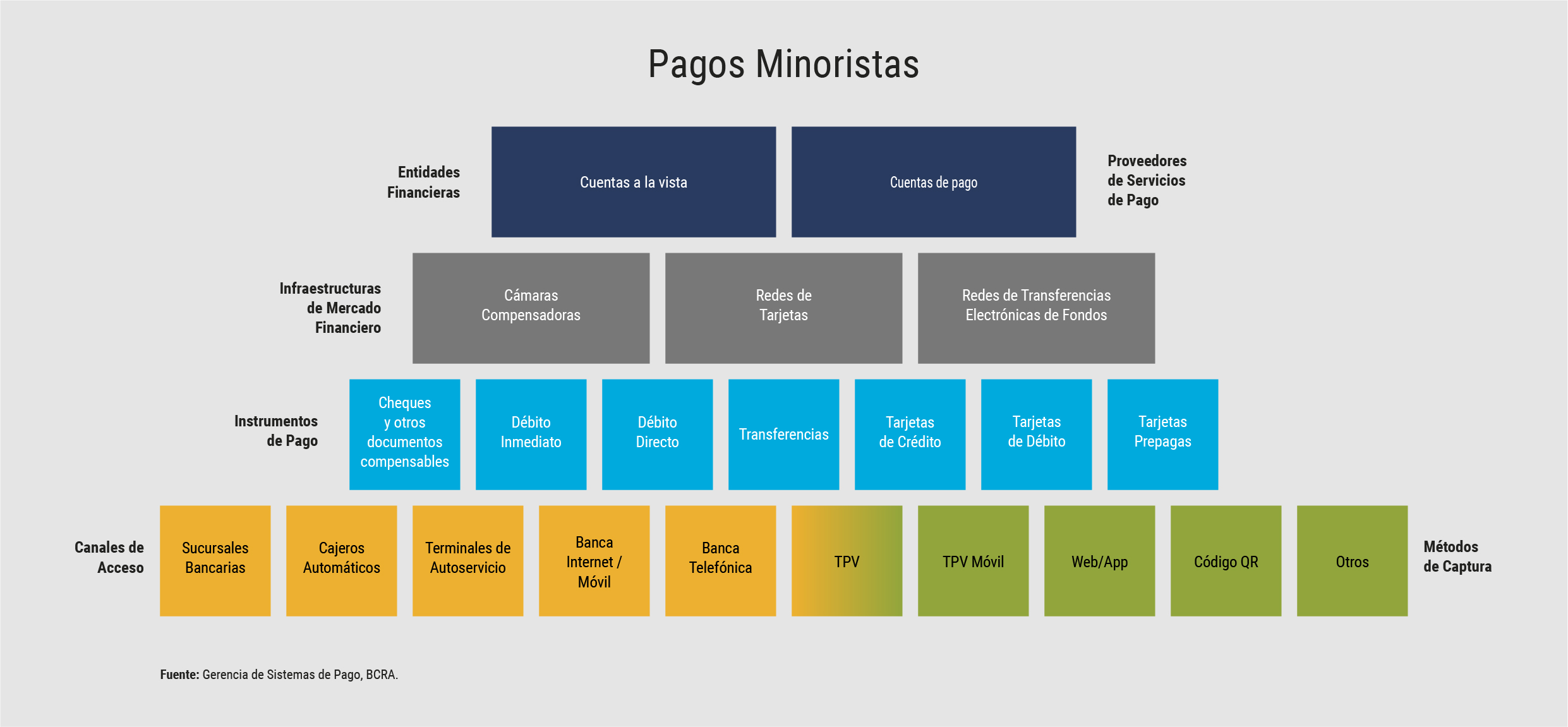

The National Payment System facilitates the circulation of money. It includes all means of payment and their operational and commercial rules, financial market infrastructures and the different participants in the provision of payment services. Its structure allows retail and wholesale payments to be made.

Retail payments are all those debit and credit transactions of high and low value carried out by people and companies. For example, retail payments can be made through payment instruments such as transfers, cards, direct debits, immediate debits, checks, and ATM withdrawals.

Transactions of financial institutions among themselves and with the Central Bank are not included in retail payments. This type of operation is part of wholesale payments.

Wholesale payments are made through the Electronic Payment Method (MEP) administered by the Central Bank. The MEP channels interbank market and monetary policy operations.

MEP participants:

- -Banks

- – Finance companies

- – Electronic low-value clearing and high-value clearing chambers

- – Other bodies: such as Caja de Valores SA, Bolsas y Mercados SA, A3 Mercados SA, Argentina Clearing y Registro SA and the National Social Security Administration

- – Settlement and Clearing Agents (ALYC)

Financial institutions and other authorized agencies maintain current accounts in the MEP to carry out transactions between those who participate in the system. Halfway through the operating cycle, the MEP settles the net clearing balances of the electronic clearing houses.

Electronic clearing houses process retail payments made through: checks, direct debits, transfers, certificates of deposit, money orders, electronic credit invoices and immediate debits, among other instruments. They also liquidate the balances of the ATM networks and purchase and credit cards.

Payment service providers offering payment accounts (PSPCs) participate in the Low Value Vault (CEC-BV) through financial institutions. Payment accounts allow individuals and legal entities to have freely available funds in non-banking companies registered with the BCRA and regulated by the rules on “Payment Service Providers”. In this way, people can receive and make transfers easily. In addition, they can make transfer payments via QR codes if their PSPC provides the interoperable digital wallet service.

In the oversight of financial infrastructure, the Central Bank applies the security and efficiency requirements set out by the “Principles for Financial Market Infrastructures” of the Committee on Payment Systems and Financial Market Infrastructures (CPMI) and the International Organization of Securities Commissions (IOSCO) to the systemically important payment systems under its orbit:

- – Electronic Payment Method (MEP)

- – High-Value Electronic Clearing House (CEC AV)

- – Low Value Electronic Clearing House (CEC BV)

- – ATM networks

- – Central Registry and Settlement of Public Debt Instruments, Monetary Regulation and Financial Trusts

- – Caja de Valores SA (CVSA)

- – Argentina Clearing y Registro SA (ACyRSA)

- – Mercado Argentino de Valores SA (MAV)

Each infrastructure assesses the degree of compliance with the established requirements once every two years, or sooner if the Central Bank deems it appropriate. Based on the self-assessments, the BCRA makes its own assessment of the appropriate areas to improve and increase the safety and efficiency of the financial system.