2017

During the last year, work continued on the three strategic objectives of the Central Bank:

- – Monetary stability: sustainable and systematic reduction of the inflation rate.

- – Financial stability: development and deepening of the domestic financial system, in conjunction with macroprudential supervision and regulation of the sector in accordance with the best international standards.

- – Banking, financial inclusion and electronic means of payment: reduction in the use of cash, streamlining and greater security in transactions, greater financial education.

The following measures were taken, among others:

- – Launch of the Inflation Targeting Regime with the 7-day pass rate as a reference rate

- – Enabling banks to pay interest on deposits in current accounts

- – The DEBIN began to be operational

- – Push for banks to invest in fintech

- – Facilitation of the use of electronic transfers for payment of salaries

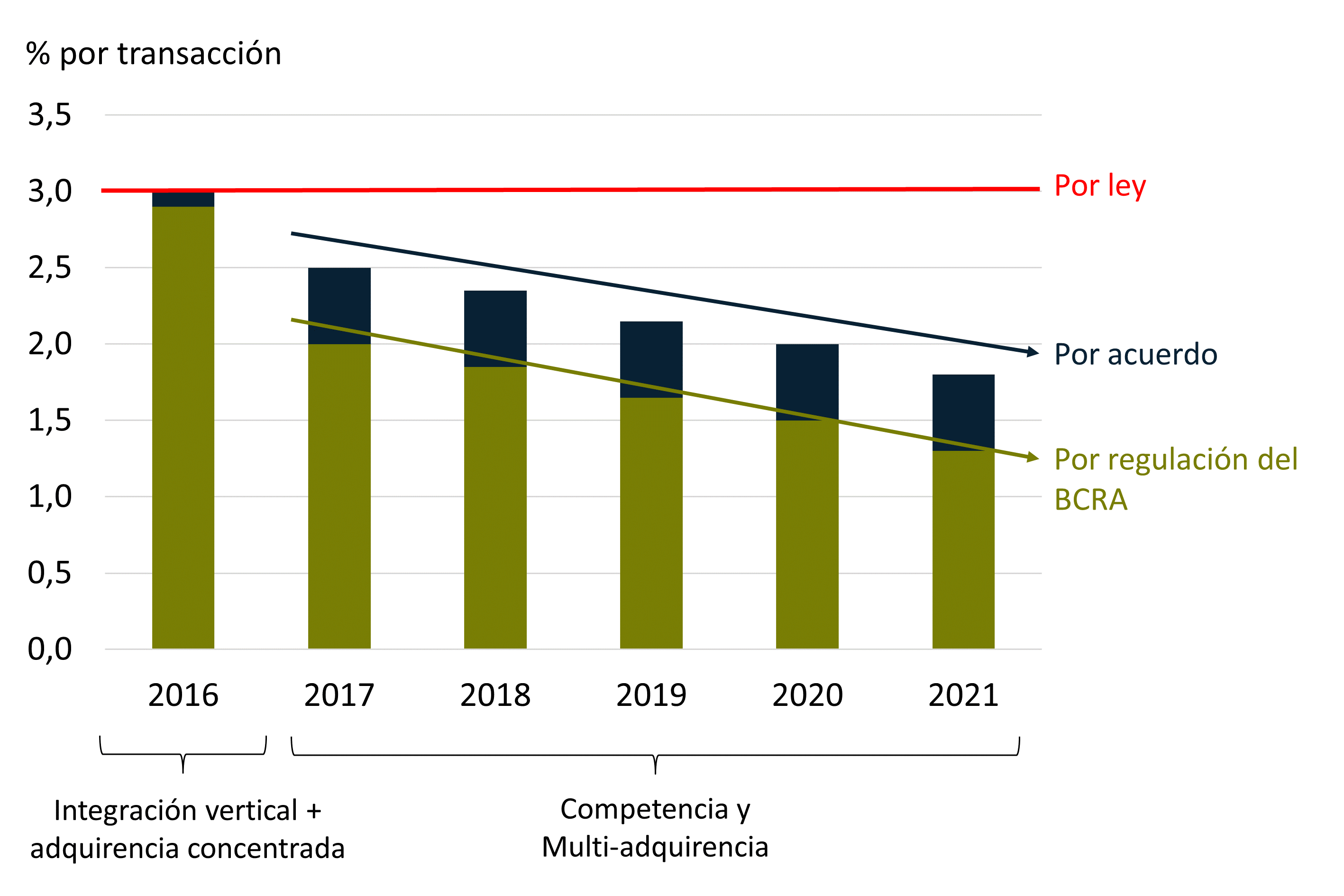

- – Promotion of competition in the credit and debit card market

- – Boosting the bank alias instead of the 22-digit CBU

- – Development of more accessible financial services

- – Relaxation of flow transport regulations

- – Remote opening of demand accounts for individuals

- – Mortgage loans in UVA totaled $56,300 million granted

- – The BCRA removed limits for bank transfers

- – Expansion of financing to exporters

- – Promotion of the installation of non-bank ATMs

- – Simplification of the mortgage loan process

- – Since June 1, all bank accounts have a CBU alias

- – The BCRA increased the rate of destruction of damaged banknotes

- – Publication of statistics on the UVA market

- – The rules on indebtedness of the provinces are modified. Stricter limits were imposed on the indebtedness of the provinces

- – Facilitation of the procedure for opening branches

- – Elimination of remnants of the exchange clamp and simplification of foreign exchange regulations in general

- – Authorization to submit tax affidavits to banks on a voluntary basis

- – New $20 bill launched

- – Publication of the new wholesale rate for fixed terms

- – Replacement of banks under the incognito customer modality

Below are the advances, grouped into three strategic thematic areas: Monetary and exchange rate policy, development and deepening of the local financial system, and banking and financial inclusion and means of payment.

- Citizenship Benefits

- – Freedom, stability and predictability for the management of personal, family and business finances.

- – Stimulation of long-term economic growth and improvement in income distribution thanks to the reduction of inflation.

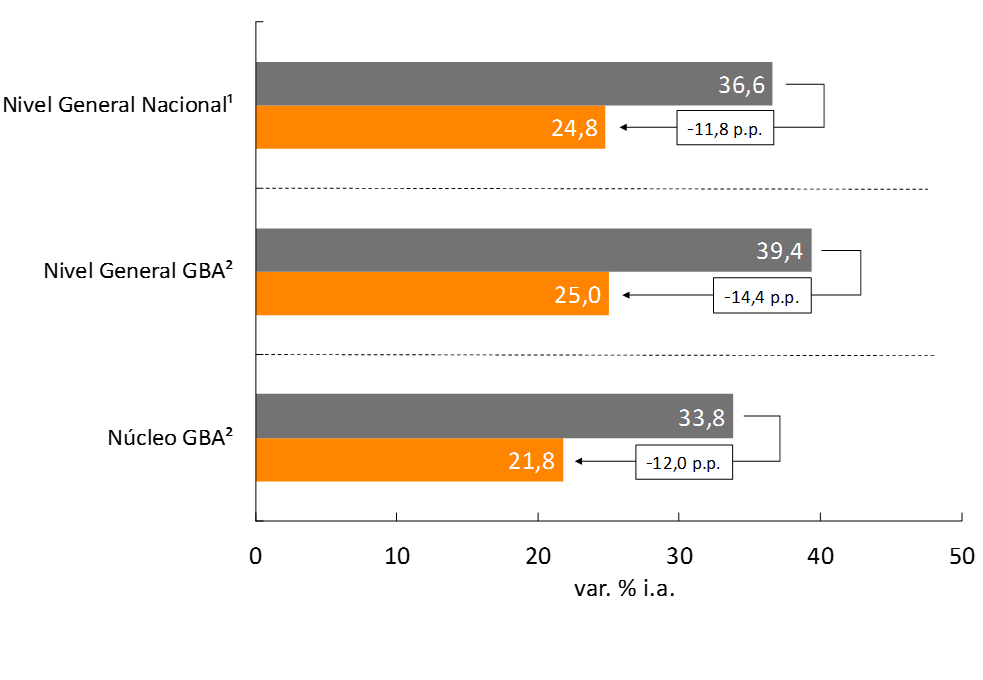

Inflation fell in 2017

1 To calculate the year-on-year variations for 2016, the CPI-NP (weighted average by expenditure based on the CPIs of the City of Buenos Aires, Córdoba and San Luis) was taken.

2 To calculate the year-on-year variations for 2016, INDEC’s CPI-GBA was used, spliced backwards with the CPI of the City of Buenos Aires.

Source | INDEC and Statistical Directorates of the City of Buenos Aires, San Luis and Córdoba.

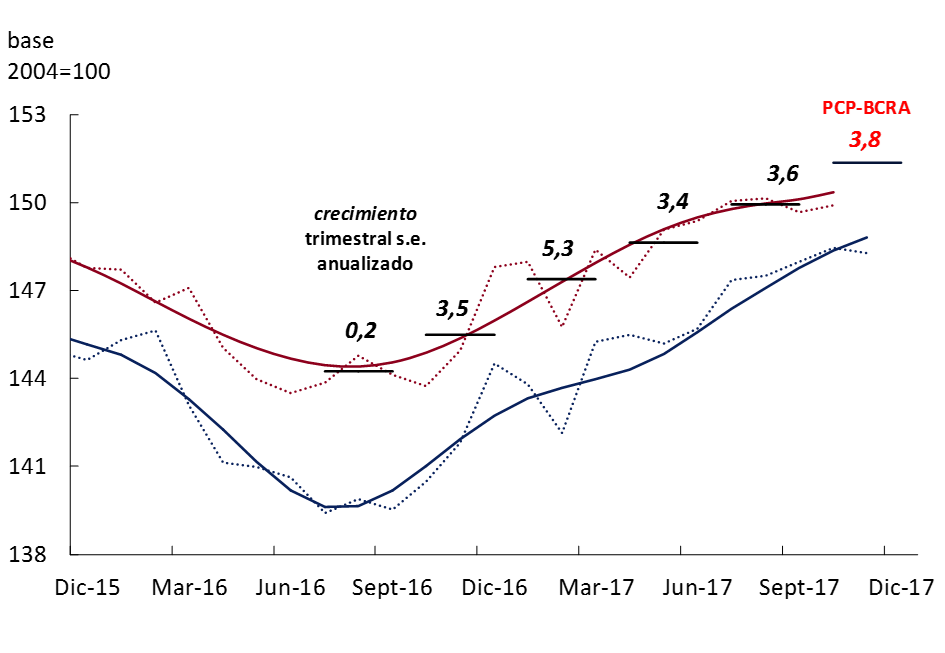

The disinflation process has been accentuated in recent months.

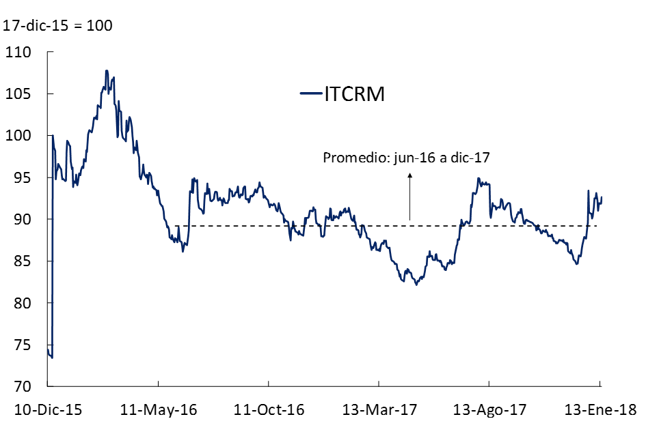

The disinflation process was achieved with a constant Multilateral Real Exchange Rate (MRER). This is a novelty in Argentine history

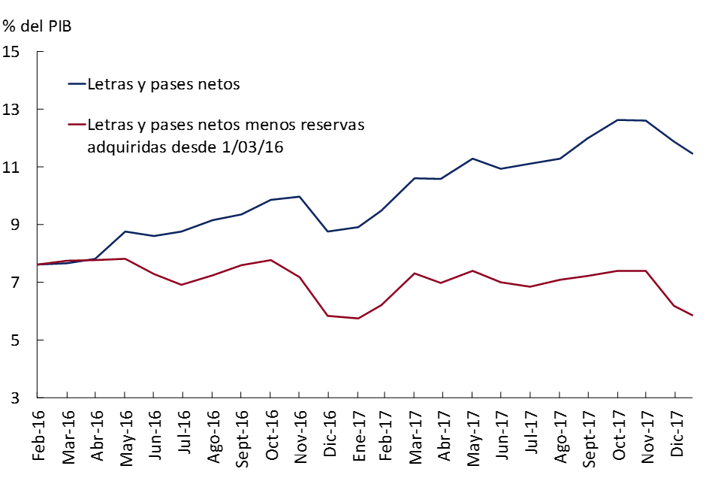

The stock of bills and passes, net of the international reserves acquired, remained stable in terms of GDP.

- Citizenship Benefits

- More opportunities in access to financing for projects, safeguarding savings and a context of financial stability, all elements conducive to economic development.

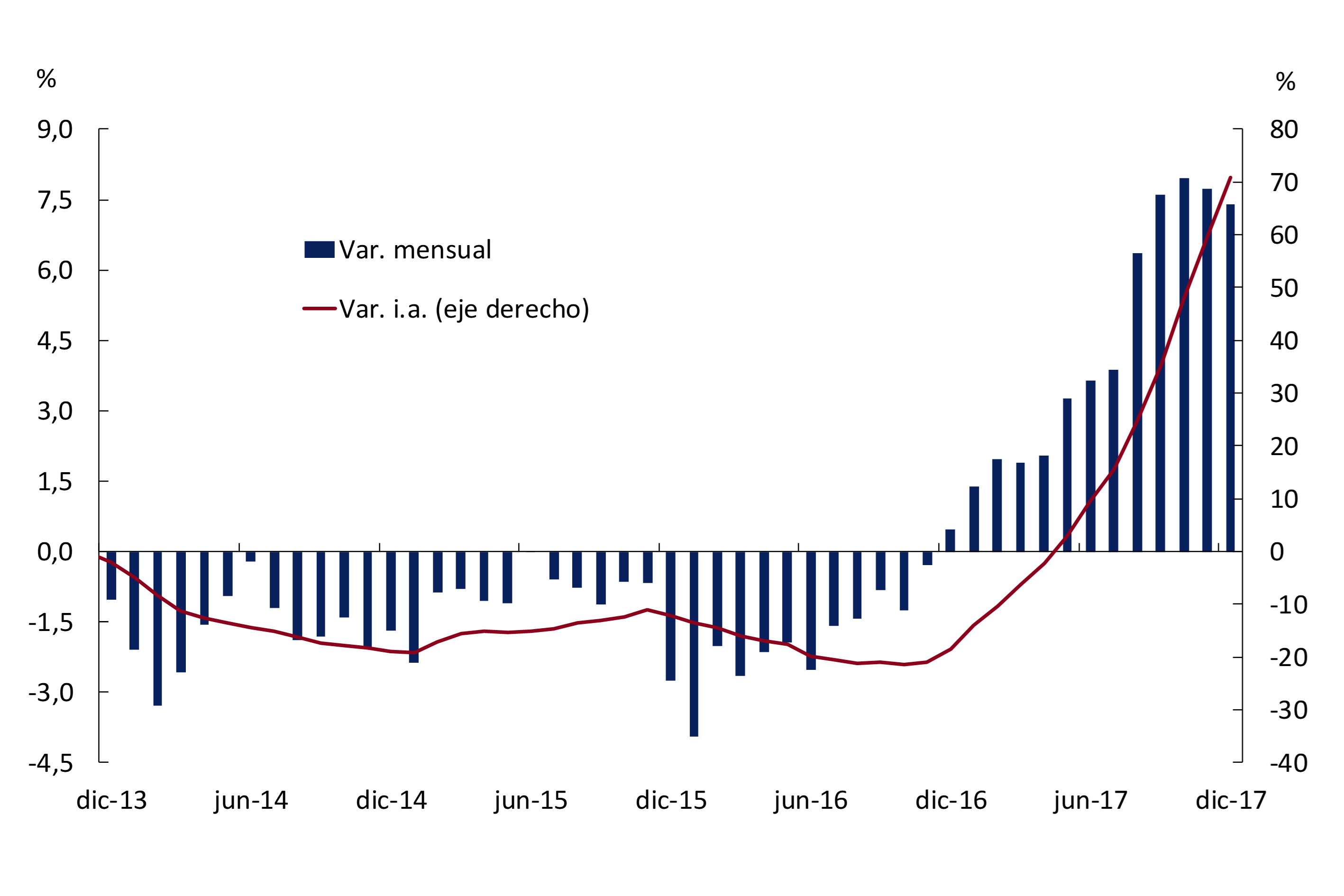

A strong recovery in credit was evident

– UVAs expand access to mortgage credit for families | Press Release

– Regulationof surface rights as bank guarantees | Press Release

– Publication of statistics on the UVA market |Press Release Missing news to be uploaded- More transparency: more information in the Debtors’ Center | Press Release – The BCRA creates a new way of contact with users of financial services | www.usuariosfinancieros.gob.ar Press Release “Financial Users” Need to Be Loaded – The BCRA will relieve banks under the incognito customer modality | Press Release

– Gambling Companies Will Have Restrictions on Owning Banks | Press Release Missing to load news

Mortgage Loans -in real and seasonally adjusted terms, variation in the average monthly balance-

- Citizenship Benefits

- Facilitate access to and use of financial services.

- Agility, security and lower costs in payments and collections.

- Combating criminal activities and greater equity in the distribution of tax burdens.

The BCRA continued to promote new means of payment

– The cost of what banks charge for card transactions falls.

Exchange Acquiring – % per transaction –