First Report on Retail Payments

September 27, 2019. The BCRA has published the first report on the status, prospects and development of retail means of payment in Argentina, which includes debit and credit transactions between sight accounts, except for typical inter-bank transactions. This report will be released every six months.

The current issue deals with transactions made through different payment instruments or channels, such as transfers, cards, direct debits, instant debits, checks, digital wallets or withdrawals from ATMs.

It focuses on the number of transactions made through electronic means of payment and on innovative developments during the period.

As regards electronic means of payment, instant transfers increased by 49%, reaching nearly 145 million transactions in the first half of 2019.

Highlights

The National Payments System goes on expanding significantly

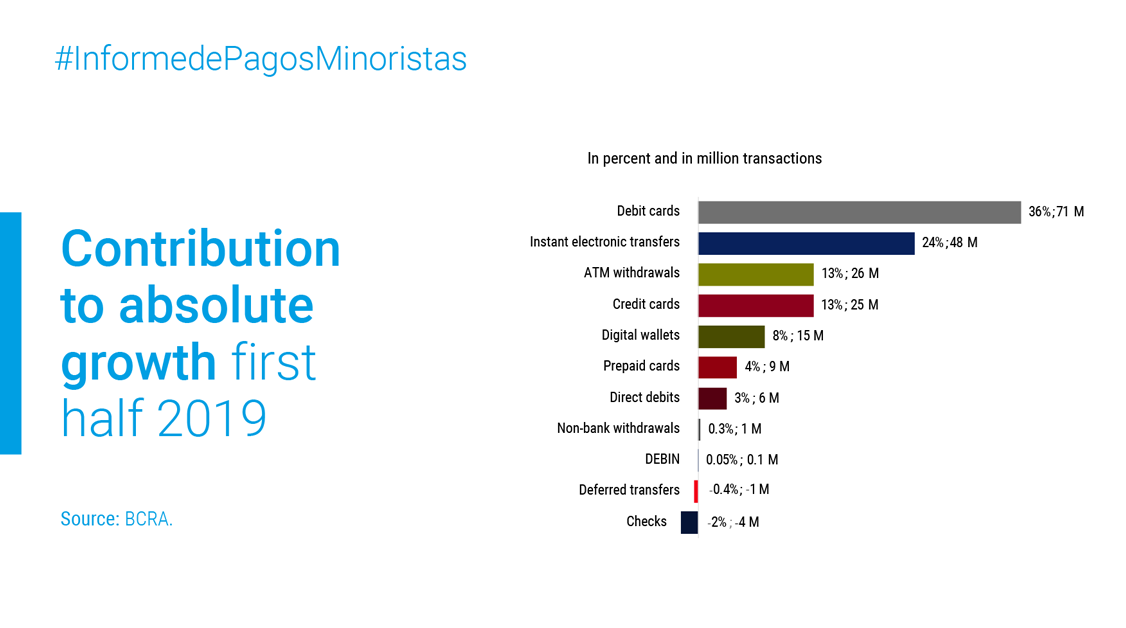

More than 1.8 billion retail transactions were made in the first half of 2019, which amounts to a 12% y.o.y. growth. The use of electronic means of payment has increased by 16%, debit cards and instant electronic transfers being at the top. More companies and families have chosen electronic means of payment for transactions involving low amounts.

Instant electronic transfers growth continues to accelerate

The first half of 2019 exhibits a 49% increase in the number of instant electronic transfers vis-à-vis the same term of the previous year, with nearly 145 million transactions, out of which 15% are payments and purchases in shops.

Instant debit gains momentum

Instant debit or DEBIN transactions accounted for more than ARS10 billion in June 2019, thus starting to play a key role as a payment instrument which boosts a more competitive market for time deposits. Billeteras digitales: crecen como iniciadoras de pagos y como esquema de pago propio.

The use of digital wallets as a way of initiating payment transactions and making payment transactions within their own structure has increased

During the first half of 2019, 77 million payment transactions were initiated with cards using digital wallets, and nearly 20 million were made among the digital wallets' own payment accounts. These figures represent a 146% and 279% growth, respectively, compared with the first half of last year.

Latest innovative developments: Electronic check – ECHEQ – and recurring instant debit

During the first half, the BCRA, in consultation with the market, adopted the necessary operative measures for developing the ECHEQ—available to the public since July 1—and redesigning the recurrent instant debit (DEBIN).