Federico Sturzenegger on the XXII Argentine Industrial Conference organized by the Argentine industrial union

Within the framework of the XXII Argentine Industrial Conference organized by the Argentine Industrial Union (UIA), Federico Sturzenegger, governor of de Central Bank, presented the ´Perspectives of 2017 economy. The Central Bank´s look´, Tuesday 22th, November.

The full speech is transcribed below.

´It is a pleasure to be here with you today and to have the chance of discussing the perspectives of the industry for the following years.

We know this year has been difficult for the industry. We are aware of the reality of each sector; however, current challenges are connected with the construction of the future. Therefore, at the moment of making a diagnose I kindly ask you to take into account that Argentine industry did not grow during the last five years and that this year we aim at laying the bases for our country to retake the path of sustained growth. In this sense, we have made major amendments to the functioning of our economic system. Let’s take, for instance, the resolution for causing the foreign exchange market to return to normalcy adopted by the Central Bank on December 17th, 2015 (a process that was completed on August 8th, 2016). We believe this adjustment improved the levels of competitiveness and speed up commercial transactions. The normalization of our debt situation was another transcendental change in the year, since after 15 years we definitely closed a chapter in our history, paving the way for better and more affordable sources of financing. A downturn in taxes (withholdings, income tax, law of SMEs) was other important measure, whereby the government resigned to an amount equivalent to a whole monthly collection, so as to generate competitiveness for the productive sector. Finally, I would like to underscore the reduction of inflation, a topic into which I will delve today in this presentation. At the same time, we are experiencing an improvement in the quality of public expenditure, a process which is neither magic nor instantaneous; in fact, it has already begun and in time it shall produce yields and turn out to be fruitful. Without going that far, a great progress has been recorded this year.

We do not seek to wash our hands of responsibility but, there are two external factors to our management that influenced the annual productive cycle. The first factor was a strongly negative effect on the GDP as a result of a slowdown in stock during the first quarter. Prior to the removal of clamps, the uncertainty on how this process would be developed produced a stock accumulation phenomenon in the production chain and even in households and construction, situation that was naturally reversed in the first quarter.

A reduction in stocks triggered a negative effect on the economy, which according to National Statistics and Census Institute (known in Spanish as INDEC) entailed a fall of 2% in the first quarter. On the other hand, technicians from the Central Bank estimated that the inefficient economic performance of Brazil has given rise to an additional fall of 0.8% in Argentine GDP during this year. I repeat, this comments are not intended to wash our hands of responsibility. In fact, external conditions of commodity prices are quite normal and the financial situation is very positive. Nonetheless, we must be aware that those factors have been determinant for the economic development during this year.

It should be noted that the reduced level of inflation we are witnessing today paves the way for a reversion of the recession, a process that has already begun by the middle of last year.

In this presentation I would like to develop three key topics. In the first one I will explain our anti-inflationary policy and the reasons why this policy is the best for the industry. Later, I would like to debate on the eternal topic regarding credit in our country. Finally, I would like to clarify some concepts concerning exchange rates in the new macroeconomic scheme we are building.

Let’s begin with anti-inflationary policy.

As you know, we are working to design a macroeconomic scheme that has two basic constituents from a monetary and foreign exchange view: a low level of inflation, materialized in our target of 5% annual inflation for 2019, on the one hand, and a flexible exchange rate, on the other hand. The low level of inflation is an essential and imperative condition to achieve a solid economic growth. Moreover, the floating exchange rate is a key instrument to ensure that the Argentine economy may defend itself from external shocks, restraining the vulnerability of our economy in the face of external fluctuations (particularly in these days when we clearly see that the foreign exchange scheme is valuable!).

I should state (what’s more, I believe that speaking plainly should not be understood as a sign of confrontation, and this is a very constructive aspect of this new era) that the Argentine Industrial Union (known in Spanish as UIA) is the fiercest critic of our anti-inflationary policy. I am sure that not every member of the Union is that critical, but several leaders have moved in the critical direction.

As a consequence, I should devote a few minutes to this subject. I believe that attacking the policy of disinflation is a mistake, even from the point of view of your own interests. Therefore, I really appreciate the opportunity given here to express my opinion on this aspect. I wish this explanation helps to unify criteria and align our daily efforts.

A slowdown in inflation is an essential element that will allow Argentina to finally take off. Therefore, attacking the policy of disinflation hinders growth and our productive capacity, which is central to a healthy and booming industry. High inflation undermines the expected structural or potential growth of an economy in the long term. There are several channels through which this harmful effect is produced. High inflation rates destroy the informational component of prices, producing high volatility of relative prices, and thereby greater uncertainty regarding future relative prices of the economy. These effects do not only impair the competitive structure of the market, but also exert a direct and negative impact on the saving and investments decisions of the whole society: hiring terms and horizon shorten, and the perceived risk increases, discouraging myriads of medium and long-term projects that would have been profitable.

In this context, saving tends to flee from the local financial system in search of robustness in other currencies and assets; consequently, the credit inevitably becomes rachitic, utterly destroying equal opportunities to access resources for financing ideas and productive undertakings. Only those already that already have resources may invest, perpetuating inequality in the economic and social structure. Thus, inflation is a huge hindrance to economic development as it impacts on income distribution on a bluntly and regressive basis.

There are many examples in the world that allow us to see the positive effects of economic growth as a consequence of reducing inflation. Maybe Argentine experience should be enough, but this is not the case. Therefore, I invite you to read the last Monetary Policy Report that shows that 85% of the countries which have reduced in a sustainable manner their inflation below the 20% threshold virtually doubled their average economic growth rate over the next decade.

Moreover, the inflation tax reduction, as I have already mentioned, will bring about a remarkable improvement in the income distribution, which is not only imperative but stands for a stimulus to industrial sector’s dynamism. You should bear that Argentina’s level of inflation over this year took up roughly 20% of the salary at decile of lower income, but only a 3% at decile of higher income.

It is essential to overcome inflation to ensure a path of sustainable and dynamic economic growth in the long term. Some people may say that winning this battle entails paying too much for it; but the truth is that no one has demonstrated that this is the case in Argentina, which is particularly meaningful bearing in mind that so much has been analyzed and written on this topic. In fact, low inflation periods in our country were not necessarily low growth periods, but in general the former has paved the way for higher dynamism in the economy.

All in all, even if these costs existed, there is no doubt that they would amply be exceeded by long term benefits derived from price stability.

In this regard, I would share with you an extract from the story ´The Immortal´ of The Aleph by Borges to enlighten this issue: ´I have noticed that in spite of religion, Jews, Christians and Muslims all belief in immortality, but the veneration paid to the first century of life is proof that they truly believed only in those hundred years, for they destine all the rest, throughout eternity, to rewarding or punishing what one did when alive.´

This analogy, leaving philosophic differences aside (forgive me Borges), may be applied to the challenge of reducing inflation. If we only believed in the present, or if we were unable to see a horizon beyond a couple of quarters, we would commit the future, the life quality of our children, grandchildren, and the Argentine society as a whole by giving up the fight against inflation.

We have already gone over the reasons for winning this battle, now let´s analyze the way to do it.As you already know, the Central Bank shall establish as from 2017 an institutional scheme commonly referred as Inflation Target Regime. The mechanics of this scheme is as follows: the monetary authority sets and announces the inflation targets for upcoming years and directs its instruments to achieve its goal. The interest rate is the chief instrument for monetary policy. If inflation rises, the policy rate rises. There are no trajectories or predetermined paths for this variable. Here, the Central Bank constantly monitors the development of present and future inflation, as well as future inflation expectations. At any time, the Central Bank assesses risk-targets deviation.

Rates rise through three channels: the credit cannel, the exchange rate channel and the expectations channel. They are all driven to produce a fall in inflation. If inflation comes down, the rate shall be reduced. As simple as that, this is neither a trivialization, nor a bizarre invention of our own. This is a mechanism used by the vast majority of countries that nowadays enjoy price stability. Every country that used this mechanism has successfully managed to reduce inflation. So, why should it be impractical in our country?

As I have already mentioned several times, the targets are crystal-clear: to reduce monthly inflation to 1.5% or less in the last quarter of 2016, ranging from 12% to 17% in the next year, and to reach an annual 5% in 2019.

We have already discussed the reasons and the way we will reduce inflation. Which are the preliminary results of this policy?

I consider it is appropriate to recall that the assessment of the results of our task becomes more complex making allowances for the fact that the monetary policy operates with certain delay. Thus, bearing in mind that our monetary issuance in 2015 was 40%, clearly inflationary pressures were exerted on price evolution during this year.

It is striking that academics, consulting firms or the press can hardly link this year inflation with 2015 monetary policy, bearing in mind that this is a relevant relation. Similarly, today’s issuances—which have considerably declined (today monetary aggregates grow at 20% annually and continue slowing down)—clearly set the inflation pace for the following year. The hard policy implemented by the Central Bank during the first half of the year led to a significant reduction of the inflation rate in the last few months. In fact, the average inflation of August, September and October was 1.2%, and the Central Bank feels confident about the fulfilment of its monthly inflation goal of 1.5% or less during the last quarter of this year (which will even be set up at less than 1% monthly in the last quarter of 2017). In this context, during October the rate fixed by the Central Bank was closely linked to the idea of tempering expectations for next year against the fare adjustments made last month. Thus, the benchmark rate of the past few weeks was changed since price indicators monitored by the Central Bank flagged an evolution in line with the disinflation path pinpointed by the monetary authority for November.

The Central Bank´s role is limited to announcing and fulfilling its goals. Then, with that information in hand, every citizen is free to make the most appropriate decision according to their business or specific activity. Evidently, the construction of credibility is a process. Each decision we make, as long it is consistent with the goals sought, will cause the credibility bases to be cemented.

Within this framework, I would like to dwell briefly on what usually occurs when one sector diverts its prices from the path proposed by the Central Bank and which are the likely real effects derived from this type of decisions. For example, price decisions during the first quarter of 2016 were not entirely consistent with the disinflation targets proposed by the Central Bank. When companies started to realize that their prices and disinflation policies were moving on different directions, they began to generate a multiplicity of promotions and discounts that echoed the effect of Central Bank monetary policies (2x1, 3x1, 70% of discount in the second unit, 40% of discount, just to mention a few).

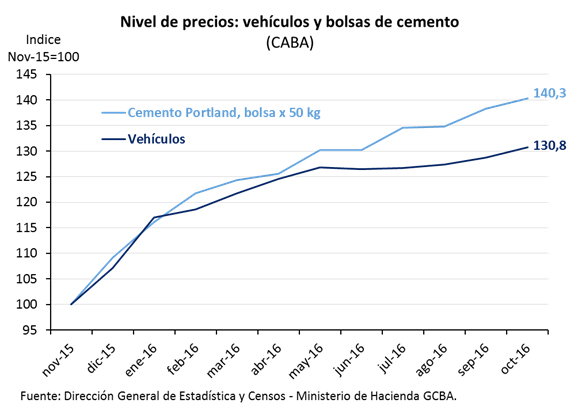

In these months, some sectors have begun to accommodate to the new setting of the monetary economy. A good example is the automotive sector, which aligned its prices with the monetary policy (as shown in the chart below, prices have increased only 3.2% since May) giving rise to a significant growth in sales. We have noticed that these adjustments in several sectors had the same effect on sales and activities; but that was not the case in all sectors. By way of illustration, the price of cement kept on detaching from the disinflation path exhibited by other goods. The price increased 3% in May, July and September. Naturally, construction has evolved differently if compared to car sales. As a consequence, a raise in prices in a disinflation context ´just in case´ is a mistake. Hence, raising prices ‘just in case’ implies raising the relative price of other goods with clear-cut consequences on sales.

We are convinced that the society is gradually making decisions on prices in line with the disinflation path announced by the Central Bank, which will ensure that disinflation will help minimize any deviations in prices in specific sectors. I wish this lecture contributes to align our efforts and goals.

The second topic I would like to analyze here is related to credit facilities. When we visited the UIA together with the Central Bank Team, Diego Coatz focused on this aspect. I believe this is a key issue that is worth examination and discussion.

For us the diagnosis is clear. Whilst the real interest rate for depositors is negative, savings intermediation through the local financial sector is unfeasible. In the absence of deposits, credit can hardly expand. Therefore, in Argentina deposits stand for 15% of the GDP, while in Chile they reach 100% of the GDP. For the same reason, credit availability is highly more beneficial for Chilean industrial entrepreneurs than for Argentinean businessmen in the same productive sector.

Now, the dilemma is that of a permanent request of the industrial sector for ´softer´ credits. That ´softness´ is, ultimately, financed by depositors through lower deposit rates, discouraging deposits and, consequently, hindering credit blossom. Then, the concept of ´Soft Credits´ is known as ´oxymoron´, an obvious contradiction. Thus, if credit is soft, it will not flourish because no one will finance it.

Moreover, projects financed at a real negative interest rate are likely to be financed at a real negative rate of return. This has a dramatic effect because it implies that the capital allocation, far from generating economic growth, creates economic impoverishment. Capital allocation to projects with a negative interest rate of return certainly destroys the capital, instead of causing it to be multiplied. There is substantial literature on international economy regarding the concept of ´impoverishment growth´. This literature discusses how economies with relative and severely distorted prices created investment patterns that, at international prices, reduced the GDP. I believe we have to reflect deeply on this topic which, in my opinion, is rooted in the low yields of our investments and low growth in the last 5 years (among other reasons, of course).

Then, we must understand that in order to have credit we first need deposits, and to have deposits we need to pay the depositor a real positive interest rate. This necessarily implies that a real positive interest rate should be paid for the credits.

If we check credit evolution in 2016, there is an entire segment that has already been operating dynamically in this way. This is the foreign currency segment, whereby this year’s interest rates were unprecedentedly low, even though positive in real terms. These interest rates range from 2% to 6% in dollars, and the amounts granted accumulated 191% increase insofar this year, from US$ 3 billion in last December to 8.9 billion disbursed to date.

The financing substitution of dollars for pesos in the long term carried out by several sectors of the economy throughout the year also has the advantage of increasing the availability of funds for the activities that can only be financed in pesos.

Nowadays, the average nominal lending rates in pesos for the industry (specifically, unsecured documents) are lower than last year, clearly because the Central Bank is keeping an eye on inflation. Consequently, we have lower nominal rates, though higher in real terms. Real rates are not only the instrument, as we previously mentioned, for the reduction of inflation (I hope UIA supports the cause more decisively in the future) but also they enable us to recompose a financial sector more efficiently and, thereby, creating greater availability of credit.

In fact, part of this effect has already been observed. During the last four months the total lending reversed the tendency of the first part of the year and continued growing in real terms in a consecutive manner, accumulating a real increase of 4.2% in such period.

I will then close the lecture with one of the key topics for you: exchange rates.

I have already discussed in several occasions the virtues of a flexible exchange rate scheme, capable of providing the economy with a tool to adjust to external swings. Today, reality makes us go through periods of global fluctuations derived from the U.S. electoral result. If our exchange scheme were not flexible, our economy would lose great margin to react against external news of this type. The new administration of U.S. will probably move towards striking a balance of its domestic finance with higher interest rates and a global appreciation of dollar. I am relieved that we have a flexible exchange rate that enables to detach ourselves from that appreciation, preserving competitiveness in our economy and, therefore, protecting economic activity and, mainly, the industry.

Colombia is a good example of the satisfactory outcome of adjustment to this new scheme. Last year Colombia suffered a strong impact due to a fall in the oil price which sunk from over 100 dollars a barrel down to 30 dollars in a few months. The Colombian economy reacted devaluating its currency 70% but inflation rose barely from 4% to 7% annually; and at the same time the economy maintained, despite that mayor negative shock, a steady growth of 3.1% over the year.

Moving forward, it is important to remember that nowadays we are in a context of floating exchange rate with a nominal parity that fluctuates according to demand and supply in the foreign exchange market. In this scheme, nominal depreciations or appreciations cannot be forecasted. The reason is simple, if everyone knew that currency will depreciate, it would depreciate immediately and people would stop thinking that currency would depreciate because it would have already happened. Something similar might happen in the case of appreciation.

This hides a clear virtue: under this scheme, such situations (where exchange rate remained behind as unanimously recognized) as we have witnessed so many times in the past are not likely to occur. If this were the case, the market would immediately correct it. The exchange rate is neither an anchor, nor an instrument that will be deliberately used by the Central Bank as a correction tool for manipulation. Argentina’s problems connected with the exchange rate are typically rooted in the context of stabilization programs aimed mainly at setting exchange parity, which was central to its economic policy. In these cases, the exchange rate was an adjustment variable, which entailed long periods of overvaluation of the local currency. This hindered planning, and eventually experiencing abrupt and traumatic reversions.

These situations do not occur in regimes with floating exchange. Perhaps the most important prevention measure is to have capital flow available, especially in the short run, which may affect the market balance giving rise to sudden and transitional movements. The Central Bank is aware of these developments. For example, at the beginning of this year when an increasing number of foreign actors started to invest in LEBAC, we restrained their placement to those listed in the local market, which proved to be entirely effective to limit the interest of foreigners on these instruments. During the last few months, in turn, we have derived benefit from current juncture to recompose international reserves of the Central Bank by buying US$ 12 billons at an average price of $/U$S 14.24. Even though the purchase of reserves was aimed at strengthening our balance sheet, everyone is aware that this purchase allowed mitigating the tendency to appreciation produced by the entry of capitals during this year.

Against the backdrop of this particular moment in international markets, I would also like to ponder about the existing connection between exchange rate and the price in pesos of external products. To assess the effects of any exchange movement, it is not adequate but rather confusing to consider only the bilateral exchange rate with the dollar. Instead, the focus should be placed on the multilateral exchange rate. I mean, for example, that even though there is a change in the peso-dollar rate, the peso-Brazilian real rate is not clear enough (against, for example, a worldwide general appreciation of the dollar). Therefore, it is not clear which will be the final effect of a change on the dollar value, in particular if at the same time other currencies are subject to change, creating disinflationary impacts on our economy.

In other words, the effects of the global appreciation of the dollar on prices (which is nothing but a devaluation of all foreign currencies against the dollar at once) are different from the effects of a merely bilateral appreciation against argentine peso.

Now, how is Argentina today in terms of its real exchange type? I mean, how is the exchange competitiveness evolving?

I believe the following chart is quite significant. Let’s consider it for a moment. It illustrates the development of the Argentine currency in real and effective terms (taking into account the effect of a fall in withholdings) vis-à-vis each one of our main business partners since the removal of clamps. This chart shows that there were substantial gains of real competitiveness as under the management of the ongoing government in contrast with all the countries that hold an important role in our international trade. In multilateral terms, the real effective exchange rate is 32% higher than the level recorded prior to foreign exchange standardization.

The second chart shows more specifically the evolution of the foreign exchange competitiveness in the manufacturing sector. As you may see, the greatest profit of competitiveness was recorded in connection with Brazil (our main business partner), amounting to 50% (in real and effective terms) compared to the moment previous to the removal of clamps. In multilateral terms, the increase of exchange competitiveness of the manufacturing sector is around 27%. Thus, the new macroeconomic configuration established by this government allowed Argentine manufactures to be a 27% more competitive in international markets.

Therefore, I cannot tell for sure the future path of such variables on which the Central Bank does not intend to act. However, I can assure, within the framework of our explicit goals, that Argentina will finally reach a low and steady inflation; that such low inflation will unfold greater economic growth; and, consequently, that such low inflation will recover credit facilities and will create a society with equal chances and reduced levels of poverty. Moreover, this will be a predictable macroeconomic scheme with reduced capital costs and exchange rates which will not be artificially deviated from a reasonable benchmark and may even act as a buffer within the economic activity—a buffer which Argentina has never managed to construe—. This scheme is proposed in a context of dialogue, of search for collaborative solutions, and of respect for the institutions that build a true Republic. Our message is based on coherence, austerity and work. We believe that the three of them are necessary for the growth and development of industry without complexes and within a global scenario, and at the same time for a growing, strong domestic market.

Thank you very much.

November 22nd, 2016