The BCRA launches stage 3 of the economic program that started on December 10, 2023. In this new stage, (i) the exchange rate in the Free Foreign Exchange Market (Mercado Libre de Cambios, MLC) may fluctuate within a moving currency band between ARS1,000/USD1 and ARS1,400/USD1, with the floor and ceiling expanding at a 1% monthly pace; (ii) the “blend” dollar (a combination of two exchange rates for the settlement of export proceeds) has been removed, foreign exchange restrictions applicable to natural persons have been lifted, the distribution of profits to foreign shareholders has been allowed for fiscal years starting in 2025, and the terms for the payment of foreign trade transactions have been relaxed; and (iii) the nominal anchor is strengthened by adjusting the monetary policy framework without the BCRA issuing pesos for financing fiscal deficit or for remunerating monetary liabilities.

These measures will allow the BCRA to advance toward its main goal—reducing inflation. Also, removing foreign exchange restrictions will boost Argentina’s economic activity, employment, investment and productivity together with the current strengthening of the domestic savings recovery and credit to the private sector. The progress in economic policy enhances monetary predictability, exchange rate flexibility and freely available reserves which support the economic program. Together with the removal of the foreign exchange clamp and strong fiscal commitment, the foundations have been laid down for a lasting economic equilibrium.

I. THE BCRA’S BALANCE SHEET CLEANUP ALLOWS LIFTING THE FOREIGN EXCHANGE CLAMP

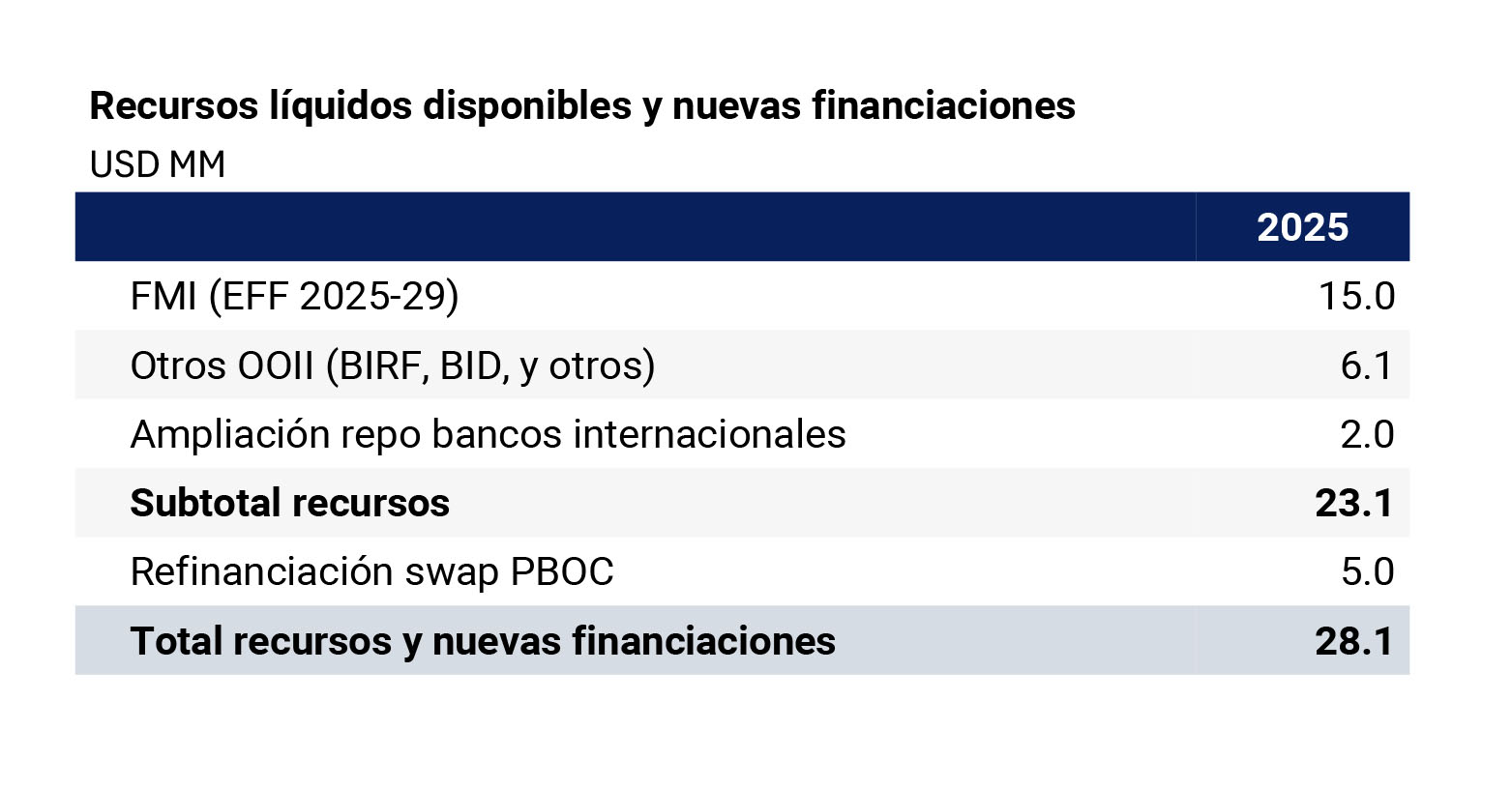

A new Extended Fund Facility (EFF) arranged with the International Monetary Fund (IMF) for USD20,000 million—of which USD15,000 million are freely available disbursements in 2025—will support the consolidation of the economic program. These liquid funds will strengthen the BCRA’s balance sheet through the repurchase of non-transferable bills by the Ministry of Economy. Additional disbursements agreed between the Ministry of Economy and other international agencies of about USD6,100 million will supplement this initial transition.

In turn, the BCRA will work with international banks on a new auction to extend the repo facility executed in January 2025 for up to USD2,000 million.

All in all, these agreements have the potential to contribute with an increase of USD23,100 million of the BCRA liquid reserves in 2025. Finally, the BCRA and the People’s Bank of China (PBC) have renewed the active tranche of the currency swap agreement for 12 months (about USD5,000 million).

II. RELAXATION OF THE EXCHANGE RATE REGIME

(a) The BCRA sets up a floating exchange regime within a currency band.

Given the bi-monetary nature of the Argentine economy, characterized by a high level of dollarization, the transition toward free currency competition is moving forward through the implementation of a prudent exchange rate band regime within a ARS1,000–ARS1,400/USD1 range. Within this band, the exchange rate will float freely according to market supply and demand dynamics. Both the floor and ceiling of the band will evolve gradually and predictably over time: -1% and +1% per month, respectively.

Looking at other economies that have adopted exchange rate band regimes, it has been shown that their introduction contributes to the efficiency and credibility of stabilization programs, anchoring expectations and containing volatility. This feature is especially beneficial when the exchange rate bands are managed by adequately-capitalized central banks backed by a balanced fiscal policy and a predictable monetary policy.

The BCRA will regulate the exchange rate band system as follows:

• Band floor (ARS1,000 – 1% per month): Whenever the exchange rate in the MLC reaches the lower bound of the band, the BCRA will buy dollars in order to keep the exchange rate within the desired band range and, meanwhile, accumulate international reserves. The BCRA will not sterilize the pesos issued for these foreign currency purchases, thereby facilitating the economic re-monetization that may arise from increases in real money demand.

• Band ceiling (ARS1,400 + 1% per month): Whenever the exchange rate in the MLC reaches the upper bound of the band, the BCRA will sell dollars to keep the exchange rate within the desired band range and, meanwhile, reduce monetary liabilities. These BCRA’s foreign currency sales will allow for the rapid absorption of excess liquidity that may result from declines in real money demand.

• Within the band: The exchange rate will float freely within the limits set. The BCRA may consider purchasing dollars based on its macroeconomic and net international reserve (NIR) accumulation targets, and may consider selling dollars to mitigate unusual volatility. Under no circumstances will such an intervention be sterilized.

This careful calibration of the exchange rate bands by the BCRA, combined with substantial liquidity support from the IMF, is expected to enable a disruption-free transition in the ongoing disinflation process. It is important to highlight that the new monetary and exchange rate regime is flexible enough to support the re-monetization required by a rapidly expanding economy, and allows for the swift removal of liquidity surpluses that could arise from unexpected, significant shifts in external conditions.

(b) Lifting of the foreign exchange clamp, while mitigating risks associated with stock imbalances.

Today, the Board of the BCRA approved Communication A 8226, which introduces the following changes to the regime governing access to the MLC:

For natural persons: The foreign exchange clamp is lifted—eliminating the USD200 cap—along with all restrictions on access to the MLC related to government assistance received during the pandemic, subsidies, public sector employment, and others. The restrictions established in Communication

For the payment of new imports:

• Imports of goods may be paid through the MLC as from the date of customs registration (it used to be 30 days after customs registration).

• Imports of goods by micro, small, and medium-sized enterprises (MSMEs) may be paid through the MLC as from the time of shipment from the port of origin (it used to be 30 days after customs registration).

• Imports of services may be paid through the MLC as from the time the service is rendered (it used to be 30 days after service provision).

• Imports of capital goods may be paid through the MLC as follows: 30% in advance, 50% upon shipment from the port of origin, and 20% upon customs registration (it used to be 20% in advance and only for MSMEs).

• Imports of services between related companies may be paid through the MLC as of 90 days from the date of provision of the service (previously it was 180 days)

In addition to these measures, and with the aim of adjusting payments for imports and financial debts that might be paid through the financial forex market (blue-chip swap dollar (dólar contado con liquidación, CCL), the BCRA will eliminate, on a one-time basis, the 90-day restriction stated in Communication A 7340 (“cross restriction”), allowing legal persons to operate efficiently in the MLC once again.

For legal persons:

Flows

In addition to the authorization to access the MLC, without prior approval, for the payment of compensatory interest accrued from January 1, 2025, on financial debts with related companies (as approved by the Board of the BCRA on December 19, 2024), access to the MLC is now also authorized for the payment of dividends to non-resident shareholders derived from profits from balance sheets for fiscal years starting on January 1, 2025.

Stocks

The BCRA is developing a new series of Bonds for the Reconstruction of a Free Argentina (BOPREAL), as a supplement to the relaxation granted for access to the MLC focused on flows, and in response to a potential residual demand to access the MLC (in relation to inherited stocks of dividends and debt services with related parties). Such BOPREALs may be purchased in pesos to meet foreign liabilities related to debts incurred or dividends obtained before 2025 as well as commercial debts before December 12, 2023.

These actions will be supplemented with measures affecting transactions in the MLC that do not fall strictly under the scope of the BCRA:

• The Export Increase Program (80/20 or “blend” dollar) for the settlement of export proceeds will be repealed. The deadlines for the inflow of foreign currency funds into the MLC derived from exports of goods and services will remain unchanged. This simplification of the spot forex market is expected to ease the development and liquidity of forward markets, both for the exchange rate and for commodities, which are relevant to broad sectors of the economy.

• The minimum holding period (“parking”) for securities transactions applicable to natural persons (General Resolution 959/2023 issued by the National Securities Commission (Comisión Nacional de Valores, CNV)) will be eliminated.

III. STRENGTHENING OF THE MONETARY REGIME

(a) The BCRA will strengthen the nominal anchor of the program by enhancing the monetary aggregates framework.

Stage 3 of the macroeconomic program seeks to establish a conventional monetary regime focused on strict money supply monitoring. The fundamental basis of this monetary framework will remain restrictive as follows: (a) zero financing of fiscal policy by the BCRA, and (b) zero issuance to pay interest on the BCRA’s remunerated liabilities.

From this premise, the new monetary regime will be characterized by a tighter control and a more restrictive bias compared to the regime being replaced, which was based on a limit to the broad monetary base (BMB).

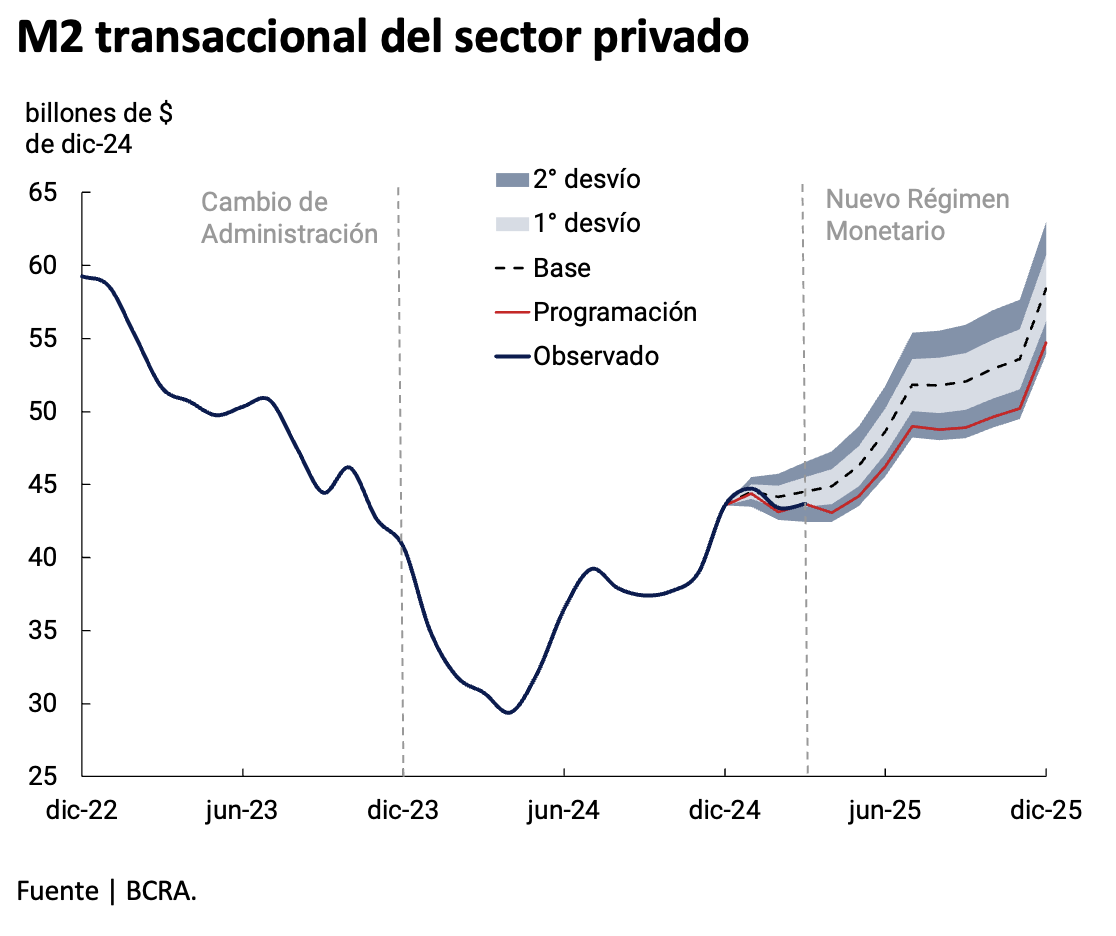

Objectives of the BCRA’s monetary programming. To make the new regime operational, the BCRA will publish its monetary programming estimates based on its money demand models, in a manner consistent with its price stability mandate (Section 3 of the Charter of the BCRA). Based on these models, monetary programming will allow the BCRA to quarterly monitor the evolution of monetary aggregates, with particular attention to the evolution of transactional private M2. At the start of the regime, the defined time frame will be calendar year 2025, consistently with the time frame set in the agreement with the IMF (see below).

This improvement to the monetary framework—using monetary aggregates as a nominal anchor of the economy—will enable the BCRA to closely monitor the path of the money supply in the economy. The degree of convergence between the observed M2 (the average of the last month of each quarter) and the target M2 will allow the BCRA to assess whether to take action to regulate domestic liquidity, thus effectively guiding and consolidating the disinflation process.

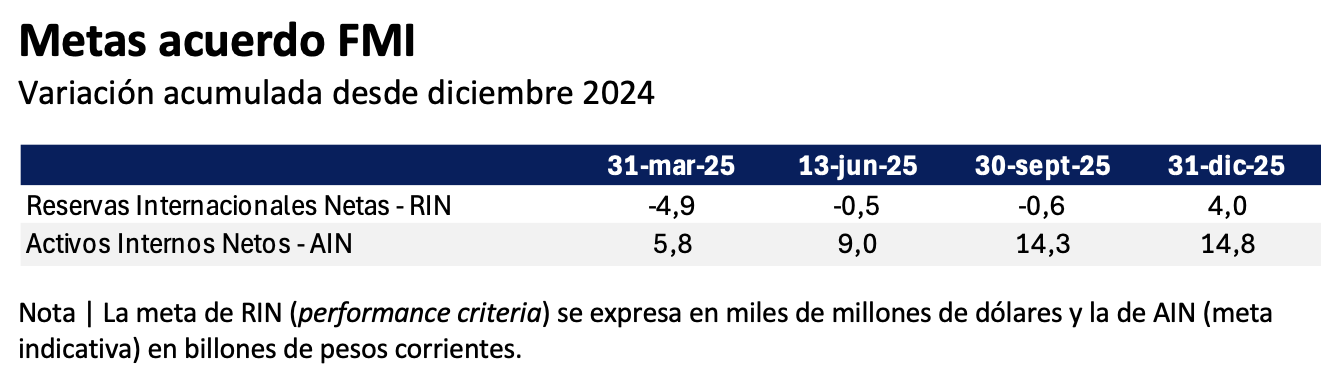

Monetary and international reserve targets defined in the agreement with the IMF. This conventional monetary framework is consistent with the quarterly monetary monitoring framework outlined in the agreement with the IMF. However, a supplementary monetary metric is used for monitoring the targets of the agreement with the IMF: the evolution of net domestic assets (NDA).

In fact, the program agreed with the IMF contains quarterly guidelines for the accumulation of NIR and the evolution of NDA. Both are determined based on the quarterly projection of the monetary base (MB) resulting from the BCRA’s programming. It should be noted that the NIR target and the evolution of NDA are defined in the program as performance criteria and as an indicative target, respectively.

(b) The BCRA will have a broad set of tools to regulate monetary liquidity.

The BCRA has liquidity management tools that will be used in a manner consistent with the exchange rate band regime.

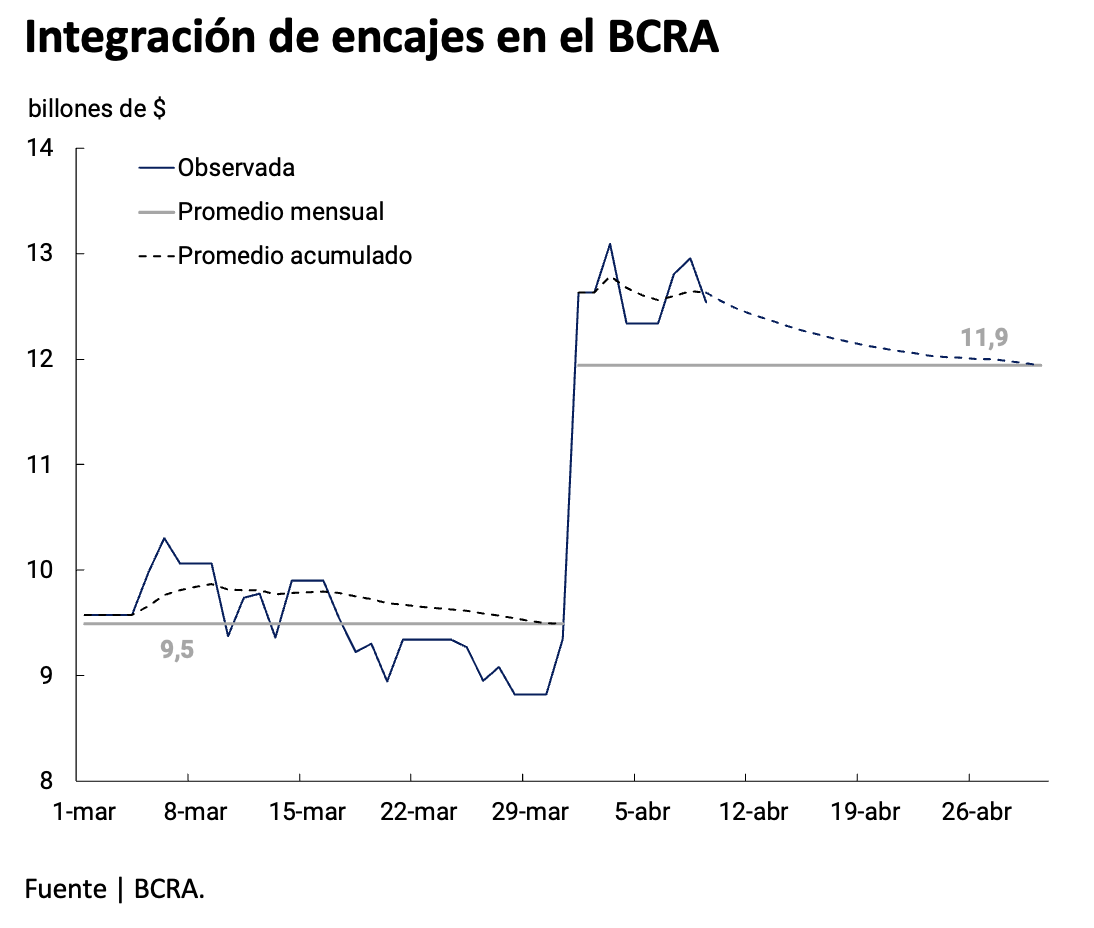

• Within the exchange rate bands. As long as the exchange rate fluctuates within the band, the BCRA may choose to operate in the secondary peso markets through open market operations (using its portfolio of Treasury securities for this purpose), or change regulations related to required ratios and composition of minimum cash requirements (reserve requirements).

• On the exchange rate bands. When the exchange rate reaches either the lower or upper bound of the band, the BCRA will conduct foreign exchange transactions through the MLC, as necessary. These transactions will not be sterilized and will result in either the re-monetization or contraction of pesos (respectively) as needed to restore monetary balance, as indicated by the evolution of money demand. In this context, the BCRA’s purchases (sales) at the lower (upper) bound of the band are understood as a sign of higher (lower) demand for pesos, and therefore will not affect the assessment of the original monetary target.

(c) To reinforce the nominal anchor, the BCRA has implemented a restrictive bias in its monetary framework at the start of the new regime.

Given the external volatility and the inherent uncertainty that may affect domestic monetary policy transitions, the BCRA has decided to apply a restrictive bias to its monetary policy in the immediate future. Key factors that reflect this bias include:

• A more restrictive money target than the baseline projection scenario. The monetary target (transactional private M2) has been set based on two deviation values below the baseline projection derived from demand models (see chart).

Change to minimum cash requirement with a restrictive impact on available liquidity. In April, a change in the minimum cash requirement regime was adopted (due to lower deductions from exemptions). This represents a significant absorption of pesos, also recorded in the increase observed in the monetary base (see chart).

• Convergence of bank funding availability relative to credit. The improvement in the economic outlook is driving a convergence between the immediate liquidity of the banking system and the pace of its allocation to bank credit, both in the peso and dollar segments (see chart 3).