Know what the Debtors’ Center is

What is the Debtors Central?

The Central Bank of Debtors of the Financial System is a database where financial institutions and other credit providers inform the Central Bank of the financing of each person for the last 24 months.

This information includes, for example:

– Personal and pledge loans.

– Credit card balances.

– Home mortgage loans.

The Central is updated monthly with the data sent by: banks, credit or purchase card issuers, other credit providers, financial trusts, mutual guarantee societies, public guarantee funds and peer-to-peer credit platforms.

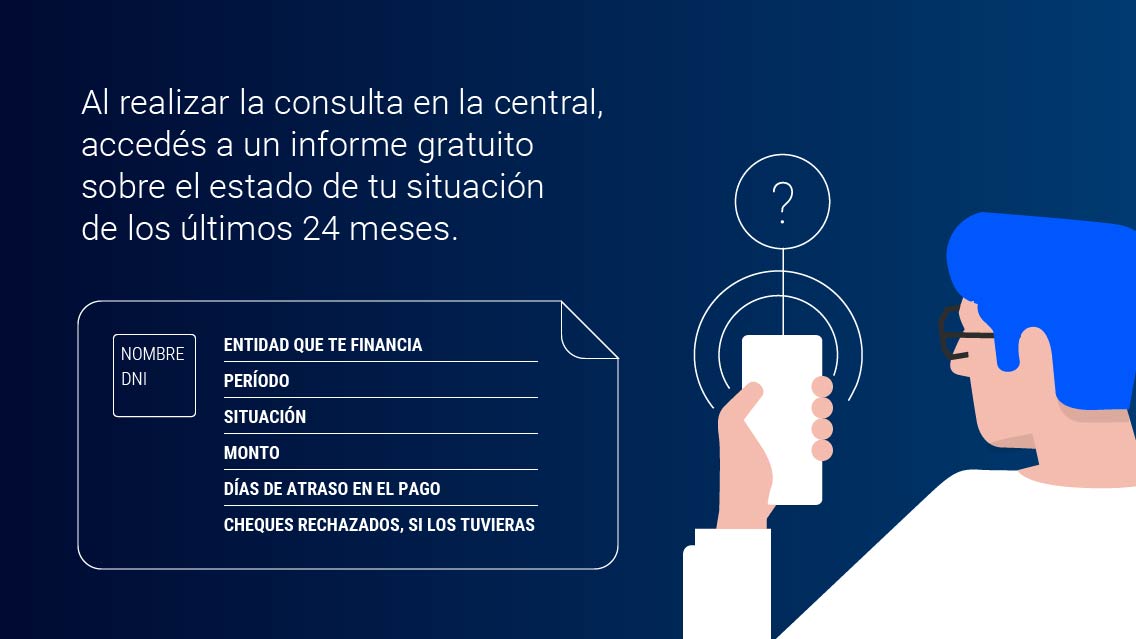

What information you can see in your consultation

To check your registration you need your CUIT, CUIL or CDI. When you log in, you’ll see:

– The entity that reported the funding.

– The amount owed, expressed in thousands of pesos.

– The situation or rating assigned to you by each entity.

– The days of late payment.

– Observations, if any.

This information helps you understand how the financial system sees you and is the reference that banks use when evaluating whether to grant you a new loan.

How situations are classified

If we look only at the default, the situations reflect the risk of default on a debt:

– Situation 1 / Normal | Delay that does not exceed 31 days.

– Scenario 2 / Low Risk | Delay of more than 31 and up to 90 days.

– Scenario 3 / Medium risk | Delay of more than 90 and up to 180 days.

– Situation 4 / High Risk | Delay of more than 180 days up to one year.

– Situation 5 / Unrecoverable | Arrears of more than one year.

In addition to the arrears, the entities consider your legal status, the information from the rest of the system, the situation with former entities in liquidation and the current refinancings .

More information: Ordered text (OT) on Information Centers