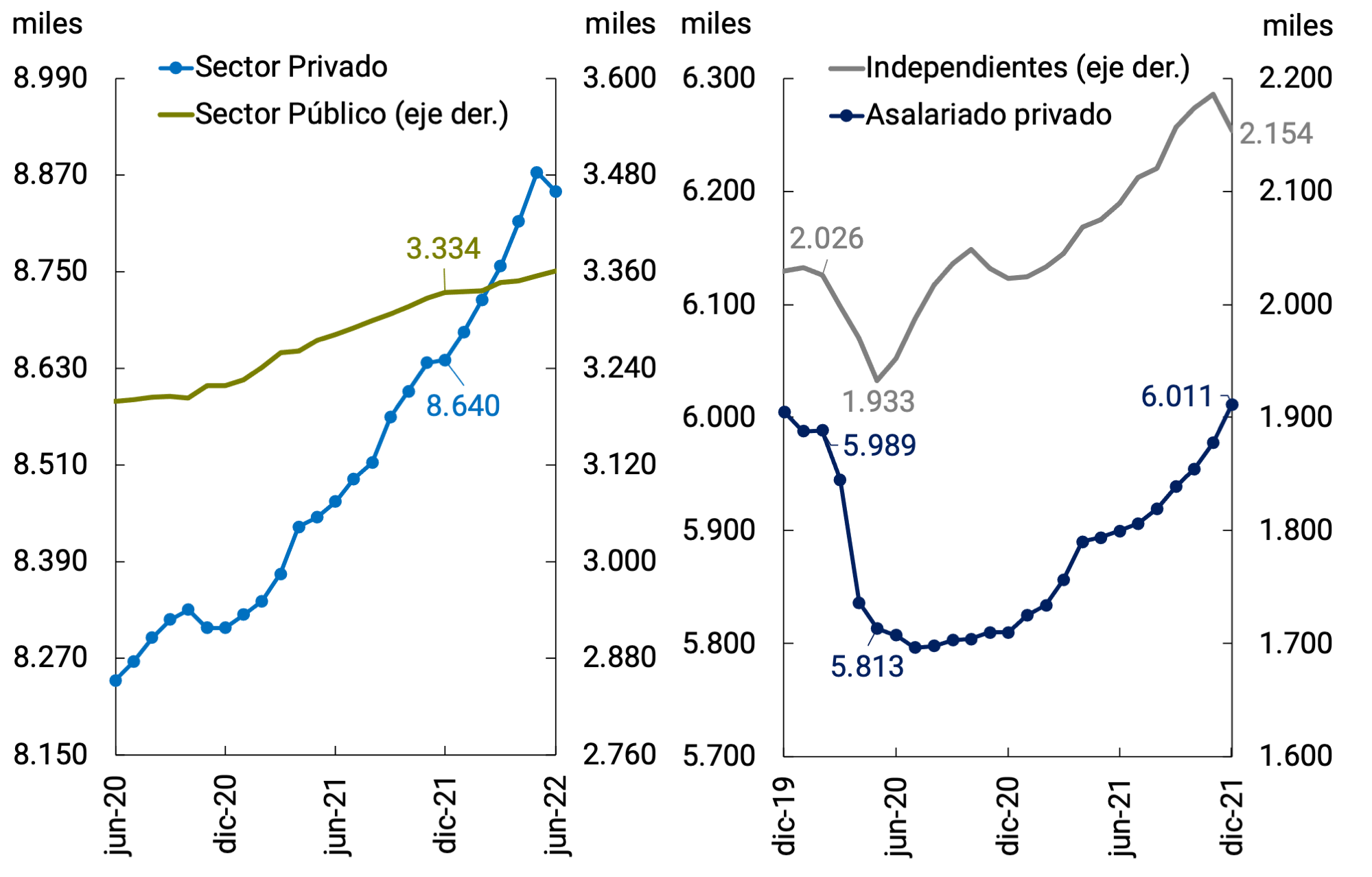

During the second quarter of 2022, the rise in registered employment was mainly driven by private registered salaried employment (0.5% s.e. monthly average). Public employment, for its part, maintained the average monthly growth rate compared to the previous quarter (0.1% s.e.), although moderating the speed of expansion achieved in 2021 (0.3% s.e.; see Figure 3.9). Self-employment (self-employed and single-payers) reduced the growth rate to 0.1% s.e. (0.8% s.e. during the first quarter). This decrease was explained entirely by a one-off drop in single-payers during the month of June (-2.9% s.e.), which in turn was more than offset by an increase in social single-payers.

Figure 3.9 | Public, private, private and self-employed

Source: BCRA based on data from MTEySS.

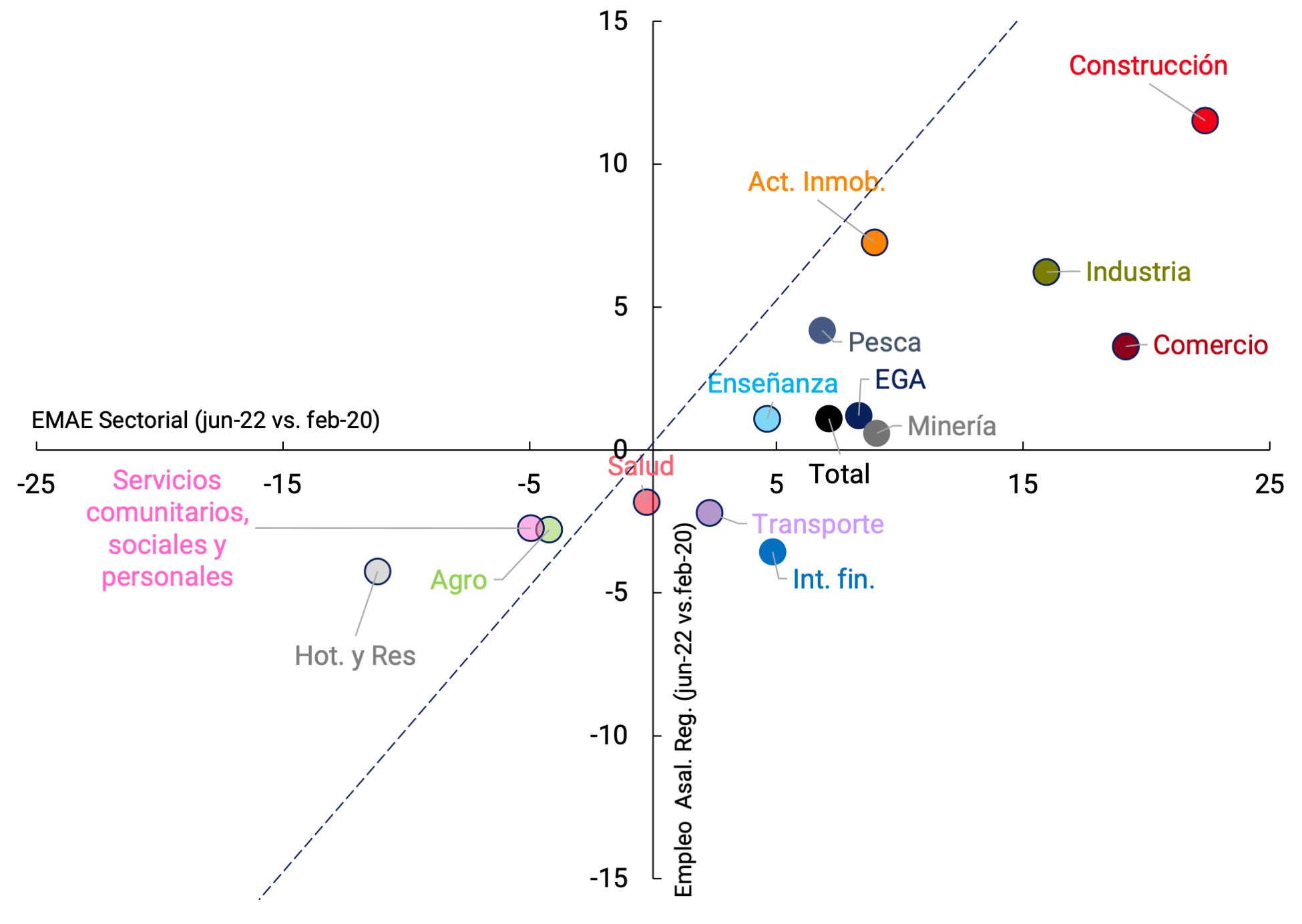

The growth in private salaried employment between March and June 2022 has been widely disseminated both regionally and sectorally: it has grown in 22 of the 24 provinces and in 11 of the 14 sectors surveyed. In turn, it is possible to distinguish, as in the previous quarter, a strong dynamism in branches such as Hotels and restaurants (6.2% s.e. acum.) and Construction (4.4% s.e. acum.). However, taking into account pre-pandemic levels, it is observed that the Hotels and Restaurants sector, as well as Community, Social and Personal Services and Agriculture, have recovery potential both in terms of activity and staff hiring. On the other hand, in the sectors that have already recovered in terms of activity, the growth in registered salaried employment has occurred to a lesser extent (see Figure 3.10).

Figure 3.10 | Activity and Registered Employment. Percentage

Source: BCRA based on data from MTEySS and INDEC.

The Labor Indicators Survey (EIL) as of July 2022 ratified the positive trend in net hiring expectations that began in February 2021, chaining 18 consecutive months of positive values. On the other hand, suspensions, after a sharp reduction during 2021, remained at levels within the historical average and the rate of layoffs remains in a limited range, although it showed a slight increase during July probably associated with the end of the double severance benefit.

3.2. Perspectives

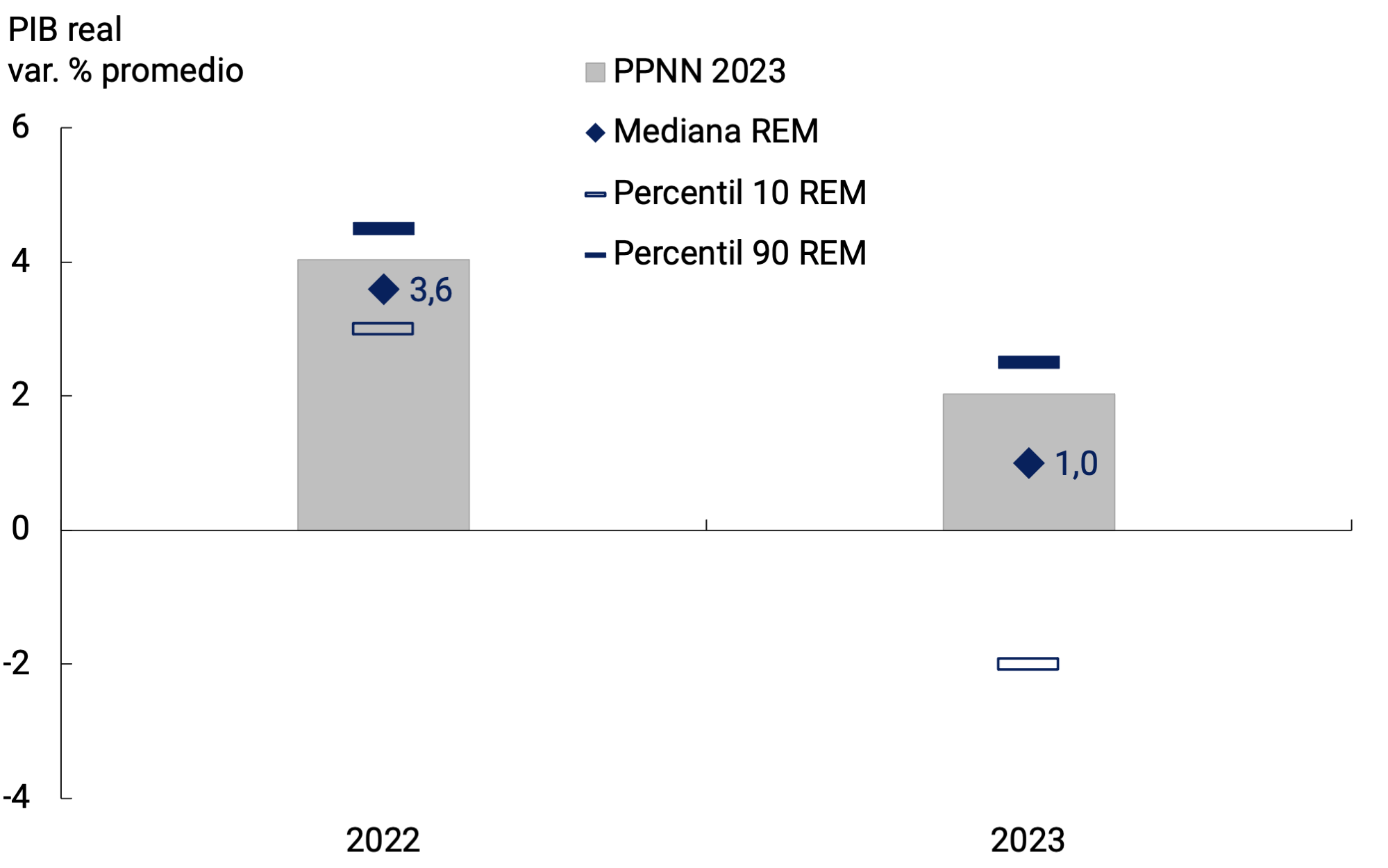

After recovering by an average of 6.5% YoY in the first half of the year, the growth of economic activity stopped in July and growth expectations for the rest of the year deteriorated. According to the median of the estimates of the Market Expectations Survey (REM) at the end of August 2022, specialized analysts pointed to falls in economic activity of 1.1% and 1.2% quarter-on-quarter s.e. for the third and fourth quarters of this year, respectively. Implicitly, this forecast implies that the economy would start next year with a negative statistical drag (-1.3 p.p.). Thus, after successive upward corrections in line with the publication of official data, the economic growth forecast for the 2022 average stood at 3.6% annually and 1% for 2023 (see Figure 3.11).

Figure 3.11 | Economic growth prospects 2022 and 2023

Source: REM-BCRA and draft National Budget Law 2023

At the international level, growth prospects contemplate a slowdown in the coming months, associated with the systematic reduction of monetary stimuli by advanced economies and the continuation of bottlenecks in some supply chains, as a result of geopolitical conflicts and health policies implemented in China. This scenario continues to put pressure on external financing costs for emerging countries and on international commodity prices, such as energy, which remain at historically high levels despite the downward correction of recent months (see Chapter 2. International Context).

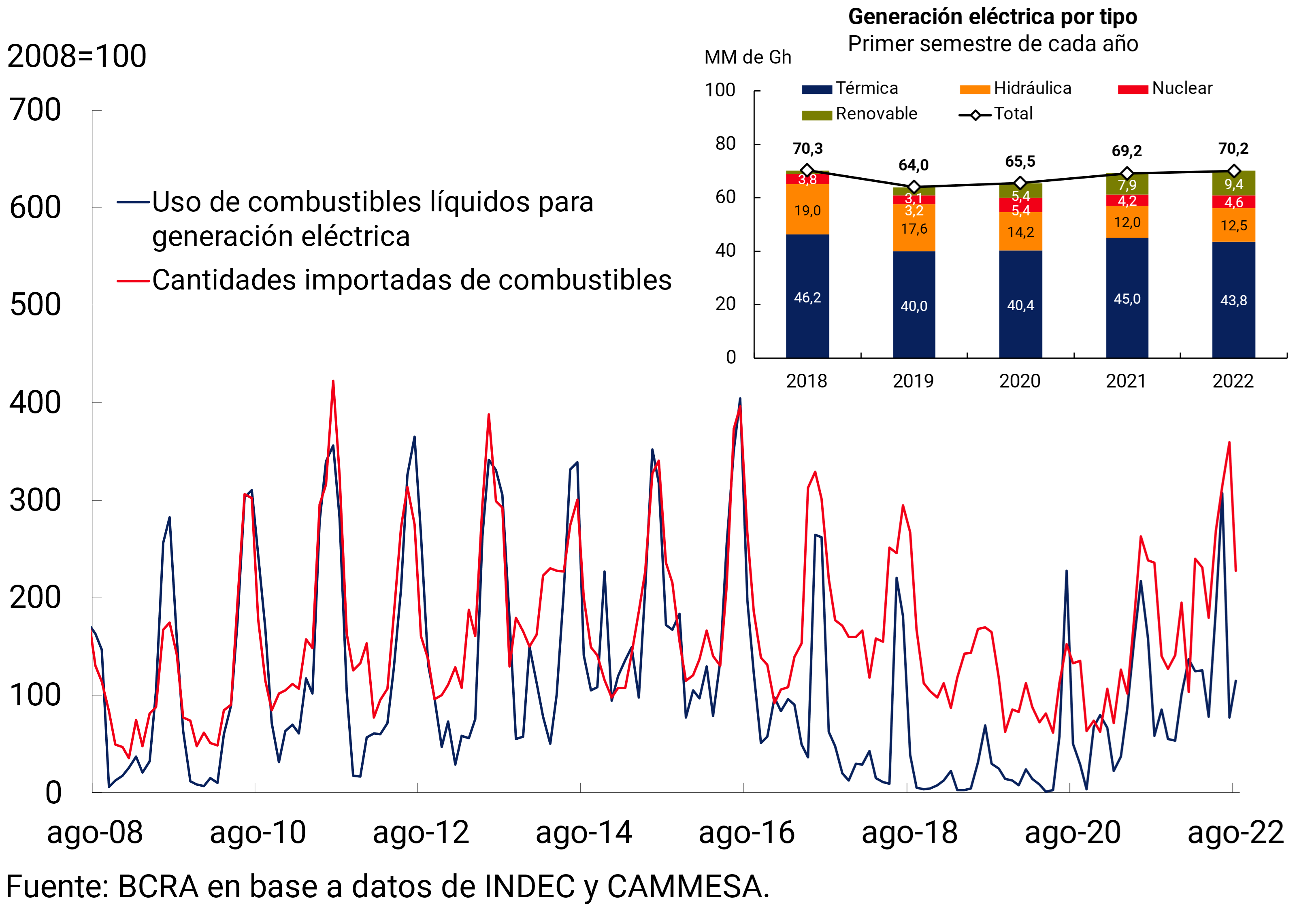

The economic policy measures recently implemented linked to the strengthening of reserves, fiscal ordering, and the preservation of savings in pesos will allow macroeconomic stability to continue to be strengthened. In the same sense, the construction and commissioning of the first section of the Néstor Kirchner gas pipeline will contribute more in the medium term, which will allow significant savings in foreign currency and will demand more job creation.

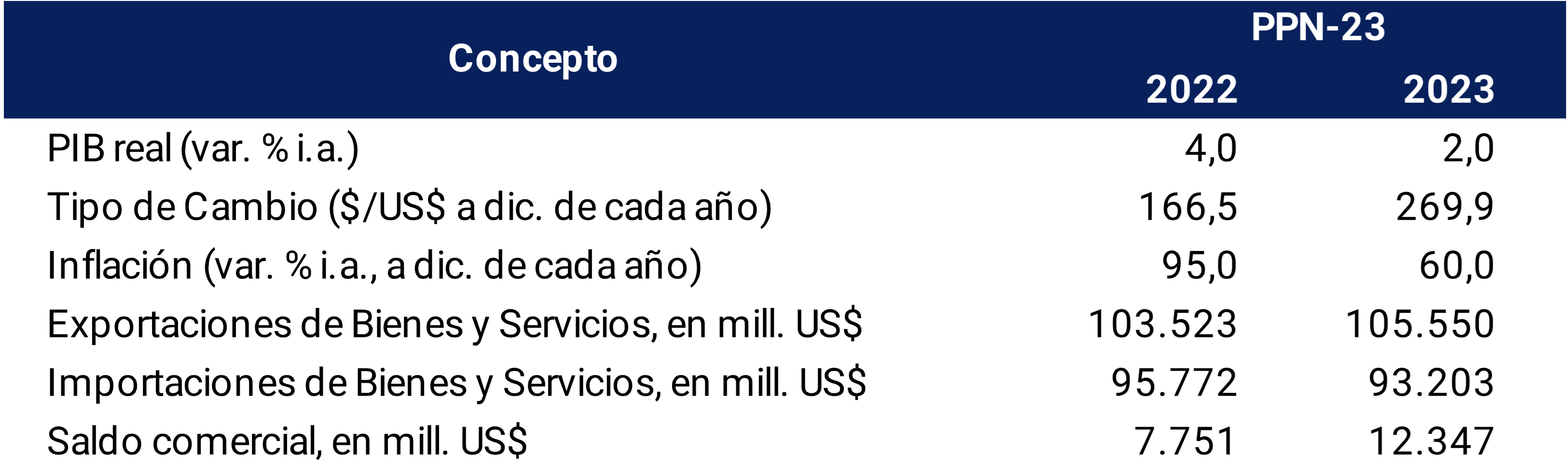

A context of greater stability will favor investment, while the institutionality of wage negotiations—which contributes to sustaining the real income of families—combined with the low level of unemployment will reinforce consumption levels. Thus, economic activity is expected to regain dynamism from September and during 2023, despite the uncertainty typically associated with election years and the challenge of reducing the current high levels of inflation. This scenario is reflected in the 2023 National Budget Bill (PPN-23, see Section 4 / Main aspects of the 2023 National Budget Bill), which shows growth of 4% for this year and 2% for 2023, within the range contemplated in the agreement with the IMF (between 3.5% and 4.5%).

Back to top

4. External Sector

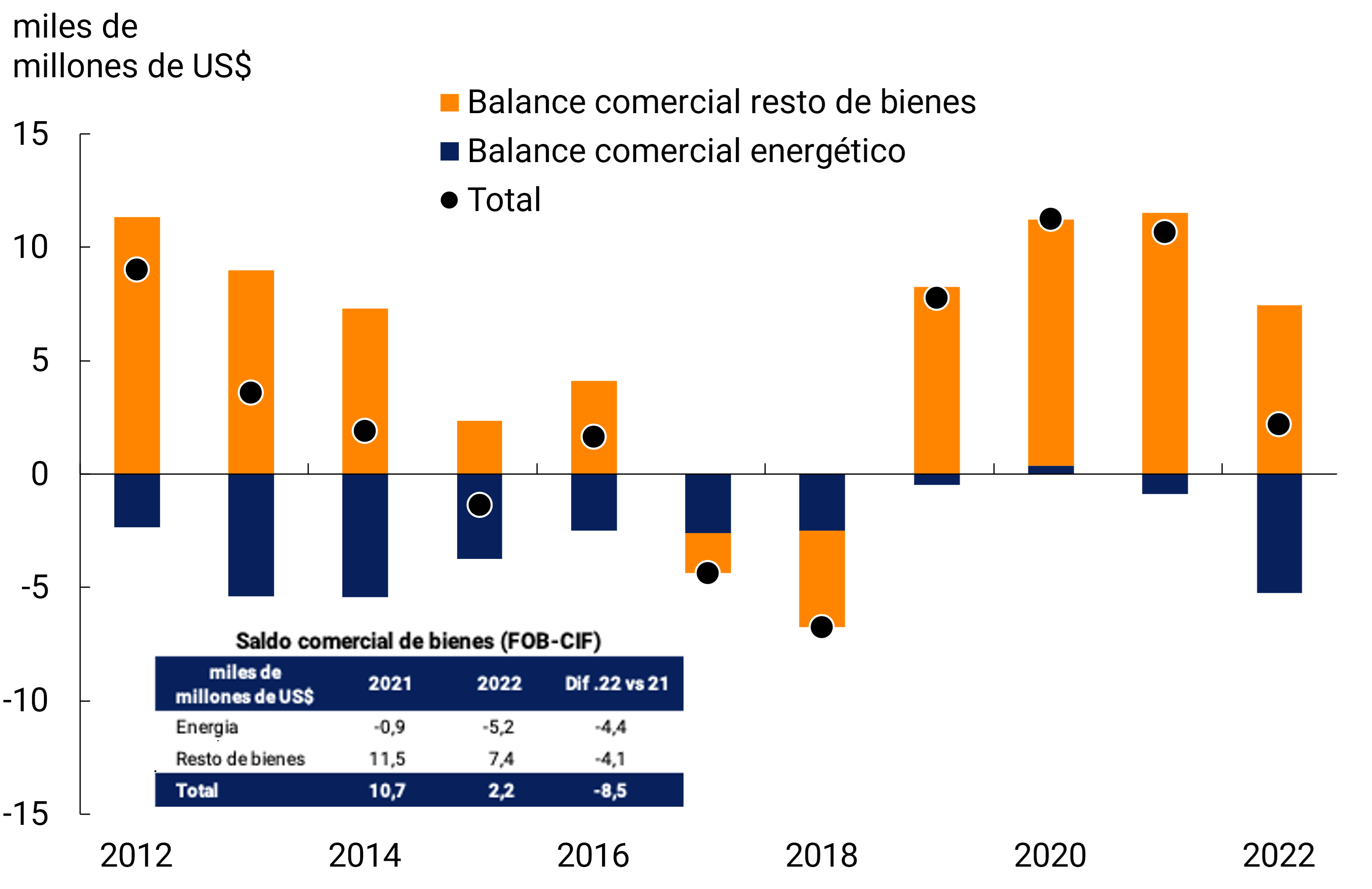

In the second quarter of 2022, in a context of trade flows at record levels (measured in current dollars, but with falls in quantities) the economy operated with a current account deficit, mainly due to a sharp deterioration in the terms of trade. In the July-August two-month period, previous trends deepened: increases in import prices that exceed those of exports and falls in traded volumes. In this context, the current account deficit is expected to be sustained in the third quarter of the year, and that it will only return to positive values in the fourth quarter.

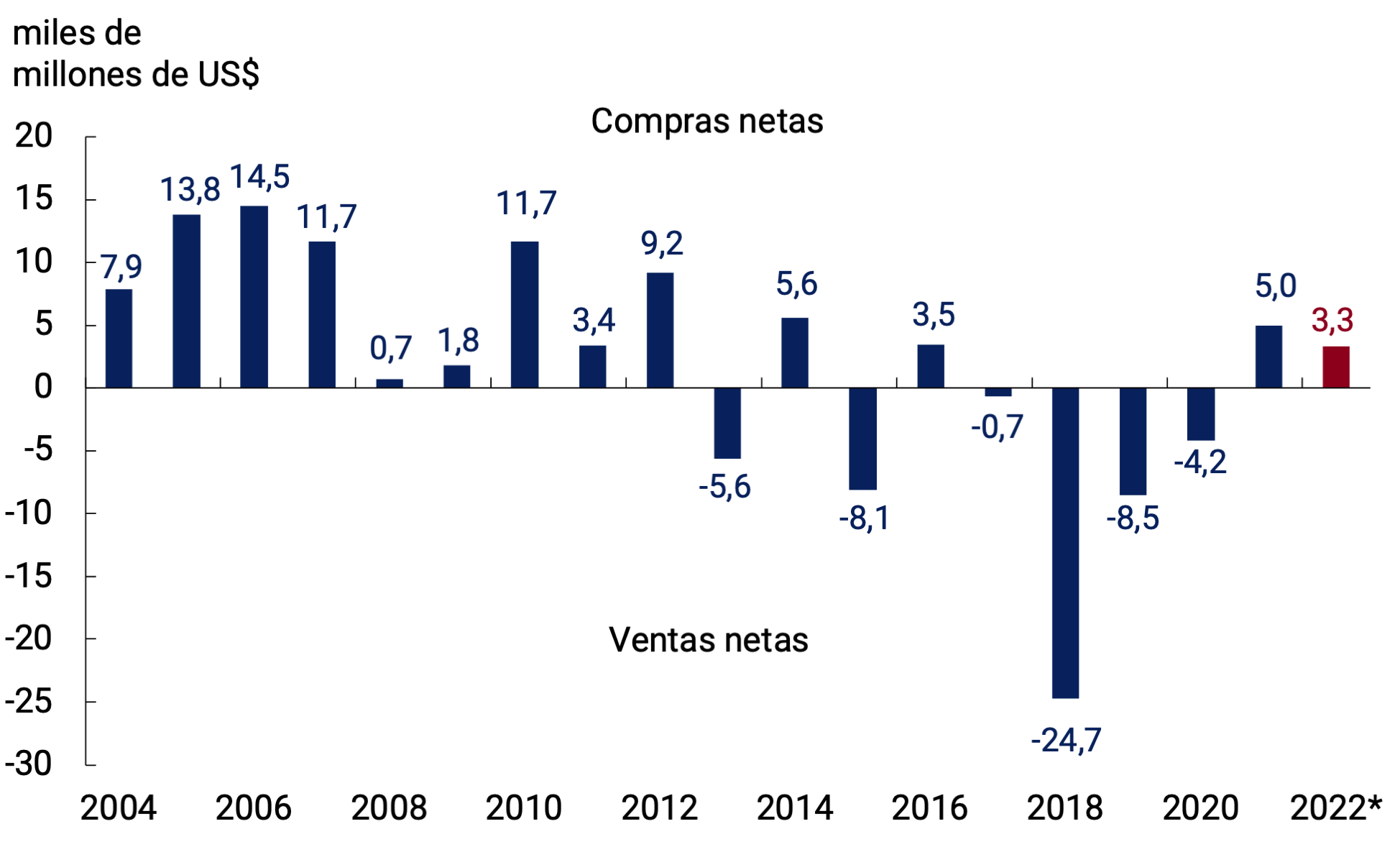

The evolution of exports and imports of goods, added to the dynamics of commercial debt for these concepts, resulted in a net result in the exchange market for goods of US$10,989 million in the first eight months of 2022, decreasing by 13% compared to what was observed in the same period of the previous year. Additionally, net outflows were recorded through the foreign exchange market for services, interest and other financial transactions for US$11,463 million, while entities made purchases for US$64 million. For its part, the BCRA had a neutral result in its interventions in the foreign exchange market and made net payments through the Local Currency System (SML) for US$536 million.

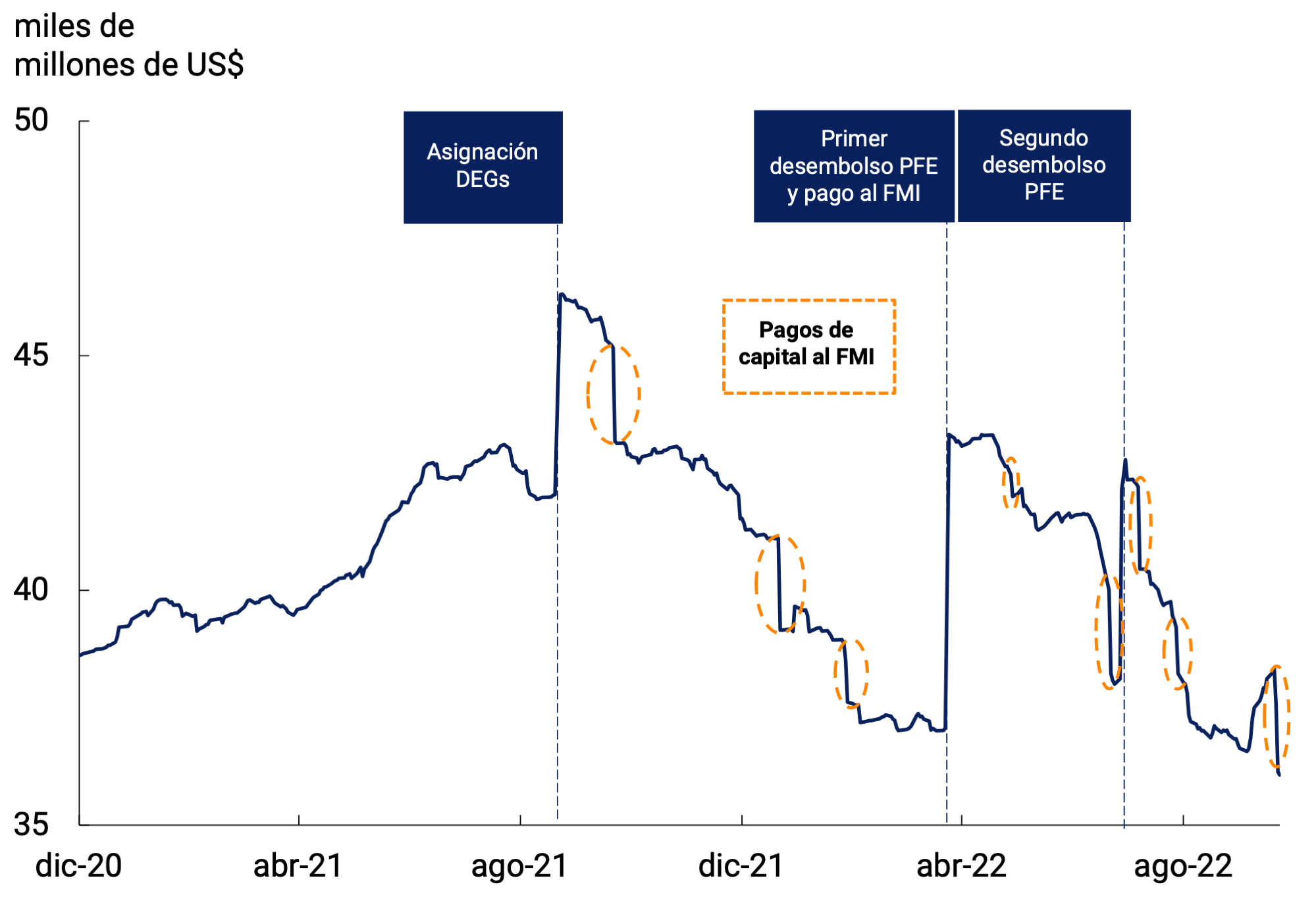

The operations in the foreign exchange market and the BCRA’s SML, together with the decrease in the prices of the assets that make up the international reserves in relation to the U.S. dollar, which resulted in a decrease of about US$2,196 million, brought the level of international reserves to US$36,734 million at the end of August. which represented a drop of US$2,928 million below its value at the end of 2021. However, based on the incentives generated by the “Export Increase Program”, the oilseeds and cereals sector liquidated US$5,300 million through this mechanism at the close of this report. The rebound in liquidations in the sector allowed the BCRA to buy some US$3,300 million in the foreign exchange market during the month of September.

Within the framework of the Extended Facilities Program (EFP) with the IMF, the accumulation of Net International Reserves for June 2022 was slightly lower than the established target, mainly due to the lower revenues of International Organizations compared to those projected. However, in line with the commitments assumed, the accumulation of reserves under the established measurement guidelines will be US$9,800 million during 2022 and 2023. The construction of the Néstor Kirchner gas pipeline would contribute to this objective, which will allow energy imports to be replaced in the winter of 2023.

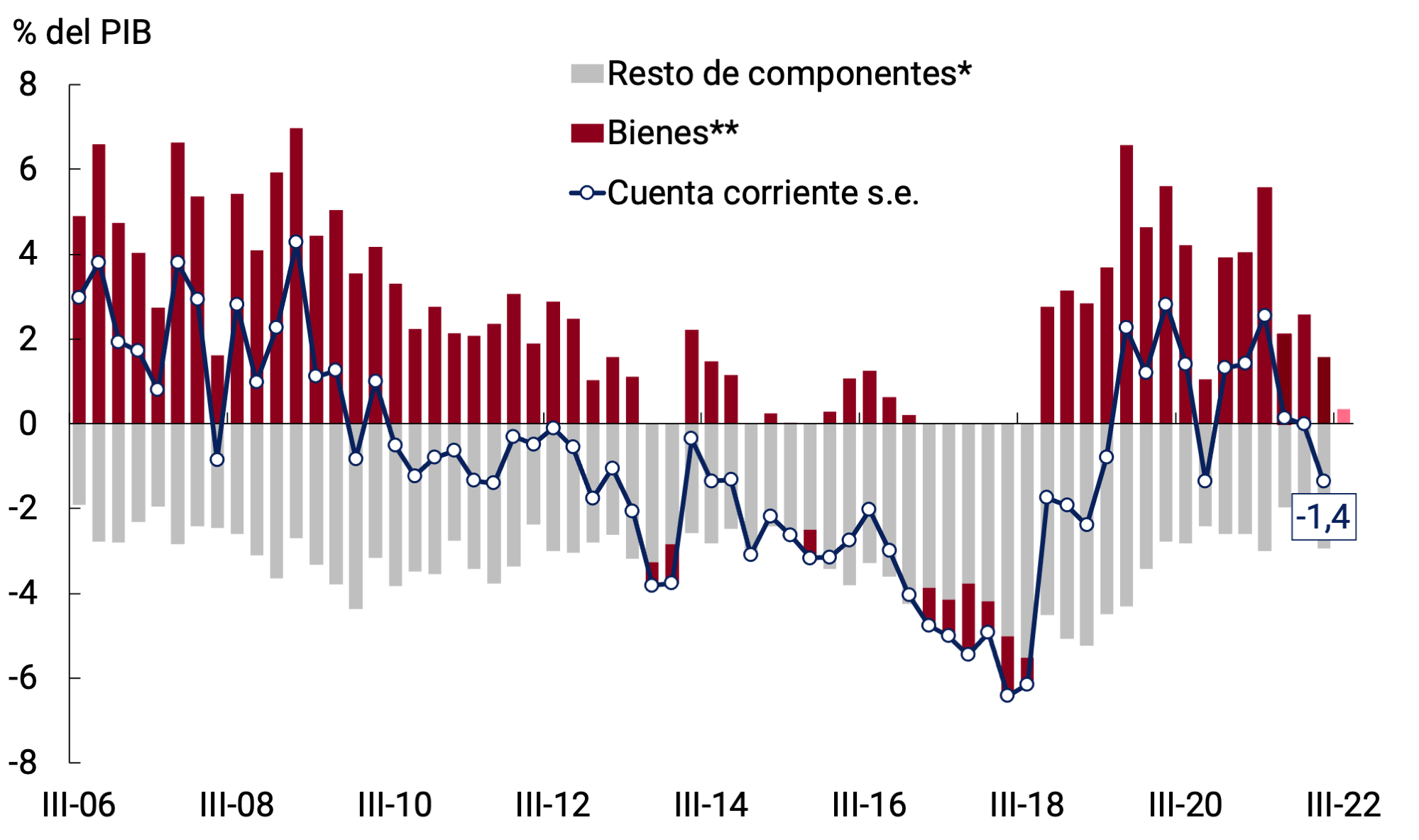

4.1. In the second quarter of 2022, the economy operated with a current account deficit for the second consecutive period

In the second quarter of 2022 (latest official data available) the Argentine economy recorded a current account deficit of US$894 million – equivalent to 1.4% of GDP in seasonally adjusted and annualized terms. The sharp deterioration in the terms of trade of goods compared to the first quarter was the main reason behind the larger current account deficit.

In the July-August 2022 two-month period, the trade balance of goods deepened its dynamics. In this context, the seasonally adjusted current account would have remained in negative territory in the third quarter of 2022 (see Figure 4.1).

Figure 4.1 | Seasonally adjusted current account. Annualized

* Includes accounts: primary income services and secondary income.

** III-22: data up to August 2022.

Source: BCRA based on INDEC data.

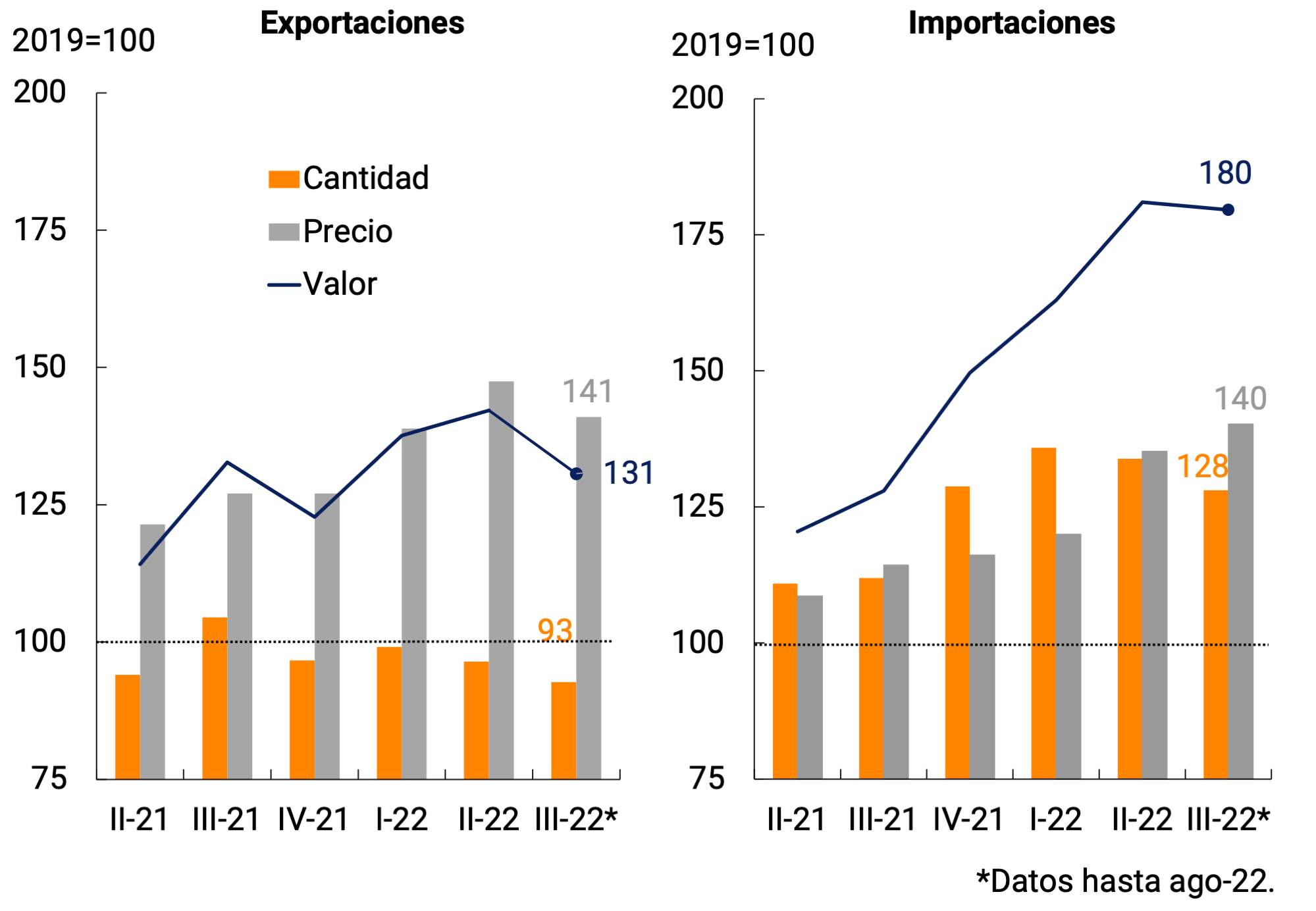

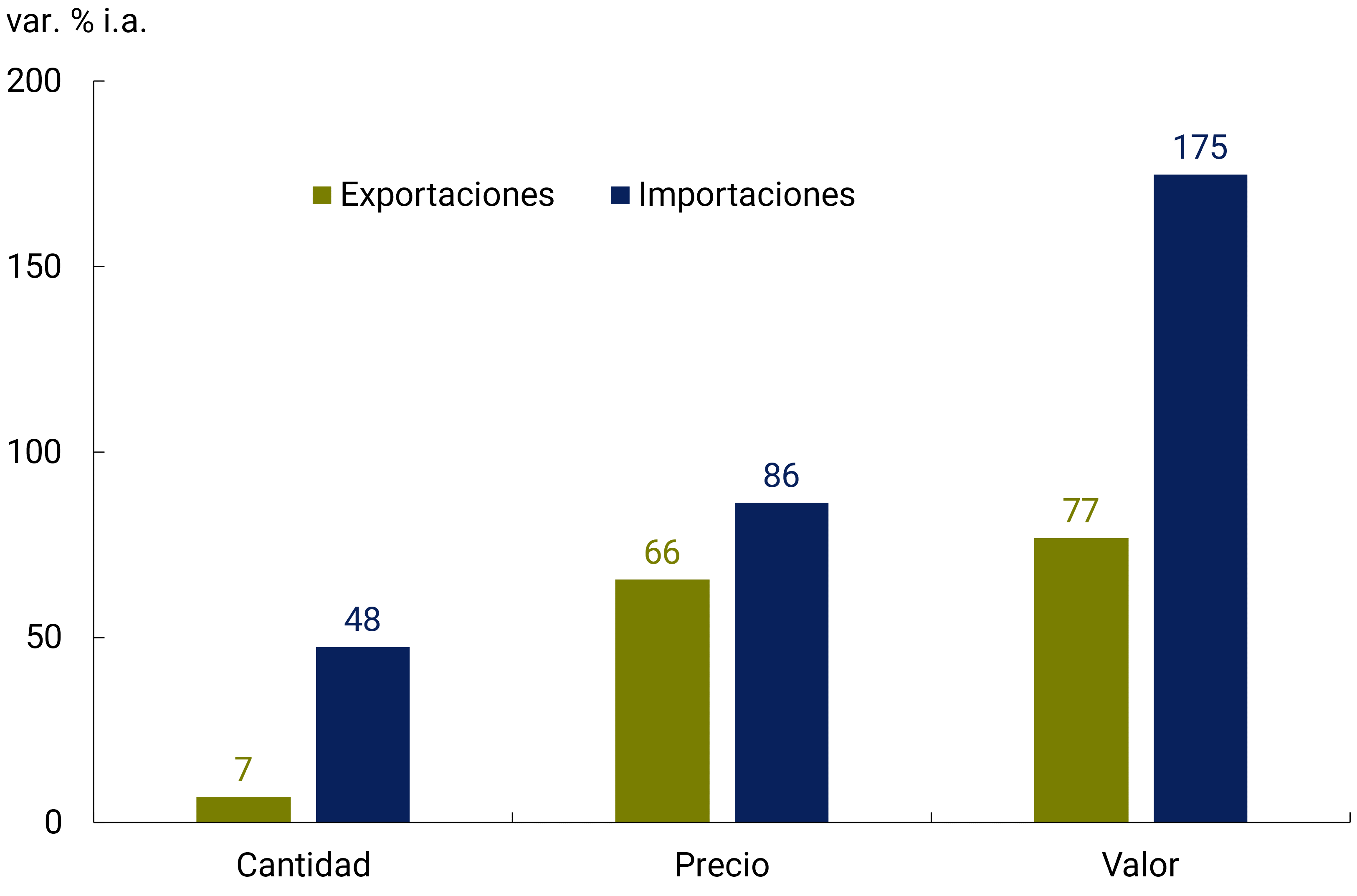

Between April and June 2022, the exported values of seasonally adjusted goods reached US$23,142 million (Free on Board (FOB)) at current prices, which represented an increase of 3.3% compared to the level recorded in the first quarter of 2022. This evolution was mainly due to the performance of export prices, which grew 5.9% s.e. in this period. On the other hand, the quantities exported of goods fell 2.5% s.e. In the July-August two-month period, the fall in volumes was compounded by a decline in export prices.

On the other hand, in the second quarter of 2022, seasonally adjusted imports of goods totaled US$22,225 million (CIF) at current prices, 11.0% higher than the first quarter of the year. This performance of imported values was explained exclusively by the increase in prices (12.7% QoQ, s.e.), since the quantities showed a slight decline (see Chart 4.2). In the July-August two-month period, this dynamic was maintained, with price increases and falls in quantities.

Figure 4.2 | Trade in goods. Seasonally

* Data up to August 2022.

Source: BCRA based on INDEC data.

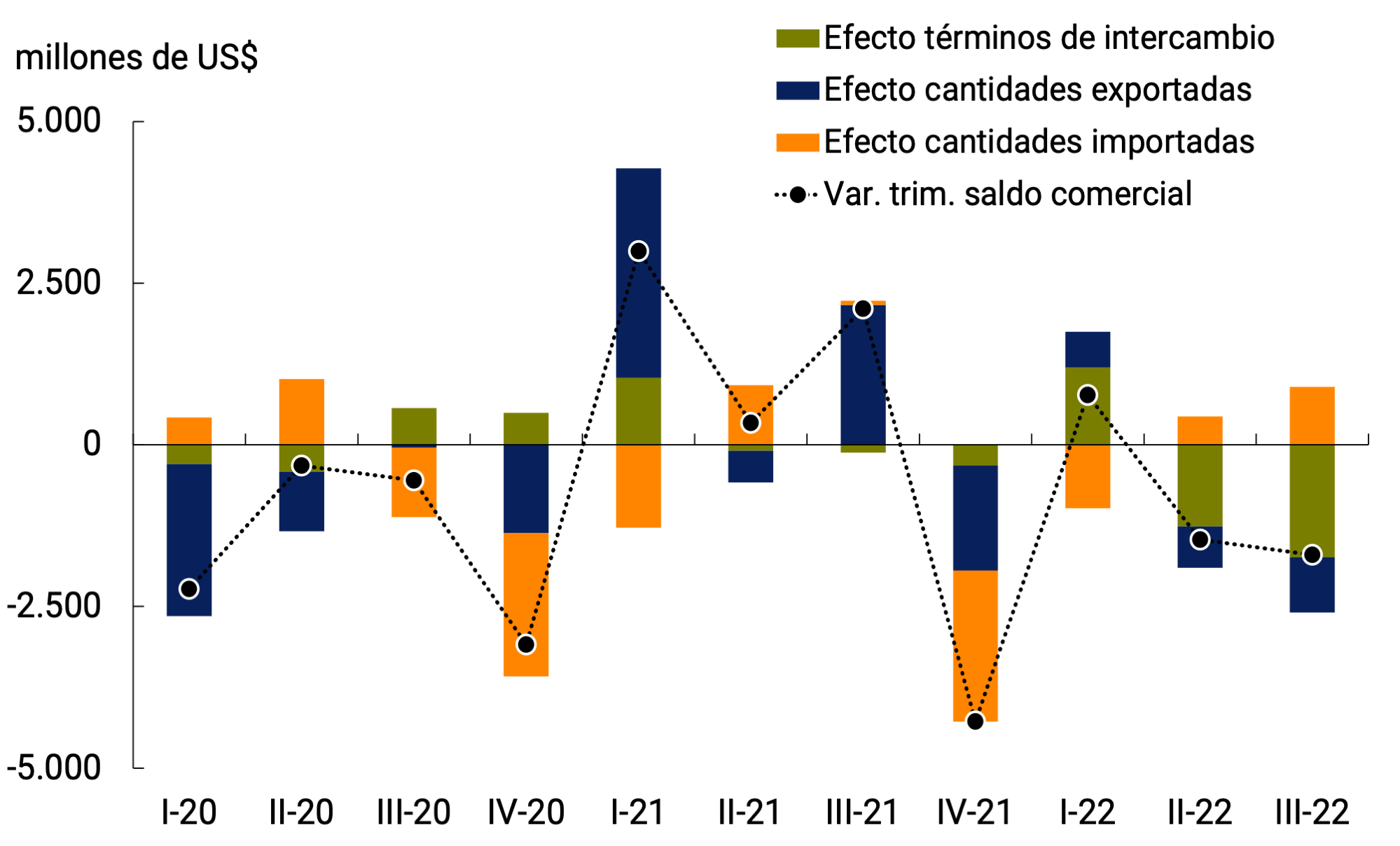

As a result of the recent evolution of exports and imports, the seasonally adjusted average monthly trade surplus went from US$794 million in the first quarter of 2022 to US$306 million in the second quarter, reaching a deficit of US$261 million in the July-August two-month period. The deterioration in the terms of trade accounted for US$2,999 of the US$3,164 cumulative fall in the trade balance in the last two quarters (see Figure 4.3).

Figure 4.3 | Factors of quarterly change in the trade balance of goods*

* FOB-CIF balance adjusted for seasonal factors. III-22 equiv a bimestre jul-ago trimester.

Source: BCRA based on INDEC data.

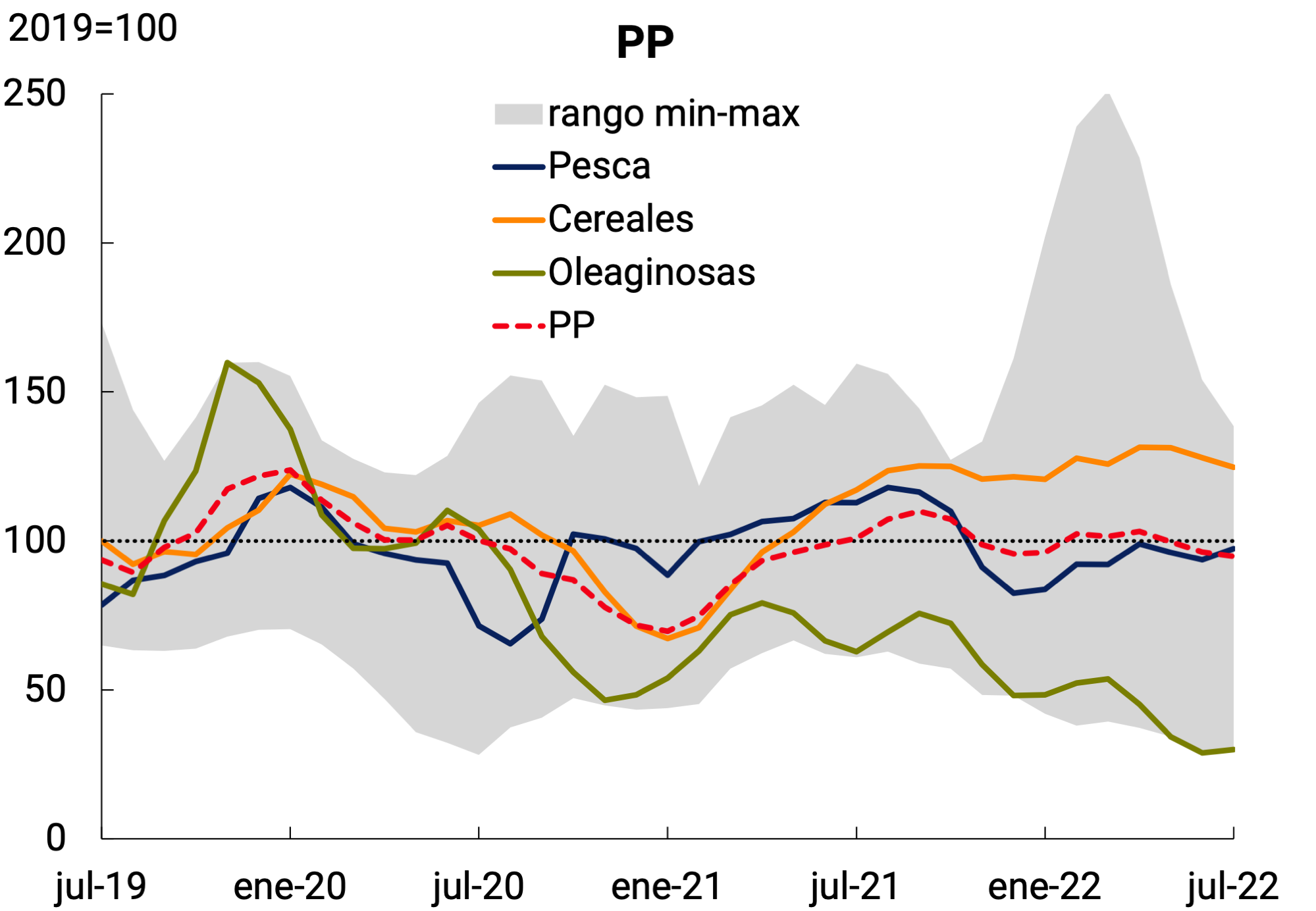

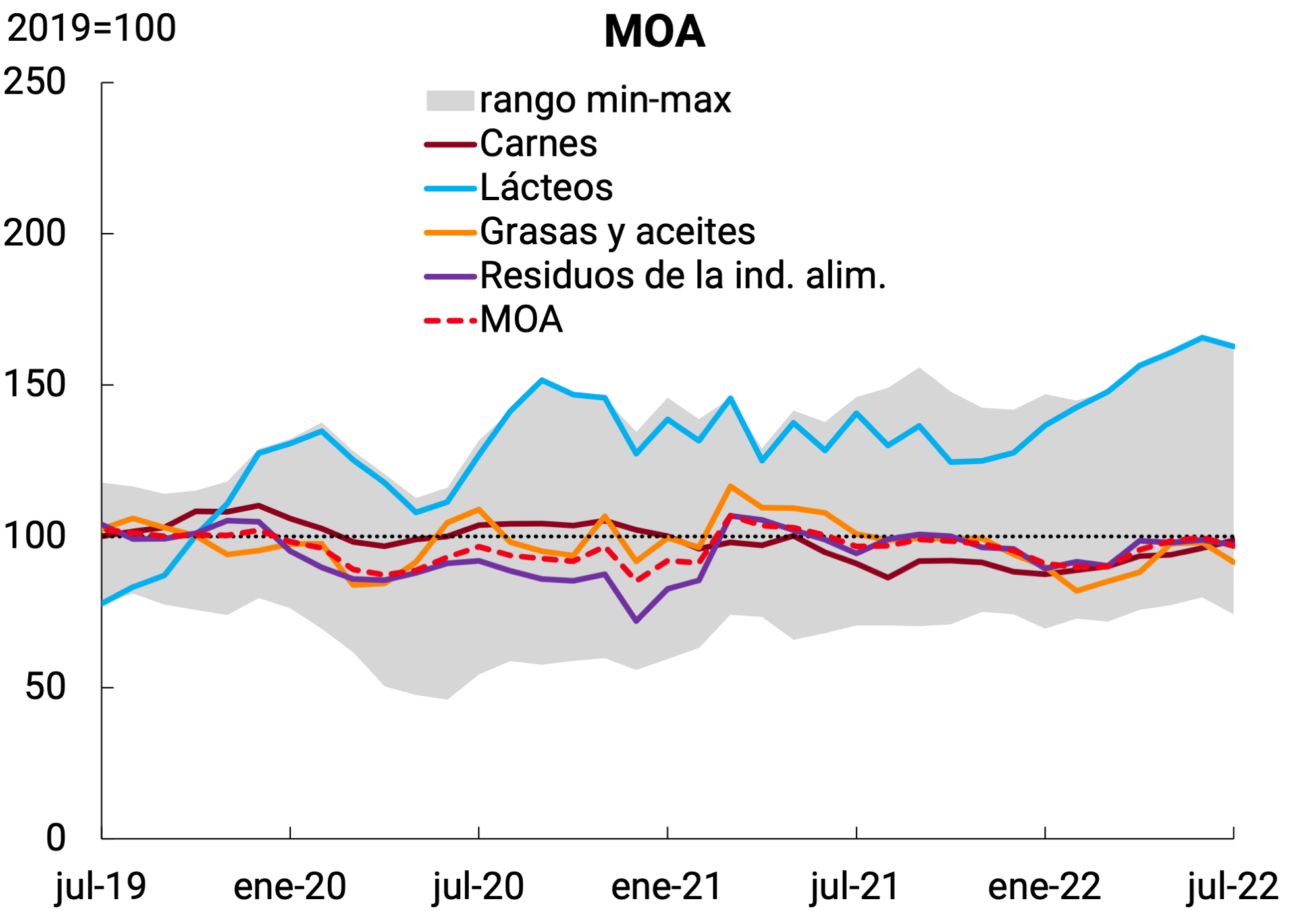

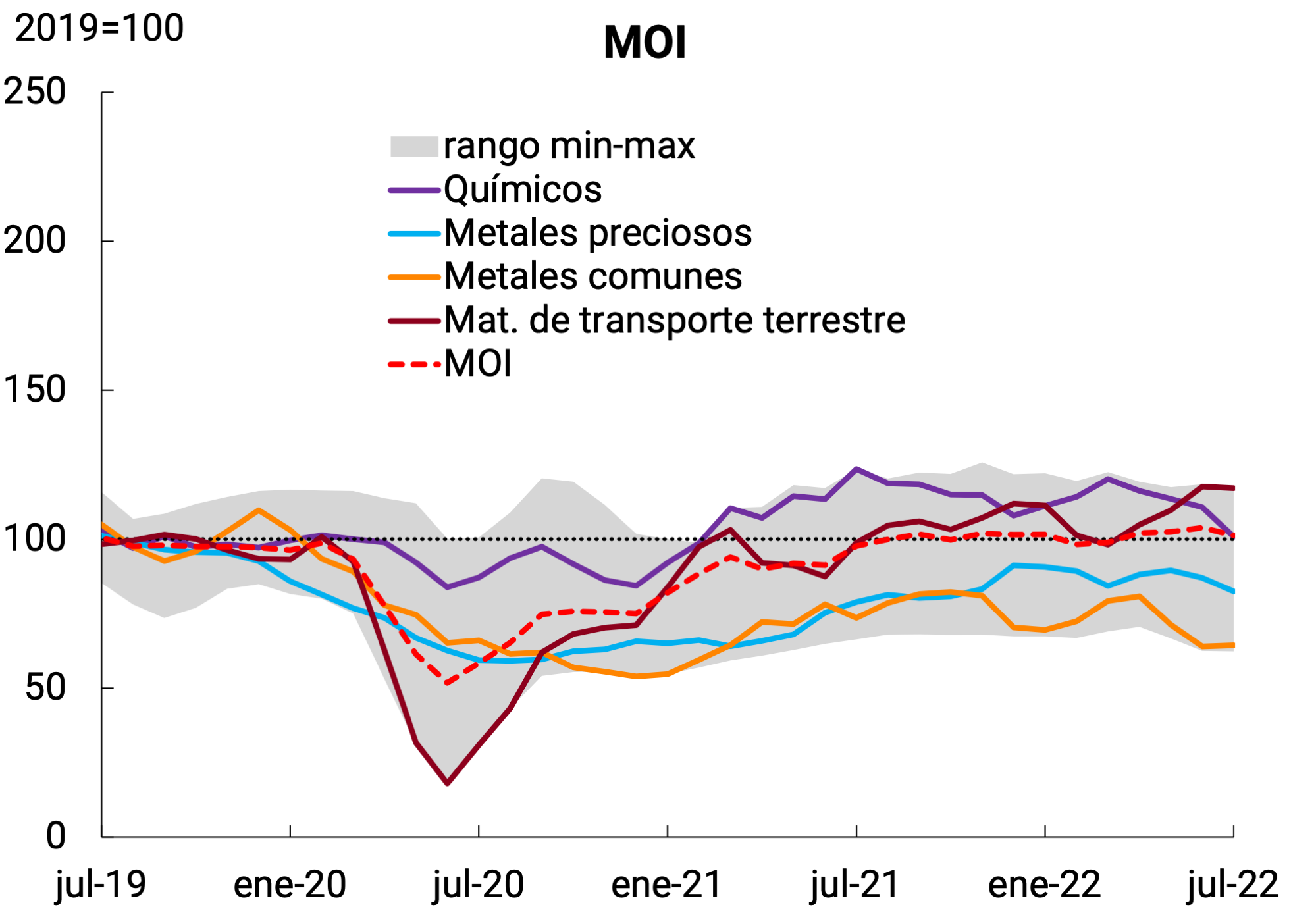

Two of the four main export items had increases in exported volumes in the second quarter of 2022. In the case of Manufactures of Agricultural Origin (MOA, +11% qq. s.e.), the growth was very widespread (13 of 14 grouped showed increases), with higher shipments of soybean derivatives standing out for their incidence, after a very weak first quarter. The exported quantities of Manufactures of Industrial Origin (MOI) increased 5% quarter. s.e., mainly underpinned by higher vehicle exports. On the other hand, shipments of Primary Products (PP) fell (-5% qoq. s.e.), with a strong negative incidence of oilseeds, in particular, soybeans. Finally, the quantities exported of Fuels and Energy (S) fell 8% s.e. in the quarter, affected by a decline in shipments of crude oil, the main category of the category (see Figure 4.4).

Source: BCRA based on INDEC data.

Box. Vehicle exports

One of the sectors that contributed to the growth of MOIs was the automotive industry, which has a high relevance in terms of value-added exports in addition to the creation of formal jobs.

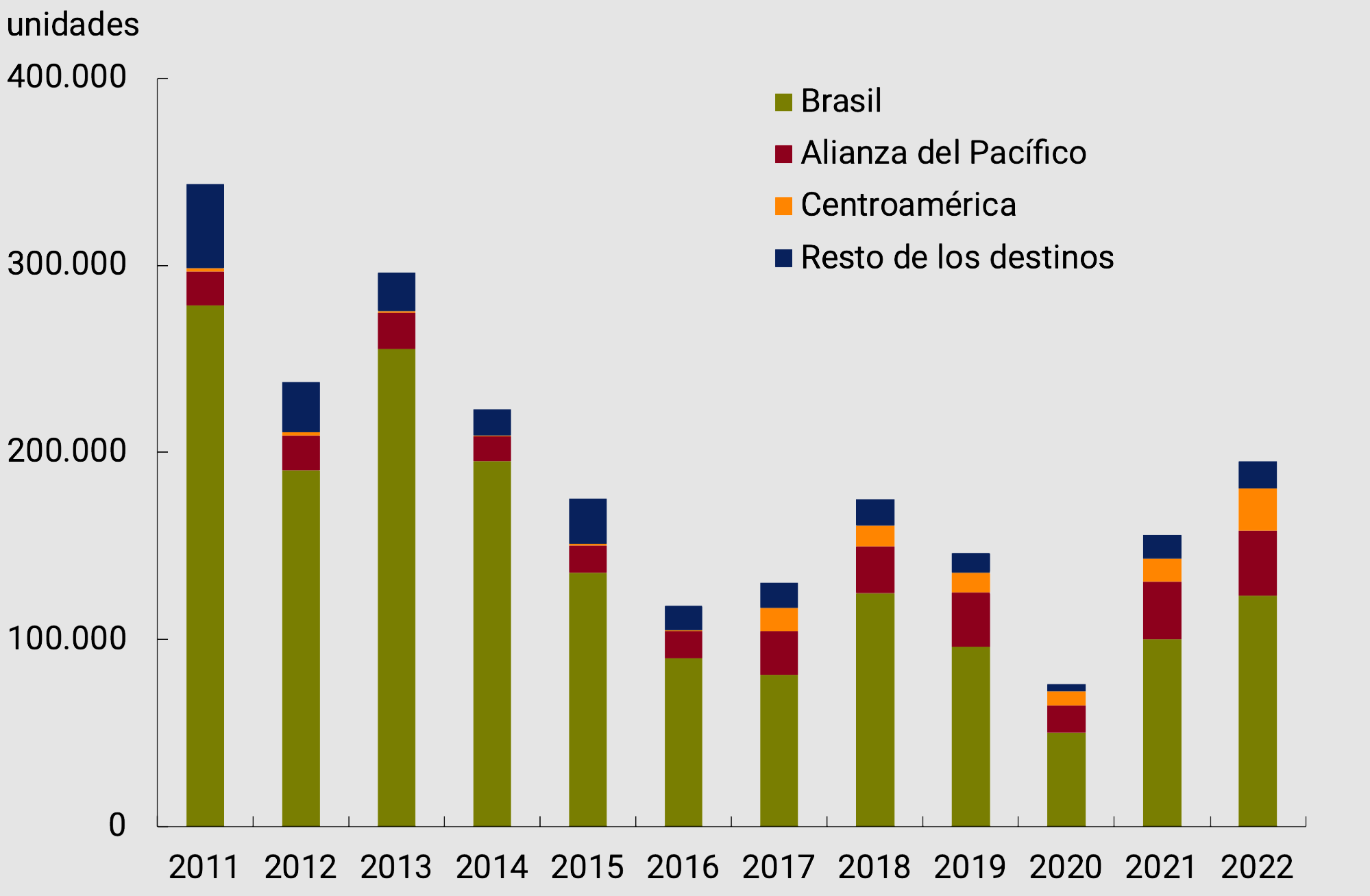

In the first 8 months of the year, a total of 195,385 vehicles were exported, which represents 25% more than what was accumulated in the same month of 2021 and 250% more than what was exported in the same period of 2020 (see Figure 4.5).

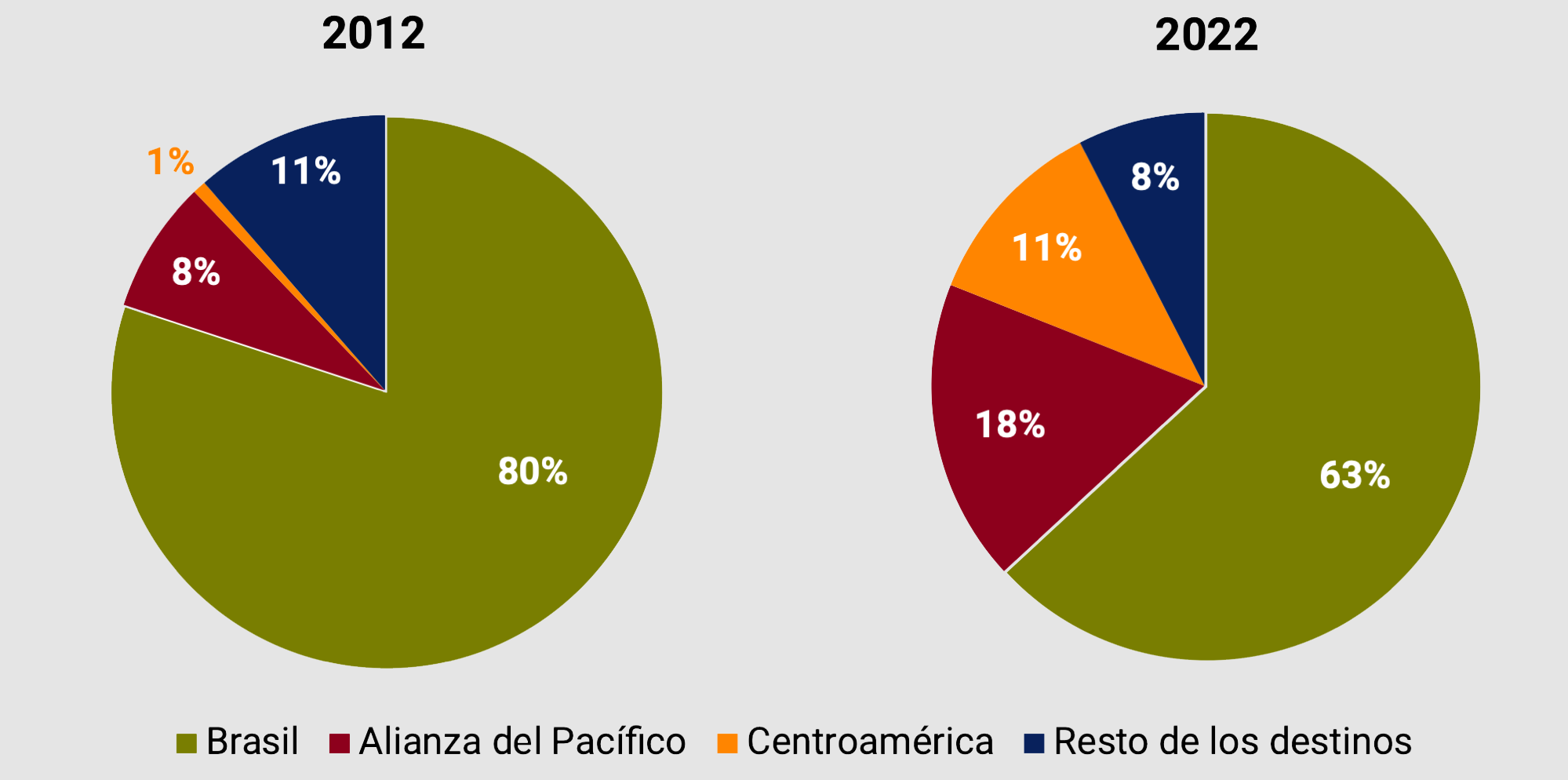

In conjunction with this aggregate growth, there is also a greater diversification of export markets, characterized by a more than proportional growth of the Central American destination (84% YoY). This is a positive aspect since it diversifies risks and removes dependence of the automotive industry with respect to the economic situation and commercial decisions made by Brazil, which continues to be the main export destination of the sector (see Figure 4.6).

This diversification of destinations occurred simultaneously with a change in the purchasing pattern of Brazil, our main buyer, which is tending to acquire fewer imported vehicles due to a policy of promotion of its national industry. In this line, a framework of growth opportunities was generated for new markets with high potential, mainly in the utility vehicle segment, in which Argentina is competitive internationally.

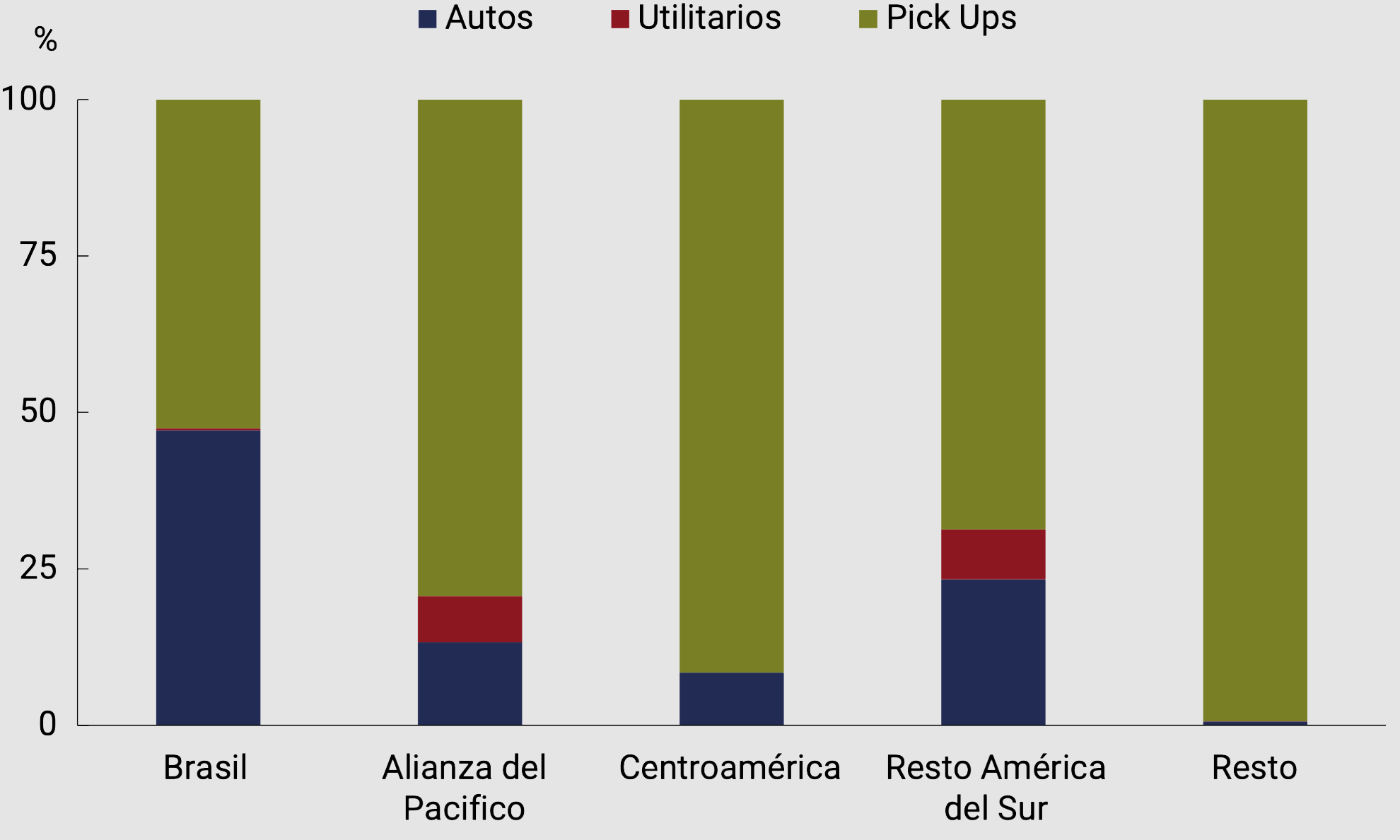

The automotive industry shows, among its main characteristics, a strong specialization towards the export of pick-ups, especially to Central America and the rest of the world where its share exceeds 90%. Shipments to Brazil are more distributed with a greater participation of private passenger vehicles, although in this case Mercosur’s corporate supply strategies of multinational firms located on both sides of the border seem to have an impact. Finally, exports of utility vehicles are concentrated to countries of the Pacific Alliance and the rest of South America (see Figure 4.7).

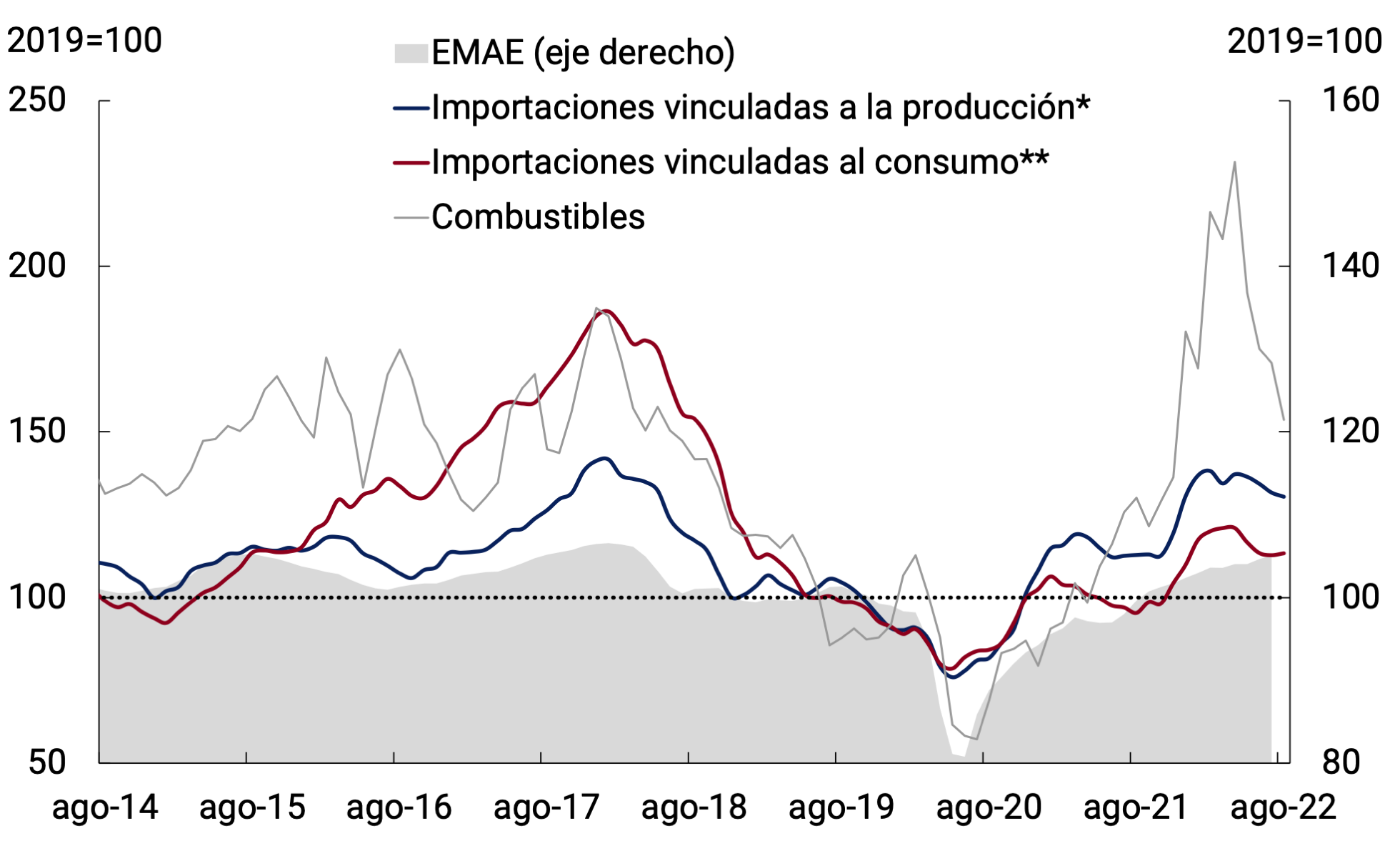

For their part, the imported quantities of goods have exhibited a generalized downward trend since March 2022. Since then, and adjusting for seasonal factors, the cumulative falls were 42% in the case of fuels, 13% in the case of goods directly associated with consumption, and 7% in those related to production (see Figure 4.8). In the first case, the calculation of the recent fall was influenced by the high level reached by purchases of fuels produced in the first months of the year (see Section 3 / Energy Trade Balance). The recent decline in the imported volumes of goods associated with production led the group to a level similar to that recorded in July 2017, when the level of economic activity was similar to the current one.

Figure 4.8 | Quantities imported. Seasonally

* Includes imports of capital goods and their parts of intermediate goods.

** Includes imports of consumer goods and vehicles.

Source: INDEC.

4.3. So far in 2022, the BCRA’s purchases in the foreign exchange market accumulated US$3,300 million, underpinned by the Export Increase Program

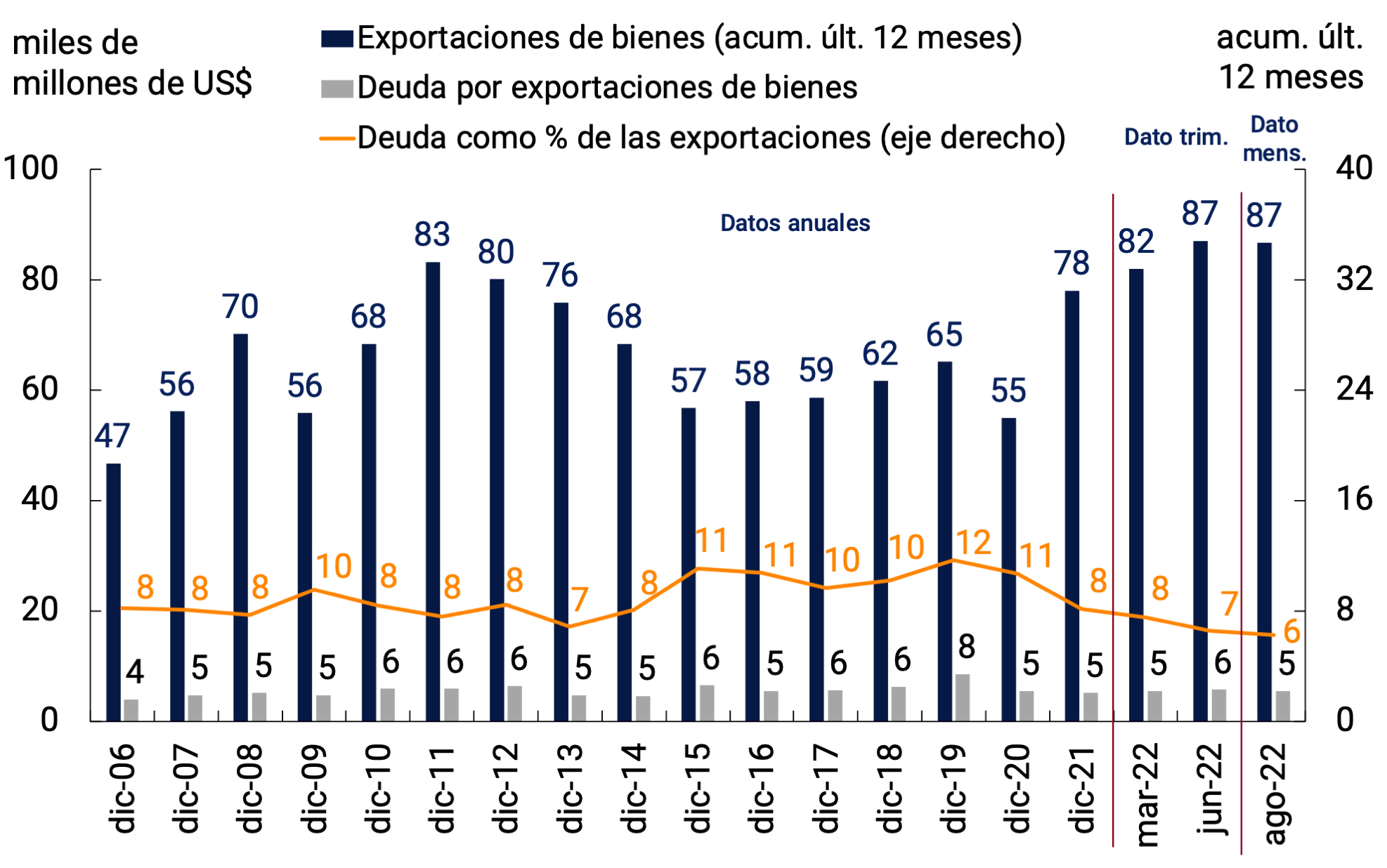

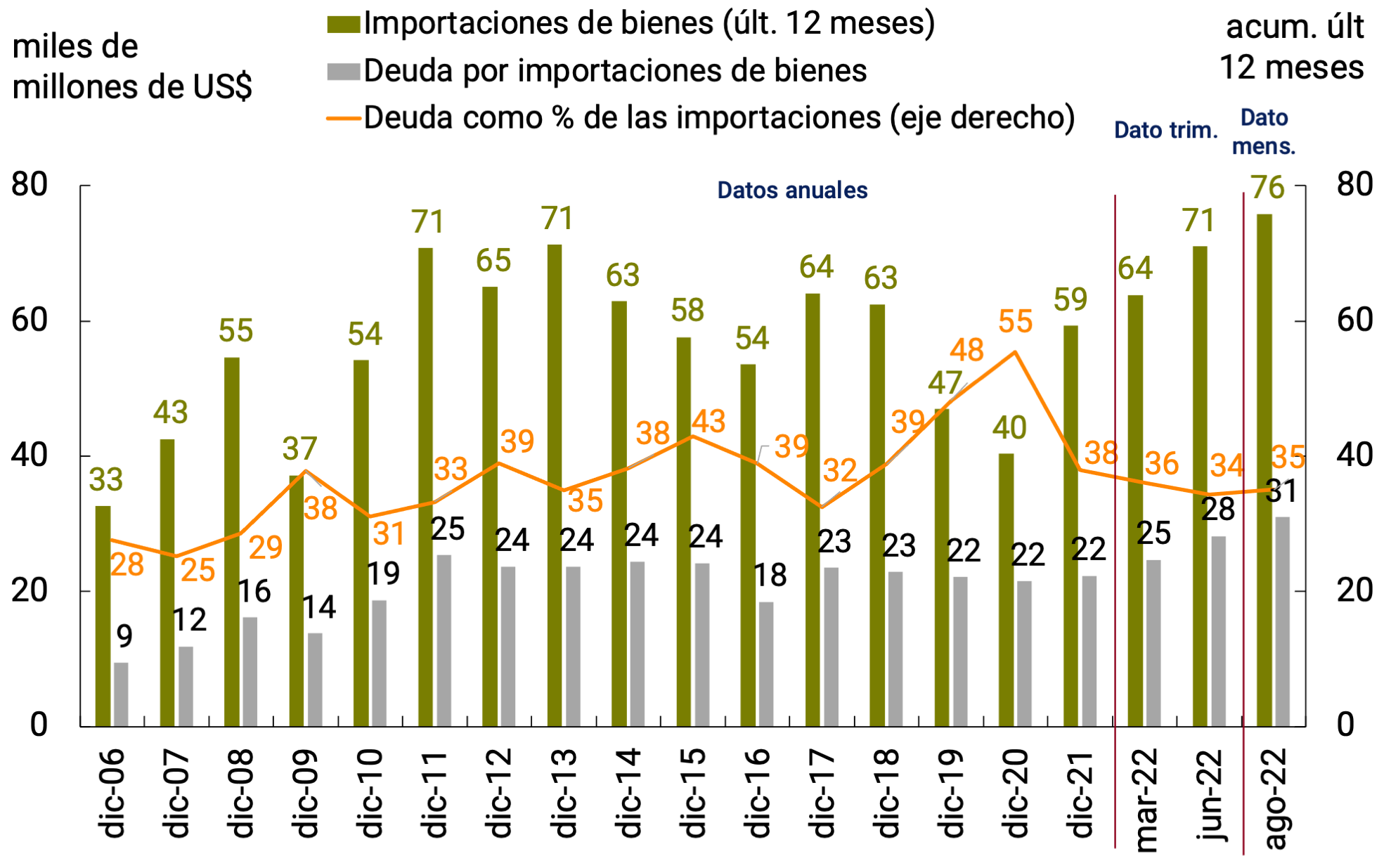

During the first eight months of 2022, exporters recorded revenues from exports of goods of about US$59,100 million. For its part, exports of goods totaled about US$59,500 million, so a slight decrease in external debt for advances and pre-financing of about US$400 million is estimated. Thus, the ratio of this type of indebtedness to exported securities is reduced to 6.2% and represents the lowest ratio verified since December 2006 (see Figure 4.9).

Figure 4.9 | Assets. Exports and external debt for exports

Note: Debt of Jul-22 and Aug-22 estimated based on accrual data and cash.

Source: BCRA based on INDEC data and own data.

During 2020, the BCRA established a series of regulations that aim to promote the allocation of foreign currency more efficiently, with an impact on both the evolution of private commercial and financial debt. These rules were maintained throughout 2021 and continued to be refined throughout 2022. In this context, during the first eight months of 2022, payments for imports of goods through the foreign exchange market for around US$48,100 million were about US$6,150 million below FOB imports for the period, which would imply a rise in foreign debt for this concept. Thus, the ratio of external debt to the level of imports rose in August 2022, reaching 35% (see Figure 4.10).

Figure 4.10 | Assets. Imports and external debt for imports

Note: Debt of Jul-22 and Aug-22 estimated based on accrual data and cash.

Source: BCRA based on INDEC data and own data.

The aforementioned evolution of trade in goods and trade debt for exports and imports of goods, resulted in a net result for goods in the foreign exchange market of US$10,989 million in the first eight months of the year, higher by about US$5,000 million than the result of the FOB trade balance of the same period and exhibiting a fall compared to the previous year (13% y.o.y.).

With regard to financial debt, and as part of the current regulatory framework mentioned above, in September 2020, Communication “A” 7106 established the guidelines under which private sector companies could initiate a process of refinancing their respective external liabilities, which would allow their maturity profile to be adapted to the guidelines required for the normal functioning of the foreign exchange market. This communication, which reached certain capital maturities between 15-Jan-20 and 31-Mar-21, was extended by Communication “A” 7230, covering maturities from then until the end of 2021. Likewise, Communication “A” 7422 extended the term of the maturities until 30-Jun-22 and Communication “A” 7466 did so until 31-Dec-22.

In this context, the renegotiations recorded during the first eight months of 2022 had an impact on lower net purchases in the foreign exchange market of about US$1,470 million compared to the original maturities for that same period, accumulating lower net payments of about US$4,000 million since its inception. It should be noted that in the first eight months of 2022, net cancellations represented only 26% of the maturities reached, with almost three-quarters of the maturities of securities and financial debts being refinanced.

As for the BCRA’s result in the foreign exchange market in the year to August, the entity’s purchases and sales were offset, while International Reserves fell by US$2,928 million in the same period.

The variation in International Reserves up to August was explained by the decrease in the valuation of assets by about US$2,196 million, the fall in the foreign currency holdings of the entities by about US$1,700 million and sales in the Local Currency System by US$528 million. These movements were partially offset by the net inflows of foreign currency debt of the National Government of about US$1,500 million (net income of the IMF of about US$3,500 million and net payments of other debt in foreign currency of US$2,000 million).

It should be noted that in addition to the measures implemented since July10 aimed at encouraging sales and settlement in the foreign exchange market of agricultural products, on September 5 was added the creation by Decree 576/22, of the “Export Increase Program” through which an exchange rate of $200 for every US$1 was established until September 30. for exports of soybeans and their derivatives.

Based on the incentives generated by this program, the oilseeds and cereals sector liquidated US$5,300 million through this mechanism in the foreign exchange market at the close of this report. The upturn in liquidations in the sector allowed the BCRA to buy some US$3,300 million in the foreign exchange market during the month of September (see Figure 4.11).

Figure 4.11 | Exchange market. Result

*Data as of Sep 20-22.

Note: joint cumulative result of the BCRA and the National Treasury in the foreign exchange market.

Source: BCRA.

4.4. Perspectives

For the year 2022, the economy is expected to register a trade surplus in goods for the fourth consecutive year, within the framework of a managed floating exchange rate policy. Meanwhile, the current account balance would return to positive territory in the fourth quarter of the year. For next year, the growth in agricultural production, particularly soybeans, and the commissioning of the Néstor Kirchner gas pipeline at the end of June 2023, which will reduce fuel imports, will contribute to the strengthening of the trade surplus of goods and, consequently, to the accumulation of International Reserves.

The international context will continue to play a leading role in the risk matrix of the external sector of the Argentine economy. The speed with which central banks in advanced economies tighten their monetary policy in response to high inflation in their economies (in a context in which a worsening of bottlenecks in some global value chains resulting from China’s COVID 0 health policy cannot be ruled out), It will affect the growth of our trading partners and the prices of raw materials in general. On the other hand, the duration and potential escalation of the war in Ukraine will influence the evolution of the global cost of energy and the terms of trade of our economy.

The BCRA will continue to prudently manage foreign exchange regulations in order to adapt them to the needs of the situation, favoring monetary and exchange rate stability. Along these lines, on September 8, 2022, the provisions of Communication “A” 7532 were extended until the end of the year, to allow time for the normalization of foreign trade, which, in order to respond to the extraordinary needs for foreign currency to meet energy imports and in order to sustain the economic growth and development of SMEs, the import financing system was extended for one quarter to those made under Non-Automatic License and to the import of services. Likewise, it was decided in coordination with him, at that time, the Ministry of Productive Development to expand the tariff positions of goods equivalent to those produced in the country that will have access to the market from 180 days and that of luxury goods that will be able to access from 360 days.

Going forward, and to the extent that macroeconomic conditions allow, exchange rate regulations will be made more flexible, with the aim of maintaining in the medium and long term a set of macroprudential regulations compatible with the dynamization of capital flows aimed at the real economy.

Back to top

5. Public Finance

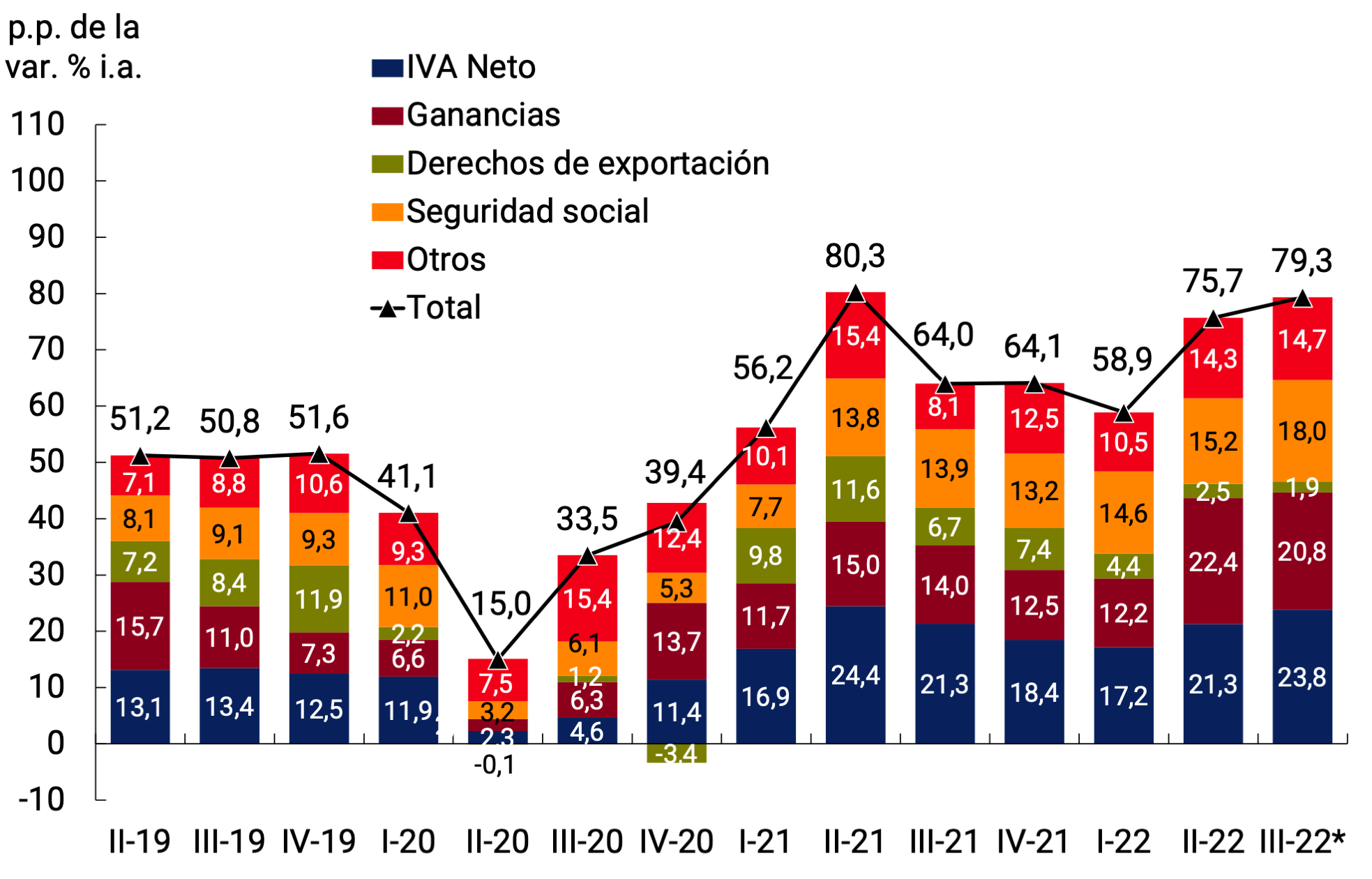

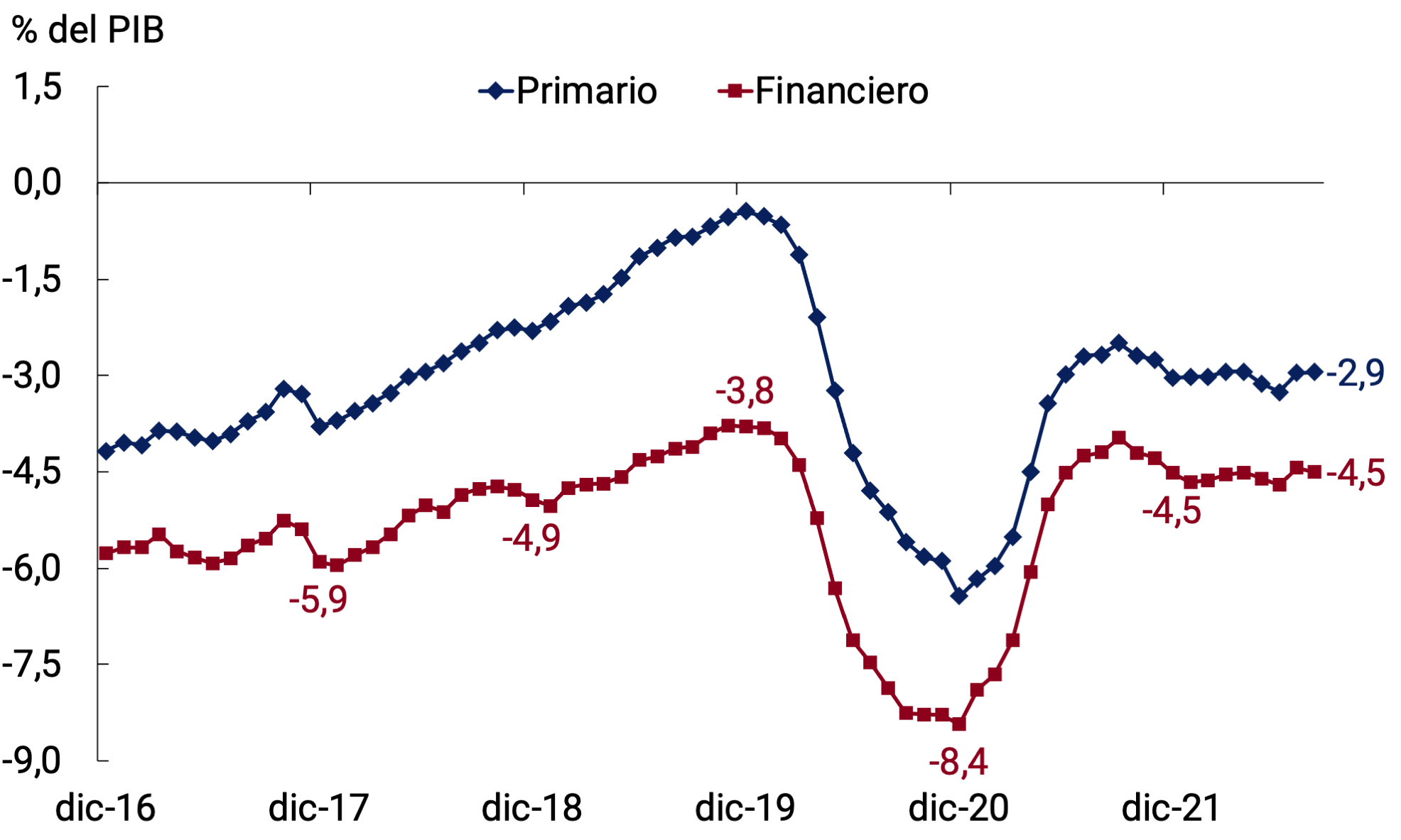

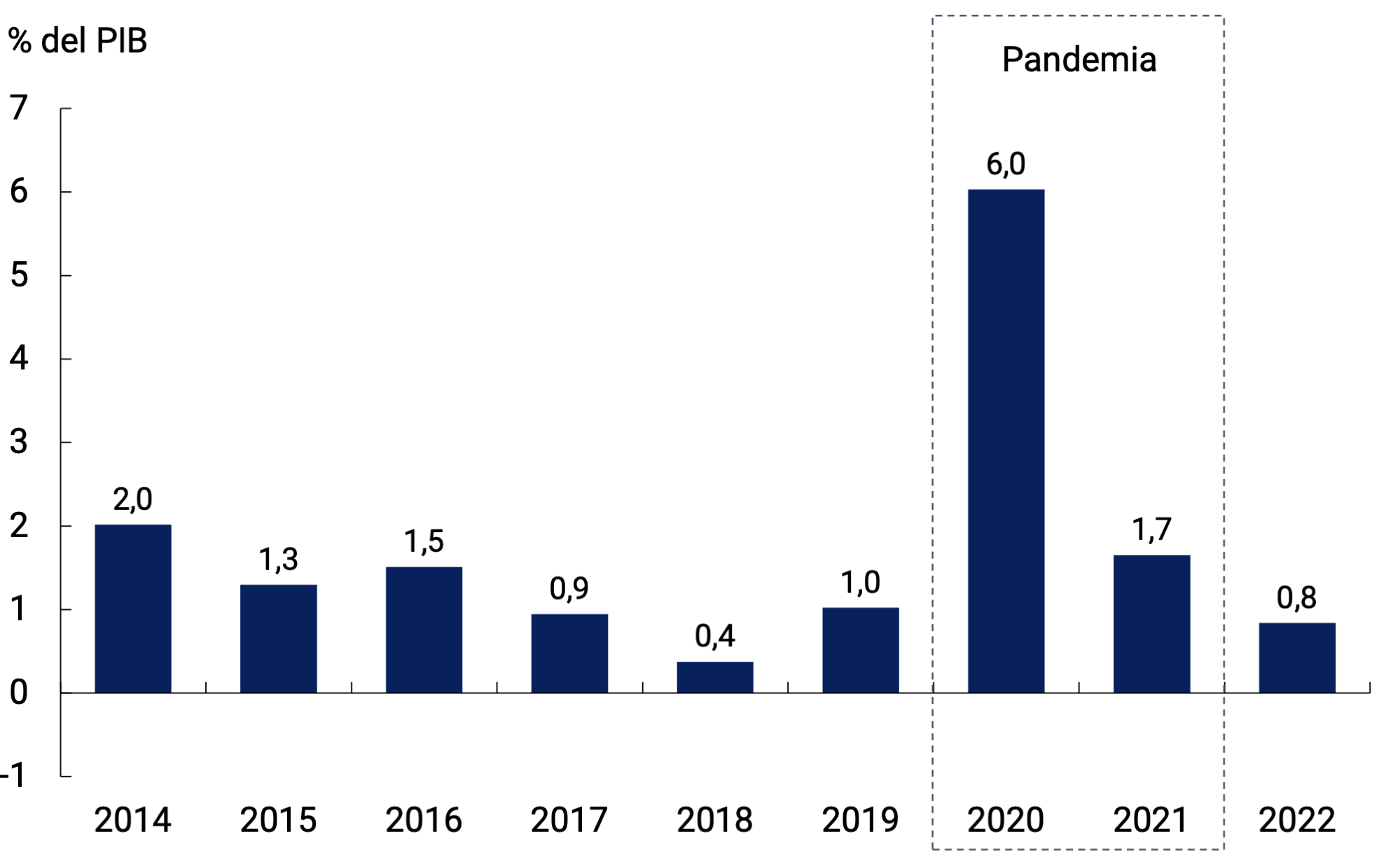

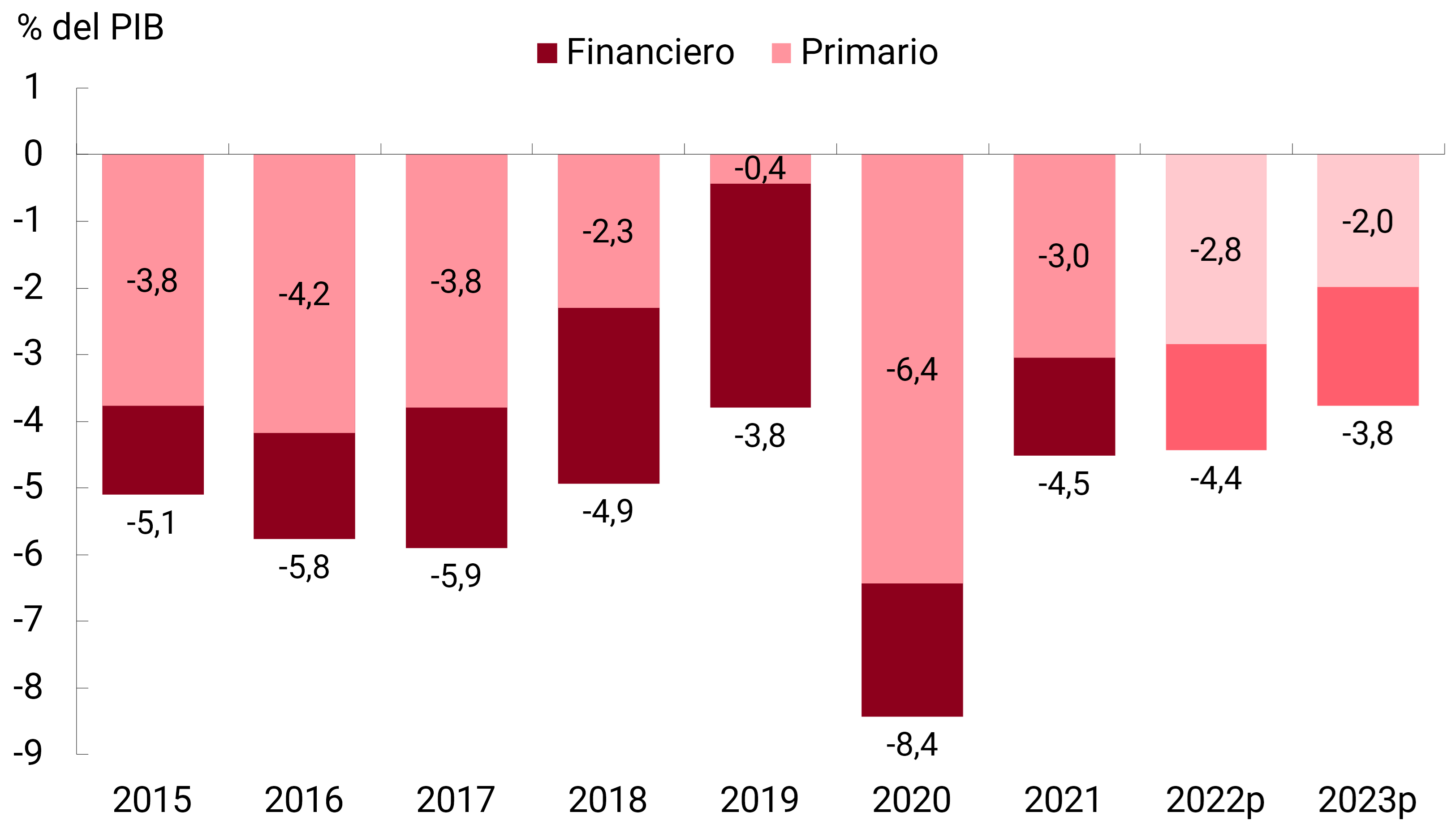

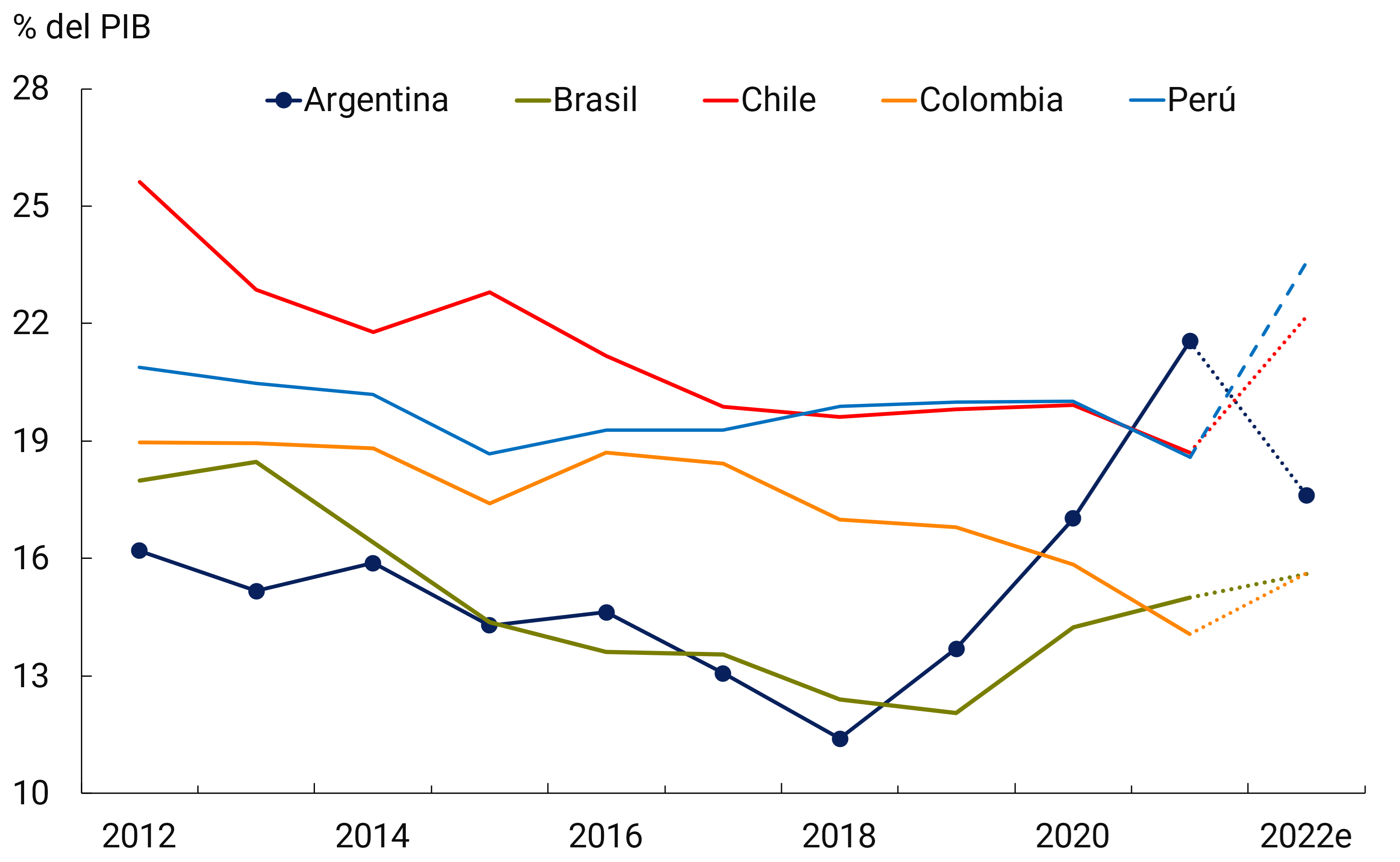

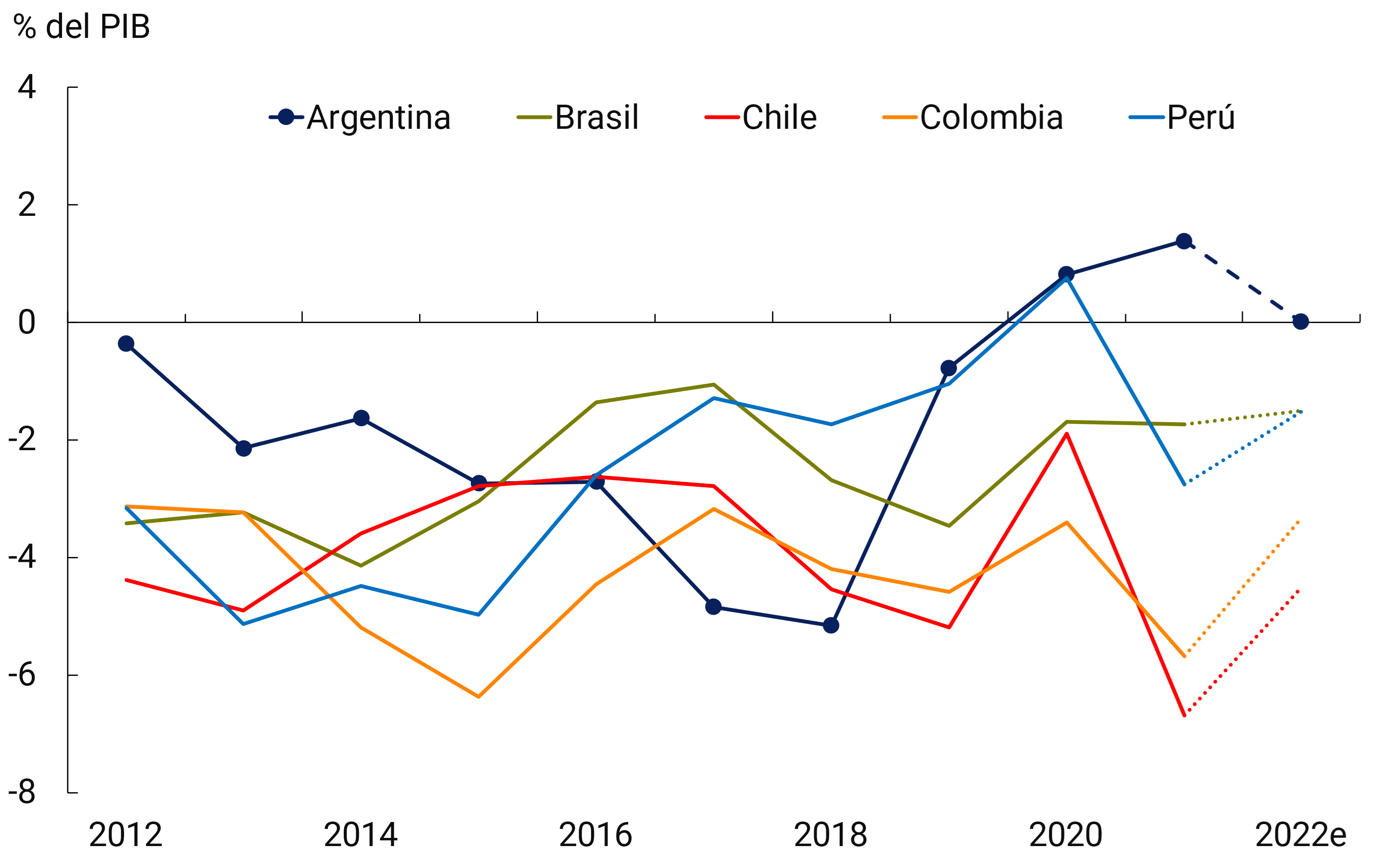

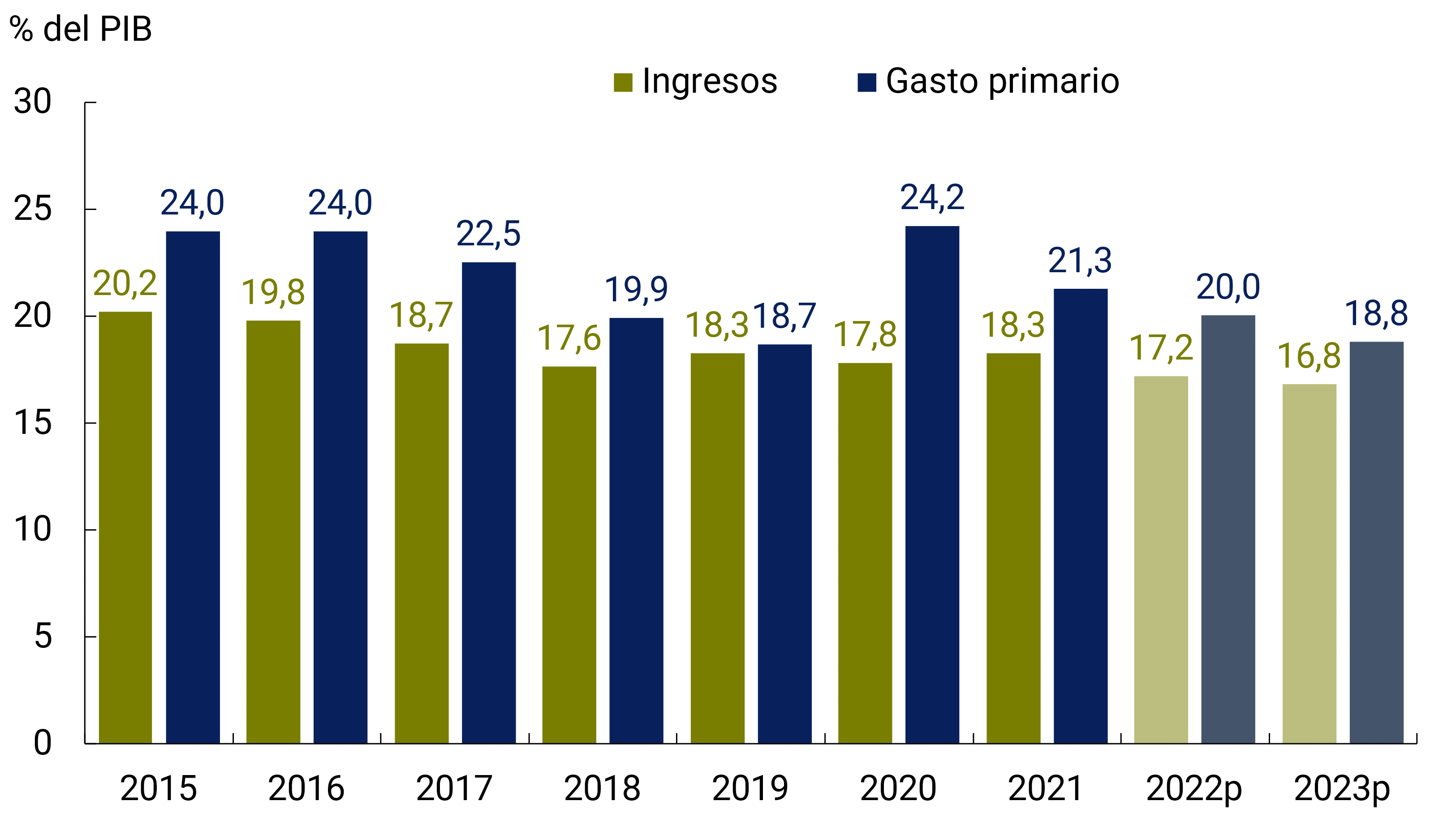

In July and August, revenues grew above primary expenditures, in contrast to what happened during the first half of 2022. Thus, the primary fiscal result on a cash basis of the National Non-Financial Public Sector (NFPS) accumulated in the last 12 months to August a deficit balance equivalent to approximately 2.9% of GDP and remained at levels lower than those of the end of 2021 (3.0% of GDP), a value that had already been significantly lower than that observed during 2020 (6.4% of GDP). For its part, the NFPS financial deficit represented 4.5% of GDP in the same period. The Ministry of Economy reaffirmed the fiscal path compatible with an annual NFPS primary deficit of 2.5% of GDP for 2022, without modifying the target originally set within the framework of the program with the IMF.

In the July-August two-month period, collection grew 79.3% YoY (+2.8% YoY in real terms). Economic growth and improved employment and wages contributed to this tax performance. Taxes associated with foreign purchases maintained a high dynamism, while export duties had a more limited advance in the margin. On the side of tax resources, measures were implemented that will contribute to achieving the proposed fiscal objective. Advances on Income Tax for corporations were brought forward and the collection on account of this tax on foreign currency transactions for the purchase of banknotes and for outbound tourism expenses or through the use of cards increased. The “Export Increase Program” was also created to stimulate the commercialization of soybeans, with an effect on the collection of duties in September.

On the expenditure side, the budget appropriations were adjusted in order to reflect the execution currently projected and the freezing of the personnel of the National Public Administration including decentralized public companies was reinforced. Likewise, measures were provided to segment the rates of public services (electricity, gas and water), which will generate savings in the associated subsidies. Meanwhile, a program began to be implemented that will seek the gradual incorporation into private sector jobs of current beneficiaries of social plans. For its part, priority was given to expenses related to the construction of the Vaca Muerta-Salliqueló “Néstor Kirchner” gas pipeline, which will contribute to generating significant savings in the future.

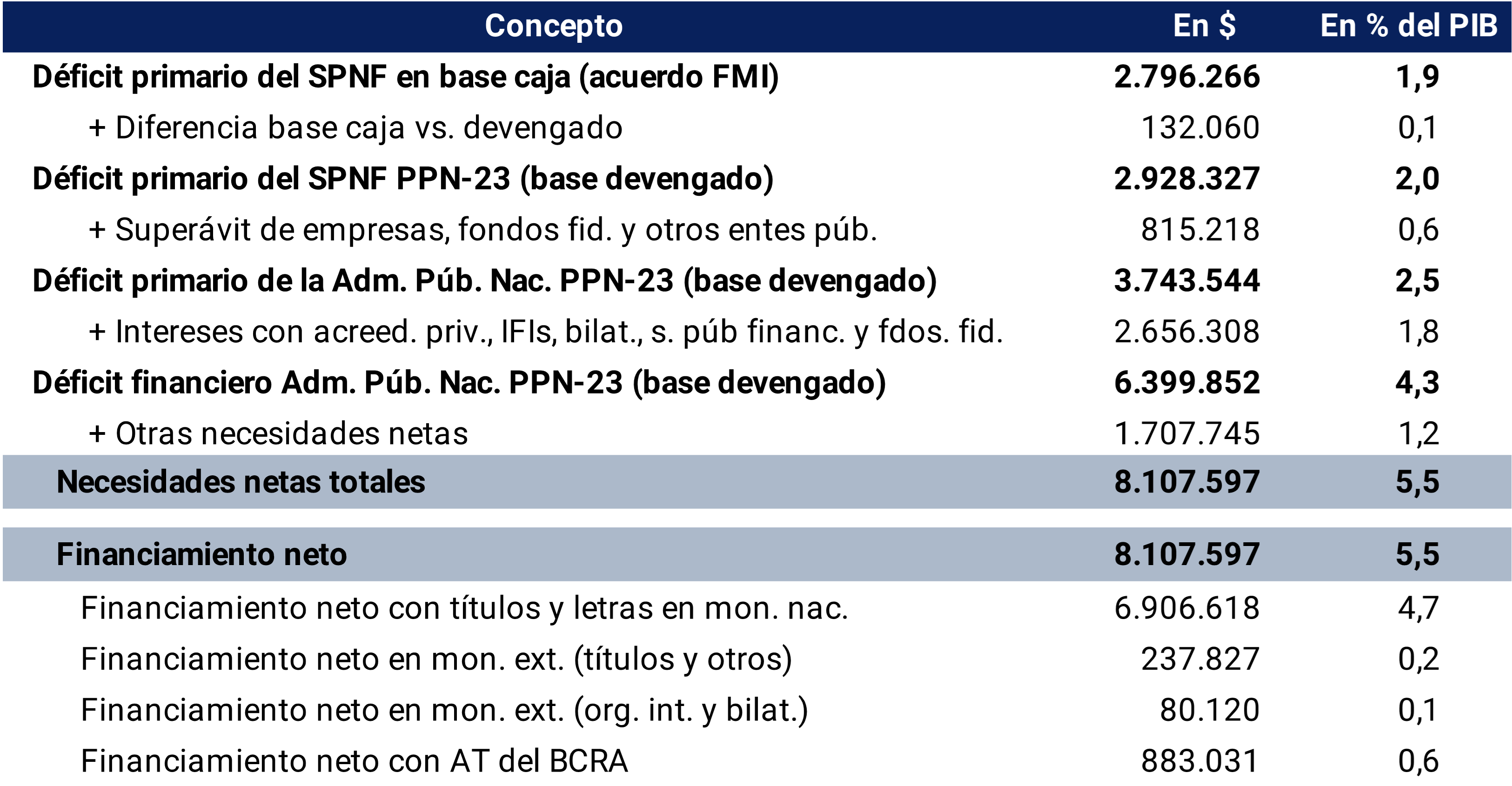

The fiscal targets established within the Extended Facilities Program (PFE) with the International Monetary Fund (IMF) for the second quarter of the year were met. In turn, the National Government sent the Draft Budget Law for 2023 to the National Congress, adapting it to the current conditions of the macroeconomic context, foreseeing convergence to a primary deficit for next year of 1.9% of GDP, in line with the current agreement with the IMF.

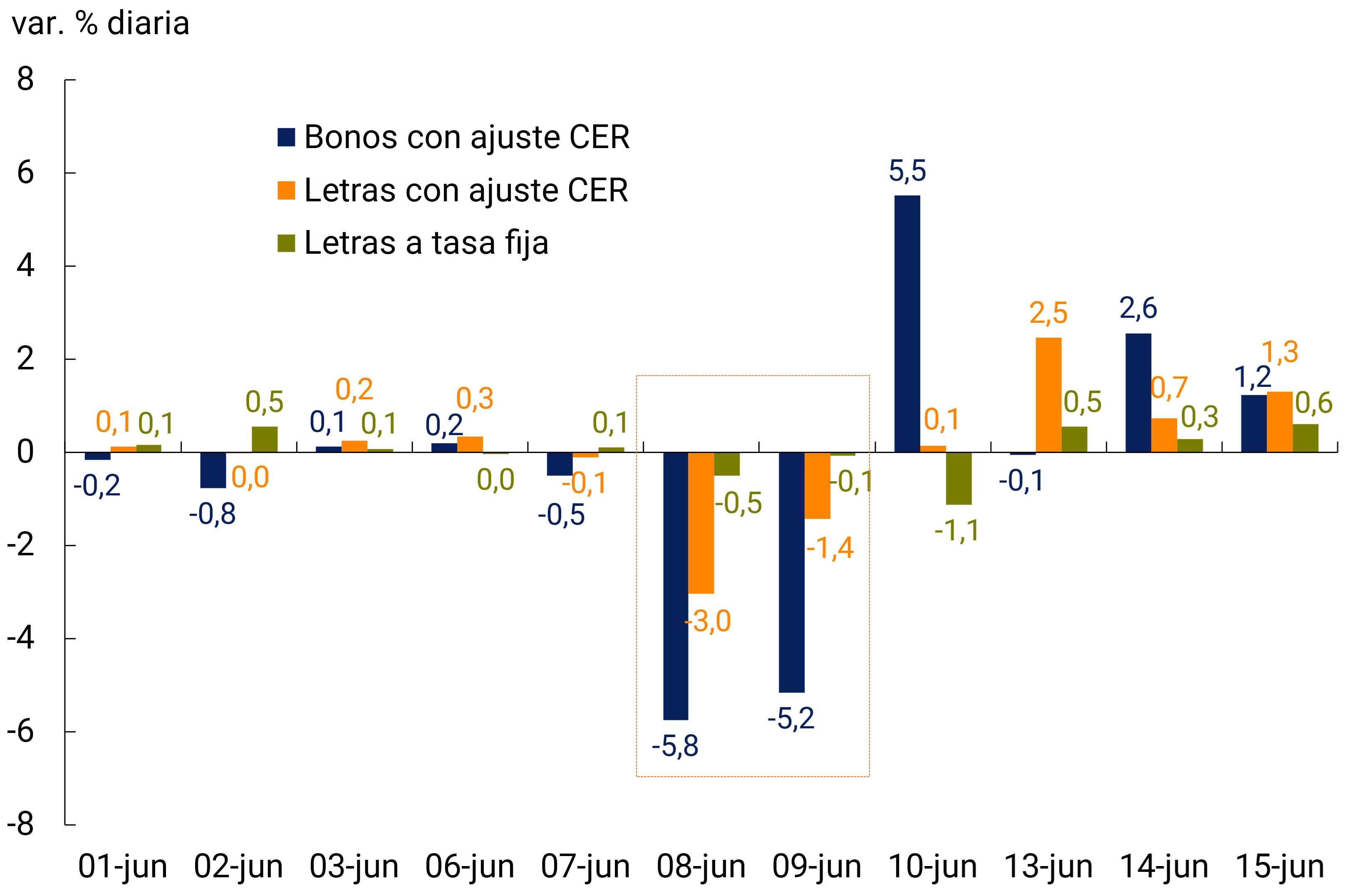

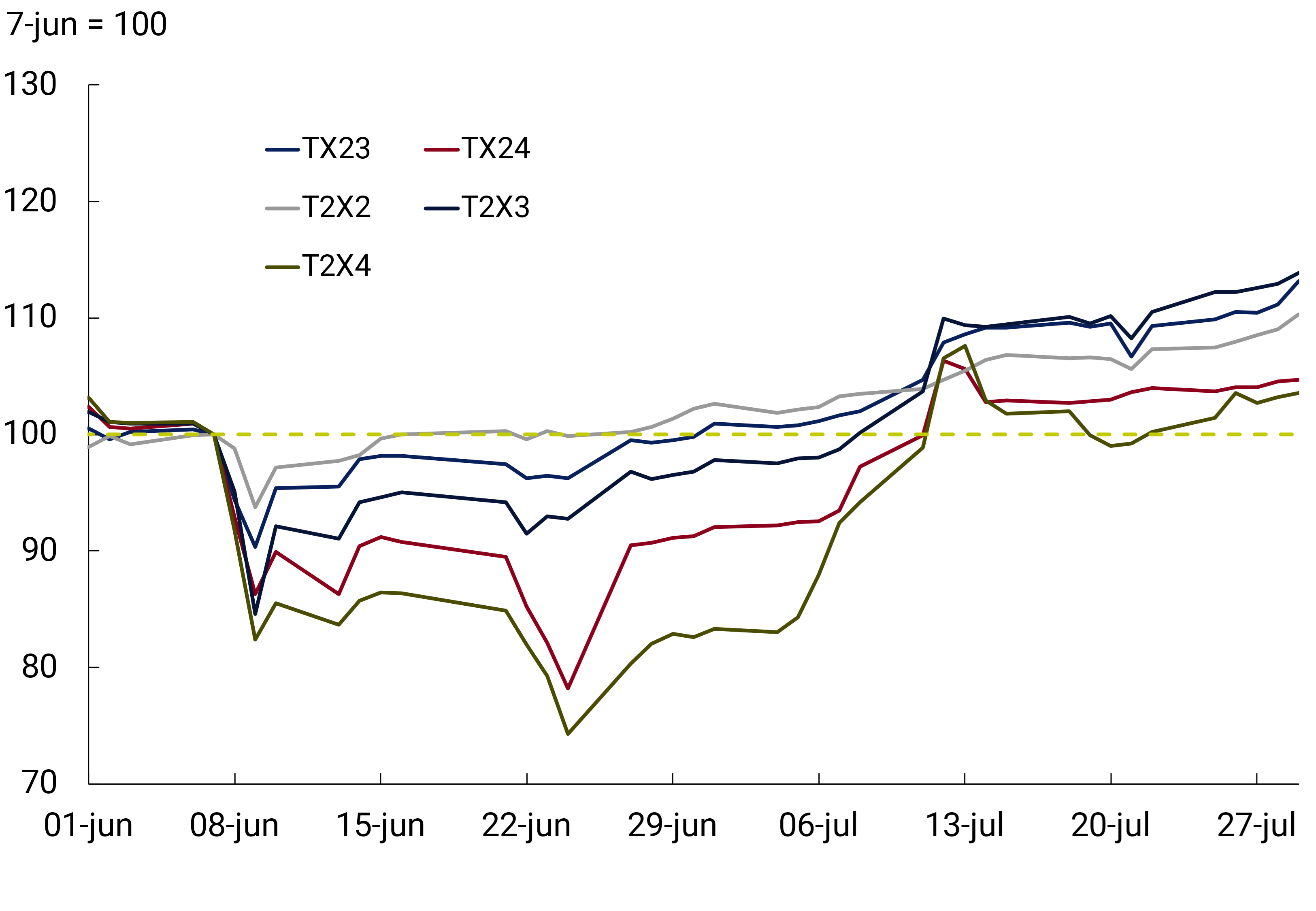

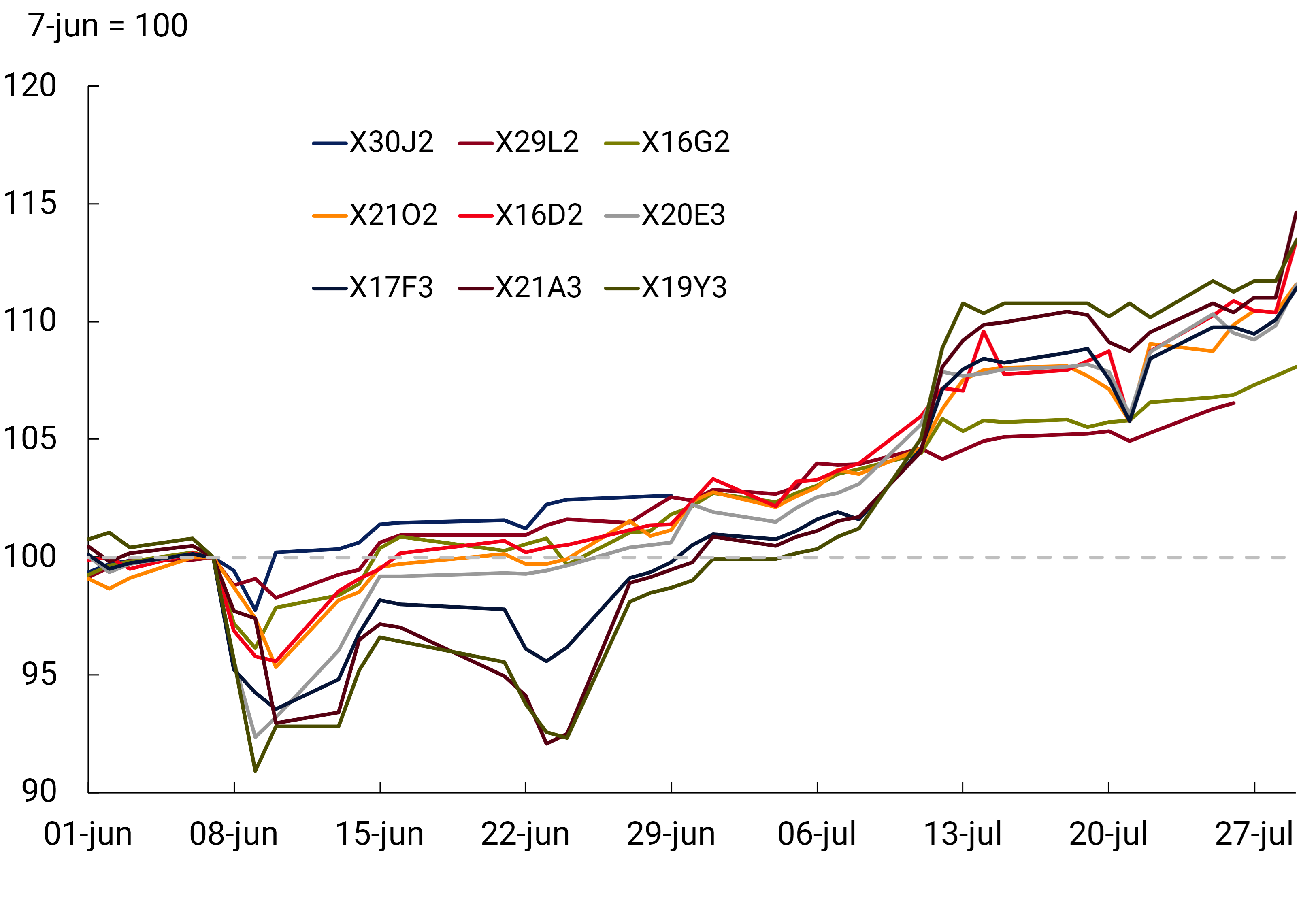

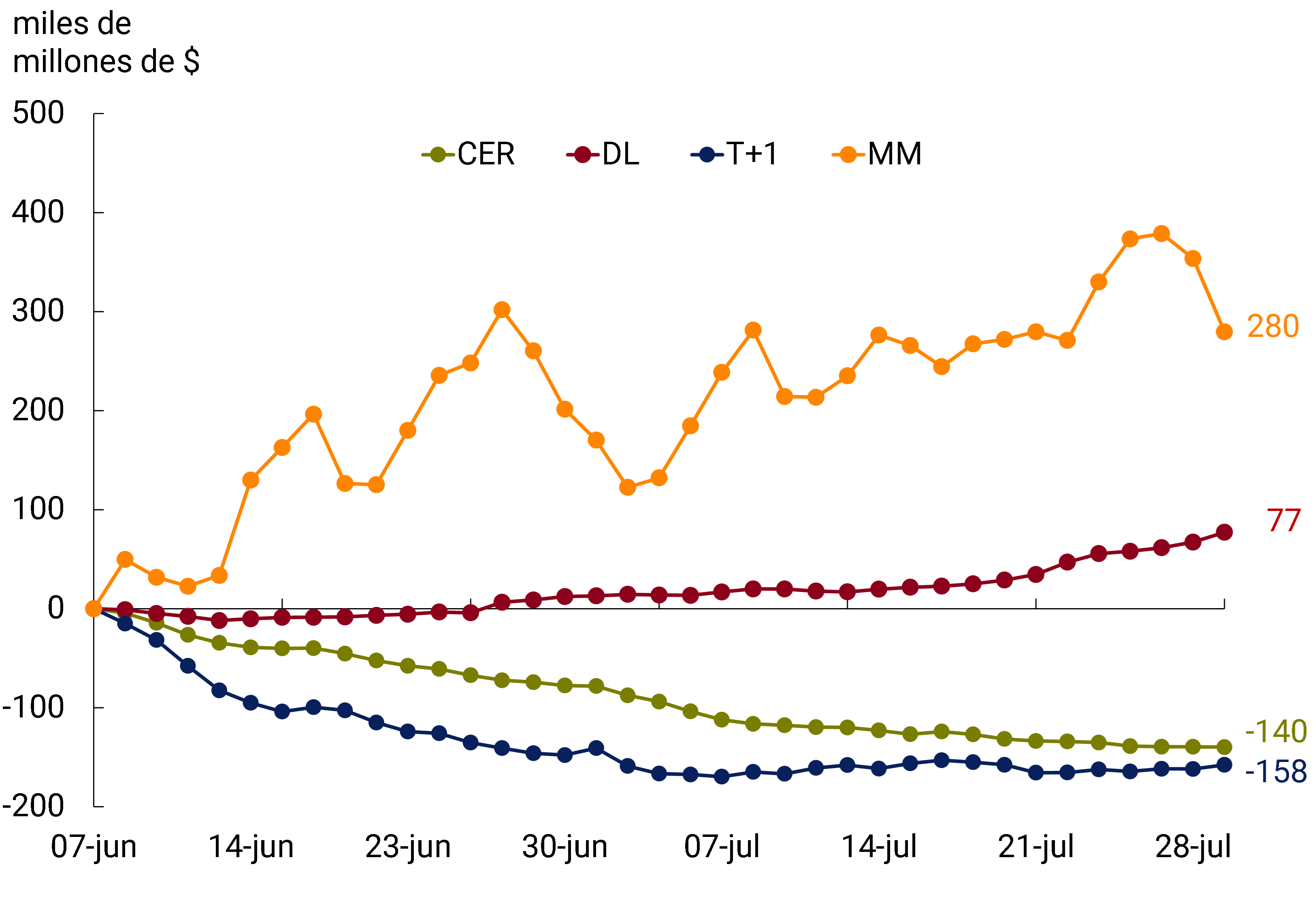

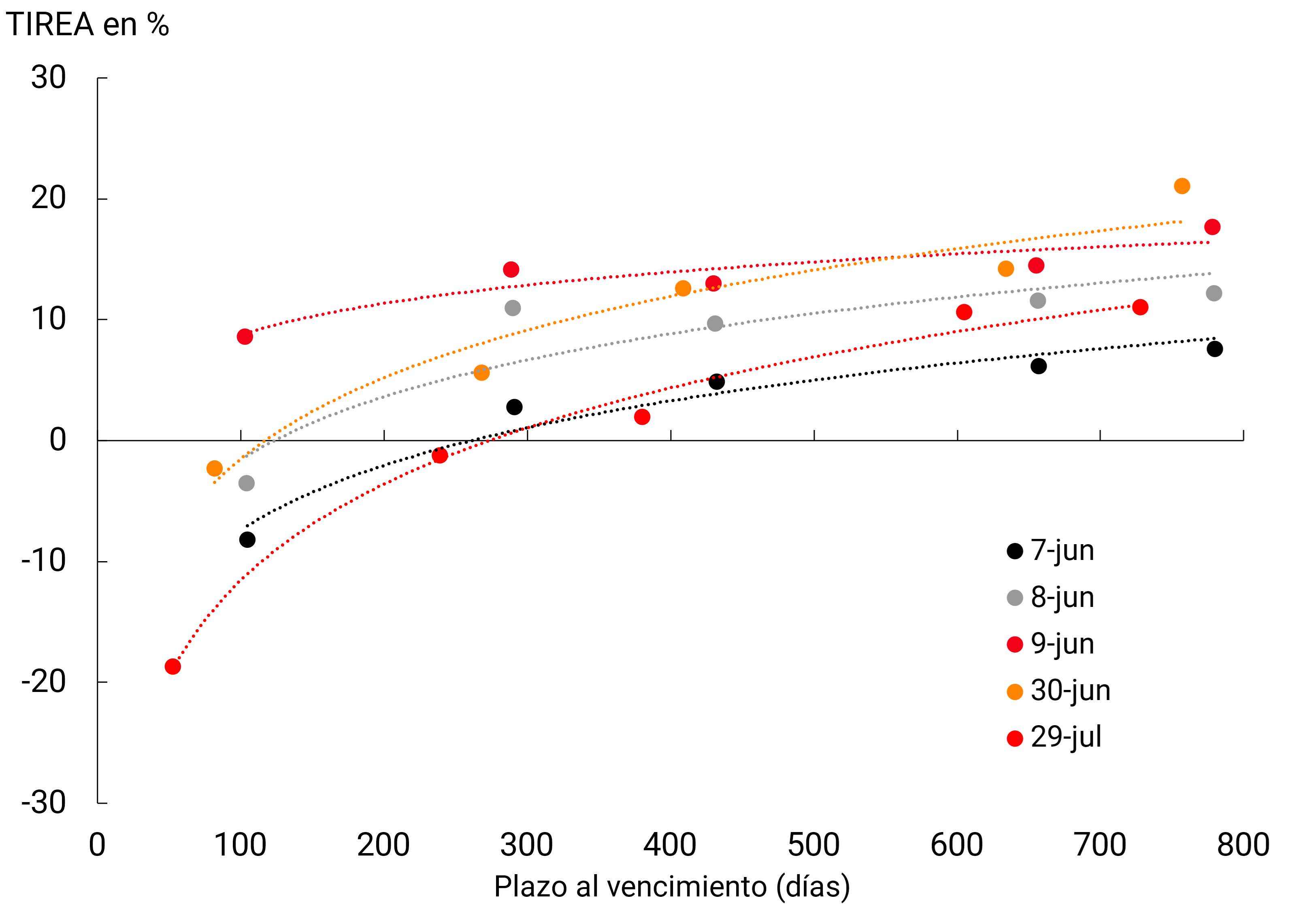

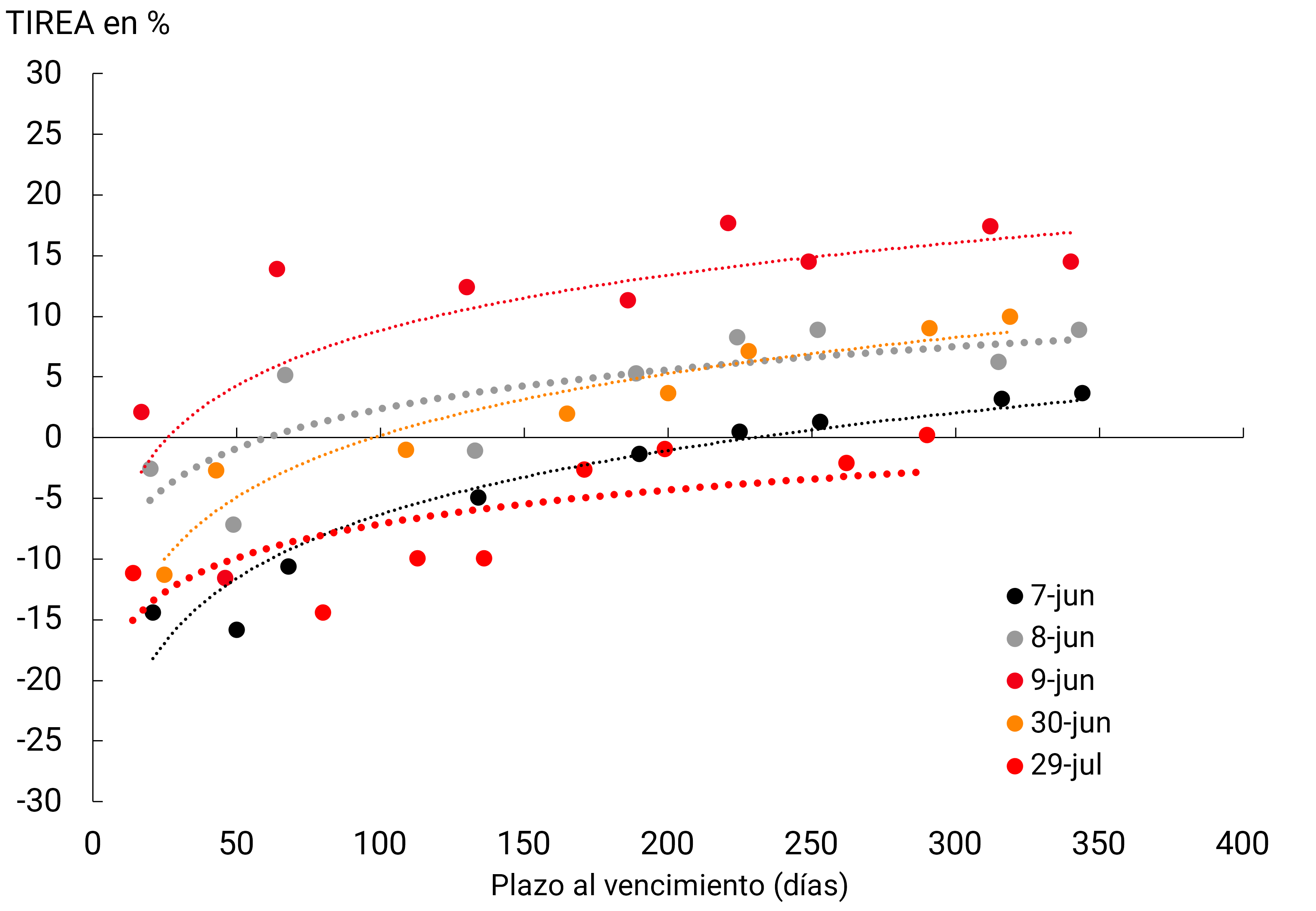

At the beginning of June, in a context of greater financial volatility at the international and local levels, tensions were generated in the sovereign debt market in pesos. The extraordinary intervention by the BCRA in the secondary public debt market to preserve financial stability, the successful implementation of a short-term debt swap and the increase in rates implicit in the auctions of the demanded instruments managed to stabilize the market. The financing strategy made it possible to obtain net funding of about $1.5 billion in the first eight months of the year. The stock of National Public Debt at the end of August13 , 2022 represented approximately 80% of GDP, exhibiting a reduction of about 9.6 p.p. compared to the end of 2019.

5.1. National tax collection strengthened national tax revenues by sustaining its growth in real terms during the second quarter and early third quarter

National tax collection increased 75.7% during the second quarter of 2022 compared to the previous year (see Figure 5.1), which meant a real growth of 9%. With data up to August, during the third quarter collection advanced 79.3% y.o.y. (+2.8% y.o.y. in real terms). The performance of taxes between April and August responded to the consolidation of the economic recovery and the improvement in wages and formal employment. Taxes associated with foreign purchases made real progress while export duties were reduced: grain quantities were impacted by lower agricultural supply due to drought and the commercial decisions of sector actors, while prices fell at the margin.

Figure 5.1 | Contribution to the growth of national tax

* Data as of Aug-22.

Source: BCRA based on AFIP data.

The vast majority of taxes related to the domestic market (Value Added Tax (VAT), Profits, among others) continued to show a good performance between the end of the second and the beginning of the third quarter due to the maintenance of the recovery of economic activity. Net VAT grew 73.6% YoY in the second quarter and 84.4% YoY with partial data in the third. On the other hand, the Tax on credits and debits in bank accounts advanced 71.2% YoY and 83.8% YoY in the second and third quarters to August, respectively. The exemption to the Health sector operated negatively on this tax until June. The income tax showed great dynamism: it grew 100.1% YoY between April and June and 97.9% YoY between July and August. This is explained by improvements in the labour market, as well as by better results of companies with a balance sheet closure in December 2021 compared to the previous period. Likewise, an increase of 10 percentage points (p.p.) in the withholding on account of taxes on Income and Personal Assets for the consumption of foreign currency for travel and expenses abroad14.

Other taxes continued to show a more irregular advance: Internal Taxes grew 54.3% YoY between April and June and 80.7% YoY between July and August, while Fuels advanced only 30.5% YoY and 9.0% YoY in the same periods, mainly due to the delay in updating the tax. On the other hand, Personal Assets advanced 64.9% YoY and 41.4% YoY in the second and third quarters, respectively, affected in part by a high base of comparison due to different temporality in maturities in 2021 and 2022.

Social security resources, driven by improvements in the labour market (see Chapter 3. Economic Activity and Employment), both due to increases in registered employment and improvements in the real formal wage, had an increase of 77.1% y.o.y. between April and June and 80.2% between July and August. It is worth adding that these resources were negatively impacted by the measures taken by the National Government – in force until June 2022 – which reduced employer contributions in the health sector, to the critical sectors contemplated in the REPRO program and to companies located in the provinces of the Norte Grande.

Import duties and the statistical tax showed a joint increase of 67.4% y.o.y. during the second quarter and 90.7% y.o.y. in the third. This behavior was explained by higher imported values (see Chapter 4. External Sector). Finally, export duties had a more limited performance: +25.7% YoY between April and June and +22.8% YoY between July and August, in a context of drought that affected agricultural production, which was partly offset by the favorable international context for international prices of the main export products and the recovery of external demand. However, these prices were reduced at the margin. Effective during the month of September, the Export Increase Program15 was created to stimulate the commercialization of soybeans, with an effect on the collection of duties. The program also seeks to improve the reality of producers, help regional economies and strengthen reserves.

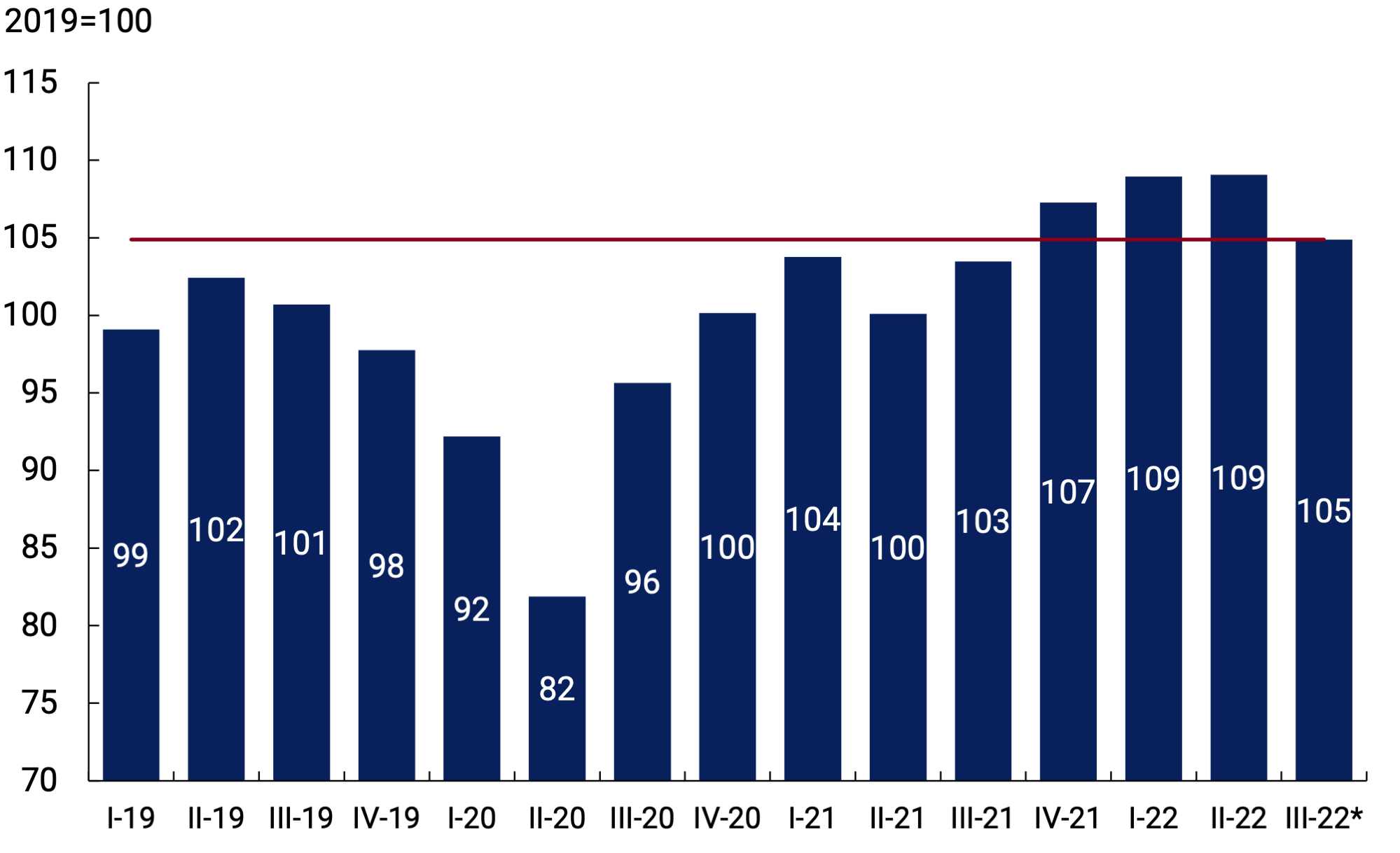

Figure 5.2 | Real national tax collection seasonally adjusted

*Data as of Aug-22.

Source: BCRA based on data from the Ministry of Economy and INDEC.

In real terms, seasonally adjusted national tax collection grew 0.1% in the second quarter of 2022 and fell 3.8% during the third quarter with partial data to August. In any case, this indicator was 5.0% above the level shown in 2019 between July and August (see Figure 5.2). This performance reflects the maintenance of the consolidation of tax revenues after the adverse effects of the COVID-19 pandemic. It should be noted that in relation to 2019, the tax structure had been modified at the end of 2019, mainly from the creation of the PAIS Tax, the changes in the export duty rates and on the Personal Property Tax, as well as the revision of the tax reform promoted during 2017 that affected social security resources. All this explains a higher real collection.

The evolution of tax revenues allowed the total revenues of the National Non-Financial Public Sector (NFPS) to increase in nominal terms by 63.6% YoY in the second quarter (+1.8% YoY in real terms) and 78.3% YoY in the third quarter (+2.2% YoY in real terms, with partial data as of Aug-22). The performance of resources was positively influenced by the higher record of property income linked to the primary issuances of public securities in 202216 and negatively by the record of non-tax income from the Solidarity and Extraordinary Contribution to help mitigate the effects of the pandemic during 2021 as of May. Net of these effects, funds would have shown a nominal increase of 75.7% YoY in the second quarter and 77.3% YoY in July and August. Tax and social security revenues increased by 70.5% YoY in the second quarter and 76.6% YoY in the third quarter with data as of August.

Meanwhile, tax collection in all provinces showed a similar behavior to that observed at the national level. According to the partial information available, in the second quarter of the year the nominal advance of own tax resources would have shown an increase of around 70% y.o.y., while at the beginning of the third quarter it would have expanded by about 80% y.o.y.

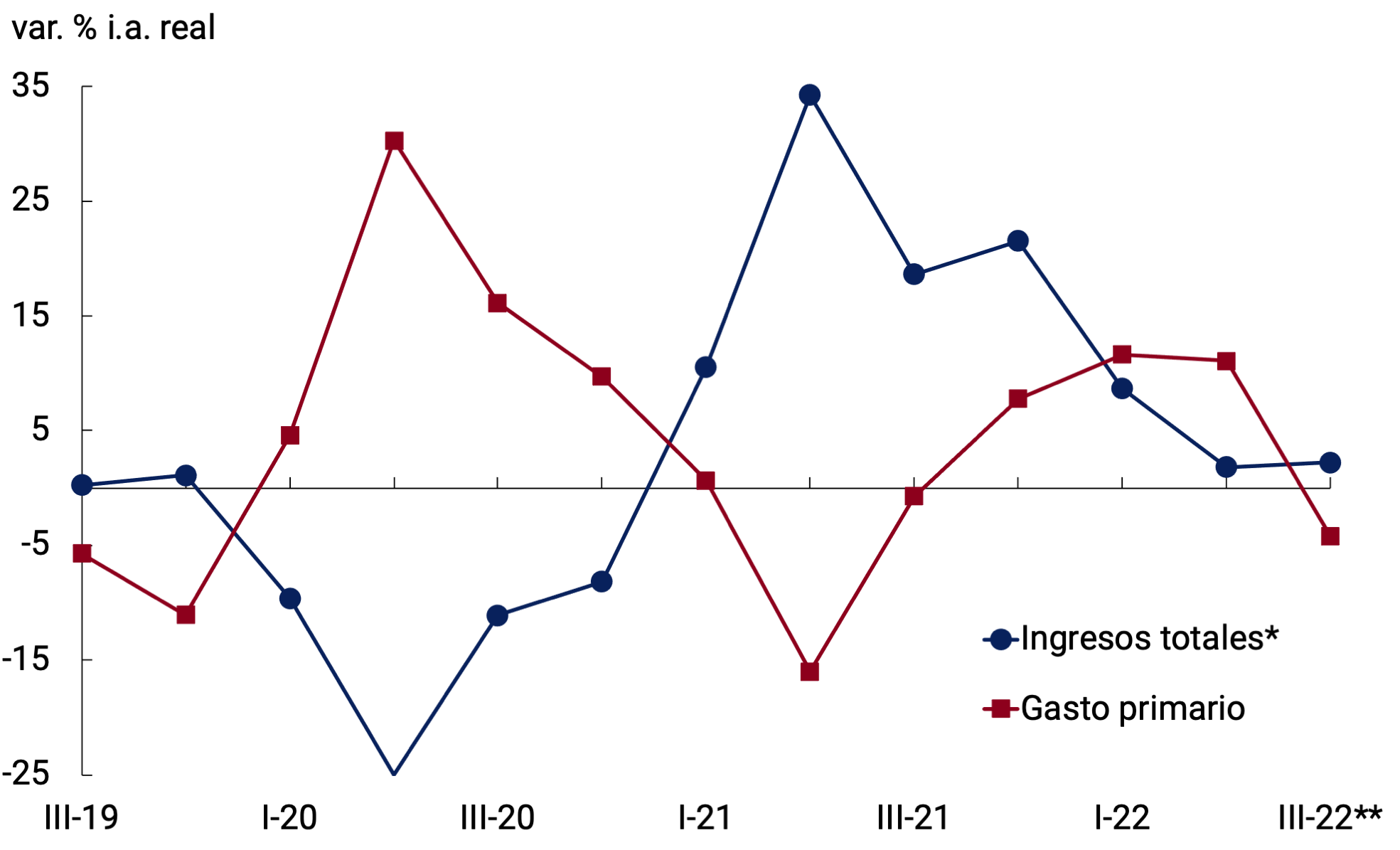

5.2. The fiscal order had a positive impact on the results of July and August

In line with the provisions of the Ministry of Economy in the sense of ordering the public accounts to comply with the current budget, during July and August public revenues grew above primary spending, reaffirming a fiscal path compatible with an annual deficit of the NFPS on a cash basis of 2.5% of GDP.

Among other measures, the freezing of the staff for all sectors of the National Public Administration was reinforced, reaching this limitation to decentralized public companies. Likewise, the current budget appropriations17 were adjusted in order to reflect the execution currently projected, seeking to contribute to the fulfillment of the fiscal order objective. In addition, measures were provided to segment the rates of public services (electricity, gas and water), which will generate savings in the associated subsidies. Meanwhile, a program began to be implemented that will seek the gradual incorporation into private sector jobs of current beneficiaries of social plans. On the other hand, priority was given to expenses related to the construction of the gas pipeline that will contribute to generating significant savings in the future.

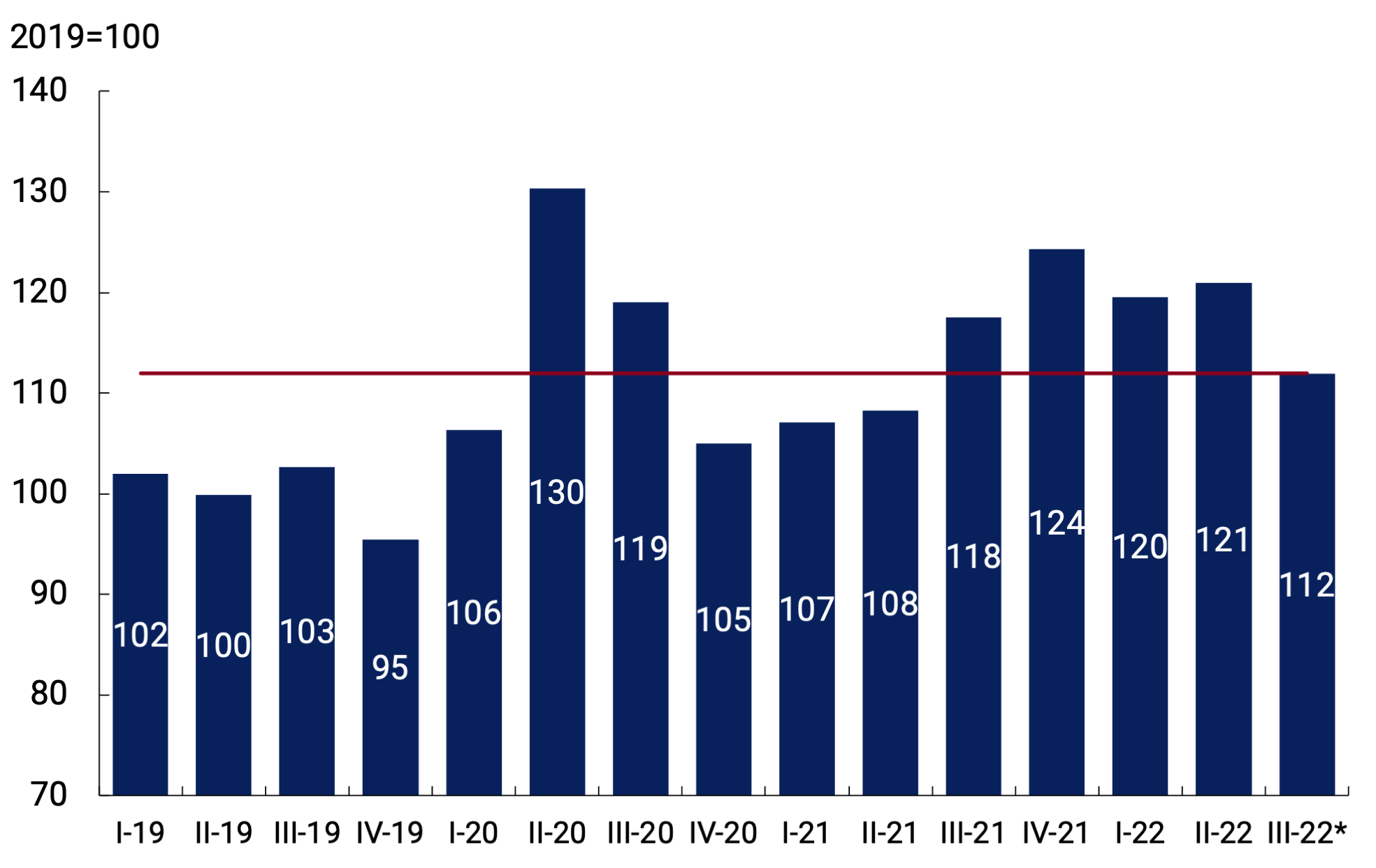

Thus, NFPS primary expenditure exhibited a nominal increase of 67.5% y.o.y. during the third quarter of 2022 —with data as of Aug-22—, 11 p.p. below the nominal advance of revenues in the same period. Therefore, during the third quarter, real primary expenditures would be contracting 4.2% compared to the same period in 2021, after having an expansion of 11.1% real y.o.y. in the second quarter (see Figure 5.3).

Figure 5.3 | NFPS

Real Primary Income and Expenditures

* Net of Special Drawing Rights (SDR) Allocation in Sep-21.

** Data as of Aug-22.

Source: BCRA based on data from the Ministry of Economy and INDEC.

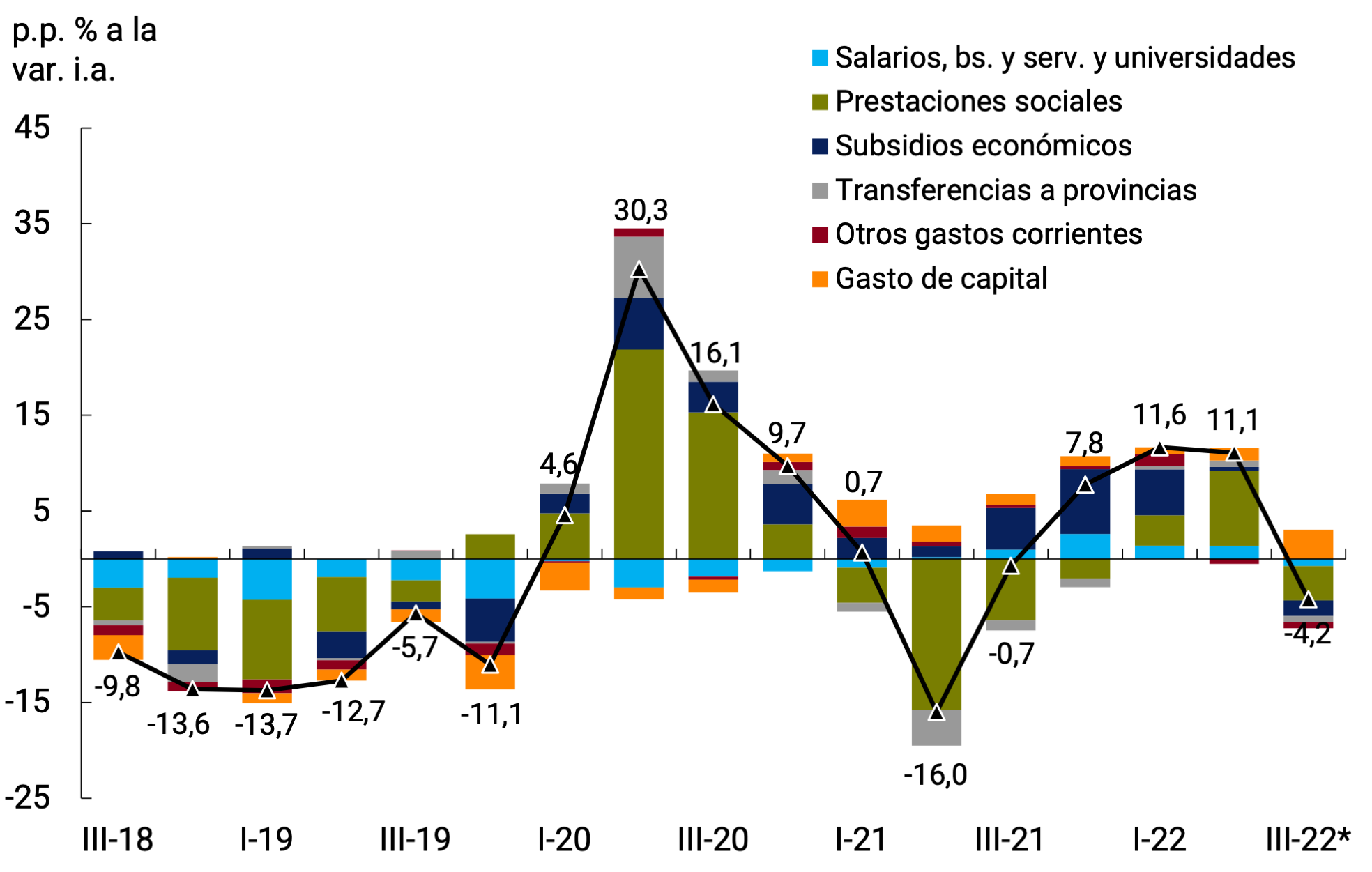

Real spending advanced during the second quarter, compared to a year ago, mainly driven by social benefits, salaries and capital spending. This evolution reflected the National Government’s impulse to implement extraordinary reinforcements of household incomes in the face of the impact of the acceleration of the general price level. As of the third quarter of the year, the measures announced in relation to the ordering of public accounts began to take effect. The reduction in primary public expenditure in real terms in the months of July and August was proof of this.

In this sense, seasonally adjusted real primary expenditure contracted compared to the previous two quarters. However, it is still 12% above the average for 2019 (see Figure 5.4).

Figure 5.4 | Real seasonally adjusted primary expenditure of the NFPS

*Data as of Aug-22.

Source: BCRA based on data from the Ministry of Economy and INDEC.

Among the main items of expenditure that explain this evolution during the third quarter are social benefits and expenditures on economic subsidies (see Figure 5.5). Expenditure on social benefits had increased by 13.7% y.o.y. in real terms in the second quarter, especially driven by expenditures on transfers in aid to people due to the income reinforcement policies carried out by the National Government to protect and improve the purchasing power of households in the face of rising food prices.

Figure 5.5 | Contribution to real growth of NFPS

*Data as of Aug-22.

Source: BCRA based on data from the Ministry of Economy and INDEC.

Pension benefits (retirements and pensions) increased by 4.4% YoY in real terms in the second quarter of the year and would have contracted by 3.6% YoY during the months of July and August, without taking into account the reinforcement of income paid in those months to those who receive lower benefits. This behavior is influenced by the fact that the Pension Mobility Law18 established a variation of 62.7% y.a. in salaries as of June, 1.3 p.p. lower than the accumulated inflation during the same period. In September, the more than 7 million people who are holders of retirements and pensions will have received their pension benefits with the increase of 15.53% corresponding to the third quarterly increase in the year provided for by the Pension Mobility Law19. Along with this increase, a monthly reinforcement of $7,000 will be paid in the months of September, October and November for more than 6 million retirees, pensioners, and pensioners. The quarterly increase also includes family allowances, including the Universal Child Allowance (AUH) and Pregnancy Allowance, impacting the income received by almost 9 million children and adolescents. As for the remaining social benefits, these expenditures had a reduction in real terms during July and August, after a strong real boost in the second quarter (36.7% YoY).

The Empower Work, Food Benefit and Progress programs continue to be the three main policies for assistance to the population in vulnerable situations, with coverage of 1.3 million, 2.4 million and 1.5 million benefits, respectively. It is worth noting the increase in the amounts of the benefit received by the beneficiaries of the Empower Work program due to the advance to August of the 45% increase in the SMVM initially planned for December and the 21% increase between September and November, to which were added bonuses of $6,000 in April and $11,000 in August. Regarding the Food Benefit, in May the amounts were increased by 50%, standing at $9,000/$13,500/$18,000 depending on 1/2/3 or more dependent children. In relation to the Progresar program, since December 2021, coverage was extended to young people from 16 to 17 years old, until then limited to the 18 to 24 age group, and the amount of scholarships was increased by 50%, in addition to an extra sum of $1,000 per month for connectivity. On the other hand, in August, the minimum amount of the scholarship for all lines of the program was raised from $6,400 to $7,400 and the “Training and certification in foreign languages” Program was created for scholarship recipients of the Progresar and the Manuel Belgrano Strategic Scholarships. The program will offer courses and at the end of them the beneficiaries will receive a bonus of $6,000.